albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

We’ll Be Here Through the Outbreak: Join Us Online

Like you, the coronavirus has cleared out our calendars and prompted our global teams to work remotely. So, since people are not getting together in person, we’ve launched a program of daily online events called Coresight Conversations so people can stay connected—and up to speed with fast-changing events—during this challenging time.

The outbreak is impacting us all heavily, so it will be a key component of our programs—but the series won’t be all coronavirus, all the time. We’ll continue exploring the ongoing shifts in retail and the pockets of opportunity opening as the world changes.

Here are some upcoming Coresight Conversations events:

Mondays: We focus on our Innovators team, diving into startups and innovators transforming retail. A separate event will focus on a thematic research-driven topic.

11:00 am EST: Thematic research-driven webinar.

1:00 pm EST: Coresight Conversations Innovator team.

Tuesdays: East to West: What Western retailers can learn from Asia and especially China. This session will also look at how retailers in China coped with the coronavirus outbreak.

9:00 am EST.

Wednesdays: The Future of Retail.

1:00 pm EST.

Thursdays: Female Founders Forum.

1:00 pm EST.

Fridays: Coresight Classroom, featuring learnings and opportunities for those at home.

1:00 pm EST.

In these unprecedented times, the retail industry and those who work with it face great challenges. And, as individuals we face the challenge of adjusting to more isolated ways of living and working. I want to assure all our clients that Coresight Research will continue to publish world-leading research examining the long-term, structural changes in retail. These include deep dives on the US mall landscape and off-price retail, published this week. And, we continue to expand our coverage of the coronavirus outbreak and its implications in our ongoing coverage of the outbreak and the new, data-driven Coronavirus Tracker.

Please join our new program of digital events and reach out to us should you have questions about our research or the implications for your business of the developments we are seeing around us.

US RETAIL AND TECH HEADLINES

![]() Costco Buys Final-Mile Delivery Firm

(March 17) Company press release

Costco Buys Final-Mile Delivery Firm

(March 17) Company press release

- Costco has acquired third-party end-to-end logistics services provider Innovel Solutions for $1 billion. Innovel was a subsidiary of Transform Holdco, which operates Sears and Kmart stores.

- Costco hopes the deal with improve e-commerce sales of big and bulky items. Innovel will continue to serve Sears and other third-party customers under Costco’s ownership.

![]() JCPenney Introduces Interactive Fitting Rooms

(March 17) Chainstoreage.com

JCPenney Introduces Interactive Fitting Rooms

(March 17) Chainstoreage.com

- JCPenney has partnered with retail technology firm Checkpoint Systems to launch a “Brand Defining Store” concept store in Texas featuring new styling rooms kitted out with Checkpoint’s InterACT Fitting Room tool and its proprietary Style@Your Service technology.

- The tool helps customers find and virtually “try on” clothing of different sizes and colors without leaving the fitting room. It includes interactive screens which display product information, recommendations and can communicate with store associates.

![]() Walmart and Walmart Foundation Pledge $25 Million

(March 17) Company press release

Walmart and Walmart Foundation Pledge $25 Million

(March 17) Company press release

- Walmart and Walmart Foundation have committed $25 million to the global coronavirus response. The first grant will be issued this week.

- The fund will provide $5 million to help countries prevent and detect the coronavirus, $10 million to support food banks and school meal programs with the remaining going to local communities in the US and international markets.

![]() Amazon To Hire 100,000 Distribution Workers

(March 16) CNBC.com

Amazon To Hire 100,000 Distribution Workers

(March 16) CNBC.com

- Amazon plans to hire 100,000 warehouse and delivery workers to cope with surging demand for online orders. The company also plans to increase warehouse and delivery worker pay by $2 per hour to $17 per hour in the US, with similar raises in the UK and Europe.

- The company will spend some $350 million on the higher pay rate.

Kohl’s and Lands’ End Announce New Partnership

(March 17) Company press release

Kohl’s and Lands’ End Announce New Partnership

(March 17) Company press release

- Kohl’s has announced a new partnership with Lands’ End under which Kohl’s will offer Lands’ End’s entire assortment on its website by fall 2020.

