FROM THE DESK OF DEBORAH WEINSWIG

The Elongated Holiday Season Hits a Softer Tone on Cyber Monday

By now, we may all be tired of hearing that 2020 is a “year like no other,” but this holiday retail season has no precedent. The holiday season is normally considered to span November and December, yet this year’s season started in October. Retailers such as Target and Walmart recommended that consumers start shopping early, and this October included retail events such as Amazon Prime Day (typically held in July) and the new 10.10 Shopping Festival, which was founded by Coresight Research in partnership with several charities, retailers and technology providers.

Black Friday, which typically kicks off the US holiday retail season in earnest, is not as definitive as it used to be. Over the past few years, we have seen retailers compete to offer the earliest Black Friday; the trend continued this year, leading to the coining of the term “Black November.” Retailers have also motivated consumers to jump the gun in recent years by opening on Thanksgiving, but many retailers curtailed the event this year, likely in anticipation of soft demand and to give employees a rest. However, online sales for the Thanksgiving weekend were solid, suggesting that consumers opted to stay at home and shop from the comfort of their sofas this year.

Coresight Research visits US retail stores every Black Friday. This year, we found it to be the

quietest in 20 years, which is in line with our estimate that traffic would be down by around 50%. Still, traffic picked up throughout the day, and conversion rates appear to have been up versus last year.

This brings us to Cyber Monday, which was a bit anticlimactic this year. Online, Cyber Monday has exceeded Black Friday (which typically focused on in-store sales) for several years, and 2020 was no exception. With deals starting as far back as October and “Black November,” consumers likely took advantage of many of the bargains early on and were somewhat “shopped out” come Cyber Monday.

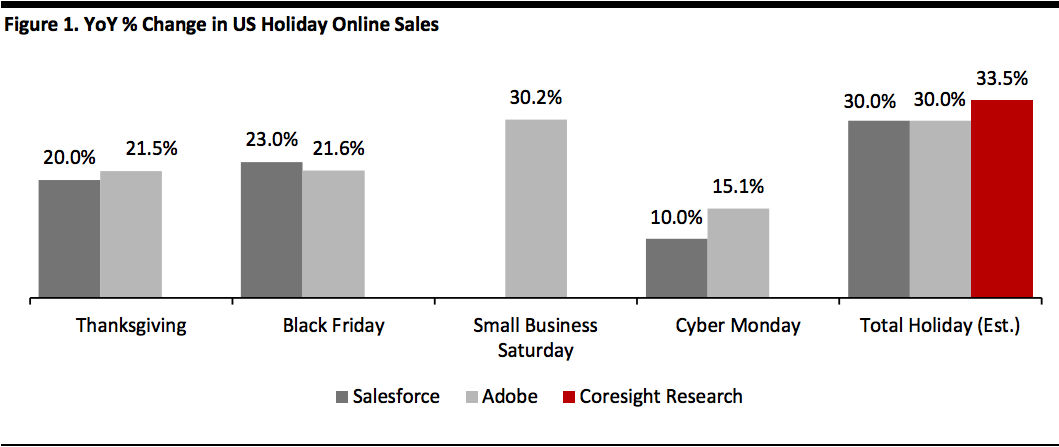

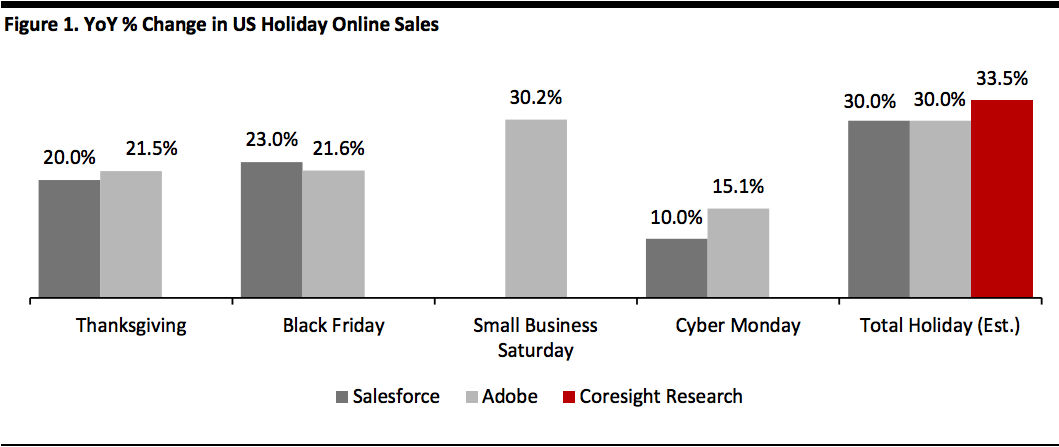

Figure 1 shows data for online sales growth during the Black Friday weekend in the US, released by Adobe and Salesforce, plus those for the entire holiday season, which includes Coresight Research’s estimate. Following the Black Friday figures, Adobe reduced its holiday growth forecast to 30% from 33% year over year, with Cyber Monday sales of $10.8 billion coming in at the low end of its original range of $10.8–12.7 billion (representing year-over-year growth of 15–35%).

[caption id="attachment_120230" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Interestingly, the top sales categories on Black Friday were food and beverage, electronics and home, according to Salesforce—echoing consumer spending during much of the lockdown. This suggests that consumers had likely completed their holiday shopping earlier and were taking advantage of deals on items that they would normally buy.

Cyber Monday marks the entry into the homestretch for the holiday season. While Black Friday and Cyber Monday typically provide an early read on the holiday season, this year’s season is like no other, having started in October with strong year-over-year growth in US retail sales. Coresight Research

estimates growth of 5% in US retail sales across the extended holiday season of October–December this year.

US RETAIL AND TECH HEADLINES

Salesforce Grows Third-Quarter Revenues by 20%, Acquires Slack Technologies

(December 1) Company press release

- Salesforce has reported revenue growth of 20% in its third quarter, reaching $5.4 billion. Its subscription and support revenues increased by 20% to $5.1 billion, and professional services and other revenues rose by 22% to $0.3 billion. The company’s operating margin came in at 4.1%, versus 1.4% in its third quarter last year.

- Salesforce has raised its full-year revenue guidance to $21.1 billion, an approximate increase of 23%, versus the previously announced $20.8 billion, implying a 21–22% increase. The company expects its full-year operating margin to come in at 2.0%.

- Salesforce has announced the acquisition of communications platform Slack, whose shareholders will receive $26.79 in cash and 0.0776 shares of Salesforce common stock for each Slack share. Salesforce expects its revenues for the fiscal year to come in at approximately $25.5 billion, up by 21% year over year, which includes $600 million related to the acquisition.

Walmart Set To Lay Off Over 1,200 Staff To Streamline Supply Chain

(December 1) IBTimes.com

- Walmart has announced that it will lay off 1,241 employees in Arkansas and New Jersey on January 31, 2021, according to the Worker Adjustment and Retraining Notifications notices filed in the respective states.

- The planned layoffs are in accordance with Walmart’s plan to streamline its omnichannel operations, as per a July memo in which the retailer announced internally that layoffs were imminent.

Sephora To Open 850 Shops-in-Shops in Kohl’s Stores over Two Years

(December 2) Company press release

- In a joint press statement from the two companies, Kohl’s and Sephora announced that the latter will open “at least” 850 shop-in-shop locations in Kohl's stores by 2023, which will gradually replace the beauty brand’s partnership with JCPenney.

- Around 200 stores will open by the fall of 2021, and the beauty specialist plans to launch an online store on Kohls.com at the same time. The stores, dubbed “Sephora at Kohl’s,” will measure 2,500 square feet and will be “prominently located at the front of the store,” according to the joint press release.

Sycamore Acquires Ann Taylor and Other Ascena Brands for $540 Million

(November 30) RetailDive.com

- Ascena Retail Group has agreed to sell its Ann Taylor, Lane Bryant, LOFT and Lou & Grey brands to an affiliate of private equity firm Sycamore Partners for $540 million.

- According to the deal that is expected to be completed by mid-December, Sycamore has committed to retaining a “substantial portion of the retail stores and associates affiliated with these brands,” as stated in a company press release.

DoorDash Seeks Valuation of Approximately $32 Billion in IPO

(November 30) CNBC.com

- Food delivery app DoorDash aims to raise up to $2.8 billion through its IPO (initial public offering), which would see its overall valuation increase to $32 billion on a fully diluted basis, according to the company’s statement in a new filing on November 30.

- The last-mile logistics platform plans to sell an estimated 33 million shares of Class A common stock for $75–$85 each. In June, the company raised $400 million in Series H funding, enabling it to reach a valuation of $16 billion.

Dick’s Sporting Goods Set To Launch Two New Outdoor Concept Stores

(December 1) RetailWire.com

- Dick’s Sporting Goods is set to trial a new outdoors concept called “Public Lands” in 2021. The company plans to open two new outdoor-focused retail stores as early as August 2021, according to a statement from outgoing CEO of Dick’s Sporting Goods, Ed Stack, in an investor call last week.

- The new stores will open in Pittsburgh and Columbus, Ohio, in two existing locations of Field & Stream—the hook and bullet arm of Dick's Sporting Goods. “We think there’s a real opportunity from people getting outdoors: camping, hiking, biking, kayaking, fishing, etc. It will be different than what you would see with Recreational Equipment, Inc. and carve out a different niche,” said Stack.

EUROPE RETAIL AND TECH HEADLINES

Debenhams Set To Wind Down Operations

(December 1) TheRetailBulletin.com

- UK department store chain Debenhams is set to wind down its operations following its failure to find a buyer, including a recent unsuccessful rescue deal with JD Sports. The company’s administrators announced that stores will remain open until stock has been cleared.

- “The decision to move forward with a closure program has been carefully assessed and, while we remain hopeful that alternative proposals for the business may yet be received, we deeply regret that circumstances force us to commence this course of action,” said Geoff Rowley of FRP Advisory, joint administrator to Debenhams and partner at FRP.

Balenciaga To Unveil Latest Offering Through a Video Game

(November 28) BBC.com

- Luxury fashion house Balenciaga is set to launch its latest clothing collection through an original video game, which customers can play through their browser. Titled Afterworld: The Age of Tomorrow, the game will launch on December 6 and enable customers to explore the luxury brand’s fall/winter 2021 collection via an interactive virtual world.

- Other luxury brands such as Burberry, Gucci and Louis Vuitton have previously explored releasing video games in the past year, but Balenciaga’s foray into this space will represent the first attempt to launch a full collection exclusively in a digital video-game format.

Arcadia Group Enters Administration

(December 1) TheRetailBulletin.com

- British fashion group Arcadia has entered administration after the recent closure of nonessential stores in the UK impacted the group’s business, which puts some 13,000 jobs at risk. The group operates eight of the UK’s top fashion banners, including Dorothy Perkins, Miss Selfridge, Topman and Topshop.

- The company has appointed Deloitte to oversee administration proceedings, and the stores and e-commerce site will continue to operate until administrators find a resolution, including seeking a buyer.

Yoox Net-A-Porter Appoints New CEO

(November 30) Company press release

- E-commerce platform Yoox Net-A-Porter has appointed Geoffroy Lefebvre as its CEO, effective January 4, 2021. Lefebvre is currently the Group Digital Distributor at parent firm Richemont.

- The current CEO Federico Marchetti will remain with Yoox Net-A-Porter as Chairman and help Lefebvre to transition into the new role.

Adidas and Prada Unveil New Sneaker Designed for Sailing

(December 1) Company press release

- Adidas and Prada have unveiled a new sneaker, dubbed A+P Luna Rossa 21, designed for the Luna Rossa Prada Pirelli sailing team. This is the second product that the brands have launched together as part of their ongoing partnership.

- Made of recycled materials, the sneaker will be available in white from December 9 at global Prada boutiques, Adidas flagship stores, selected wholesalers and on both companies’ online stores.

ASIA RETAIL AND TECH HEADLINES

Grab Launches Delivery-Only Supermarket in Malaysia

(December 2) TechInAsia.com

- Ride-hailing, food delivery and payments firm Grab, has launched a delivery-only supermarket called GrabSupermarket in Malaysia. The supermarket currently serves the country’s Klang Valley region, and the company plans to expand this service to other cities in Malaysia.

- Consumers can order some 2,500 products from beauty, fresh produce, health, household and pantry categories for delivery within 24 hours.

Meituan Posts 28.8% Revenue Growth in Its Third Quarter

(December 1) Pandaily.com

- Chinese e-commerce firm Meituan grew revenues by 28.8% to ¥35.4 billion ($5.4 billion) in its third quarter. Meituan’s hotel and travel segment revenues increased by 4.8% during the quarter as the domestic economy began to recover.

- Meituan’s food-delivery segment revenues jumped by 32.8% as restaurants began to open during the quarter. The company is working to expand its new grocery retail service to over 1,000 cities and counties by the end of 2020 by opening more warehouses and strengthening its logistics.

Tata Group Reportedly Close to Agreeing Deal To Buy Alibaba-Backed BigBasket

(December 2) Livemint.com

- Indian conglomerate Tata Group is close to a deal to buy as much as 80% of Alibaba-backed online grocery retailer BigBasket for about $1.3 billion, according to sources that spoke to newspaper Livemint.

- The deal could value BigBasket at $1.6 billion. The sources told the newspaper that both firms have been in talks for about five months and that the Tata Group could buy about 50–60% from existing investors, including Alibaba.

Alibaba’s Ant Financial Reportedly Considers Stake Sale amid Diplomatic Tensions Between India and China

(December 2) Reuters.com

- Alibaba’s fintech arm Ant Financial is looking to sell its 30% stake in Indian digital payments firm Paytm amid growing diplomatic tensions between India and China, according to sources that spoke to Reuters.

- The Indian government recently tightened rules for investments from China and has banned over 40 apps owned by Chinese firms including Tencent, Alibaba and ByteDance.

Nice Tuan Raises $196 Million in Series C3 Funding

(November 30) DealStreetAsia.com

- Chinese community e-commerce platform Nice Tuan has raised $196 million in Series C3 funding, its fourth funding round this year. This round was jointly led by Alibaba and Hong Kong-based investment firm Jeneration Capital.

- Nice Tuan plans to use the fresh funds to help its small- and medium-sized fresh produce merchants and brands to expand their businesses.

Source: Company reports/Coresight Research[/caption]

Interestingly, the top sales categories on Black Friday were food and beverage, electronics and home, according to Salesforce—echoing consumer spending during much of the lockdown. This suggests that consumers had likely completed their holiday shopping earlier and were taking advantage of deals on items that they would normally buy.

Cyber Monday marks the entry into the homestretch for the holiday season. While Black Friday and Cyber Monday typically provide an early read on the holiday season, this year’s season is like no other, having started in October with strong year-over-year growth in US retail sales. Coresight Research estimates growth of 5% in US retail sales across the extended holiday season of October–December this year.

Source: Company reports/Coresight Research[/caption]

Interestingly, the top sales categories on Black Friday were food and beverage, electronics and home, according to Salesforce—echoing consumer spending during much of the lockdown. This suggests that consumers had likely completed their holiday shopping earlier and were taking advantage of deals on items that they would normally buy.

Cyber Monday marks the entry into the homestretch for the holiday season. While Black Friday and Cyber Monday typically provide an early read on the holiday season, this year’s season is like no other, having started in October with strong year-over-year growth in US retail sales. Coresight Research estimates growth of 5% in US retail sales across the extended holiday season of October–December this year.