DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Welcome to 2020: Likely To Be Another Challenging Year for Retail With the champagne corks and confetti from New Year’s Eve 2019 now cleaned up, retailers are busy closing out merchandise, holding after-Christmas sales, processing returns and redeeming gift cards. The early read on the holiday season has been positive even with the abbreviated shopping calendar, with Bloomberg reporting that Super Saturday (December 21, the last Saturday before Christmas) was the biggest shopping day in US history, despite a 9.7% year over year decline in store traffic, according to Sensormatic Solutions ShopperTrak. The shortened calendar likely drove more consumers to shop online. Mastercard SpendingPulse reported that total US retail sales from November 1 through Christmas Eve increased 3.4% year over year, while online sales jumped 18.8% and in-store sales grew a paltry 1.2%. Digital accounted for a record 14.6% share of total sales. That said, many of the challenges retailers faced in 2019 will likely continue into 2020. E-commerce continues to take share from physical retail, while a host of direct-to-consumer brands are busy building relationships directly with consumers. However, physical touchpoints are proving to be pivotal to building brands and relationships—which is prompting many digital natives to open physical stores. Retailers will soon begin taking stock of holiday performance and finalizing plans for 2020. We expect a new crop of store-closure announcements as companies assess holiday performance and make tough decisions about leases and return on investment for specific store locations. And with several large retailers facing steep financial challenges, we may see further bankruptcy announcements. There is a silver lining: Old-school retail is adapting to e-commerce encroachment and getting more in tune with shifting consumer tastes, so the survivors should be better able to compete. Consumers want e-commerce, buy online, pick up in store (BOPIS) services and speedy free delivery, and retailers are working to meet these expectations. With established store footprints digital natives could never hope to match, traditional retailers that can successfully reinvent themselves as multichannel retailers stand to prosper amid the ongoing challenges. Legacy retailers seeking to thrive in a digital age can look to Coresight Research’s BEST framework, which is designed to help retailers frame their approach to physical retail, focusing on four themes:- Brand building—stores that are more than just distribution points.

- Experiences—deepen engagement with shoppers in physical stores.

- Service—differentiate through service offerings.

- Technology integration—reduce the in-store data deficit and close the gap between physical and digital retail.

US RETAIL AND TECH HEADLINES

DishDivvy Partners with DoorDash For Homemade Food Deliveries

(December 30) Prnewswire.com

DishDivvy Partners with DoorDash For Homemade Food Deliveries

(December 30) Prnewswire.com

- DishDivvy, a marketplace to connect local home cooks with nearby customers, has partnered with on-demand food delivery service DoorDash to offer door-to-door delivery for orders on the DishDivvy platform.

- Users can now pay a nominal mileage-based delivery fee for homemade food delivery from home cooks who are part of the DishDivvy network. DoorDash will be directly integrated into DishDivvy’s mobile app.

Swarovski Jewelry Collaborates with Susan Rockefeller

(December 30) Scmp.com

Swarovski Jewelry Collaborates with Susan Rockefeller

(December 30) Scmp.com

- Jewelry retailer Swarovski has partnered with Susan Rockefeller to launch Panda-themed jewelry as a part of the company’s sustainability initiative.

- The jewelry collection will include mix-and-match earrings, necklaces, bracelets, cocktail rings and bags. Proceeds will be donated to the Nature Conservancy to support giant panda protection.

Tim Hortons Regional President to Lead US, Canada and Latin America

(December 30) BakingBusiness.com

Tim Hortons Regional President to Lead US, Canada and Latin America

(December 30) BakingBusiness.com

- Canada-based coffee and fast-food company Tim Hortons has appointed Alex Schwan as Regional President of US, Canada and Latin America. Current President Alex Macedo will leave the company in March 2020.

- Schwan was previously global chief marketing officer and led the company through a series of transitions. Prior to joining Tim Hortons, Schwan was Chief Marketing Officer at Burger King.

MyValue365.com to Launch Wholesale Grocery Delivery

(December 30) Prnewswire.com

MyValue365.com to Launch Wholesale Grocery Delivery

(December 30) Prnewswire.com

- Online grocery delivery company MyValue365.com is set to launch a wholesale grocery delivery service in Chicago to cater to increasing requests from restaurants.

- The founders of MyValue365 say the customer-friendly website, standard pricing and same-day delivery service solves many pain-points for restaurants.

EUROPE RETAIL AND TECH HEADLINES

Nestlé Completes 20 Billion Share Buyback Program

(December 30) America-Retail.com

Nestlé Completes 20 Billion Share Buyback Program

(December 30) America-Retail.com

- Swiss food giant Nestlé completed its planned CHF 20 billion ($20.7 billion) share buyback this year, and plans to buy back up to CHF 20 billion worth of additional shares.

- Since July, 2017, Nestlé has repurchased more than 225 million shares at an average price of CHF 88.82 per share. The 2020 program is likely to conclude by the end of 2022.

Marks & Spencer Looking for a New Finance Chief

(December 30) RetailGazette.co.uk

Marks & Spencer Looking for a New Finance Chief

(December 30) RetailGazette.co.uk

- Marks & Spencer (M&S) is looking for a replacement for CFO Humphrey Singer.

- M&S says it will appoint an interim CFO after an initial shortlist of permanent replacements did not produce an acceptable candidate.

Joy to File for Administration

(December 30) RetailGazette.co.uk

Joy to File for Administration

(December 30) RetailGazette.co.uk

- UK fashion and lifestyle brand Joy has filed notice of its plans to appoint administrators and has put KRE Corporate Recovery on standby to handle the administration—just two years after it was acquired out of insolvency in a pre-pack deal by its founders.

- This will be the third time Joy has fallen into administration. KRE managed Joy’s previous administration in 2017.

Forever 21 Announces Store Closures in Europe

(December 30) America-Retail.com

Forever 21 Announces Store Closures in Europe

(December 30) America-Retail.com

- Forever 21 has announced it will close stores in Europe and has stopped sales on its European online store. The company filed for bankruptcy in September and expects to close about 300 stores worldwide.

- The company plans to reduce its international presence in Asia and Europe to focus on the US, Mexico and the rest of Latin America.

ASIA RETAIL AND TECH HEADLINES

Yeo Hiap Seng CEO Steps Down, Replaced by Coco-Cola VP

(December 30) BusinessTimes.com

Yeo Hiap Seng CEO Steps Down, Replaced by Coco-Cola VP

(December 30) BusinessTimes.com

- Melvin Teo, CEO of Singapore-based beverage company Yeo Hiap Seng, will step down in March to pursue other interests. The company announced that Samuel Koh, currently serving as Vice President, Business Development and Strategic Initiatives, Greater China and Korea Business for the Coca-Cola Company, will replace Teo.

- Koh will serve as group CEO-designate from Jan 14, 2020, and take over as CEO starting March 14. Teo will stay on as an adviser until July to ensure a smooth transition.

1-India Family Mart Plans to Open 100 New Stores by 2020

(December 31) FashionNetwork.com

1-India Family Mart Plans to Open 100 New Stores by 2020

(December 31) FashionNetwork.com

- Indian fashion retail chain 1-India Family Mart plans to open around 100 new stores by 2022, targeting tier-3 and tier-4 markets. The company plans to open the new stores in the states of Odisha, West Bengal and states in the far northeast.

- 1-India Family Mart sells clothing and lifestyle accessories and currently has 100 stores in 81 cities in various north Indian states. The company is expected to close this fiscal year with sales of around INR 7 billion ($98 million).

Red Chief Plans to Launch New Brands and Expand Retail Footprint in India

(December 30) FashionNetwork.com

Red Chief Plans to Launch New Brands and Expand Retail Footprint in India

(December 30) FashionNetwork.com

- India-based footwear brand Red Chief plans to launch three new sub-brands and expand its retail footprint in India in 2020, including women’s footwear brand Lamoure, men’s footwear brand Top-Brass and a unisex party wear brand.

- Red Chief plans to open 150 new stores over the next three years, nearly doubling its store count in India from 170 to 320. Red Chief currently sells through its own stores, plus over 3,000 multi-brand outlets and all leading e-commerce platforms in India.

Grab and Singtel Partner to Open a Digital Bank in Singapore

(December 30) scmp.com

Grab and Singtel Partner to Open a Digital Bank in Singapore

(December 30) scmp.com

- Singapore-based ride sharing company Grab has partnered with Singapore Telecommunications (Singtel) to apply for a full digital banking license to open a digital bank. Grab will own 60% of the joint venture and Singtel the rest.

- Grab is a ride-hailing platform that is expanding regionally. The company already has an existing base of online payments from ride-share users and local merchants.

Lakme Fashion Week Announces Four Budding Designers for Summer Resort in 2020

(December 30) scmp.com

Lakme Fashion Week Announces Four Budding Designers for Summer Resort in 2020

(December 30) scmp.com

- Lakme Fashion Week’s Gen Next committee has selected four new brands to showcase at its upcoming summer resort 2020 edition in February. The brands include Graine by Mannat Sethi and Harshna Kandhari; Chandrima by Chandrima Agnihotri; AKHL by Akhil Nagpal; and, All2Defy by Ananya Modi Jain.

- AKHL features gowns and sarees made from unique textiles, Chandrima features traditional cross-stitch embroidery from the Indian state of Gujurat, the Graine collection is made from recycled materials and All2Defy is a modern, refined take on streetwear.

LATIN AMERICA RETAIL AND TECH HEADLINES

Alpargatas Sells Its Footwear Brand Topper Argentina for $64 Million

(December 30) FashionNetwork.com

Alpargatas Sells Its Footwear Brand Topper Argentina for $64 Million

(December 30) FashionNetwork.com

- Brazilian Footwear and apparel company Alpargatas has sold its footwear brand, Topper Argentina, to owner of the Sforza group Carlos Wizard Martins.

- The brand was founded in Argentina in 1975 by the Argentine subsidiary of Alpargatas.

Buró Trade Fair Lands in Northern Colombia

(December 30) FashionNetwork.com

Buró Trade Fair Lands in Northern Colombia

(December 30) FashionNetwork.com

- Colombian business-to-consumer trade fair Buró will host an event in Cartagena from January 2 to 6—its first-ever outside Bogotá. The event is a highly curated trade fair specializing in fashion, art and gastronomy.

- Buró celebrated its twelfth edition with an event in Bogotá from December 12 to 19, attended by more than 400 Colombian brands.

Banco Azteca and Western Union Form Alliance

(December 30) America-Retail.com

Banco Azteca and Western Union Form Alliance

(December 30) America-Retail.com

- Mexico’s Banco Azteca has formed an alliance with Western Union to expand its reach in Peru. Banco Azteca has been operating in Peru since January 2008, primarily providing banking services to the lowest income sectors.

- As part of the alliance, customers can make payments on personal loans and credit card bills at the more than 3,300 Western Union branches located in shopping centers, warehouses, bookstores, pharmacies and office buildings throughout Peru.

Surtimayorista Ends 2019 with 30 Stores in Colombia and Plans to Expand in 2020

(December 30) America-retail.com

Surtimayorista Ends 2019 with 30 Stores in Colombia and Plans to Expand in 2020

(December 30) America-retail.com

- Colombian cash-and-carry retailer Surtimayorista has ended 2019 with 30 points of sale in Colombia and plans to expand in 2020. The company invested more than 20 billion pesos ($6 million) to open 12 new stores in 2019.

- Future expansion plans include digital kiosks in stores to enhance the customer experience. The company will also launch a loyalty scheme for professional clients which will feature personalized benefits.

PayPal Expands Partnership with MercadoLibre

(December 30) Pymnts.com

PayPal Expands Partnership with MercadoLibre

(December 30) Pymnts.com

- PayPal has announced it will expand its partnership with Argentinian e-commerce company MercadoLibre to increase its market share in Latin America. PayPal will integrate with MercadoLibre’s digital payment technology Mercado Pago.

- Mercado Pago users in Brazil and Mexico will now be able to use PayPal for online checkout at merchants integrated with Mercado Pago. PayPal is also expanding Xoom, its online money transfer service, to enable remittances to Mercado Pago wallets in Mexico and Brazil.

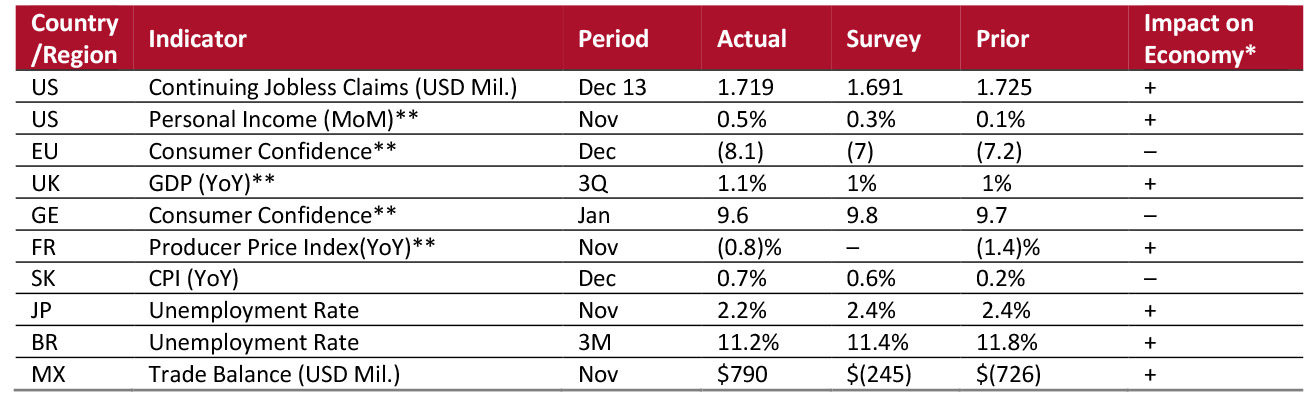

MACRO ECONOMIC UPDATE

Key points from global macro indicators released December 25–31, 2019: 1) US: Continuing jobless claims in the US fell to 1.72 million in the week ended December 13 from 1.73 million in the previous week. Personal income increased 0.5% month over month in November, faster than the 0.1% increase in October. 2) Europe: Eurozone consumer confidence fell to (8.1) in December, from (7.2) in the previous month. In the UK, gross domestic product (GDP) in volume terms increased 1.1% year over year in the third quarter ended September, versus 1% growth in the previous quarter. 3) Asia Pacific: Korea’s consumer price index (CPI) increased 0.7% year over year in December, faster than the 0.2% increase in November. Japan’s seasonally adjusted unemployment rate fell to 2.2% in November from 2.4% the previous month. 4) Latin America: Brazil’s unemployment rate fell to 11.2% for the three months ended November from 11.8% in the previous period. Mexico registered a trade surplus of $790 million in November, compared to a $726 million deficit in October. [caption id="attachment_101855" align="aligncenter" width="700"] **Indicators released from the week ended December 24 as current week indicators are not available. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

**Indicators released from the week ended December 24 as current week indicators are not available. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Department of Labor/Bureau of Economic Analysis, Department of Commerce/Eurostat/Office for National Statistics/GFK /INSEE/National Statistical Office, Korea/Statistics Bureau of Japan/IBGE/INEGI/Coresight Research [/caption]

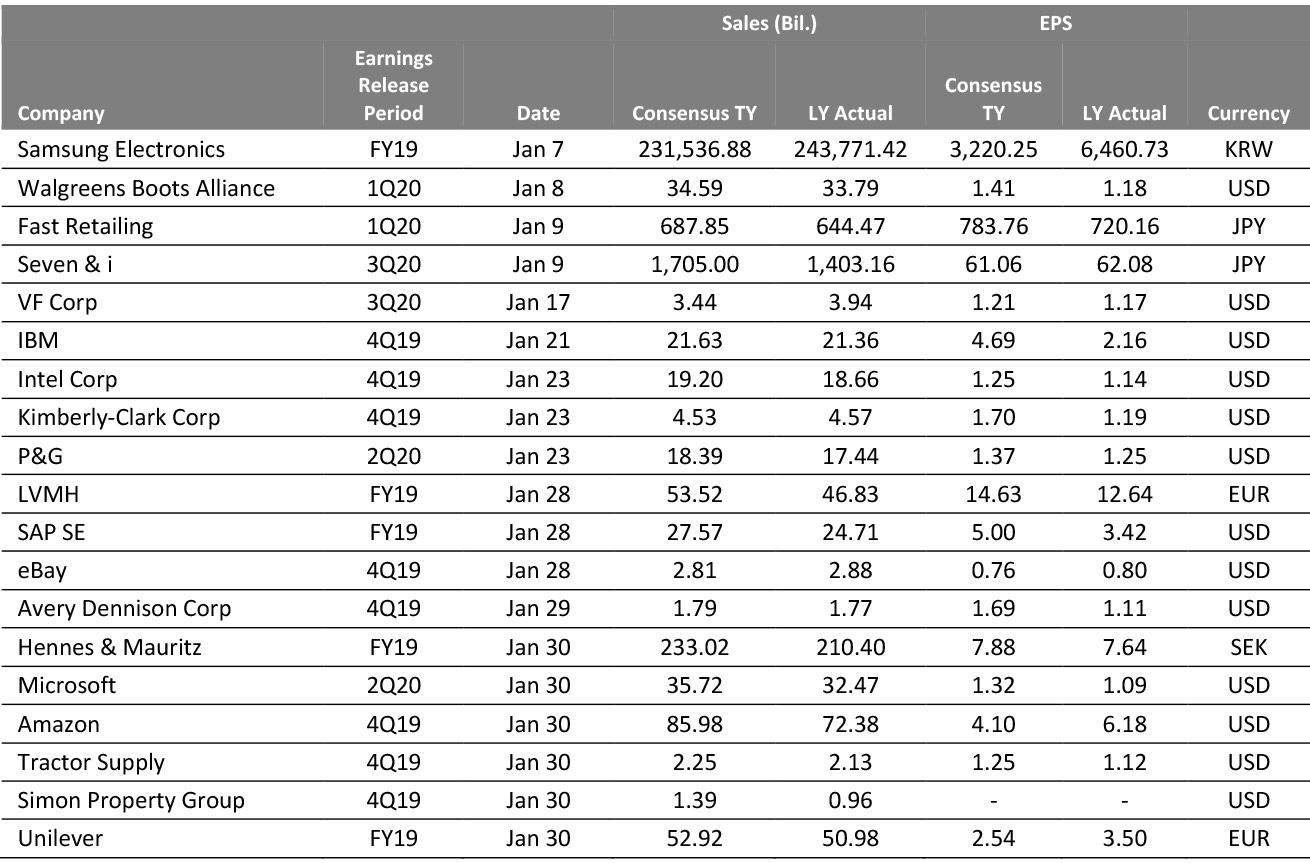

EARNINGS CALENDAR

EVENT CALENDAR