FROM THE DESK OF DEBORAH WEINSWIG

What Will US Retail Demand Look Like During and After the Coronavirus Crisis?

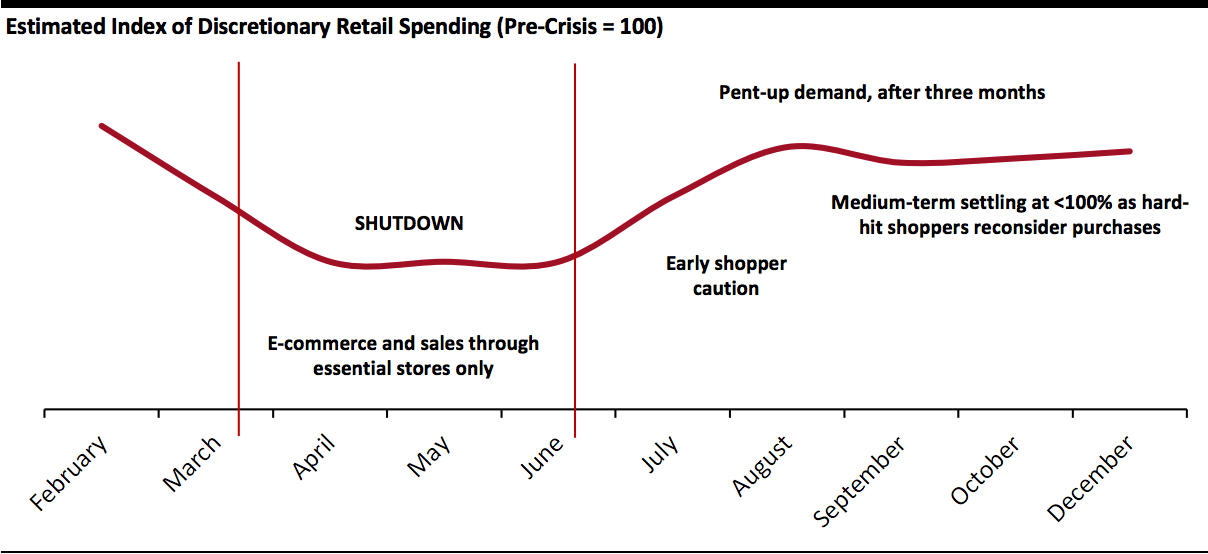

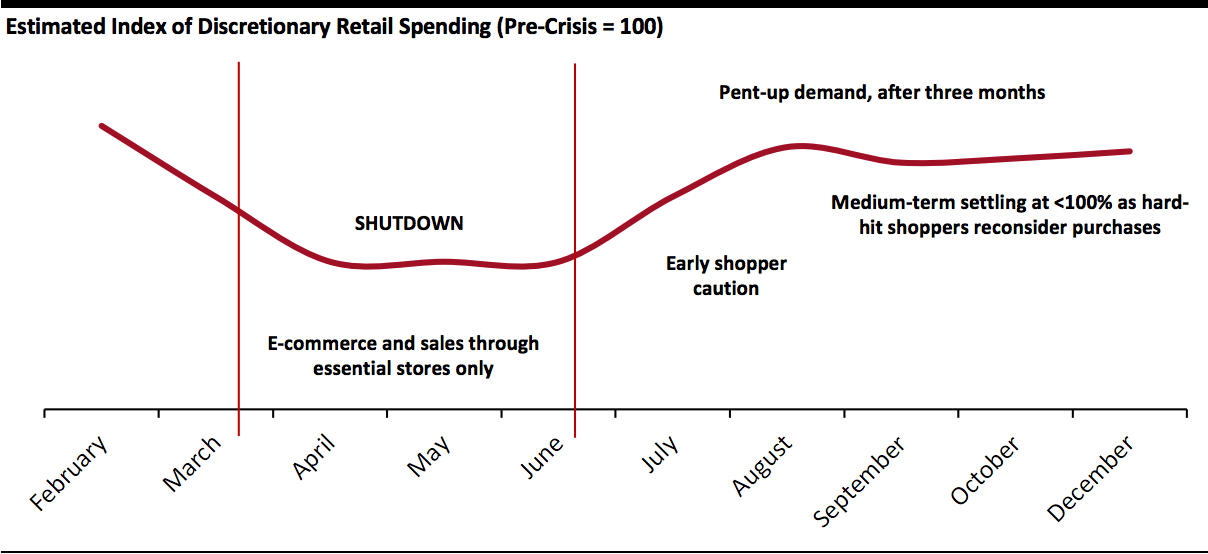

Predicting consumer demand and consumer behavior in the early stages of an unprecedented crisis is fraught with dangers. That said, here are our estimates for how US retail demand could look during the coronavirus shutdown and what the shape of the retail recovery could look like.

