FROM THE DESK OF DEBORAH WEINSWIG

What Simon Said: The State of Retail REITs

As one of the largest real-estate investment trusts (REITs), Simon Property Group provides a meaningful overview of the state of REITs and the entire retail real-estate sector. The company’s second-quarter earnings report, published this week, offers interesting data on store openings and rent payments by retailers.

Simon Property Group closed all of its retail properties in the US on March 18, 2020, due to coronavirus lockdowns—and they remained closed through the full month of April. Properties began to reopen from May 1, and the REIT’s portfolio had fully reopened as of July 10. However, there were some reclosures on July 15 due to new government restrictions. Despite this, 91% of the tenants across Simon Property Group’s US retail properties were open and operating as of August 7.

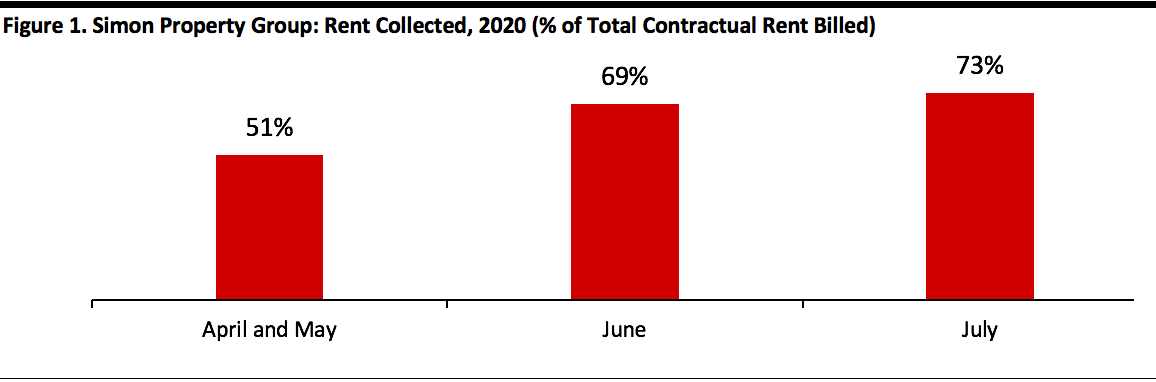

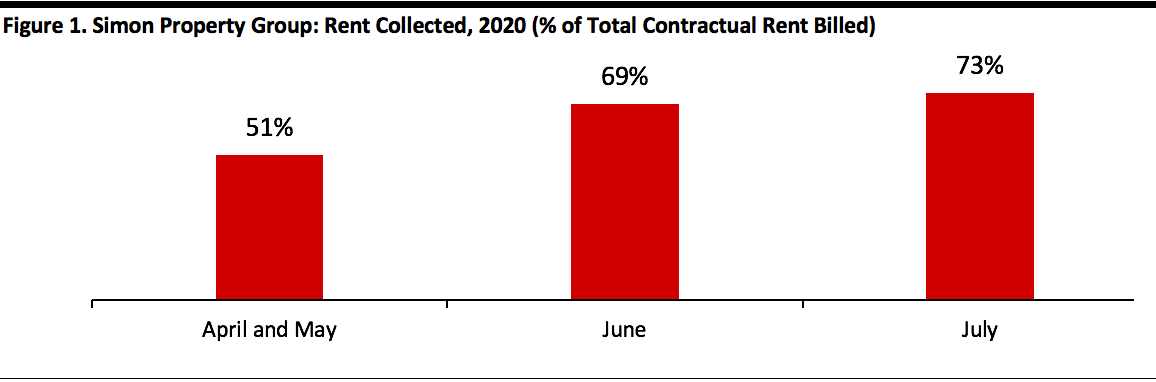

In terms of rent collected, although the percentages in recent months are low, the good news is that the numbers have seen steady improvement since April and May—reaching nearly three-quarters of total rent billed in July (see Figure 1). These percentages have not been adjusted for granted rent abatements, which Simon Property Group reported reduced its earnings by $215 million in the second quarter. Similarly, Taubman Centers reported $32.6 million in uncollectable rent in its second quarter. Retail bankruptcies remain a dampening factor on rent collections, as they continued at a high rate in July—and more are likely to follow.

[caption id="attachment_114411" align="aligncenter" width="700"]

Source: Company reports

Source: Company reports[/caption]

Despite the hefty earnings reduction, the Simon Property Group report delivered positive news about the state of retail. The company stated that its US tenants had reported 50% of the prior year’s sales volumes in May, which increased to more than 80% in June. The international story is even better—all of the REIT’s international and designer outlets are now operating, with store traffic at 90% compared to the previous year.

The company also provided insightful comments about its strategy of acquiring retailers. The company reiterated that Sparc Group—its 50-50 joint venture with Authentic Brands Group—had made offers to acquire Lucky Brand Jeans and Brooks Brothers. Simon Property Group sees three benefits from these acquisitions:

- Acquiring below-cost inventory

- Reducing overheads

- Increasing cash flow

Because of the nature of the bankruptcy code, Sparc Group is able to reject any leases that do not meet its financial criteria. This means that it expects every store to have positive earnings before interest, taxes, depreciation and amortization (EBITDA) soon after their integration. The company also expects to make back its equity investments within one year.

Simon Property Group judiciously did not comment on its reported interest in JCPenney. The company has reportedly teamed up with Brookfield to make an acquisition offer. As a definitive transaction is yet to be announced, there is always potential for these deals to change or fall through.

Using Simon Property Group as an example, the REIT offers positive data points about the improving state of the retail industry. Nevertheless, setbacks remain prominent—sales and rent collections remain below last year’s levels and are under pressure. The company has reported looking forward to new acquisition opportunities— illustrating the value that it finds in these retailers.

US RETAIL AND TECH HEADLINES

Authentic Brands and Simon Property Group Partner To Buy Brooks Brothers for $325 Million

(August 12) MarketWatch.com

- Sparc Group LLC, a venture backed by licensing firm Authentic Brands and Simon Property Group, has agreed to acquire apparel company Brooks Brothers for $325 million. Subject to bankruptcy court approval, the purchase will enable 125 of 200 Brooks Brothers stores to remain open.

- The retailer, which filed for bankruptcy last month, chose Sparc Group’s initial bid of $305 million as the stalking-horse bid for a planned auction of its assets. The deadline for rival offers passed last week and no auction was held, thus making Sparc Group’s the sole offer on the table.

Sur La Table Sells for $90 Million

(August 11) BloombergQuint.com

- High-end cookware retailer Sur La Table has sold for nearly $90 million at auction. The retailer plans to keep around 50 stores open, according to court documents.

- The documents also showed that a joint venture between e-commerce investment firm CSC Generation and Marquee Brands won the auction bid, but the companies did not confirm the news.

Walmart and Instacart Announce Partnership To Provide Same-Day Delivery

(August 11) CNBC.com

- Walmart has partnered with Instacart to provide same-day delivery across several product categories—including grocery, alcohol, pantry staples, home improvement, personal care and electronics. The service is currently being trialed in three markets in California and one in Oklahoma.

- Walmart’s initiative comes at a crucial time, as consumers are increasingly relying on online grocery and home delivery amid the coronavirus pandemic. Instacart already partners with Aldi, Costco, Kroger, Target, Sam’s Club and Walmart, among other chains, for grocery delivery.

Saks Fifth Avenue and Glossier Lay Off Store Staff

(August 11) RetailDive.com

- Saks Fifth Avenue plans to lay off an unspecified number of store operations staff as part of its efforts to streamline business. These plans predate the pandemic, a spokesperson told Retail Dive.

- Separately, direct-to-consumer beauty brand Glossier announced that it has laid off all retail staff and will not open its three stores for the rest of the year, or as long as the pandemic lasts. The company has offered its redundant staff 12 weeks of severance and health coverage through October.

Simon Property Group and Amazon May Convert Vacant Department Stores into Distribution Hubs

(August 9) WallStreetJournal.com

- Mall owner Simon Property Group and Amazon are reportedly in discussion to convert real estate vacated by distressed department stores into fulfillment centers for the e-commerce giant.

- Sources that spoke to the Wall Street Journal said that stores formerly or currently occupied by JCPenney and Sears were being considered for conversion to distribution hubs.

Casper Sleep Posts 16% Revenue Growth in Second Quarter

(August 11) Company press release

- Sleep products retailer Casper Sleep grew sales by 15.7% to $110.2 million in the second quarter, ended June 30, 2020. Its direct-to-consumer revenues rose by 5% to $81.0 million due to slow sales growth at owned stores and the temporary closure of its locations for several weeks during coronavirus-related lockdowns. Its retail partnership revenues jumped 61.1% to $29.2 million.

- The company recorded an increase of 26.4% in operating expenses primarily related to its retail expansion: It had 59 stores as of the end of the quarter, compared to 32 in the year-ago period. Adjusted EBITDA loss improved by 50% to $11.4 million and net loss improved by 10.1% to $24.2 million.

EUROPE RETAIL AND TECH HEADLINES

Zalando Revenues Surge 27.4% in Second Quarter Through June

(August 11) Company press release

- European fashion pure play Zalando posted revenue growth of 27.4% to €2.0 billion ($2.3 billion) in the second quarter, ended June 30—driven by a 20.4% surge in active customers and a 28.6% rise in order numbers. Its gross merchandise volume (GMV) jumped 33.0% to €2.7 billion ($3.2 billion) and the adjusted group EBIT margin climbed four percentage points to 10.4%, despite a difficult trading environment against the backdrop of the pandemic.

- Zalando stated that 180 new brand partners enrolled into its program that helps brands to scale their digital business in the second half of 2020—leading to 100% growth of partner-program GMV during the period. It provided the following updated guidance for the year: GMV growth of 20–25%, revenue growth of 15–20% and an adjusted EBIT of €250–300 million ($294–352 million).

Debenhams Confirms Plans To Cut 2,500 Jobs

(August 11) RetailGazette.co.uk

- Debenhams has confirmed plans to cut 2,500 jobs as part of cost-saving measures to help it survive the ongoing crisis. The cuts will involve sales manager, visual merchandise manager and selling support manager positions.

- The company stated that the affected personnel, who are still on furlough, have been informed and will leave the business by the end of this week.

Retail Sales Grow in July—the First Full Month of Reopened Stores

(August 11) BRC.org.uk

- UK retail sales rose 3.2% year over year in July—the first full month of reopened stores following lockdown easing in June—according to the BRC-KPMG Retail Sales Monitor. This is a slight slowdown from the 3.4% recorded in June, when lockdowns on nonessential stores began easing from the middle of the month. Comparable sales, excluding temporarily closed stores but including digital sales, increased by 4.3% year over year in July.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended July, total food sales increased 6.1%—the highest increase since June 2009—and total nonfood sales were down 4.3%. Online nonfood sales jumped 41% in July.

Aldi Tests Audio Prompts for Traffic-Light Store-Entry System

(August 11) TheRetailBulletin.com

- Aldi has partnered with the Royal National Institute for Blind People (RNIB) to test the use of audio prompts for its traffic-light entry system that was introduced to stores during the coronavirus-led lockdown.

- The technology accompany the traffic lights with a series of beeps to help visually impaired customers enter and exit the stores safely, maintaining social distance requirements. Aldi is piloting the technology at its Goldthorpe store in South Yorkshire, UK.

ASOS Provides Pre-Close Trading Update and Expects Full-Year Revenue Growth of 17–19%

(August 12) Company press release

- Apparel pure play ASOS reported that it expects full-year revenue growth of 17–19% and profit before tax of £130–150 million ($170–196 million), “as a result of a focus on trading dynamically and managing the business rigorously.”

