Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

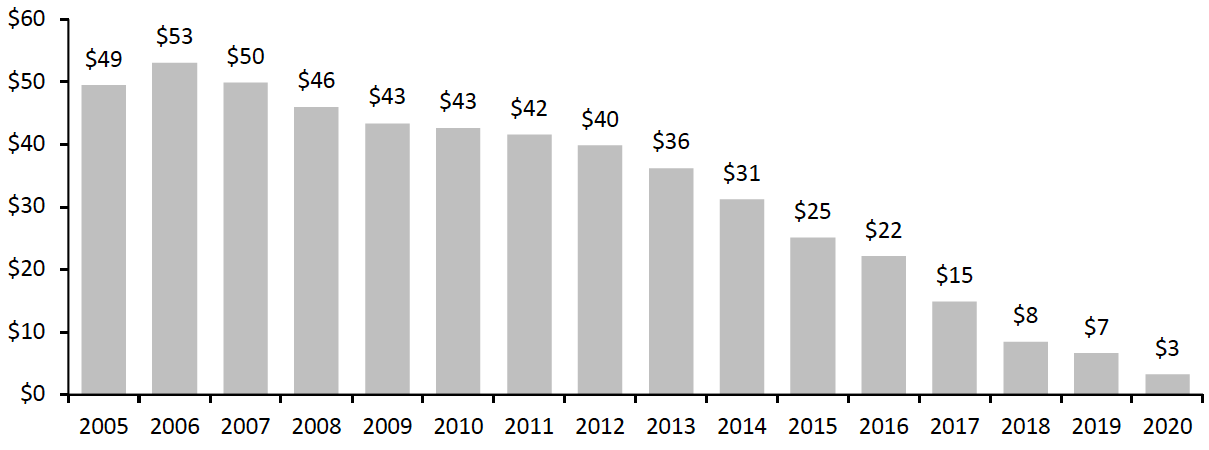

The End of an Era: Kmart Is Down to Just Five Stores This week, Kmart’s holding company announced that it plans to close its store in Hamilton, Montana, bringing the total number of Kmart banners down to five, as reported in our Weekly Store Trackers. The chain operated as many as 2,100 locations at the time of its bankruptcy filing in 2002, which declined to 1,400 when it was acquired by Sears in 2004, which itself filed for bankruptcy in 2018. Although Sears subsequently emerged from bankruptcy, it has since sold off major brands, such as DieHard and Craftsman, and is steadily reducing its store count.Figure 1. Sears Holdings: Annual Revenue (USD Bil.) [caption id="attachment_139423" align="aligncenter" width="700"]

Source: Statista[/caption]

Kmart’s origins lie in a five-and-dime store (an early variation of dollar stores) opened in Detroit, Michigan, in 1899 as SS Kresge Corporation by founder Sebastian Kresge. The first Kmart-branded store opened in 1962, with the “K” in Kmart deriving from Kresge’s name. At its peak in 2000, the company operated more than 2,000 stores and generated $37 billion in revenues. Kmart’s 2002 annual report describes the company as “the nation’s second-largest discount retailer and fourth-largest general merchandise retailer.”

Visiting the stores during the company's peak years, we fondly recall the public-address systems that would announce, “attention Kmart shoppers...” to direct shoppers’ attention to a blue-light special—a limited-time (15-minute) in-store bargain, indicated by a flashing blue light mounted on a pole, like a beacon on a police car. Kmart’s blue-light specials were ahead of their time in generating unique, in-store experiences accompanied by a feeling of urgency and the fun of a treasure hunt.

The reasons behind the decline of Kmart and Sears are complex, centering on lack of management focus and not keeping up with consumer trends, plus the growth of e-commerce. Yet the mass merchandising sector resonates with today’s consumers more than ever, with many having migrated to the value section of Weinswig’s Hourglass in various recessions, including the Global Financial Crisis, and have continued to spend there, driving robust results from dollar stores, Costco, Target and Walmart.

While Kmart is becoming just a fond memory, retail continues to survive and thrive.

Source: Statista[/caption]

Kmart’s origins lie in a five-and-dime store (an early variation of dollar stores) opened in Detroit, Michigan, in 1899 as SS Kresge Corporation by founder Sebastian Kresge. The first Kmart-branded store opened in 1962, with the “K” in Kmart deriving from Kresge’s name. At its peak in 2000, the company operated more than 2,000 stores and generated $37 billion in revenues. Kmart’s 2002 annual report describes the company as “the nation’s second-largest discount retailer and fourth-largest general merchandise retailer.”

Visiting the stores during the company's peak years, we fondly recall the public-address systems that would announce, “attention Kmart shoppers...” to direct shoppers’ attention to a blue-light special—a limited-time (15-minute) in-store bargain, indicated by a flashing blue light mounted on a pole, like a beacon on a police car. Kmart’s blue-light specials were ahead of their time in generating unique, in-store experiences accompanied by a feeling of urgency and the fun of a treasure hunt.

The reasons behind the decline of Kmart and Sears are complex, centering on lack of management focus and not keeping up with consumer trends, plus the growth of e-commerce. Yet the mass merchandising sector resonates with today’s consumers more than ever, with many having migrated to the value section of Weinswig’s Hourglass in various recessions, including the Global Financial Crisis, and have continued to spend there, driving robust results from dollar stores, Costco, Target and Walmart.

While Kmart is becoming just a fond memory, retail continues to survive and thrive.

US RETAIL AND TECH HEADLINES

Albertsons Companies Reports Strong Sales Growth in Its Third Quarter; Raises Full-Year Comp Guidance (January 11) SupermarketNews.com- Grocer Albertsons Companies reported total revenue growth of 8.6% in its third quarter of fiscal 2021 (ended December 4, 2021). Comparable sales increased by 5.2% year over year and 17.5% on a two-year basis. The company’s adjusted EPS increased by 19.6% year over year.

- The company raised its fiscal 2021 comp growth guidance and now forecasts comps to be (0.8)%–(1.2)%, up from its prior guidance of (2.5)%–(3.5)%. CEO Vivek Sankaran stated that the company has continued to see benefits from its digital and omnichannel investments, including the ongoing expansion of its Drive Up & Go curbside pickup option and the opening of its first Midwest micro-fulfillment center.

- DTC razor brand Billie has begun rolling out its products on Walmart.com, and is set to launch in 4,000 Walmart stores in February 2022, marking the company’s first brick-and-mortar appearance.

- The announcement comes just over a month after consumer products conglomerate Edgewell Personal Care, owner of razor brand Schick, paid $310 million in cash for the DTC brand.

- Famous, an e-commerce design firm that helps retailers to market and sell products online, has unveiled Amaze Free, a code-free e-commerce design platform.

- Amaze free features animations, immersive designs and transitions that allow businesses to quickly create unique landing pages—with no design or technical knowledge required. Amaze Free assists businesses in creating personalized shopping experiences that promote content relevant to their target audiences.

- Headgear and apparel retailer Lids has opened a store spanning 7,000 square feet at the iconic American Dream shopping center in East Rutherford, New Jersey. The new store is the company’s first flagship location on the East Coast.

- Lawrence Berger, chairman of FanzzLids Holdings, owner of Lids, stated that the store will offer the most comprehensive variety of headgear and jerseys available anywhere in the US. The flagship store features an expansive Custom Zone that allows on-site customization of hats, jerseys, T-shirts and other items.

- ShopRite has become the first supermarket on the East Coast to use an automated pickup system. The Bell and Howell QuickCollect Go Pod allows customers to collect their online grocery orders from a pickup pod for a quick and easy self-service experience.

- This self-contained pod will be available at ShopRite in New Rochelle, New York. Customers receive a message on their phone featuring a QR code to scan on the console screen when their items are available. The pod is temperature controlled, allowing for all grocery items to be safely stored until the customer arrives.

EUROPE RETAIL AND TECH HEADLINES

BIRA To Launch New Online Trading Platform To Support Independent Businesses (January 10) ChargedRetail.co.uk- UK trade association BIRA will launch Neartoo, a new online trading platform next month. The platform aims to support independent retailers to recover from the pandemic and provide them with a new, cost-efficient option to sell online—enabling them to expand their footprint locally and nationally.

- Retailers will be able to use Neartoo in conjunction with their physical outlets. BIRA members can use the platform free for 12 months, while non-BIRA members can sign up and get five months free.

- Detailresult Groep (DRG), parent company of supermarket chains DekaMarkt and Dirk, has announced that the two banners will become independent legal entities, subject to approval by the Netherlands Authority for Consumers and Markets.

- The organizational restructuring began in April 2021 with the appointment of new operational and commercial management teams. The process aims to give each branch a “distinctive identity,” according to the company, with Dirk being positioned as a discount banner and DekaMarkt as a full-service supermarket.

- Swedish apparel retailer H&M has launched its first virtual fashion collection, using actor and ongoing collaborator Maisie Williams as the face of the campaign.

- The new collection was made in collaboration with digital and virtual clothing platform Dress-X and will be available exclusively through a competition. Winners will receive an outfit that is digitally fitted to them, which they can post on their social media channels.

- Chinese e-commerce giant JD.com has opened two automated retail outlets in the Netherlands, its first physical stores in Europe. Robots prepare parcels for collection and delivery from the new location.

- The store concept is branded Ochama, a combination of “omnichannel” and “amazing,” according to the company. The two stores are located in Leiden and Rotterdam, and offer beauty products, fresh and packaged food, fashion items, home furnishings, household appliances, and mother and child products—all available through JD.com’s Ochama app.

- UK-based supermarket chain Tesco has announced that all 20 million Clubcard members will be able to use its new debit card, Tesco Clubcard Pay+. The new card aims to “revolutionize” the way shoppers make payments, according to the company.

- Customers will be able to use the new Pay+ card as a debit card to pay via Apple Pay or Tesco’s digital wallet, earn Clubcard points and save money. Shoppers will be also able to transfer money from any British bank account into their Pay+ account, using the Tesco mobile banking app.

ASIA RETAIL AND TECH HEADLINES

AS Watson Partners with Amazon Singapore To Strengthen Its Online Presence (January 12) InsideRetail.asia.com- Health and beauty retailer AS Watson has partnered with Amazon Singapore to offer its product line to Prime members, expanding the company’s online presence in the region.

- The collaboration is Amazon Singapore’s first partnership with a beauty and health retailer. Thousands of AS Watson’s beauty, health and personal care products will be available for same-day delivery via Amazon, with brands including Anessa, Aveeno, Biore, L’Oréal Paris and Oral-B.

- SoftBank-backed startup GlobalBees Brands, which aggregates and invests in e-commerce brands, has acquired three new DTC companies: The Butternut Company, a healthy snack brand; Mush, a sustainable clothing brand; and Strauss, a sports and fitness equipment brand.

- GlobalBees Brands was founded a year ago and joined the unicorn club in December 2021 after raising $111.5 million in Series B funding. With the new acquisitions, GlobalBees now has 11 DTC brands in its portfolio.

- Chinese e-commerce giant JD.com has expanded its collaboration with luxury goods conglomerate LVMH to add brands Bulgari, Dior, Givenchy and Louis Vuitton to JD.com’s mini programs, allowing brands to tap into the expanding base of young luxury consumers in China.

- “Luxury will continue to be one of the fastest-growing categories within fashion on JD.com,” stated Kevin Jiang, President of International Business at JD.com’s Fashion and Lifestyle segment. He added that luxury sales on JD.com have climbed by more than 200% since 2019.

- Netherlands-based baby gear retailer Nuna will launch its first flagship store in Tokyo, Japan, on January 24, in collaboration with its local distributor Katoji. The store will be located in Daikanyama and will offer baby products and accessories.

- Nuna stated that customers can trial items using its rental service, which will be free till the end of January. Customers will be also reimbursed the cost of the rental service if they subsequently purchase the product.

- Vietnam-based social commerce company On has raised $1.1 million in a seed round headed by Touchstone Partners, with participation from ThinkZone Ventures. The funds will be used to expand its operation and provide capital support, delivery and management to its merchants.

- On is a resale network that allows consumers to sell products and earn commission on each transaction. The platform covers the entire reselling process for its users, including delivery, order processing and fulfillment. Its platform is used by over 10,000 merchants, who each earn up to $300 a month, selling a total of around 20,000 products—with delivery handled by over 24,000 shippers.