albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Prices Fell but Also Rose During the Black Friday to Cyber Monday Shopping Period

In partnership with competitive intelligence provider DataWeave, Coresight Research aggregated and analyzed pricing data for more 53,000 product listings on major US retailers’ websites on Black Friday and Cyber Monday 2019. We analyzed the scale and distribution of price cuts on Amazon.com on Black Friday and Cyber Monday, comparing to Best Buy, Home Depot and Macy’s, using prices on November 21 as the base.

We looked at average discounts, the greatest discounts and the percentage of products offered at discount for these retailers and reviewed data in the electronics, furniture, health and beauty, men’s fashion and women’s fashion categories. We also analyzed price changes over the Black Friday to Cyber Monday period.

Here are the major findings of our analysis:

- Black Friday no longer dominates as the biggest promotional day of the holiday season. Some retailers offer deeper discounts or cut prices on more products on Cyber Monday.

- Men’s fashion offered the highest average discount on both days and furniture the lowest.

- In women’s fashion, Macy’s offered an average discount of around one-third on both Black Friday and Cyber Monday.

- HomeDepot.com led furniture with the greatest average discount, with a significant lead over Amazon.com.

- In electronics, the average discounts on both days were bigger on BestBuy.com than on Amazon.com.

- We also saw prices rise: On Amazon.com, almost one-fifth of products in health and beauty, men’s fashion and women’s fashion featured higher prices on Cyber Monday.

One key insight of our analysis is that Black Friday no longer dominates as the biggest promotional day of the holiday season. At Amazon and Home Depot, we found a greater proportion of products on promotion on Cyber Monday than on Black Friday and at Amazon and Best Buy, we found higher average price discounts on Cyber Monday than on Black Friday. Macy’s tended to buck both these trends, typically offering more promotions and at a deeper level on Black Friday than on Cyber Monday.

On Amazon.com, men’s fashion and women’s fashion both were offered at an average double-digit percentage discount on both days. The average discount for electronics expanded 70 basis points on Cyber Monday, but the highest discount offered was the same on both days. The furniture and health and beauty categories also increased their average discounts on Cyber Monday.

Interestingly, we also discovered prices on Amazon.com for some products rose on both days compared to November 21. And, prices on more products increased on Cyber Monday than on Black Friday across all five categories. Almost one-fifth of products in health and beauty, men’s fashion and women’s fashion were more expensive on Cyber Monday than on November 21.

When comparing prices on Amazon.com, a higher percentage of the products we tracked were offered at discount on Cyber Monday than on Black Friday. In electronics, 9.1% were cheaper on Black Friday than Cyber Monday, while 9.9% were cheaper on Cyber Monday than Black Friday. That means 9.9% of electronics continued to lower their prices on Cyber Monday, a trend we saw in all five categories.

This year’s calendar featured Thanksgiving falling six days later than last year and resulting the shortest possible number of days between Black Friday and Christmas. Many retailers started holiday promotions early, but online sales results on both days were still stronger than last year. On Black Friday, brands and retailers in the US generated $7.2 billion in digital revenue, up 14% over last year, and Cyber Monday online sales were $9.4 billion, up 19% from last year, according to data from Salesforce and Adobe.

For more information on Black Friday pricing see our report US Black Friday and Cyber Monday Online Pricing Insights.

US RETAIL & TECH HEADLINES

Jared and James Allen Team up for Concept Store

Jared and James Allen Team up for Concept Store

(December 17) FashionNetwork.com

- Jared jewelers has teamed up with sister online diamond company James Allen to launch their first ever collaborative concept store in Fredrick, Maryland. The new store is in Francis Scott Key mall.

- The concept store offers an omnichannel shopping experience: Customers can access jewelry specialists for a personalized experience and James Allen’s collection of more than 250,000 loose diamonds.

![]() Bed Bath & Beyond Announces Extensive Management Changes

Bed Bath & Beyond Announces Extensive Management Changes

(December 17) Company press release

- Bed Bath & Beyond has announced an extensive restructuring of its management team, including the departure of six executives: the company’s chief brand officer, its chief merchandising officer, chief marketing officer, chief digital officer, chief legal officer & general counsel and its chief administrative officer.

- The company has appointed interim leads and started the search to fill the positions. The new team will be responsible for streamlining decision-making, accelerating transformation and re-establishing the company’s competitive advantage in the market through a more customer-oriented and more omnichannel retail operation.

Costco Expands Same-Day Alcohol Delivery to 200 Stores

(December 17) SupermarketNews.com

Costco Expands Same-Day Alcohol Delivery to 200 Stores

(December 17) SupermarketNews.com

- Costco has expanded its same-day delivery of alcohol to 200 of its stores in 11 states and the District of Columbia, through its partnership with delivery service provider Instacart. Costco clubs already offer same-day grocery delivery at all stores and the retailer is also trialing prescription deliveries in partnership with Instacart.

- Customers must be 21 or above to order alcohol, must enter date of birth at checkout and with present ID on delivery.

Target to Provide Free Delivery on Holiday-Season Orders

(December 16) Company press release

Target to Provide Free Delivery on Holiday-Season Orders

(December 16) Company press release

- Target has announced guaranteed delivery before Christmas and free shipping on select products purchased on Target.com by 12 p.m. Central Time on Friday, December 20. The products will be tagged as “guaranteed by Christmas.”

- Customers can place same-day order pickup or drive up orders on target.com or the Target app up to two hours prior to the store close on Christmas eve, and the company says orders will be ready in as little as one hour.

![]() Hibbett Sports Appoints Michael Longo President and CEO

(December 16) Company press release

Hibbett Sports Appoints Michael Longo President and CEO

(December 16) Company press release

- Hibbett Sports has appointed Michael Longo as President and CEO, effective immediately. Longo succeeds Jeff Rosenthal, who announced his retirement in March after serving as President and CEO for nine years.

- Longo previously served as CEO of footwear and apparel retailer City Gear and oversaw City Gear’s acquisition by Hibbett Sports in 2018.

EUROPE RETAIL AND TECH HEADLINES

![]() The Book People Falls into Administration

(December 17) New.Sky.com

The Book People Falls into Administration

(December 17) New.Sky.com

- UK-based online book retailer The Book People has fallen into administration with almost 400 employees facing uncertainty. The retailer has appointed PricewaterhouseCoopers (PwC) as administrators to handle the insolvency process.

- The company said the business will continue with no immediate layoffs. The Book People has been here before: The company fell into administration in 2014 but was later acquired by private equity group Endless.

More House of Fraser Stores to Shut

(December 17) TheGuardian.com

More House of Fraser Stores to Shut

(December 17) TheGuardian.com

- Sports Direct CEO Mike Ashley anticipates more House of Fraser stores will shut unless the government undertakes a review of the system of business rates (a property tax).

- When asked about a time frame for closures, Ashley commented “Realistically, it is months, not years,” but did not disclose the number of stores that might shut.

![]() Razer Gaming Launches its Debut Store in London

(December 16) InsideRetail.Asia

Razer Gaming Launches its Debut Store in London

(December 16) InsideRetail.Asia

- Gaming hardware, software and financial services company Razer opened its first store in Europe with a shop in London’s Chinatown on December 14. The 3,700-square-foot store spans two floors and is Razer’s largest store in the world.

- Shoppers can trial Razer goods including mice and keyboards designed for gamers, headsets and the brand’s Blade-series laptops. The lower floor features a streaming booth and an area dedicated to playing the game “Fortnite” using Razer equipment.

Mothercare Partners with Boots

(December 16) Drapersonline.com

Mothercare Partners with Boots

(December 16) Drapersonline.com

- British maternity retailer Mothercare has secured a new lease on life with a new, five-year deal with Boots to sell its maternity and early childhood products in Boots stores across the UK. Mothercare collapsed into administration and plans to close all its stores in February 2020.

- A limited range of Mothercare products will also be available for purchase on boots.com from mid-2020. Boots already sells Mothercare’s Mini Club range—apparel goods for kids up to two years of age—at its larger outlets.

Carrefour Italia Acquires 28 Auchan Outlets

(December 16) ESMMagazine.com

Carrefour Italia Acquires 28 Auchan Outlets

(December 16) ESMMagazine.com

- Carrefour Italia has entered into an agreement with Italian retailer Conad to purchase 28 Auchan stores in the Lombardy region of Italy for an undisclosed sum. The deal is expected to close at the beginning 2020 and includes measures to secure the jobs of current employees.

- Most of the Auchan stores are a small proximity format, with sales areas ranging from 1,600 to 6,500 square feet. Carrefour Italia announced a transformation plan for 2019–2022 in February which focuses on expanding proximity stores such as Carrefour Express in key locations.

ASIA RETAIL AND TECH HEADLINES

Hermès-Backed Chinese Brand Shang Xia to Launch in Singapore

(December 17) Marketing-Interactive.com

Hermès-Backed Chinese Brand Shang Xia to Launch in Singapore

(December 17) Marketing-Interactive.com

- Hermès-backed Chinese luxury brand Shang Xia has entered the Singapore market. The brand has also appointed fashion entrepreneur Adriana Lim Escano as its exclusive distributor for Shang Xia in Singapore.

- The brand hired ad agency Tribal Worldwide Singapore to market the brand there, and has opened a pop-up store in the upmarket Takashimaya department store, working with Tribal.

L’Oréal Partners with Lotte Duty Free to Launch Digital Makeup Service ModiFace

(December 17) MoodieDavittReport.com

L’Oréal Partners with Lotte Duty Free to Launch Digital Makeup Service ModiFace

(December 17) MoodieDavittReport.com

- L’Oréal Group has partnered with Korea-based Lotte Duty Free to launch ModiFace, an artificial intelligence (AI)-powered try-on makeup service. The service will be available via Lotte Duty Free Online and will let shoppers use augmented reality to virtually “try” on various beauty brands.

- Lotte Duty Free launched the service at a special event at its flagship store in Seoul. The event brought together VIP customers, domestic and international influencers.

Estée Lauder Teams up with China Duty Free Group for Holiday Exhibit in Haitang Bay Mall

(December 17) TRBusiness.com

Estée Lauder Teams up with China Duty Free Group for Holiday Exhibit in Haitang Bay Mall

(December 17) TRBusiness.com

- Estée Lauder has partnered with China Duty Free Group (CDFG) to launch an Estée Lauder Holiday Exhibition in the CDF mall in Haitang Bay, on China’s popular beach destination Hainan Island. The opening event on December 14 was attended by over 1,000 shoppers, influencers, press and VIPs, and will run through December.

- The exhibition features special illustrations by fashion illustrator Megan Hess as well as animations and a light show that will play three times a day until Christmas.

(December 17) InsideRetail.Asia

- Hong Kong-based snack shop chain Best Mart 360 opened its first store in Macau on December 17. The store is the first of as many as 15 stores planned for Macau as the company seeks to diversify away from Hong Kong.

- Best Mart 360 operated 98 stores as of September this year, a net 21 more than the same time a year earlier, with most of the new outlets opened in mainland China.

Fashion Platform Zilingo Acquires Sri Lanka Software Company nCinga for $15.5 Million

(December 16) TechCrunch.com

Fashion Platform Zilingo Acquires Sri Lanka Software Company nCinga for $15.5 Million

(December 16) TechCrunch.com

- Singapore fashion start-up Zilingo has acquired Sri Lanka software company nCinga for $15.5 million in a cash-and-stock deal. Zilingo will leverage nCinga’s manufacturing execution system (MES) software, a data analytics platform that enables real-time production monitoring on factory floors.

- Zilingo plans to use nCinga’s software across its network of 6,000 factories and 75,000 businesses. Zilingo will also expand the reach of nCinga’s software to core fashion manufacturing markets such as Bangladesh, India, Vietnam, Indonesia, Thailand and Turkey.

LATIN AMERICA RETAIL AND TECH HEADLINES

Huawei Launches Cloud Service in Peru

(December 17) America-Retail.com

Huawei Launches Cloud Service in Peru

(December 17) America-Retail.com

- Huawei has launched cloud service Huawei Cloud in Peru. Huawei already operates cloud services in Chile, Mexico and Brazil and has the most data centers in Latin America of any cloud service provider.

- Huawei Cloud also announced the launch of the Huawei Cloud Partner Network (HCPN), which aims to help partners develop services or solutions in Huawei Cloud by providing commercial, technical and marketing support.

![]() H&M Opens Mega Store in Chile’s Capital

(December 17) America-Retail.com

H&M Opens Mega Store in Chile’s Capital

(December 17) America-Retail.com

- H&M has opened a mega store in Santiago, Chile’s capital city, on December 12 and spanning over 35,500 square feet across three levels in the Kennedy shopping mall.

- The store will feature H&M’s fashion collections as well as its furnishings and decoration collections H&M Home.

![]() Walmart Regional Head to Retire in March 2020

(December 16) America-Retail.com

Walmart Regional Head to Retire in March 2020

(December 16) America-Retail.com

- Enrique Ostalé, EVP and Regional CEO of UK, Latin America and Africa at Walmart International and Chairman of the Walmart Council of Mexico and Central America, is set to retire in March 2020. Richard Mayfield, current Director of International Finance, will succeed Ostalé.

- Ostalé assumed his role in April 2017 after serving as CEO of Walmart Latin America, India and Africa from 2016 to 2017. He will continue to serve the company in an advisory role, subject to approval in the next annual general meeting.

![]() OXXO Partners with Mexican Government to Launch Program for Local Suppliers

(December 16) America-Retail.com

OXXO Partners with Mexican Government to Launch Program for Local Suppliers

(December 16) America-Retail.com

- Mexican convenience store chain OXXO has partnered with the Mexican State Secretariat for Economic Development to launch a "Made in Quintana Roo" program. (Quintana Roo is a state in the country’s far southeast, home to popular tourist destination Cancun). The program will train suppliers to develop products and services to sell to established markets.

- OXXO will allocate space within its stores for products made by local companies and hold promotions for these products. The program will begin by marketing 40 products from 11 suppliers in 20 stores in the Mexican state of Quintana Roo.

Falabella Group to Launch a New Pilot Store That Combines Sodimac and Maestro

(December 16) Peru-Retail.com

Falabella Group to Launch a New Pilot Store That Combines Sodimac and Maestro

(December 16) Peru-Retail.com

- Chile’s retail giant Falabella Group is testing a new pilot store in Peru that combines its home improvement chains Sodimac and Maestro in a single store under the brand Sodimac Maestro. The concept store will be tested in a location that previously operated under the Maestro brand.

- The store will feature an expanded assortment of products in new categories such as furniture and home products from Sodimac. Maestro and Sodimac have also integrated their digital offering and offer a single e-commerce site.

MACRO ECONOMIC UPDATE

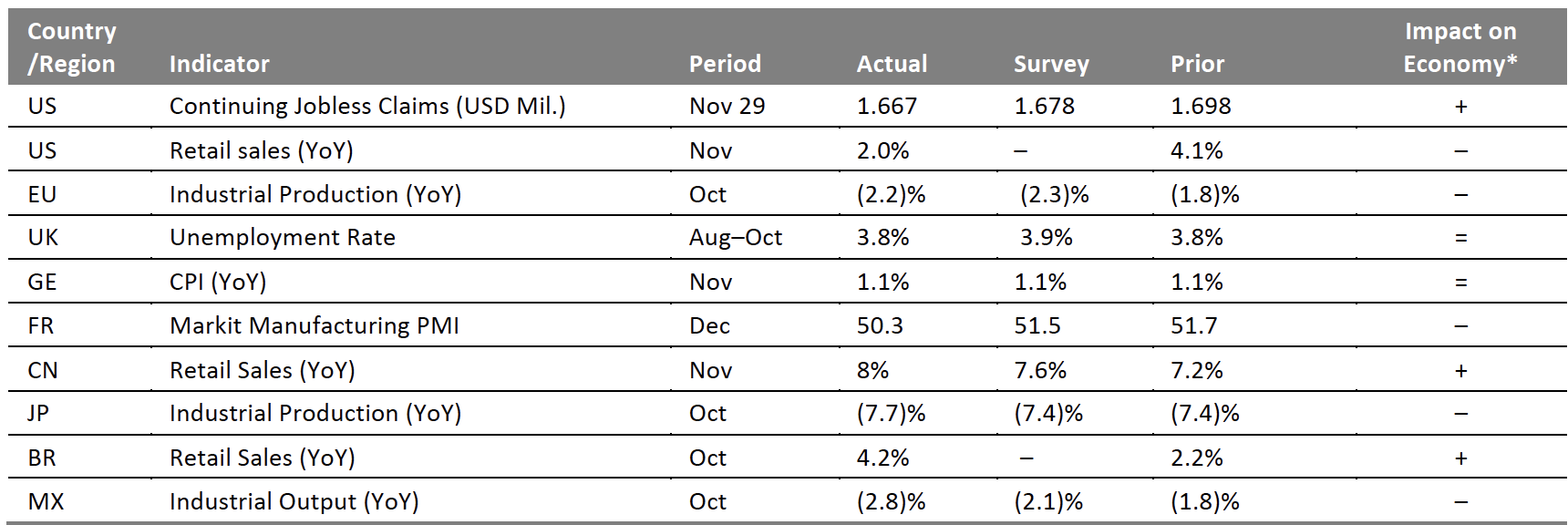

Key points from global macro indicators released December 11–17, 2019:

1) US: Continuing jobless claims in the US fell to 1.67 million in the week ended November 29, from 1.70 million in the previous week. Total retail sales excluding automobiles and gasoline increased 2.0% year over year in November, slowing from 4.1% in October. 2) Europe: Eurozone industrial production fell 2.2% year over year in October, versus an 1.8% decrease in September. In Germany, the Consumer Price Index (CPI) increased 1.1% year over year in November, in line with the consensus estimate and the same as October’s 1.1% growth. 3) Asia Pacific: In China, retail sales climbed 8% year over year in November, higher than the 7.2% growth in October. In Japan, industrial production fell 7.7% year over year in October, versus a 7.4% slide in September. 4) Latin America: In Brazil, retail sales grew 4.2% year over year in October, up from 2.2% in September. In Mexico, industrial output fell 2.8% year over year in October, versus a 1.9% decrease the previous month. [caption id="attachment_101487" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Department of Labor/US Census Bureau/Eurostat/Office for National Statistics/Statistisches Bundesamt Deutschland/Markit Economics/National Bureau of Statistics of China/Ministry of Economy, Trade and Industry/IBGE/INEGI/Coresight Research[/caption]

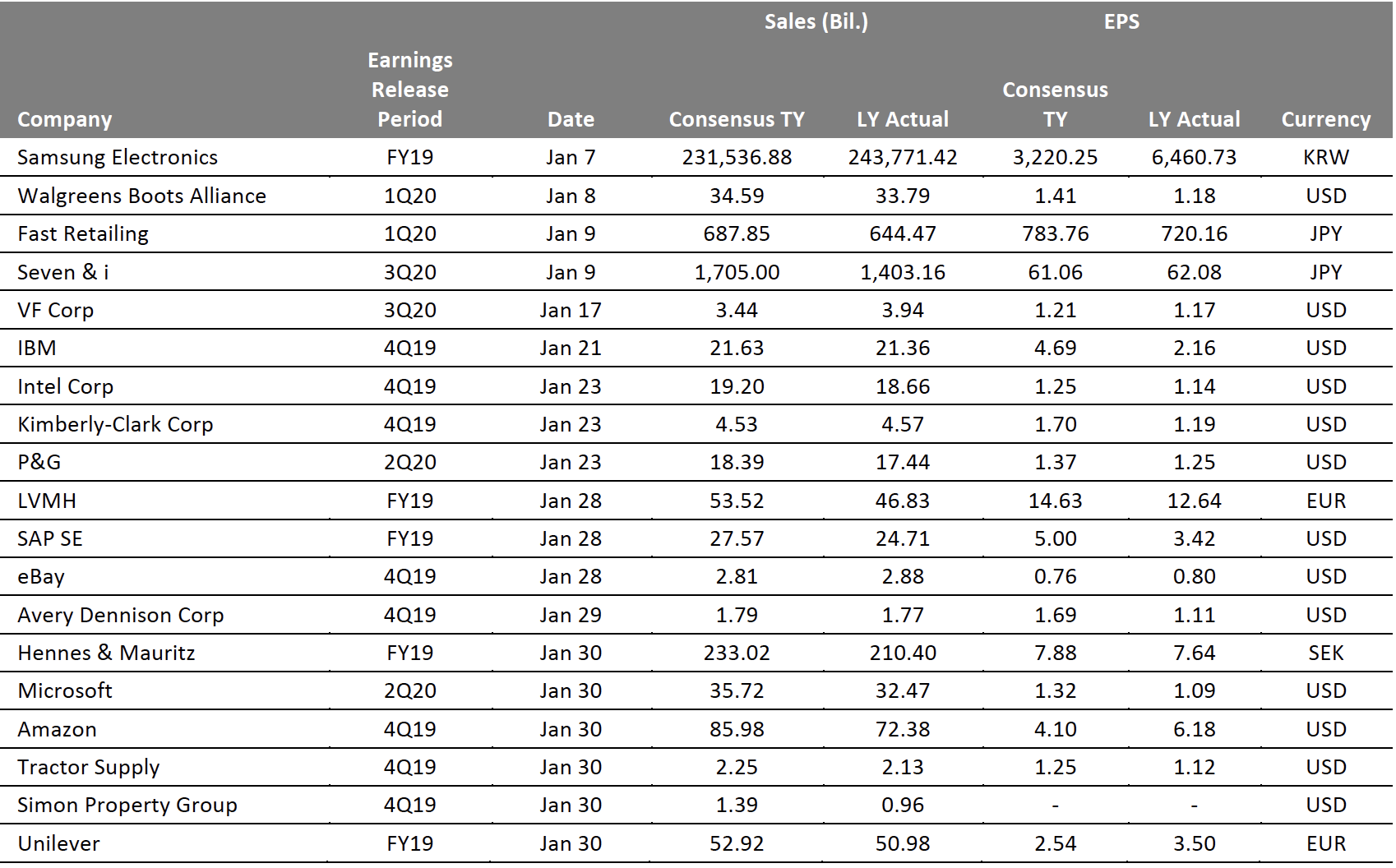

EARNINGS CALENDAR

[caption id="attachment_101488" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

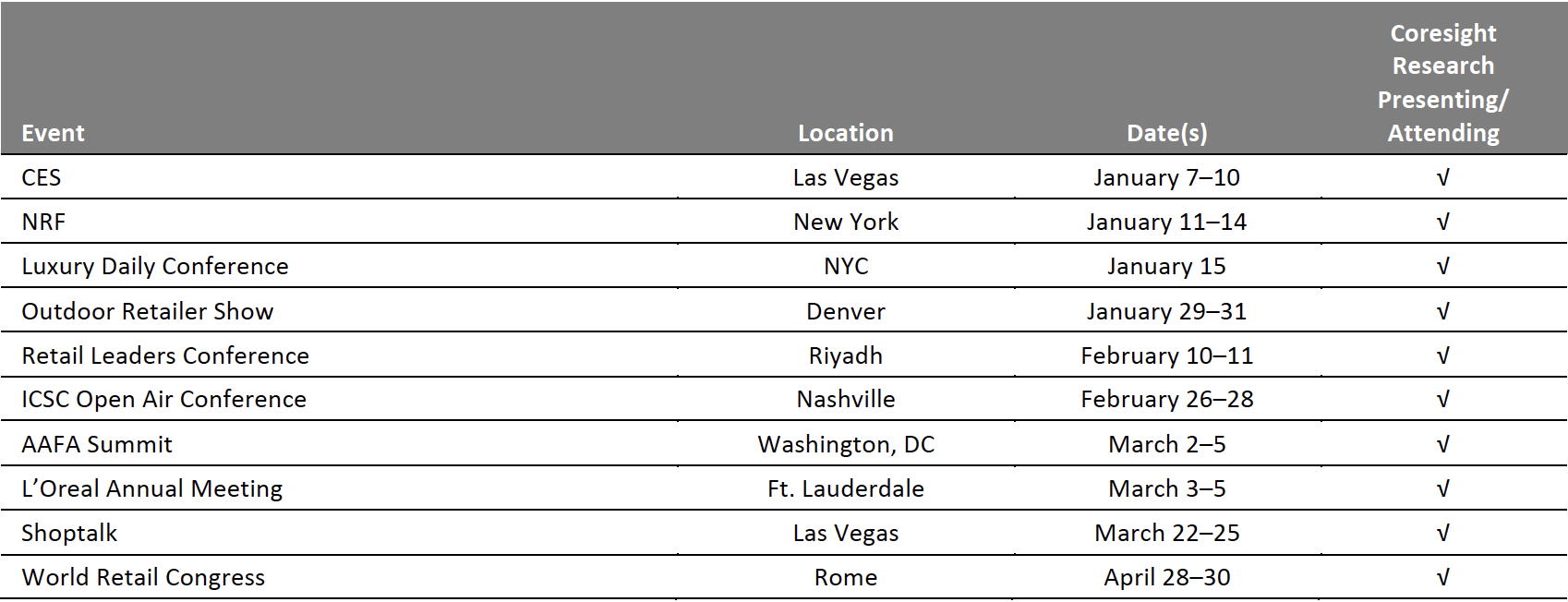

EVENT CALENDAR