- The company stated that the expectations reflect stronger-than-expected underlying demand and fewer product returns from shoppers. The company will release its results report for the full year ended August 31, 2020 on October 14, 2020.

ASIA RETAIL AND TECH HEADLINES

Alibaba Group and Total (China) Investment Sign Deal To Leverage Resources and Digital Capabilities

(August 11) Company press release

- Energy firm Total (China) Investment has signed a memorandum of understanding with Alibaba Group for resource and digital capability sharing between the companies.

- Under the memorandum, Total will use Alibaba’s technology across e-commerce, digital payments, supply chain, big data, and other functions to support its business in China. In return, Total’s customers will be able to access its products via Alibaba’s platforms: Alipay, Amap, Eleme, Taobao and Tmall.

World Co To Close 358 Japan Stores by March 2021

(August 12) RetailNews.Asia

- Japanese apparel retailer World Co plans to shut 358 stores in Japan by March 2021 due to the impact of the coronavirus pandemic. The company was set up over 60 years in Japan and went private 16 years ago.

- Over 200 staff are expected to be laid off, with some given voluntary early retirement as part of the closure plan.

NYX Cosmetics Closes Hong Kong and Macau Stores

(August 12) RetailNews.Asia

- L’Oréal-owned beauty brand NYX Cosmetics is closing its stores across Hong Kong and Macau as part of its plan to wind down its business in Asia. This follows the company’s previous exit from Malaysia, with the moves described by the company in a Facebook post as a “business strategy readjustment.”

- The brand debuted in Hong Kong three years ago and operates three standalone stores and three concessions at department stores.

Amazon Prime Subscribers in India Surpass 1 Million, Record Seller Participation on Prime Day

(August 10) Company Blog

- Amazon reported that it has garnered 1 million subscribers to its Prime loyalty program in India, with twice as many signing up for a membership on Prime Day 2020 (held on August 6 and 7), compared to last year. The company announced that over 65% of new members were from outside the top 10 cities.

- Amazon stated that over 91,000 small and medium-sized businesses (SMBs) participated, with over 4,000 SMBs each recording sales of over ₹1 million ($13,368).

Digital Bank Livi Launches in Hong Kong

(August 12) SCMP.com

- Virtual bank Livi has launched in Hong Kong, offering consumers a convenient payment method at several retailers, including 7-Eleven and Maxim’s Cake Shop. The bank is co-owned by Bank of China, e-commerce group JD.com’s fintech arm JD Digits and multinational conglomerate Jardines.

- Livi will also offer users cash rewards for registration and customers incentives for inviting up to 10 people to join, which become available once they successfully register. Users can earn further cash rewards by playing games on the Livi app.

Source: Company reports[/caption]

Despite the hefty earnings reduction, the Simon Property Group report delivered positive news about the state of retail. The company stated that its US tenants had reported 50% of the prior year’s sales volumes in May, which increased to more than 80% in June. The international story is even better—all of the REIT’s international and designer outlets are now operating, with store traffic at 90% compared to the previous year.

The company also provided insightful comments about its strategy of acquiring retailers. The company reiterated that Sparc Group—its 50-50 joint venture with Authentic Brands Group—had made offers to acquire Lucky Brand Jeans and Brooks Brothers. Simon Property Group sees three benefits from these acquisitions:

Source: Company reports[/caption]

Despite the hefty earnings reduction, the Simon Property Group report delivered positive news about the state of retail. The company stated that its US tenants had reported 50% of the prior year’s sales volumes in May, which increased to more than 80% in June. The international story is even better—all of the REIT’s international and designer outlets are now operating, with store traffic at 90% compared to the previous year.

The company also provided insightful comments about its strategy of acquiring retailers. The company reiterated that Sparc Group—its 50-50 joint venture with Authentic Brands Group—had made offers to acquire Lucky Brand Jeans and Brooks Brothers. Simon Property Group sees three benefits from these acquisitions: