DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Starbucks Commits To Becoming Resource Positive On the company’s 50th anniversary, Starbucks announced a new emphasis on sustainability, including short- and long-term goals through 2030. In a letter to company partners, customers and stakeholders, Starbucks CEO Kevin Johnson stressed a heightened sense of urgency to do much more to take care of the planet. Johnson also outlined a goal of becoming a front-runner in Leadership in Energy and Environmental Design (LEED), an internationally recognized building certification system that provides third-party verification that a building or community has certain standards around energy use, water use, CO2 emissions, indoor environmental quality, resource stewardship and overall awareness of the impact of its operations. Starbucks aims to become environmentally positive in the long term: That means its activities will avoid or remove from the atmosphere more carbon than the company’s operations emit, it will eliminate waste and supply to the world more clean water than it consumes. To accomplish these goals, Johnson outlined five strategies:- Expand plant-based options.

- Shift from single-use to reusable packaging.

- Invest in innovative and regenerative agricultural practices, reforestation, forest conservation and water replenishment in its supply chain.

- Invest in better ways to manage waste to ensure more reuse, recycling and waste elimination.

- Innovate to develop more eco-friendly stores, operations, manufacturing and delivery.

US RETAIL AND TECH HEADLINES

Lucky’s Market Files for Bankruptcy

(January 27) WSJ.com

Lucky’s Market Files for Bankruptcy

(January 27) WSJ.com

- Kroger-backed grocery chain Lucky’s Market filed for Chapter 11 bankruptcy protection on January 27. The grocer plans to close at least 32 of its 39 stores by early February. Lucky's Market plans to keep seven stores open: in Michigan, Ohio, Missouri, Florida, and Colorado.

- The company said it signed asset-purchase agreements with Aldi for five leased stores and one owned property, and with US supermarket chain Publix for five leased stores, subject to court approval.

Foot Locker To Unify Its Loyalty Program Across Brands

(January 27) RetailDive.com

Foot Locker To Unify Its Loyalty Program Across Brands

(January 27) RetailDive.com

- Foot Locker is set to launch a new loyalty program called FLX that will let customers earn points at any Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs, Footaction or Eastbay.

- The program has three membership levels: X1, X2 and X3, determined by annual spend. Members get other benefits such as free shipping on all orders and a birthday gift. X3 level members get access to events and members-only sales.

Vitamin Shoppe Collaborates with LA Fitness

(January 27) ChainStoreAge.com

Vitamin Shoppe Collaborates with LA Fitness

(January 27) ChainStoreAge.com

- Vitamin Shoppe has teamed up with fitness center chain LA Fitness to open shops inside LA Fitness health clubs. The shops span around 300 square feet and offer a select mix of sports nutrition products, vitamins, minerals, supplements, snacks and beverages.

- Vitamin Shoppe has already opened shops in nine LA Fitness health clubs.

Casper Sleep IPO To Raise $182.4 million

(January 27) Reuters.com

Casper Sleep IPO To Raise $182.4 million

(January 27) Reuters.com

- US-based online mattress retailer Casper Sleep hopes to raise up to $182.4 million in its upcoming IPO. The retailer will offer 9.6 million shares priced between $17 and $19.

- Casper’s IPO comes as the company expands into brick-and-mortar retail, switching from temporary to permanent locations. Its current investors include Target, investment firms Lerer Hippeau Ventures, IVP and NEA, American actor Leonardo DiCaprio and rapper 50 Cent.

Gap Shuts 40 Stores

(January 27) BusinessInsider.com

Gap Shuts 40 Stores

(January 27) BusinessInsider.com

- Clothing and accessories retailer Gap has confirmed the closure of 40 stores on January 26, 2020, of which 29 were in the US, seven in Canada and four in the UK.

- In February 2019, Gap announced it will close 230 stores over a two-year period as part of a restructuring plan. The recent 40 closures are part of the previously announced closures.

EUROPE RETAIL AND TECH HEADLINES

Sainsbury’s CEO Denies Exit Is Over Failed Asda Deal

(January 28) Reuters.com

Sainsbury’s CEO Denies Exit Is Over Failed Asda Deal

(January 28) Reuters.com

- Sainsbury’s CEO Mike Coupe recently announced he will step down from his role at the end of May 2020—and more recently stated he was not stepping down because of the failed merger deal with Asda.

- Last year, Sainsbury’s proposed a £12 billion ($15.6 billion) merger with Asda which was blocked by the UK Competition and Markets Authority (CMA). Sainsbury’s Retail and Operations Director Simon Roberts will replace Coupe on June 1, 2020.

C&A Announces 13 Store Closures in Germany

(January 27) RetailDetail.eu

C&A Announces 13 Store Closures in Germany

(January 27) RetailDetail.eu

- European apparel retailer C&A has announced it will close 13 stores in Germany and 30 stores in France as part of a restructuring strategy.

- In December 2019, the chain was considering plans to close as many as 100 stores under a restructuring plan called “Turnaround Germany,” according to German Manager magazine.

IKEA To Extend its Home Assembly Service to 27 UK Sites

(January 27) RetailGazette.co.uk

IKEA To Extend its Home Assembly Service to 27 UK Sites

(January 27) RetailGazette.co.uk

- IKEA has said it will expand its home assembly service to reach a total of 27 UK sites, including services such as furniture assembly, wall mounting and minor home repairs. The retailer will launch the service in six new locations: Leeds, Sheffield, Nottingham, Gateshead, Southampton and Exeter, by the end of this month.

- The service will be offered both online and in-store, in partnership with TaskRabbit, an online marketplace that connects customers with skilled professionals.

Planet Organic Aims To More Than Double Store Count

(January 27) RetailGazette.co.uk

Planet Organic Aims To More Than Double Store Count

(January 27) RetailGazette.co.uk

- UK retailer Planet Organic has announced plans to more than double its store count within the next four years. The retailer operates eight stores and intends to open at least 10 more in the next five years, taking its store count to 18 stores in the UK.

- Planet Organic began its expansion project in August 2019 with the opening of a new location in Queens Park, London. The retailer stated it recorded total sales of $35.1 million in the last fiscal year ended August 31, 2019, growing 8% year over year.

McColl’s COO To Retire

(January 27) Company press release

McColl’s COO To Retire

(January 27) Company press release

- UK food retailer McColl’s has announced the retirement of Dave Thomas from his role as COO and member of the board. Thomas will remain as a consultant and retire on on April 6, 2020, after the annual meeting on April 3, 2020.

- Thomas first joined McColl’s in 1998 as a Regional Manager for Convenience and has served the company for 23 years.

ASIA RETAIL AND TECH HEADLINES

Gojek Invests in Indonesian Wearable Tech Startup

(January 28) KR-Asia.com

Gojek Invests in Indonesian Wearable Tech Startup

(January 28) KR-Asia.com

- Indonesia-based multi-service technology platform Gojek has reportedly invested in Indonesian wearable tech and apparel startup Zulu. The startup was founded in 2018 and sells through e-commerce platform Lazada.

- Zulu’s line of products includes air filtration masks, riding gloves, goggles and other gear for urban bikers. Zulu also sells Bluetooth-enabled helmets that give users hands-free access to voice calls and GPS navigation. The helmets are also used by Gojek delivery riders.

Prada Partners with DFS To Launch New Sunglass Collection

(January 28) MoodieDavittReport.com

Prada Partners with DFS To Launch New Sunglass Collection

(January 28) MoodieDavittReport.com

- Italian luxury brand Prada has partnered with Hong Kong-based travel retailer DFS Group to launch a “Prada Special Project for Asia Sunglasses” collection. The range will be available in DFS Group’s downtown T Galleria stores in Hong Kong and Macau, ahead of a global launch in February.

- The collection features large metal frames, adjustable nose pads, oversized lenses and comes in two colors—black and rose gold. The collection will be promoted across DFS Group’s physical locations and on its online platforms.

Ferns N Petals Enables Ordering Via Alexa Enabled Devices

(January 28) IndianRetailer.com

Ferns N Petals Enables Ordering Via Alexa Enabled Devices

(January 28) IndianRetailer.com

- Indian flower and gifting retailer Ferns N Petals has launched Alexa Skill, a program that allows customers to place orders through Alexa-enabled devices. It will be available for customers who already have an account with Ferns N Petals and an address saved in their profile.

- Alexa Skill will also give customers suggestions and options to choose from the best-selling gifts. Ferns N Petals will enable Alexa Skill for customers in the UAE by June 2020, and in Singapore by the end of this year.

Forevermark Partners with Indian Gem And Jewellery Creation To Expand In India

(January 28) FashionNetwork.com

Forevermark Partners with Indian Gem And Jewellery Creation To Expand In India

(January 28) FashionNetwork.com

- International jewelry brand Forevermark has partnered with Indian jewelry retailer Indian Gem and Jewellery Creation to expand its retail presence in India. Forevermark opened a second boutique in Kolkata (formerly known as Calcutta) through the partnership.

- The new boutique will house a wide variety of elegant cuts, designer jewelry and loose diamonds from Forevermark. The companies plan to open more stores in Kolkata and other east Indian cities in the coming years.

Flipkart Signs Agreement To Promote Local Handicrafts in India

(January 28) Company press release

Flipkart Signs Agreement To Promote Local Handicrafts in India

(January 28) Company press release

- Walmart-backed Indian e-commerce platform Flipkart has signed an agreement with Gujarat Handloom and Handicrafts Development Corporation, a state organization for handicrafts in the state of Gujarat, to promote local artisans. The partnership is part of Flipkart’s Samarnath initiative, which helps artisans, weavers and craftsmen set up online businesses.

- Flipkart will help local sellers set up shop, offering training and support. Flipkart plans to bring about 50,000 small- to medium-sized enterprises onto its platform in one year.

LATIN AMERICA RETAIL AND TECH HEADLINES

Falabella To Launch New Digital Payment App

(January 28) AmericaRetail.com

Falabella To Launch New Digital Payment App

(January 28) AmericaRetail.com

- Chilean retailer Falabella has launched Fpay, its new digital payment app. The new app functions as a digital wallet and will allow users to make third-party transfers through credit cards.

- Fpay will also allow payments through QR codes across the Falabella store network. The new app and the recently implemented delivery services in its Tottus hypermarket chain are part of the group's digitalization strategy, spearheaded by CEO Gastón Bottazzini.

Nike To Consider Closing Its Argentine Operations

(January 28) AmericaRetail.com

Nike To Consider Closing Its Argentine Operations

(January 28) AmericaRetail.com

- Nike is considering leaving Argentina as part of a restructuring of its global business. The company has been operating in Argentina through its subsidiary Nike Argentina for more than two decades.

- If Nike does close operations in the country, it will maintain its brand presence by marketing and distributing its products through third parties. Nike has around 30 stores in Argentina that sell over seven million pair of shoes per year.

Kimberly Clark To Invest $190 Million in Mexico in 2020

(January 28) EN24.com

Kimberly Clark To Invest $190 Million in Mexico in 2020

(January 28) EN24.com

- Kimberly-Clark has announced it will invest MXN 3.5 billion ($190 million) in its Mexican operations in 2020. Around two-thirds of the total investment will go to capital goods investment to increase capacity, on product improvements, innovation and cost reduction projects.

- Kimberly-Clark de Mexico CEO Pablo Gonzalez Guajardo said, “When it comes to 2020, we are more optimistic. There has been much uncertainty regarding the Mexican economy in general and consumption in particular, but we believe that growth will pick up this year.”

Vans Launches Capsule Collection in Collaboration with Brazilian Skater Ricardo Fernandes

(January 27) FashionNetwork.com

Vans Launches Capsule Collection in Collaboration with Brazilian Skater Ricardo Fernandes

(January 27) FashionNetwork.com

- Vans has launched a capsule collection in Brazil in collaboration with local skateboarder Ricardo “Dexter” Fernandes. The collection features a Slip-On Pro shoe, a short-sleeved shirt and a 3/4-sleeved shirt.

- The Slip-On Pro sneaker costs R$359.99 ($85.8), the 3/4 sleeve t-shirt costs R$129.99 ($31) and the short-sleeved shirt R$109.99 ($26.2), all are available in select skate shops, Vans stores and in Vans online store.

Alpaca Garment Brand Kuna Launches an Online Store

(January 27) FashionNetwork.com

Alpaca Garment Brand Kuna Launches an Online Store

(January 27) FashionNetwork.com

- Peruvian clothing brand Kuna has launched an online store selling to Peru, Chile, the US and Australia. The brand is known for its Alpaca wool-based products and plans to increase its global reach through its online stores.

- Kuna also plans to expand its international presence with physical stores, set to open in the US and Spain in 2020. The brand currently has 24 stores in Peru and 15 stores in various other countries.

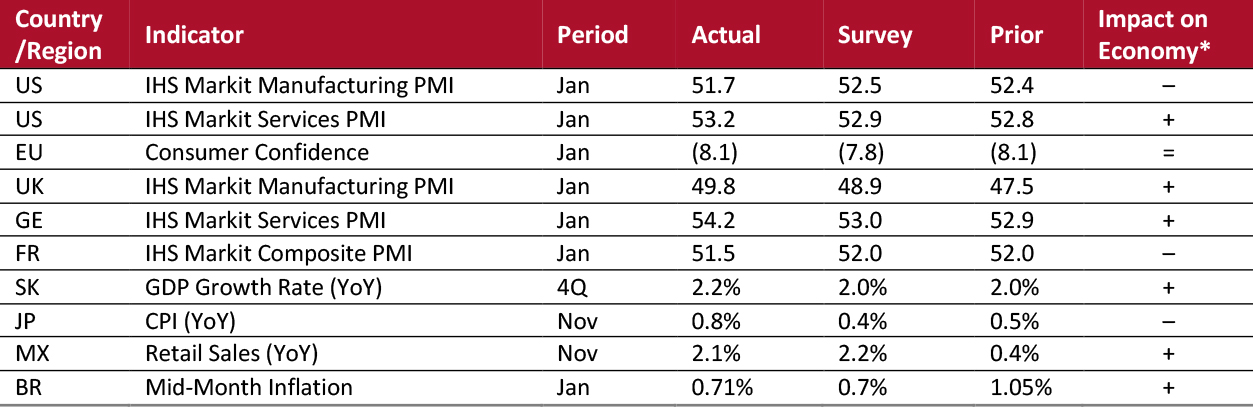

MACROECONOMIC UPDATE

Key points from global macro indicators released January 22–28, 2020: 1) US: The IHS Markit manufacturing purchasing manager’s index (PMI) was 51.7 in January, versus 52.4 in December, and below the consensus estimate of 52.5. The IHS Markit services PMI was 53.2 in January, versus 52.8 in December and ahead of the consensus estimate of 52.9. 2) Europe: The eurozone consumer confidence indicator remained unchanged at (8.1) points in January, below the consensus estimate of (7.8) points. In the UK, the IHS Markit manufacturing PMI was 49.8 in January, improving from 47.5 in December and above the consensus estimate of 48.9. 3) Asia Pacific: Japan’s consumer price index (CPI) increased 0.8% year over year in November, versus a 0.5% increase in October. Korea’s GDP expanded 2.2% year over year in the fourth quarter, following 2.0% growth in the third quarter. 4) Latin America: Brazil’s mid-month inflation was recorded at 0.71% in January, versus 1.05% in December, and marginally above the consensus estimate of 0.7%. In Mexico, total retail sales grew 2.1% year over year in November, versus 0.4% growth in the previous month. [caption id="attachment_102995" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Markit Economics/European Commission/Bank of Korea/Statistics Bureau of Japan/IBGE/INEGI/Coresight Research [/caption]

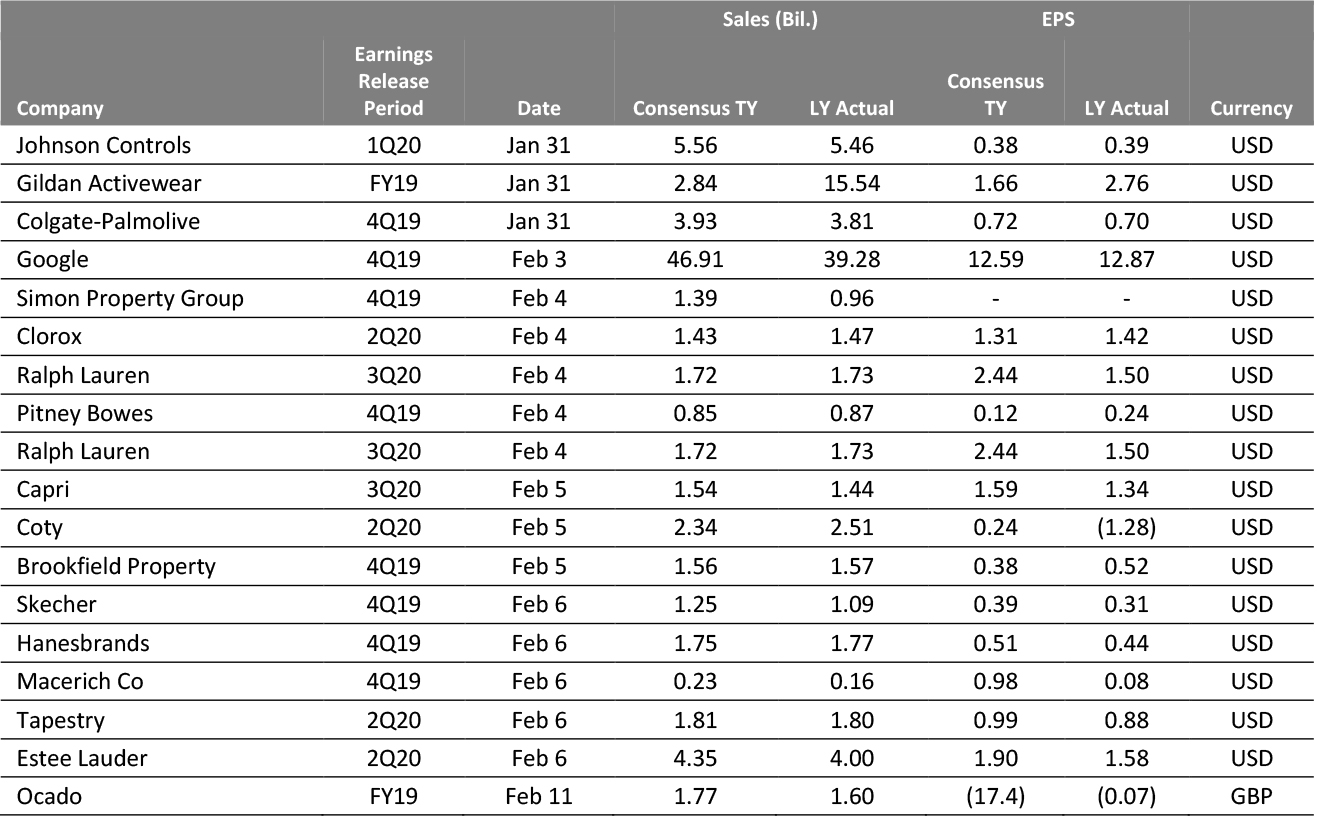

EARNINGS CALENDAR

[caption id="attachment_102996" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR