albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Retailers Taking Action During the Coronavirus Crisis

The worsening coronavirus outbreak in the US has forced many retailers to temporarily close stores—many of their own accord before government-imposed closures in several states and major cities. This is not the only thing retailers are doing to respond to this unprecedented time: Across the industry, we are seeing the private sector step up to support their communities, their consumers—and find ways to continue operating amid increasingly challenging conditions.

Delivery to the curb. With more people working from home, demand for IT equipment and office devices is on the rise. Best Buy is positioned to tap into this demand, but faces the challenge of doing so while also following social distancing guidelines. So, the company has unveiled enhanced curbside service (on an interim basis) starting March 22. Dick’s Sporting Goods offers a similar service. Other retailers offering curbside pickup include Barnes & Noble, Game Stop, Joann and Michaels.

Hiring additional employees. While many retailers are faced with tough staffing decisions, others are hiring—some in huge numbers. According to The Wall Street Journal retailers in the US are looking to hire an additional 500,000 workers. This should provide some support to the large number of restaurant and entertainment workers who suddenly find themselves out of work. Walmart alone says it plans to hire 150,000 workers, Amazon wants to hire 100,000, CVS is looking for 50,000 new employees and Dollar General wants to hire 50,000. Amazon CEO Jeff Bezos has specifically appealed to laid-off restaurant and bar workers to join his company.

Shopping hours for senior citizens. With many highly sought-after products such as hand sanitizer, cleaning wipes and toilet paper flying off the shelves as soon as they arrive, seniors may not be able to compete effectively to grab them. Retailers such as Target have set aside an hour before store opening or the first shopping hour of the day for seniors, giving them preferential access to these and other products—and also helping them minimize exposure to others.

Raising wages. Several retailers of staple products and groceries are temporarily raising wages to reward them for operating stores when they may be at risk. Target announced a $300 million program to pay its frontline employees an additional $2 an hour through at least May 2, in addition to paid leave for certain employees, bonuses in April and a fund to support team members. Walmart is also raising employee pay through Memorial Day (May 25), and Dollar General is investing approximately $35 million in bonuses for store, distribution center and private fleet employees who work during a six-week period starting mid-March.

Returns. We’ve seen many retailers offer extended return periods as stores are closed, making it difficult (or impossible) for consumers to return items. Apple said on its website it will take returns for up to 14 days after its stores reopen, Sephora will accept returns up to 30 days after reopening and even increased its online order return limit to 60 days. These retailers have in recent days been joined by Macy’s, Gap, and J.Crew in extending return windows.

Promotions. Many retailers are offering promotions to get consumers shopping, including American Eagle, Nike, and Macy’s, which is offering a “Relax, Recharge & WFH” promotion with up to 30% off and the minimum purchase needed to get free shipping cut to $25.

Prioritizing warehouse space for essentials. Amazon recently announced would suspend shipments of nonessential products into its warehouses through April 5 to allow the company to prioritize staple goods, medical supplies and other high-demand products. This affects shipments from the Fulfillment by Amazon program as well as goods that Amazon purchases and resells.

Social media. People working from home are likely to use more social media for news and entertainment. Our recent social-media report found social media is part of the shopping process for 57% of respondents, and almost half make purchases through social media platforms.

Although retailers appear frozen in place due to widespread store closures, a surprising number are taking measures to stay relevant to customers and to smooth the shopping experience in this difficult time.

For additional information, please see our recent Coronavirus Insights and US Store Closures 2020 Outlook.

US RETAIL AND TECH HEADLINES

![]() Dollar General To Recruit Up to 50,000

Dollar General To Recruit Up to 50,000

(March 23) Company press release

- Dollar General has announced it will 50,000 new employees by the end of April to meet surging customer demand for household essentials amid the coronavirus outbreak.

- The company specified that it is looking for candidates who want to start a career with the company—but specifically mentions people whose jobs have been impacted by the outbreak. Most of the new hires are likely to be temporary.

![]() Neiman Marcus in Bankruptcy Talks with Lenders

Neiman Marcus in Bankruptcy Talks with Lenders

(March 24) Bloomberg.com

- Luxury store chain Neiman Marcus is in discussions with lenders to file for bankruptcy as it struggles to reduce its $4.3 billion debt load.

- An unnamed source reported that Neiman Marcus had preliminary talks with lenders on a possible bankruptcy loan that would keep the business going while it works on a restructuring plan, and that no decisions were made.

