Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Walmart and Amazon Go Head to Head Again, but Apparently with Different Priorities We continue to see new fronts in the Walmart-Amazon battle, with the most recent involving encroachments by both parties on each other’s traditional territories. The developments show how these retailers are grappling with channels that are nontraditional parts of their businesses: We are seeing a push for e-commerce profitability on Walmart’s part, while Amazon spends to win share in grocery through brick-and-mortar stores. Walmart Fulfillment Services On February 24, Walmart launched fulfillment services for third-party vendors on its marketplace, offering services similar to “Fulfilled By Amazon.” Like the ecosystem of Amazon’s third-party vendor services, Walmart Fulfillment Services handles all customer support and returns for vendors’ orders. When a customer places an order on Walmart.com, WFS picks, packs and ships to the customer on the third-party seller’s behalf. Notably, in Walmart’s 4Q20 earnings call, management pointed out that the company needs to scale its marketplace business to drive e-commerce profitability—and that involves supporting that marketplace with fulfillment services. Walmart+ Walmart has confirmed that it is developing a program called Walmart+, a move widely seen as challenging Amazon’s Prime. The company has not provided or confirmed details of the program, but reported the program will start as a rebrand of the retailer’s existing Delivery Unlimited grocery service; the retailer could then expand the program from there. With Delivery Unlimited, customers pay $98 a year for unlimited, same-day delivery of groceries from one of the 1,600-plus stores in the US in which it’s available. However, should Walmart+ retain a pure grocery focus, it will not be a direct rival to Amazon Prime. If Walmart is seeking to compete head on with Amazon, we expect added benefits to be folded into Walmart+. Walmart is likely after the shopper loyalty and cross-category purchasing we see among Amazon Prime members—as we have noted before, Prime members are much more likely than average shoppers to buy nontraditional categories on Amazon, such as apparel and groceries. This behavior pushes up customer lifetime value—something that will appeal to Walmart as it tries to stem reported losses in its e-commerce division. In the pursuit of profitability, Walmart recently closed its premium Jet Black e-commerce service and appears to have scaled down Jet.com. Amazon Go Grocery Just as Walmart is getting to grips with e-commerce, Amazon continues to explore brick-and-mortar retail in grocery—a market in which Walmart continues to lead. We have previously noted that Amazon struggled to crack the grocery market with an online-only model; however, it appears not to have settled on a single grocery format, with Amazon Go, Whole Foods and now Amazon Go Grocery. On February 25, Amazon opened the first Amazon Go Grocery store, a full-sized (10,400 square feet), cashierless store, in Seattle. Although it uses similar “just-walk-out” technology to small-format Amazon Go stores, the Amazon Go Grocery store features a much larger selection of around 5,000 items, including fresh produce, meat, dairy, packaged seafood, bakery treats, household goods and a full selection of alcohol, including spirits, wine and beer. One unknown relating to Go Grocery is the cost of the technology, with the hardware for each small Amazon Go store costing a reported $1 million. The inference could be that, while Walmart appears to be focused more on profitability, Amazon has deep pockets and is willing to spend on building share in grocery.US RETAIL AND TECH HEADLINES

Target Reports Fourth-Quarter Results

(March 3) Company press release

Target Reports Fourth-Quarter Results

(March 3) Company press release

- Target reported mixed fourth-quarter and full-year 2019 results with promising growth in e-commerce. Annual revenue grew 1.8% to $23.40 billion.

- In the fourth quarter, the retailer’s earnings per share came in ahead of expectations at $1.69, up 10.6% over last year. Comparable sales grew 1.5%. Same-day services, including online order pickup, accounted for more than 80% of Target’s comparable digital sales growth of 20%.

- Clothing rental service Rent the Runway has introduced a new subscription option with a two-swap plan. The new plan will allow customers to swap out four rented items twice per month for a monthly fee of $135. The current $89 plan allows it only once.

- There is an existing unlimited subscription of $159 per month which allows customers to borrow four items at any time, swapping those out as frequently as the customer wants. The company said many customers want to rent more than four items each month but do not necessarily want the unlimited option.

- Bed Bath & Beyond has appointed Joe Hartsig as CMO; he previously served at Walgreens in the same role. Hartsig will also become President of the retailer’s Harmon store business.

- Hartsig will be responsible for revamping the company’s private label brands and launching new ones. Prior to Walgreens, Hartsig worked for nearly five years in Walmart’s Sam’s Club division.

The Fresh Market Appoints New CEO

(March 2) Company press release

The Fresh Market Appoints New CEO

(March 2) Company press release

- Supermarket chain The Fresh Market has appointed Jason Potter as CEO with effect from March 2, to replace Larry Appel, who resigned.

- Potter has more than 30 years of experience in the grocery industry and most recently served as EVP of Operations at Canadian grocer Sobeys.

- Walmart is in talks with Verizon to introduce 5G wireless network technology to provide in-store digital health services. Customers can securely share medical data with healthcare professionals and interact with doctors via video streaming on a dedicated app.

- Walmart will test the service in two stores. If successful, the company will expand the service to all 4,700 US stores, creating in-store hubs for medical services.

EUROPE RETAIL AND TECH HEADLINES

- Sainsbury’s has opened its second On the Go convenience store in Birmingham’s business district. The store offers in-store food and drinks.

- Sainsbury’s has used shopping data and analytics to tailor its product offerings to local city workers with various breakfast, lunch and meal-for-tonight options. The layout of the store has been revamped with extra space for checkout so shoppers can pay more quickly.

- Boots plans to recycle 86,000 plastic bottles per year and use the material to create its own brand of eco-friendly tights. The new range of black, opaque tights is available online and in selected stores.

- The company said it takes around four plastic bottles to make one pair of tights and no nylon is used in the process. The plastic bottles are shredded into micro particles before being melted down and spun into yarn.

Inditex Closes Massimo Dutti’s Children’s Line

(March 2) Modaes.es

Inditex Closes Massimo Dutti’s Children’s Line

(March 2) Modaes.es

- Spanish clothing group Inditex has decided to close the children’s line of Massimo Dutti and focus on the children’s fashion offer in Zara Kids instead.

- The existing collection will remain in store until July and later be transferred to Zara Kids. The closure will affect 20 employees; Inditex has offered to relocate them to other stores.

- European retailer B&M has appointed Alex Russo as Executive Director and CFO. He is currently group finance director of UK retailer Wilko and previously spent five years at Asda as Executive Director and CFO.

- Russo will replace Paul McDonald, who is retiring after over 10 years in the role, and will begin on a mutually agreed start date no later than June 2021.

- Marks & Spencer has announced it will extend its trial of refillable groceries to a second store in Manchester city center this month. The retailer launched the program in December 2019 at its Southampton store.

- The expansion follows a recent survey by the retailer which showed more than 75% of the consumers are consciously trying to reduce their use of plastic packaging.

ASIA RETAIL AND TECH HEADLINES

- H&M India is planning to expand beyond tier I cities to meet increasing demand for its apparel in tier II and tier III markets. H&M has partnered with local e-commerce platforms to reach shoppers outside the large cities in which it has a physical presence.

- The company grew sales 43% in India in the last fiscal year, with around half its stores located in tier II cities.

- Carrefour China has achieved its first quarterly profit in seven years, according to Tian Rui, CEO of Suning Group which acquired the French retailer last September. The company has improved operating efficiency through the digital transformation of its stores and synergies from integrating with Suning.

- Since incorporating its product offering and stores into Suning’s Convenience Store app on February 6, the average daily order volume for Carrefour Flash Delivery is up 202% month over month, the company said.

- Hong Kong-headquartered apparel retailer Bossini will close all its 51 stores in Taiwan by July 31.

- Chairman Bess Tsin said the company will start discussions with landlords over terms for early exit from leases. The closure is estimated to cost about HK$20 million ($2.57 million), subject to the outcome of negotiations with landlords.

- Tesco will start evaluating offers made for its businesses in Thailand and Malaysia. With the assets valued around $9 billion, there is no certainty that any of the bids will be accepted.

- Tesco operates around 2,000 supermarkets and convenience stores in Thailand and 74 in Malaysia via a joint venture with Sime Darby Group.

- eBay is planning to sell its business in Korea, including its online marketplace, Gmarket, in a deal that would fetch the company $5 billion. The company has planned to sell the business since last year.

- Possible buyers include large retailers such as Lotte Shopping, Shinsegae, Hyundai department store group or private equity fund MBK.

LATIN AMERICA RETAIL AND TECH HEADLINES

- Uruguayan women’s apparel brand Rotunda has landed in Argentina with a new point of sale in the city of Rosario, its first store outside Uruguay.

- Rotunda was founded in 2014 and offers clothing, footwear, underwear and swimwear that it distributes through its 10 outlets in Uruguay.

Mercado Libre To Invest $100 Million in Chile

(March 3) FashionNetwork.com

Mercado Libre To Invest $100 Million in Chile

(March 3) FashionNetwork.com

- Argentine e-commerce company Mercado Libre plans to invest $100 million in Chile over the next two years. Mercado Libre will use the funds to bolster its logistics capabilities, boost its buyer protection programs, subsidize free shipments and strengthen its loyalty programs.

- The company has a two-phase plan to improve its logistics capabilities in the region, initially operating out of a 100,000 square-foot, third-party distribution center starting this month and eventually shifting operations to a new 269,000 square foot facility, which will be built by 2021 in the city of Cerro Navia.

- French sporting goods retailer Decathlon has opened a new logistics center in Colombia. It spans over 100,000 square feet and is located eight kilometers outside the capital Bogota.

- The center will house products from more than 4,000 brands, which will be distributed to all of its stores in the country and will also be used to fill online orders.

eRetail Day Mexico Held on March 5 in Mexico City

(March 3) FashionNetwork.com

eRetail Day Mexico Held on March 5 in Mexico City

(March 3) FashionNetwork.com

- The seventh edition of eRetail Day Mexico, a convention focused on the e-commerce industry in Latin America, was held on March 5 in the Sheraton María Isabel hotel in Mexico City

- The event featured eCommerce Awards to recognize the companies and entrepreneurs that had significant impact on the digital ecosystem in the region.

- Nike has launched a new concept store in Peru, located in the Jockey Plaza shopping center, focused on personalized service and sports innovation.

- The store has 21 specialist athletes who will provide guidance to customers in the different sports the brand caters to, including running, football, training and others. The store will also feature the Nike By You service which allows customers to create their own shoe models in 90 minutes.

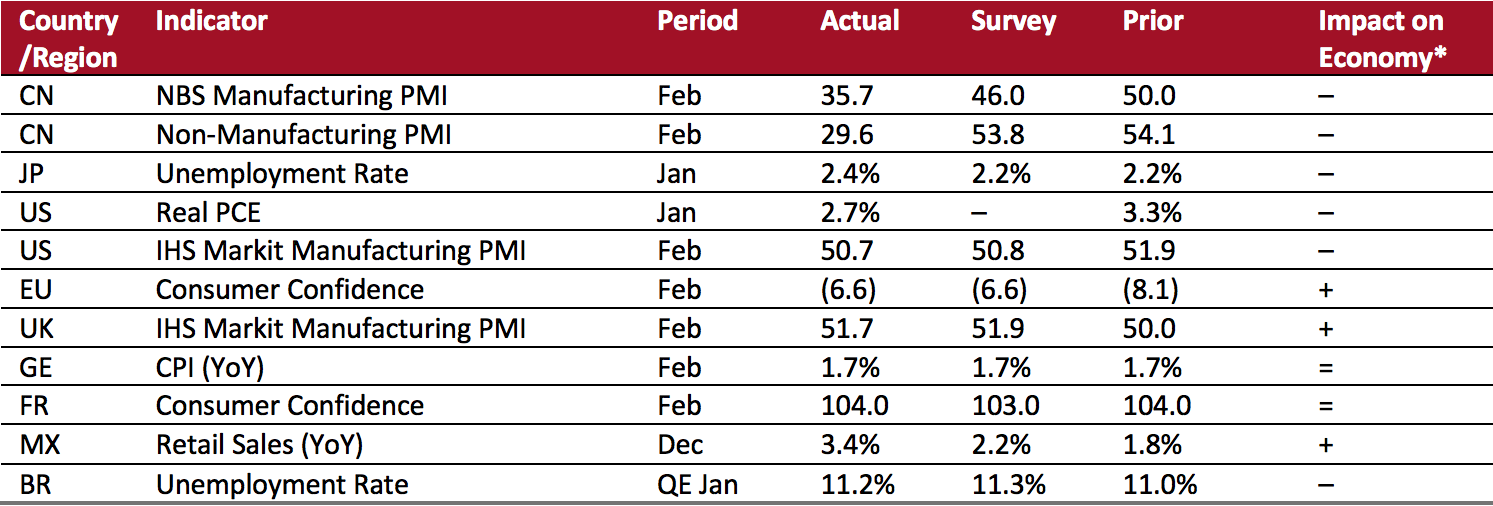

- Asia: China’s National Bureau of Statistics (NBS) manufacturing Purchasing Managers’ Index (PMI) and non-manufacturing PMI fell to a record low; the coronavirus shutdown drove this slump. The manufacturing PMI came in at 35.7 in February, down sharply from 50.0 in January and below the consensus estimate of 46.0. The non-manufacturing PMI was 29.6 in February, versus 54.1 in January and below the consensus estimate of 53.8. In Japan, unemployment rose to 2.4% in January, versus 2.2% in December and above the consensus estimate of 2.2%.

