DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Could 2020 Be the Tipping Point for Sustainability in Apparel? The global fashion industry is big, with about $2.5 trillion in sales and accounting for about 3% of global GDP in 2018. Commensurate with its size, it also creates its share of waste, producing about 20% of global waste water and accounting for about 10% of global carbon emissions, according to the United Nations Economic Commission for Europe (UNECE). The industry consumes water as well, requiring 10,000 liters of water to grow the cotton needed for a one-kilogram pair of jeans—and that does not even include the massive amounts of water used to process the cotton and fabric. And the issues surrounding waste have grown: The number of garments produced doubled over a 15-year span, also according to UNECE. Once these garments are worn out or no longer wanted, they are most likely incinerated or end up in landfills. About 5% of US landfill space is occupied by textiles and only about 15% of post-consumer textile waste is recycled, according to the US Environmental Protection Agency. This is equal to more than 82 pounds per US resident. Fast fashion’s frequent replenishment of low-priced apparel has made apparel practically disposable, exacerbating the issue of apparel ending up in landfills and increasing apparel’s total impact as consumers replace (and dispose of) garments more regularly. And while many garments are made from wool or cotton, which are biodegradable, many are made from synthetic materials that do not biodegrade. How should the apparel industry address this issue? One solution is recycling. For example, H&M offers a program that lets consumers drop off used clothing. Wearable clothing is sold as second-hand apparel, textiles that cannot be re-worn are converted for remake collections or cleaning cloth. Textiles that cannot be reused are turned into acoustic and thermal insulation. Similarly, Inditex has announced that all of its clothes will be organic, sustainable or recycled and that renewable sources will provide 80% of its energy by 2025. There are many other examples of designers upcycling fabrics, using recycled materials or accepting used goods such as jeans for recycling. Another solution is rental and resale. The consumer’s mindset is changing—he or she does not necessarily need to own new clothing and is willing to wear used clothing regularly. Companies such as Poshmark, The RealReal and ThredUp are key players in the $7 billion recommerce market, but major retailers and brands such as Nike, Target and Walmart are also getting into the $1.2 billion rental subscription market. These supplement the broader secondhand market that includes traditional options such as Goodwill, Salvation Army and yard sales. The younger generations—specifically, Gen Zers—are also driving change. In a recent survey by First Insight, 62% of Gen Zers said they prefer to buy from sustainable brands, while 73% said they are willing to pay more for sustainable products. Whatever brands and retailers do, it’s clear consumer expectations around sustainability will only continue rising. The increasing focus and purchasing power of emerging generations, along with rising consciousness in the industry, could push the apparel industry past the tipping point towards a more sustainable future. Coresight Research’s contribution to this developing conversation is its new EnCORE framework, which is designed to help retailers and brands frame their approach to sustainability. We will launch EnCORE and discuss its components in an upcoming series of reports—keep any eye out for these on coresight.com. Please also see other Coresight Research reports on sustainability: Supply Chain Briefing: A Growing Emphasis on Sustainability and A New Push for Sustainability in Fashion: Messe Frankfurt Texpertise Network Partners with the Conscious Fashion Campaign and the United Nations.

US RETAIL AND TECH HEADLINES

Tailored Brands Names New Chief Marketing Officer

(February 10) Chainstoreage.com

Tailored Brands Names New Chief Marketing Officer

(February 10) Chainstoreage.com

- US apparel retailer Tailored Brands has appointed Carolyn Pollock as Chief Marketing Officer, in charge of marketing for all the company’s brands, including Men’s Wearhouse, Jos. A. Bank, Moores Clothing for Men and K&G.

- Pollock joined the company in a consulting role in mid-2018, initially defining the brand strategies for Men’s Wearhouse and Jos. A. Bank.

Under Armour May Drop NY Flagship

(February 11) Company press release

Under Armour May Drop NY Flagship

(February 11) Company press release

- Under Armour may drop its plans for a New York flagship store to focus on profitability after the company reported a net loss of $15 million in the fourth quarter, ended December 31, 2019. The store opening would cost the company up to $250 million.

- Despite the fourth-quarter loss, Under Armour recovered from a net loss of $46 million in 2018 to post net income of $92 million for full-year 2019. The company announced it is discussing a restructuring plan to further improve profitability and cash flow.

The Home Depot To Hire 80,000 Associates for Spring

(February 11) Company press release

The Home Depot To Hire 80,000 Associates for Spring

(February 11) Company press release

- The Home Depot has begun to hire 80,000 associates to prepare for the busy spring season. Jobseekers can apply for both full-time and part-time positions over the next several months.

- To help the associates get trained quickly, the company will provide innovative training programs and tools, including a gamified mobile app, e-learning and on-the-job coaching.

Brandless Closes After Months of Turbulence

(February 10) GroceryDive.com

Brandless Closes After Months of Turbulence

(February 10) GroceryDive.com

- Softbank-backed e-commerce company Brandless has shut operations and stopped taking orders. Around 90% of Brandless’s staff will be laid off, while 10 employees will remain to fulfill existing orders and evaluate acquisition offers.

- Brandless was launched in 2017 selling private-label grocery, household and personal care products at low prices. In July 2019, it received $240 million in funding from The Softbank Vison Fund.

Simon Property Group To Acquire Rival Taubman Centers

(February 10) Company press release

Simon Property Group To Acquire Rival Taubman Centers

(February 10) Company press release

- US real estate company Simon Property Group has agreed to buy shopping mall operator Taubman Centers for about $3.6 billion. Simon said it would buy an 80% stake in Taubman Realty Group Limited Partnership, the entity through which Taubman Centers conducts business.

- The company said the Taubman family will sell approximately one-third of its ownership interest at the transaction price but retain a 20% stake. The deal is expected to close by mid-2020.

EUROPE RETAIL AND TECH HEADLINES

Hurr Collective Launches Its First In-Store Wardrobe Rental Pop-Up

(February 10) ChargedRetail.co.uk

Hurr Collective Launches Its First In-Store Wardrobe Rental Pop-Up

(February 10) ChargedRetail.co.uk

- Peer-to-peer wardrobe rental platform Hurr Collective has launched its first ever physical pop-up store in London’s Selfridges department store. The pop-up will run for six months and feature a collection of 200 curated pieces available for customers to rent for between four and eight days.

- Hurr will also host a series of interactive workshops covering sustainable fashion, building an online brand, styling and other topics. The store will rotate stock on a weekly basis and include specially curated London Fashion Week, Valentine’s Day and holiday editions.

Marks & Spencer Appoints New CFO

(February 10) Company press release

Marks & Spencer Appoints New CFO

(February 10) Company press release

- Marks & Spencer has appointed Eoin Tonge as CFO. Tonge is currently CFO of Irish food company Greencore Group.

- Tonge will replace Humphrey Singer who quit last September. Current interim CFO David Surdeau will remain with the business to support Tonge as he transitions into his new role.

Metro AG Reaches Deal To Sell Real Hypermarket Units

(February 11) ESMMagazine.com

Metro AG Reaches Deal To Sell Real Hypermarket Units

(February 11) ESMMagazine.com

- German wholesale and retail company Metro AG has signed an agreement to sell its Real hypermarket business to a consortium of The SCP Group and x+bricks for about €1 billion ($1.09 billion).

- The retailer also said it continues to expect over €1.5 billion ($1.63 billion) in net proceeds from the sale of Real and a majority stake in its China-based operations.

MatchesFashion Appoints Amazon Executive as CEO

(February 11) RetailGazette.co.ok

MatchesFashion Appoints Amazon Executive as CEO

(February 11) RetailGazette.co.ok

- UK luxury retailer MatchesFashion has appointed Ajay Kavan as CEO. Kavan currently serves as Vice President of International Special Projects at Amazon, where he has worked for nine years.

- Kavan is set to begin in his new role on March 19 and will replace Ulric Jerome, who left MatchesFashion in August 2019. Kavan was responsible for launching grocery business Amazon Fresh in Europe and Japan, and built partnerships including with Morrisons in the UK.

Ubamarket App Adds Facial Recognition Technology

(February 11) ChargedRetail.com

Ubamarket App Adds Facial Recognition Technology

(February 11) ChargedRetail.com

- European retail app Ubamarket has overhauled its white-label “Scan, Pay and Go” app to include new facial recognition AI features so store staff can approve customers for purchases that normally require identification, such as alcohol.

- The new app has expanded its cashier-less offering to allow customers to scan items while shopping and pay for them in-app. The app also lets customers input a shopping list and then be guided around the store in the most efficient route possible through a virtual aisle-to-aisle map.

UK Comparable Retail Sales Flat in January

(February 10) BRC.org.uk

UK Comparable Retail Sales Flat in January

(February 10) BRC.org.uk

- UK retail sales picked up 0.4% year over year in January, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales were flat year over year. BRC Chief Executive Helen Dickinson stated that recent political uncertainty and a decade of austerity appear to have prompted a more cautious approach to shopping.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended January, total food sales increased 0.6% and total nonfood sales were down 1.3%. The 12-month average sales declined 0.2%.

ASIA RETAIL AND TECH HEADLINES

6ixty8ight Expands Its Online Presence in Southeast Asia

(February 11) InsideRetailAsia.com

6ixty8ight Expands Its Online Presence in Southeast Asia

(February 11) InsideRetailAsia.com

- Asian lingerie brand 6ixty8ight has expanded its online presence in Southeast Asia with a debut on e-commerce sites Shoppe and SGC.com. This is in line with the brand’s recent focus on e-commerce, as well as the launch of its own online store in November and its debut on e-commerce platform Lazada this year.

- 6ixty8ight is now available online to buyers from Singapore, Malaysia, Indonesia and Korea. The firm also operates more than 200 physical outlets in Asia, including greater China, Korea, Singapore and Malaysia.

Savoir Beds Opens Its First Showroom in Singapore

(February 11) InsideRetail.asia

Savoir Beds Opens Its First Showroom in Singapore

(February 11) InsideRetail.asia

- UK-based luxury mattress brand Savoir Beds has opened its first showroom in Singapore. This is the brand’s 14th showroom, with others in London, New York, Paris, Shanghai, Moscow and Hong Kong, among other locations.

- The showroom is located in the Raffles Hotel arcade, spans 1,500 square feet and will showcase eight new and existing Savoir bed designs.

GudangAda Secures Funding

(February 10) TechInAsia.com

GudangAda Secures Funding

(February 10) TechInAsia.com

- Indonesian business-to-business marketplace GudangAda has raised an undisclosed amount in a recent funding round led by venture capital firms Alpha JWC Ventures and Wavemaker Partners, with Singapore private equity fund Pavilion Capital also participating.

- GudangAda operates a platform for traders in the fast-moving consumer goods supply chain to interact and transact online. The funds will be used to onboard members, add more services and strengthen its leadership team.

Alibaba Announces Measures To Support Firms Affected By Coronavirus Outbreak

(February 10) Alizila.com

Alibaba Announces Measures To Support Firms Affected By Coronavirus Outbreak

(February 10) Alizila.com

- Alibaba Group has unveiled measures to help small and medium-sized enterprises (SMEs) in China affected by the coronavirus outbreak. The conglomerate will waive service fees for the first half of 2020 on its platforms, including Tmall, and also waive fees for warehouse rentals before the end of March.

- Its online bank brand MYbank will offer interest-free and low-interest loans to Taobao and Tmall merchants. It said ¥10 billion ($1.43 billion) will be made available for firms in Hubei, the epicenter of the outbreak, and another ¥10 billion ($1.43 billion) for other SMEs in China.

Reebok To Launch New Collection In Japan

(February 10) FashionNetwork.com

Reebok To Launch New Collection In Japan

(February 10) FashionNetwork.com

- Footwear brand Reebok plans to launch Reebok Eightyone in Japan, a new collection designed by Kohei Ohkita. The name “Eightyone” comes from the country’s international dialing code (81) and the collection will feature an urban look with a beige, gray and black color palette.

- The collection will feature Reebok staples such as “Instapump Fury” and “Zig Kinetica,” and will focus on apparel items with color combinations, materials and silhouettes that are not available in conventional Reebok lines.

LATIN AMERICA RETAIL AND TECH HEADLINES

H&M Plans To Open Two New Stores In Peru

(February 11) Modaes.com

H&M Plans To Open Two New Stores In Peru

(February 11) Modaes.com

- Swedish fashion retailer H&M plans to open two new stores in Peru, in Chiclayo and El Callao, by the end of the first half of 2020. The new openings will take the company’s store count to 15 in Peru.

- The store in Chiclayo will span 20,500 square feet and will include H&M’s entire offering for women, men and children, in addition to its Divided line. The store in El Callao will span 16,300 square feet and will also include H&M’s entire line.

Carrefour Negotiates Purchase of Makro Assets In Brazil

(February 11) ESMMagazine.com

Carrefour Negotiates Purchase of Makro Assets In Brazil

(February 11) ESMMagazine.com

- Carrefour is in the final phase of negotiations to acquire the assets of Brazilian wholesaler Makro. The addition of Makro’s assets will boost Carrefour’s Brazilian wholesale unit Atacadão, which accounts for most of Carrefour’s turnover in Brazil.

- Makro currently operates 74 stores in Brazil and has an annual turnover of around R$7 billion ($1.62 billion). The deal is said to be valued at around R$5 billion ($1.15 billion) and is expected to close soon, although neither Carrefour Brazil nor Makro have disclosed details.

Amazon Signs Strategic Alliance with Mexican University

(February 11) FashionNetwork.com

Amazon Signs Strategic Alliance with Mexican University

(February 11) FashionNetwork.com

- Amazon’s cloud computing branch Amazon Web Services has signed a strategic alliance with Mexican university Tec de Monterrey to develop emerging technologies and applications in cloud computing.

- The alliance will focus on four areas: education, development of use cases with voice assistants, a cloud innovation center as a space for innovation and products in the cloud. Tec de Monterrey is only the third university to sign such an agreement with Amazon after Arizona State University and University of British Columbia.

Argentina Government Program Increases Sales in Supermarkets in Its First Month

(February 10) MDZOL.com

Argentina Government Program Increases Sales in Supermarkets in Its First Month

(February 10) MDZOL.com

- Precios Cuidados, a program implemented by the Ministry of Internal Trade of Argentina to help reduce price product price dispersion, saw an increase in sales that averaged 14% and up to 207% for certain products in January compared to December.

- The program, which debuted on January 7, includes an app that customers can download and use to compare over 334 products from various supermarkets. The categories that had the highest increases in sales were perfumes at 68%, dairy at 62% and cleaning products at 22%.

Flormar Lands in Mexico

(February 11) Modaes.com

Flormar Lands in Mexico

(February 11) Modaes.com

- Turkish cosmetics company Flormar has landed in Mexico with a store in Monterrey. The company also plans to further expand in Mexico with store openings planned for Aguascalientes, Monterrey and Mexico City.

- The store is located within the Paseo La Fe shopping center and features over a thousand of the company’s products in cosmetics, beauty and perfumes.

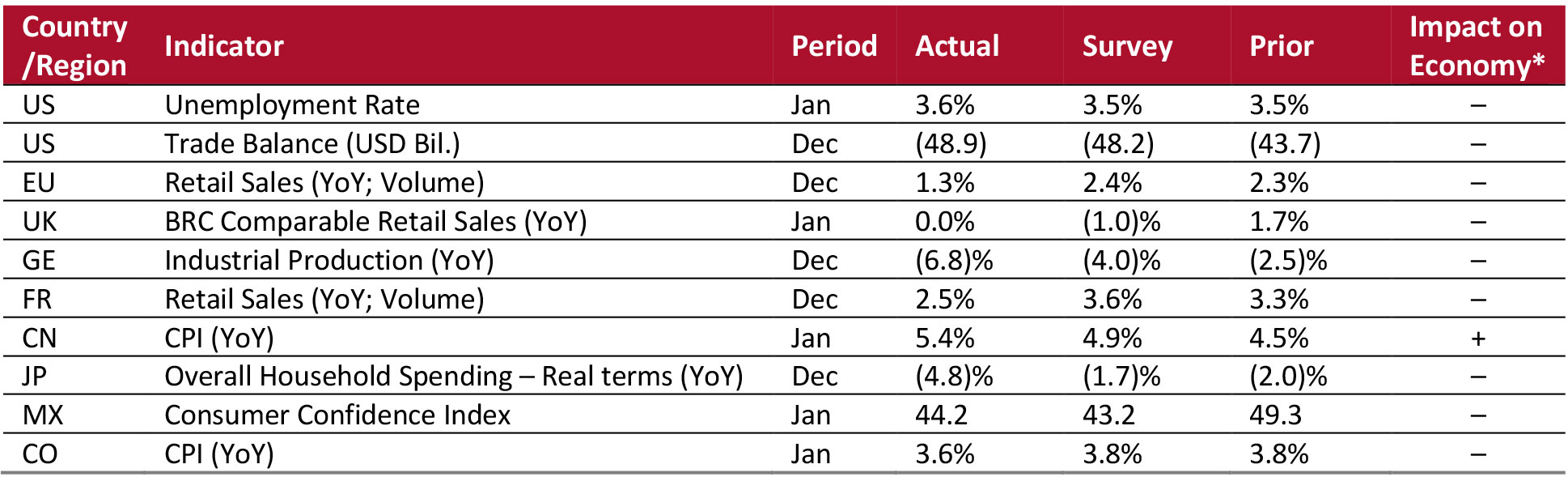

MACROECONOMIC UPDATE

Key points from global macro indicators released February 5–11, 2020: 1) US: The unemployment rate increased to 3.6% in January, from 3.5% in December and above the consensus estimate of 3.5%. The trade deficit widened to $48.9 billion in December from $43.7 billion in November. 2) Europe: In the eurozone, total retail sales increased 1.3% year over year in December, versus a 2.3% increase in November, and lower than the consensus estimate of 2.4%. In the UK, comparable retail sales were flat year over year in January compared to a 1.7% increase in December, as recorded by the British Retail Consortium (BRC), and below the consensus estimate of 1.0%. 3) Asia: In China, the consumer price index (CPI) climbed 5.4% year over year in January, versus a 4.5% increase in December, above the consensus estimate of 4.9%. In Japan, overall household spending declined 4.8% year over year (real terms) in December, versus a 2.0% drop in November. 4) Latin America: In Colombia, the CPI increased 3.6% year over year in January, versus 3.8% in December, and slower than the consensus estimate of 3.8%. In Mexico, the consumer confidence index fell to 44.2 in January from 49.3 in December, above the consensus estimate of 43.2. [caption id="attachment_103684" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Bureau of Labor Statistics/The US Census Bureau/Eurostat/BRC/DESTATIS/National Bureau of Statistics China/Statistics Bureau of Japan/INEGI/DANE/Coresight Research [/caption]

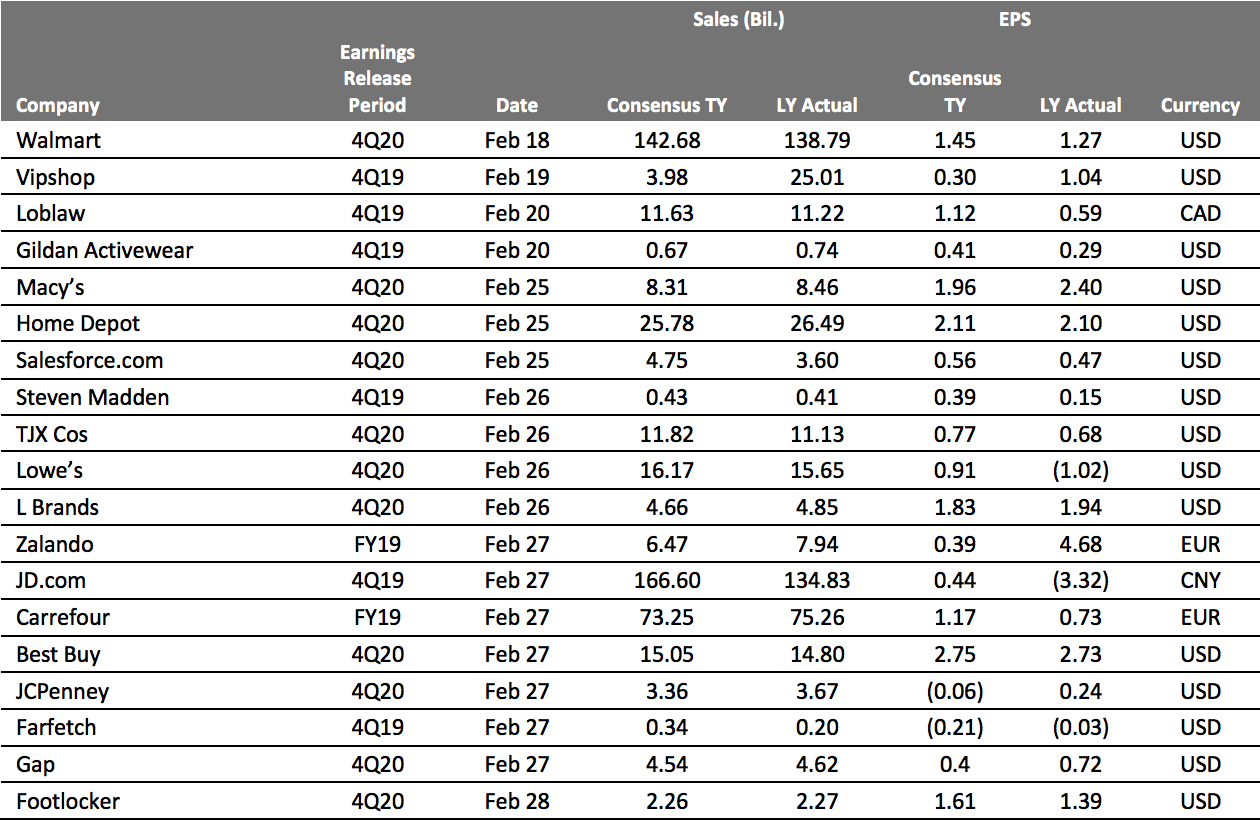

EARNINGS CALENDAR

[caption id="attachment_103725" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

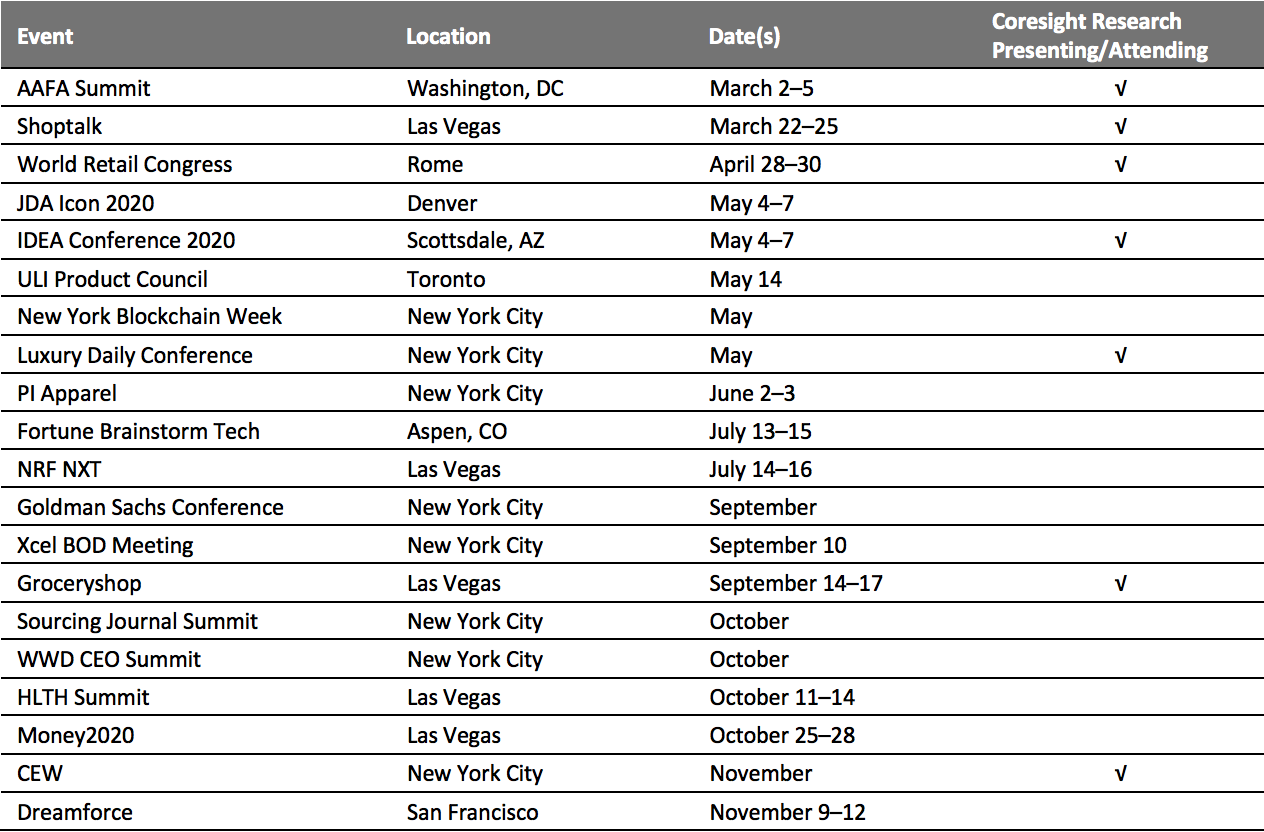

EVENT CALENDAR