Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

What’s Walmart Doing with Jet.com? Walmart-owned Jet.com looks to be in near-terminal decline. The site saw traffic fall to an all-time low in December, according to data from web-traffic firm SimilarWeb and cited by Marketplace Pulse. The data firm found Jet’s December visits totaled just 1.4 million, sliding 82.5% from one year earlier and almost 96% from the site’s December peak 2016. The decline partly reflects Walmart’s refocusing of marketing spend from Jet.com to Walmart.com. In 2019, Marc Lore, the founder of Jet.com and President and CEO of Walmart eCommerce, said: “Across most of the country, we saw we could get a much higher return on our marketing investments with Walmart.com, so we’ve dialed up our marketing spend there.” Downsizing Jet The slump in traffic follows a series of changes at Jet and the e-commerce division of its parent company Walmart. In November, the company closed Jet.com’s grocery delivery division, which served New York, after less than a year. In October, the Wall Street Journal reported that Walmart was seeking investors to spin off its JetBlack division, which provides concierge-style personal shopping services for a $50 monthly fee. In summer 2019, Walmart fully integrated Jet’s team into the parent company. In October, Walmart sold another of its acquired pure-play brands, Modcloth. In announcing the integration of Jet with Walmart in 2019, management indicated it sees Jet as designed to help the company reach urban consumers. The New York focus of JetBlack and the site’s short-lived grocery service testify to this, and also suggest a niche emphasis that appears to be at odds with mass-market Walmart. Jet.com’s Backstory Jet began life as an online warehouse club: shoppers were encouraged to buy in bulk and the company originally planned to charge customers a monthly fee—although implementation was repeatedly deferred before being formally dropped. Shoppers were given other options to lower prices, such as in exchange for opting out of free returns. In August 2016 Walmart acquired Jet.com for $3.3 billion. Pure-Play Losses The purchase of Jet.com was part of an acquisition spree Walmart started in 2016 as it sought to scale up its online presence and close the gap with Amazon, Walmart acquired digital retailers and brands ShoeBuy, Moosejaw, ModCloth, Bonobos, Eloquii, Bare Necessities, and Jet.com. However, the sale of ModCloth and the paring back of Jet.com imply Walmart is renewing its focus on core digital assets, pushing to grow its online grocery business (most acquisitions had been in apparel) and unwilling to subsidize loss-making businesses. In mid-2019, Recode reported Walmart was on track to lose $1 billion on its US e-commerce business for the year, on revenue of $21–22 billion. As of summer 2019, JetBlack was losing $15,000 per customer annually, according to the Wall Street Journal. Walmart’s 2018 acquisition of a majority stake in loss-making Indian e-commerce platform Flipkart was another example of an online investment putting downward pressure on earnings. Supporting Walmart.com Should Walmart shrink Jet.com further or even close it, its legacy appears to have been to jump-start Walmart’s e-commerce expansion. In 2019, Lore noted: “Bringing together talent from Jet and Walmart into joint teams has created more opportunity for our business and our people.” In the meantime, Walmart.com is picking up the slack. The company has developed Walmart.com into a marketplace with a lot of choice: As of January 2018 (and restated by management in early 2019), the site offered around 75 million SKUs, up from 35 million in January 2017. The company has boosted its online offering substantially by carrying products from many more third-party sellers. In its latest reported quarter, ended October 25, 2019, Walmart US e-commerce revenues climbed 41% year over year, supported by strong online grocery growth. Pure Play Challenges While Walmart appears to have gained talent and capabilities from the Jet.com acquisition, the reported fall in traffic for Jet.com underscores the costly nature of pure-play retailing: with no stores to attract traffic, online-only retailers must spend heavily and consistently on marketing to stay top of mind among shoppers. This heavy marketing spend, coupled with the fulfillment costs associated with picking and shipping orders, typically makes online-only retailing a costly business.

US RETAIL AND TECH HEADLINES

VF Corporation Announces Plans to Optimize Brand Portfolio Under Its Work Segment

(January 21) Company press release

VF Corporation Announces Plans to Optimize Brand Portfolio Under Its Work Segment

(January 21) Company press release

- US apparel and footwear brand owner and retailer VF Corporation has announced it has started a review of strategic alternatives for the occupational portion of its Work segment to make VF a more “consumer-minded and retail-centric enterprise.”

- The nine brands under review are: Red Kap, VF Solutions, Bulwark, Workrite, Walls, Terra, Kodiak, Work Authority and Horace Small, which accounted for approximately $865 million of the company’s $4.7 billion in revenues in fiscal 2019 and approximately 50% of its Work segment sales.

- CVS Health has expanded its HealthHUB format to nine pharmacy locations in the Tampa area. The new store format offers a greater selection of health and wellness products, personalized support, counselling for chronic conditions and access to in-store community programs.

- The new HealthHUB stores in Tampa add to 15 locations in Houston and 16 in Atlanta, part of a plan to scale the concept nationally, with up to 1,500 locations in the US by the end of 2021.

- Online sneaker resale marketplace StockX announced the company exceeded $1 billion in gross merchandise volume (GMV) in 2019. Global buyer and seller registrations more than doubled in 2019, according to CEO Scott Cutler.

- StockX also saw more than 200% growth in Europe GMV last year, with international markets accounting for nearly 30% of revenue.

- Travel stop retailer Love’s Travel Stops & Country plans to open 40 new stores this year, which will include Love’s Truck Care centers and Speedco service centers.

- Love's also intends to enhance the Love's Connect mobile app with additional features and release a new mobile app for its financial services business, Love's Financial, to help users manage cash flow and expenses.

7-Eleven Acquires Its Oklahoma Franchise Stores

(January 20) Retail-Insight-Network.com

7-Eleven Acquires Its Oklahoma Franchise Stores

(January 20) Retail-Insight-Network.com

- Convenience store chain 7-Eleven has signed an agreement to acquire over 100 franchise stores in Central Oklahoma. With this acquisition, the retail chain will directly operate more than 9,700 stores in the US and Canada.

- The financial details of the deal were not disclosed and is still subject to regulatory approvals and other customary conditions, but is expected to close in the next two to three months.

EUROPE RETAIL AND TECH HEADLINES

UK Department Store Chain Beales Falls into Administration

(January 21) RetailGazette.co.uk

UK Department Store Chain Beales Falls into Administration

(January 21) RetailGazette.co.uk

- UK-based department store retailer Beales has entered administration after it failed to find a new owner, putting over 1,300 jobs at risk. Beales appointed accounting firm KPMG as administrators, and will also continue the search for a new buyer during the administration process.

- Beales did not indicate specific plans to close any of its 22 stores, but the retailer did shut its online operations.

Carrefour Acquires Potager City

(January 21) Company press release

Carrefour Acquires Potager City

(January 21) Company press release

- French retailer Carrefour has acquired Lyon-based startup Potager City. The company was founded in 2007 and offers subscription-based boxes of fresh seasonal fruits and vegetables. Carrefour expects the acquisition to strengthen its food e-commerce.

- Potager City delivers to 350 towns in France through seven logistics centers and a network of over 3,300 pick-up points. The startup has developed a network of more than 750 local producers and farmers.

- James Cox, CEO of UK-based footwear retailer Dune Group, will step down from his role on March 9 and be replaced by company founder Daniel Rubin. Cox will remain on the board as a Non-Executive Director.

- Cox joined Dune in 2010 as Group Finance Director, before being promoted to Chief Operating Officer in 2013 and finally to CEO in 2017. Rubin founded the company in 1987 and currently serves as Executive Chairman.

- UK online retailer and financial services provider The Very Group (formerly Shop Direct) has added 50 new beauty and fragrance brands (with a total of 1,320 product lines) to its portfolio through its flagship consumer brand Very.co.uk.

- co.uk said its retail beauty and fragrance sales grew 78% over the last four years, and the company plans to launch even more new brands in 2020 to expand its beauty offering.

Vesa Equity Investment Raises Stake in Groupe Casino

(January 20) Company press release

Vesa Equity Investment Raises Stake in Groupe Casino

(January 20) Company press release

- Private equity firm Vesa Equity Investment, held by Czech businessmen Daniel Kretinsky and his partner Patrik Tkac, announced it raised its equity stake in French food and general merchandise retailer Casino Group from 4.6% to 5.64%. Vesa Equity Investment bought its initial stake in Casino Group in September 2019, becoming the second largest shareholder.

- Kretinsky said the investment reaffirms the duo’s conviction that Casino Group is the best-positioned retail group on the French market and among European retailers the best able to respond to profound changes in the sector.

- Associated British Foods reported that Primark grew total UK sales 4% in the 16 weeks ended January 4, although the company noted UK comparable sales were slightly negative. Eurozone total sales were up 5.1% at constant currency, with positive comparable sales growth.

- Total Primark sales were up 4.5% at constant currency, with management pointing to an improved comparable-sales performance, driven by a “marked upturn” in the eurozone. US comparable sales were positive, though unspecified.

ASIA RETAIL AND TECH HEADLINES

- Malaysian leather goods and bags retailer Leather Avenue plans to redesign 30 of its outlets in Malaysia. The new store design is intended to give customers a more immersive experience. The concept is currently on show at its flagship store in Selangor.

- Leather Avenue Executive Director Stanny Chan said while expansion in Malaysia remains the company’s current focus, the company hopes to expand regionally over the next two to three years into Singapore, Indonesia, Thailand, Vietnam and the Philippines.

Pomelo Completes Acquisition of Looksi

(January 21) Kr-Asia.com

Pomelo Completes Acquisition of Looksi

(January 21) Kr-Asia.com

- Bangkok-based online fashion company Pomelo has completed the acquisition of Thai fashion e-commerce platform Looksi for an undisclosed sum. As a part of the deal, Looksi’s operations, social media channels and entire platform, including its user base, will be integrated with Pomelo’s app and website.

- In September 2019, Pomelo raised US$52 million in a series C funding round from Central Group and others to fund its expansion in Asia.

- China’s Tencent Holdings plans to widen the scope of its international investments and explore tie-ups with more start-ups and new market segments such as smart retail.

- Tencent President Martin Lau said there are more than 800 companies in Tencent’s investment portfolio, of which over 70 are listed, while more than 160 are unicorns or startups with a market value of US$1 billion.

- The Malaysian unit of France-based beauty and personal care chain Sephora has launched a new flagship store in the Fahrenheit88 shopping mall in downtown Kuala Lumpur. The store is the chain’s largest store in Southeast Asia at 17,000 square feet.

- The new store features over 10,000 products from 100 brands, including eight new brands. The store has a floor dedicated to Sephora University, a Sephora Lounge for events and a photography studio for beauty-brand takeovers to engage with customers, influencers and key opinion leaders (KOLs).

LATIN AMERICA RETAIL AND TECH HEADLINES

Gucci Opens a Store in Mexico City

(January 21) FashionNetwork.com

Gucci Opens a Store in Mexico City

(January 21) FashionNetwork.com

- Italian luxury brand Gucci has opened a new store in Mexico City, its 16th in Mexico and its third store in 2020. The new store will feature handbags, purses, footwear and accessories.

- The store is located inside the El Palacio de Hierro Santa Fe shopping center and shares space with other luxury brands such as Carolina Herrera, Burberry, Adolfo Domínguez and Purificación García.

Studio F Opens a New Store in Chile

(January 21) Modaes.com

Studio F Opens a New Store in Chile

(January 21) Modaes.com

- Colombian fashion brand Studio F has opened a new store in the Opel Plaza Kennedy shopping center the Chilean capital Santiago, its sixth store in Chile.

- The brand operates over 80 stores in Latin American, including Mexico, Peru, Panama, Guatemala, the Dominican Republic, Costa Rica, Paraguay and Bolivia, and has over 430 stores in Colombia.

- French supermarket chain Carrefour has relaunched “Prices Corajudos” in inflation-beleaguered Argentina. in 2019).

- The products include food, beverages, cleaning supplies and personal hygiene products. Customers can buy these products in hypermarkets, markets, and maxi express stores across the Carrefour chain.

- Spanish clothing brand Desigual has crossed the 100-store mark in Mexico with a new store in the Paseo Interlomas shopping center in Huixquilucan. Desigual has thirteen points of sale the new store follows two new outlets in Veracruz state in 2019.

- Desigual landed in Mexico in 2015, it operates nearly 500 stores in 90 countries.

H&M Signs Franchise Agreement for Central America

(January 20) FashionNetwork.com

H&M Signs Franchise Agreement for Central America

(January 20) FashionNetwork.com

- Swedish fashion retailer H&M has signed a franchise agreement with Hola Moda—a private company founded by retail groups Phoenix Group and Dorben Group, to expand and develop its brand in Central America. Hola Moda has experience in retail operations in more than 15 countries.

- H&M plans to open its first store in Central America later in the year in Panama City, Panama. H&M has 35 stores in South America in Chile, Peru and Colombia.

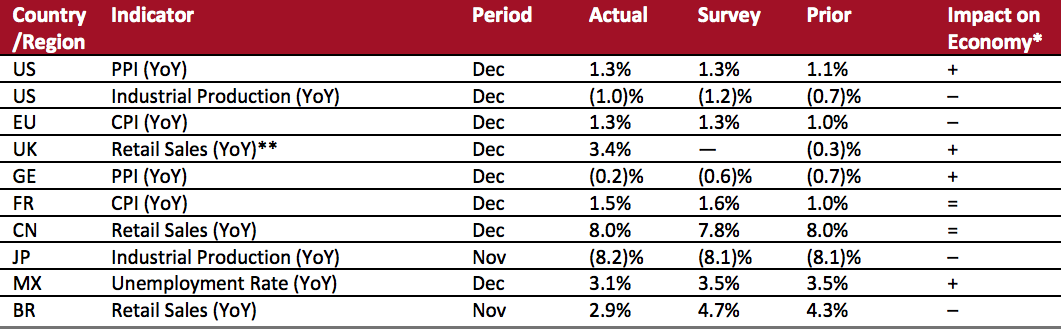

MACROECONOMIC UPDATE

Key points from global macro indicators released January 15–21, 2020:- US: The producer price index (PPI) climbed 1.3% year over year in December, versus a 1.1% increase in November, and in line with the consensus estimate. Industrial production fell 1.0% year over year in December following a 0.7% decline in November.

- Europe: In December, the eurozone’s consumer price index (CPI) remained level with November at 1.3%, in line with the consensus estimate. UK retail sales grew 3.4% year over year in December, versus a 0.3% decline in the previous month.

- Asia Pacific: In China, December total retail sales growth was level with November at 8.0%, slightly higher than the consensus estimate of 7.8%. In Japan, industrial production fell 8.2% year over year in November, following an 8.1% decrease the previous month.

- Latin America: In Brazil, total retail sales were up 2.9% year over year in November, slowing from a 4.3% increase in the previous month. In Mexico, the unemployment rate was 3.1% in December, versus 3.5% in the previous month.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.**Total retail sales ex automotive fuel

Source: US Bureau of Labor Statistics/The Federal Reserve US/Eurostat/Office for National Statistics/Statistisches Bundesamt Deutschland/INSEE/National Bureau of Statistics of China/Statistics Bureau of Japan/INEGI/IBGE/Coresight Research[/caption]

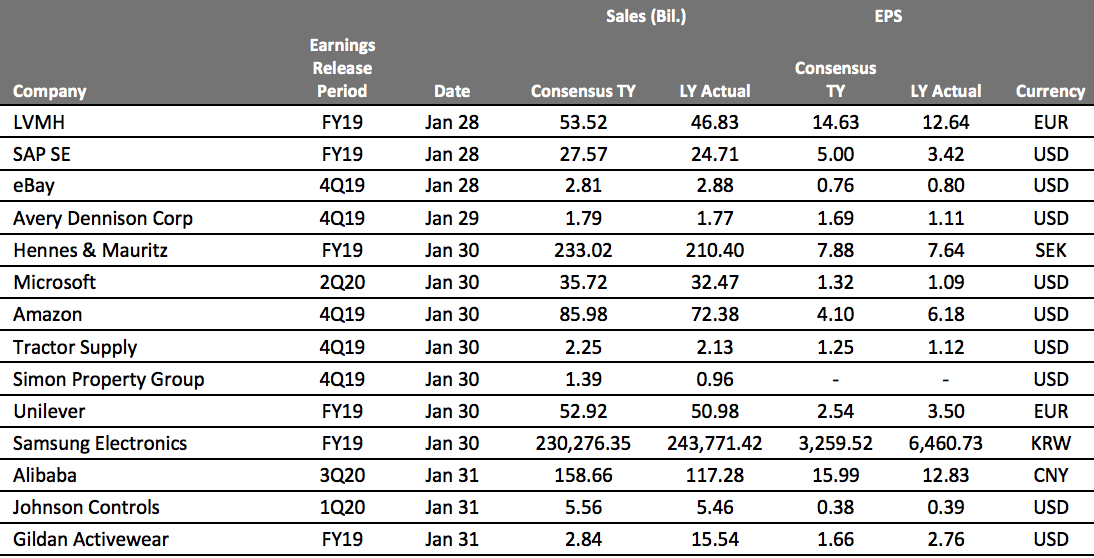

EARNINGS CALENDAR

[caption id="attachment_102700" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

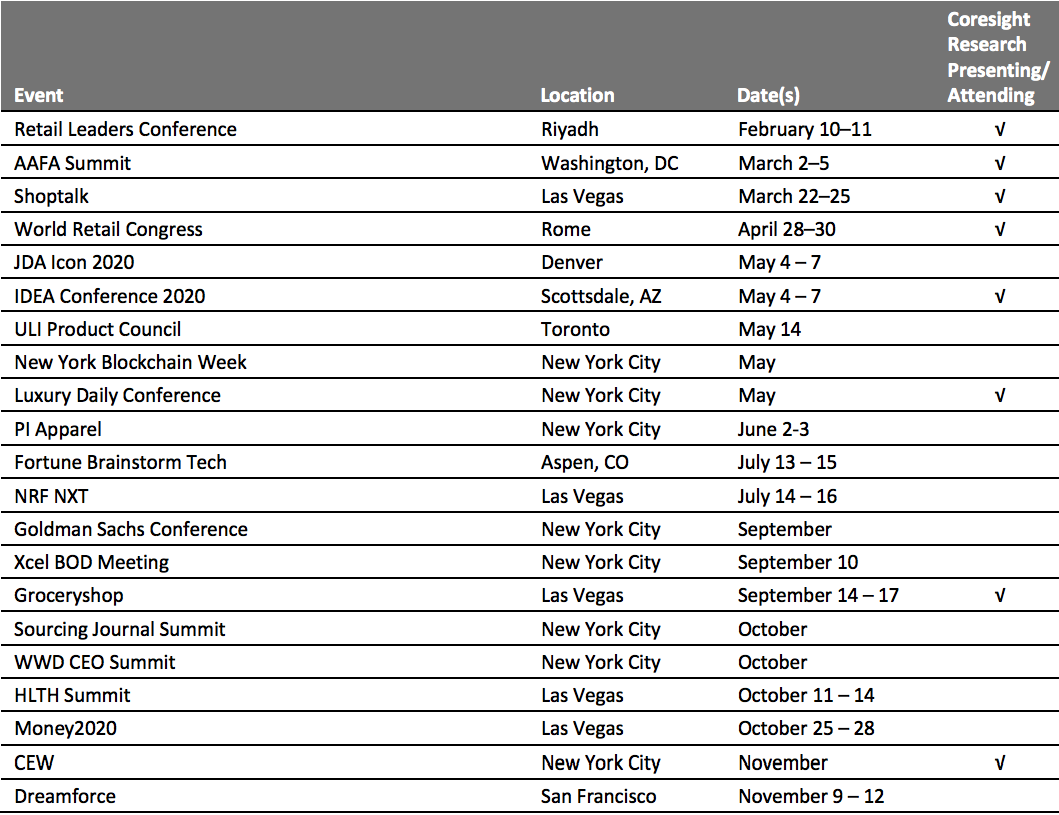

EVENT CALENDAR