Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

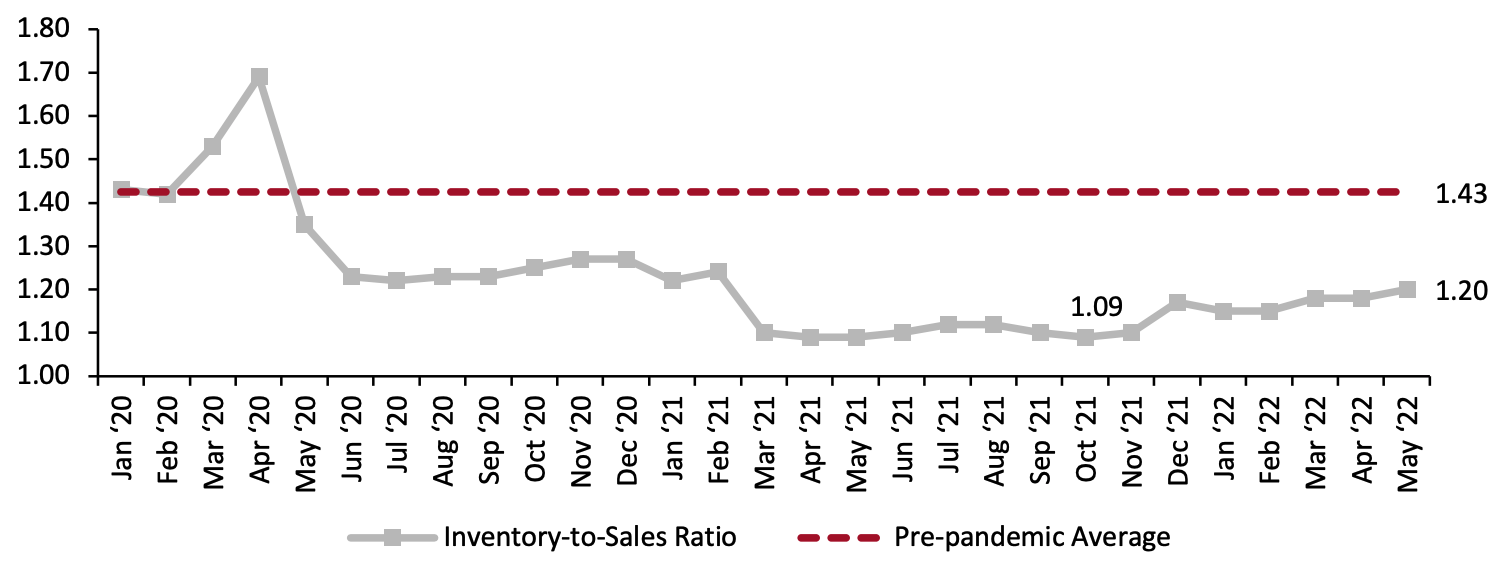

Will Holiday 2022 Inventory Be a Golden Goose or an Albatross for Retailers? Getting holiday inventory planning right is a tricky business. If retailers order too much, they will have to discount it heavily in January—but if they order too little, they leave money on the table, and risk customers turning permanently to competitors. Forecasting demand for this holiday season seems especially fraught with uncertainty, due to fluctuations in consumer demand alongside mixed macroeconomic indicators. At the same time, retail sales remain solid despite consumers facing continuing high inflation rates, geopolitical conflict and layoff concerns emanating from the technology sector. Retail sales have increased every month to date this year, culminating in 5.6% growth in June (excluding automobiles and gasoline). Other data including low unemployment rates and solid job creation figures support solid consumer demand. Many retailers are looking back to a strong 2021 holiday shopping season, when they scrambled to get enough trapped goods off cargo ships and onto shelves in an environment of solid consumer demand. Coresight Research calculates that holiday 2021 retail sales increased by 12.6% year over year, which represents exceptionally robust performance. What's more, these figures were generated despite limited availability of some goods, such as appliances and consumer electronics, due to the global chip shortage. While retailers will understandably place bold orders for holiday 2022, based on strong retail sales thus far and remembering last year’s shortages, will an aggressive position on inventory leave retailers in tears this holiday season? Retailers have been reaccumulating inventory, starting in October 2021 and continuing through May 2022, as shown in the figure below. The US inventory-to-sales ratio of 1.20 nevertheless has some way to go before reaching its pre-pandemic average of 1.42.Figure 1. Retailers’ Inventory-to-Sales Ratio [caption id="attachment_153726" align="aligncenter" width="700"]

Source: FRED/US Census Bureau[/caption]

We have already seen two major retailers—Target and Walmart—reduce their annual earnings guidance due to steep markdowns on goods to reduce excess inventory levels. Still, these actions occurred early in the year and the excess inventory will likely clear by the holiday period. It is also possible that many goods arrived late due to shipping bottlenecks, and therefore were out of season.

Capri Holdings is taking an aggressive view of holiday inventory. The company’s recent second-quarter earnings report cited a 25% increase in inventory versus pre-pandemic levels, with the company ordering early to offset any supply chain delays. Management expects inventory levels to moderate by the end of its fiscal year in March 2023, falling below year-ago levels.

Ultimately, only consumer demand during the holidays will validate conservative or aggressive inventory positions. We are also currently seeing divergence as luxury retailers post solid results, whereas mass merchandisers are reporting that customers are economizing and trading down, with a significant effect on their profitability. In total, consumers have been reducing their purchase volumes, while still spending more in dollar terms as they absorb some of the impacts of inflation. That nominal (dollar) increase suggests that shoppers appear unfazed by two quarters of negative GDP growth and generally remain able and willing to spend.

Source: FRED/US Census Bureau[/caption]

We have already seen two major retailers—Target and Walmart—reduce their annual earnings guidance due to steep markdowns on goods to reduce excess inventory levels. Still, these actions occurred early in the year and the excess inventory will likely clear by the holiday period. It is also possible that many goods arrived late due to shipping bottlenecks, and therefore were out of season.

Capri Holdings is taking an aggressive view of holiday inventory. The company’s recent second-quarter earnings report cited a 25% increase in inventory versus pre-pandemic levels, with the company ordering early to offset any supply chain delays. Management expects inventory levels to moderate by the end of its fiscal year in March 2023, falling below year-ago levels.

Ultimately, only consumer demand during the holidays will validate conservative or aggressive inventory positions. We are also currently seeing divergence as luxury retailers post solid results, whereas mass merchandisers are reporting that customers are economizing and trading down, with a significant effect on their profitability. In total, consumers have been reducing their purchase volumes, while still spending more in dollar terms as they absorb some of the impacts of inflation. That nominal (dollar) increase suggests that shoppers appear unfazed by two quarters of negative GDP growth and generally remain able and willing to spend.

US RETAIL AND TECH HEADLINES

Amazon Expands Contactless Payment to Whole Foods Market Stores Across California (Aug 9) ChainStoreAge.com- Amazon has stepped up the rollout of its Amazon One palm-recognition payment system, which lets customers use their palm to complete their purchase at a checkout, to stores of supermarket chain and Amazon subsidiary Whole Foods Market across California.

- The technology is currently available in 65 Whole Foods stores in Malibu, Santa Monica and Montana Avenue in Los Angeles, which will be expanded to other parts of Los Angeles Orange County, the San Francisco Bay Area, Sacramento and Santa Cruz in the coming weeks.

- Luxury fashion company Capri Holdings has reported sales growth of 8.5% year over year in its fiscal 2023 first quarter, ended June 30, 2022. Its adjusted gross margin declined by 190 basis points (bps) year over year to 66.2% due to inflationary increases in product and supply chain costs. The company’s adjusted EPS increased by 5.6% year over year.

- For fiscal 2023, the company revised down its sales growth guidance to an increase of 3.5% year over year, compared to previous guidance of 5.0% growth. Capri Holdings expects its gross margin to be flat year over year.

- Supermarket chain Island Pacific Market has appointed finance executive Herman Chiu as its new CFO. Chiu held the position of Executive Vice President at Tawa Supermarket for two years prior.

- Before working at Tawa Supermarket, Chiu was CFO of Santa Monica Seafood, a multi-state supplier and distributor of seafood in the US, for 17 years.

- Apparel and footwear company Ralph Lauren has reported year-over-year sales growth of 8.0% in its first quarter of fiscal 2023, ended June 30, 2022. Its comparable sales grew in the mid-teens year over year, and its adjusted EPS increased by 17.9% year over year.

- The company’s adjusted operating margin was 12.7%, exceeding its outlook of 12.2%, as its operating expense discipline more than offset the higher freight costs to fulfill stronger consumer demand. For fiscal 2023, Ralph Lauren reiterated its sales guidance of high-single-digit growth year over year on a constant-currency basis and an adjusted operating margin of 14.0–14.5%.

- Jewelry retailer Signet jewelers has struck a deal to acquire Blue Nile, an online retailer of engagement rings and fine jewelry, for $360 million in cash.

- According to Signet, the acquisition will accelerate its efforts to expand its bridal offerings and grow its accessible luxury portfolio while extending its digital capabilities. Furthermore, the company stated that the acquisition will also bring a younger, more affluent and ethnically diverse customer base into Signet’s business.

EUROPE RETAIL AND TECH HEADLINES

Ahold Delhaize Reports Double-Digit Sales Growth in Its Second Quarter (Aug 10) Company press release- Dutch food retailer Ahold Delhaize has reported sales growth of 15.0% year over year in its second quarter of fiscal 2022, ended July 4, 2022. Comparable sales, excluding gasoline and foreign currency translation benefits, grew 4.7%. The company’s net online sales increased by 4.8% year over year at constant exchange rates.

- For fiscal 2022, the company updated its guidance and now expects mid-single-digit growth in EPS, versus prior expectations of a decline in the low-to mid-single digits year over year. The total capital expenditure as a percent of sales is expected to be around 3% per annum till 2025, down from previous guidance of 3.5% per year.

- UK-based food delivery company Deliveroo is set to exit the Netherlands, citing a difficult economic environment and stiff competition from Just Eat Takeaway and Uber Eats. This company aims to manage widening losses reported for the second quarter of fiscal 2022, ended June 30, 2022.

- The company stated that the Netherlands accounted for just 1% of its gross transaction value (GTV) and would have had to invest considerably to gain a strong market position. The planned exit will happen by the end of November.

- Swiss-based travel retailer Dufry has reported revenue of CHF 2.92 billion ($3.06 billion) for the first half of fiscal 2022, ended June 30, equating to 146.2% growth year over year. The company reported a core EBITDA margin of 7.8% with an operating profit of CHF 152.4 million ($159.6 million).

- The retailer estimates that its July sales reached 90% of 2019 levels on a constant currency basis. Dufry has 2,091 of its stores open worldwide as of the end of June 2022, which places it at above 90% of its sales capacity.

- The Edit LDN, a UK-based online marketplace for clothing and sneakers, is launching in the metaverse with a new store within Bloktopia’s crypto paradise, a virtual skyscraper that is built on Web3 technology. Bloktopia will offer an option to purchase The Edit LDN’s sneakers through non-fungible tokens (NFT), which can be worn by avatars across different games and other metaverses.

- The company aims to capitalize on the Web3 craze as its digitally focused customers express increasing interest in cryptocurrency and NFTs.

ASIA RETAIL AND TECH HEADLINES

Alibaba Lays Off Nearly 10,000 Employees (Aug 9) Bloomberg.com- Chinese e-commerce giant Alibaba Group Holding laid off 9,241 employees in the three months ended June 2022, according to the company’s latest filing.

- This follows job cuts of 4,375 employees in the three months ended March 2022, reflecting a trend among global technology companies to cut costs in the face of rising inflation, increased material costs and political tensions.

- Indonesian fashion retailer Claude has launched its first store in Singapore, in the Takashimaya Shopping Center. The feet brick-and-mortar store spans 1,600 square feet.

- According to Christie Johana, Co-Founder and Creative Director of Claude, the company aims to create an experiential space for its consumers to drive engagement and boost sales.

- Luxury brand Kering Eyewear has launched its first store in South Korea, on the eighth floor of the Lotte Duty-Free store in Busan. The new boutique is Kering’s largest store in Asia to date. The store features a giant media wall displaying new merchandise, and also offers a virtual fitting service for Kering eyeglasses.

- The company has also stated plans to increase the prominence of its Gucci brand in China by 2025.

- Paxel, an Indonesia-based logistics start-up, has raised $23 million in series C funding from Astra Digital International, Central Capital Ventura and MDI Ventures. Paxel offers a variety of logistical services, including same-day local and intercity deliveries, smart locker service PaxelBox, neighborhood snack platform PaxelMarket, bulk delivery service PaxelBig and waste management service PaxelRecycle.

- Since its inception in 2017, the company has served 2 million customers and delivered 17 million products. The business intends to use the new funding to increase its capacity in the cold chain and to expand its presence.

- Israeli smart grocery cart start-up Shopic has raised $35 million in a series B funding round that was led by Qualcomm Ventures, Vintage Investment Partners, Clal Insurance.

- Shopic offers an artificial intelligence (AI)-powered cameras that can be mounted onto a shopping cart to detect items placed in it in real-time. Customers are also shown applicable promotions and discounts via the screen. Shopic intends to use the funding to expand its presence in international markets.