Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

The Holiday Shopping Sprint Has Just Begun The numbers are in, marking a solid start to the truncated 2019 holiday shopping season. US e-commerce sales during Cyber Week hit $31 billion, up 15% from the prior year, according to data from Salesforce. The term “Cyber Week” is loosely defined and generally refers to the shopping period that includes Thanksgiving, Black Friday, Small Business Saturday, the following Sunday and Cyber Monday. The importance of Black Friday and Cyber Monday has become more blurred every year, as Black Friday sales begin earlier in November, continue through Cyber Monday and even beyond. This year, with many large retailers such as Amazon, Best Buy, Target and Walmart began previewing or starting Black Friday sales on Thanksgiving or earlier in the week, and many Black Friday bargains continued through Cyber Monday and into the rest of the week. Salesforce figures show how consumer online purchases have shifted timing this year. E-commerce sales grew 16% on Thanksgiving Day, 14% on Black Friday and 11% on Cyber Monday. The size of these days helps put their growth rates into perspective: Thanksgiving has the lowest e-commerce sales of the three days, which means it can more easily grow quickly, and Cyber Monday is the largest, making it more difficult to post high growth rates. Still, the figures show US consumers are increasingly willing to shop on Thanksgiving Day. With the solid increase in online sales, it’s no surprise consumers visit stores less often. Physical store traffic declined 4.2% during the Thursday-Sunday period, and 2.1% on Black Friday, likely owing to many deals being available online (even before the day). The early start to Black Friday and the blurring of the entire holiday weakens the need for consumers to show up at a store in person, making “doorbuster” deals less urgent. With the Thanksgiving holiday now behind us and Black Friday deals tapering off, the sprint to complete holiday shopping in time has started. This year there are just 26 days between Thanksgiving and Christmas, which has implications for shoppers and retailers. First, the number of shopping days represents the shortest possible span, so consumers have to concentrate holiday shopping within a smaller timeframe. Shoppers will likely turn to online shopping more heavily than usual with just three weekends before Christmas. Second, the abbreviated shopping calendar also presents challenges for retailers and shippers. The last year with a similar calendar was 2013, when e-commerce was not nearly as big as it is today. We expect online sales this year will be double that of 2013, and retailers and shippers may face challenges meeting this demand. With Christmas falling on a weekday, the most recalcitrant procrastinators can still elect overnight shipping on Tuesday, December 24. For the rest of us, ground shipping deadlines are rapidly approaching, falling between December 13 and 16—the end of next week. In 2013, execution issues and severe weather caused some shippers to miss the deadline, so many have since greatly increased capacity. UPS, for example, now delivers packages on Saturday and Sunday. FedEx’s split with Amazon earlier this year should also free up capacity for the holiday season. Notwithstanding an outbreak of severe weather across the US, early results from the Thanksgiving weekend augur a solid holiday season. Although consumers visit stores less, they are making up for it online. Consumers can offset a shortened holiday shopping calendar and fast-approaching shipping deadlines with online shopping and express shipping. For more information on Black Friday, see the Coresight Research report Holiday 2019: US Black Friday Sees Companies Promote More Heavily, Shoppers Continue to Migrate Online.

US RETAIL & TECH HEADLINES

- Department store chain JCPenney has appointed Karl Walsh as SVP, Chief Digital Officer, effective December 2. In his new role, Walsh will lead the development of JCPenney’s digital platforms, expand its e-commerce offering and drive traffic across all channels.

- Walsh has more than 18 years of experience in e-commerce and prior to joining JCPenney worked as Chief Digital Officer at jewelry retailer Pandora.

Glossier Taps Nordstrom’s Stores for Pop-Up Shops

(December 3) CNBC.com

Glossier Taps Nordstrom’s Stores for Pop-Up Shops

(December 3) CNBC.com

- Online beauty brand Glossier has teamed up with Nordstrom to open temporary pop-up shops in seven Nordstrom stores from December 3 through February 16.

- Glossier plans to sell only the “Glossier You” fragrance, its highest-rated product on glossier.com. The locations are Nordstrom’s new New York flagship, along with six other locations in Seattle, Chicago, Dallas, Houston, Washington, D.C., and Santa Anita, California.

New Look Vision To Enter US Market with the Acquisition of Edward Beiner

(December 3) Company press release

New Look Vision To Enter US Market with the Acquisition of Edward Beiner

(December 3) Company press release

- Canadian optical company New Look Vision is targeting the US market with the acquisition of Miami-based eyewear retailer Edward Beiner. The transaction is expected to close on or about January 2, 2020, and is subject to customary closing conditions.

- After the acquisition, Edward Beiner will continue operating as a stand-alone entity within the New Look Vision Group and the combined entity will have a store network of 390 locations.

Norwest Equity Partners Sells Stake in Christy Sports to TZP Group

(December 2) Company press release

Norwest Equity Partners Sells Stake in Christy Sports to TZP Group

(December 2) Company press release

- Minneapolis-based investment firm Norwest Equity Partners (NEP) has sold its investment in sporting goods retailer Christy Sports to US-based private equity firm TZP Group for an undisclosed sum. The transaction was concluded on November 25, 2019.

- The sale comes four years after NEP purchased a majority stake in Christy Sports. In the last four years, Christy Sports has expanded from 41 stores to 63 stores, made five acquisitions, increased its overall footprint and geographic reach.

Kroger Partners with ClusterTruck to Launch Kroger Delivery-only Kitchen

(December 2) Company press release

Kroger Partners with ClusterTruck to Launch Kroger Delivery-only Kitchen

(December 2) Company press release

- Kroger has partnered with Indianapolis-based software platform ClusterTruck, which powers delivery-only kitchens, to launch Kroger Delivery Kitchen. The kitchen offers an elaborate menu featuring fresh meals for free delivery in less than 30 minutes.

- Customers in the Carmel, Indianapolis and Columbus delivery zones can place orders online or via the ClusterTruck app, customers in Denver order online only.

EUROPE RETAIL AND TECH HEADLINES

- Impacted by a late Black Friday, UK retail sales fell 4.4% year over year in November, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 4.9%. Retail sales rose 9% on a total basis in November after adjusting for the timing of Black Friday.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended November, total food sales increased 1.3% and total nonfood sales were down 4.1%.

M&S Collaborates with Six Startups in the First Year of Founders Factory Retail Joint Venture

(December 3) Company press release

M&S Collaborates with Six Startups in the First Year of Founders Factory Retail Joint Venture

(December 3) Company press release

- Apparel and food retailer Marks & Spencer said it has worked with six start-ups in the first year of its joint venture (JV) with start-up incubator and accelerator Founders Factory. This month marks the first anniversary of the Founders Factory Retail JV, which recognizes and accelerates innovative start-ups.

- The portfolio of investments to date includes portable mobile-charging network Charged Up, 3D-scanning tech firm Texel, organic dog food manufacturer Rocketo, custom suit retailer The Drop, farmers marketplace Cogz and sustainable apparel manufacturer Ruley.

Waitrose and John Lewis Trial DNA-Based Food Advice Service

(December 2) Company press release

Waitrose and John Lewis Trial DNA-Based Food Advice Service

(December 2) Company press release

- DNA testing pioneer DnaNudge has teamed up with British supermarket chain Waitrose and high-end department store John Lewis to launch trial in-store services. The pop-up stores are opening at Waitrose in Canary Wharf and John Lewis in White City for a three-month trial.

- Shoppers can try a genetic test that helps them make healthier lifestyle changes based on the DNA report. Once tested, they can use the DnaNudge App or a wrist-worn DnaBand to scan over 500,000 food and drink product barcodes to determine the product's suitability based on the

Ocado Launches $642 Million Bond to Fund Robotic Warehouses

(December 2) Reuters.com

Ocado Launches $642 Million Bond to Fund Robotic Warehouses

(December 2) Reuters.com

- British online grocery retailer and technology firm Ocado has launched a $642 million convertible bond offering, due in 2025, partly to finance the installation of robotic warehouses for its offshore partners.

- Ocado signed an agreement with Japan’s supermarket group Aeon as its latest overseas technology partner last Friday. Ocado will supply Aeon with customer fulfillment centers and end-to-end software applications to serve millions of customers across Japan.

- Swedish apparel retailer GANT has promoted its EVP of Global Markets and Sales Patrik Söderström to CEO, effective February 2020. Söderström will replace Brian Grevy who has served as CEO since June 2018.

- Söderström joined GANT as EVP of Global Markets and Sales in Prior to that he worked with Reebok and Levi Strauss.

ASIA RETAIL AND TECH HEADLINES

Vingroup to Merge with Masan Group to Form Vietnam’s Largest Retail Company

(December 3) Reuters.com

Vingroup to Merge with Masan Group to Form Vietnam’s Largest Retail Company

(December 3) Reuters.com

- Vietnam conglomerate Vingroup plans to merge with consumer retailer Masan Group to form Vietnam’s largest retail company. Vingroup said the companies are finalizing legal procedures for the merger between its retail and agriculture units and Masan Consumer, a subsidiary of Masan Group.

- Following the merger, Masan will handle the operations of the newly formed company, while Vingroup will be a shareholder. The new company is expected to operate 2,600 supermarkets and convenience stores, and 14 hi-tech farms across the country.

Walmart India Launches New Credit Card in Partnership with HDFC Bank

(December 2) Company press release

Walmart India Launches New Credit Card in Partnership with HDFC Bank

(December 2) Company press release

- Walmart India has partnered with Mumbai-based banking and financial services company HDFC Bank to launch a cobranded credit card. The card offers interest-free credit up to 50 days and will be available only to members of its Best Price Modern Wholesale stores.

- The card was launched at an event at the Best Price store in Hyderabad and simultaneously at 26 other Best Price Modern Wholesale Stores across the country.

- Hong Kong-based cosmetics Retailer Sa Sa International plans to close all 22 of its retail stores in Singapore. The decision comes after the company recorded six consecutive years of losses in Singapore despite measures to improve sales in recent years.

- Sa Sa stated the move will allow the company to focus on other markets such as Hong Kong, Macau, mainland China and Malaysia, as well as its e-commerce business.

Gucci Forms Strategic Partnership with Tencent

(December 2) WWD.com

Gucci Forms Strategic Partnership with Tencent

(December 2) WWD.com

- Italian luxury brand Gucci has formed a strategic partnership with China’s Tencent to expand its digital offering. The venture created out of the new partnership is the first native content project created by Tencent for a luxury brand.

- In October, the partnership launched its first venture called “Gucci Inspiration Map,” a series of short films released on Tencent Video featuring a popular international cast and Gucci ambassadors. The series reportedly has already generated more than 64 million views on Tencent video and Gucci platforms in China as well as over 440 million views on Weibo.

Esprit Partners with Mulsanne Group to Operate its Mainland China Business

(December 2) InsideRetail.asia

Esprit Partners with Mulsanne Group to Operate its Mainland China Business

(December 2) InsideRetail.asia

- Hong Kong-based fashion retailer Esprit has announced a JV with investment holding company Mulsanne Group to oversee the marketing and retailing of its products in mainland China. The JV is subject to regulatory approvals and is expected to launch in June 2020.

- Esprit will hold a 40% interest in the JV through its subsidiary Million Success. The deal will focus on mainland China, excluding Hong Kong, Macau and Taiwan.

LATIN AMERICA RETAIL AND TECH HEADLINES

- Peruvian fashion retailer Crepier launched an online store on November 29 as part of its expansion and omnichannel digital strategy. Crepier plans to open two more storesby 2020.

- The new online store will feature a catalog of the company’s four product lines: women, men, travel and s Crepier said it aims for the online store to increase the company’s total annual sales by 4% in its first year of operation.

Miniso Opens a New Store in an Affluent Location in Bogotá

(December 3) FashionNetwork.com

Miniso Opens a New Store in an Affluent Location in Bogotá

(December 3) FashionNetwork.com

- Discount retailer Miniso has opened a new store in Parque de la 93, one of the most luxurious locations in Bogotá, The store sells items such as wallets, purses, necklaces and fashion clothes priced between $2.5 and $20.

- Miniso’s store count has reached close to 50 in Colombia, and the company aims to reach 60 locations by next year. The retailer expects to start 2020 with 8,000 global locations, of which at least 300 will be in Latin America.

- Luxury department store Luxury Point has opened a 3,230-sqaure-foot pop-up store in La Plata, Argentina. The store features premier brands such as H&M, Forever 21, Bershka, Custo Barcelona and Birkenstock.

- The store offers over 15,000 spring/summer garments for men, women and children. Shoppers also have the option of paying in three or six installments.

- China’s sportswear company Li-Ning plans to open 100 new stores in Mexico over a period of five years. Li-Ning first entered the Mexico market with an online store in 2017 and opened its first physical store in Mexico City in 2018.

- The company has opened 16 stores across Mexico in the last two years and is present in 100 department stores.

- US apparel and footwear brand Vans landed in Peru with the opening of its first store at the retail plaza Mall del Sur in Lima in late November. The brand plans to open two more stores in Peru.

- The new 700-square-foot store will feature iconic brands such as Herschel, Kappa, Superga and Fjällräven. Vans also plans to develop commercial alliances with local retailers to begin its expansion across the country.

MACRO ECONOMIC UPDATE

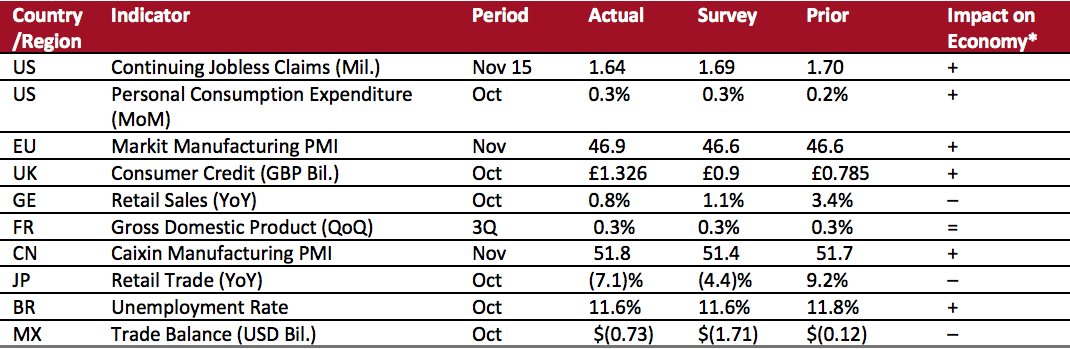

Key points from global macro indicators released November 27–December 3, 2019:- US: Continuing jobless claims in the US fell to 1.64 million in the week ended November 15 from 1.70 million in the previous week. Personal consumption expenditures increased 0.3% month over month in October, marginally higher than the 0.2% increase in the previous month.

- Europe: In the eurozone, the IHS Markit manufacturing Purchasing Managers’ Index (PMI) climbed slightly to 46.9 in November from 46.6 in October. In Germany, retail sales increased 0.8% year over year in October, versus a 3.4% increase in September.

- Asia Pacific: In China, the Caixin manufacturing PMI increased marginally to 51.8 in November from 51.7 in October. In Japan, retail trade fell1% year over year in October, versus a 9.2% increase in September.

- Latin America: In Brazil, the unemployment rate was 11.6% in October, slightly lower than the 11.8% in September. Mexico registered a trade deficit of $726 million in October, widening from $116 million in September.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Department of Labor/Bureau of Economic Analysis, Department of Commerce/Markit Economics/Bank of England/ Statistisches Bundesamt Deutschland/INSEE /Ministry of Economy, Trade and Industry/Instituto Brasileiro de Geografia e Estatistica/INEGI/Coresight Research[/caption]

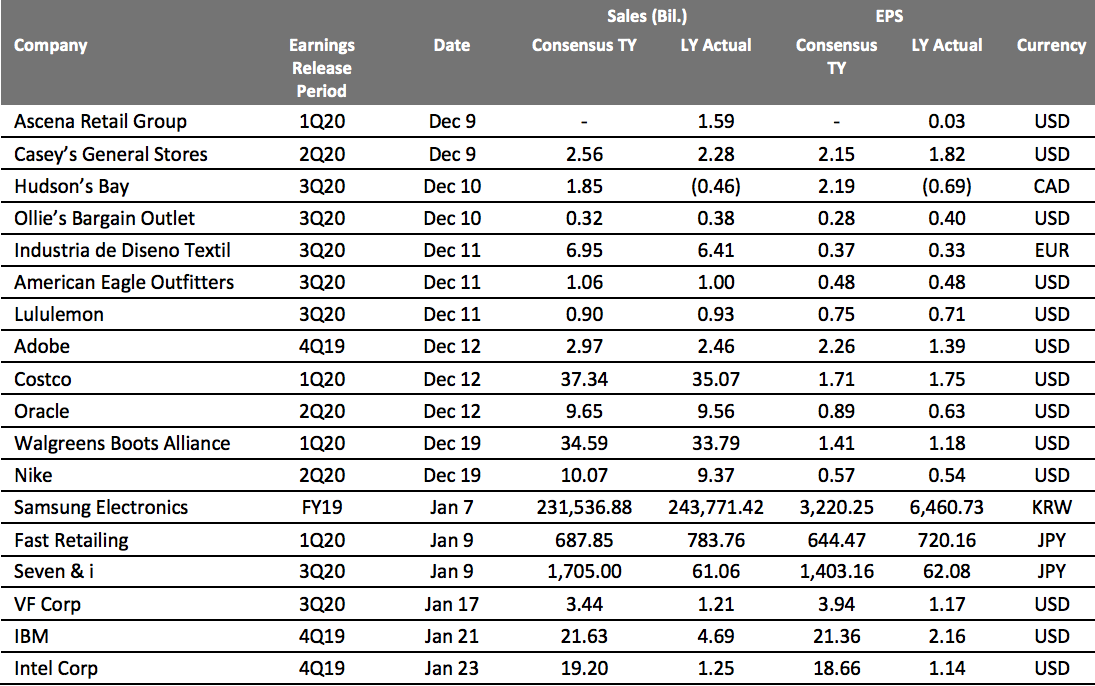

EARNINGS CALENDAR

[caption id="attachment_100831" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

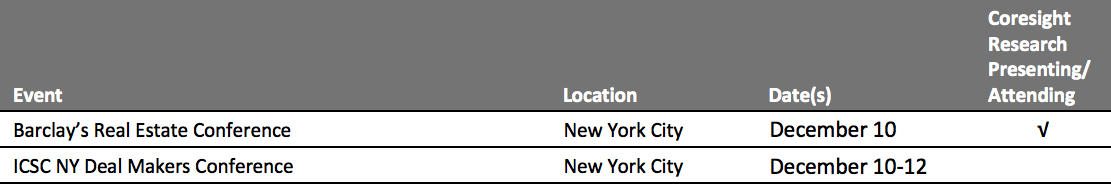

EVENT CALENDAR