DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Computer Vision Was a Major Theme at NRF 2020

This year’s annual NRF Big Show was another year of even greater interest in retail technology—and computer vision was one of the biggest themes we saw this year.

Microsoft CEO Satya Nadella outlined in his keynote address how retailers possess an enormous amount of data, generating some 40 petabytes (40 x 1015 bytes) of data per hour, and there are great potential benefits from harnessing this information. Nadella urged retailers to increase “tech intensity” to be able to use this data to amplify their strengths.

One large generator of and compelling application for data is computer vision, which was demonstrated by numerous vendors at the show. The technology, combined with artificial intelligence (AI) and the machine learning tools that power it, has made major strides: Retailers can now use AI without needing a team of PhDs in computer science to operate and maintain it. Below are some of the more interesting applications we saw at the show.

Unstaffed stores. We saw two demonstrations of the application of computer-vision technology. Intel presented a demonstration of an unstaffed store by Cloudpick, which currently operates stores in China. This deployment uses a combination of computer vision, motion detection and weight sensors to detect when a customer takes a product and walks out with it (similar to the technology used by the Amazon Go stores). Toshiba demonstrated unstaffed store technology that it says has been specifically designed to work with existing stores, no need to build out new, smart stores.

AI at the edge. Despite the enormous benefits of cloud computing, many retail computer-vision applications require rapid video processing that cannot be supported due to the relatively slow speed of uploading and processing video in the cloud. Behind the scenes were many dedicated AI processing units that perform image processing locally. These devices are largely ruggedized PCs that can be deployed in a store backroom, designed to withstand harsher operating environments than traditional desktop PCs, such as wider temperature ranges, dirt and vibration. Intel has also developed video cameras with embedded AI chips, which we saw being used by several vendors at the show.

Inventory monitoring. Computer vision has other applications inside the store. Sensormatic showed off cameras that scan store shelves to provide real-time data on inventory, alerting associates if inventory falls below a certain level.

Customer activity. Cameras can also monitor important activities such as consumer dwell time inside the store, what items they pick up, what they put back, take to the dressing room, etc. Properly analyzing this data can provide a trove of valuable insights. For example, an item frequently taken to the dressing room but which has a low conversion rate could indicate a problem with fit or material quality. Vision systems can also connect facial recognition with dwell time, not to determine customer’s identities, but for the purpose of distinguishing frequent customers who make purchases from visitors.

Collection of customer data. We also saw a demo of a smart kiosk from AT&T that leverages its high-speed 5G wireless network to display videos, which change depending on the customer profile. The kiosk can determine the viewer’s sex, age and other characteristics to offer a customized coupon via QR code that can be exchanged in the store. This data can also be combined with information on AT&T’s payment network to offer further personalized communications.

Outside-the-store applications. Sensormatic demonstrated an application that uses cameras to monitor parking in parking spaces set aside for BOPIS pickup. This can provide a feedback loop on efficiency and the amount of time required to complete an in-store pickup.

Consumers will increasingly see an array of cameras and sensors in retail stores. Although these cameras look like traditional security cameras, they are collecting data that enable retailers to better respond to customer desires, more quickly identify problems and overall to deliver a better shopping experience.

Please read our reports on the annual NRF Big Show’s Day 1, Day 2 and Day 3.

US RETAIL AND TECH HEADLINES

- Grocery delivery provider Instacart plans to expand its Instacart Pickup service to all 50 US states by the end of 2020. Instacart also announced the appointment of Sarah Mastrorocco as General Manager of Instacart Pickup.

- Instacart claims retailers experience an average 15% increase in online basket size on pick-up orders when they use Instacart Pickup, and says on one occasion close to 20% of one store’s total Instacart sales were driven by pickup orders within 4–8 weeks of release.

- US supermarket chain Giant Food Stores, a subsidiary of Ahold Delhaize, has announced plans to invest $114 million to grow its business over the next 18 months. Giant Food Stores will invest in a fulfillment center for its e-commerce brand Giant Direct, open two new stores and refurbish its 35 existing stores in 2020.

- The company will also provide increased capacity, better logistics and space to expand home delivery and in-store pick-up for online orders. In 2019, Giant Food Stores opened 17 new stores and launched two new brands, Giant Heirloom Market and Giant Direct.

- CVS Health has announced plans to remodel 600 stores into HealthHUB concept stores by the end of 2020 and to take the HealthHUB store count to 1,500 by the end of 2021. Around 20% of the store space will be allocated for health services and wellness products.

- The HealthHUB locations will also include wellness rooms for CVS professionals to host events such as health classes and seminars. The company launched the HealthHUB concept store in Houston in 2018 and expanded it to 50 locations across four markets in 2019.

- Walmart plans to expand its robotic workforce to an additional 650 stores by the end of summer, bringing robots to a total of 1,000 US stores. Walmart says the robots allow associates “to focus on serving customers and addressing areas of the store with the most need.”

- The six-foot-tall robots, designed by robotics company Bossa Nova Robotics, are fitted with 15 cameras and can conduct routine tasks such as cleaning floors, scanning shelves and unloading inventory.

Abercrombie & Fitch To Shrink Store Sizes

(January 13) Bloomberg.com

Abercrombie & Fitch To Shrink Store Sizes

(January 13) Bloomberg.com

- Abercrombie & Fitch plans to exit top malls and shopping centers as the company’s technology investments have driven online sales to about 30% of revenue. The retailer will also shrink many existing stores.

- Abercrombie & Fitch said it will also cut the number of flagship stores from 19 in 2019 to 12 by the end of 2020 as leases expire, according to Bloomberg. On Monday, CEO Fran Horowitz said continuing to adjust store footprint will be her top priority this year.

True Fit Enters Strategic Partnership with Google Cloud

(January 12) Company press release

True Fit Enters Strategic Partnership with Google Cloud

(January 12) Company press release

- Data-driven personalization platform True Fit has entered into a partnership with cloud computing services platform Google Cloud. Through this collaboration, retailers can use Google Cloud to access True Fit’s connected data set for fashion, called Fashion Genome.

- Carrie Tharp, Vice President, Retail at Google Cloud said: “We are thrilled to partner with True Fit and further help retailers harness the power of data to build better, more personalized shopping experiences that ultimately drive sales and build a more loyal customer base.”

EUROPE RETAIL AND TECH HEADLINES

Travis Perkins Appoints Christopher Rogers as Wickes Chairman Designate

(January 15) Reuters.com

Travis Perkins Appoints Christopher Rogers as Wickes Chairman Designate

(January 15) Reuters.com

- UK builders' merchant and home-improvement retailer Travis Perkins has appointed Christopher Rogers as Chairman Designate of home-improvement subsidiary Wickes. Rogers will step down as a Non-Executive Director of Travis Perkins after its annual shareholders meeting on April 28.

- In July 2019, Travis Perkins announced it was planning to separate Wickes operations from the parent company. The company said Rogers’ appointment represents “another milestone in the process,” which it says is on track to be completed in the second quarter of the year.

ASOS Launches “See My Fit” Augmented Reality App

(January 14) ChargedRetail.co.uk

ASOS Launches “See My Fit” Augmented Reality App

(January 14) ChargedRetail.co.uk

- UK online fashion and cosmetic retailer ASOS has partnered with Israeli augmented reality (AR) company Zeekit to launch the “See My Fit” AR app. Users click the See My Fit option in the app to view the product on 16 virtual models of different body sizes and types.

- ASOS is currently testing See My Fit with 800 dresses across its desktop and mobile platforms.

Auchan Unveils “Auchan 2022” Business Plan: Company To Slash More Than 500 Jobs in France

(January 14) Company press release

Auchan Unveils “Auchan 2022” Business Plan: Company To Slash More Than 500 Jobs in France

(January 14) Company press release

- French discount retail group Auchan has unveiled a business plan it calls “Auchan 2022,” which focuses on e-commerce and local products. The company also said there will be a reduction of 517 jobs in France as part of efforts to cut costs and adapt to changing shopping habits.

- Auchan aims to position itself as the benchmark player by giving customers a variety of local produce. The plan includes giving local partners space to sell products and services directly in both food and nonfood sections.

- Entertainment retailer HMV has announced five of 10 stores at risk of closing will remain open after the company secured new deals with landlords. The five locations are Glasgow Braehead, Edinburgh Ocean Terminal, Reading, Sheffield Meadowhall and Grimsby.

- HMV also confirmed the stores in Bullring & Grand Central shopping mall in Birmingham and Headrow, Leeds, will shut at the end of January. The remaining three of the total stores could also shut down at the end of this month, unless new deals are negotiated with landlords.

Very Reports 6.1% Revenue Increase Over Christmas Period

(January 15) Company press release

Very Reports 6.1% Revenue Increase Over Christmas Period

(January 15) Company press release

- UK online retailer Very reported a 6.1% increase in retail sales year over year in the seven weeks ended December 27, driven by increased revenue across all of its product categories. However, overall revenue was flat across the Very Group, including Littlewoods, although retail sales rose 2.5%.

- Online retailer and financial services provider Shop Direct recently officially rebranded itself as the Very Group, putting the group name and identity more in line with its flagship consumer brand, Very.co.uk.

ASIA RETAIL AND TECH HEADLINES

Tmall Gears up for Tokyo 2020

(January 14) Alizila.com

Tmall Gears up for Tokyo 2020

(January 14) Alizila.com

- Alibaba has launched a series of marketing campaigns on its e-commerce platform Tmall to promote the upcoming Tokyo 2020 Summer Games. Liu Bo, General Manager of Tmall, said Alibaba aims to enable its 500 million consumers to experience Tokyo 2020 through shopping, games and other interactive activities.

- Tmall launched an in-app, interactive feature as part of the campaign, so users can virtually challenge Olympic medalists in interactive games to win prizes. Tmall also plans to launch other events in the lead up to the Tokyo 2020 Summer Games.

Foreo Launches New Anti-Aging Device in Korea in Partnership with Lotte and Hyundai

(January 13) TRBusiness.com

Foreo Launches New Anti-Aging Device in Korea in Partnership with Lotte and Hyundai

(January 13) TRBusiness.com

- Swedish beauty brand Foreo has partnered with Korean duty-free companies Lotte Duty Free and Hyundai Duty Free to launch a new anti-aging device called Bear in Korean duty-free and travel retail shops. The company plans to launch the device in China in partnership with local duty-free companies.

- The company says the new devices use microcurrent and T-sonic pulsations to provide a more youthful and contoured complexion.

- Walmart India has downsized by laying off 56 employees, which includes eight senior-level management and 48 middle- to low-level management roles at its corporate office in Gurgaon, near the capital New Delhi.

- The company said the layoffs in its sourcing, agri-business and fast-moving consumer goods divisions are the result of a review of its structure to ensure that it was organized optimally.

- Amazon CEO Jeff Bezos announced Amazon will invest $1 billion to help Indian small and medium businesses move online. The announcement was made at Amazon SMBhav, a two-day conference to explore ways for the e-commerce giant to work with small- and medium-sized businesses.

- Bezos added that Amazon plans to scale locally produced products from India using Amazon’s global footprint to create $10 billion in Indian exports by 2025.

Renaissance Global Teams Up with Chinese Jewelry Retailer To Launch in China

(January 13) FashionNetwork.com

Renaissance Global Teams Up with Chinese Jewelry Retailer To Launch in China

(January 13) FashionNetwork.com

- Jewelry manufacturer Renaissance Global has partnered with leading Chinese jewelry retailer Lao Feng Xiang (LFX) to enter the China market. LFX operates over 3,700 stores.

- As part of the partnership, Renaissance will launch its Jay Gems subsidiary Enchanted Disney Fine jewelry brand in China. The brand features engagement rings, earrings and pendants inspired by Disney princesses.

LATIN AMERICA RETAIL AND TECH HEADLINES

- Colombian lingerie brand Lili Pink has opened three new stores in Costa Rica, taking its store count in the country to 12. Two of the new stores are in Alajuela and the third in Guanacaste. Each store is around 1,070 square feet.

- The company has more than 300 stores in Colombia and 50 stores and outlets across Ecuador, Peru, Panama, Costa Rica and Guatemala. The company expects to continue expanding its presence in Central America.

Dior Hires New Regional Director for Latin America

(January 14) TheMDS.com

Dior Hires New Regional Director for Latin America

(January 14) TheMDS.com

- French luxury goods company Dior has appointed Hugo Charles as Regional Director for Latin America. The company also said it plans to expand its presence in Latin America with new stores in countries such as Mexico.

- Charles has experience in the Mexican retail industry via his most recent post as Director – Luxury Division at department store El Palacio de Hierro for three years.

- Argentine shoe brand Renzo Rainero is to close all its physical stores and focus exclusively on its online business. The company has three stores in Córdoba, which it plans to shutter on January 31, and will leave only one store open as a showroom.

- The company plans to launch its fall/winter 2020 collection in March (just ahead of the southern hemisphere’s winter), its first product launch available only online.

L'Oréal Appoints New Marketing and Communications Chiefs in Argentina

(January 13) FashionNetwork.com

L'Oréal Appoints New Marketing and Communications Chiefs in Argentina

(January 13) FashionNetwork.com

- Beauty brand L'Oréal has appointed Gabriela Pérez Millón as Chief Marketing Officer (CMO) and Mariana Petrina as Chief Communications Officer (COO) for its operations in Argentina. The pair replace Pablo Sánchez Liste who was CMO and COO of L'Oréal Argentina but now serves as CMO and COO of the company’s division in Mexico.

- Millón has 10 years’ experience in digital marketing, and previously served as Director Digital Associative Creative Director, Latin America at L'Oréal. Petrina joined L'Oréal in 2016 as Communication and Digital Manager and has served as Corporate Communications and Responsibility Manager since 2019.

Falabella To Launch Delivery Application for Tottus in Chile and Peru

(January 13) Peru-Retail.com

Falabella To Launch Delivery Application for Tottus in Chile and Peru

(January 13) Peru-Retail.com

- Chilean retail company Falabella plans to launch a delivery service application for wholly owned Tottus Supermarkets in Chile and Peru in the first quarter of 2020. The company also plans to launch a digital credit card to strengthen its online offering.

- Falabella General Manager Gaston Bottazzini said the fast delivery service will be available not only to Tottus but will also serve Sodimac and Falabella for certain product categories such as gifts, which could arrive much faster than promised.

MACROECONOMIC UPDATE

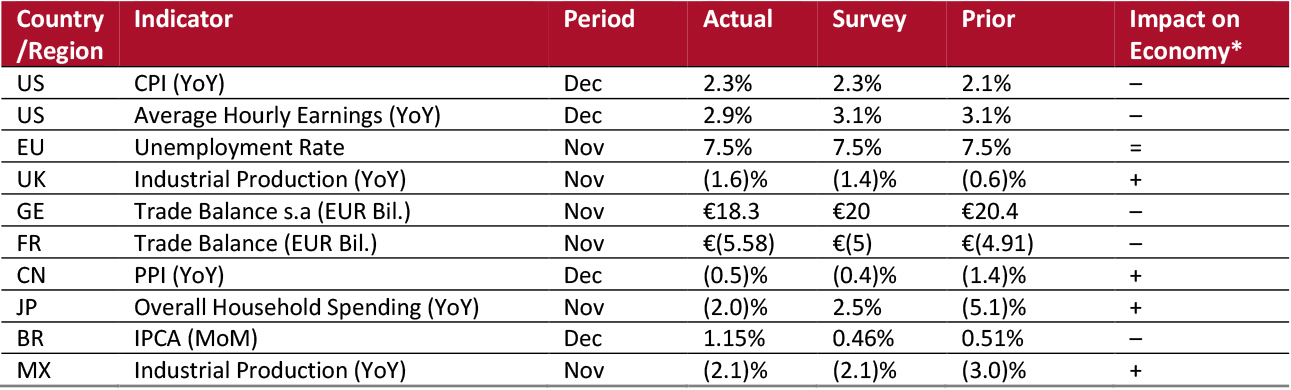

Key points from global macro indicators released January 8–14, 2020: 1) US: The consumer price index (CPI) climbed 2.3% year over year in December, following a 2.1% increase in the previous month, and in line with the consensus estimate. Average hourly earnings grew 2.9% year over year in December, compared to November’s 3.1% increase. 2) Europe: The eurozone unemployment rate remained flat at 7.5% in November and in line with the consensus estimate. UK industrial production fell 1.6% year over year in November, versus a 0.6% decline the previous month. 3) Asia Pacific: In China, the producer price index (PPI) slipped 0.5% year over year in December, improving slightly from a decline of 1.4% in November. In Japan, overall household spending decreased 2% year over year in November, versus a 5.1% decrease the previous month. 4) Latin America: In Brazil, the Extended National Consumer Price Index (IPCA) was up 1.15% in December, increasing from 0.51% in November. In Mexico, industrial production fell 2.1% year over year in November, versus a 3% decrease the previous month. [caption id="attachment_102406" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Bureau of Labor Statistics/Eurostat/ONS/Statistisches Bundesamt Deutschland/MINEFA/National Bureau of Statistics of China/Statistics Bureau of Japan/INEGI/IBGE/Coresight Research [/caption]

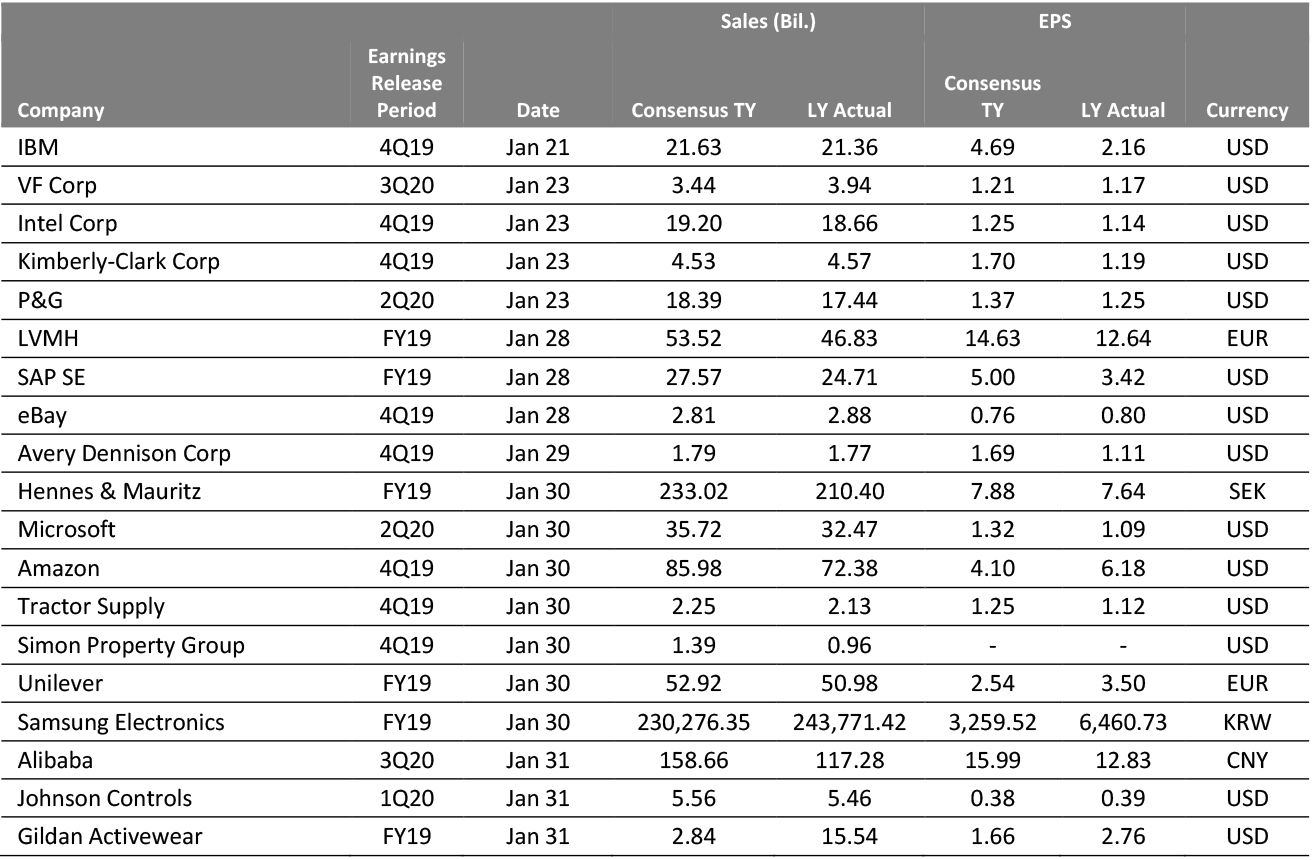

EARNINGS CALENDAR

[caption id="attachment_102407" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR