Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

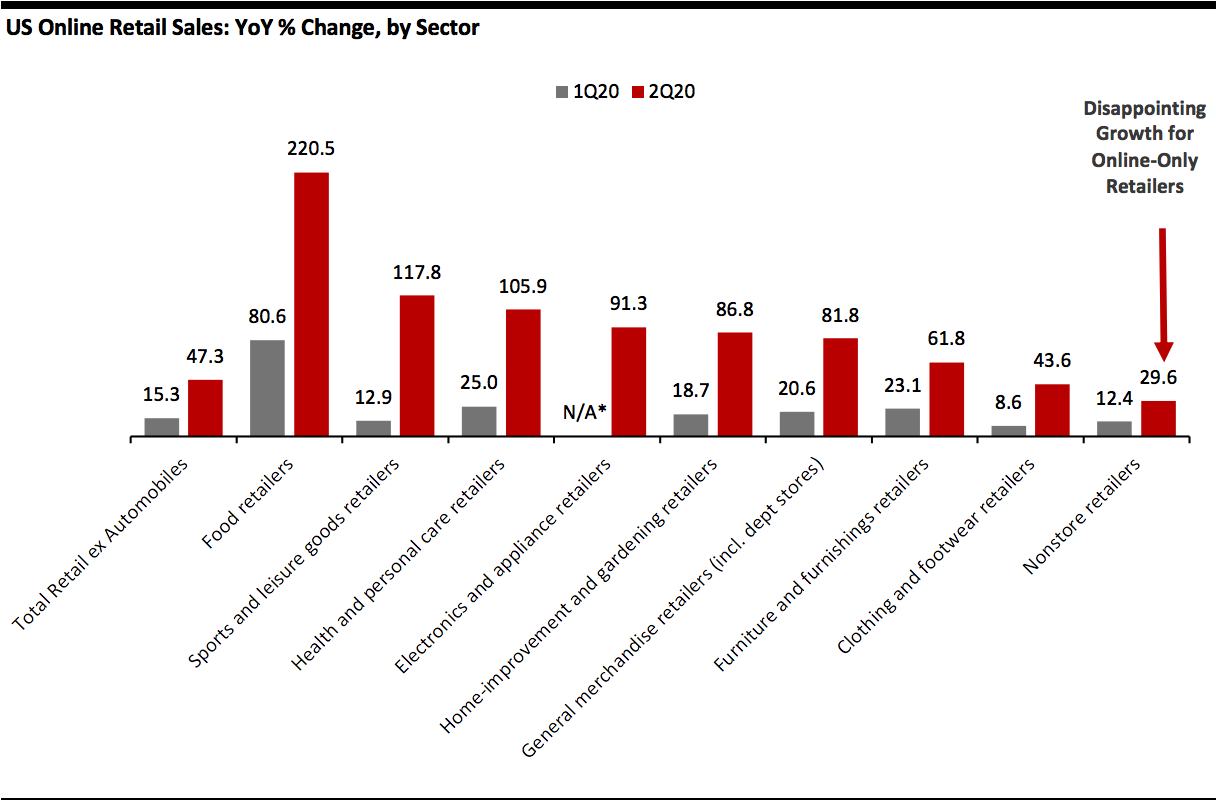

Three Learnings from the Latest US E-Commerce Data Reporting another bumper month for total US retail sales, the US Census Bureau recently released its quarterly e-commerce data, showing the extent of online retail growth during and after lockdowns: Total online sales rose by 47% in the second quarter (excluding automobile dealers). The data is significant because of the scale of the Census Bureau’s survey—it covers by far the biggest number of US retailers, outpacing sample-based data sets from independent research firms. [caption id="attachment_115770" align="aligncenter" width="700"] *Data for electronics and appliance retailers not reported for 1Q

*Data for electronics and appliance retailers not reported for 1QSource: US Census Bureau/Coresight Research[/caption] We bring this data together with recent commentary from company earnings to identify e-commerce learnings for three different types of retailer: 1. Online-only retailers, in aggregate, underpaced total e-commerce growth, reporting an overall year-over-year increase of around 30% to the market’s 47%. In the quarter ended June 30, Amazon reported that North America revenues were up 43% year over year—although this included its high-growth Amazon Web Services segment. Amazon grew global product sales by 40% year over year. Store-based retailers with e-commerce operations have fared better than pure-play rivals: Walmart US grew online sales by 97% in the second quarter, and Target’s digital comparable sales were up 195%. We expect this online demand at multichannel retailers to fuel a sustained increase in consumers’ use of collection services, including curbside collection, through the holiday peak—particularly if shoppers become more attuned to potential pressures in shipping. 2. Food retailers saw stellar e-commerce growth—but the more-than-tripling of online sales by food retailers does not represent the total food e-commerce market. Pure-play e-commerce firms such as Amazon hold a share of the grocery e-commerce market, as do store-focused retailers outside of the Census Bureau-defined food retail sector—such as Target, Walmart and warehouse clubs. Our monthly US CPG Tracker reported that total online food sales—by any type of retailer—grew by around 90% year over year in the four weeks ended July 12. This growth is still very strong but considerably more modest than the figures reported by the Census Bureau for the second quarter. Assuming moderating but still-strong grocery e-commerce growth as we move through the year, we estimate that total online food sales will be up by around 50% in 2020. 3. Big-ticket home-goods retailers, such as furniture stores and home-improvement retailers, were among the top-performing nonfood sectors online, providing further confirmation that shoppers are spending on their homes in lieu of apparel and nonretail services. This demand is not only supporting those that specialize in these sectors but also retailers such as Burlington Stores, Dollar General, Kohl’s, Nordstrom, Ross Stores, TJX and Urban Outfitters, which have highlighted home as an outperforming category as they report earnings. We expect the home category to continue to see outsized growth through the end of the year and high performance during the holiday season. On the assumption that e-commerce growth will prove more moderate after the second quarter—given the timing of lockdowns—we expect total US e-commerce sales to rise by around 31% in 2020. Given the evidence so far, store-based retailers are expected to drive this growth. While the crisis has hit store operations badly, it is providing multichannel retailers with an opportunity to capture online share from nonstore rivals such as Amazon.

US RETAIL AND TECH HEADLINES

Walmart To Launch Walmart+ on September 15 (September 1) Company press release- Walmart plans to launch its new membership program Walmart+ on September 15. The membership, which costs $98 annually or $12.95 a month, will offer a 15-day free trial and provide unlimited free delivery, including same-day delivery, on over 160,000 items.

- Walmart+ members can also access Walmart’s Scan & Go option on the Walmart app, allowing them to scan items as they shop in-store and pay via Walmart Pay for a contactless checkout experience. Members can also save up to $0.05 per gallon of gasoline when they refill at any of the 2,000 Walmart Murphy USA and Murphy Express fuel stations.

- The US Federal Aviation Administration (FAA) has designated Amazon’s drone fleet, called Amazon Prime Air, an “air carrier.” This allows Amazon to begin its first commercial deliveries using drones in the US.

- Amazon is yet to clear certain regulatory and technical barriers for it to routinely deliver groceries and supplies using drones. Alphabet’s Wing, a partner of Walgreens and FedEx, and shipping company United Parcel Service are among the other businesses that have received the FAA’s approval to trial deliveries using drones.

- JCPenney’s lenders, including H/2 Capital Partners, may make a bid to own the retailer as discussions with bidders, including mall owners Brookfield Property Partners and Simon Property Group, have reached an impasse.

- Attorney Joshua Sussberg of Kirkland & Ellis told a bankruptcy court that JCPenney may close additional stores as a result of the impasse; last month, the retailer announced the closure of around 150 stores when it filed for bankruptcy.

- Investment firm Saadia Group has bought the e-commerce business and intellectual property of apparel retailer RTW Retailwinds for $40 million through a bankruptcy auction. The transaction includes the assumption of some liabilities, such as honoring gift cards.

- Assets set for acquisition include the websites www.nyandcompany.com, www.fashiontofigure.com, and rental subscription businesses www.nyandcompanycloset.com and www.fashiontofigurecloset.com. Saadia Group doubled the price of the bid offered by Sunrise Brands to win the auction.

- Women’s fashion retailer J. Jill has announced a financial restructuring agreement with lenders that hold over 70% of its term loans. The agreement could see a waiver of some noncompliance with the company’s credit facilities and provide additional liquidity to the company.

- The agreement, which is pending consent from some lenders, could extend the maturity of certain debts by two years. If J. Jill fails to obtain consent from those lenders, the company will file for Chapter 11 bankruptcy.

EUROPE RETAIL AND TECH HEADLINES

Marks & Spencer and Ocado Partnership Officially Launches (September 1) RetailGazette.co.uk- The partnership between Marks & Spencer (M&S) and online grocery retailer Ocado officially launched on September 1, as customers received their first deliveries of M&S grocery orders placed on Ocado.

- To meet growing demand for online orders amid the coronavirus pandemic, M&S has made some 6,800 products exclusively available through Ocado. Waitrose and Ocado parted ways after an 18-year-long partnership, creating a new opportunity for M&S.

- German tech investment firm Rocket Internet has decided to delist its shares as it has access to adequate funds outside of the stock market and wishes to pursue a long-term approach to investing. The company’s founder Oliver Samwer and his Global Founders Capital fund will retain existing stakes in the company, which total roughly 50%.

- The company, which founded firms such as Delivery Hero and HelloFresh, will buy back 8.84% of the shares at €18.57 ($22.05) per share until September 15 and will seek authorization to buy back a further 10% at an extraordinary shareholders’ meeting on September 24 to decide the terms of the offer. The remaining shares are held by the public and institutional investors.

- Lingerie retailer Ann Summers is considering launching a company voluntary arrangement (CVA) after facing losses of £16 million ($21 million) in the last year, according to its recent financial report.

- As Chief Executive Jacqueline Gold expects business rates and property costs to rise next year, the company may choose to launch a CVA due to some landlords’ refusal to negotiate better terms, even after the owning family injected cash to keep the business running.

- Homebase has partnered with The Hut Group’s e-commerce division THG Ingenuity to enhance the home and garden retailer’s digital shopping experience.

- THG Ingenuity’s end-to-end e-commerce application suite will replace Homebase’s current system and include web development and hosting, fulfillment and payment infrastructure, digital channel and proposition management, and brand building and strategy. THG Ingenuity will also provide Homebase with digital content from its own content studios.

- Debenhams’ advisers from investment bank Lazard had asked bidders to send in their bids by 5:00 p.m. on September 1. However, talks are still in progress as its management team are yet to arrive at a resolution.

- The retailer hopes to strike a suitable deal by the end of September—otherwise, it will be forced to explore other options, including full liquidation of its chain. Debenhams has not been paying its rent obligations nor has it been paying its suppliers, which may complicate finding a smooth resolution.

ASIA RETAIL AND TECH HEADLINES

Reliance Acquires Future Group’s Retail, Wholesale and Logistics Businesses (August 31) Reuters.com- Reliance Industries Limited, the Indian conglomerate that owns Reliance Retail, has announced that it will acquire Future Group’s retail, wholesale, logistics and warehouse business for approximately $3.38 billion.

- The acquisition of the Future Group businesses, which includes over 2,000 retail stores and the Big Bazaar grocery chain, will bolster Reliance’s 11,000-strong network of stores that sell a range of products—from groceries to electronics—as well as its e-commerce arm JioMart, which offers free, fast delivery from neighborhood stores.

- Alibaba has signed a strategic cooperation agreement with Shanghai-based logistics firm YTO Express that will see it increase its stake in the company to 12%.

- Through the agreement, YTO and Alibaba hope to derive synergies from their joint capabilities in express logistics, air cargo, international networks and supply chains, and digital technology, in order to boost the global service capabilities of both firms.

- Bunnymaicai, a Beijing-based online-to-offline grocery retailer, has raised $10 million in Series A funding from Country Garden Venture Capital, Joy Capital and ZWC Partners.

- The service, which offers 30-minute deliveries on orders placed at over 100 physical stores or on its WeChat mini-program or app, is currently only available in Wuxi, Jiangsu. Bunnymaicai will use the funds to expand its store network in Wuxi and other cities in East China and improve its supply chain and retail software infrastructure.

- Japanese mall operator Aeon has reported a loss of $2.3 million—representing a drop of 19.9% in net income—in its Malaysian operations in the second quarter. The coronavirus crisis and movement control orders imposed in the region prompted the closure of non-essential stores and low rental incomes, leading to the loss.

- Aeon Malaysia plans to prioritize providing a safe shopping environment though its personal shopper and home-delivery services. It also plans to launch a virtual mall and expand its drive-thru services to more locations in the region.

- Online retailer Shopee has beaten Lazada to become the most-visited e-commerce site in Singapore in the second quarter of 2020, according to data compiled by iPrice Group and Similar Web.

- Shopee’s traffic surged 82% during the quarter, garnering an additional 5 million average visitors, driven by marketing initiatives and sales events. Shopee’s ranking for visitor numbers is followed by Lazada, Qoo10, Amazon and EZBuy.