- US: Personal consumption expenditure (PCE) in real terms was up 2.7% year over year in January versus a 3.3% year over year rise in December. The IHS Markit manufacturing PMI was 50.7 in February, down from 51.9 in January and below the consensus estimate of 50.8.

- Europe: The eurozone consumer confidence index was (6.6) points in February, significantly better than (8.1) points in January and in line with the consensus estimate. In the UK, the IHS Markit manufacturing PMI was 51.7 in February, up from 50.0 in January but below the consensus estimate of 51.9.

- Latin America: In Mexico, retail sales grew 3.4% year over year in December, much stronger than the 1.8% year over year growth in November and above the consensus estimate of 2.2%. In the rolling quarter ended January, Brazil registered a 11.2% unemployment rate, versus the 11.0% rate in the quarter ended December.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: BEA/European Commission/Markit Economics/DESTATIS/INSEE/NBS China/Statistics Bureau of Japan/INEGI/IBGE/Coresight Research[/caption]

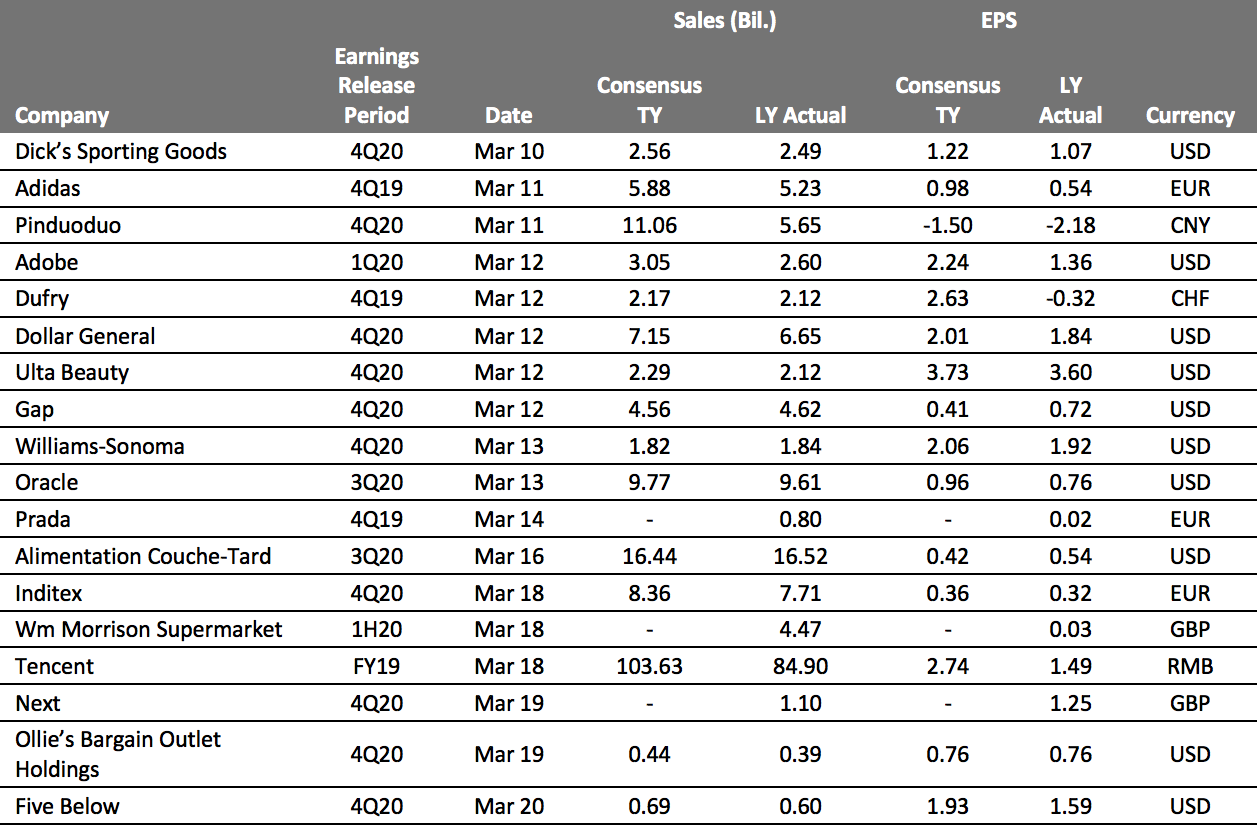

EARNINGS CALENDAR

[caption id="attachment_104857" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]