DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Macy’s Radically Reshapes: Lessons from the Retailer Macy’s this week announced plans to dramatically reduce its store footprint: it will close around 125 stores, representing around one-fifth of its department-store estate, over three years, focusing on its least-productive stores in lower-tier malls. At the same time, the company plans to open more off-price departments in Macy’s stores, as well as opening more standalone off-price stores and smaller, off-mall stores. The moves are all part of a new plan the company calls Polaris. Necessary but Not Inevitable We think store cuts are necessary given Macy’s positioning and the channel shifts happening in retail. But that does not mean a decline was inevitable: We think the retailer has done too little to revive its core Macy’s chain over a number of years. Macy’s department stores made only limited progress in upgrading its in-store proposition. It acquired Story, which offers a rotating selection of emerging brands, and brought the format into a few dozen stores. Similarly, Market@Macy’s offers a changing product selection in a handful of Macy’s stores. The company also invested in experience-focused technology retailer B8ta. However, these add-ons only tinkered at the edges of select department stores. For most stores, and for most of the space even in stores with these add ons, Macy’s stores remained underwhelming and underinvested, with little apparent attempt to revive the store experience. This extends to Macy’s Herald Square flagship store in New York City, where a Story department fails to offset a mediocre experience across the rest of the store. In 2018, the company announced it would upgrade 50 stores with new lighting, flooring and fitting rooms—but this ambition sounds modest even for the 50 stores, and that is only 50 out of 636 department stores under the Macy’s banner. Competing on Functional Retailing Macy’s trades solely in the discretionary market and should have moved away from “functional retailing,” which shoppers increasingly found online or from more price-focused retailers. Macy’s could have become the place for shoppers to experience brands and where companies turn to build those brands. It could have inspired and excited shoppers through merchandising and events. And, its pre- and post-sales service could have been amplified as a differentiator to functional rivals. There is still time to do this, but it requires more than just culling store numbers or a slap of paint and new flooring. In the coming years, we expect the most successful discretionary retailers to adopt “spectacular retail” formats: experience-rich destination stores offering a huge choice of products and add-ons such as customization and personalization. Legacy retailers such as Macy’s can look to Coresight Research’s BEST framework, which is designed to help retailers frame their approach to physical retail, focusing on four themes:- Brand building—stores that are more than just distribution points.

- Experiences—deepen engagement with shoppers in physical stores.

- Service—differentiate through service offerings.

- Technology integration—reduce the in-store data deficit and close the gap between physical and digital retail.

- See our recent report Macy’s Announces New Three-Year Strategy, Closing Approximately 125 Stores.

US RETAIL AND TECH HEADLINES

Sephora Announces Largest-Ever Store Expansion Plan

(February 4) Company press release

Sephora Announces Largest-Ever Store Expansion Plan

(February 4) Company press release

- Beauty retailer Sephora has announced plans to open 100 new stores in 75 cities in North America this year. The new stores will be located closer to local neighborhoods and community centers and will be smaller than its mall-based stores.

- The stores will feature beauty products from over 400 brands ranging from cosmetics, hair care, wellness and fragrance, along with new beauty studios. All new stores will be powered by 100% renewable energy.

Macys’s To Close 125 Stores

(February 5) Company press release

Macys’s To Close 125 Stores

(February 5) Company press release

- Department store chain Macy’s has announced plans to close 125 stores over the next three years, which includes the 29 closures announced in January.

- The company said that it plans to exit weaker shopping malls and shift to smaller-format stores outside of malls. Macy’s will cut around 2,000 jobs, close a headquarters in Cincinnati and move dot com operations from San Francisco top New York.

Intercontinental Exchange Makes Takeover Offer for eBay

(February 4) Wsj.com

Intercontinental Exchange Makes Takeover Offer for eBay

(February 4) Wsj.com

- New York Stock Exchange owner Intercontinental Exchange (ICE) has made a bid to acquire eBay, in a deal that could value the company at over $30 billion, according to people familiar with the matter.

- The companies have not yet entered talks so there is no indication that eBay management will accept the offer. ICE wants to buy the online marketplace only, not the Classified Ad business unit eBay is considering selling.

Forever 21 To Sell Its Assets for $81 Million

(February 3) CNNBusiness.com

Forever 21 To Sell Its Assets for $81 Million

(February 3) CNNBusiness.com

- Forever 21 has reached an agreement to sell its assets for $81 million, according to court documents. The buying consortium includes Simon Property Group, Brookfield Properties and brand management firm Authentic Brands Group.

- The sale will include all Forever 21 assets, including stores and its beauty company Riley Rose. The news surfaces nearly four months after Forever 21 filed for Chapter 11 bankruptcy protection in September 2019 and requested approval to close 178 US stores.

Earth Fare To Close All Stores

(February 3) Company press release

Earth Fare To Close All Stores

(February 3) Company press release

- US supermarket retailer Earth Fare plans to close all its stores and its corporate office as it prepares to sell off assets to pay off debt. The company said that it was unable to refinance its debts.

- Earth Fare operates 50 stores in the US, and plans to start inventory clearance sales at all its stores.

EUROPE RETAIL AND TECH HEADLINES

IKEA Announces Its First UK Store Closure

(February 4) TheGuardian.com

IKEA Announces Its First UK Store Closure

(February 4) TheGuardian.com

- IKEA plans to shut its Coventry city center store by summer 2020, putting over 350 jobs at risk. Ikea cited its inability to make the store profitable as the primary reason for closure.

- The company said it will enter consultations with 352 employees and will try to retain as many as possible at nearby stores in Birmingham and Nottingham.

Puig and Bosch Launch a Device to Create Perfumes at Home

(February 3) Modaes.com

Puig and Bosch Launch a Device to Create Perfumes at Home

(February 3) Modaes.com

- Spanish fragrance company Puig and German appliance manufacturer Bosch, through their joint venture Noustique, have launched a device that lets customers create their own perfume at home. The device costs around €350 ($386), fragrance capsules cost around €20 ($22) and come in 35 different fragrances.

- The consumer can produce up to one milliliter of the perfume to test and adjust the fragrances to obtain the desired result. The device also lets users share formulas through a digital platform called The Alchemist Atelier.

Allbirds To Open its Second Store in the UK

(February 3) RetailGazatte.co.uk

Allbirds To Open its Second Store in the UK

(February 3) RetailGazatte.co.uk

- US footwear company Allbirds will open a second UK store, located on Marylebone High Street in London. The design was inspired by the nearby Regent’s Park.

- The company hopes to educate customers on the benefits of its shoes and socks by giving them a place to touch and feel the Merion wool, eucalyptus tree fiber and sugarcane used to make Allbirds products.

Hawkins Bazaar Shuts All Stores

(February 3) RetailGazatte.co.uk

Hawkins Bazaar Shuts All Stores

(February 3) RetailGazatte.co.uk

- UK gift and toy shop chain Hawkins Bazaar has closed all its 18 stores in the UK as part of the administration process. The stores offered customers up to 90% discount to clear merchandise.

- The retailer collapsed into administration on January 23 after it was unable to find a buyer, and subsequently appointed Moorfields Advisory partners Tom Straw and Simon Thomas as joint administrators.

H&M To Reposition Its Stores

(February 3) ChargedRetail.co.uk

H&M To Reposition Its Stores

(February 3) ChargedRetail.co.uk

- Swedish fashion retailer H&M plans to reposition more than 5,000 stores into logistic hubs to focus on digitalization. Newly appointed CEO Karl Johan Persson aims to limit store openings and use existing stores as logistics hubs for online orders.

- The retailer has invested in supply chain, digitalization, advanced analytics and AI as a part of its repositioning plan. Currently, H&M has supports BOPIS in 14 countries and online returns to be made in-store in 16 countries, with plans to expand further.

ASIA RETAIL AND TECH HEADLINES

Kjus Opens Flagship Store in Beijing

(February 5) RetailNews.Asia

Kjus Opens Flagship Store in Beijing

(February 5) RetailNews.Asia

- Luxury sportswear brand Kjus has opened a flagship store in Beijijng, which features a VIP lounge housing a café.

- The store was designed by an Austrian interior design company 5 Star Plus Retail Design and features premium stone and metal retail fixtures. The store also features special lighting effects and other technology to explain product features, key products and collections.

L’Oréal India Appoints New Director, Consumer Products Division

(February 4) BusinessWorld.in

L’Oréal India Appoints New Director, Consumer Products Division

(February 4) BusinessWorld.in

- L’Oréal India has appointed Pankaj Sharma as Director of Consumer Products. He will replace Aseem Kaushik, who now serves as Head of Professional Products for L’Oréal Asia Pacific.

- Sharma has been with L’Oréal India for 15 years and most recently served as Head of Garnier & Maybelline New York brands, prior to which he served in various sales and marketing positions.

Prada Selects Indian Startup BigThinx for Its Fashion Tech Accelerator Program

(February 4) Retail.EconomicTimes.com

Prada Selects Indian Startup BigThinx for Its Fashion Tech Accelerator Program

(February 4) Retail.EconomicTimes.com

- Prada has selected Indian tech startup BigThinx for its maiden fashion tech accelerator program. BigThinx has developed an artificial intelligence program that can create a personalized 3D virtual avatar from 2D images for fashion brands and their customers.

- BigThinx was one of 10 startups chosen from over 1,200 that participated in Prada’s Startupbootcamp.

Grab Acquires Bento Invest To Enter Retail Wealth Management

(February 4) StratisTimes.com

Grab Acquires Bento Invest To Enter Retail Wealth Management

(February 4) StratisTimes.com

- Singaporean multi-service technology firm Grab has acquired wealth technology startup Bento Invest to expand into retail wealth management and investment solutions. Bento is a business-to-business technology firm that provides services for companies to launch digital wealth solutions.

- After the acquisition, Bento will be rebranded GrabInvest and be integrated into Grab’s app by the first half of 2020. GrabInvest will adopt a low-cost model that it hopes will be easy for Grab users to understand.

Tiffany & Co Opens Its First India Store in New Delhi

(February 3) CNBCTV18.com

Tiffany & Co Opens Its First India Store in New Delhi

(February 3) CNBCTV18.com

- Tiffany & Co has landed in India with a new store in the capital New Delhi. CEO Alessandro Bogliolo said “Tiffany & Co.’s debut in India represents an important milestone for our iconic brand.”

- The store spans 2,600 square feet and features new designs as well as its classic collections such as Tiffany T, Tiffany HardWear, Tiffany True and the Home & Accessories collection. The store also has a private salon for scheduled appointments for a more personal consumer shopping experience.

LATIN AMERICA RETAIL AND TECH HEADLINES

Mexico To Hold eRetail Day Mexico 2020

(February 5) FashionNetwork.com

Mexico To Hold eRetail Day Mexico 2020

(February 5) FashionNetwork.com

- The eCommerce Institute of Latin America and the Mexican Association of Online Sales will organize eRetail Day Mexico 2020, an event focused on the latest trends and success stories in e-commerce.

- The event will feature a competition in which local e-commerce startups present to a panel of retail professionals. The winner is named best ecommerce startup.

Mercado Libre To Join Chilean Initiative for Small and Medium Enterprises

(February 4) Company press release

Mercado Libre To Join Chilean Initiative for Small and Medium Enterprises

(February 4) Company press release

- Argentine e-commerce company Mercado Libre has decided to join the “Arriba Tu Pyme” project, an initiative by the Chilean Ministry of Economy and other government funded startup agencies to foster the development of small and medium-size enterprises (SMEs) in Chile.

- As part of the project, the company will offer SMEs free training tutorials in e-commerce and guidance to improve and increase sales. Mercado Pago, the company’s payment processor, will offer participating SMEs special rates and payment plans.

Bata Opens a New Store in Bolivia

(February 4) FashionNetwork.com

Bata Opens a New Store in Bolivia

(February 4) FashionNetwork.com

- Switzerland-based footwear brand Bata has opend a large format store in the El Alto, Bolovia. The new store is located in the Cielo Mall, spans 1,830 square feet and will have virtual shopping and payment methods.

- The store will feature a wide variety of footwear, products for school and a collection of briefcases and accessories. Bata has 33 stores in Bolivia and over 1,200 stores in Latin America.

H&M Retail Grew Latin America Sales 32% in 2019

(February 3) America-Retail.com

H&M Retail Grew Latin America Sales 32% in 2019

(February 3) America-Retail.com

- H&M recorded retail sales of SEK 7.42 billion ($774.9 million) in Latin America in the fiscal year ended November 31, 2019, an increase of 32%. Growth was driven by sales in Puerto Rico, Mexico and Colombia, in addition to expansion in the region.

- The company’s business in Mexico grew 29% to SEK 3.69 billion ($382 million), sales in Puerto Rica grew 52% to SEK 122 million ($11.7 million) and in Colombia by 30% to SEK 528 million ($54 million). The company has 90 stores in Latin America and plans to enter Panama in 2020.

Gucci and Disney Open a Popup store in Mexico City

(February 3) FashionNetwork.com

Gucci and Disney Open a Popup store in Mexico City

(February 3) FashionNetwork.com

- Italian luxury brand Gucci has opened a pop-up store in Mexico City to launch its Disney Capsule collection, expected to remain open until March 1. The store is modelled on Victorian-era fashion and is covered with imagery of Mickey Mouse.

- The new collection was inspired by the Chinese Year of the Mouse, hence the heavy use of Mickey Mouse as the main figure on its products. The assortment includes tennis shirts, t-shirts and outfits complete with the Gucci monogram and a small Mickey on each garment.

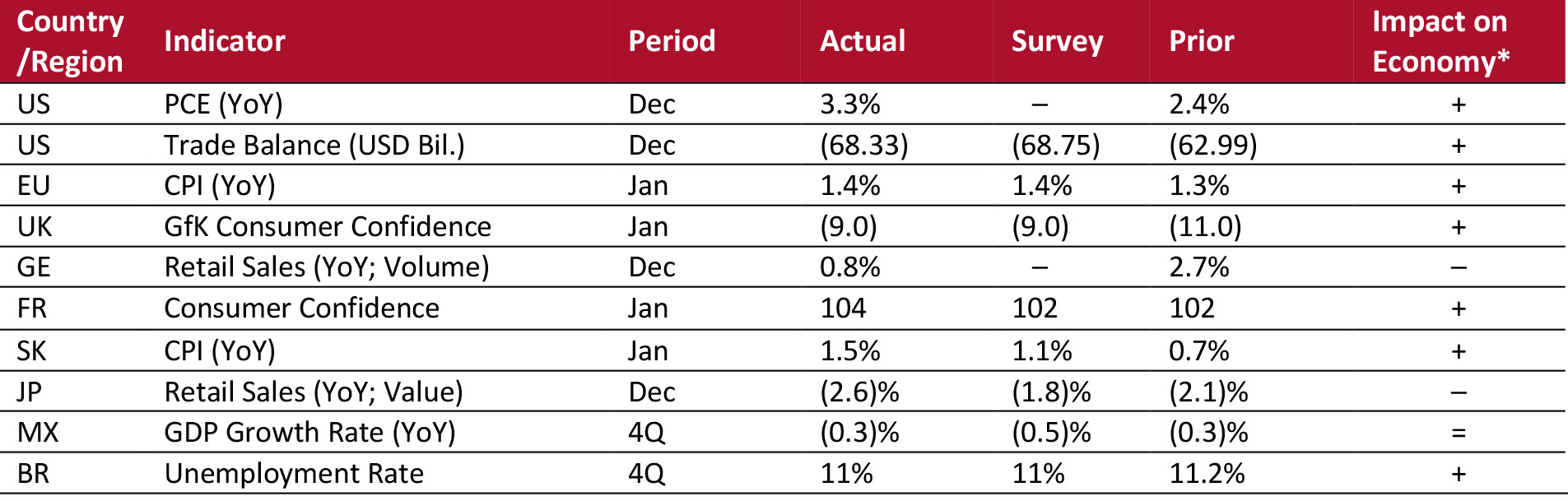

MACROECONOMIC UPDATE

Key points from global macro indicators released January 29 to February 4, 2020:- US: Personal consumption expenditure (PCE) was up 3.3% year over year in December, versus 2.4% growth in November. The trade deficit climbed to $68.33 billion in December following November’s $62.99 billion deficit.

- Europe: The eurozone consumer price index (CPI) climbed 1.4% year over year in January, following a 1.3% increase in December, in line with the consensus estimate. In Germany, total retail sales increased 0.8% in volume (real terms) in December, versus a 2.7% increase in November.

- Asia Pacific: In Japan, total retail sales slumped 2.6% year over year in value terms December, following a 2.1% decline in November. Korea’s CPI increased 1.5% year over year in December, following a 0.7% increase in November.

- Latin America: Brazil’s unemployment rate was 11.0% in the fourth quarter, versus 11.2% in the previous quarter and in line with consensus estimate. Mexico’s GDP contracted 0.3% year over year in the fourth quarter, unchanged from the previous quarter and ahead of the consensus estimate of (0.5)%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: BEA/The US Census Bureau/Eurostat/GfK/DESTATIS/INSEE/KOSTAT/METI/INEGI/IBGE/Coresight Research [/caption]

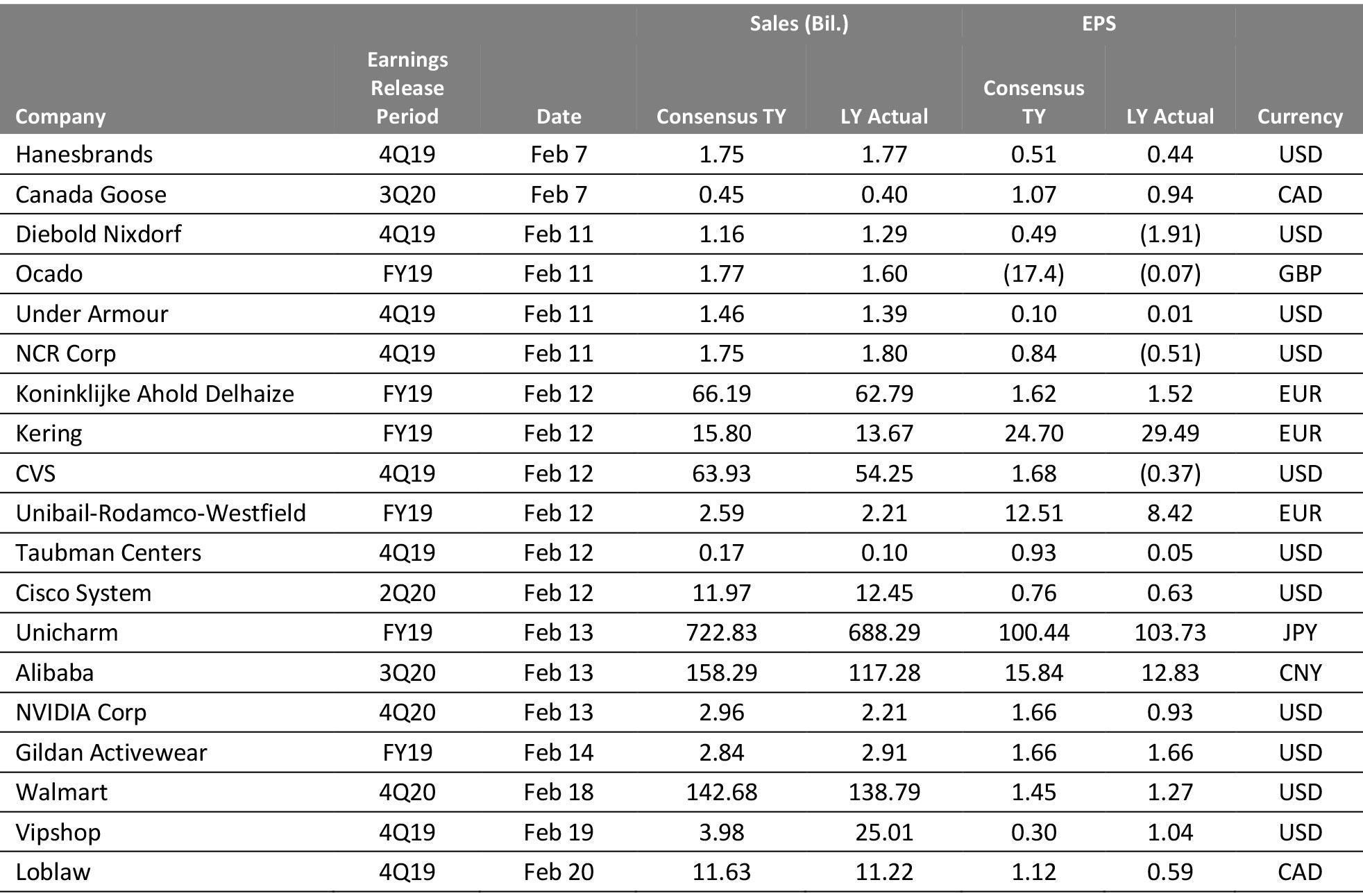

EARNINGS CALENDAR

[caption id="attachment_103362" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR