Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

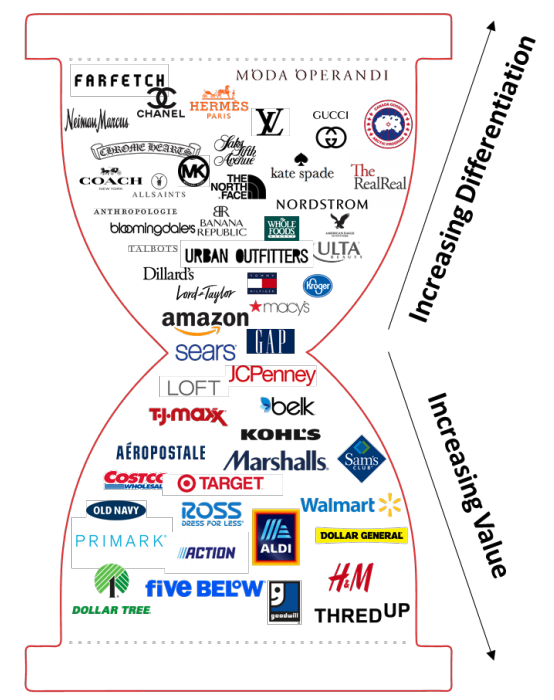

Discount Stores Are Still Booming After years of (more or less) steadily rising retailer store closure announcements, Ross Stores recently dropped a stunning headline: The company opened 19 stores in the first quarter, and plans to open a total of 100 new stores in fiscal 2020. The entire discount-store category has been flourishing, posting years of steady net store openings, as shown in the graph below. Although total net new store openings dipped in 2019, we expect growth to revive in 2020. [caption id="attachment_105160" align="aligncenter" width="700"] Weinswig’s Hourglass

Weinswig’s HourglassSource: Coresight Research[/caption] For additional information, please watch for the upcoming Coresight Research report Off-Price Retail: Two Companies Dominate the Market.

US RETAIL AND TECH HEADLINES

Coach CEO and Brand President Departs While Tapestry CEO Stays

(March 9) Company press release

Coach CEO and Brand President Departs While Tapestry CEO Stays

(March 9) Company press release

- Tapestry-owned Coach has announced that its CEO and Brand President Joshua Schulman will step down to be temporarily replaced by Tapestry Chairman and CEO Jide Zeitlin.

- Schulman joined Coach as Brand President in 2017. Prior to joining Coach, he had worked with companies including Jimmy Choo and Gap. While in search of a permanent successor, Zeitlin will directly oversee Coach’s operations and strategies.

- Dick’s Sporting Goods revenues increased 4.7% to $2.61 billion during the fourth quarter, ended February 1. Same store sales increased 5.3%. Full-year diluted EPS was up 3% to $3.34 versus $3.24 in the year-ago period.

- The company plans to remove its hunting category, which includes guns, from nearly 440 additional stores in 2020.

- Amazon announced it will license its Just Walk Out cashierless store technology to other retailers, including installation and 24-hour support.

- Shoppers enter the store with a credit card and the Just Walk Out technology tracks products purchased in a virtual cart. Once customers finish shopping, the credit card is billed for the items in the virtual cart. Shoppers can get an email receipt if they sign up for it at an in-store kiosk.

- Discount retailer Ross Stores announced it will open 100 new stores in fiscal 2020, including 19 Ross Dress for Less and seven dd’s DISCOUNTS already opened this year. The expansion will include 75 Ross and 25 dd’s DISCOUNTS stores.

- Gregg McGillis, Group EVP, Property Development, said the company now operates a total of 1,831 Ross Dress for Less and dd’s DISCOUNTS locations in 39 states, and the company plans to grow the Ross Dress for Less chain to 2,400 locations and the dd’s DISCOUNTS chain to 600.

Art Van Furniture Files for Chapter 11 Bankruptcy

(March 9) Furnituretoday.com

Art Van Furniture Files for Chapter 11 Bankruptcy

(March 9) Furnituretoday.com

- Furniture retail chain Art Van Furniture has filed for Chapter 11 bankruptcy protection, estimating the retailer has between $100 million and $500 million in assets and a similar amount of debt.

