DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

How Amazon’s Deal with Pinduoduo Taps Three Growth Segments in China Ahead of Black Friday, and four months after shutting its domestic Amazon.cn marketplace in China, Amazon this week opened a pop-up store on China’s e-commerce platform Pinduoduo. The store launched on November 25 and will run until the end of December, according to Amazon. The pop-up storefront features a selection of 1,000 products from Amazon’s cross-border offering, spanning electronics, cosmetics, personal-care products and apparel. Pinduoduo says Amazon is one of its partners for Black Friday promotions. Amazon’s move surprised some, given its withdrawal from the China market, but we see its partnership with Pinduoduo as tapping into three major trends in Chinese retail. 1. Demand from Lower-Tier Cities Retailers and marketplaces are increasingly turning growth opportunities in non-tier-1 cities, which are experiencing higher growth rates as incomes rise. On Singles’ Day 2019, Alibaba said a surge in shoppers from lower-tier markets helped it achieve its goal of attracting 100,000 new consumers. Lower-tier cities were also a key growth contributor for JD.com, with over 70% of new Singles’ Day participants coming from tier-3 to tier-6 cities. Pinduoduo is highly popular among price-conscious consumers in lower-tier Chinese cities. The platform enables users to receive steep discounts of as much as 90% on certain products if they invite enough friends to buy together. Pinduoduo’s strategy of targeting price-sensitive consumers from lower-tier cities has supported its rapid growth. 2. Popularity of Shopping Festivals We have just seen another bumper Singles’ Day, with a 26% jump in already-extraordinary sales by Alibaba (and comparing solidly to 27% growth in 2018). But shopping festivals in China don’t end with Singles’ Day: In December, we will see Alibaba’s 12.12 festival, while Black Friday and Cyber Monday are gaining traction in the market. Meanwhile, Suning “owns” the 8.18 Shopping Festival as it celebrates the company’s anniversary, and JD.com offers its 6.18 Shopping Festival. Despite closing Amazon.cn in July, Amazon continued to promote Prime Day to China-based cross-border customers. Pinduoduo’s Black Friday event gives Amazon a chance to piggyback a growing festival in China. 3. Outsized Growth in Cross-Border E-Commerce Cross-border e-commerce continues to gain traction in China, driven by consumption growth and rising demand for international products. According to data provider iiMedia, the value of China’s cross-border e-commerce market will climb by 19% to ¥10.8 trillion ($1.5 trillion) in 2019. That 19% growth compares to an estimated 14% increase in total e-commerce sales in China this year, according to Statista, demonstrating that cross-border sales are gaining share of total online sales year over year. In China, Amazon has committed itself to cross-border sales, but the company is still battling big rivals such as Alibaba, and it will seek to drive awareness and cement its place among cross-border shoppers. The Pinduoduo agreement follows Amazon’s launch of its cross-border e-commerce mini program on WeChat in September. These moves confirm that Amazon has not abandoned China—instead, the company has radically adjusted its strategy. US RETAIL & TECH HEADLINES

US RETAIL & TECH HEADLINES

- American fashion brand Universal Standard has opened a new experiential concept store called Universal Standard 1:1 in New York City. The store at 192 Mercer Street is designed to be a shopping and community space.

- Universal Standard plans to host its own programs and community events with local brands, artists and organizations for unique events and gatherings. Customers can book the 1:1 community space for personal gatherings free of charge.

A.C. Moore To Shut all Stores

(November 25) Company press release

A.C. Moore To Shut all Stores

(November 25) Company press release

- Nicole Crafts, parent company of American arts and crafts chain A.C. Moore, announced it will close its entire fleet of more than 145 stores. As a part of the shutdown, arts and crafts company Michael’s will acquire nearly 40 A.C. Moore locations and a distribution facility.

- The company said it has stopped taking online orders, although previously placed orders will be filled. The company will announce details of individual store closures in the coming weeks.

Toys “R” Us Is Back, Opens First Store

(November 25) Patch.com

Toys “R” Us Is Back, Opens First Store

(November 25) Patch.com

- Toys “R” Us returned to the US with its first “new” retail store on November 27. The 6,500-sqaure-foot store is located at the Westfield Garden State Plaza mall in Paramus, New Jersey.

- The retailer said the store will offer a limited collection, but customers can choose from a wider range of products online through Target.com, under a partnership with Target. Toys “R” Us also announced that its second store is scheduled to open by December 1 at The Galleria in Houston, Texas.

LVMH To Acquire Tiffany & Co.

(November 25) Company press release

LVMH To Acquire Tiffany & Co.

(November 25) Company press release

- Luxury conglomerate LVMH has announced that it will acquire US-based luxury jeweler Tiffany & Co. for €14.7 billion ($16.2 billion).

- Both LVMH and Tiffany’s boards approved the deal on Sunday, and the transaction is expected to close by mid-2020, subject to customary approvals.

eBay Sells StubHub to Viagogo for $4.05 Billion

(November 25) Company press release

eBay Sells StubHub to Viagogo for $4.05 Billion

(November 25) Company press release

- E-commerce platform eBay has announced the sale of its US-based ticket marketplace StubHub to UK-based secondary ticketing company Viagogo for $4.05 billion. The sale is expected to close by the end of the first quarter of 2020, subject to regulatory approval and customary closing conditions.

- Viagogo serves a global audience as a ticket marketplace for live sport, music and entertainment events for fans in Europe, Asia, Australia and Latin America.

EUROPE RETAIL AND TECH HEADLINES

Wilko Appoints Alexei Cowan as First Head of Design

(November 26) RetailGazette.co.uk

Wilko Appoints Alexei Cowan as First Head of Design

(November 26) RetailGazette.co.uk

- UK home furnishings retailer Wilko has appointed Alexei Cowan for the newly created role Head of Design, starting December 2. Cowan joins from trend forecasting and analytics company WGSN, where he was Senior Editor, identifying and reporting on trends for the WGSN lifestyle and interior team.

- Cowan will be responsible for establishing a competent product design capability within Wilko, focusing on trend analysis and creating products.

Groupe Fnac Darty and Carrefour Strengthen Ties in France

(November 26) Company press release

Groupe Fnac Darty and Carrefour Strengthen Ties in France

(November 26) Company press release

- French food retailer Carrefour and electronics retailer Fnac Darty have strengthened their partnership in France with plans to open around 30 Darty shop-in-shops in Carrefour hypermarkets.

- Darty opened its first two pilot shop-in-shops in November 2018 in Carrefour hypermarkets at Limoges and Ville-du-Bois, Paris The groups are reviewing operational procedures for rollout in 2020 and 2021, although the plan is subject to authorization by France’s competition authority, the Autorité de la concurrence.

Prada and Adidas Launch a Collaborative Sneaker

(November 25) Company press release

Prada and Adidas Launch a Collaborative Sneaker

(November 25) Company press release

- Italian luxury fashion house Prada and German sportwear brand Adidas have unveiled the first product of their partnership: Adidas' all-white Superstar sneakers and Prada’s Bowling Bag tote. The sneaker is made in Italy and will be limited to 700 pieces with a unique serial number.

- The release marks the 50th anniversary of the iconic Superstar sneaker. The duo collection will be available at select Prada stores worldwide as well as prada.com and adidas.com from December 4.

Sports Direct To Rebrand as Frasers Group

(November 25) Company press release

Sports Direct To Rebrand as Frasers Group

(November 25) Company press release

- UK sporting goods retailer Sports Direct announced plans to rebrand itself as Frasers Group, one year after it acquired department store House of Fraser for £90 million ($115.8 million). Earlier this year, the company announced plans to launch a chain of upmarket high-street stores called Frasers in the next financial year.

- The company said the rebranding reflects its plan to raise its retail proposal across all channels and illustrates the evolution in recent years to a diversified portfolio of sports, fitness, fashion and lifestyle banners.

Albert Heijn Opens Digital Store at Schiphol

(November 25) Company press release

Albert Heijn Opens Digital Store at Schiphol

(November 25) Company press release

- Dutch supermarket chain Albert Heijn has opened a 150-square-foot cashierless store located in front of Schiphol Plaza in Amsterdam on a two-month trial basis. The store was developed in collaboration with US tech startup AiFi and financial services company ING.

- Customers enter by scanning a contactless debit card at the door. Items are automatically registered and the shopper’s card charged without having to download an app or register in advance.

ASIA RETAIL AND TECH HEADLINES

Missoni Launches Flagship Store in Singapore

(November 26) Insideretail.asia

Missoni Launches Flagship Store in Singapore

(November 26) Insideretail.asia

- Italian luxury fashion retailer Missoni has launched a flagship store at Marina Bay Sands in Singapore. Missoni celebrated with a cocktail party attended by local media and celebrities as well as Angela Missoni, the company’s Creative Director and President.

- The new store spans 1,600 square feet and will feature a wide range of apparel products. The central product featured at launch was the new M Missoni collection by Margherita Maccapani Missoni.

Alibaba Begins Trading on the Stock Exchange of Hong Kong

(November 26) Alizila.com

Alibaba Begins Trading on the Stock Exchange of Hong Kong

(November 26) Alizila.com

- Alibaba Group began trading on the Stock Exchange of Hong Kong on November 26. Hong Kong was Alibaba’s preferred destination for an initial public offering in 2014, but Hong Kong capital market rules—primarily on shareholder classes—kept the company waiting.

- Hong Kong has changed its rules, paving the way for Alibaba to leverage the exchange as part of it global offering of 500 million new shares. Its Hong Kong shares are fully fungible with the shares listed on the New York Stock Exchange.

Amazon To Open a Pop-Up Store on Pinduoduo

(November 26) Reuters.com

Amazon To Open a Pop-Up Store on Pinduoduo

(November 26) Reuters.com

- Amazon has announced that it will open a pop-up store on China’s e-commerce platform Pinduoduo. The store will offer around 1,000 overseas products and will run until the end of December.

- The decision to partner with Pinduoduo is due to its popularity with China’s rural residents compared to the nation's other e-commerce giants.

India’s Financial Technology Firm Paytm Raises $1 Billion

(November 25) TechCrunch.com

India’s Financial Technology Firm Paytm Raises $1 Billion

(November 25) TechCrunch.com

- Indian digital payments platform Paytm has raised $1 billion in its latest Series-G funding round, led by US asset manager T. Rowe Price. In September, Paytm announced plans to invest $2.7 billion in its business over the next two years.

- Existing investors Ant Financials and SoftBank Vision Fund contributed $400 million and $200 million respectively, while Discovery Capital also participated in the round. Paytm raised the funds based on a valuation of $16 billion.

America Eagle To Close All of Its Stores in Japan

(November 25) Fashionnetwork.com

America Eagle To Close All of Its Stores in Japan

(November 25) Fashionnetwork.com

- American Eagle is set to close all its American Eagle and Aerie stores in Japan by the end of December. This comes primarily due to a shift in focus by its local franchisee, Aoyama Trading Co, to business wear.

- The company will start closing 33 stores starting December 18 and its local e-commerce site on December 31.

LATIN AMERICA RETAIL AND TECH HEADLINES

Marisa Lojas Board Approves Share Offering

(November 26) Reuters.com

Marisa Lojas Board Approves Share Offering

(November 26) Reuters.com

- The board of Brazilian retailer Marisa Lojas has approved a share offering of at least 46.9 million new shares, scheduled for December 6. The company may offer up to 14 million additional shares depending upon investor demand.

- Based on the November 25 the closing price, Marisa Lojas could raise up to R654.4 million ($155.97 million). The company will use the proceeds from the offering to pay down debt and strengthen working capital of the company.

H&M Partners with Colombian Designer Johanna Ortiz

(November 25) fashionnetwork.com

H&M Partners with Colombian Designer Johanna Ortiz

(November 25) fashionnetwork.com

- Swedish clothing retailer H&M has teamed up with Colombian designer Johanna Ortiz to launch a new capsule collection. The collection of four dresses will be introduced online and in stores worldwide on December 3, with the complete collection available by March 2020.

- The collection includes a tunic, a minidress, a wrap and a tiered floor-length silhouette in floral prints. The March 2020 collection will not be limited to dresses, but will also include separates and swimwear.

Vans Remodels Its Flagship Store in Mexico

(November 25) Fashionnetwork.com

Vans Remodels Its Flagship Store in Mexico

(November 25) Fashionnetwork.com

- Vans has reopened its flagship store in Mexico City. The remodeled store is just 2024 square feet and has an array of models and sizes available in clothing, footwear and accessories.

- The new store will feature free daily workshops for shoe and clothing customization as well as monthly workshops.

Natura Plans To Make Half of Its Products Refillable

(November 25) Milenio.com

Natura Plans To Make Half of Its Products Refillable

(November 25) Milenio.com

- Brazilian cosmetics company Natura is set to make half of its catalog suitable for refilling within five years as part of the company’s sustainability program. About 30% of its products can be refilled currently.

- Products such as shampoos and conditioners will be the most likely candidates: The company recommends reusing these containers up to 10 times.

Blue Star Group Opens Six Stores in Brazil

(November 25) Fashionnetwork.com

Blue Star Group Opens Six Stores in Brazil

(November 25) Fashionnetwork.com

- Argentine fashion giant Blue Star Group has opened six Todomoda stores in São Paulo, Brazil, in a span of 10 days. The move comes as part of its plan to expand in Brazil that was announced earlier this month.

- The stores were opened between November 16 and November 25 across various shopping centers in São Paulo and had an average area of around 600 square feet.

MACRO ECONOMIC UPDATE

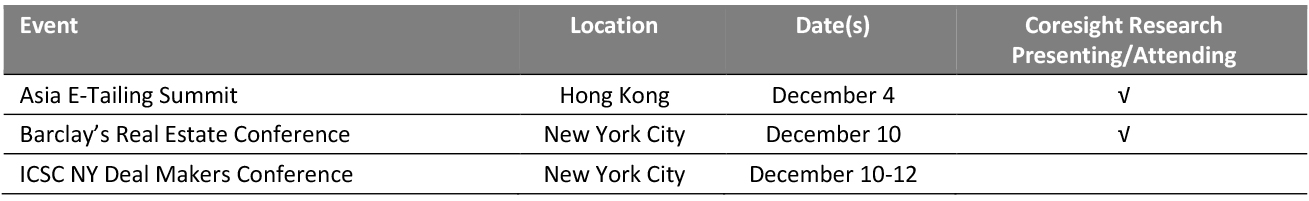

Key points from global macro indicators released on November 20–26, 2019: 1) US: The IHS Markit manufacturing Purchasing Managers’ Index (PMI) increased marginally to 52.2 in November from 51.3 in October. Continuing jobless claims increased to 1.695 million in the week ended November 9, from 1.692 million the previous week. 2) Europe: In the eurozone, consumer confidence was (7.2) in November, slightly better than (7.6) in October. In Germany, the Producer Price Index (PPI) decreased 0.6% year over year in October, versus a 0.1% decrease in September. 3) Asia Pacific: China’s central bank lowered interest rates from 4.2% to 4.15% in October. In Japan, the Consumer Price Index (CPI) declined 0.2% year over year in October, the same rate as the previous month. 4) Latin America: In Mexico, gross domestic product (GDP) contracted 0.3% year over year in the third quarter, versus a 0.4% decline in the second quarter. In Brazil, the CPI climbed 2.67% year over year in November, versus 2.72% in October. [caption id="attachment_100508" align="aligncenter" width="700"] **There is no information on how investments in China are faring after the interest rate cut. Hence, we cannot evaluate the short-run impact on the economy.

**There is no information on how investments in China are faring after the interest rate cut. Hence, we cannot evaluate the short-run impact on the economy. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit Economics/US Department of Labor/European Commission/Statistisches Bundesamt Deutschland /The People´s Bank of China/Statistics Bureau of Japan/INDEGI/IBGE/Coresight Research [/caption]

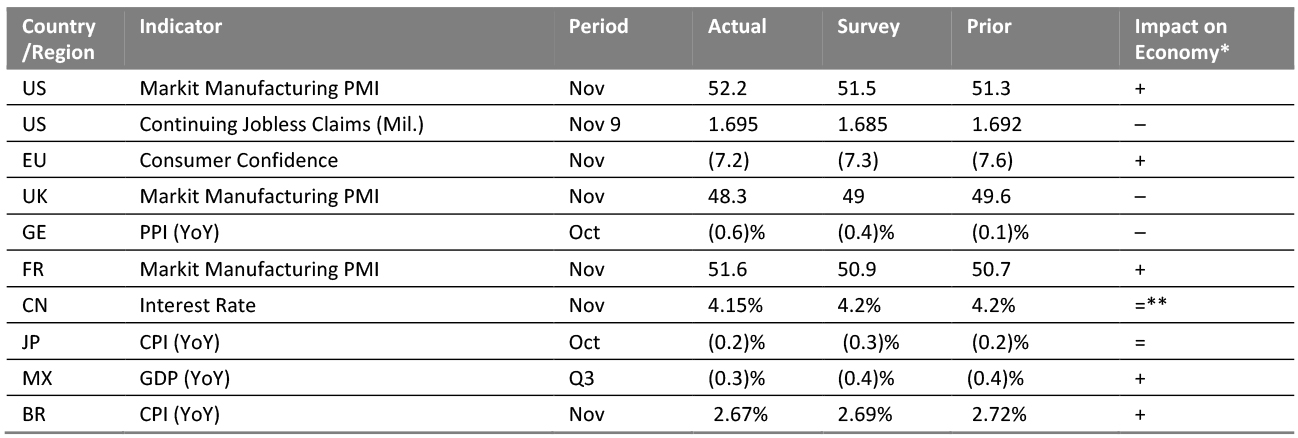

EARNINGS CALENDAR

[caption id="attachment_100509" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

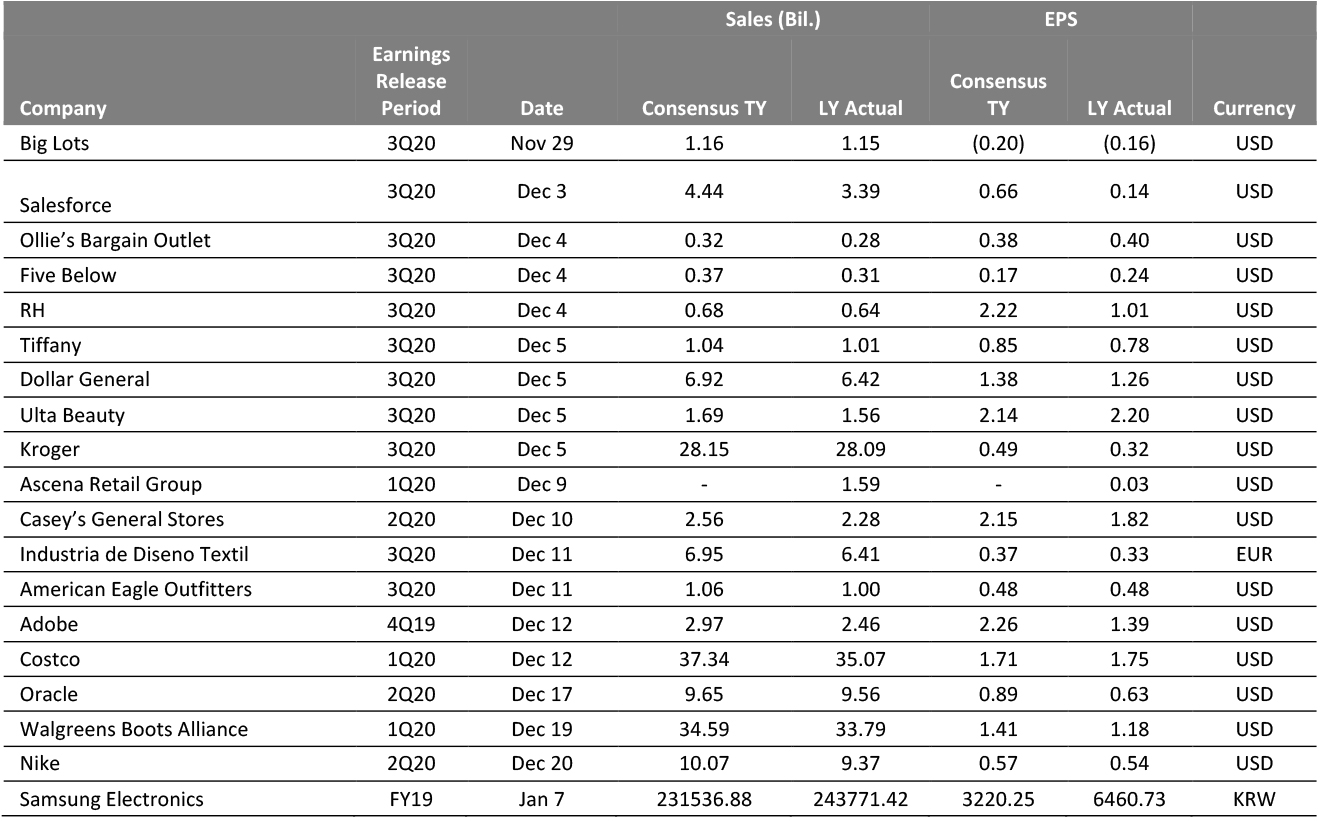

EVENT CALENDAR