FROM THE DESK OF DEBORAH WEINSWIG

What Role Will Stores Play in a Holiday Season That Is Heading Online?

We expect the recent boom in US e-commerce to be followed by a very strong holiday season for online retailing. In the second quarter, US online retail sales

climbed by 47%—in exceptional circumstances that included the lockdown period. In the fourth quarter, we expect the pace of growth to moderate but remain at elevated levels. In this context, what role will brick-and-mortar stores play this holiday season?

Less Focus on Traditional Events and Experiences

For obvious reasons, retailers are not seeking the traditional store traffic associated with Black Friday. More and more big names are announcing that they will be closed on Thanksgiving or are stretching promotional campaigns over an extended period to take the emphasis off Black Friday. However, this does not mean that brick-and-mortar stores will be redundant this holiday season. In a “mask economy,” physical stores will shift from the increasing focus on the quality of experiences that we saw pre-crisis, to a more functional focus on consumers

simply getting hold of products conveniently and safely.

More Emphasis on Fulfillment

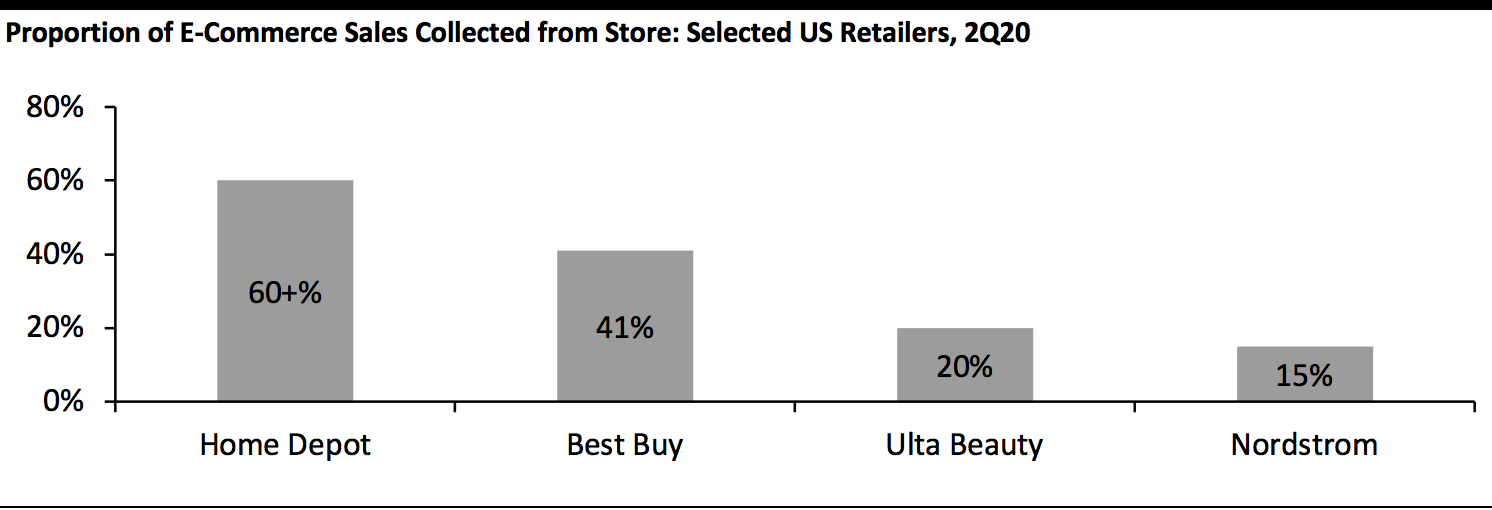

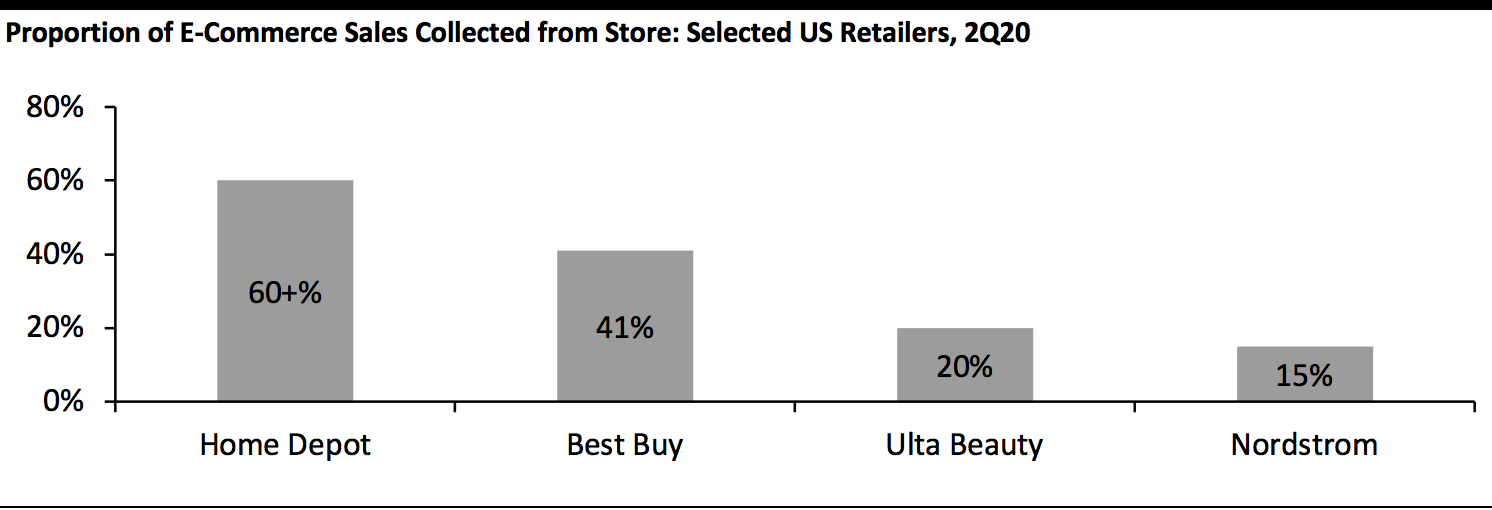

Fulfillment will be a major role for many stores this season. As retailers have reported second-quarter earnings, several have pointed to very high rates of collection of online orders. As we chart below, pickup reached as high as 60+% at Home Depot, for example.

[caption id="attachment_116348" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

In addition to at-store pickup, retailers will call on ship-from-store capabilities to serve online demand. In the second quarter, Target reported that store-enabled digital fulfillment options—which included ship-from-store, in-store pickup and curbside pickup—accounted for 90% of its total e-commerce orders. In addition, same-day services that were fulfilled from stores—including rapid delivery and collection—contributed a full six percentage points of the company’s 24% comparable sales growth.

Rethinking Stores

In response, we expect retailers to continue to reshape their omnichannel operations. Best Buy is designating around 250 of its approximately 1,000 stores to handle a higher volume of packages, to speed up order fulfillment and improve efficiency for the holiday season and beyond.

Retailers must stand prepared for fluctuations in how consumers expect online orders to be fulfilled: In a new survey, Coresight Research found that a greater number of consumers expect to increase their use of delivery services for online orders in the remainder of 2020 than those that expect to increase their use of collection services—suggesting that we could see a relative easing of pickup within the online shopping mix as we head into the holidays.

The Long Term

Beyond holiday 2020, we expect retailers to continue to review their store estates in the context of a likely sustained uplift in e-commerce. Retailers must look at the whole value of a store—in terms of brand building, product discovery, comparison and research, and transaction and fulfillment.

However, we are still likely to see

further store closures as a consequence of these channel shifts. We expect that a number of multichannel retailers will have been surprised by the extent of online sales retention during periods of store closures. For some retailers, this will have been the only hard evidence of possible sales-retention rates without stores (albeit in exceptional circumstances). Along with consumer shopping patterns in the coming holiday season, these numbers are likely to feed into decisions on their future brick-and-mortar presence. Retailers will be looking at the extent to which these channel shifts are sustained post lockdown—and so we could see more store closure announcements into 2021 in response.

- For more data and insights, keep an eye out for our US E-Commerce: Post-Crisis Outlook, publishing next week, and our US Holiday Survey report later this month.

US RETAIL AND TECH HEADLINES

Amazon Announces the Launch of Luxury Stores

(September 15) Company press release

- Amazon has announced a new shopping platform, called Luxury Stores, featuring emerging and established luxury fashion and beauty brands on its platform. The platform is available on the Amazon app to select Prime members in the US, by invitation only.

- Designer Oscar de la Renta will unveil the first store, which features Pre-Fall and Fall/Winter 2020 collections of ready-to-wear, handbags, jewelry, accessories and a new fragrance. More brands will join Luxury Stores over the next several weeks.

Francesca’s Exploring Strategic Alternatives, Including Bankruptcy

(September 15) Company press release

- Apparel retailer Francesca’s has announced that it is considering strategic alternatives to improve its liquidity and financial position, including private restructuring or bankruptcy.

- The company reported a 29.0% decline in net revenues to $76 million in its second quarter ended August 1, 2020. Francesca’s said its plans are not yet finalized and are subject to approvals from, and negotiations with, various parties.

Apple Trialing New Store Format for Easy Pickup

(September 14) 9to5Mac.com

- Apple is piloting a new retail store concept, called Express, in Burlingame, California that allows customers to pick up online orders quickly and safely. The Express store is partitioned off from the main Apple store by a wall and resembles a bank-teller counter.

- At the counter, shoppers need to produce government-issued identification and the QR order confirmation code emailed to them to collect their order. Only one customer is allowed inside the Express store at any time.

GNC Cancels Bankruptcy Auction, Sells Itself to Majority Stakeholder Harbin Pharmaceutical Group

(September 15) RetailDive.com

- Health supplements retailer GNC has canceled its bankruptcy auction as it failed to receive suitable bids before the deadline.

- Instead, it is instead selling itself to Harbin Pharmaceutical Group, its largest investor and partner for a joint venture in China. The group has made a stalking horse bid of $760 million. GNC’s sale is subject to approval by a bankruptcy court.

Macy’s Thanksgiving Day Parade To Go Virtual This Year

(September 14) Company press release

- Macy’s has confirmed that its annual Thanksgiving Day Parade will take place “solely as a television event” in light of the pandemic. The retailer has also reduced the total number of participants by 75%.

- Macy’s reported that it is implementing several precautions, such as participants wearing masks and additional personal protective equipment based on their roles as well as observing safe distancing. The parade will air on NBC from 9:00 a.m. to 12:00 p.m. on November 26, 2020.

EUROPE RETAIL AND TECH HEADLINES

Klarna Raises $650 Million from Silver Lake and Other Investors

(September 15) Company press release

- Swedish fintech firm Klarna has raised $650 million in new funds, taking its valuation to $10.65 billion. The funding round was led by Silver Lake, with participation from Singapore’s sovereign wealth fund GIC, and funds and accounts managed by BlackRock and HMI Capital.

- Klarna offers an alternative payment method on e-commerce sites, allowing shoppers to buy now and pay later across three or four installments. Klarna will use the funds to “further invest in its unique shopping offering, continue to grow its global presence and accelerate its strong momentum across all markets, especially in the US.”

Creditors Approve New Look’s Company Voluntary Arrangement

(September 15) Company press release

- New Look’s proposal for a company voluntary arrangement (CVA) has been approved by its creditors. The CVA includes a financial recapitalization transaction to extend New Look’s working capital facilities and an investment of £40 million ($52 million) to support its business plan.

- The CVA also includes de-leveraging the balance sheet with a debt for equity swap, which will reduce some debt from £550 million ($712 million) to £100 million ($129 million) and a subsequent reduction in interest costs.

ScS Creates 300 New Positions as Orders Surge

(September 14) RetailGazette.co.uk

- UK-based sofa and carpet specialist ScS has created 300 new positions to handle a surge in orders since the lockdown restrictions were eased. ScS has hired some 150 new staff through August and is looking to hire 150 more across various business functions.

- ScS reported that its order intake jumped 92% year over year between May and July, and the momentum continued in August and September, with orders up 51% year over year on a comparable basis in the last six weeks.

H&M Group Sales Down 16% in Third Quarter, Recovery “Better than Expected”

(September 15) Company press release

- H&M Group’s sales declined by 16% at constant currency and declined by 19% in reporting currency to SEK 51 billion ($6 billion) in its third quarter ended August 31, 2020. The group had closed around 900 of its over 5,000 stores at the start of the quarter and ended the quarter with some 200 stores closed.

- The group said that recovery was “better than expected” and that higher “full-price sales combined with strong cost control enabled the company to already turn to profit in the third quarter.” It added that preliminary results indicate a profit before tax of SEK 2 billion ($228 million) during the period, rebounding from a loss of SEK 6.5 billion ($741 million) in the second quarter. The company reports final third-quarter results on October 1, 2020.

Morrisons Appoints New Chief Customer and Marketing Officer

(September 15) RetailGazette.co.uk

- UK supermarket group Morrisons has appointed Rachel Eyre as its new chief customer and marketing officer. Eyre will replace Andy Atkinson who was appointed the group’s commercial director earlier this year.

- Eyre has been leading Sainsbury’s marketing communications over the last five years and launched Future Brands, the company’s venture arm. She will start her new role at Morrisons next year and report to CEO David Potts.

ASIA RETAIL AND TECH HEADLINES

Alibaba To Invest in Grab

(September 16) Bloomberg.com

- Alibaba is looking to invest approximately $3 million in Singapore-based ride-hailing and payments firm Grab, according to sources that spoke to Bloomberg. Alibaba is sole investor in the round and may acquire some portion of Uber’s stake in Grab’s equity.

- This transaction could potentially give Alibaba access to data on millions of users from eight countries, an expanding delivery fleet and an increased share in the digital wallet and financial services market.

Tencent Picks Singapore as Its Regional Hub After Setbacks in US and India

(September 15) StraitsTimes.com

- Chinese technology giant Tencent Holdings has chosen Singapore as its regional hub for Asia after encountering bans and political obstacles in the US and India.

- Tencent already has offices in Malaysia, Indonesia and Thailand. In Singapore, it is recruiting for positions in technology and business development in cross-border e-commerce, gaming and cloud computing.

Flipkart To Hire 70,000 for Festive Season in India

(September 15) ETRetail.com

- Indian e-commerce company Flipkart plans to fill 70,000 seasonal positions across its supply chain, including delivery staff, pickers, packers, and sorters, as it gears up for its annual flagship 10-day shopping event Big Billion Days. The event is typically held during the festive season between late September and early November.

- The firm has also onboarded some 50,000 local convenience stores as partners in last-mile delivery in preparation for the deluge of orders it expects during the event.

Naver Invests $80 Million in Carousell

(September 16) InsideRetail.Asia

- South Korean search engine company Naver led a consortium of companies in a funding round for Singaporean classified ads firm Carousell. The round raised $80 million, pushing Carousell’s valuation above $900 million.

- Carousell will also leverage Naver’s search engine expertise to personalize its search recommendations and produce more efficient results for its users.

Topshop and Topman Exit Singapore

(September 15) InsideRetail.Asia

- Apparel retailers Topshop and Topman have closed their last store in Singapore, in the VivoCity shopping center, with plans to only operate online from September 17.

- The retailers plan to focus on their digital strategy in the country and will sell online through their own sites, as well as on Asian fashion pureplay Zalora.

Source: Company reports/Coresight Research[/caption]

In addition to at-store pickup, retailers will call on ship-from-store capabilities to serve online demand. In the second quarter, Target reported that store-enabled digital fulfillment options—which included ship-from-store, in-store pickup and curbside pickup—accounted for 90% of its total e-commerce orders. In addition, same-day services that were fulfilled from stores—including rapid delivery and collection—contributed a full six percentage points of the company’s 24% comparable sales growth.

Rethinking Stores

In response, we expect retailers to continue to reshape their omnichannel operations. Best Buy is designating around 250 of its approximately 1,000 stores to handle a higher volume of packages, to speed up order fulfillment and improve efficiency for the holiday season and beyond.

Retailers must stand prepared for fluctuations in how consumers expect online orders to be fulfilled: In a new survey, Coresight Research found that a greater number of consumers expect to increase their use of delivery services for online orders in the remainder of 2020 than those that expect to increase their use of collection services—suggesting that we could see a relative easing of pickup within the online shopping mix as we head into the holidays.

The Long Term

Beyond holiday 2020, we expect retailers to continue to review their store estates in the context of a likely sustained uplift in e-commerce. Retailers must look at the whole value of a store—in terms of brand building, product discovery, comparison and research, and transaction and fulfillment.

However, we are still likely to see further store closures as a consequence of these channel shifts. We expect that a number of multichannel retailers will have been surprised by the extent of online sales retention during periods of store closures. For some retailers, this will have been the only hard evidence of possible sales-retention rates without stores (albeit in exceptional circumstances). Along with consumer shopping patterns in the coming holiday season, these numbers are likely to feed into decisions on their future brick-and-mortar presence. Retailers will be looking at the extent to which these channel shifts are sustained post lockdown—and so we could see more store closure announcements into 2021 in response.

Source: Company reports/Coresight Research[/caption]

In addition to at-store pickup, retailers will call on ship-from-store capabilities to serve online demand. In the second quarter, Target reported that store-enabled digital fulfillment options—which included ship-from-store, in-store pickup and curbside pickup—accounted for 90% of its total e-commerce orders. In addition, same-day services that were fulfilled from stores—including rapid delivery and collection—contributed a full six percentage points of the company’s 24% comparable sales growth.

Rethinking Stores

In response, we expect retailers to continue to reshape their omnichannel operations. Best Buy is designating around 250 of its approximately 1,000 stores to handle a higher volume of packages, to speed up order fulfillment and improve efficiency for the holiday season and beyond.

Retailers must stand prepared for fluctuations in how consumers expect online orders to be fulfilled: In a new survey, Coresight Research found that a greater number of consumers expect to increase their use of delivery services for online orders in the remainder of 2020 than those that expect to increase their use of collection services—suggesting that we could see a relative easing of pickup within the online shopping mix as we head into the holidays.

The Long Term

Beyond holiday 2020, we expect retailers to continue to review their store estates in the context of a likely sustained uplift in e-commerce. Retailers must look at the whole value of a store—in terms of brand building, product discovery, comparison and research, and transaction and fulfillment.

However, we are still likely to see further store closures as a consequence of these channel shifts. We expect that a number of multichannel retailers will have been surprised by the extent of online sales retention during periods of store closures. For some retailers, this will have been the only hard evidence of possible sales-retention rates without stores (albeit in exceptional circumstances). Along with consumer shopping patterns in the coming holiday season, these numbers are likely to feed into decisions on their future brick-and-mortar presence. Retailers will be looking at the extent to which these channel shifts are sustained post lockdown—and so we could see more store closure announcements into 2021 in response.