DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Up, Up, Up! Retail Sales Rise Year over Year in the US, the UK and Germany Retail sales are bouncing back: Even compared to the benign context of the year-ago period, total sales are up—not only in the US, but also in comparable markets such as Germany and the UK. This shows that the retail industry is far from decimated in the wake of Covid-19—although these gains are unevenly distributed. In the US, total sales jumped by 9.2% year over year in June. The strength of this recovery is surprising, but the trend is broadly comparable with international peers: In the same month, we saw a bounce back in Germany and a return to positive growth in the UK.Total Retail Sales: YoY % Change

[wpdatatable id=374 table_view=regular]All data are unadjusted. UK and US exclude gasoline and automobiles; Germany excludes automobiles. Source: US Census Bureau/Office for National Statistics/Destatis/Coresight Research A common theme across these markets is the strength of home-improvement demand. In the US, home-improvement sector sales climbed by close to 25% year over year in June; this cannot be solely attributed to pent-up demand, given that sales continued to rise during lockdown as hardware stores were allowed to remain open. We also saw double-digit growth in Germany and the UK—although the home-improvement sector in Germany peaked in May.

Home-Improvement Sector Sales: YoY % Change

[wpdatatable id=375 table_view=regular]*June data not yet available for the home-improvement sector in Germany, so we have used data for the broader furnishings, household appliances and building supplies sector as a proxy Source: US Census Bureau/Office for National Statistics/Destatis/Coresight Research Also common across these countries is the sluggish demand for apparel. The store-based specialty apparel sector remained deeply negative in June. In the US, the scale of this sector and its significance for shopping centers mean that closures and bankruptcies in apparel (and department stores) is driving the story of post-crisis retail pain.

Clothing and Footwear Retailers: YoY % Change

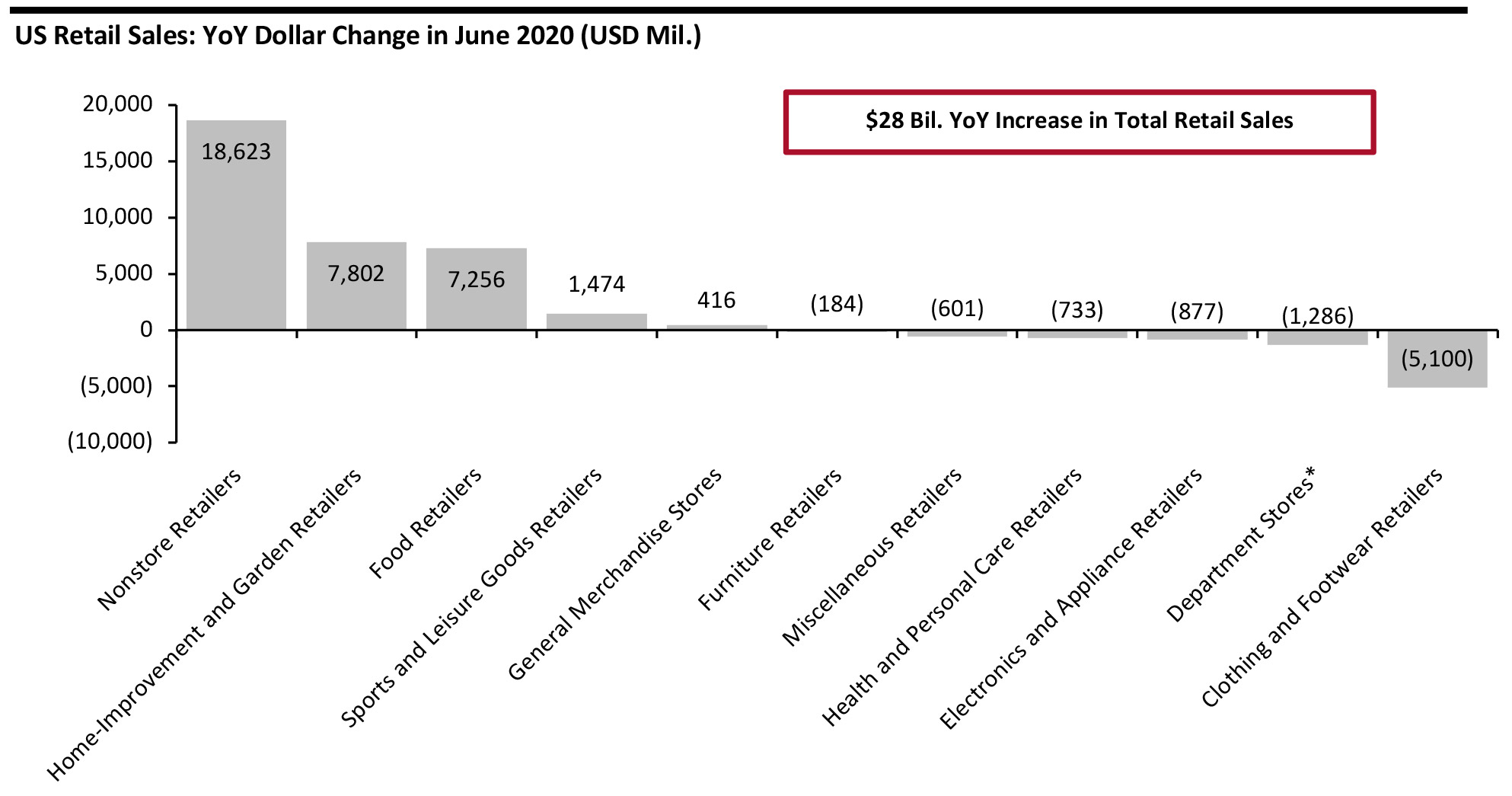

[wpdatatable id=376 table_view=regular]UK data are for clothing retailers only, ex footwear Source: US Census Bureau/Office for National Statistics/Destatis/Coresight Research What Is Driving Up US Sales? In June, selected sectors drove the exceptional increase in total US retail sales: nonstore retailers (up 30.2% year over year), home-improvement retailers (up 22.6%), sports and leisure goods retailers (up 22.4%) and food retailers (up 11.4%). However, these sectors are not equal in size— below, we show the cash contributions to retail’s total uptick in June, when total retail sales (excluding gasoline stations and automobile retailers) rose by $28 billion year over year.

- Underscoring the scale of the switch to e-commerce, two-thirds of that net increase was accounted for by an $18.6 billion year-over-year increase in nonstore retailers’ sales (which, due to the way the Census Bureau categorizes sales, actually includes online sales by some store-based retailers).

- The cash figures underscore the contribution from home improvement: Its contribution exceeds even that of the staple food sector, which has been boosted by less dining out and more working at home.

- In contrast, in June, the apparel specialty retail sector lost just over $5 billion in sales compared to the same month in 2019.

*A sub-set of General Merchandise Stores

*A sub-set of General Merchandise Stores Source: US Census Bureau/Coresight Research [/caption] So, e-commerce (via “nonstore”) has been driving the recovery in US retail sales—but not solely, and our latest weekly survey found hints of a more recent slowdown in online shopping. Food retailers and home-improvement are major contributors to recent growth—for the shape of retail, it is significant that both sectors are typically located on off-mall sites. While consumers staying at home is supporting home-improvement demand, it is hitting apparel badly: The continued difficulties are most heavy in the department-store and clothing sectors—and that spells bad news for the shopping malls in which they are key tenants.

US RETAIL AND TECH HEADLINES

Walmart Delays Launch of Membership Program Walmart+ Once Again (August 4) Vox.com- Walmart has once again delayed the launch of its membership program Walmart+ , according to news site Vox. Its launch, previously scheduled for July, was deferred due to the coronavirus pandemic.

- The Walmart+ subscription service will reportedly cost $98 per year and, similar to Amazon Prime, offer same-day delivery of groceries and general merchandise and early access to product deals. Members can also benefit from discounts on gas at Walmart gas stations.

- Home Depot plans to open three distribution centers in Atlanta over the next 18 months to meet rising customer demand for convenience and speed. Stephanie Smith, SVP of Supply Chain at the company, said that customers flocked to e-commerce as the pandemic set in, and demands for quick and convenient delivery have surged ever since.

- The retailer was one of the first to pivot to curbside pickup in late March—its online sales jumped 80% year over year in the quarter ended May 3, and were equivalent to around 15% of its net sales.

- NIKE plans to reduce its workforce by some 500 staff at its Oregon headquarters and surrounding offices, according to a notice filed with the State of Oregon.

- The company said that the first tranche of layoffs will begin October 1 and it will provide dates of further tranches subsequently. NIKE is yet to provide the job titles and the exact number of cuts, but reported that it will include some members of the corporate leadership team and their executive assistants.

- Airport retailer Hudson Group announced that it has slashed 40% of its workforce, including corporate and field staff, as of July 31, 2020. This reduction is expected to trim personnel expenses by approximately $140–160 million on an annualized basis.

- The retailer said that its decision stemmed from “the current state of the overall North American and global travel industry and uncertainty around future developments relating to Covid-19, including a possible second wave of infections.”

- Microsoft is looking to acquire the US subsidiary of hit video app TikTok from its Chinese parent company ByteDance. The app has been under scrutiny in the US due to concerns regarding the security of user data.

- After Microsoft CEO Satya Nadella’s discussions concluded with the US President, the company confirmed that it will proceed with negotiations to purchase TikTok, subject to a full security review. Microsoft hopes to conclude talks with ByteDance by September 15, 2020.

EUROPE RETAIL AND TECH HEADLINES

UK Competition Regulator Clears Amazon to Buy Stake in Deliveroo (August 4) TechCrunch.com- The Competition and Markets Authority (CMA), the UK’s competition regulator, has approved Amazon’s purchase of a 16% stake in food-delivery firm Deliveroo after reviewing it for nearly 15 months.

- The CMA said that it cleared the deal based on a detailed investigation of documents from Amazon and Deliveroo, a survey of 3,000 customers and analysis of other factors—but if Amazon move to acquire greater control in Deliveroo in future, it may trigger further investigation.

- Amazon plans to open 10 Amazon Go convenience stores in the UK and is in discussions to eventually open a further 20. The first store is expected to launch in London before the end of the year.

- The unstaffed stores have automatic checkouts and are presumed to be located near transport hubs, with a focus on commuters. In a separate development, Amazon is in discussions with shopping center owners to seek vacant spaces to launch bookstores or its 4-star stores, which sell items that are customer-rated at four stars and above on the company’s website.

- German grocery retailer Aldi has called for computer vision and artificial intelligence startups to present their innovations by registering on a dedicated website. The retailer is seeking companies with test-ready technologies that facilitate automatic product recognition through cameras in stores or shopping carts, or on shoppers’ phones.

- Aldi is also looking for technology that displays information such as stock levels, allergens and special dietary information on shopper apps. While Aldi’s plans to explore these technologies hint at ambitions to develop cashierless Amazon Go-style stores, the retailer has not confirmed such plans.

- British electronics retailer Dixons Carphone plans to cut 800 jobs as it restructures its store management teams. The company reported that the reshuffle will result in a flatter management structure as sales increasingly move online.

- Dixons Carphone said that the restructuring will remove the retail manager, assistant manager and team leader positions, and introduce new sales manager, customer experience manager and operational excellence manager roles in stores.

- British grocery retailer Waitrose has introduced a drive-thru online order collection service at 70 of its stores in the UK. Customers phone ahead to confirm their arrival and drive to dedicated parking spots where they are greeted by a member of staff who assists them.

- Customers can also return food orders through this service. Some stores also provide Click & Collect and return services for orders placed with John Lewis, its department-store counterpart.

- UK-based bookseller WHSmith recorded a 57% decline in total revenues in July, with Travel retail revenues down 75% and High Street retail revenues down 25%, year over year. The company reported in its trading update that it expects to lay off 1,500 staff due to these steep declines and slow recovery.

- Due to the impact of the pandemic, the group expects to incur losses in the range of £70–75 million ($92–98 million) in its fiscal year to August 31. WHSmith estimates restructuring costs to amount to £15–19 million ($20–25 million).

ASIA RETAIL AND TECH HEADLINES

Sa Sa Partners with Boutir in Digital Push (August 5) SCMP.com- Hong Kong-based beauty retailer Sa Sa has enlisted e-commerce technology provider Boutir to bolster its digital strategy and cope with new competition and reduced foot traffic due to the coronavirus pandemic.

- Sa Sa plans to establish “personal online stores” in a move to merge its offline and digital formats and allow its beauty consultants to engage with customers. Chairman and CEO Simon Kwok said that this will also help storefront staff earn additional commission income amid the pandemic, when fewer shoppers are visiting stores.

- South Korean convenience-store retailer GS Retail plans to recruit local residents to expedite delivery of orders placed with neighborhood stores. The company plans to leverage residents’ familiarity with their neighborhoods to deliver orders faster than personnel who are unfamiliar with the areas.

- The deliveries will be within a 1.5km radius of the resident’s home location, with the potential for them to earn $2.35–$2.68 in commission per delivery. GS Retail plans to test this out at three stores in Seoul and roll it out to all stores in the city on August 17.

- Japanese casual fashion retailer Uniqlo recorded a 4.4% year-over-year rise in same-store sales, including online sales, and 4.7% year-over-year growth in total sales in July.

- The company said that despite rain and low temperatures during July, sales growth came on the back of strong demand for “items that perfectly suited the recent demand for stay-at-home clothing.”

- Indian conglomerate Reliance Industries is looking to enter the online pharmacy space with a reported acquisition of online pharmacy retailer Netmeds.

- Sources that spoke to The Economic Times stated that the acquisition is estimated at $120 million and could spark a wave of deals involving Netmeds’s competitors PharmEasy and Medline, leading to consolidation within the sector.

- Walmart-owned Indian e-commerce platform Flipkart has rolled out several dark stores for deliveries to nearby locations in a move to compete with Reliance Industries’s hyperlocal grocery delivery platform JioMart.

- Flipkart has been acquiring food and grocery-specific storage spaces spanning 3,000 to 4,000 square feet within metro cities to expand its warehousing capacities. Last week, it launched Flipkart Quick, a two-hour delivery service for fresh food and grocery orders placed with local stores.