albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

The US Inflation Rate Subsides, Finally—But Will This Trend Be Sustained? This week brought the news that total consumer price rises had started to ease (slightly) in the US. Welcome news—but not yet cause for celebration, and certainly not for retailers. The most meaningful drivers of the easing of overall inflation were nonretail categories—namely energy (particularly the gasoline subset within energy) and used vehicles. This follows President Biden’s announcement at the end of March of plans to release up to 1 million barrels of oil per day from the country’s strategic reserve, to help quell price rises in gasoline. So, for inflation overall, including in core retail categories, we are not yet out of the woods.Figure 1. US Consumer Prices Inflation (CPI), Selected Categories [wpdatatable id=1969]

Note: Bps=Basis points Source: BLS/Coresight Research

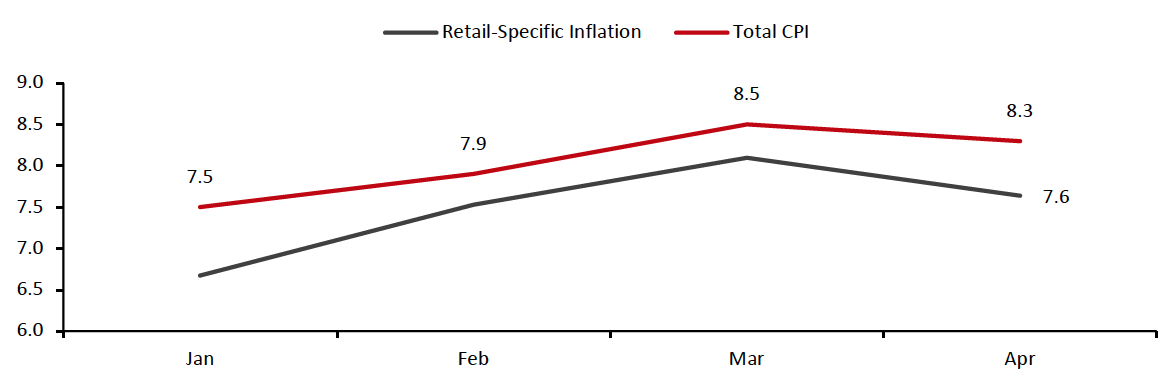

Each month, Coresight Research calculates its retail-specific inflation metric to represent the mix of products sold in retail. In April 2022, a slowdown in retail inflation was driven by an easing in apparel and meaningful deflation in electronics, implying that discretionary retailers may be easing the pace of price hikes as momentum wanes in consumer demand—as we discuss below, buying fewer items is the top consumer response to price rises in nongrocery retail. Meanwhile, price growth in the biggest nondiscretionary category continued to accelerate: food-at-home price growth reached an eye-watering 10.8% on a year-over-year basis in April.Figure 2. Coresight Research’s Retail-Specific Inflation Metric vs. Total CPI (YoY % Change) [caption id="attachment_147208" align="aligncenter" width="700"]

Coresight Research’s retail-specific inflation represents total retail sales excluding automobiles and gasoline.

Coresight Research’s retail-specific inflation represents total retail sales excluding automobiles and gasoline.Source: BLS/Coresight Research[/caption] We have covered reactions to, and the implications of, rising prices extensively in our recent research. As we discussed this week, our US Consumer Tracker surveys are picking up shifts in how consumers are responding to rising prices. In nongrocery shopping, between our late-March and early-May surveys, we recorded a sharp, 17.9 percentage-point (PPT) decline in the proportion of shoppers switching to cheaper brands, potentially in favor of buying fewer items in aggregate. Underscoring the risk to volumes in discretionary retail, buying fewer items was the top response in nonfood shopping with about half of respondents indicating they are purchasing fewer nongrocery items in response to inflationary pressures. Our US Consumer Tracker confirms that active responses to rising prices are widespread: In both grocery and nongrocery shopping, only around one in 10 respondents are not changing their shopping behavior in response to inflation. This week, we also covered in detail the implications of rising costs and consumer prices in apparel and footwear, and concluded that consumers are set to seek out apparel and footwear brands and retailers that offer value, such as off-price retailers, e-commerce giant Amazon and mass merchandisers, as well as strong brands and retailers such as NIKE and American Eagle Outfitters. We expect apparel and footwear brands and retailers without a differentiating market position to struggle amid price increases. Finally, what are the near-term prospects for US retail in aggregate? This week, we released our monthly projections for US retail sales. Those projections suggest that, in real terms, total retail sales growth is likely to have been negative in April and will remain negative in May: In nominal terms, total sales are likely to increase by low- to mid-single digits, year over year, but with retail-specific inflation running at close to 8%, total retail sales are falling in real terms. We will continue to cover the issue of inflation in detail and with regularity—check coresight.com for further research insights.

US RETAIL AND TECH HEADLINES

Ahold Delhaize USA Transitions Its Warehouse to Self-Distribution (May 9) SupermarketNews.com- Food retailer Ahold Delhaize USA has transformed its distribution center in York, Pennsylvania, into a self-managed facility. According to Ahold Delhaize’s distribution and logistics arm, ADUSA supply chain, the company now operates 22 self-managed facilities.

- The latest facility will expand Ahold’s grocery capacity by 1.2 million square feet spanning over 10 floors, serving approximately 400 Giant Food and Giant/Martin’s (The Giant Company) stores.

- Footwear retailer Designer Shoe Warehouse (DSW) has unveiled its “warehouse reimagined” store format at Hedwig Village in Houston, as revealed by its parent company Designer Brands. The new format spans 15,000 square feet, which is smaller than a regular DSW store but employs greater design efficiency to offer the same quantity of merchandise.

- The new Houston store has a modern, warehouse-inspired design that offers shop-in-shops, comprehensive family products and head-to-toe lifestyle images to elevate the company's owned brands. It also features popular national brands.

- Instant grocery delivery startup Food Rocket is set to open a fulfillment center in Chicago this summer, located adjacent to convenience store chain Circle K, which will provide 15-minute delivery for products sold by both retailers. However, the deal is not yet finalized.

- Food Rocket plans to open store locations in Boston, Los Angeles, Philadelphia and Washington D.C. later in 2022 and will seek additional funding to support its expansion beyond what it has already received from Circle K and other investors.

- Grocery retailer SpartanNash has teamed up with online food delivery platform DoorDash, wherein DoorDash will be incorporated as an e-commerce partner, service provider and distribution client for SpartanNash.

- Under the deal, DoorDash will provide on-demand grocery delivery from more than 100 stores owned by SpartanNash as well as become a delivery and e-commerce services option for SpartanNash’s network of 2,100 independent retailer customers. SpartanNash will also serve as a distributor for DoorDash's online convenience store, DashMart, which is set to launch soon in New York City and expand to additional locations later in 2022.

- Outdoor gear and apparel retailer The North Face has relaunched its resale program Renewed in partnership with resale technology provider Archive and clean technology and logistics company Tersus Solutions. This follows the initial launch of the program in 2018.

- The Renewed collection includes refurbished and remade clothing and gear. The North Face obtains product identification, cleaning, repairs and site listing information for goods in the Renewed supply chain. The company will use this visibility to more accurately price items for resale and gain a better understanding of how products hold up over time.

EUROPE RETAIL AND TECH HEADLINES

IKEA to Invest $3.15 Billion in New and Existing Stores To Fulfill Online Orders (May 9) Company press release- Home-furnishings retailer IKEA, which is managed by Ingka Group, has announced that it will invest more than €3.0 billion ($3.15 billion) in new and existing stores by the end of 2023 to become more accessible to its customers. The investments will cover all 32 of Ingka’s markets, including the US, Canada and the UK.

- The company will focus its expansion investments on new physical stores, beginning with the opening of a store on May 11 in Nice, France. One-third of the investment, totalling €1.2 billion ($1.27 billion), will go to IKEA’s London market, including its Oxford Street store and a new distribution center in Dartford that will enable home deliveries within 24 hours.

- Spanish apparel retailer Zara, which is owned by Inditex, has launched a fee for customers on returning products bought online. Zara shoppers will be charged £1.95 ($2.41) for returning items, with the fee deducted from their refund.

- According to the company, customers will have 30 days to return items and will not be able to return separate orders in the same box. The move comes against the backdrop of high return rates in recent months among various fashion retailers.

- Spanish supermarket chain Mercadona has upgraded its ready-to-eat section following a four-month trial period in select stores.

- Mercadona’s ready-to-eat service allows customers to choose from more than 35 dishes. All dishes are provided in containers made of natural materials such as sugar cane (which is compostable), cardboard or paper.

- British grocery and convenience store chain One Stop has announced its partnership with US-based online food delivery platform Uber Eats, to expand the former’s grocery and convenience operations. An initial 100 One Stop stores have already launched on the Uber Eats app, with a further 400 set to be added later this year.

- Products for delivery range from confectionery and alcohol to fresh meats, fruit and vegetables, as well as seasonal deals and offers. One Stop’s Managing Director Jonny McQuarrie said, “Customers will be able to have great quality products at their doorstep within minutes. We look forward to offering the Uber Eats service to both our existing loyal customers and new customers across the country.”

- Swedish hypermarket SPAR has announced that SPAR Hungary has invested heavily in its logistics network, with more than €8.7 million ($9.1 million) spent in 2021 on transportation and logistics developments, and an additional €11.4 million ($12.0 million) in spending planned for 2022.

- SPAR Hungary's transport fleet currently consists of 121 motor vehicles and 120 trailers, with more on the way as the company expands its operations. SPAR Hungary purchased 20 truck trailers in 2021 and plans to purchase another 20 in 2022.

ASIA RETAIL AND TECH HEADLINES

Delhivery Raises $304 Million Funds Ahead of IPO (May 11) ETRetail.com- Indian logistics and supply chain startup Delhivery has raised ₹23.5 billion ($303.8 million) from 64 anchor investors in its latest investment round, ahead of its initial public offering (IPO). Notable investors include Aberdeen Standard Life, Amansa, Bay Capital, Baillie Gifford, Fidelity, GIC, Government Pension Fund Global, Invesco HK, Schroders, Steadview and Tiger Global.

- The supply chain startup will leverage the funds to fuel its organic growth plans, including building economies of scale, expanding its network and improving its logistics operating system. It will also utilize some of the funds for acquisitions and other inorganic growth initiatives.

- Pakistan-based social commerce and resale platform Markaz has secured $2.4 million in its latest seed funding round. Indus Valley Capital led the investment round, with participation from Suya Ventures’ founder Kyane Kassiri and executives from companies including Amazon, Careem, Deloitte and Gojek.

- The platform currently offers more than 10,000 products across multiple categories. It plans to use the fund to enhance user experiences and hire more employees.

- Indian retail conglomerate Reliance Brands Ltd. (RBL) has entered a partnership with Tod's, an Italian luxury lifestyle brand. Under the deal, RBL is the brand’s official retailer in the Indian market across all major categories, comprising accessories, footwear and handbags.

- RBL will be responsible for enhancing Tod’s presence across offline and online sales channels, as well as managing Tod's existing stores in India.

- China’s third most-populous city and southern technology hub, Shenzhen, has announced plans to offer cash grants worth ¥11.0 million ($1.6 million) to third-party service providers that enable Chinese brands to sell products overseas.

- This move is in line with the country’s aims of boosting its cross-border e-commerce community, including merchants, service providers and warehouse operators to grow sales of Chinese products to foreign consumers.

- Hong Kong-based e-commerce platform Shopline has partnered with Hong Kong-based electronic payment platform Octopus Cards Limited to provide its users with a new payment option.

- The new payment platform allows shoppers to use consumption vouchers issued by the Hong Kong government to pay at Shopline, benefitting both voucher holders and merchants. The scheme was announced on April 3, 2022, with residents receiving their first vouchers of $4,000 on April 7, 2022. Shopline believes that the partnership will help increase order conversion rates and enhance overall shopping experiences.