DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

10 Things We Learned in 2019

Our global team of analysts, working with Coresight Research proprietary data, uncovered an abundance of insights about key retail trends in 2019. Here are our top-10 stand-out discoveries.

1. US store closures set a record

As of December 20, there were over 9,300 US store closures: 2019 set a new record for total number of store closures. The jump this year followed an easing of closure numbers in 2018 after a previous spike in 2017. Given the high number of closures in 2019 and the previously observed ebb and flow of closure peaks, closures may moderate in 2020. However, the reshaping of US physical retail is not complete: as more sales move online, we expect retail to see a steady, ongoing reconfiguring of physical space.

2. Amazon became the most-shopped apparel retailer in the US

Our annual survey of apparel shoppers found Amazon became the most-shopped retailer for clothing and footwear in 2019. Measured by number of shoppers who bought from the retailer in the past year, Amazon Fashion is now the most-shopped apparel retailer in the US, up from second place in 2018 and overtaking Walmart. Our survey confirmed Prime members drive high overall rates of Amazon apparel shopping.

3. CBD moved further into the mainstream

In the US, the cannabidiol (CBD) market blossomed, following the late 2018 passage of a bill which made hemp explicitly legal in all US states and allowed its transport across state lines. Reflecting this, a Coresight Research November 2019 consumer survey found relatively widespread use of CBD products—yet the most-used products are more traditional CBD/hemp products such as oil and tinctures. As a result, we see a long runway to bring CBD into more mainstream categories, such as beauty and personal care and supplements.

4. The US marijuana market grew, too, driven by medical use

On January 1, 2020, Illinois will become the 11th US state to legalize marijuana for recreational use. Despite the rise in legal recreational use, medical reasons remain the key driver of demand: When we surveyed marijuana users in states in which it is already legal, around 70% cited medical reasons for use. And, when we factored in average spending by survey respondents, the results showed that consumers who use marijuana (partly or wholly) for medical reasons account for an even greater share of total legal spend.

5. E-commerce and shopping festivals distorted the traditional rhythms of retail

Still-new shopping holidays such as Prime Day and “Black Friday in July,” coupled with the ease and convenience of online shopping, have prompted US consumers to move more of their spending away from the traditional holiday peak. We found the proportion of annual US retail sales in November and December fell steadily from almost 24% in 1998 to 21% in 2018. As retailers place more emphasis on nontraditional shopping festivals, we see this trend continuing.

6. Cheap, imported apparel brands dominated Amazon’s UK fashion offering

In the UK, we found the breadth of Amazon’s fashion offering has been supported by cheap, generic-style brands shipped from overseas sellers—mainly in China. Our analysis of over 2 million clothing products on Amazon.co.uk found unknown, overseas brands are the most-listed brands on Amazon Fashion UK, with several listing tens of thousands of clothing products on the site and accounting for a large share of total listings.

7. Brand mashups became big in China

We saw a wave of collaboration between major brands to launch new products in the uniquely fast-moving and innovative China market. In many cases, these brand mashups involve creating products that feature elements of a brand from a highly dissimilar category: for example, Moschino clothing with Budweiser-inspired designs, Skechers footwear branded with the Snickers logo, and Sprite-themed shower gel from Lux.

8. Maybelline led beauty on Amazon.com

We found L’Oréal’s Maybelline New York brand is the most-listed beauty and personal care brand on Amazon.com, in our analysis of over 200,000 products listed on the site. Third-party sellers dominate the beauty offering on Amazon’s US site: Our research found that over 90% of all beauty and personal care products on Amazon.com were listed by third-party sellers.

9. Many more US consumers bought groceries online

More than one-third of US consumers now buy groceries online (as of April 2019), up from less than one-quarter a year earlier. However, over 70% of those online shoppers buy only a small portion of their groceries online, depressing the size of the market.

10. Chinese tourists supported global beauty sales

This year, beauty was the most-bought retail category among Chinese outbound travelers, pulling ahead of apparel by number of shoppers, according to our annual survey. Almost three-quarters of travelers from China said they bought this category abroad in the past 12 months, supporting category sales worldwide. And, luxury beauty is also the top category on which travelers from China expected to increase their overseas purchases in the next 12 months.

We look forward to sharing a host of new insights in 2020.

Super Saturday Sets One-Day Sales Record

(December 23) Bloomberg.com

Super Saturday Sets One-Day Sales Record

(December 23) Bloomberg.com

Eastpak Partners with Ader Error on Baggage Styles

(December 23) FashionNetwork.com

Eastpak Partners with Ader Error on Baggage Styles

(December 23) FashionNetwork.com

Tempur Sealy Announces Multiple Executive Promotions

(December 23) StreetInsider.com

Tempur Sealy Announces Multiple Executive Promotions

(December 23) StreetInsider.com

Mastercard Announces Acquisition of RiskRecon

(December 23) Techcrunch.com

Mastercard Announces Acquisition of RiskRecon

(December 23) Techcrunch.com

Amazon Expands Free Return Policy for the Holiday Season

(December 23) Forbes.com

Amazon Expands Free Return Policy for the Holiday Season

(December 23) Forbes.com

Waitrose & Partners Increases Orders of Loose Vegetable and Refillables

(December 20) Company press release

Waitrose & Partners Increases Orders of Loose Vegetable and Refillables

(December 20) Company press release

Falconeri Expands its Footprint in Spain

(December 23) America-Retail.com

Falconeri Expands its Footprint in Spain

(December 23) America-Retail.com

Pandora Appoints New Board Chairman

(December 23) FashionNetwork.com

Pandora Appoints New Board Chairman

(December 23) FashionNetwork.com

JW Anderson Partners with Onward Luxury Group

(December 23) FashionNetwork.com

JW Anderson Partners with Onward Luxury Group

(December 23) FashionNetwork.com

Adidas and PrimaLoft Intensifies Collaboration

(December 23) FashionNetwork.com

Adidas and PrimaLoft Intensifies Collaboration

(December 23) FashionNetwork.com

Aeon Malaysia Appoints new Managing Director

(December 24) StratisTimes.com

Aeon Malaysia Appoints new Managing Director

(December 24) StratisTimes.com

Alibaba’s Fliggy Launches Feizhu Hotel Alliance

(December 24) Alizila.com

Alibaba’s Fliggy Launches Feizhu Hotel Alliance

(December 24) Alizila.com

Tmall Global Launches Initiative to Help Smaller Brands

(December 23) Alizila.com

Tmall Global Launches Initiative to Help Smaller Brands

(December 23) Alizila.com

Mustard Fashion Opens Two New Stores in Delhi and Plans to Open 100 Stores in India by 2023

(December 23) FashionNetwork.com

Mustard Fashion Opens Two New Stores in Delhi and Plans to Open 100 Stores in India by 2023

(December 23) FashionNetwork.com

Eraman Malaysia Opens Dior, Lancôme and Swarovski boutiques at Kuala Lumpur Airport

(December 23) MoodieDavittReport.com

Eraman Malaysia Opens Dior, Lancôme and Swarovski boutiques at Kuala Lumpur Airport

(December 23) MoodieDavittReport.com

Pandora Opens a New Store in Colombia

(December 24) FashionNetwork.com

Pandora Opens a New Store in Colombia

(December 24) FashionNetwork.com

Bata Opens New Store in Chile

(December 24) FashionNetwork.com

Bata Opens New Store in Chile

(December 24) FashionNetwork.com

Wong Launches Food Traceability App

(December 23) America-retail.com

Wong Launches Food Traceability App

(December 23) America-retail.com

Brazil to Launch National Artificial Intelligence Strategy

(December 23) ZDNet.com

Brazil to Launch National Artificial Intelligence Strategy

(December 23) ZDNet.com

Chinese Laundry to Arrive in Northern Mexico

(December 23) America-Retail.com

Chinese Laundry to Arrive in Northern Mexico

(December 23) America-Retail.com

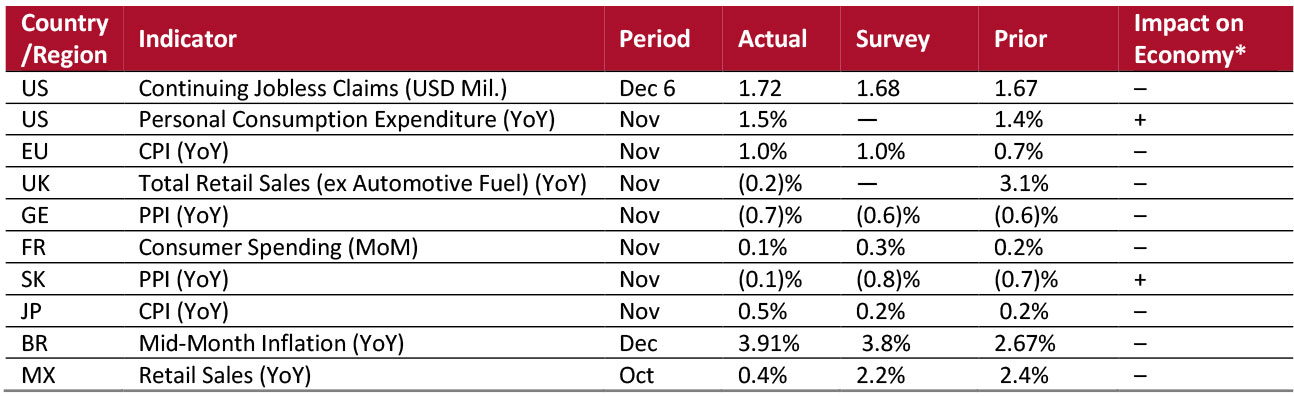

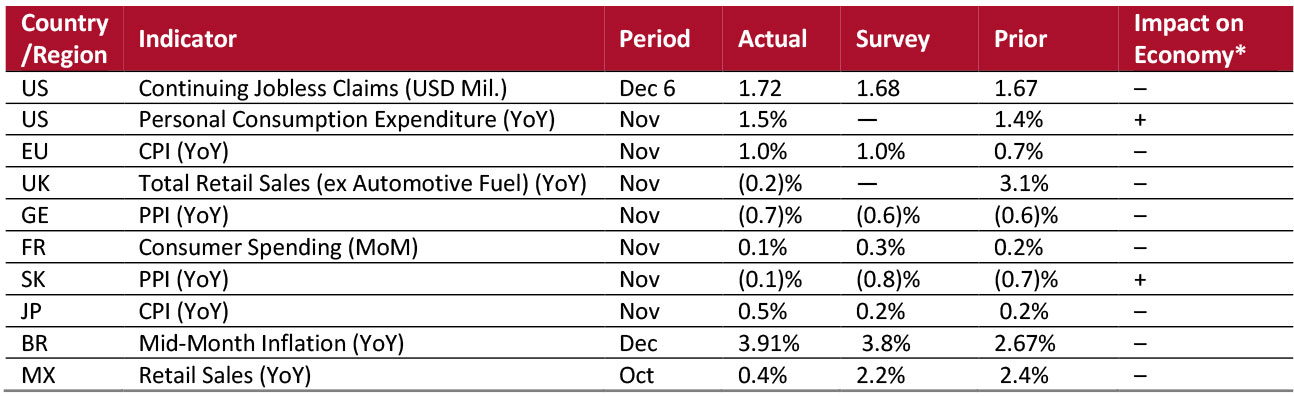

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/Bureau of Economic Analysis, Department of Commerce/Eurostat/Office for National Statistics/Statistisches Bundesamt Deutschland/INSEE/Bank of Korea/Statistic Bureau of Japan/IBGE/INEGI/Coresight Research [/caption] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

US RETAIL & TECH HEADLINES

Super Saturday Sets One-Day Sales Record

(December 23) Bloomberg.com

Super Saturday Sets One-Day Sales Record

(December 23) Bloomberg.com

- Super Saturday sales hit $34.4 billion in the US this year—the biggest single day in US retail history, according to consulting and research company Customer Growth Partners.

- Super Saturday results exceeded Black Friday’s $31.2 billion by 10%. Foot traffic was down at most malls, but the conversion rate rose, according to Customer Growth Partners.

Eastpak Partners with Ader Error on Baggage Styles

(December 23) FashionNetwork.com

Eastpak Partners with Ader Error on Baggage Styles

(December 23) FashionNetwork.com

- US-based backpack retailer Eastpak has partnered with Korean streetwear brand Ader Error to launch a new backpack collection. The collaboration includes three variants: The Padded Pak'r, Ader Sling bags and the Ader Crossbody.

- All three offerings will bear a co-branded logo and sell for between $155 and $200. The collection is available in all Eastpak stores and online.

Tempur Sealy Announces Multiple Executive Promotions

(December 23) StreetInsider.com

Tempur Sealy Announces Multiple Executive Promotions

(December 23) StreetInsider.com

- Mattress manufacturer and retailer Tempur Sealy announced several executive promotions on December 23. Cliff Buster was promoted to President, US Direct-to-Consumer division; Steve Rusing was promoted to President, US Sales; and, Tom Murray was promoted to EVP and Chief Marketing Officer, US.

- Tempur Sealy Chairman and CEO Scott Thompson said, “These executives have played key roles in the success of the Tempur Sealy business in the past. But more importantly, I am confident they are the leaders who will help lead Tempur Sealy into the future and meet the company's business needs going forward.”

Mastercard Announces Acquisition of RiskRecon

(December 23) Techcrunch.com

Mastercard Announces Acquisition of RiskRecon

(December 23) Techcrunch.com

- On December 23, Mastercard announced the acquisition of RiskRecon, a risk assessment automation startup based in Salt Lake City, Utah. RiskRecon uses publicly available data to build security assessments of organizations so they can improve security.

- RiskRecon launched in 2015 and has raised over $40 million in funding, according to Crunchbase. The key investors include Accel, Dell Technologies Capital, General Catalyst and F-Prime Capital.

Amazon Expands Free Return Policy for the Holiday Season

(December 23) Forbes.com

Amazon Expands Free Return Policy for the Holiday Season

(December 23) Forbes.com

- Amazon has expanded its returns policy for the holiday season to include electronics, pet supplies and household items, among others. The free return policy will be applicable to merchandise bought between November 1 and December 31, which will remain eligible for return until January 31.

- Customers can return goods to one of 18,000 physical Amazon locations, such as an Amazon store, Amazon Hub, Kohl’s store, Amazon Books and 5,800 UPS sites.

EUROPE RETAIL AND TECH HEADLINES

Waitrose & Partners Increases Orders of Loose Vegetable and Refillables

(December 20) Company press release

Waitrose & Partners Increases Orders of Loose Vegetable and Refillables

(December 20) Company press release

- British supermarket chain Waitrose & Partners has increased orders of best-selling loose vegetables and refillables (unpackaged products sold in bulk in reusable containers) this Christmas by 75% year over year, mainly due to demand from environmentally conscious shoppers.

- The retailer confirmed that sales of products in refillable format such as pasta, lentils, frozen fruit, coffee, wine and beer at its four Waitrose Unpacked shops outsold packaged counterparts by 68%.

Falconeri Expands its Footprint in Spain

(December 23) America-Retail.com

Falconeri Expands its Footprint in Spain

(December 23) America-Retail.com

- Italian luxury brand Falconeri has opened a fourth store in Palma de Mallorca in Spain. Falconeri has stores in the L'illa Diagonal shopping center and on Pasco de Gracia in Barcelona and on Serrano Street in Madrid.

- This store spans 753 square feet and will be located on Jaime III Avenue, one of the main commercial streets in Palma de Mallorca.

Pandora Appoints New Board Chairman

(December 23) FashionNetwork.com

Pandora Appoints New Board Chairman

(December 23) FashionNetwork.com

- Danish jewelry retailer Pandora has appointed Peter Ruzicka Chairman of the Board of Directors. Ruzicka recently resigned as President and CEO of Norwegian conglomerate Orkla.

- Ruzicka will replace Peder Tuborgh who held the role since 2014. Ruzicka’s appointment will be effective from January 1, 2020.

JW Anderson Partners with Onward Luxury Group

(December 23) FashionNetwork.com

JW Anderson Partners with Onward Luxury Group

(December 23) FashionNetwork.com

- British fashion company JW Anderson has signed a licensing deal with Onward Luxury Group, the European subsidiary of the Japanese fashion group of the same name. Onward Luxury will make and distribute JW Anderson’s men's and women's footwear lines starting with the fall/winter 2020–2021 season for men’s footwear and just before the autumn 2020 season for the women’s line.

- Onward Luxury Group owns brands such as Jil Sander, MoreauParis and Joseph. It is also the licensee for ready-to-wear footwear label Mulberry and Proenza Schouler.

Adidas and PrimaLoft Intensifies Collaboration

(December 23) FashionNetwork.com

Adidas and PrimaLoft Intensifies Collaboration

(December 23) FashionNetwork.com

- Sportswear brand Adidas and US based material manufacturer PrimaLoft have extended their long-standing collaboration. PrimaLoft converts plastic waste collected from beaches and coasts worldwide into insulation material.

- The two companies jointly developed high-performance, sustainable products that use PrimaLoft insulation material from recycled ocean plastic. Adidas will introduce the concept products at ISPO, a leading sports fair in Munich, and at the Outdoor Retailer and The Snow Show in Colorado both in January 2020.

ASIA RETAIL AND TECH HEADLINES

Aeon Malaysia Appoints new Managing Director

(December 24) StratisTimes.com

Aeon Malaysia Appoints new Managing Director

(December 24) StratisTimes.com

- Malaysian retail Group Aeon has appointed Shafie Shamsuddin as Managing Director. He will succeed Shinobu Washizawa, who is set to retire on December 31.

- Shamsuddin currently serves as Chief Strategy Officer at Aeon Asia and will also assume the post of Managing Director at Aeon when he joins his new role. Prior to joining Aeon, he served as President and CEO of PT Trans Retail Indonesia from 2013 to 2019.

Alibaba’s Fliggy Launches Feizhu Hotel Alliance

(December 24) Alizila.com

Alibaba’s Fliggy Launches Feizhu Hotel Alliance

(December 24) Alizila.com

- Alibaba’s travel service platform Fliggy launched the Feizhu Hotel Alliance, a campaign to connect China’s independently operated hotels with travelers that also offers benefits to travelers. The alliance has signed up 15,000 hotels in over 300 Chinese Cities.

- Alliance hotels receive special labels on the Fliggy app, but can also keep their own branding. Fliggy will give alliance hotels Alibaba tools and technology to streamline operations such as booking management, membership retention and finance.

Tmall Global Launches Initiative to Help Smaller Brands

(December 23) Alizila.com

Tmall Global Launches Initiative to Help Smaller Brands

(December 23) Alizila.com

- Alibaba’s e-commerce site Tmall Global has launched a new campaign called Global Discovery Day, designed to help small to mid-sized businesses and brands that have just entered China promote products.

- The new initiative curates a series of products themed around a specific consumer pain point, based on analytics from parent company Alibaba Group. For example, the campaign recently featured “quick-fix beauty” products from more than 100 international brands, including facial cleaning devices and beauty gadgets.

Mustard Fashion Opens Two New Stores in Delhi and Plans to Open 100 Stores in India by 2023

(December 23) FashionNetwork.com

Mustard Fashion Opens Two New Stores in Delhi and Plans to Open 100 Stores in India by 2023

(December 23) FashionNetwork.com

- Women’s apparel brand Mustard Fashion opened two new stores in New Delhi on December 19. Mustard Fashion has announced plans to invest INR 487 million ($6.8 million) to expand in India, with plans to open 100 new stores over the next three years.

- The brand opened new stores at GK-1’s M-Block market and in the Pacific Mall in Dwarka, taking its store count in Delhi to eight. The stores will offer affordable apparel in categories such as casual, party wear, office wear and ethnic wear.

Eraman Malaysia Opens Dior, Lancôme and Swarovski boutiques at Kuala Lumpur Airport

(December 23) MoodieDavittReport.com

Eraman Malaysia Opens Dior, Lancôme and Swarovski boutiques at Kuala Lumpur Airport

(December 23) MoodieDavittReport.com

- Malaysia Airports Holdings’ retail division Eraman Malaysia has opened new boutiques in partnership with fashion brands Dior, Lancôme and Swarovski at Kuala Lumpur International Airport. The move comes as part of the company’s strategy to expand the airport’s retail footprint.

- The stores opened on December 19 collectively span 2,438 square feet, and feature fragrances, cosmetics and skincare from the LVMH owned brands, jewelry lines from Swarovski and a wide range of beauty products from the Lancôme beauty portfolio.

LATIN AMERICA RETAIL AND TECH HEADLINES

Pandora Opens a New Store in Colombia

(December 24) FashionNetwork.com

Pandora Opens a New Store in Colombia

(December 24) FashionNetwork.com

- Danish jeweler Pandora has opened a new store in Cali, Colombia. The store is located at the Chipichape shopping center and is Pandora’s second store in Cali.

- The store features a new island-style layout and spans around 320 square feet in one of the main entrances of the commercial complex in the north of the city. Pandora opened four new stores in Colombia in December, increasing its store count in the country to 15.

Bata Opens New Store in Chile

(December 24) FashionNetwork.com

Bata Opens New Store in Chile

(December 24) FashionNetwork.com

- Footwear and accessories retailer Bata opened a new store in Chile’s capital Santiago. The company also plans to add around 15 new stores to its network in Chile in 2020.

- The store is located on the second level of the in the newly opened Open Kennedy shopping center and offers a wide variety of shoes.

Wong Launches Food Traceability App

(December 23) America-retail.com

Wong Launches Food Traceability App

(December 23) America-retail.com

- Chilean supermarket chain Wong has launched SUKU, an app that lets customers trace the origin of Wong Premium meats. Wong developed the app using block chain technology in partnership with US-based tech startup Citizens Reserve.

- The app scans QR codes on the Wong Premium meat package to provide information such as the location of the farm, quality certifications, the distribution process, the date of arrival in store—along with cooking tips.

Brazil to Launch National Artificial Intelligence Strategy

(December 23) ZDNet.com

Brazil to Launch National Artificial Intelligence Strategy

(December 23) ZDNet.com

- The Brazilian government has announced the launch of a national AI strategy. Brazil has previously announced eight new research facilities focused on AI.

- The government has opened a public consultation to gather input focused on six themes: qualifications for a digital future; workforce; research and development; innovation and entrepreneurship; government applications; and, AI applications in public safety.

Chinese Laundry to Arrive in Northern Mexico

(December 23) America-Retail.com

Chinese Laundry to Arrive in Northern Mexico

(December 23) America-Retail.com

- California-based women’s footwear brand Chinese Laundry is set to land in northern Mexico’s Sinaloa state next year. The firm offers footwear such as boots, flats, booties and slippers, among others.

- The new store will join brands such as Adidas, Cloe, Under Armour, Studio F and Adidas in a shopping center set to open in the first half of 2020.

MACRO ECONOMIC UPDATE

Key points from global macro indicators released December 18–24, 2019: 1) US: Continuing jobless claims in the US rose to 1.72 million in the week ended December 6 from 1.67 million the previous week. Personal consumption expenditures increased 1.5% year over year in November, slightly higher than the 1.4% increase in October. 2) Europe: In the eurozone, the Consumer Price Index (CPI) increased 1% year over year in November, versus a 0.7% decrease in September. In the UK, total retail sales excluding automotive fuel fell 0.2% year over year in November, versus 3.1% growth in October. 3) Asia Pacific: Korea’s Producer Price Index (PPI) slipped 0.7% year over year in November, slightly higher than the 0.6% decline in October. Japan’s CPI rose 0.5% year over year in November, marginally higher than the 0.2% increase in October. 4) Latin America: In Brazil, the mid-month inflation rate in December was 3.91% year over year, faster than the 2.67% rise in November. In Mexico, retail sales grew 0.4% year over year in October, versus 2.4% growth in September. [caption id="attachment_101674" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Department of Labor/Bureau of Economic Analysis, Department of Commerce/Eurostat/Office for National Statistics/Statistisches Bundesamt Deutschland/INSEE/Bank of Korea/Statistic Bureau of Japan/IBGE/INEGI/Coresight Research [/caption]

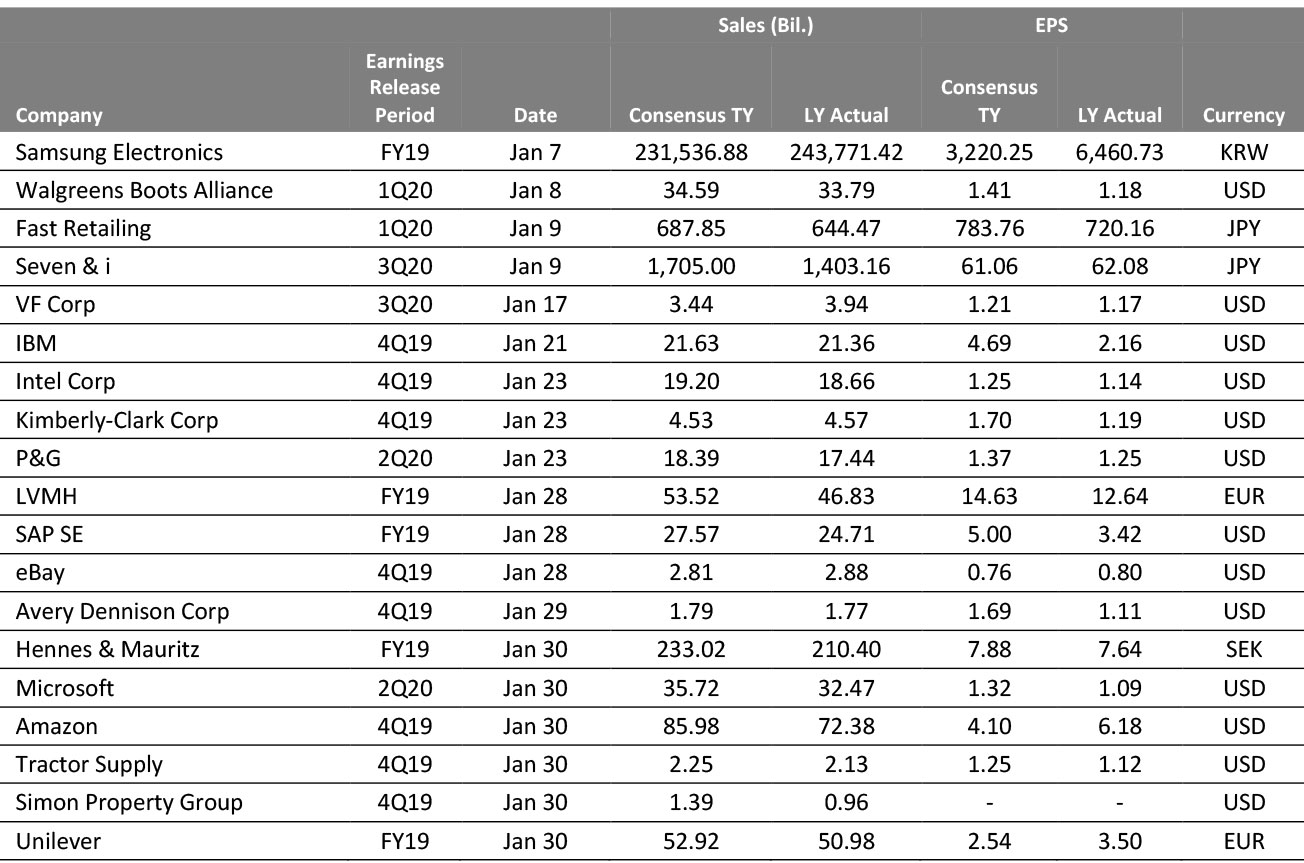

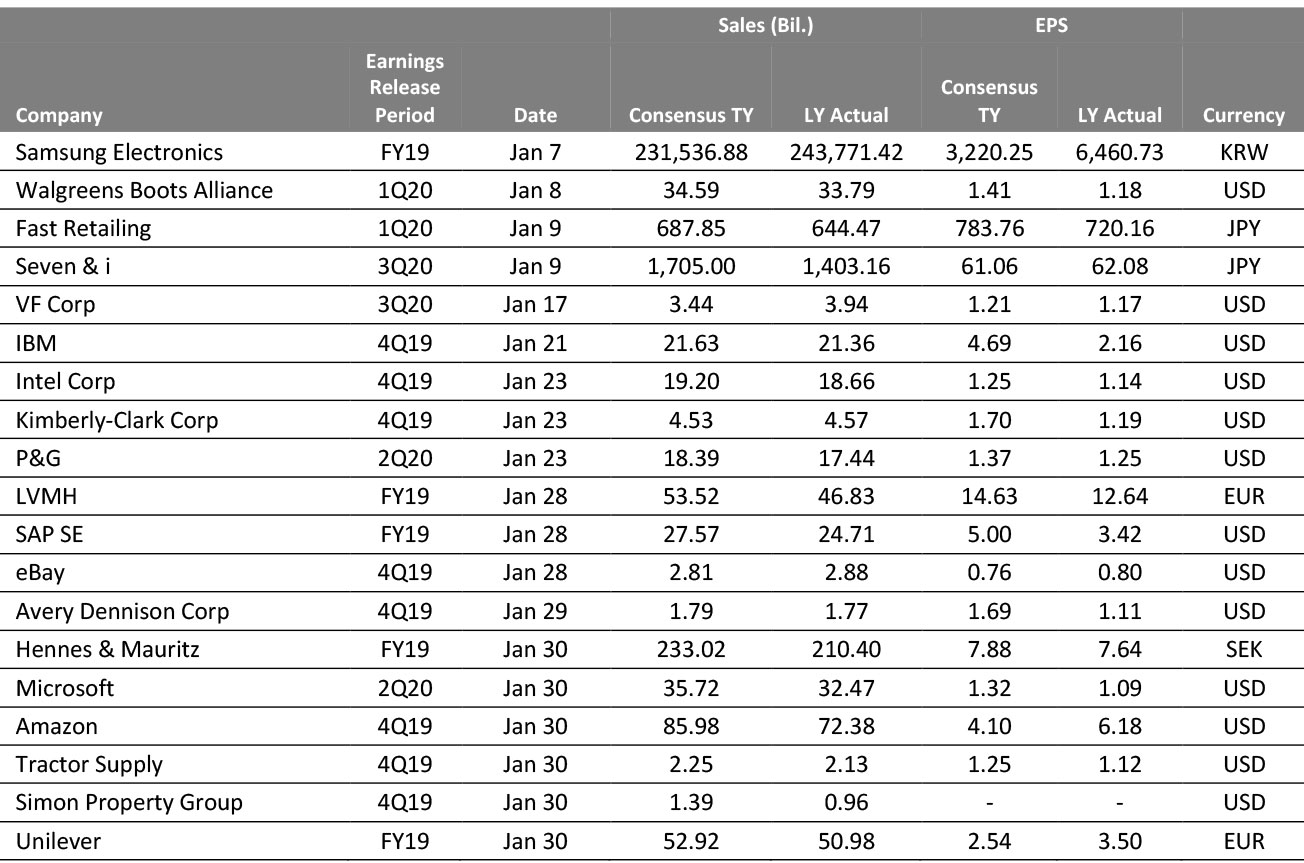

EARNINGS CALENDAR

[caption id="attachment_101675" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR