Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

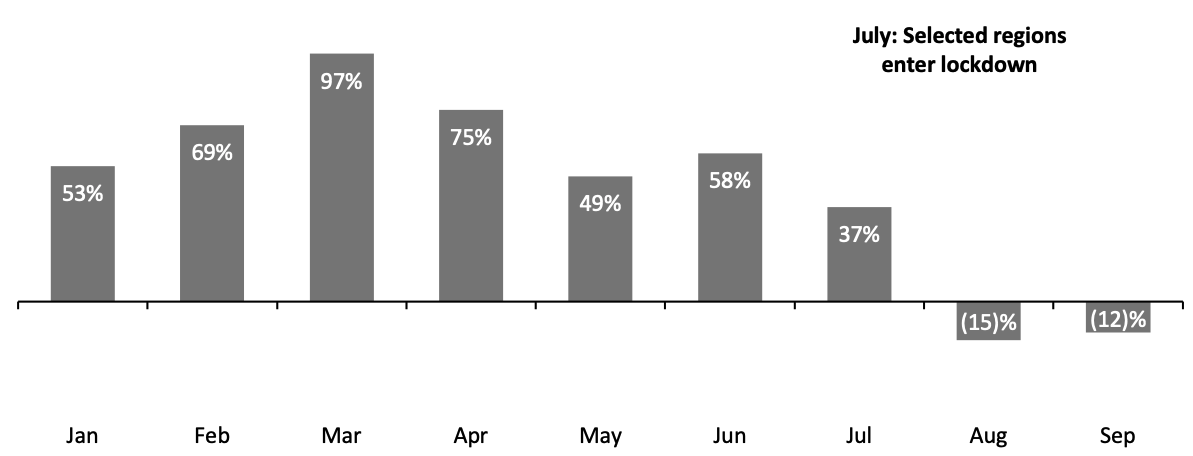

“Yo-Yo” Sourcing To Characterize 2022 Amid Omicron Disruption in Supply Chains The Omicron wave is the latest cause of inconvenience to consumers and disruption to retailers in the West. In China, meanwhile, coronavirus outbreaks are prompting new lockdowns, as the new variant’s increased transmissibility confronts the country’s zero-Covid strategy. Assuming China maintains its zero-Covid stance, it is hard to see how the country will avoid further major lockdowns through 2022. Coupled with past restrictions in other markets, notably Vietnam, we foresee a “yo-yoing” between sourcing locations in 2022 as brands and retailers chase apparent resilience in the supply chain. Ultimately, we expect that these developments will strengthen the multiyear trend for diversified sourcing that includes a more prominent role for nearshoring and onshoring. China: Vulnerable to Further Outbreaks This week, the city of Yuzhou (population: 1.1 million) was locked down, which included the closure of its public transport system and the forced closure of nonessential stores. It joined Xi'an (population: 13 million), which has been under a strict lockdown since December 23. These measures fall ahead of the Chinese New Year on February 1 and the Winter Olympics, due to be held in Beijing from February 4. Lockdowns in various countries fueled global sourcing and supply chain difficulties in 2021: In China, two major ports—Yantian in Shenzhen and Ningbo-Zhoushan—were struck by shutdowns due to the pandemic. We expect further restrictions in China to only amplify and expedite the shift of product sourcing away from the country. The greater transmissibility associated with Omicron implies that brands and retailers would need to be willing to accept potentially greater disruption to sourcing than they did in highly challenged 2021, and we think that is unlikely. China’s power blackouts have only added to the negatives. In December 2021, the China manufacturing Purchasing Managers’ Index (PMI) recorded a contraction for export orders, even while the overall PMI index was marginally positive (at 50.3—over 50 represents expansion, less than 50 represents contraction), according to the China Federation of Logistics & Purchasing and the National Bureau of Statistics. Vietnam: Recent Past Suggests Cautious Outlook Even as firms seek to diversify sourcing, it is not obvious that manufacturing destination Vietnam will be a major beneficiary—the country is the second-largest exporter to the US, after China. Vietnam’s lockdowns in 2021 poured more glue into the cogs of global supply chains. Regional lockdowns in the third quarter of 2021 prompted a decline in sourcing activity, as represented by supply chain inspection and audit volumes recorded by audit and inspection company QIMA. Yet, this followed increasing popularity in sourcing from Vietnam earlier in 2021 as companies sought to diversify sourcing destinations, underscoring the sometimes-rapid swings between sourcing trends.Figure 1. Vietnam Inspection and Audit Volumes: % Change, 2021 vs. 2019 [caption id="attachment_139006" align="aligncenter" width="700"]

Source: QIMA[/caption]

Vietnam’s lockdown of Ho Chi Minh City, Hanoi and other regions started in July, hitting factory output in categories such as apparel and footwear. Those lockdowns ended in September and October 2021 but the country’s cautious approach to Covid-19 so far implies that Omicron could drive renewed restrictions.

Diversified Approaches Benefit Multiple Markets

QIMA meanwhile noted spikes in Cambodia off the back of the apparent retreat from Vietnam: third-quarter 2021 inspection and audit numbers were up 34% compared to the same quarter of 2019 (prepandemic). India, too, has been a beneficiary with recorded inspection and audit volumes up 67% in the third quarter of 2021 versus two years earlier; in December, India’s manufacturing PMI stood at 55.5 and export volumes have been up solidly in recent months. Moreover, Bangladesh saw similar strength in audit and export volumes. As Western (and especially European) companies seek closer-to-market manufacturing, with that demand recently strengthened by the cost of shipping, Turkey stands to make further gains. Merchandise exports have been up very solidly, and Turkey’s manufacturing PMI stood at 52.1 in December.

2022 is likely to see further intrayear shifts in sourcing locations as companies react to new developments with sometimes-yo-yoing sourcing approaches. We ultimately expect these challenges to bolster a number of secular trends:

Source: QIMA[/caption]

Vietnam’s lockdown of Ho Chi Minh City, Hanoi and other regions started in July, hitting factory output in categories such as apparel and footwear. Those lockdowns ended in September and October 2021 but the country’s cautious approach to Covid-19 so far implies that Omicron could drive renewed restrictions.

Diversified Approaches Benefit Multiple Markets

QIMA meanwhile noted spikes in Cambodia off the back of the apparent retreat from Vietnam: third-quarter 2021 inspection and audit numbers were up 34% compared to the same quarter of 2019 (prepandemic). India, too, has been a beneficiary with recorded inspection and audit volumes up 67% in the third quarter of 2021 versus two years earlier; in December, India’s manufacturing PMI stood at 55.5 and export volumes have been up solidly in recent months. Moreover, Bangladesh saw similar strength in audit and export volumes. As Western (and especially European) companies seek closer-to-market manufacturing, with that demand recently strengthened by the cost of shipping, Turkey stands to make further gains. Merchandise exports have been up very solidly, and Turkey’s manufacturing PMI stood at 52.1 in December.

2022 is likely to see further intrayear shifts in sourcing locations as companies react to new developments with sometimes-yo-yoing sourcing approaches. We ultimately expect these challenges to bolster a number of secular trends:

- More diverse sourcing, with greater resilience inbuilt due to reduced reliance on any one location and likely raised interest in destinations beyond the very top tier of producers (i.e., countries such as China and Vietnam).

- Greater nearshoring, to the benefit of countries such as Turkey and Mexico, with this trend supported by the still-high cost of shipping.

- Incremental onshoring, where technologies such as automated production and 3D printing make it efficient to do so.

US RETAIL AND TECH HEADLINES

7-Eleven Hawaii Offers Home Delivery and In-Store Pickup for SNAP-Eligible Products (January 3) Convenience.org- Customers of convenience store chain 7-Eleven Hawaii who are eligible for the country’s Supplemental Nutrition Assistance Program (SNAP) will soon be able to order SNAP-eligible products for home delivery or pickup at 65 locations via delivery service Vroom.

- 7-Eleven Hawaii and Vroom have been working on the initiative for over a year alongside the US Department of Agriculture’s Food and Nutrition Service (FNS), according to the companies. All stores on the Vroom platform can now choose to offer the service.

- Consumer electronics retailer Best Buy has launched Best Buy Ads, a new in-house media company that aims to assist its suppliers in attracting customers. The service offers targeted promotional messaging informed by Best Buy’s customer relationships and information to deliver meaningful messages at the right moment.

- Best Buy engages with consumers 3 billion times every year, both in store and online, according to the company—and the new in-house media organization will assist customers in discovering deals, products and services.

- Online sports apparel and merchandise retailer Fanatics has acquired trading card giant Topps. Industry sources place the deal at approximately $500 million—however, the financial terms were not disclosed.

- The acquisition includes all aspects of the company’s global trading cards and collectibles business—both physical and digital, which sells in more than 100 countries and has physical operations in 10, including Brazil, Germany, Italy, Japan and the United Kingdom.

- Storage and organization products retailer The Container Store has acquired Closet Works, a home-storage and closet organization company, for $21.5 million. The acquisition will grow The Container Store’s custom closet service by expanding customization choices.

- Closet Works’ former Co-Owner and President, Tom Happ, has joined The Container Store as Closet Works President to help with the company’s integration.

- Walmart is stepping up its efforts to deliver goods directly into customers’ kitchens and refrigerators, even when they are not at home. InHome, the company’s $148 per year or $19.95 per month delivery option, will be available to 30 million US households by the end of the year—up from six million currently.

- The company plans to hire approximately 3,000 additional employees to deliver orders. When Walmart staff enter customers’ houses, they wear a camera that customers can watch live on their smartphones. Customers will not be charged for the camera, but they must use an existing smart lock, a garage keypad, or a new smart lock from InHome for $49.95.

EUROPE RETAIL AND TECH HEADLINES

PLUS and Coop Merge To Form a New Cooperative (January 3) Company Press Release- Dutch supermarket chains PLUS and Coop have completed their merger, leading to a formation of a new cooperative, under the name PLUS—with a nationwide network of 550 stores and sales of €5.0 billion ($5.7 billion).

- The newly merged company is the third-largest grocery chain in the Netherlands. The company expects the complete conversion of Coop stores to PLUS to take three years.

- UK-based food and clothing retailer Mark & Spencer has invited the 14 million members of its reward scheme, Sparks, to take part in a two-month sustainability challenge, called “Sparking Change.” The initiative aims to encourage customers to make more sustainable food choices and save money in the process.

- The challenge emphasizes reducing food waste, taking up a plant-based diet and cooking from scratch. Sparks customers that go on a plant-based diet for one day a week in January will be offered discounts on the company’s meat-free Plant Kitchen range. February’s challenge focuses on reducing food waste and aims to help customers save up to £20.0 ($27.1) per weekly shop.

- Croatian grocery retailer Tommy has been put up for sale, with negotiations intensifying in recent weeks. UK-based private-equity firm CVC Capital Partners is a potential buyer, according to Croatian news portal T-Portal.

- CVC Capital Partners acquired Polish retail chain Zabka in February 2017 and its portfolio includes 73 companies worldwide, worth an estimated $75 billion. Tommy’s network consists of more than 200 stores across many formats (hypermarkets, maxi markets, markets and supermarkets) and is visited by around 250,000 customers per day, according to the company.

- Swedish furniture retailer IKEA has confirmed that it will raise the average price of items in its UK stores by more than the global average of 9.0%—due to increasing supply chain costs amid the pandemic.

- IKEA stated that it has absorbed large cost increases across the supply chain since the beginning of the pandemic but has now been forced to raise its prices to offset the negative impact on its business, following in the footsteps of many of its competitors.

- Netherlands-based retail chain Jumbo Supermarkets and German rapid-delivery company Gorillas have entered into a strategic partnership to offer rapid delivery via the Gorillas app in large cities across Netherlands and Belgium.

- The partnership is a long-term venture, according to the companies. Jumbo will supply Gorillas with a substantial portion of its product line, including Jumbo private-label, organic and exclusive La Place products.

ASIA RETAIL AND TECH HEADLINES

Amorepacific To Reduce Its Retail Store Footprint in China (January 5) RetailinAsia.com- South Korea-based cosmetics giant Amorepacific plans to downsize its retail store footprint in China, following a drop in sales. In 2019, the company operated 1,280 stores in China for five brands—Etude, Hera, IOPE, Laneige and Mamonde—reducing the number to 800 in 2020 due to the pandemic, and is now set to bring it down to 140 in 2022.

- The move comes as part of the company’s strategy to increase its online sales and refocus its portfolio on high-end products and luxury cosmetics brands.

- Walmart-owned Flipkart’s wholesale business Flipkart India and its e-commerce marketplace arm Flipkart Internet registered 25% and 32% growth in revenue from operations, respectively, in fiscal 2021—ended March 31, 2021.

- Flipkart Internet’s operational revenue for fiscal 2021 stood at ₹78.4 billion ($1.05 billion), up from ₹59.2 billion ($790 million) in fiscal 2020—although its losses widened by 48.8% to reach ₹28.8 billion ($390 million). However, the company’s wholesale business saw an increase in revenue to ₹429.4 billion ($5.8 billion) in fiscal 2021 from ₹341.7 billion ($4.6 billion) in the prior year, reducing its losses by 22.4% to ₹24.5 billion ($329 million).

- Indonesian retail coffee chain Kopi Kenangan has entered the unicorn club—companies with a valuation of $1 billion and above—after raising $96 million in a Series C funding round led by Tybourne Capital Management, Falcon Edge Capital and existing investors B Capital, Horizons Ventures and Kunlun.

- The company will use the funding to expand its new brands’ business across Indonesia, including bread business Cerita Roti, chicken business Chigo and soft-cookies business Kenangan Manis. The company currently operates 600 stores across 45 Indonesian cities and plans to expand its network internationally.

- India-based Tata Group’s luxury lifestyle platform Tata Cliq has partnered with online grocery platform BigBasket to launch a luxury gourmet store on its platform.

- Launched in Mumbai, the store offers curated products across staples and specialty categories, including biscuits, beverages, cereals, chocolates and dry fruits from leading global and Indian luxury gourmet brands. The platform plans to expand the format to other Indian cities in the coming months, including Bangalore and New Delhi.

- Japanese supermarket chain Uny has opened a supermarket spanning 34,000 square feet in the Tseung Kwan O neighborhood in Hong Kong. The new store is the company’s third in the city after Uny Lok Fy and Uny Yuen Long.

- The new store features new brands from Japan and South Korea, alongside seasonal specialties and a large pet supply section that features 1,000 Japanese products. It also houses a wide range of lifestyle goods from Japan and South Korea. Additionally, it features a K Food Town, which offers Korean delicacies and gourmet brands.