- Starting in fall 2020, 150 Kohl’s stores will carry Lands’ End merchandise, focusing on seasonal goods.

EUROPE RETAIL AND TECH HEADLINES

![]() Halfords Closes Its Cycle Republic Stores

(March 16) Retailgazette.co.uk

Halfords Closes Its Cycle Republic Stores

(March 16) Retailgazette.co.uk

- Car parts retailer Halfords plans to close its 22 Cycle Republic chain stores and performance center sites in Evesham, England, to focus on its online cycling business Tredz.

- The closure, which puts 226 jobs at risk, is due to complete in the first half of the next financial year and cost the firm between £25 million ($30.25 million) and £35 million ($42.36 million).

![]() Morrisons Profits Rise Amidst Coronavirus Outbreak, Sets Out Special Measures

(March 17) Theretailbulletin.com

Morrisons Profits Rise Amidst Coronavirus Outbreak, Sets Out Special Measures

(March 17) Theretailbulletin.com

- Morrisons pre-tax profits grew 3% to £408 million ($490.26 million) with total sales down 1.1% to £17.5 billion ($21.05 billion) in the fiscal year ended February 2. The company has also introduced several measures to help its staff and customers during the coronavirus outbreak.

- The retailer will expand online delivery service by adding more delivery slots to its own website and to Amazon Prime, use 100 stores to pick customers’ orders and launch a call center to take orders over the phone for those who do not shop online. Morrisons will recruit 2,500 people as pickers and drivers and 1,000 people for its distribution centers.

Tesco and Sainsbury’s Introduce Measures to Avoid Panic Buying

(March 18) Retailgazette.co.uk

Tesco and Sainsbury’s Introduce Measures to Avoid Panic Buying

(March 18) Retailgazette.co.uk

- Tesco will cut hours at its 24-hour stores due to disruptions caused by the coronavirus outbreak, closing all 24-hour stores at 10:00 pm and opening at 6:00 am to give employees time to restock.

- Sainsbury’s has announced it will place limits on purchases of all grocery products to curb panic buying and shut cafes and fresh food counters. Customers can buy a maximum of three of any product, and some items such as toilet paper and soap are capped at two per customer.

![]() Laura Ashley Falls into Administration

(March 16) Independent.co.uk

Laura Ashley Falls into Administration

(March 16) Independent.co.uk

- Clothing and home furnishing retailer Laura Ashley has gone into administration. The company was recently seeking a £15 million ($18.38 million) emergency loan from Homebase owner Hilco Capital, but rescue talks with its lenders were derailed by the coronavirus outbreak.

- The firm reported a loss of 166% in its fiscal half ended December, with a 10.8% decrease in group sales. The company currently operates 150 stores in the UK and employs around 2,700 people.

![]() LVMH To Produce Hand Sanitizers

(March 16) BBC.com

LVMH To Produce Hand Sanitizers

(March 16) BBC.com

- LVMH announced it will repurpose perfume production lines to make hand sanitizer in response to a coronavirus-driven shortage.

- The company plans to deliver the sanitizer free to health authorities.

![]() Dixons Carphone To Close its Carphone Warehouse Stores

(March 17) Company press release

Dixons Carphone To Close its Carphone Warehouse Stores

(March 17) Company press release

- UK technology retailer Dixons Carphone has announced it will close 531 standalone Carphone Warehouse stores in the UK by April 3, 2020, putting 2,900 jobs at risk. The company will focus on selling mobile devices through its shop-in-shops at 305 large Currys PC World stores and online.

- The company expects around 1,800 employees to be re-staffed internally and hopes the closures will help it turnaround its mobile phone business, expected to incur £90 million ($110.03 million) in losses this year.

ASIA RETAIL AND TECH HEADLINES

![]() Marks & Spencer Opens Food Store in Singapore

(March 18) Insideretail.asia

Marks & Spencer Opens Food Store in Singapore

(March 18) Insideretail.asia

- Marks & Spencer has opened its first standalone food store in Singapore. Along with M&S branded groceries, the store offers takeaway hot food, ice cream and coffee.

- The store features digital ticketing, self-checkout and digital menus. The retailer has teamed up with DBS bank and Botty to introduce a chatbot service so customers can pre-order coffee using M&S Facebook messenger for pick up and pay using DBS PayLah!

Tag Heuer Opens a Pop-Up Store in Tokyo

(March 18) Retailnews.asia

Tag Heuer Opens a Pop-Up Store in Tokyo

(March 18) Retailnews.asia

- Swiss luxury watch maker Tag Heuer has opened a Tag Heuer Connected pop-up store in the Shibuya Parco in Japan.

- The pop up will conduct a promotional campaign called “Digital Tag Heuer Touch Rally” through which customers scan a QR code from the brand’s poster in the store for a chance to get original Tag Heuer branded gifts.

![]() Isetan To Exit Thailand

(March 16) Insideretail.asia

Isetan To Exit Thailand

(March 16) Insideretail.asia

- Japanese department store Isetan will close its Bangkok outlets after 28 years of operation in the country.

- The company will not renew its rental contract, which expires in August, in the CentralWorld shopping center.

![]() Flipkart To Sell E-Policies on its Platform

(March 16) Company press release

Flipkart To Sell E-Policies on its Platform

(March 16) Company press release

- Flipkart has partnered with Aegon Life Insurance to sell life insurance on its platform. Existing Flipkart customers between the ages of 18 and 65 can get a policy without filling out paperwork of undergoing medical tests.

- The policy will offer life insurance from INR 100,000 ($1,352.75) to INR 1,000,000 ($13,527.50) with premiums starting at INR 129 ($1.75).

Gome Flagship Store Launches in JD.com

(March 16) Retailnews.asia

Gome Flagship Store Launches in JD.com

(March 16) Retailnews.asia

- China’s electrical appliance retailer Gome has launched a flagship store on JD.com, in a move to expand its customer reach by tapping into JD.com’s 360 million active annual users.

- The company will use JD’s supply chain to introduce consumer goods to its online platform gome.com. As part of this partnership, JD will provide data, technology and customer service-related support to Gome.

LATIN AMERICA RETAIL AND TECH HEADLINES

Carrefour Implements Measures To Help Elderly Customers in Argentina

(March 16) America-Retail.com

Carrefour Implements Measures To Help Elderly Customers in Argentina

(March 16) America-Retail.com

- Supermarket chain Carrefour has implemented measures to help customers over 65 in Argentina shop during the coronavirus outbreak, offering hours for people over the age of 65 only from 7:30 to 8:30 am Monday to Saturday.

- The company will also allow older shoppers to place orders via telephone for home delivery.

![]() Makro To Launch New Store Format in Colombia

(March 16) America-Retail.com

Makro To Launch New Store Format in Colombia

(March 16) America-Retail.com

- Wholesale retailer Makro plans to test a smaller store format in the Colombian city Barranquilla, and if successful, will be replicated across South America.

- The new store Makro Urban format will take up just 19,000 square feet, compared to the typical 86,000-96,000 square feet. The company also plans to invest $110–120 million to expand in Colombia in the next three to four years.

![]() Lacoste Opens a New Store in Mexico

(March 16) Modaes.com

Lacoste Opens a New Store in Mexico

(March 16) Modaes.com

- French clothing brand Lacoste has opened a new store in Puebla, Mexico. The brand currently has more than 30 stores in various cities in Mexico.

- The new store is located in the Angelópolis shopping complex and offers a wide variety of footwear, clothing and accessories.

El Palacio de Hierro Brings Two New Fashion Brands To Its Stores

(March 16) FashionNetwork.com

El Palacio de Hierro Brings Two New Fashion Brands To Its Stores

(March 16) FashionNetwork.com

- Mexican luxury department store El Palacio de Hierro has announced the arrival of two new brands to its stores on March 16—Gucci Kids and its own women’s footwear brand Chester & Peck.

- Gucci Kids products are available exclusively at the El Palacio de Hierro Perisur branch in Mexico City, while Chester & Peck products are available in El Palacio de Hierro branches of Polanco, Perisur, Satélite as well as on its online store.

MACROECONOMIC UPDATE

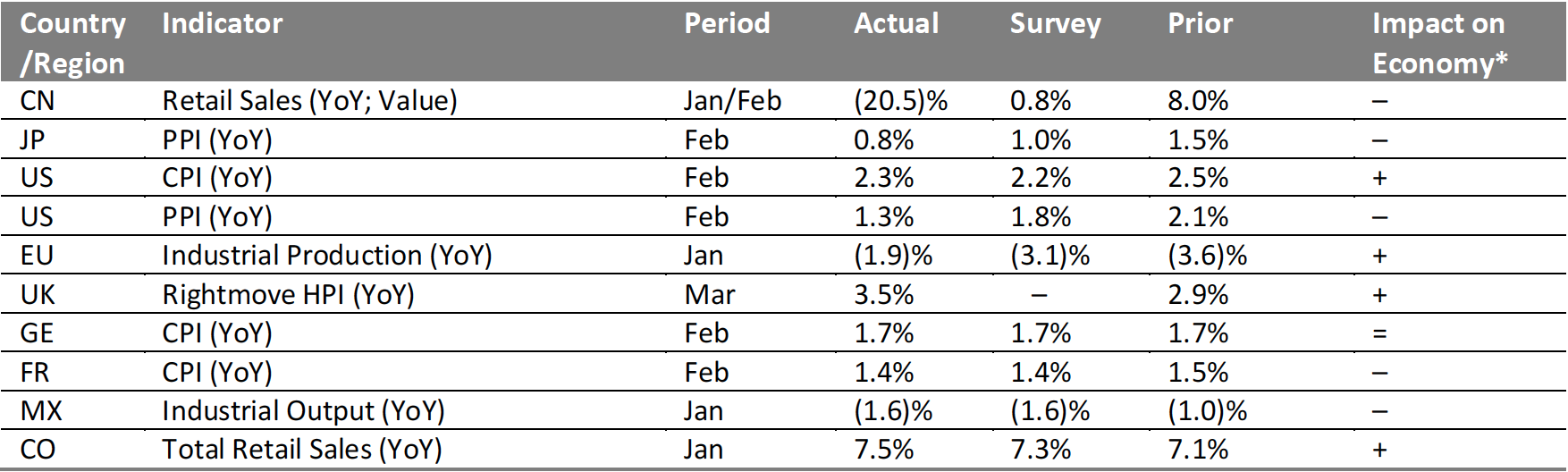

Key points from global macro indicators released March 11–17, 2020:

- Asia Pacific: China’s retail trade declined 20.5% year over year in January and February combined, the first drop since the series started in 1993, and far below December’s 8.0% rise and the consensus estimate of 0.8%. The record low was driven by the coronavirus shutdown. In Japan, the Producer Price Index (PPI) was up 0.8% year over year in February, slower than the 1.5% increase in January and below the consensus estimate of 1.0%.

- US: The consumer price index (CPI) was up 2.3% year over year in February, versus 2.5% growth in January. The PPI was up 1.3% year over year in February, versus 2.1% growth in December and below the consensus estimate of 1.8%.

- Europe: Eurozone industrial production dropped 1.9% year over year in January, following a 3.6% decline in December but better than the consensus estimate of (3.1)%. In the UK, the Rightmove House Price Index (HPI) increased 3.5% year over year in March, following a 2.9% increase in February.

- Latin America: Industrial production in Mexico fell 1.6% year over year in January, versus a 1.0% drop in December and in line with consensus estimate. In Colombia, total real retail sales posted a 7.5% year over year rise in January, following a 7.1% rise in December.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: National Bureau of Statistics China/Bank of Japan/US Bureau of Labor Statistics/Eurostat/Rightmove/DESTATIS/INSEE/INEGI/DANE/Coresight Research[/caption]

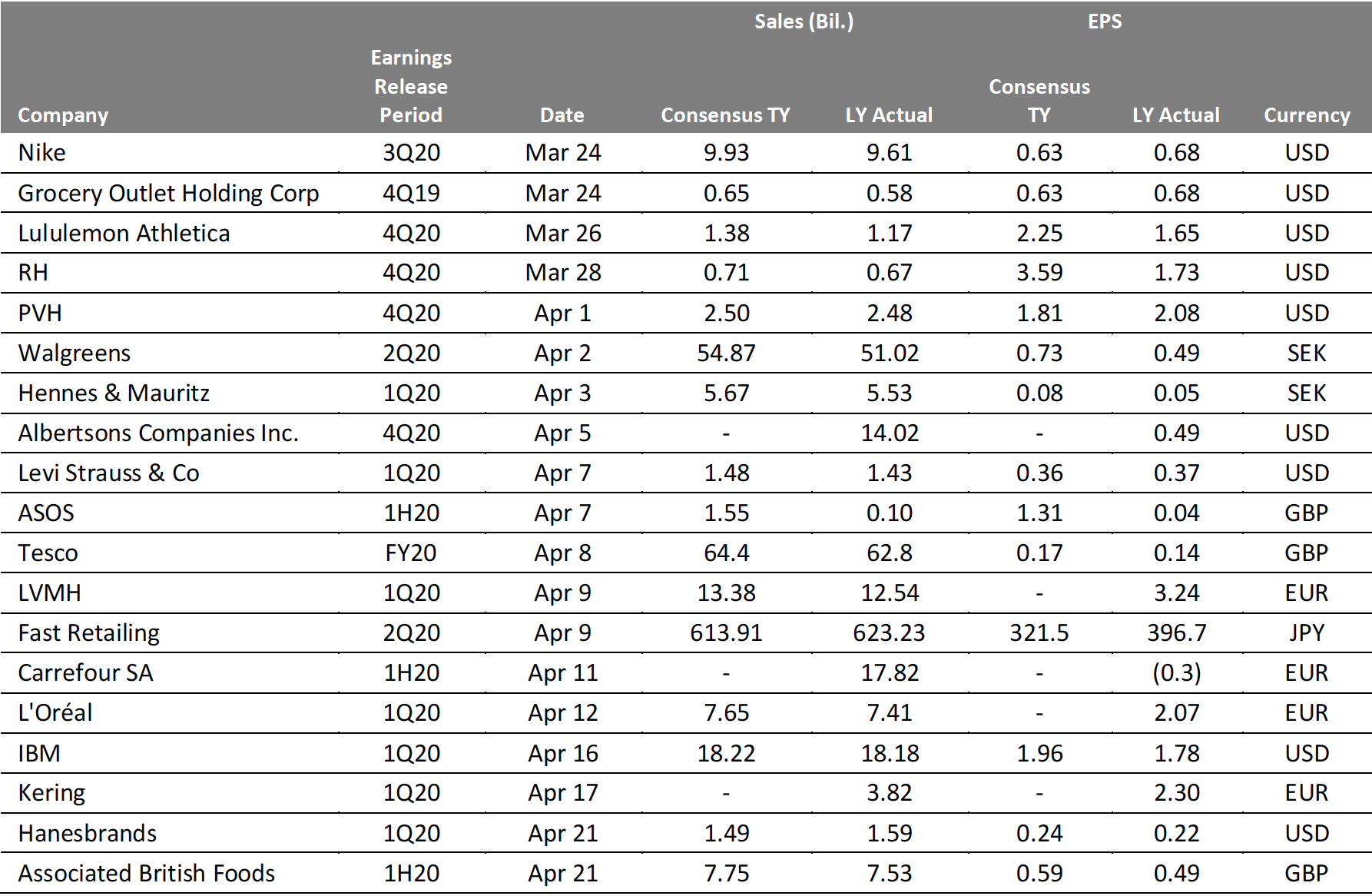

EARNINGS CALENDAR

[caption id="attachment_105834" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]