- The company started liquidating its stores on March 6 and the process is estimated to take about 60 days, according to the company. The liquidation will include 72 furniture and mattress stores and 77 freestanding PureSleep locations.

EUROPE RETAIL AND TECH HEADLINES

- UK retail sales picked up 0.1% year over year in February, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 0.4%. BRC Chief Executive Helen Dickinson said sales were affected by three major storms—Ciara, Dennis and Jorge—and that at the end of the month spending on food and healthcare rose due to concerns about coronavirus.

- In the three months ended February, total food sales increased 1.0% and total in-store nonfood sales increased 0.7%.

- Italian fashion brand Benetton Group has appointed Massimo Renon as CEO. The group, owned by holding company Edizione, has been without a CEO since 2017.

- Renon was CEO of eyewear group Marcolin and will end his contract with the company on April 14.

B&M Sells Its German Unit

(March 10) Company press release

B&M Sells Its German Unit

(March 10) Company press release

- B&M announced it will sell its German retail business Jawoll five months after a strategic review of its performance. B&M will sell its 80% stake in the business to a consortium led by AC Curtis Salta for €12.5 million ($14.15 million).

- The company said €2.5 million ($2.8 million) will be payable upon completion of the transaction and the remaining €10 million ($11.3 million) on December 31, conditional on the ongoing trading of the business.

- French Connection has reported a £2.9 million ($3.75 million) loss for the year ending January 31. Its revenues dropped 11.4% to £119.9 million ($154.99 million) due to store closures, a weak trading environment in the UK and uncertainty due to the coronavirus outbreak.

- The company closed 11 stores, three outlets and four concessions, driving down revenues 20%. The company also closed its loss-making China and Hong Kong joint-venture stores, which generated a loss of £500,000 ($650,000).

- Spanish supermarket chain Mercadona has announced it will sell its portfolio of 36 properties in Spain. The company expects to raise €200 million ($226.34 million) under a sale and leaseback formula.

- Chairman Juan Roig said Mercadona owns a significant number of properties due to investments made in land and local acquisitions last year and is now looking to sell and use the resources to transform the firm.

ASIA RETAIL AND TECH HEADLINES

- Tesco has agreed to sell its Thailand and Malaysia business for $10.6 billion to CP Group entities. The board intends to return £5 billion ($6.5 billion) to shareholders through a special dividend.

- The deal will be completed in the second half of this year, subject to customary regulatory approval in Thailand and Malaysia, and Tesco Group shareholder approval.

- IKEA has announced it will open a virtual store on Alibaba’s e-commerce platform Tmall, the first time it will sell through a third party. The store will showcase around 3,800 IKEA products and offer delivery and assembly services.

- IKEA will use this to evaluate how third-party platforms fit into its channel mix. The move also helps IKEA reach shoppers in China at a time when its 30 stores there are closed due to the coronavirus outbreak.

- Alibaba has launched a three-year plan to make its Alipay mobile app platform available to 40 million service providers in China. Alipay will work with 50,000 independent software vendors (ISVs) to help service providers digitalize operations and reach more customers.

- The ISVs will package Alipay technologies into applications that serve specific industries and use cases, including consumer retail, food services, hotels, transportation and medical services.

- Carrefour, operated in Pakistan by the Majid Al Futtaim retail group, has introduced a mobile app to serve customers in Lahore.

- With the app, customers can shop around 50,000 products available at the store for delivery to the home. The app will offer grocery and household products first, then expand to include clothing, light household items and fresh food.

- Walter Mart has opened six new stores in the Philippines in Luzon province, adding an online capability as well. The company said online will let it expand its customer base beyond the reach of physical stores.

- GM Rosemarie Caalam said that the expansion will boost Walter Mart’s presence in Luzon. Currently, Walter Mart has 41 stores in Manila, central and southern Luzon.

LATIN AMERICA RETAIL AND TECH HEADLINES

Inditex To Strengthen Its Online Presence in Latin America

(March 10) Modaes.com

Inditex To Strengthen Its Online Presence in Latin America

(March 10) Modaes.com

- Spanish fashion retailer Inditex plans to launch online Zara stores in Uruguay, Argentina and Peru. The online stores in Peru and Uruguay will launch on March 18, and in Argentina a few days later.

