Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

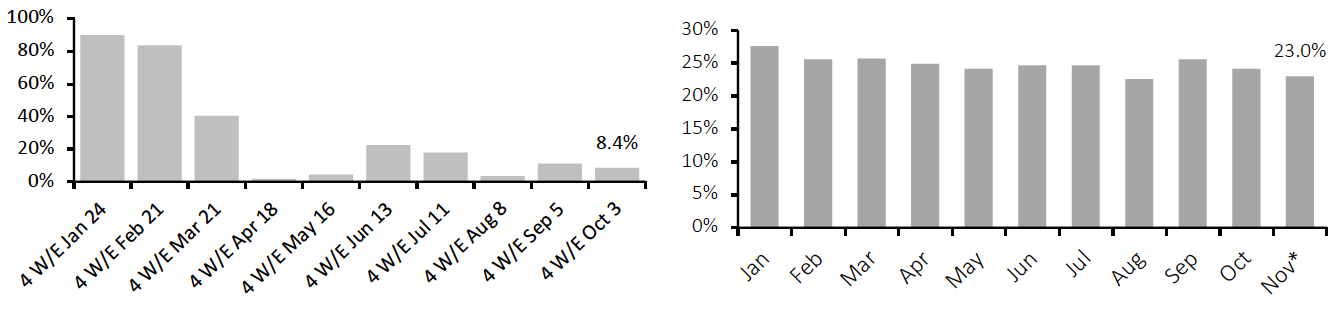

The Stickiness of Online Grocery—Persisting into 2022 Of all the shifts we saw among US consumers in 2020, shopping online for groceries has proved one of the stickiest. Each week, our US Consumer Tracker survey reports confirm still-elevated levels of online shopping for food. Each month, our US CPG Sales Tracker proves likewise with IRI-reported sales data. As charted below, each month so far this year has seen positive year-over-year growth in US online food sales—even as the market has cycled ultrastrong comparatives from 2020—growth upon growth is the story in grocery e-commerce. Regular participation has remained high at around one-quarter of all US consumers, even though the pattern across the year has been a slight unwinding in shopper numbers. Online grocery shopping typically peaks in the busy holiday season as frazzled shoppers look for convenience, especially when buying bigger baskets than usual, so we are likely to see an uptick in the participation metric in the coming weeks.Figure 1. US: YoY % Change in Online Food and Beverage Sales (Left) and % of Respondents That Purchased Food or Beverages Online in the Prior Two Weeks (Right), 2021 [caption id="attachment_137240" align="aligncenter" width="700"]

*Through November 15

*Through November 15Source: IRI E-Market Insights™/Coresight Research[/caption] The threat of omicron disruption will only boost the market further. Even if concerns prove to be unfounded, short-term worries fueled by panicky headlines will prompt some shoppers to stock up their pantries online rather than in-store. And we are penciling in a reacceleration in online grocery growth for 2022, as the yearly comparatives become less demanding, relatively high participation rates hold steady and shoppers continue to increase the online share of their total grocery spend. Within the total market, we see a number of trends and segments benefitting from online stickiness as we enter 2022: Meal kits: Coresight Research estimates that the US meal-kit market surged by 69.3% year over year in 2020 and will have grown by a further double-digit percentage in 2021, outperforming total food e-commerce expansion this year. HelloFresh has consolidated its position in the market, with a year-to-date (nine months) US sales increase of around three-quarters versus the same period of 2020. Quick commerce: Coresight Research estimates that retail sales (predominantly grocery/essentials) by major players in the US quick-commerce market will have totaled $20–25 billion in the US this year. Operators such as Fridge No More, JOKR and 1520 have entered the market, joining longstanding quick-commerce players such as Gopuff and Instacart, and promising delivery in as little as 10–15 minutes. Direct-to-consumer (DTC): This segment is niche in grocery and we are more skeptical about it becoming a meaningful channel than the two segments named above—not least because which consumer wants to go to one website to buy a can of beans and then to another website to buy a packet of oatmeal? In addition, the small-basket/high-fulfillment-cost mix may look unfavorable to CPG giants more used to wholesaling to retailers than shipping individual items to shoppers. Yet, from a small base, it remains an emerging segment, with brand owners such as Beyond Meat, Kraft Heinz, PepsiCo, Nestlé and Unilever all seeking to expand DTC sales, and we will watch its progress next year. Still, in 2022, we expect the majority of food e-commerce sales to be funneled through major multichannel retailers, as the majority of shoppers seek cross-channel convenience, familiar retailers and trusted brands (including private labels). Pure-play online grocery retail has failed to attract a majority share of grocery e-commerce markets in any Western country, and we see this trend persisting. Shoppers’ strong cross-channel preferences in food retail (and particularly fresh food, where Amazon’s online share is tiny) are why we expect Amazon to continue pushing heavily into brick-and-mortar grocery space, notably through its Amazon Fresh supermarket format.

US RETAIL AND TECH HEADLINES

Boxed To Acquire MaxDelivery (November 29) SupermarketNews.com- Online bulk products retailer Boxed has announced plans to acquire pure-play online grocery company, MaxDelivery to enter the instant needs grocery delivery industry. The transaction is set to close in December 2021.

- With the addition of MaxDelivery, Boxed aims to expand its dark store and micro-fulfillment capacity, as well as rapid on-demand grocery delivery. Founder, President and Chief Technology Officer of MaxDelivery Chris Siragusa will join Boxed as Senior Vice President of Operations.

- eBay has acquired Sneaker Con’s authentication business, a sneaker authenticator with operations in Australia, Canada, Germany, the UK, and the US.

- This deal is an extension of the continuing collaboration between eBay and Sneaker Con. The acquisition will allow eBay to strengthen its Authenticity Guarantee service that offers full vetting and verification of select sneakers bought on the marketplace, via a team of Sneaker Con’s industry experts.

- Edgewell Personal Care, a consumer products company, has completed the acquisition of a women’s personal care company Billie Inc. for $310 million. According to the terms of the deal, Billie’s founders—Georgina Gooley and Jason Bravman—will continue to lead the company.

- Billie’s product portfolio complements Edgewell’s product offering and will help the company to strengthen its position in the women's shaving product category.

- Global athletic apparel company Under Armour plans to leverage Nedap’s iD Cloud RFID-based inventory visibility platform across its 400 owned and operated stores globally.

- Through this deployment, Under Armour will be able to access a real-time view of inventory, attain operational efficiencies and fuel innovation in consumer experiences.

- Brett Biggs, Walmart’s CFO and Executive Vice President, plans to step down from his current role by early 2023, after spending more than 20 years with the company. During his tenure, Biggs has served various leadership roles, including CFO for Walmart International, Walmart U.S. and Sam’s Club.

- Biggs will continue to lead the company until his successor takes over his role. He will also continue representing the company as a board member on Walmart’s FinTech startup joint venture with Ribbit Capital, until the appointment of the new CFO.

EUROPE RETAIL AND TECH HEADLINES

Asda Charters Cargo Ship To Ensure Delivery of Christmas Supplies; Announces its Third Quarter Results (November 30) EsmMagazine.com- British supermarket chain Asda has chartered its own cargo ship to ensure the availability of key festive items for the holiday season. The cargo ship is carrying 350 containers holding clothing, decorations, gifts and toys, and is due to arrive in the UK shortly.

- The company also announced that its like-for-like sales (excluding fuel) declined by 0.7% in its third quarter, ended September 30, 2021. However, the company saw 2.0% growth on a two-year basis. The company also reported third-quarter revenue of £4.93 billion ($6.57 billion).

- Inditex, Spanish fashion retailer and the owner of Zara, has appointed Marta Ortega as a Chairwoman of the group, effective April 1, 2022. The company has also appointed Oscar Garcia Maceiras as CEO, effective immediately. Marta Ortega has worked with the company for 15 years, starting as an assistant in its retail brand Bershka while Oscar Garcia Maceiras joined as General Counsel and Board Secretary in March 2021.

- Chairman Pablo Isla stated that the time was right for the changes given the strong position of the company, backed by second-quarter 2021 sales (ended July 31) surpassing pre-pandemic levels

- Dutch supermarket chain Coop has announced that its members approved its proposed merger with supermarket chain Plus. The deal is expected to close in early 2022 after the approval of the Netherlands Authority for Consumers and Markets (ACM).

- As a part of the merger, Coop stores would be converted to the Plus format, creating a nationwide network of 550 stores, providing jobs to over 40,000 people and serving 4.5 million customers per week.

- British fashion retailer M&S has announced plans to buy more high-end garments from Bangladesh manufacturers as a commitment to its suppliers and to diversify its customer offerings.

- The company currently spends over £1.0 billion ($1.3 billion) on garments made in Bangladesh each year, making the country the largest sourcing destination for M&S apparel items.

- Tesco Ireland, subsidiary of the British supermarket group Tesco, has acquired 10 Joyce’s Supermarkets retail stores in Galway, subject to the approval of the Competition and Consumer Protection Commission (CCPC) of Ireland.

- The retail stores will be rebranded as Tesco stores throughout 2022 on a phased basis and Joyce’s staff from the acquired stores will be welcomed as employees of Tesco Ireland, according to the company.

ASIA RETAIL AND TECH HEADLINES

Tablevibe Raises $1.5 Million in Seed Round of Funding (November 30) TechinAsia.com- Tablevibe, a Singapore-based software-as-service (SaaS) platform for restaurants, has raised $1.5 million in a seed round led by venture capital firm Global Founders Capital. Tablevibe, founded by ex-Google executives Jeroen Rutten and Mathieu Sneep in 2021, provides data services to food and beverage enterprises.

- The company stated that the $1.5 million funding will aid in the development of a direct ordering and loyalty solution that will help eateries to achieve long-term growth.

- Snapdeal, Indian online retailer backed by SoftBank Group and Alibaba Group, plans to file preliminary documents for a $250 million initial public offering in early 2022.

- The company aims to raise at least $200 million at a $1.5 billion valuation. After the unfortunate debut of Paytm's parent firm, Snapdeal would become the largest tech startup to put its initial public offering (IPO) to the test, focusing on middle-class customers who are often overlooked by larger competitors, according to the company.

- Outdoor sports brand The North Face plans to open its largest store in Asia-Pacific, which will span 3,800 square feet in K11 Art mall in Hong Kong.

- The store is seen by the local retailing industry as a vote of confidence in the market as retailers eagerly await the return of Chinese tourists when the border with the mainland reopens early next month.

- Food delivery company Uber Eats announced that it is closing its Hong Kong operations on January 1, five years after entering the market.

- Uber Eats competes with rivals Food panda and Deliveroo, which have 272,000 and 122,000 active customers year to date, respectively, while Uber Eats only has 48,400 active users, according to app market insights provider App Annie.

- India-based online food delivery platform Zomato has launched its Zomato Wings initiative designed to help investors connect with restaurants looking for investment.

- Zomato will help restaurants to position their metrics and story to connect with the right investor and intends to be the go-to platform for restaurant and cloud-kitchen to get investments, with the goal of funding at least 100 restaurants in the next three years.