Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Amazon Makes a Go in Unstaffed Grocery Stores This week, Amazon opened a new grocery store called Amazon Go Grocery in the Capitol Hill neighborhood of Seattle that uses the same unstaffed technology used in its Amazon Go stores. The new store works exactly the same way: the consumer scans a QR code for entry, collects and scans items for purchase and simply walks out, with the items billed to the consumer’s Amazon account. The new store occupies 10,400 square feet, the size of an average urban grocery store but about a quarter of the size of a typical suburban grocery store. It features about 5,000 items including fresh produce, seafood, meats, baked goods, plus meal kits, wine and beer. Its assortment also includes Whole Foods and Amazon private-label brands. Fresh produce carries individual price tags, freeing the consumer from having to weigh each item. It is notable that the new store comes under the Amazon Go banner, which implies Amazon sees Go Grocery as more of a convenience store than a fully stocked grocery store. Whereas existing Amazon Go stores are stocked similar to a convenience store for urban consumers, including a significant amount of food to go such as sandwiches and snacks in 500-2,000 square feet of space, the first Amazon Go Grocery store is 10 to 20 times that size and stocked like a “neighborhood market,” as characterized by an Amazon executive to CNBC. Amazon opened its first Amazon Go store exclusively to employees in December 2016 and spent the intervening time ironing out technology wrinkles until its first store opened to the public in January 2018. Since then, Amazon has improved the machine-vision technology and algorithms such that cameras can distinguish between items as diverse as produce and wine, improvements that enable this much larger store. An Amazon executive commented to the Wall Street Journal that its unstaffed technology faces no upper limit from store size. With the new Amazon Go Grocery store, Amazon appears to be experimenting with a new grocery concept that fits along the spectrum between a convenience store and a full-service grocery store: Amazon’s grocery portfolio now includes Amazon Go, Amazon Go Grocery and Whole Foods Markets. Amazon has also been working on opening more-traditional grocery stores. The company is reportedly planning to open several dozen grocery stores in major US cities, and has already signed leases in Los Angeles. These stores will not be under the Whole Foods Market banner and are expected to offer a wider, more typical assortment at lower price points, including items that contain artificial ingredients and other additives, as compared to the healthier assortment at a typical Whole Foods store. In addition to operating its own stores, Amazon could license its technology to other retailers and locations, such as airports or sports stadiums, or even offer unstaffed stores as a service to retailers. Amazon already has partnerships with Kohl’s and Rite Aid for package pickup and drop-off, and drugstores could also benefit from Amazon’s unstaffed technology. While the Amazon Go Grocery store is currently one-of-a-kind, Amazon continues to experiment with other formats such as its 4-star stores, and the new fleet of Amazon grocery stores is likely just around the corner. The new Amazon Go Grocery store demonstrates the attractiveness of the grocery/prepared food space and shows there is still lots of room for innovation. See our other research on Amazon’s moves into grocery, including: How Is Amazon Leveraging the Whole Foods Acquisition? Amazon Reportedly Planning to Open Several Dozen Non-Whole Foods-Branded Grocery Stores Amazon’s Ambitious Plan to Disrupt Convenience Stores—and Maybe Quick Service Restaurants, Too

US RETAIL AND TECH HEADLINES

- Forever 21’s new co-owner Authentic Brands Group has appointed Daniel Kulle as CEO. Previously, Kulle served as a strategic adviser to former H&M Group CEO Karl Johan Persson.

- Authentic Brands believes, under the new CEO’s direction, Forever 21 will enhance the company’s loyalty program and improve its online and in-store shopping experience.

- Amazon unveiled its first full-sized cashierless grocery store in Seattle’s Capitol Hill called Amazon Go Grocery. The store lets shoppers buy without having to wait in line: Shoppers scan items on their phones, pay with their phones and then walk out.

- At 10,400 square feet and with roughly 5,000 items including fresh produce, meats and alcohol, the store is a full-sized grocery store, as opposed to the much smaller Amazon Go convenience stores.

- Walmart has launched Walmart Fulfillment Services (WFS), which lets third-party vendors use the retailer’s services and facilities to store, pack and ship items for customers.

- The WFS debut follows a soft launch a few months ago, with participating sellers offering items such as footwear, apparel, home décor, sporting goods and electronics. The service was developed with marketplace seller input and does not have a monthly membership fee.

- Rue21 has announced Michael Appel will no longer serve as CEO and Chairman of the company and will resume his consulting practice. Appel was appointed CEO in November 2018, replacing Laurie Van Brunt.

- The company has named John Fleming as interim CEO and Scott Vogel as Chairman.

- Sporting goods retailer Modell’s announced it will close only 19 stores after initially announcing plans to shut 24 stores. CEO Mitchell Modell also said he is willing to sell a minority stake in the family-owned business.

- The five stores saved from closure after successful negotiations with landlords will preserve 81 jobs.

EUROPE RETAIL AND TECH HEADLINES

- Burberry has launched a new augmented reality (AR) tool which shows customers 3D images of the luxury brand’s products against a backdrop of other real-life objects in the users’ environment.

- The tool is currently available for searches of Burberry’s Black TB bag and the Arthur Check sneaker in the UK and the US. The company plans to expand the tool to include more products and geographies.

- Tesco has announced a slew of changes to transform its bakeries in large stores. The retailer said customers are purchasing fewer traditional loaves of bread, looking for alternatives such as wraps, bagels and flatbread.

- The company plans to remodel space and use partly baked products in some in-store bakeries.

- UK lingerie chain Boux Avenue has hired Deloitte to conduct a strategic review of the business as it considers insolvency to close stores.

- Boux Avenue has around 30 stores in the UK and is currently under mounting pressure of increased rents.

- UK supermarket retailer Sainsbury’s has appointed Jessica Brown as head of e-commerce for its Tu clothing brand. Brown will move from Amazon after nine years with the company.

- She joined Amazon as head of fashion in 2011 and was the principal product manager for Alexa since January 2018.

- TJ Hughes owner Lewis’s Home Retail has filed a notice of intention to appoint administrators for its outlet business.

- The outlet business includes a small number of stores, of which two were saved from administration after negotiations with landlords. The retailer continues to negotiate with other landlords for rent reductions.

Associated British Foods Warns of Shortages in Primark Clothing Supply

(February 24) Company press release

Associated British Foods Warns of Shortages in Primark Clothing Supply

(February 24) Company press release

- Associated British Foods (ABF), the parent company of fashion retailer Primark, warned of possible shortages in clothing supply as a result of the coronavirus outbreak in China, the source of a significant portion of its products.

- In its pre-close update for the first half of fiscal year 2020, ABF said it expects Primark sales to climb 4.2% over last year, driven by increased selling space; and, for operating margin to come in lower than last year, at constant currency.

ASIA RETAIL AND TECH HEADLINES

Tesco Exits Its China Joint Venture

(February 25) Company press release

Tesco Exits Its China Joint Venture

(February 25) Company press release

- Tesco has sold its remaining 20% stake in Gain Land for £275 million ($357 million). Gain Land is Tesco’s joint venture with China’s state-owned conglomerate China Resources Holdings (CRH). The deal is not subject to any regulatory approvals and is expected to close on February 28.

- Tesco first entered China in 2004 through a joint venture with a local supermarket chain. In 2014, Tesco formed a joint venture with CRH and rebranded its 131 stores as CRH Vanguard stores, with CRH holding an 80% stake in the joint venture.

- European wholesale group Metro Cash & Carry plans to launch five new locations in India by the end of the year. The new stores will open in Karnataka, Andhra Pradesh and Telangana, all in the south and where the firm currently operates 27 stores in 17 cities.

- The firm is also building supply partnerships with local small-scale kirana stores and has already secured 2,000 partners in Bengaluru, Hyderabad and Delhi. The company gives these small businesses specialized point-of-sale devices outfitted with an app that helps customers pay and order items online.

Pomelo Launches In-App Livestream Technology Ahead of a New Collection

(February 24) InsideRetail.asia

Pomelo Launches In-App Livestream Technology Ahead of a New Collection

(February 24) InsideRetail.asia

- Thailand-based fashion brand Pomelo has launched a livestreaming feature in its app ahead of its new spring and summer 2020 collection. The feature lets customers preview the collection before launch.

- Pomelo will also feature onsite interviews and interactive Q&A sessions with fashion personalities on the app.

- Tech giant Microsoft has launched the 100X100X100 program to promote Software-as-a-Service (SaaS) startups in India. The initiative will introduce 100 enterprises willing to commit $100,000 to 100 SaaS startups that have enterprise-ready applications and services.

- Launched under Microsoft for Startups, the program will help firms fast track digital transformation through quicker adoption of SaaS applications. More than 50 startups were already part of the program at launch.

India Drives Puma’s Global Growth

(February 24) EconomicTimes.IndiaTimes.com

India Drives Puma’s Global Growth

(February 24) EconomicTimes.IndiaTimes.com

- Sportswear brand Puma recorded a 26% sales growth in the Asia Pacific region in fiscal year 2019, driven primarily by India and China. The Indian unit recorded revenues of INR 14 billion ($212.4 million) and like-to-like store sales growth of 17%.

- Puma operates 365 stores in India, and over the past three years has signed up local celebrity spokespeople such as cricketer Virat Kohli, boxer Mary Kom, soccer player Sunil Chhetri and actress Sarah Ali Khan.

LATIN AMERICA RETAIL AND TECH HEADLINES

Grupo Axo Acquires C&A Stores in Mexico

(February 25) America-Retail.com

Grupo Axo Acquires C&A Stores in Mexico

(February 25) America-Retail.com

- Multibrand retailer Grupo Axo has signed an agreement to acquire European fashion retailer C&A’s stores in Mexico. The companies did not disclose financial details, and the deal is subject to regulatory approval.

- Grupo Axo was established in 1994 and distributes many foreign brands in Mexico through its stores. Grupo Axo’s portfolio of managed brands includes Bath & Body Works, Calvin Klein, Tommy Hilfiger, Coach, Guess and more.

Mexican National Banks To Back Soriana Suppliers

(February 24) ElFinanciero.com

Mexican National Banks To Back Soriana Suppliers

(February 24) ElFinanciero.com

- Mexican state-owned banks Bancomext and Nafin have signed an agreement with Mexican retailer Soriana to develop financing programs to support the retailer’s suppliers and production chains.

- The agreement aims to increase local suppliers’ production and generate jobs in the southeastern regions of Mexico. Soriana is one of Mexico’s largest retailers with over 824 stores carrying 8,300 products from more than 1,770 suppliers.

The Chemist Look Expands Into Chile

(February 25) Modaes.com

The Chemist Look Expands Into Chile

(February 25) Modaes.com

- Uruguayan cosmetics company The Chemist Look has launched an online store in Chile. The cosmetics company specializes in formulas that can be used with day-to-day cosmetics to improve effectiveness.

- The company will distribute products in partnership with a local logistics company. The company also plans to open offices in Chile to take over operations currently managed by headquarters in Uruguay.

Mango to Franchise Its Online Store in Colombia

(February 24) Modaes.com

Mango to Franchise Its Online Store in Colombia

(February 24) Modaes.com

- Spanish fashion retailer Mango has started franchising its online business in Colombia with the help of its local retail partner Grupo Uribe. The business recorded 26% growth last year, with online sales of €560 million ($607 million).

- The company started franchising parts of its e-commerce platforms in countries in which it does not have a presence in 2019.

Mercado Libre To Invest $420 Million in Mexico

(February 24) America-Retail.com

Mercado Libre To Invest $420 Million in Mexico

(February 24) America-Retail.com

- Argentine e-commerce company Mercado Libre plans to invest $420 million to expand in Mexico, a 46% increase in investment compared to 2019.

- The company will focus investments on logistics, financial services and expanding brands and products. Mercado Libre’s Mexico operations recorded revenues of $275 million in 2019, 152% higher than 2018.

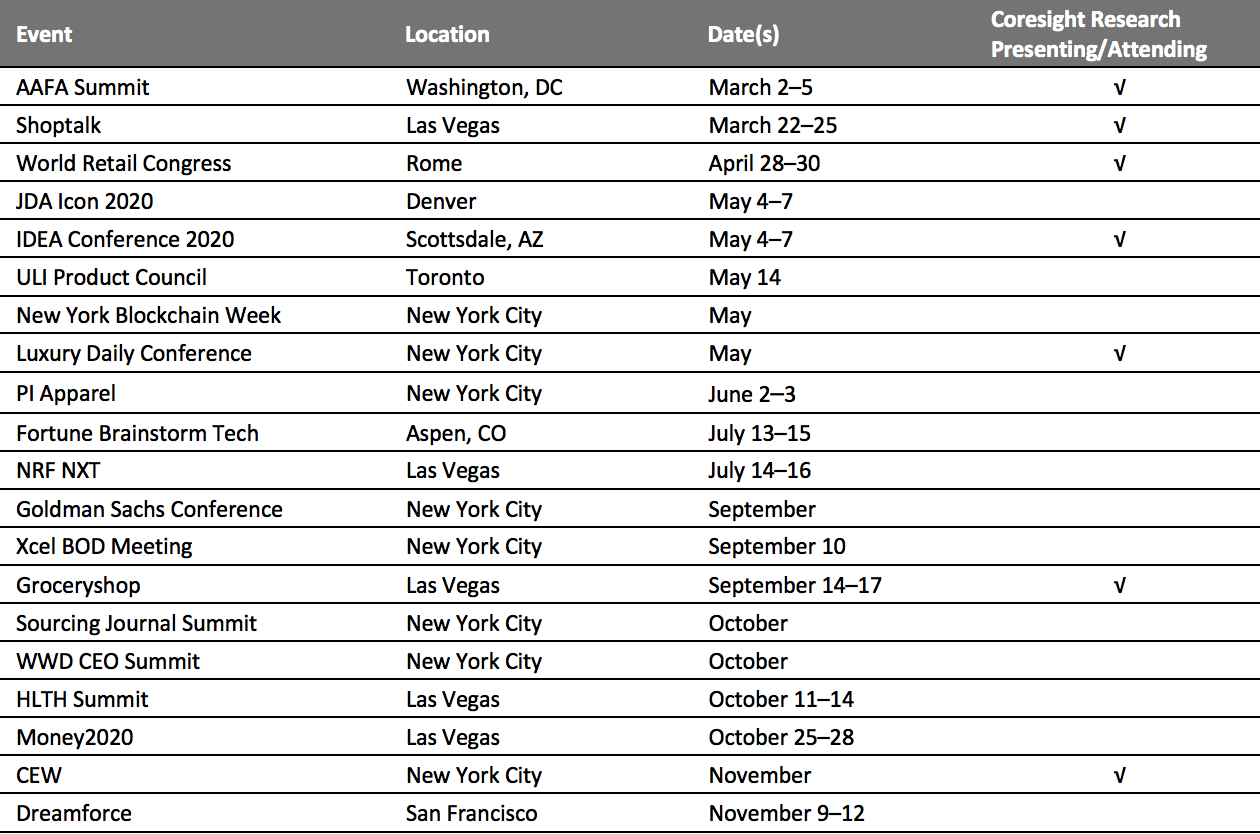

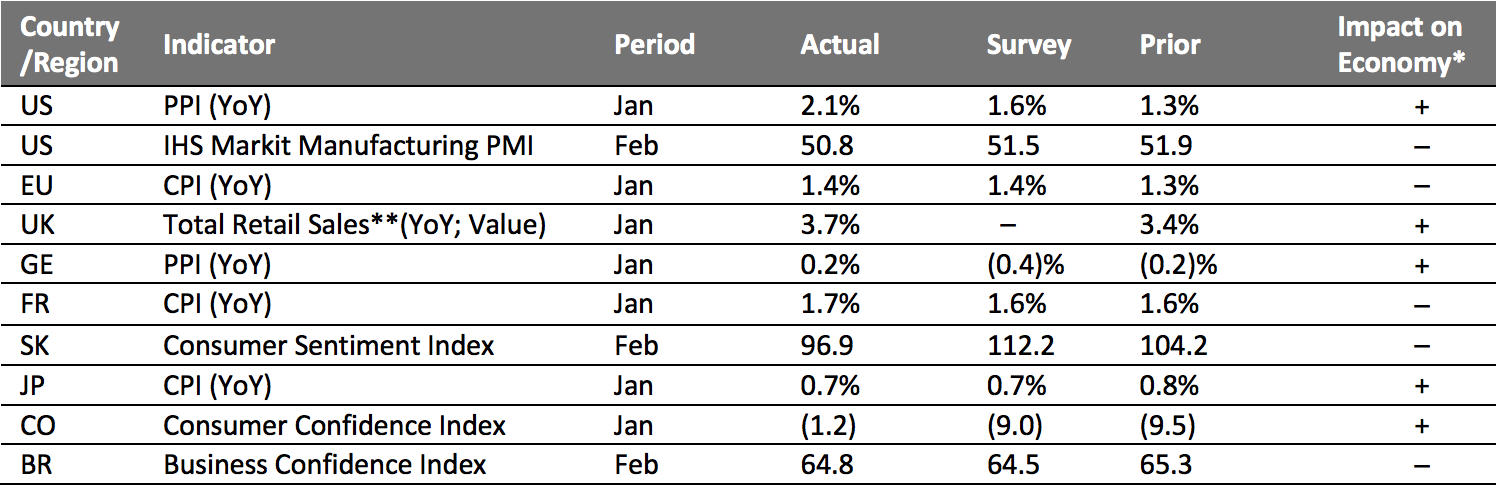

MACROECONOMIC UPDATE

Key points from global macro indicators released February 19–25, 2020:- US: The producer price index (PPI) was up 2.1% year over year in January versus a 1.3% rise in December. The IHS Markit manufacturing Purchasing Managers’ Index (PMI) was 50.8 in February, lower than 51.9 in January and below the consensus estimate of 51.5.

- Europe: The consumer price index (CPI) climbed 1.4% year over year in January, slightly ahead of 1.3% in December and in line with the consensus estimate. UK total retail sales grew 3.7% year over year in January, versus 3.4% in December.

- Asia Pacific: Japan’s CPI was up 0.7% year over year in January, slower than the 0.8% recorded in December and in line with the consensus estimate. Korea’s consumer sentiment index came in at 96.9 in February, versus 104.2 in January.

- Latin America: In Colombia, the consumer confidence index was (1.2) points in January, significantly better than the (9.5) points in December and ahead of the consensus estimate of (9.0) points. In Brazil, the business confidence index stood at 64.8 in February, below January’s 65.3.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Labor Statistics/Markit Economics/Eurostat/Office for National Statistics/DESTATIS/INSEE/Bank of Korea/Statistics Bureau of Japan/CNI/FEDESARROLLO/Coresight Research[/caption]

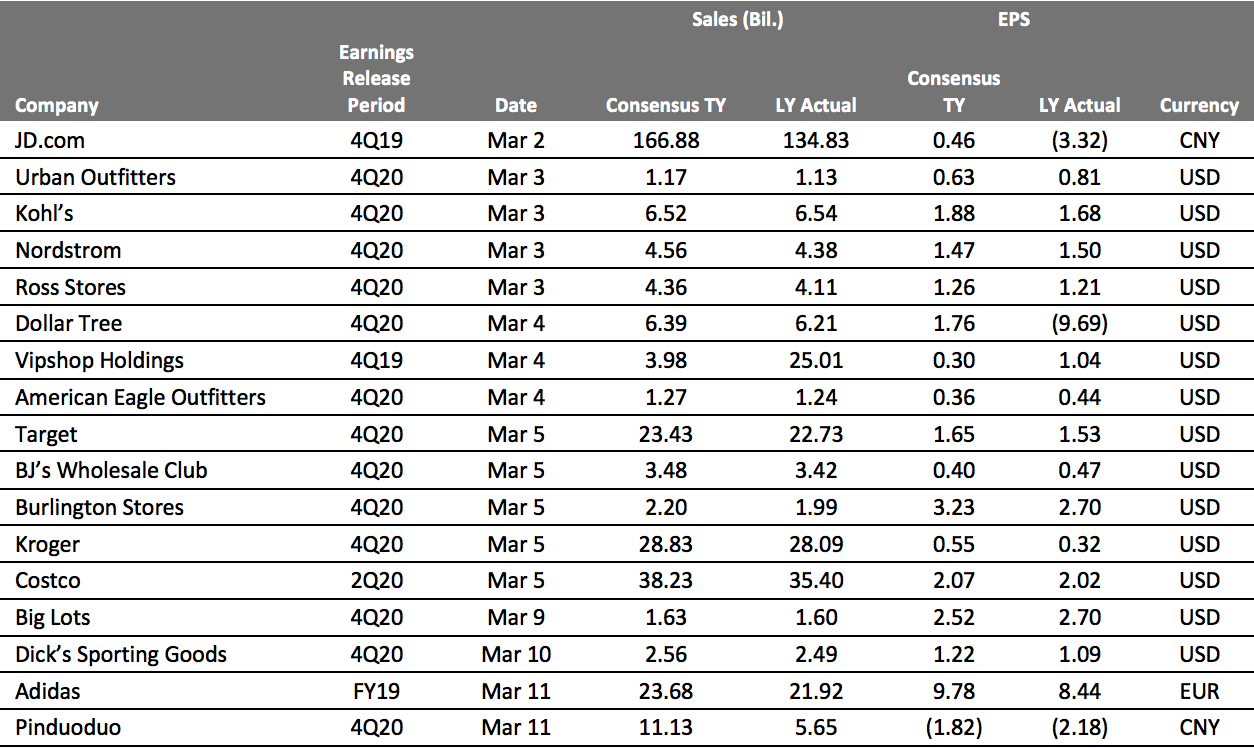

EARNINGS CALENDAR

[caption id="attachment_104322" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]