- The stores will carry Zara’s entire collection of clothing and accessories for women, men and children. This move is part of expansion plans laid out by Inditex in September 2018 to expand its online presence to all countries in the world in 2020.

- The Argentine Chamber of Electronic Commerce said e-commerce sales grew 76% in 2019, generating a total of ARS 400 billion ($6.46 billion).

- In 2019, 146 million products were sold online, up 22% from last year. Argentina also saw an increase in online customers, with 828,000 new online consumers in 2019.

Microsoft and Falabella Team Up To Deliver Digital Skills Training in Chile

(March 10) DF.c

Microsoft and Falabella Team Up To Deliver Digital Skills Training in Chile

(March 10) DF.c

- Falabella and Microsoft have signed an agreement to provide training to retail collaborators in Chile to develop digital skills. The program will focus on computational thinking, data analysis and generation of interactive graphics.

- This agreement is part of “Career Pathway,” a worldwide Microsoft program that seeks to reduce the technological skills gap in workers, ensuring they have the necessary tools to navigate future digitalization of the workplace.

Tag Heuer Presents New Collection with a Pop-Up Store in Mexico City

(March 10) FashionNetwork.com

Tag Heuer Presents New Collection with a Pop-Up Store in Mexico City

(March 10) FashionNetwork.com

- Swiss luxury watchmaker Tag Heuer opened a pop-up store in Mexico City to showcase the latest edition of its Autavia collection in one of the El Palacio de Hierro department stores. The collection featured five new models, all with the characteristic propeller and tire logo engraved in their display.

- Autavia, derived from a combination of the words “automobile and aviation,” was first launched in 1962 and versions of the first pulse chronograph created by Jack Heuer that year were exhibited in the store.

- Walmart Argentina has launched a new real-time tracking option for online purchases which customers sign up for via the email confirming the purchase.

- The service gives customers tracking information on the order, route information and the ability to track in real time until delivery.

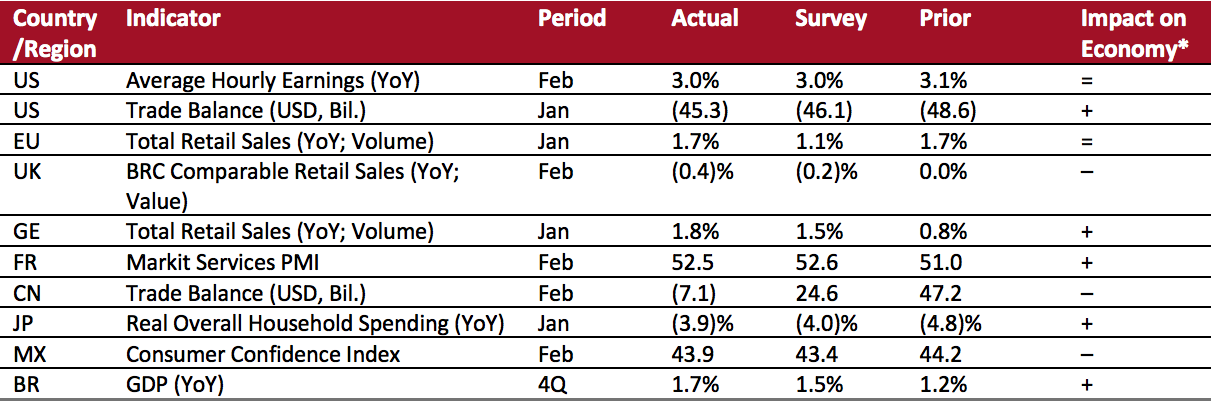

MACROECONOMIC UPDATE

Key points from global macro indicators released March 4–10, 2020:- US: Average hourly earnings increased 3.0% year over year in February, following 3.1% growth in January and in line with the consensus estimate. The trade deficit decreased to $45.3 billion in January from $48.6 billion in December.

- Europe: In the eurozone, total retail sales growth by volume stood at 1.7% year over year in January, above the consensus estimate of 1.1%. In the UK, comparable retail sales dropped 0.4% year over year in February, versus flat comparable retail sales in January, as recorded by the British Retail Consortium (BRC), and below the consensus estimate of (0.2)%.

- Asia: China recorded a trade deficit of $7.1 billion in February, a significant turnaround from January’s $47.2 billion surplus and significantly below the consensus estimate of a $24.6 billion surplus; the coronavirus shutdown drove this slump. In Japan, overall household spending fell 3.9% in real terms year over year in January, versus a 4.8% drop in December but better than the consensus estimate of (4.0)%.

- Latin America: In Mexico, the consumer confidence index fell to 43.9 in February from 44.2 in January, but was above the consensus estimate of 43.4. In Brazil, gross domestic product expanded 1.7% year over year in the fourth quarter, following a 1.2% increase in the third quarter and beating the consensus estimate of 1.5%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Labor Statistics/BEA/Eurostat/BRC/DESTATIS/Markit Economics/GACC

China/Statistics Bureau of Japan/INEGI/IBGE/Coresight Research[/caption]

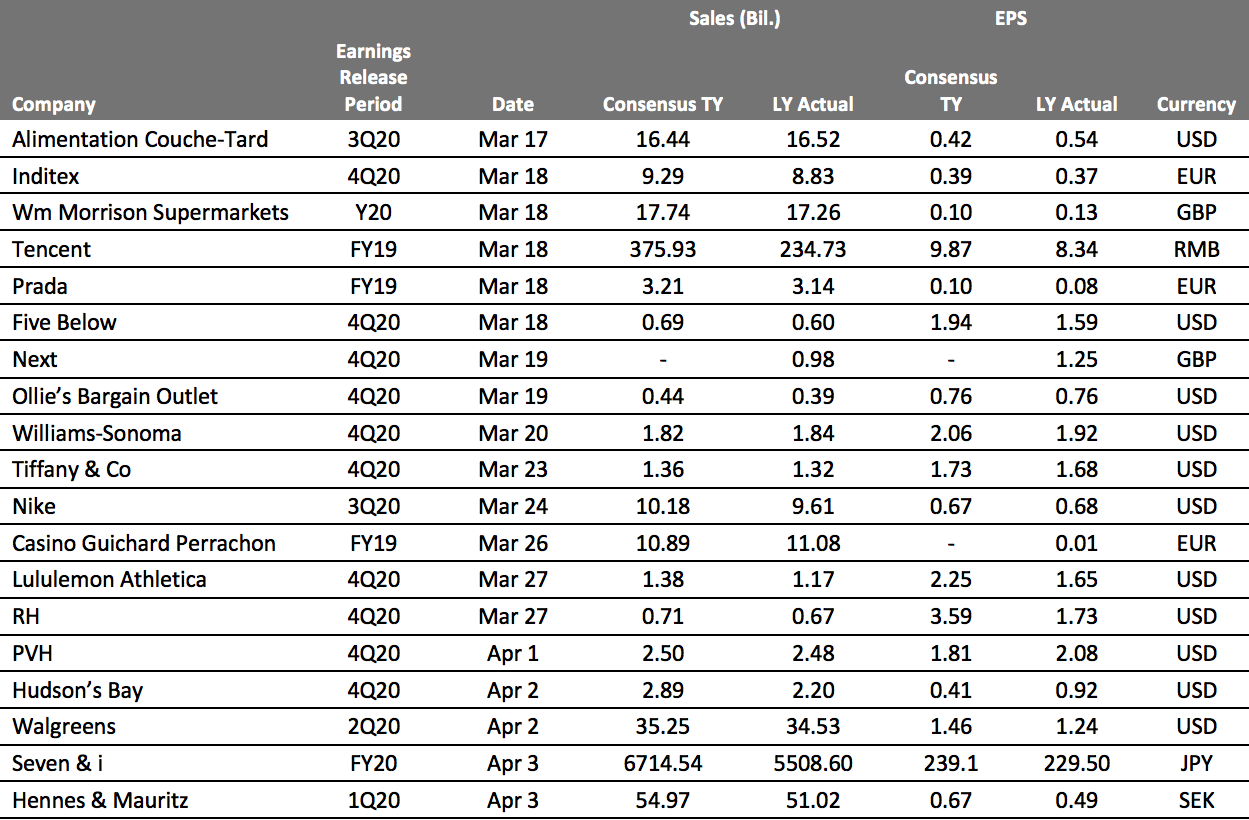

EARNINGS CALENDAR

[caption id="attachment_105183" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]