![]() Instacart To Hire 300,000 Temporary Workers; Launches “Leave at My Door” Delivery

Instacart To Hire 300,000 Temporary Workers; Launches “Leave at My Door” Delivery

(March 24) Company press release

- Grocery delivery and pickup services provider Instacart announced plans to hire an additional 300,000 temporary workers over the next three months. The company said it has seen a rapid increase in demand for grocery delivery and pickup services in the last few weeks as the coronavirus pandemic prompts people to shop from home.

- Instacart CEO Apoorva Mehta also announced the company has introduced a new “Leave at My Door” delivery service to minimize contact.

![]() Under Armour Chief Product Officer Resigns

Under Armour Chief Product Officer Resigns

(March 24) WWD.com

- Under Armour has announced that Chief Product Officer Kevin Eskridge plans to leave the company to explore other interests, effective August 15. Eskridge has been with the organization for 10 years and was promoted to his current role in May 2017.

- Eskridge is eligible to receive a lump sum payment of $640,000 and an annual incentive award based on the company’s financial results in 2020 along with health benefits for 12 months, according to the company’s filing.

![]() Amazon Suspends Nearly 4,000 Seller Accounts For “Unfairly Priced” Goods During Pandemic

Amazon Suspends Nearly 4,000 Seller Accounts For “Unfairly Priced” Goods During Pandemic

(March 24) Bloomberg.com

- Amazon has suspended thousands of seller accounts for overcharging during the coronavirus pandemic. The retailer said that it has withdrawn over half a million offers and blocked more than 3,900 selling accounts in the US for breaching its fair pricing policies.

- Amazon said that it has assigned a dedicated team to review and investigate “unfairly priced” high-demand items such as safety masks and hand sanitizer.

EUROPE RETAIL AND TECH HEADLINES

![]() UK Extends the Cap For Contactless In-Store Card Transactions

UK Extends the Cap For Contactless In-Store Card Transactions

(March 24) BRC.org.uk

- The maximum amount for contactless in-store card transactions has been increased from £30 to £45 in the UK. The new cap will apply at some stores starting April 1, 2020, but may take time to fully implement.

- The step aims to reduce the need to physical contact with PIN-Entry Devices (PEDs) in retail locations to combat the spread of coronavirus.

![]() Morrisons Installs Protective Covers for All Checkout Workers To Defend Against COVID-19

Morrisons Installs Protective Covers for All Checkout Workers To Defend Against COVID-19

(March 24) ChargedRetail.co.uk

- UK-based supermarket chain Morrisons has installed large plastic safety screens at checkout counters in all stores to protect employees.

- The clear acrylic screens, which are 3.3 ft tall and 4.9 ft wide, will include a small space next to the cashier for customers to pay. However, the retailer encourages customers to use contactless payments.

![]() Debenhams to Consider Additional Store Closures and Rent Cuts Under CVA

Debenhams to Consider Additional Store Closures and Rent Cuts Under CVA

(March 23) Drapers.com

- British department store chain Debenhams is reportedly planning additional store closures, as a part of its on-going company voluntary agreement (CVA). The retailer is also negotiating with landlords on further rent reductions to avoid new insolvency proceedings.

- Debenhams entered into administration and officially launched its CVA in April 2019. The retailer is expected to shut 50 stores under the CVA, of which 22 closed in January.

![]() Laura Ashley To Permanently Close 70 Stores

Laura Ashley To Permanently Close 70 Stores

(March 23) RetailGazette.co.uk

- UK fashion and furnishings retailer Laura Ashley will close all 70 of its stores in the UK, affecting 721 employees. The company said its online business and the remaining 77 UK stores will continue to operate.

- On March 17, Laura Ashley collapsed into administration saying the coronavirus outbreak had an immediate and significant impact on its business. The retailer said that its initial focus will be looking for buyers.

![]() Jack Wills Announces Further Store Closures

Jack Wills Announces Further Store Closures

(March 23) RetailGazette.co.uk

- UK retailing group Frasers (formerly Sports Direct) announced plans to permanently close an additional nine Jack Wills stores in the UK, in Abersock, Aldeburgh, St Andrews, Dartmouth, Harrogate, St Ives, Lincoln, Rushden Lakes and Southwold.

- This comes after the company announced the prior week plans to shutter five Jack Wills stores. In August 2019, Mike Ashley-owned Frasers Group purchased Jack Wills for £12.75 million ($15.1 million) via a pre-pack administration deal.

ASIA RETAIL AND TECH HEADLINES

![]() JD Logistics To Hire 20,000 Delivery and Warehouse Workers

JD Logistics To Hire 20,000 Delivery and Warehouse Workers

(March 25) KR-Asia.com

- The logistics division of Chinese e-commerce giant JD.com plans to hire over 20,000 warehouse and delivery workers in China to meet growing online demand, mainly driven by customers relying on e-commerce platforms to shop for daily supplies.

- The company said it will give priority to applicants whose income falls below China’s poverty threshold.

Shanghai Fashion Week Hosted on Alibaba’s Taobao Platform

Shanghai Fashion Week Hosted on Alibaba’s Taobao Platform

(March 24) SCMP.com

- Faced with cancellation, the Shanghai Fashion Week was livestreamed on Alibaba’s dedicated livestreaming channel Taobao Live and the Taobao app.

- Over 150 brands and designers from across the globe showcased their autumn-winter collections, and viewers could purchase the items on the livestream immediately on Tmall, Alibaba’s e-commerce platform.

E-Commerce Companies in India Suspend Services as Government Imposes New Restrictions

E-Commerce Companies in India Suspend Services as Government Imposes New Restrictions

(March 24) Retail.EconomicTimes.com

- E-commerce retailers in India such as Amazon and Walmart’s Flipkart have temporarily suspended logistics services citing operational constraints caused by government efforts to contain the coronavirus.

- Authorities have been closing warehouses as part of a law prohibiting large groups. The Retailers Association of India has estimated 25,000–30,000 supermarkets were affected by the supply chain disruption caused by the warehouse shutdown.

![]() Grab Pilots Grocery Delivery Service In Vietnam

Grab Pilots Grocery Delivery Service In Vietnam

(March 23) KR-Asia.com

- Singapore-based multi-service technology firm Grab will pilot its grocery delivery service GrabMart in Ho Chi Minh City. Grab has service in Indonesia, Thailand, and Malaysia.

- The number of merchants on GrabMart is currently limited but the firm hopes to grow that to include supermarkets, convenience stores and small shops.

![]() Alibaba To Donate Medical Supplies to Countries Around the Globe

Alibaba To Donate Medical Supplies to Countries Around the Globe

(March 23) America-Retail.com

- The Alibaba foundation and the Jack Ma Foundation have announced plans to donate face masks, test kits and other medical supplies to countries in Asia, South America and Africa. Alibaba owner Jack Ma said he will send 2 million masks and 400,000 test kits to 24 South American countries.

- The foundations will donate to Asian countries 1.8 million face masks, 210,000 test kits, 36,000 protective suits, plus fans and thermometers.

LATIN AMERICA RETAIL AND TECH HEADLINES

![]() Under Armour Closes Stores Across Latin America

Under Armour Closes Stores Across Latin America

(March 24) FashionNetwork.com

- Under Armour has announced the temporary closure of all of it stores in Latin America due to the coronavirus outbreak.

- Stores in Argentina, Chile, Ecuador, Mexico, Panama, Paraguay, Peru and Uruguay will temporarily close until April 5. The company primarily operates through physical channels, but its two e-commerce portals in Chile and Mexico will remain active.

Grupo Éxito Helps Suppliers with Advanced Payments

Grupo Éxito Helps Suppliers with Advanced Payments

(March 23) LaRepublica.com

- South American retailer Grupo Éxito has announced it will pay its 867 small and medium sized suppliers in advance for the month of April to help alleviate cash flow difficulties and preserve employment during the health crisis.

- The company has set aside $60,000 million for the advanced payments for small and medium sized suppliers of meat and produce.

![]() Fashion Retailers in Mexico Announce Bussiness Updates Due to Coronavirus

Fashion Retailers in Mexico Announce Bussiness Updates Due to Coronavirus

(March 23) FashionNetwork.com

- Fashion retailers in Mexico have announced temporary store closure or reduced hours due to health concerns over the Coronavirus outbreak. Luxury department store chain El Palacio de Hierro and fashion retailer Grupo Axo, both of which house various international brands, have announced reduced hours.

- Brands such as Under Armour, Miniso, United Colors of Benetton and the stores managed by Argentine retail group Blue Star Group will temporarily close stores in Mexico.

Colombian Textile Companies To Produce Medical Supplies

Colombian Textile Companies To Produce Medical Supplies

(March 23) FashionNetwork.com

- The Colombian chamber of Clothing and Related Products has reported over 105 textile companies in Colombia have voluntarily offered to make medical supplies, personal protection items and fabrics for clinical use to alleviate shortages caused by the coronavirus outbreak.

- Grupo Crystal, one of Colombia’s largest retail groups, is developing special suits made of non-porous fabric for health professionals in hospitals. Clothing manufacturer STF Group is making specialized masks and gowns, while also reorganizing its factories to make other medical products.

Natura Provides Bussiness Update in Latin America Amidst Cornonavirus Outbreak

Natura Provides Bussiness Update in Latin America Amidst Cornonavirus Outbreak

(March 23) Valor.Globo.com

- South American Cosmetics company Natura announced it plans to temporarily halt store operations in Latin America due to the coronavirus outbreak.

- Separately, the company said it will donate 15,000 kilos of alcohol gel and 150,000 liters of 70% alcohol solution to the Sao Paulo State Health Department, in addition to 2.8 million units of liquid and bar soap to people with limited resources. The company will direct its factories to make soaps and alcohol solutions.

MACROECONOMIC UPDATE

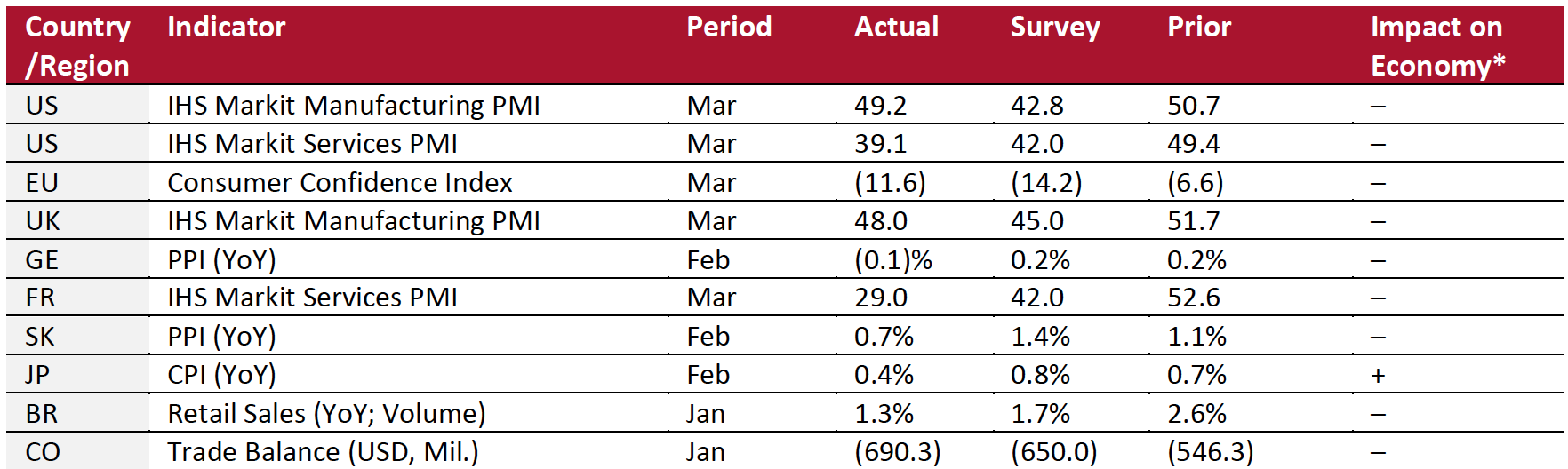

Key points from global macro indicators released March 18–24, 2020:

- US: The IHS Markit manufacturing purchasing managers’ index (PMI) was 49.2 in March, down from 50.7 in February and above the consensus estimate of 42.8. The IHS Markit services PMI was 39.1 in March, down from 49.4 in February and below the consensus estimate of 42.0.

- Europe: The eurozone consumer confidence index was (11.6) points in March, significantly lower than (6.6) points in February and above the consensus estimate of (14.2). In the UK, the IHS Markit manufacturing PMI was 48.0 in March, down from 51.7 in February but above the consensus estimate of 45.0.

- Asia Pacific: Korea’s Producer Price Index (PPI) was up 0.7% year over year in February, lower than the 1.1% increase in January and below the consensus estimate of 1.4%. Japan’s consumer price index (CPI) climbed 0.4% year over year in February, versus 0.7% in January and below the consensus estimate of 0.8%.

- Latin America: In Brazil, retail sales by volume grew 1.3% year over year in January, versus 2.6% in December and below the consensus estimate of 1.7%. In Colombia, the trade deficit increased to $690.3 million in January, up significantly from $546.3 million in December.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: Markit Economics/European Commission /DESTATIS/ Bank of Korea/Statistics Bureau of Japan/INEGI/DANE/Coresight Research[/caption]