Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

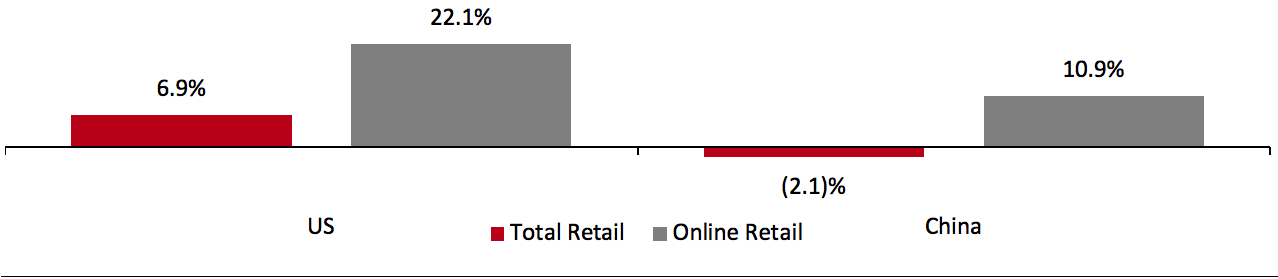

US and China: A Tale of Two Retail Economies in 2020 What a year 2020 was, surprising us in many ways—with retail sales data comparing the US and China proving equally surprising. As well as differences in the initial outbreaks, the divergence in approaches to handling the coronavirus crisis, with varying rates of effectiveness and consequences, has led to surprisingly diverse annual retail sales figures. Figure 1 compares the total and online sales growth last year in the US and China. Figure 1. US and China Retail Sales ex Food Service, Automobiles and Gasoline, 2020 (YoY % Change) [caption id="attachment_122190" align="aligncenter" width="700"] US online retail is for nonstore retailers, and is likely to understate growth versus all online retail sales

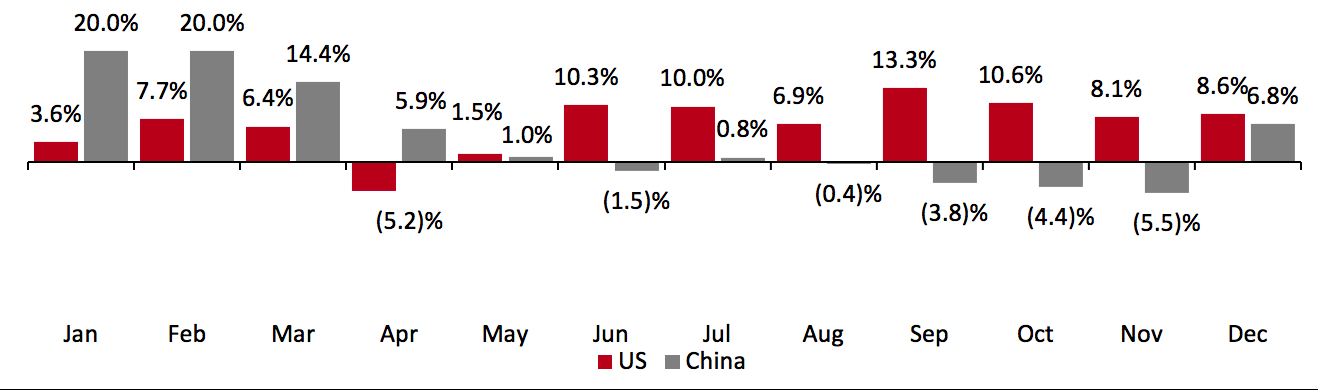

US online retail is for nonstore retailers, and is likely to understate growth versus all online retail salesSource: US Census Bureau/ China National Bureau of Statistics/Coresight Research[/caption] Let’s start with the US. Lockdowns and store closures began in March, and stores began to reopen in May, continuing throughout the summer. Reopened stores initially experienced lines of retail-starved consumers waiting to shop again, yet retail traffic remained substantially depressed compared to the year-ago period, particularly as the weather cooled and consumers continued to avoid stores and malls. We are now seeing a resurgence of some temporary store closures in US regions experiencing an uptick in cases. US annual retail sales growth hit 6.9% in 2020, exceeding 5% for the first time during the period 2010–2020 as consumers likely redirected spending toward goods from experiences, which were no longer available to them. Monthly US retail sales growth in 2020 ranged from negative figures in March through June to a rebound in the second half of the year (see Figure 2). Figure 2. Monthly Retail Sales ex Food Service, Automobiles and Gasoline, 2020 (YoY % Change) [caption id="attachment_122191" align="aligncenter" width="700"]

Data reported for China combined figures for January and February.

Data reported for China combined figures for January and February.Source: US Census Bureau/ China National Bureau of Statistics/Coresight Research[/caption] Now, let’s turn to China. The nation implemented lockdowns in affected provinces and cities from January, when the coronavirus first broke out. China began closing malls at the end of January, but 90% of malls in the country had reopened by March 22. In Figure 2, we see that China’s retail sales growth was positive during January through May but turned negative before rebounding in December. Although China’s total retail sales growth for 2020 was negative overall, as shown in Figure 1, the strong December figures likely pave the way for a strong 2021. Moreover, the months of weak or negative growth in 2020 provide easy year-to-year comparisons. China’s retail sales should therefore see a sharp rebound early in the year—we discuss our expectations in our report, Understanding China’s $5 Trillion Retail Sector. Many variables remain in the retail-sales equation. At the time of this letter’s writing, China has seen some new outbreaks and is locking down the affected areas, and the US continues to struggle with its containment of the coronavirus.

US RETAIL AND TECH HEADLINES

Bed Bath & Beyond Sells Cost Plus World Market Chain to Kingswood Capital Management (January 19) Company press release- Bed Bath & Beyond has completed the sale of Cost Plus World Market, a chain of specialty/import retail stores, to private equity firm Kingswood Capital Management. The stores sell apparel, beer, curtains, furniture, home decor and wine, as well as several international food products.

- Bed Bath & Beyond’s CEO Mark Tritton said, “The completion of this transaction marks the conclusion of our work to streamline our portfolio. These efforts will help fund our transformation and put us in the position to start fiscal 2021 with a more cohesive set of core businesses in Home, Baby, Beauty and Wellness.”

- Supermarket chain Ingles Market is modernizing its technology infrastructure in partnership with technology firm Aruba, a Hewlett Packard Enterprise company. Ingles is upgrading to Aruba’s full wireless infrastructure, including installing Wi-Fi access points and access switches for secure authentication of devices onto the wireless network.

- So far, the supermarket chain has updated 10 of its 200 stores. Through the major network upgrade, Ingles aims to enable new services at its stores, such as curbside pickup and contactless ordering.

- Kroger is testing new smart grocery cart technology in its stores in the Cincinnati area, which allows shoppers to skip the checkout line. The company launched a line of “KroGro” shopping carts that deploy artificial intelligence (AI) technology to enable shoppers to assemble their order, then pay by swiping their debit or credit card at the cart and leave the store without having to wait in a checkout line.

- The smart carts, developed by retail automation company Caper, feature a built-in video screen that can deliver promotional offers, shopping list recommendations and wayfinding capabilities. The carts also include an in-built scale to detect items sold by weight. Kroger is offering a 5% discount on its branded items to those shoppers who elect to use the smart cart.

- Office supply retailer Office Depot has rejected another takeover attempt by rival chain Staples. This was the third time Staples has tried to acquire Office Depot after the deals in 1996 and 2016 were called off over antitrust concerns.

- However, ODP, the parent company of Office Depot, said that it is open to other types of ventures, such as joint ventures or mergers of retail and e-commerce businesses.

- Walmart has entered into an agreement with Western Union to offer Western Union services, such as bill payments, domestic and international money transfers, and money orders at over 4,700 Walmart stores across the US. Walmart announced that it plans to begin rollout in the spring of this year.

- This alliance will allow Walmart’s customers to move money across around 200 countries, with money transfers being paid out in over 550,000 retail locations or into billions of bank accounts or cards.

EUROPE RETAIL AND TECH HEADLINES

Burberry Group Reports 9% Decline in Comparable Store Sales in Its Third Quarter (January 20) Company press release- Burberry reported a 4% decline in total retail revenues in its quarter ended December 26, 2020. The company witnessed a 9.0% decline in comparable store sales for its third quarter of 2020, attributed to planned reductions in markdown and reduced tourist traffic in outlets due to the Covid-19 crisis.

- Comparable store sales in the EMEA region declined by 37%, and the Americas saw a decline of 8%. For stores in the Asia-Pacific region, the company reported an 11% increase in comparable store sales, driven by strong growth in Mainland China and Korea.

- Switzerland-based luxury goods holding company Richemont reported a 1% increase in its sales during its third quarter, ended December 31, 2020. The rise in sales was driven primarily by the robust sales reported in its stores in the Africa, Asia-Pacific and Middle East regions. The company’s Jewellery Maisons business witnesses the strongest growth, at 9% during the same period.

- Richemont’s year-over-year online sales for the same period grew by 13%, while its retail sales increased marginally by 3.0%.

- UK clothing company Superdry reported a 23.4% year-over-year decline in revenues to £282.7 million ($387 million) in its first fiscal half, ended October 24, 2020. The company attributed the decline in revenue to low footfall at retail locations and store closures due to the Covid-19 pandemic. As of January 9, 2020, 173 of its stores are temporarily closed.

- The company reported a 49.8% year-over-year increase in online sales. However, it expects to witness further decline in footfall in early 2021 and a further dip in its revenues.

- Superdry reported an underlying loss before tax of £10.6 million ($14.5 million), which increased from the £2.3 million ($3.1 million) reported in 2019. The overall increase in losses can be attributed to reduced depreciation and the utilization of the company’s onerous lease provision worth £31.6 million ($43.2 million).

- Lord Simon Wolfson, CEO of UK apparel retailer Next, has joined the board of online food-delivery company Deliveroo to help the company prepare for its initial public offering.

- Deliveroo raised a total of £132 million ($180 million) in its recent Series H funding round. Since the start of the Covid-19 pandemic, the company has entered deals with major retailers including Aldi and Waitrose.

- Following the failure of its takeover plans, Canada’s Couche-Tard and France’s Carrefour are exploring operational partnership opportunities. The French government opposed Couche-Tard’s deal to take ownership of Carrefour for €16.2 billion ($19.6 million) on account of food security.

- Both companies are examining alternative opportunities, including sharing practices on fuel purchases and partnering on private labels and distribution in overlapping networks.

ASIA RETAIL AND TECH HEADLINES

IKEA Opens Stand-Alone Planning Studio in Singapore (January 20) Retailnews.asia- Swedish furniture retailer IKEA has opened a new planning studio in Jurong Point shopping mall in Singapore. The studio is powered by Singapore-based interior design and renovation platform Livspace.

- The studio spans 1,076 square feet and reflects a typical three-bedroom flat designed by the Housing Development Board—Singapore’s government agency responsible for public housing. The Livspace also offers virtual inspiration through its SmartPhotos feature.

- India is considering revising its foreign investment rules for e-commerce businesses, according to multiple sources including a government spokesperson who spoke with news agency Reuters. The move may compel Amazon and Walmart-owned Flipkart to restructure their holding in major sellers on their platform.

- The new rule will be aimed at limiting e-commerce players from selling products through sellers in which they hold a direct or indirect stake, according to the same sources.

- TikTok’s parent company ByteDance has started to roll out an e-payment service connected to Douyin, the Chinese version of short-video app TikTok.

- Douyin users will be able to connect their bank accounts to the Douyin Pay e-payment service. This feature will enable users to pay for products promoted by video influencers and also tip content makers.

- Indian conglomerate Tata Group has reportedly finalized a cash infusion in the range of $200–250 million as a part of its larger deal to acquire a majority stake in India’s largest online grocer, BigBasket, according to multiple sources.

- Tata Group will invest around $1.2 billion to acquire a 60% stake in BigBasket in a deal that involves primary and secondary sales of shares.