DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Are We Witnessing the Death of Online-Only Discount Retail?

Online-only discount retailers are struggling. Online dollar store Hollar could be shutting, according to news website Axios. If true, Hollar will join direct-to-consumer (DTC) retailer Brandless, which recently closed. Hollar offers brands while Brandless was all about private label—but both focused on undercutting branded fast-moving consumer goods (FMCGs) retailers and both ran up against the single biggest challenge discount operators face in e-commerce: making the unit economics work in sectors with ultraslim margins.

Even for retailers with nondiscount offerings, e-commerce and DTC have unfavorable economics, thanks to high marketing and fulfillment costs. The substantial cart sizes needed to cover these costs are likely a challenge Brandless faced: many shoppers want a mix of brands and private labels when they shop for FMCGs such as groceries, so Brandless’s single, uniform-looking private label probably inhibited average transaction values.

How Are Brick-and-Mortar Discount Formats Adopting E-Commerce?

Despite the travails of Brandless and possibly Hollar, discount is gradually moving online as highly successful US brick-and-mortar retailers launch digital ventures. Across three major brick-and-mortar discount segments—dollar stores, off-price and warehouse clubs—progress to omnichannel models has been slow but we’ve seen renewed impetus in recent years.

In dollar stores: Dollar General launched online operations relatively late, in 2011. More recently, the company announced plans to introduce a buy online pick up in store (BOPIS) service called DG Pickup. The company said it would test the new service through its mobile app and roll out the service slowly to ensure it resonates with customers. Citing the company’s average basket of only $12 and just five items, CEO Todd Vasos told analysts he hoped BOPIS shoppers would make incremental purchases when they collect orders and that the trial was designed to have the service “ready to roll out in a large-scale way, somewhere down the line.”

In 2018, Dollar General introduced a separate mobile app called DG GO!, which lets customers use a smart phone to scan items while shopping and check out directly via the app. Meanwhile, rival Dollar Tree’s online offering includes BOPIS and delivery. Dollar Tree-owned Family Dollar does not sell online.

In off-price: TJX launched e-commerce operations at T.J. Maxx only in 2013, and at Marshalls much later in 2019. TJX sees online and stores as complementary: In November 2019, CEO Ernie Herrman told analysts: “As with tjmaxx.com, we are differentiating marshalls.com's offering from our Marshalls stores to give consumers a compelling reason to shop both channels.”

Rival off-pricer Burlington has long sold online, but Ross Stores does not. In November 2019, Ross Stores Group President and COO Michael Hartshorn told analysts: “On e-commerce, our view has not changed. We think that the moderate off-price business, which is what we're in, would not work in an online environment with a $10 to $11 AUR [average unit retail]. The economics with free shipping and returns are just not financially sustainable, and we don't see any way that…business would be accretive to our profit.”

In warehouse clubs: Warehouse clubs were slow to invest in e-commerce, although the major clubs have shifted approach in the last couple of years. Compared to channels such as dollar stores, small basket sizes are less of a barrier, but club retailing is still low margin.

Toward the end of 2017, Costco introduced its own two-day delivery service called CostcoGrocery for shelf-stable products, and partnered with Instacart to provide same-day delivery for perishable groceries. Sam’s Club followed suit by extending same-day delivery to 100 additional clubs, for a total of 350 stores. BJ’s announced that by April 2018, all its outlets will offer same-day delivery. In 2019, Costco enlarged its BOPIS product selection and the retailer tested pick-up lockers for BOPIS purchases.

The major clubs are investing in technology to enhance their mobile applications, too. Through these applications, they let customers scan purchases in-store and eliminate the need to wait in checkout lines. In January 2020, Costco grew global online sales 17.2% at constant currency. In the quarter ended January 31, 2020, Sam’s Club grew e-commerce sales 33%.

How to Do Discount Digitally

Even as a number of US discount retailers are moving into e-commerce, some major names continue to hold out. Those that have taken the plunge are integrating digital and stores—just as nondiscount retailers do—with BOPIS and mobile apps to provide in-store convenience. And, some are ignoring shoppers’ clamor for free shipping by charging for delivery and encouraging pickup.

However, the economics of e-commerce remain a challenge, and we expect discount formats to continue focusing on bringing shoppers into physical stores, as brick-and-mortar remains the only channel for no-frills retailing that has been proven profitable.

US RETAIL AND TECH HEADLINES

Nike Announces Leadership Changes Under New CEO

(February 18) Company press release

Nike Announces Leadership Changes Under New CEO

(February 18) Company press release

- Nike’s new CEO John Donahoe has announced leadership changes that include the appointment of a new COO and a new CFO. Andy Campion, the current EVP and CFO, will replace Eric Sprunk as COO from April 1.

- Heidi O’Neill, President of Nike Direct, will become President of Consumer and Marketplace on April 1, succeeding Elliott Hill. The current CFO of Operating Segments and VP of Investor Relations, Matthew Friend, will become company CFO.

Walmart Fourth-Quarter Earnings Show a Rise in E-Commerce Sales

(February 18) Company press release

Walmart Fourth-Quarter Earnings Show a Rise in E-Commerce Sales

(February 18) Company press release

- Walmart’s total revenues increased 2.1% to $141.7 billion during the fourth quarter ended January 31, full-year revenues increased 1.9% to $524 billion. In its Walmart US segment, the company grew comparable sales by 1.9% and e-commerce sales by 35% during the quarter.

- E-commerce sales contributed 12% to international sales during the quarter, led by Indian e-commerce platform Flipkart and online grocery delivery in several markets. International sales grew 2.3% (2.2% at constant currency) to $33 billion despite a disruption in Chile that negatively affected operating income by $110 million.

Wren Kitchens To Open Its First US Store with 3D Virtual Reality

(February 18) Company press release

Wren Kitchens To Open Its First US Store with 3D Virtual Reality

(February 18) Company press release

- UK-based kitchen retailer Wren Kitchens plans to open its first store in the US in Milford, Connecticut in the summer of 2020. The 31,465-square-foot store will showcase more than 100 kitchens and offer a 3D virtual reality experience to help customers create a tailored kitchen.

- The retailer intends to open more stores in the US northeast and a manufacturing facility in Pennsylvania this year.

Pier 1 Imports Files for Chapter 11 Bankruptcy Protection

(February 17) Company press release

Pier 1 Imports Files for Chapter 11 Bankruptcy Protection

(February 17) Company press release

- US home furnishing retailer Pier 1 Imports has filed for Chapter 11 bankruptcy and will pursue a sale of the company. It plans to use the process to complete the previously announced closure of up to 450 store locations including all its stores in Canada.

- Before filing for bankruptcy protection, the retailer had secured commitments of approximately $256 million in debtor-in-possession financing from Bank of America, Wells Fargo National Association and Pathlight Capital.

American Apparel Promotes Chuck Lambert to President and CEO

(February 17) SelmaTimesJournal.com

American Apparel Promotes Chuck Lambert to President and CEO

(February 17) SelmaTimesJournal.com

- Online retailer American Apparel has announced the promotion of Chuck Lambert to President and CEO. Lambert has served as COO since 2012.

- Lambert joined the company in 2005 as General Manager of the Selma and Fort Deposit facilities.

EUROPE RETAIL AND TECH HEADLINES

Beales To Close All Stores and Liquidate Stock

(February 18) RetailGazette.co.uk

Beales To Close All Stores and Liquidate Stock

(February 18) RetailGazette.co.uk

- UK department-store chain Beales is preparing to shut all its stores after administrators KPMG failed to attract buyers. KPMG said it will continue discussions with interested parties to sell the firm but has begun preparing to close its final 11 stores.

- The retailer fell into administration in January 2020 before announcing plans to shut 12 of its 23 stores.

Loop To Launch in the UK

(February 18) Chargedretail.co.uk

Loop To Launch in the UK

(February 18) Chargedretail.co.uk

- Zero-waste online grocery service Loop, which delivers branded items in refillable containers, will launch in the UK. Loop will partner with Tesco in the UK and allow customers to order brands for home delivery in packaging specially designed for reuse.

- After using the containers, Loop collects them free, cleans and reuses them. The company also allows customers to “auto-refill” items when containers are returned.

H&M Brands Reorganize Management Team

(February 17) Retailgazette.co.uk

H&M Brands Reorganize Management Team

(February 17) Retailgazette.co.uk

- Fashion retailer H&M’s brands Arket and Cos have both reorganized management teams.

- Cos has appointed Lea Rytz Goldman Managing Director. Goldman was previously Managing Director at Arket. Meanwhile, Arket has appointed Pernilla Wohlfahrt, currently serving as Design and Collaboration Director at H&M, as Managing Director, becoming Arket’s third managing director in as many years.

Shoe Zone Warns of Closure of 100 Stores

(February 17) BBC.com

Shoe Zone Warns of Closure of 100 Stores

(February 17) BBC.com

- UK footwear retailer Shoe Zone has warned it will close 100 UK stores if business rates (a form of property tax) do not change. Chief Executive Anthony Smith said that closing a fifth of its stores would be the only option if the government does not update the business rates system.

- He said the company paid more rates in 2019 than in 2009, despite cutting store count from around 800 to 500 over the decade. The retailer is currently closing around 20 stores every year.

Blokker To Sell Its Belgium Stores

(February 18) RetailDetail.eu

Blokker To Sell Its Belgium Stores

(February 18) RetailDetail.eu

- Dutch retailer Blokker will sell all of its 123 stores in Belgium to Dutch Retail Groep, a company owned by Dutch businessman Dirk Bron. In the coming months, the stores will be converted into Mega World stores.

- The decision comes after a disappointing 30% drop in sales last year to €60 million ($64 million), and an operational loss of €4.6 million ($5 million). Dutch Retail Groep plans to keep all the stores open but convert them into discount stores.

ASIA RETAIL AND TECH HEADLINES

Foodpanda Launches Grocery Delivery Service

(February 19) InsideRetail.asia

Foodpanda Launches Grocery Delivery Service

(February 19) InsideRetail.asia

- Singapore-based food-delivery company Foodpanda has launched grocery delivery service Pandamart in Hong Kong. The service was tested in November 2019 and was able to deliver within 25 minutes, but the company aims to cut delivery time to 15 minutes.

- The service offers more than 14,000 products from over 1,000 retailers in various categories such as groceries, daily necessities, beauty and baby-care products. Pandamart will waive delivery fees for a certain minimum spend for a short period after launch.

Grab and Volocopter To Test Feasibility of Air Taxi in Southeast Asia

(February 19) KR-Asia.com

Grab and Volocopter To Test Feasibility of Air Taxi in Southeast Asia

(February 19) KR-Asia.com

- Singapore-based ride-sharing service Grab and Germany’s air mobility startup Volocopter have partnered to conduct a feasibility study on air taxis in Southeast Asia. Volocopter designs electric multirotor helicopters for air taxi use.

- The study will examine suitable cities and routes for air taxis and possibly joint flight tests by the two companies. The partnership will enable Volocopter to develop urban air mobility services for commuters using Grab’s customer and traffic data.

JustCo To Use Retail Spaces for Coworking Locations

(February 17) InsideRetail.asia

JustCo To Use Retail Spaces for Coworking Locations

(February 17) InsideRetail.asia

- Coworking space provider JustCo plans to use retail space to expand its presence in Asia. The firm plans to launch in the Centrepoint mall in Singapore as well as in Amarin Plaza in Bangkok. The company already operates in the Marina Square mall in Singapore.

- The new Centrepoint location will span 60,000 square feet and incorporate the firm’s data analytics and other enhanced proprietary technologies, including a robot butler, access by facial recognition and a digital indoor map.

Lulu Group To Invest in Expanding Its Indian Retail Presence

(February 17) FashionNetwork.com

Lulu Group To Invest in Expanding Its Indian Retail Presence

(February 17) FashionNetwork.com

- UAE-based retail and real estate firm Lulu Group International plans to invest 35 billion rupees ($48.9 million) by the end of 2021 through its retail arm Tablez to bring its portfolio of brands to Hyderabad, India.

- The company also plans to invest 15–20 billion rupees ($210–279 million) in mall projects in Hyderabad, Lucknow and Bangalore. Additionally, the company will invest 25 billion rupees ($350 million) to build hotels in cities such as Bangalore.

Alibaba’s Dingtalk Launches New Features to Help Companies Resume Work Online

(February 17) Alizila.com

Alibaba’s Dingtalk Launches New Features to Help Companies Resume Work Online

(February 17) Alizila.com

- Alibaba’s enterprise communication and collaboration app Dingtalk has launched new features to help companies continue operating amid the coronavirus outbreak.

- The app will now include video conferencing, livestreaming for over 300 participants, cloud-based document editing and approval, in addition to daily health surveys. The platform added 100,000 servers to support growing nationwide demand for cloud-based communications.

Kangol To Open Flagship Store in Tokyo

(February 17) FashionNetwork.com

Kangol To Open Flagship Store in Tokyo

(February 17) FashionNetwork.com

- UK headwear brand Kangol plans to open a flagship store in Tokyo in April, 2020, on the third floor of the Laforet Harajuku shopping center.

- The store will feature the brand’s wide range of products and also a large number of products exclusive to the new flagship store, priced in the range of ¥5,000 ($45.5) to ¥8,000 ($73).

LATIN AMERICA RETAIL AND TECH HEADLINES

DIA Appoints New CEO for Its Brazil Business

(February 18) Reuters.com

DIA Appoints New CEO for Its Brazil Business

(February 18) Reuters.com

- Spain-based supermarket chain DIA has appointed Marcelo Maia as CEO of its Brazil subsidiary to lead the local company’s restructuring process. Maia will replace Marin Dokozic, who was CEO for about a year.

- Maia previously served as a Director in Associação Brasileira de Franchising, a non-profit that focuses on franchising in Brazil. DIA Brasil closed 300 of its 900 brick-and-mortar stores last year due to underperformance, the majority franchises.

Soloio Plans To Expand in Latin America

(February 18) Modaes.com

Soloio Plans To Expand in Latin America

(February 18) Modaes.com

- Spanish fashion retailer Soloio plans to open five new stores in Latin America by the end of its fiscal year, launching in Mexico and Panama and expanding its presence in Colombia.

- In Colombia, the company plans to open two stores in Cartajena de Indias and Barranquilla; in Mexico, the company will open stores in Monterrey and Guadalajara.

Pionier Opens Its First International Store in Bolivia

(February 18) Modaes.com

Pionier Opens Its First International Store in Bolivia

(February 18) Modaes.com

- Peru-based fashion retailer Pionier has opened a store in Bolivia, its first store outside its home market. The company plans to add two more stores in Bolivia by the end of 2020.

- The store spans 2,150 square feet and is located in the Las Torres Mall in La Paz. In Peru, Pionier operates over 120 stores, employs over 1,000 and recorded 300 million pesos ($95 million) in annual sales last year.

Agua Bendita Partners with Maisonette To Launch Children’s Swimwear Line

(February 17) Modaes.com

Agua Bendita Partners with Maisonette To Launch Children’s Swimwear Line

(February 17) Modaes.com

- Colombian luxury swimwear company Agua Bendita has partnered with e-commerce platform Maisonette to launch a new children’s swimwear capsule collection under its Agua line.

- Agua Bendita will use leftover fabric to produce the collection, a children’s version of its Resort 20 line.

Carrefour Acquires 30 Makro Stores in Brazil for $455 Million

(February 17) ESMMagazine.com

Carrefour Acquires 30 Makro Stores in Brazil for $455 Million

(February 17) ESMMagazine.com

- Carrefour has entered into an agreement with rival retail chain Makro to acquire 30 cash and carry stores in Brazil for R$1.95 billion ($455 million). The stores have a total sales area of 1.77 million square feet and generated sales of around R$2.8 billion ($650 million) in 2019.

- The new stores will complement Carrefour’s Brazilian wholesale unit Atacadão’s existing network of 187 stores, expanding its presence notably in Rio de Janeiro and the northeastern region. The stores will be converted to the Atacadão banner in 12 months following the deal.

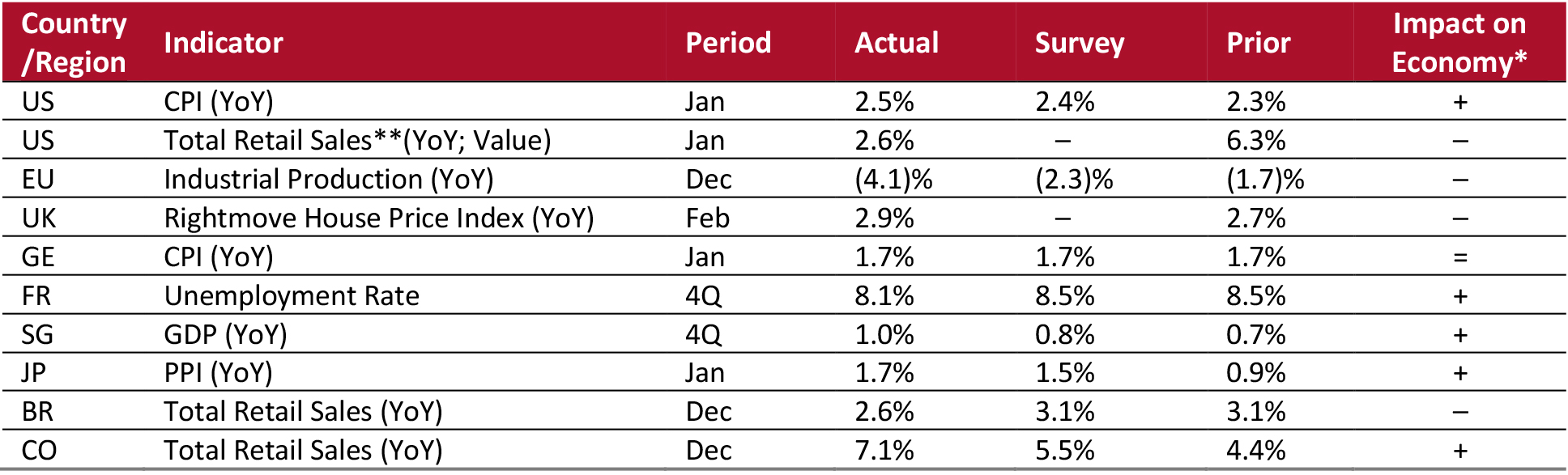

MACROECONOMIC UPDATE

Key points from global macro indicators released February 12–18, 2020: 1) US: The consumer price index (CPI) was up 2.5% year over year in January, slightly faster than December’s 2.3% increase and ahead of the consensus estimate of 2.4%. Total retail sales grew 2.6% year over year in January, slowing significantly from December’s 6.3% growth. 2) Europe: In the eurozone, industrial production slid 4.1% year over year in December following November’s 1.7% slip, and worse than the consensus estimate of a 2.3% contraction. In Germany, the CPI climbed 1.7% year over year in January, in line with the consensus estimate. 3) Asia: Singapore’s gross domestic product (GDP) grew 1% year over year in the fourth quarter, faster than the 0.7% increase in the third quarter and ahead of the consensus estimate of 0.8%. Japan’s producer price index (PPI) was up 1.7% year over year in January following a 0.9% increase in December. 4) Latin America: In Brazil, total retail sales increased 2.6% year over year in December versus a 3.1% increase in November, and below the consensus estimate of 3.1%. In Colombia, total real retail sales were up 7.1% year over year in December, compared to a 4.4% increase in November, and significantly ahead of the consensus estimate of 5.5%. [caption id="attachment_103931" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. **Unadjusted and excluding automobiles and gasoline

Source: US Bureau of Labor Statistics/US Census Bureau/Eurostat/Rightmove/DESTATIS/INSEE/MTI/Bank of Japan/IBGE/DANE/Coresight Research [/caption]

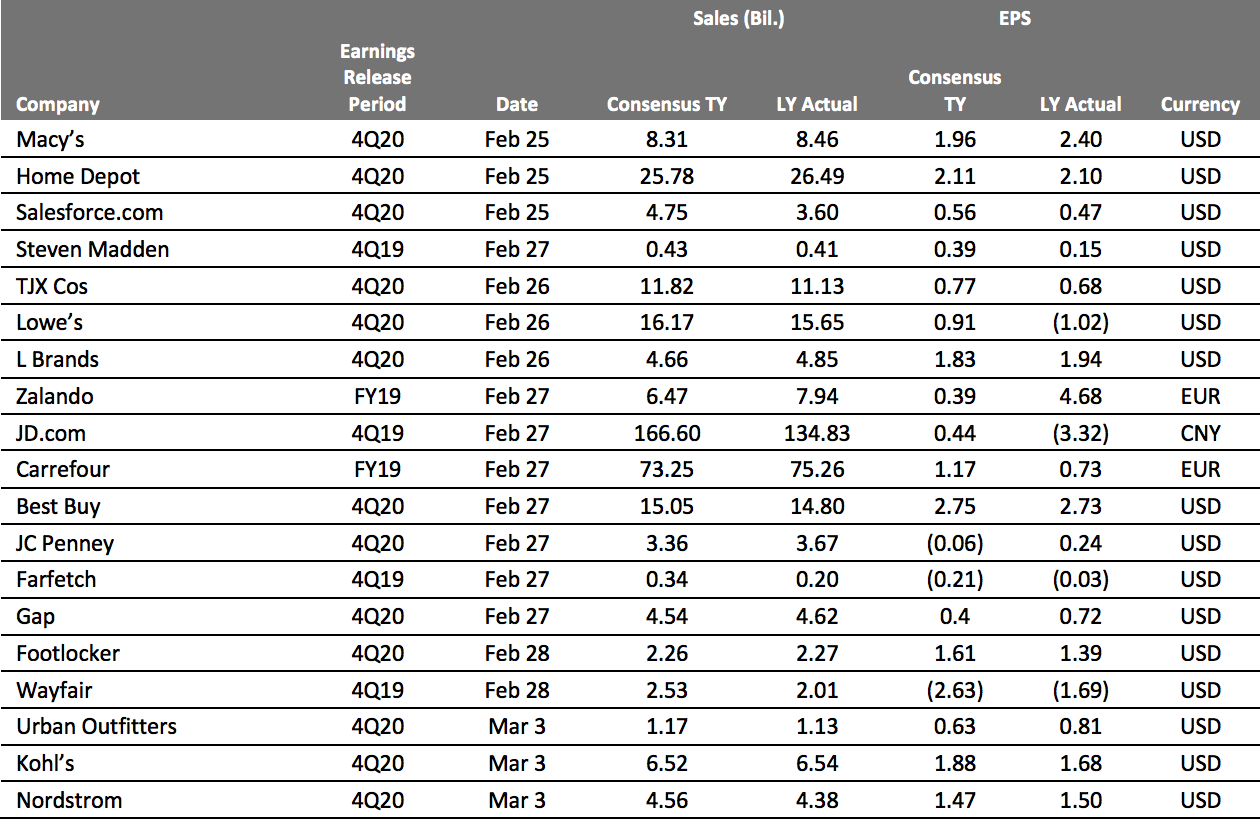

EARNINGS CALENDAR

[caption id="attachment_103954" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

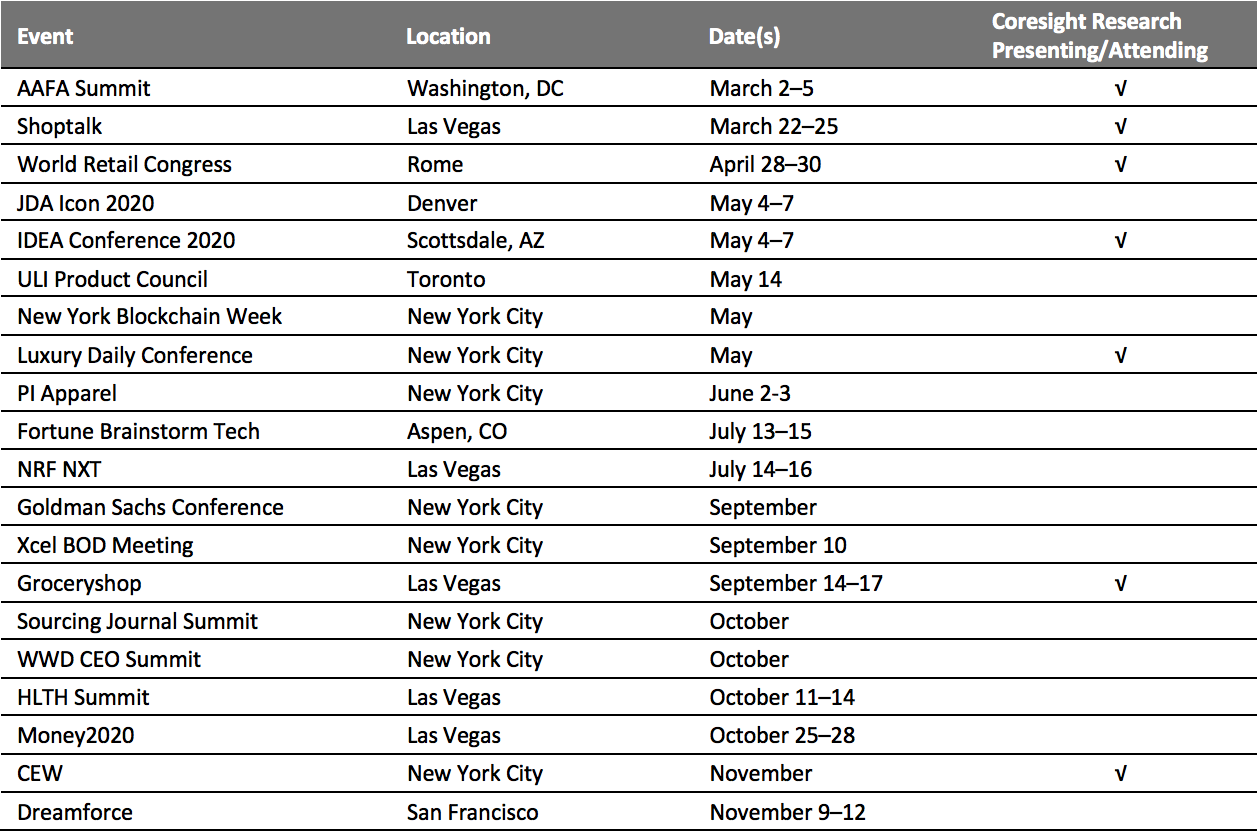

EVENT CALENDAR