US retail is likely facing a shutdown of at least two months, but possibly longer: our base case is around three months. We have long been skeptical that retailers would shut stores for only the couple of weeks or so that many initially announced: those two weeks have already passed, in many cases prompting retailers to extend them “until further notice.”

- During the physical shutdown, most remaining discretionary demand will head online—although essential retailers such as mass merchandisers remain open and will continue to sell nonfoods in stores, capturing some residual demand. How much discretionary demand remains over the course of such a shutdown is not yet apparent, but we expect it to be significantly depressed.

- In the US, e-commerce would have captured around 22% of all nonfood sales in 2020, had the coronavirus outbreak not impacted events, according to Coresight Research estimates from Census Bureau data. We expect much lower demand (even online) in categories such as apparel, some beauty categories and some home goods, due to less need by consumers stuck at home and lower interest from hard-hit shoppers.

- E-commerce will see some gains as sales transfer from closed stores—but with depressed demand, we do not anticipate online sales to be anywhere close to the value of in-store sales and that most store-based discretionary sales will be lost or postponed. Even if demand proves more resilient than our base case, capacity in online retail constrains how much can be recovered through e-commerce—particularly as some nonfood retailers halt online operations.

In total we estimate an approximate

one-quarter decline in total US retail sales in each full month of a total shutdown of nonessential retailers, driven by an approximate halving of discretionary nonfood retail sales—an estimate that we believe errs on the side of generosity. This would be partly offset by a strong,

double-digit jump in food retail sales—we would expect to see an even stronger jump in grocery-store categories in the early stages of the shutdown, as consumers rushed to stock up on essentials, which would moderate total retail declines earlier in the shutdown.

We make the following ballpark assumptions based on all nonessential retailers closing their stores, and these feed into our estimate of an approximate halving of discretionary nonfood sales. A low-to-mid-teens share of discretionary nonfood sales could continue in store, including through mass merchants such as Walmart, Target and Costco, which remain open because they sell essentials. Roughly 20% of total (pre-crisis) nonfood sales will be retained online—adjusted from a higher e-commerce penetration base rate in nonfood, factoring in an underlying decline in discretionary demand. Incremental to that are additional e-commerce sales driven by store closures: Around 25% of store-based discretionary nonfood sales could move online—representing around 19.4% of

all (pre-crisis) discretionary nonfood sales; the extent of sales transfer remains unclear and this could prove to be a generous estimate. That would almost double online nonfood sales. Even if our sales-transfer rate proves conservative, the capacity of e-commerce retailers to absorb a surge in sales will limit the rate of sales transfer from stores.

Post-crisis, we think we could see a three-phase recovery through the remainder of 2020.

First, immediately after the retail shutdown ends, we could see initial shopper caution—over both the risk of contagion when visiting physical stores, and in terms of spending big after such a profound economic and cultural shock.

Then, that caution could give way to a burst of pent-up demand, especially if, as we model, shoppers dramatically reduce discretionary purchases for as long as three months: consumers will have household repairs to make, replacement clothing to buy and will need to replenish and replace across nonfood categories. Consumers with income are likely to have three months’ worth of saved expenditures to splash on such purchases.

Finally, we think demand could subside to lower-than-pre-crisis levels, given the continued dislocation of consumer behavior and the likely profound shock to labor markets.

[caption id="attachment_107048" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

While there may be pent-up demand post-crisis, much of the spending from the shutdown period will be lost permanently. Our estimates come with the caveat that we are early into this crisis, with an incrementally shifting view of the consumer environment.

See all our coronavirus research content

here, including links to our frequently updated coronavirus tracker and blog.

US RETAIL AND TECH HEADLINES

Walmart To Take Temperature of Workers in All Its Stores and Distribution Centers

(March 31) CNBC.com

Walmart To Take Temperature of Workers in All Its Stores and Distribution Centers

(March 31) CNBC.com

- Walmart has announced that it will start taking the temperatures of all staff at its stores and distribution centers when they report to work. Any individual with a temperature of 100 degrees Fahrenheit or above will be advised to stay at home or seek medical treatment, and will not be allowed to return to duty until they are free from fever for three days.

- Walmart will also provide masks and gloves to all employees and has started installing sneeze guards at checkout counters. The retailer is launching one-way aisles and reduced store hours to manage social distancing and sanitization protocols.

Simon Property Furloughs 30% of Its Employees

(March 31) CNBC.com

Simon Property Furloughs 30% of Its Employees

(March 31) CNBC.com

- Retail real estate firm Simon Property Group has reportedly furloughed nearly 30% of its employees as it copes with all its properties being temporarily shut. The furloughs include full and part-time employees at its malls, outlet centers and headquarters.

- The company has nearly 4,500 employees, of which 1,500 are part time and 1,000 at its Indianapolis headquarters.

Hibbett Sports Appoints New CFO

(March 30) ChainStoreAge.com

Hibbett Sports Appoints New CFO

(March 30) ChainStoreAge.com

- Sporting-goods retailer Hibbett Sports has appointed Robert Volke as CFO, effective April 13. Volke will succeed interim CFO Scott Humphrey, who has been in the role since September 2019.

- Volke has served as interim CFO of Minnesota-based retailer Fleet Farm since August 2018 and held various positions at Tractor Supply Company from May 2017 to August 2018.

Apple Releases Free COVID-19 Screening Tool Via New Website and App

(March 30) ChargedRetail.co.uk

Apple Releases Free COVID-19 Screening Tool Via New Website and App

(March 30) ChargedRetail.co.uk

- Apple, the Centers for Disease Control and Prevention (CDC) and the US government’s Coronavirus Task Force have teamed up to create a free COVID-19 screening tool. The tool on Apple’s new COVID-19 website and COVID-19 app aims to provide up-to-date information.

- The screening tool asks a series of questions about risk factors, recent exposure and symptoms. In addition, users get CDC suggestions on next steps, including guidelines on social distancing, self-isolation and other recommendations.

Tailored Brands Restarts Its E-Commerce Fulfillment Centers

(March 31) Company press release

Tailored Brands Restarts Its E-Commerce Fulfillment Centers

(March 31) Company press release

- Apparel retailer Tailored Brands has reopened its e-commerce fulfillment centers and started shipping online orders, effective March 30. The retailer said the center was opened after creating enhanced social distancing and sanitation protocols.

- The company also announced that it will redirect its New Bedford plant in Massachusetts to produce washable cotton facemasks in partnership with a leading privately-owned manufacturer and medical supply distributor.

EUROPE RETAIL AND TECH HEADLINES

WHSmith Teams Up with Sainsbury’s To Supply Groceries in Hospitals

(March 31) RetailGazette.co.uk

WHSmith Teams Up with Sainsbury’s To Supply Groceries in Hospitals

(March 31) RetailGazette.co.uk

- UK-based bookseller WHSmith and Sainsbury's have partnered to support NHS workers by selling groceries at hospitals. WHSmith will stock a wide selection of essentials from Sainsbury’s at the 80 stores WHSmith operates in UK hospitals to make it easier for NHS staff to buy food and essentials.

- NHS employees will continue to receive a 20% discount on all items in WHSmith hospital stores, including the Sainsbury’s products.

SPAR Switzerland Initiates Free Home-Delivery Service for High-Risk Customers

(March 30) Company press release

SPAR Switzerland Initiates Free Home-Delivery Service for High-Risk Customers

(March 30) Company press release

- Food retailer SPAR Switzerland has launched free home delivery to vulnerable customers, working with Zämädihei, a platform that offers various support services to disadvantaged people.

- Shoppers have to apply for the service and Zämädihei will verify the person is eligible.

Boots To Test NHS Staff for COVID-19

(March 30) RetailGazette.co.uk

Boots To Test NHS Staff for COVID-19

(March 30) RetailGazette.co.uk

- Boots will open COVID-19 testing facilities nationwide for NHS workers. Boots said the retailer is working with the NHS to hire qualified practitioners from within the Boots workforce and from local communities.

- Boots also said it has encouraged employees in its in-store beauty and fragrance counters to switch to jobs in the healthcare and pharmacy departments.

BrightHouse Collapses into Administration

(March 30) News.Sky.com

BrightHouse Collapses into Administration

(March 30) News.Sky.com

- UK rent-to-own retailer BrightHouse has collapsed in administration amid the coronavirus crisis, with almost 2,400 jobs facing uncertainty. The administration occurred as investors withheld support for a proposed restructuring.

- The retailer operates 240 stores nationwide and formalized insolvency proceedings after appointing accountancy firm Grant Thornton as administrators.

Ted Baker Hires New CEO

(March 30) RetailGazette.co.uk

Ted Baker Hires New CEO

(March 30) RetailGazette.co.uk

- Ted Baker has appointed Rachel Osborne CEO. She joined the company in November 2019 as CFO.

- Osborne was named interim CEO following the resignations of CEO Lindsay Page and Chairman David Bernstein in December 2019.

ASIA RETAIL AND TECH HEADLINES

Asian Fashion Companies Produce Face Masks

(March 31) InsideRetail.asia

Asian Fashion Companies Produce Face Masks

(March 31) InsideRetail.asia

- Asian fashion companies are producing face masks. Uniqlo will donate 10 million masks produced by its Chinese manufacturing partners to medical facilities around the globe, with the majority headed for the US, Italy and Japan.

- Hong Kong-based jeweler Chow Tai Fook has set up a face-mask production line in its diamond processing factory in Shunde, China, and plans to donate the masks to medical facilities.

Shiseido Teams Up with Shopee To Boost Beauty Products in Southeast Asia

(March 31) InsideRetail.Asia

Shiseido Teams Up with Shopee To Boost Beauty Products in Southeast Asia

(March 31) InsideRetail.Asia

- Beauty company Shiseido is partnering with e-commerce platform Shopee to grow sales of its beauty products in Southeast Asia. Shiseido will use Shopee’s user base and market knowledge to boost its online presence and access into the region.

- Shiseido will offer its Anessa, Senka and Tsubaki range of products on Shopee’s platform in Indonesia, Thailand and Vietnam. Shiseido also plans to enter Taiwan through Shopee’s platform.

Lululemon To Open Flagship Store in Japan

(March 31) FashionNetwork.com

Lululemon To Open Flagship Store in Japan

(March 31) FashionNetwork.com

- Athletic apparel brand Lululemon plans to open a flagship store in Tokyo. The store will occupy two floors in the Roppongi Hills North Tower.

- The first floor will be a retail space featuring Lululemon’s wide range of products. The second floor will be a dedicated community space called “The Sweatlife Hub,” where customers can take yoga classes, attend a training session or see performances by brand ambassadors.

Amazon and Flipkart To Strengthen Essential Product Supply Chain in India

(March 30) KR-Asia.com

Amazon and Flipkart To Strengthen Essential Product Supply Chain in India

(March 30) KR-Asia.com

- Amazon and Walmart-backed e-commerce platform Flipkart are working with government officials in India to strengthen supply chains for essential goods as demand for groceries rises amid a nation-wide shutdown.

- The companies are seeking government approval to stock food at their warehouses, as foreign-owned e-commerce platforms currently are not allowed to sell retail food. The companies are also looking into using the Indian railways’ freight network to transport goods.

Weibo Launches E-Commerce Management Service

(March 30) KR-Asia.com

Weibo Launches E-Commerce Management Service

(March 30) KR-Asia.com

- Chinese social media platform Weibo has launched Weibo Xiaodian, a service that lets users add and market goods and services from customer-to-customer marketplaces, such as Taobao, JD.com and Youzanon.

- The company has also set up an online e-commerce academy to teach users how to monetize their presence on Weibo. The company plans to integrate with Alibaba’s Alipay to support third-party merchants.

LATIN AMERICA RETAIL AND TECH HEADLINES

Salon Line Provides Hand Sanitizer to Rappi Delivery Partners in Brazil

(March 31) FashionNetwork.com

Salon Line Provides Hand Sanitizer to Rappi Delivery Partners in Brazil

(March 31) FashionNetwork.com

- Brazilian beauty company Salon Line has partnered with on-demand delivery service company Rappi to supply sanitizing gel to delivery partners to support hand hygiene during deliveries.

- The beauty company is also including a unit of alcohol gel and free delivery with any purchase over R$69.90 ($13.5) in April.

Retailers in Mexico Temporarily Close Stores

(March 31) News.EN24.com

Retailers in Mexico Temporarily Close Stores

(March 31) News.EN24.com

- Multiple retailers in Mexico have announced temporary closures of all stores due to the coronavirus outbreak.

- The list includes American Eagle, Aerie, Pandora, Decathlon, Original Penguin, Bath & Body Works, Studio F and luxury department store chain El Palacio de Hierro. Despite closing physical stores, online stores will remain operational.

Brazilian Supermarkets To Hire 5,000 Temporary Workers in São Paulo

(March 31) Reuters.com

Brazilian Supermarkets To Hire 5,000 Temporary Workers in São Paulo

(March 31) Reuters.com

- Brazilian Supermarkets in São Paulo plans to hire 5,000 temporary workers to meet rising demand due to the coronavirus outbreak. Most new hires will replenish shelves.

- In keeping with social distancing protocols, interviews will be conducted mainly through WhatsApp.

Walmart Hires 5,250 Employees in Mexico and Central America

(March 30) FashionNetwork.com

Walmart Hires 5,250 Employees in Mexico and Central America

(March 30) FashionNetwork.com

- Walmart has hired 5,250 new associates in Mexico and Central America to meet surging in-store demand due to the coronavirus outbreak. The company has strengthened delivery services to meet growing demand for home delivery.

- Walmart is also offering home delivery services for partner restaurant and fast food chains and allowing pickup at Walmart stores.

Grupo Éxito Launches Dedicated Medical Personnel Delivery Service in Colombia

(March 30) America-Retail.com

Grupo Éxito Launches Dedicated Medical Personnel Delivery Service in Colombia

(March 30) America-Retail.com

- Grupo Éxito has launched a new delivery service for medical personnel in Colombia. Medical personnel enjoy priority fulfilment and pay no delivery fee for orders from Éxito and Carulla stores.

- The service will be offered in Bogotá, Medellín, Barranquilla, Cali and Cartagena through April.

Source: Coresight Research[/caption]

While there may be pent-up demand post-crisis, much of the spending from the shutdown period will be lost permanently. Our estimates come with the caveat that we are early into this crisis, with an incrementally shifting view of the consumer environment.

See all our coronavirus research content here, including links to our frequently updated coronavirus tracker and blog.

Source: Coresight Research[/caption]

While there may be pent-up demand post-crisis, much of the spending from the shutdown period will be lost permanently. Our estimates come with the caveat that we are early into this crisis, with an incrementally shifting view of the consumer environment.

See all our coronavirus research content here, including links to our frequently updated coronavirus tracker and blog.

Apple Releases Free COVID-19 Screening Tool Via New Website and App

(March 30) ChargedRetail.co.uk

Apple Releases Free COVID-19 Screening Tool Via New Website and App

(March 30) ChargedRetail.co.uk

Tailored Brands Restarts Its E-Commerce Fulfillment Centers

(March 31) Company press release

Tailored Brands Restarts Its E-Commerce Fulfillment Centers

(March 31) Company press release

WHSmith Teams Up with Sainsbury’s To Supply Groceries in Hospitals

(March 31) RetailGazette.co.uk

WHSmith Teams Up with Sainsbury’s To Supply Groceries in Hospitals

(March 31) RetailGazette.co.uk

SPAR Switzerland Initiates Free Home-Delivery Service for High-Risk Customers

(March 30) Company press release

SPAR Switzerland Initiates Free Home-Delivery Service for High-Risk Customers

(March 30) Company press release

Asian Fashion Companies Produce Face Masks

(March 31) InsideRetail.asia

Asian Fashion Companies Produce Face Masks

(March 31) InsideRetail.asia

Shiseido Teams Up with Shopee To Boost Beauty Products in Southeast Asia

(March 31) InsideRetail.Asia

Shiseido Teams Up with Shopee To Boost Beauty Products in Southeast Asia

(March 31) InsideRetail.Asia

Lululemon To Open Flagship Store in Japan

(March 31) FashionNetwork.com

Lululemon To Open Flagship Store in Japan

(March 31) FashionNetwork.com

Amazon and Flipkart To Strengthen Essential Product Supply Chain in India

(March 30) KR-Asia.com

Amazon and Flipkart To Strengthen Essential Product Supply Chain in India

(March 30) KR-Asia.com

Weibo Launches E-Commerce Management Service

(March 30) KR-Asia.com

Weibo Launches E-Commerce Management Service

(March 30) KR-Asia.com

Salon Line Provides Hand Sanitizer to Rappi Delivery Partners in Brazil

(March 31) FashionNetwork.com

Salon Line Provides Hand Sanitizer to Rappi Delivery Partners in Brazil

(March 31) FashionNetwork.com

Brazilian Supermarkets To Hire 5,000 Temporary Workers in São Paulo

(March 31) Reuters.com

Brazilian Supermarkets To Hire 5,000 Temporary Workers in São Paulo

(March 31) Reuters.com