Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

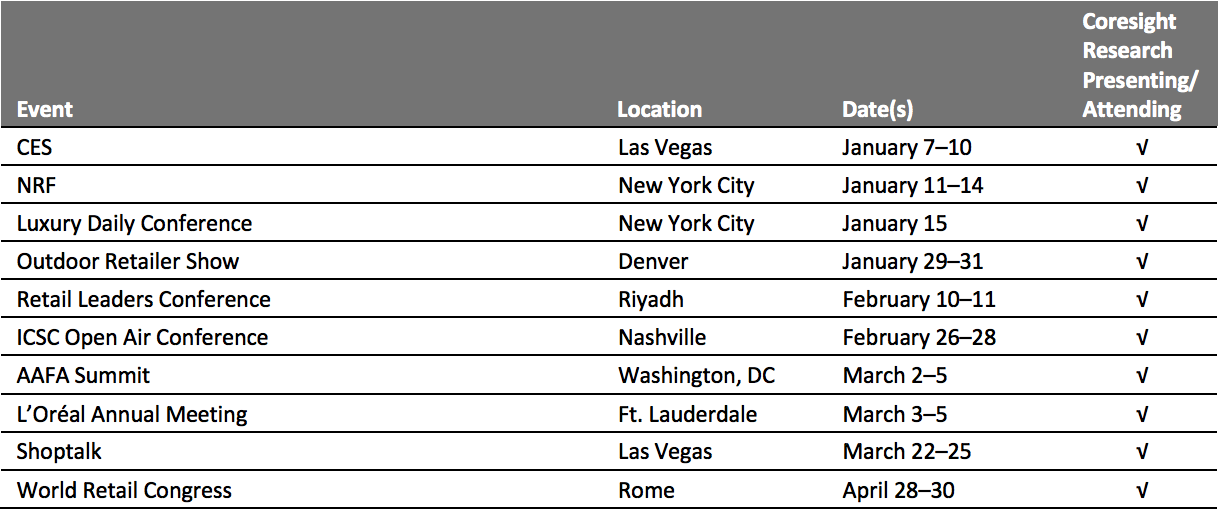

Well Into the Holiday Homestretch US Consumers Still Have a Lot of Shopping To Do We are into the holiday homestretch, but US consumers still have a lot of shopping to do—and this points to continued strong spend through the rest of the holiday shopping season. A late Thanksgiving means US shoppers have on average completed much less of their shopping by early December than they had this time last year. As we show in the chart below, survey data from Prosper Insights & Analytics reveals year-over-year increases in the proportion of respondents saying they have done only up to 75% of their holiday shopping as of early December. One in seven said they had not even started, versus one in eight last year. We also saw sharp declines in the proportion of respondents who said they completed more than 75% of their shopping by early December. [caption id="attachment_101131" align="aligncenter" width="700"] Base: Over 7,000 US Internet users aged 18 and above

Base: Over 7,000 US Internet users aged 18 and aboveSource: Prosper Insights & Analytics[/caption] This condensing of the shopping period heaps pressure on retailers to get it right the first time. Retailers have less time to recoup lost sales from any missteps in ranging, promotions or availability, and it reduces the inventory replenishment cycle, increasing logistical pressure. The good news is that we expect any negative impact on spending by consumers to be very limited: Shoppers do not buy fewer gifts or spend less per gift because of a calendar shift, so the only real loss is in incremental impulse purchases that would be made over a longer shopping season. Survey data on spending expectations appears to bear out a perception of solid demand: This year, Prosper recorded a 2.9-percentage-point decline in the proportion of respondents planning to spend less than they expected to one year earlier, from 18.1% in 2018 to 15.2% in 2019. The same survey found a 3.9-percentage-point increase in the proportion of shoppers who expect to spend the same as last year, from 50.9% in 2018 to 54.8% in 2019. Other recently reported metrics suggest solid total US holiday-season demand. Black Friday digital sales were up 19.6% this year, versus 23.6% in 2018, according to Adobe Analytics. Cyber Monday digital sales were up 19.7%, consistent with growth in 2018, Adobe said. And while offline Black Friday store traffic declined, it did so at a much slower pace than in years past, according to RetailNext. Even though there is much shopping still to be done, we think these metrics support Coresight Research’s estimate of a 4% year-over-year increase in November and December retail sales.

US RETAIL & TECH HEADLINES

Walmart Trials Robotic Grocery Deliveries in Partnership with Nuro

(December 10) Company press release

Walmart Trials Robotic Grocery Deliveries in Partnership with Nuro

(December 10) Company press release

- Walmart has announced a new pilot grocery delivery service in partnership with autonomous vehicle company Nuro. The company will trial the service at the Houston, Texas, Walmart store using small autonomous delivery vehicles to deliver online orders.

- The multi-purpose vehicles developed by Nuro are designed to carry a variety of goods with lockable compartments and can drive autonomously at speeds up to 25 mph.

Ollie’s Bargain Outlet Appoints New President and CEO

(December 10) Company press release

Ollie’s Bargain Outlet Appoints New President and CEO

(December 10) Company press release

- US discount retailer Ollie’s Bargain Outlet has appointed John Swygert as President, CEO and Director, effective immediately. Swygert has been interim president and CEO since December 2, after the unexpected passing of the company’s Founder Mark Butler.

- Swygert joined Ollie's in March 2004 as CFO and was promoted to EVP and CFO in 2011. He has been serving as EVP and COO since January 2018.

Marquee Brands to Acquire Leading Maternity Brands

(December 9) Company press release

Marquee Brands to Acquire Leading Maternity Brands

(December 9) Company press release

- US brand management company Marquee Brands will acquire maternity apparel designer and retailer Destination Maternity, including its trademarks Motherhood Maternity and A Pea In The Pod.

- The transaction is subject to customary conditions and is expected to close on December 20, 2019. The acquisition includes the intellectual property, e-commerce business and other assets of Destination Maternity.

Yahoo Shopping Attracts Customers with Cash Back Bonuses

(December 9) Company press release

Yahoo Shopping Attracts Customers with Cash Back Bonuses

(December 9) Company press release

- Verizon Media, the parent company of web services provider Yahoo, is luring customers with cashback rewards on its online marketplace Yahoo Shopping, enabled by Japanese e-commerce company Rakuten, on purchases from more than 50 online retailers.

- In addition, Yahoo email subscribers can sign up for promotions which include a dedicated “deal” view—a place to keep subscribers notified about the most valuable offers before they expire.

Lord & Taylor Returns to New York

(December 9) CNBC.com

Lord & Taylor Returns to New York

(December 9) CNBC.com

- Luxury department store Lord & Taylor is planning its return to New York under new owner Le Tote with a pop-up shop in SoHo. The 2,400-square-foot store is located at Wooster Street in SoHo.

- The shop will open from December 11 to Christmas Eve and feature a variety of Lord & Taylor products, holiday gift sets and a small section for Le Tote’s clothing rental service.

EUROPE RETAIL AND TECH HEADLINES

- Grocery retailer SPAR Austria has announced plans to open 20 new SPAR Express over the next 14 months. The retailer has revamped the design to focus on fresh items and will also incorporate eco-friendly cooling and lighting solutions to reduce the carbon footprint.

- SPAR Austria opened its first new format SPAR Express store featuring a fresh market area in Amstetten in September 2019. The store spans over 860 square feet and offers freshly baked bread and pastries, fruits, vegetables, flowers and coffee to

Co-op Plans 30 New Store Openings Before Christmas

(December 10) CityAM.com

Co-op Plans 30 New Store Openings Before Christmas

(December 10) CityAM.com

- UK-based food retailer Co-op intends to open 30 retail locations in the UK by Christmas. The new store openings began in November and will continue through December.

- The stores will include an ATM, coffee dispenser and bakery alongside standard food aisles, with car parking and Amazon lockers at select Co-op will invest £25million ($32.9 million) for the expansion and all stores will run on 100% renewable energy.

- British apparel retailer Ted Baker has announced that both Executive Chairman David Bernstein and CEO Lindsay Page have stepped down from their respective roles with immediate effect. The board has appointed Sharon Baylay as acting chair of the board and CFO Rachel Osborne as acting CEO until replacements are

- The resignations come as Ted Baker gave anotherprofit warning and cancelled a dividend payout. Last week, Ted Baker shares fell to a 10-year low and the company revealed that the group's inventory had been overstated by £20–25million ($26.3–32.9 million).

- Paul Price, CEO of UK-based fashion retailer Topshop and Topman, has stepped down from his role. A spokesman from parent company Arcadia said Price was due to leave at the end of this year to return to the US.

- Price served as CEO of Topshop/Topman after joiningArcadia in Arcadia CEO Ian Grabiner will assume Price’s role until a replacement is found.

H&M Introduces Delivery by Bicycle in The Netherlands

(December 9) Company press release

H&M Introduces Delivery by Bicycle in The Netherlands

(December 9) Company press release

- H&M has partnered with bicycle parcel delivery service Fietskoeriers.nl to offer home delivery using bicycles in over 30 cities in the Netherlands, including next-day and for the same price.

- Bicycle delivery is consistent with H&M’s goal to be climate-positive by 2040. nl picks up parcels at the H&M warehouse using biogas vehicles, then delivers them by bike from nearby hubs.

ASIA RETAIL AND TECH HEADLINES

- Alibaba has become the official partner of the 2020 Asian Games to be held in Hangzhou, China. Alibaba will manage all core systems, including competition results and support management of the venue through its cloud computing service Alibaba Cloud.

- The Asian Games organizing committee also launched a flagship store for licensed merchandise on Tmall, with plans to release on Taobao and Lazada. Alibaba plans to develop a dedicated mini program on Alipay to streamline the experience for spectators.

Chinese E-Commerce Platform Xiaohongshu to Launch Live Streaming Service

(December 10) JingDaily.com

Chinese E-Commerce Platform Xiaohongshu to Launch Live Streaming Service

(December 10) JingDaily.com

- Chinese e-commerce platform Xiohongshu plans to launch a new live-streaming service early next year, the latest e-commerce platform after Alibaba, JD.com and Mogu to launcha service that melds entertainment and shopping.

- The company will roll out the service as a test feature and have not announces a launch date. The service will include e-commerce functionality, such as a shopping cart, and links to product pages, as well as new waysfor content creators to interact with

- Walmart has launched Walmart Vriddi, a supplier development program that will see the company work more closely with 50,000 medium and small enterprises across India to help them scale, build capacity and join the global supply chain.

- Walmart will work with local organizations to develop 25 institutes over the next five years, the first of which is set to open in early 2020. The institutes will train local enterprises to help them tap into domestic and international customers and supply chains.

Beiersdorf Acquires a Significant Stake Korean Beauty Start-up LYCL

(December 9) Company press release

Beiersdorf Acquires a Significant Stake Korean Beauty Start-up LYCL

(December 9) Company press release

- Beiersdorf has acquired a significant stake in Korean skin care and tech startup LYCL, strengthening the company’s footprint in the region.

- LYCL was established in 2013 and has access to more than 1.2 million consumers. The company combines three different models: unpa.me, a review and content platform for Korean beauty products;me, an influencer network platform; and, unpa.Cosmetics, the startup’s own skin-care brand.

Desigual Partners with Tablez to Launch in India

(December 9) InsideRetail.asia

Desigual Partners with Tablez to Launch in India

(December 9) InsideRetail.asia

- Spanish clothing brand Desigual is set to launch in India in partnership with local retail group Tablez. The clothing brand will debut through Flipkart’s fashion e-commerce arm Myntra and will be available in physical stores throughout the country next year.

- Tablez plans to first open six Desigual stores in major cities and in multiple tier-II cities afterwards. Desigual is one of several leading global brands Tablez is bringing to India.

- British grocer Tesco is considering selling its operations in Malaysia and Thailand as part of a strategic review.

- The operations could be worth as much as £6.8 billion ($9 billion), according to reports. Tesco operates 74 stores in Malaysia and 1,967 stores in Thailand in addition to a number of shopping centers.

LATIN AMERICA RETAIL AND TECH HEADLINES

- USfashion brand True Religion plans to open its first store in northern Mexico in Sinaloa state next year. True Religion has been in Mexico for 15 years ago, with stores in various cities and an online store.

- The new store will join brands such as Adidas, Cloe, Under Armor and Studio F in a shopping center set to open in the first half of 2020. The company plans to open another store in Quintana Roo state in 2021.

- The National Basketball Association (NBA) has opened its first store in Mexico in the capital city. The store spans 2,023 square-feet and includes a digital video wall displaying live NBA games, scores, highlights and social media content.

- The store features apparel, jerseys, footwear, headwear, novelties and exclusive NBA gear from licensed brands. Customers can personalize hats, buy tickets to games and attend special events.

- Colombian clothing retailer Lili Pink has opened a new store in Guatemala and held a relaunch event, including a new line featuring more than five categories of garments, including beachwear and swimsuits.

- The company also plans to open a 1,000-square-foot flagship store in the country by the end of the year. Less than 18 months after having landed in the Guatemalan market, the company has 11 stores and points of sale.

H&M Partners with Rappi to Boost its Omnichannel Presence in Chile

(December 9) FashionNetwork.com

H&M Partners with Rappi to Boost its Omnichannel Presence in Chile

(December 9) FashionNetwork.com

- H&M has formed a strategic alliance with Colombian delivery startup Rappi to deliver store orders from select H&M stores in Chile through the Rappi app. H&M has set up a dedicated team to handle the orders.

- Founded in 2015, Rappi is a digital platform that offers home delivery services from markets, restaurants and self-service stores. Earlier this year, Rappi formed a similar alliance with

- Colombian fashion retailer Totto has partnered with Colombian fintech company Tpaga so shoppers canpay using the virtual payment platform. The companies expect the service to reach 100,000 transactions in the next year.

- Initially, the payment option will be available in only 10 Totto stores, but could expand if the pilot goes well.

MACRO ECONOMIC UPDATE

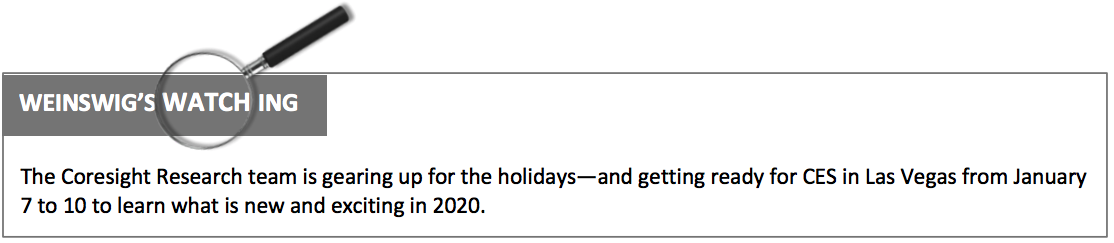

Key points from global macro indicators released December 4–10, 2019:- US: Consumer credit increased 5.5% year over year in October, versus a 2.8% increase in September. Continuing jobless claims in the US rose to 1.69 million in the week ended November 22 from 1.64 million in the previous week.

- Europe: In the eurozone, retail sales increased 1.4% year over year in October, versus a 2.7% increase in September. In the UK, the trade deficit was £5.19 billion in October, widening from £1.92 billion the previous month.

- Asia Pacific: In China, the consumer price index (CPI) climbed 4.5% year over year in November, versus a 3.8% increase in October. In Japan, GDP grew 1.8% year over year in Q3, versus a 0.2% rise in the previous quarter.

- Latin America: In Brazil, industrial production increased 0.8% month over month in October, versus a 0.3% increase in September. In Mexico, the CPI climbed 2.97% year over year in November, versus a 3.02% increase in October.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Board of Governors of the Federal Reserve/Department of Labor/Eurostat/Office for National Statistics/Statistisches Bundesamt Deutschland/MINEFA/National Bureau of Statistics of China/Cabinet Office/IBGE/INEGI/Coresight Research[/caption]

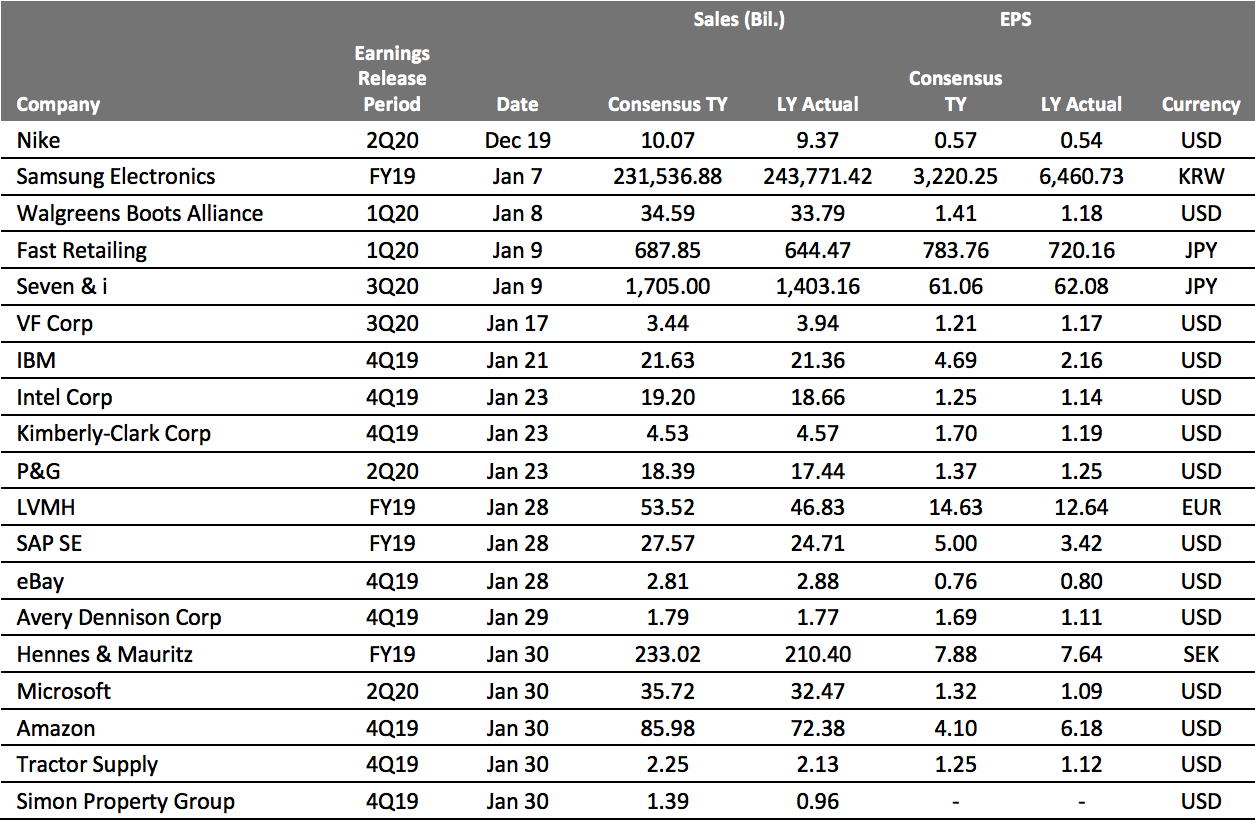

EARNINGS CALENDAR

[caption id="attachment_101158" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

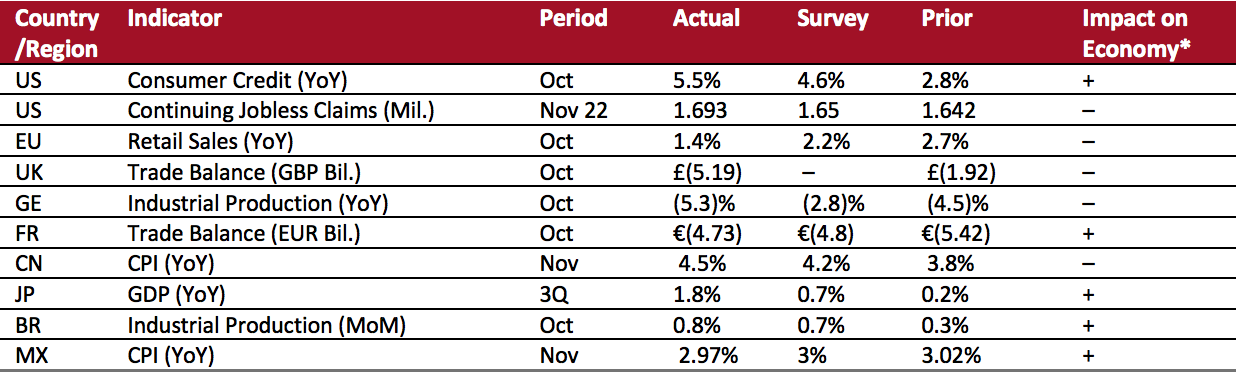

EVENT CALENDAR