Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

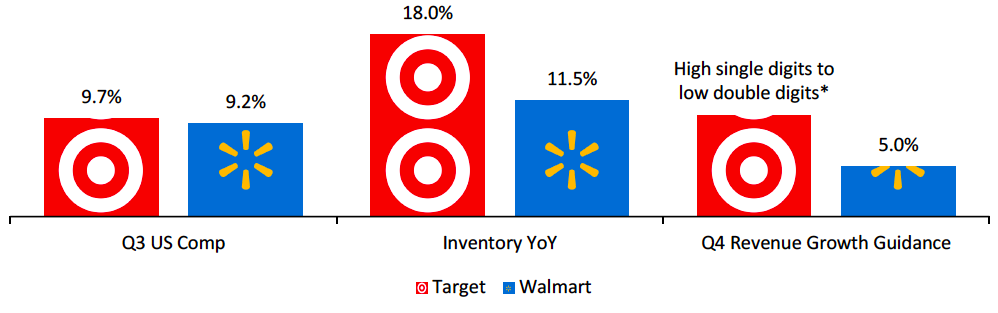

Target and Walmart Have Loaded Up on Inventory To Capitalize on an Expected Strong Holiday Season Supply chain challenges continue to make headlines and will likely persist for quite some time—ships are waiting to be unloaded given the shortages of workers and the shortage of 80,000 truck drivers to distribute goods, according to the American Trucking Associations. Last year, major retailers such as Target advised consumers to shop early to avoid shortages, and this year, they have been joined by retailers including Brooks Brothers in issuing advice to shop early. Target and Walmart have the scale and resources to overcome supply-chain bottlenecks to bring in more inventory for this holiday season, as well as more influence than smaller retailers, plus the capacity to charter airplanes and ships to ensure that goods arrive before the holidays. In their most recent earnings reports, both Target and Walmart reported strong comps, stronger year-over-year inventory growth, yet both reported lighter guidance for their fourth quarters. Figure 1 presents a snapshot of the two retailers’ third-quarter comps, year-over-year inventory change and fourth-quarter guidance.Figure 1. Snapshot: Target and Walmart [caption id="attachment_136848" align="aligncenter" width="700"]

Notes: Target comp is in-store. Inventory growth is as reported in earnings call.

Notes: Target comp is in-store. Inventory growth is as reported in earnings call.*Target Q4 revenue growth guidance is for high single digits to low double digits; a 10% figure has been used for reference.

Source: Company reports[/caption] Walmart stated that the actions it has taken to mitigate transit and port delays, including adding lead time to orders, chartering ships and expanding overnight hours, had positioned the company well for an expected strong holiday season. Target made similar comments, lauding its team for overcoming multiple challenges and obstacles, prioritizing holiday-sensitive categories within imports, and thoughtfully planning domestic transportation. The company disclosed that its inventory grew $3.5 billion versus two years ago, up 31%. The company said that it has clear visibility on inventory, which will flow into stores over the next few weeks. Both mass marketers also have a huge advantage in mitigating the effect of inflation on pricing given their scale. Walmart reported that fighting inflation is in the company’s DNA and that it has a broad portfolio of levers it can use to keep prices low for customers. Target stated that it has a guest-first focus on value while focusing on profitability. What is a smaller retailer to do if they lack the means to charter planes and ships to get goods into the country for the holiday? There could be something of a silver lining to the holiday inventory situation. While some retailers are considering loading up on inventory, other retailers could just refuse deliveries of late holiday merchandise, which would then be directed into the off-price channel, creating a very positive buying environment and attractive prices for customers.

US RETAIL AND TECH HEADLINES

American Eagle Outfitters Reports Strong Third-Quarter Results; Revenue Grows 24% (November 23) Company press release- Apparel specialty retailer American Eagle Outfitters has reported revenue growth of 24% year over year for its third quarter, ended October 30, 2021. The company’s digital revenue grew 10%, while store revenue increased by 29%. The company’s operating margin stood at 16.5%, its highest level since 2007.

- For its fourth quarter, American Eagle Outfitters forecasts that its capital expenditure will be at the lower limit of $250–275 million, while additional freight costs will be in the range of $70–80 million to meet holiday demand and ensure that customers do not feel any impact of supply chain disruption.

- Off-price retailer Burlington Stores’ total revenues increased by 30% year over year in its third quarter, ended October 30, 2021. The company reported comps of 16%. Adjusted EPS increased by 369% year over year and adjusted EBIT grew 139.5%.

- For 2021, Burlington Stores forecasts capital expenditures of approximately $425 million. The company plans to open 101 new stores and relocate or close 24 stores, with a total of 77 net new stores in 2021. It plans to open 120 new stores in 2022 and 130–150 new stores every year afterward.

- Sporting goods retailer Dick’s Sporting Goods’ sales increased by 13.9% year over year in its third quarter, ended October 30, 2021. The company’s comp sales increased by 12.2%. Its digital sales increased by 1% year over year, reporting e-commerce penetration at 19%—down from 21% in the same quarter last year. The company’s adjusted EPS increased by 59%.

- For 2021, Dick’s Sporting Goods forecasts sales to be in the range of $12.12–12.19 billion and comps to be 24%–25% year over year. The company expects adjusted EPS to increase by 140% year over year.

- Apparel specialist Gap reported a sales decline of 1.3% year over year in its third quarter, ended October 30, 2021. The company’s sales declined by 1.4% on a two-year basis (versus the corresponding quarter in 2019). Its comparable sales increased by 5% on a two-year basis and it reported online sales growth of 48% compared to 2019. The company’s adjusted operating margin stood at 4.3%, down 320 basis points (bps) on a two-year basis.

- For 2021, Gap forecasts net sales growth of 20% year over year and expects its adjusted operating margin to be 5%—remaining on track to achieve a 10% operating margin by 2023. In 2021, the company expects the revenue loss due to supply chain restrictions on available inventory to be $550–650 million and a total annual air freight charge of about $450 million.

- Apparel and footwear brand owner Guess? reported revenue growth of 13% year over year in its third quarter, ended October 30, 2021. The company’s adjusted net income increased by 11.2% year over year.

- Guess? raised its full-year 2021 operating margin guidance to 11.0%, from prior guidance of 8.6%. It did not provide detailed guidance for its fourth quarter or the full year 2022 due to uncertainty surrounding the pandemic but expects fourth-quarter year-over-year sales to be down mid-single digits, and year-over-year sales for the full year 2022 to be down low-single digits.

- Department store Nordstrom’s sales increased by 18% year over year in its third quarter, ended October 30, 2021. By banner, Nordstrom’s sales were up 11% and Nordstrom Rack’s sales grew 35%. The company’s EBIT was $127 million, up from $106 million in the same quarter last year. Digital revenue decreased by 12%.

- For its full year, Nordstrom expects sales to increase by more than 35% year over year and its EBIT margin to be 3.0%–3.5%.

- Apparel specialty retailer Urban Outfitters’ sales increased by 16.7% year over year in its third quarter, ended October 31, 2021. On a two-year basis, its total sales increased by 14.6%. By brand, comparable retail segment sales increased by 55% in the Free People Group on a two-year basis, 9% in the Anthropologie Group and 7% in Urban Outfitters.

- For its fourth quarter, Urban Outfitters expects its gross profit margin to increase by approximately 100 bps year over year. The company stated that its strong comp trend has continued into its fourth quarter with quarter-to-date retail segment comps exceeding their third-quarter trends.

EUROPE RETAIL AND TECH HEADLINES

LVMH To Hire 2,000 People in Italy over the Next Three Years (Nov 23) UK.FashionNetwork.com- French luxury goods conglomerate LVMH plans to hire 2,000 artisans and craft specialists in Italy in the next three years. The move aims to meet rising demand for its products and to boost its production capacity, while offsetting its skilled labor shortage.

- The company invests €100.0 million ($112.5 million) in Italy every year and employs 12,000 people (including 6,000 artisans), across its seven labels, 30 production sites and 246 stores. At a group level, the company also plans to hire 8,000 people in 2022 and 30,000 by the end of 2024.

- Marks & Spencer (M&S) has bought a 25% stake in women’s fashion brand Nobody’s Child for an undisclosed price. Since its launch last year on the M&S online store, Nobody’s Child has consistently been its “most visited guest brand,” according to the company.

- According to M&S, Nobody’s Child will continue to operate independently, while gaining the opportunity to scale its business using investment and infrastructure from M&S. As the partnership evolves, M&S also sees opportunities for collaboration—including developing fashion and design talent, alongside sustainability initiatives.

- UK-based luxury accessories brand Mulberry has launched a new limited-edition collection of bags made using the world’s lowest-carbon leather, according to the company. Mulberry launched the collection in partnership with Muirhead, a Scottish Leather Group member.

- The collection is in line with Mulberry’s sustainable manifesto announced in early 2021, “Made to Last,” which aims to transform its business using a regenerative and circular model. The collection features rawhide sourced from the UK and Ireland, tanned and treated by Muirhead, and made in Mulberry’s carbon-neutral factories.

- German supermarket chain Rewe has launched a sustainable supermarket on board a train, in partnership with Deutsche Bahn subsidiary DB Regio and Fairtrade Deutschland. The supermarket offers around 3,000 items across a range of Fairtrade, organic and regional foods and is open between 9.00 a.m. and 7.00 p.m.

- The train has three shopping carts and an onboard bistro. A team of 30 apprentices operates the supermarket at all train stations.

- Dutch supermarket chain Spar has announced plans to expand its online service throughout Kosovo, due to demand for an easy-to-use home-delivery option. Spar’s new online grocery platform is compatible with desktop and mobile, and offers more than 600 basic grocery and homecare items.

- To make the online store accessible to as many customers as possible, Spar offers free deliveries for a minimum order value of €20.00 ($22.50) during a fixed timeslot, and both advance and on-delivery payment options.

ASIA RETAIL AND TECH HEADLINES

Arabian Centres Company Opens New Shopping Mall in Riyadh (November 22) Zawya.com- Saudi Arabian mall operator Arabian Centres Company has opened its 23rd shopping mall, “The View,” in Riyadh. The mall’s total gross leasable area covers 560,000 square feet and is built on a plot spanning approximately 1,150,000 square feet, which the company acquired for SR290 million ($78.6 million).

- The mall’s occupancy rate has exceeded 70% since opening and it currently houses over 170 stores, including international and local brands across cosmetics, fashion, and food and beverage. It also features a variety of entertainment options, including a cineplex.

- South Korea-based health and beauty chain CJ Olive Young aims to raise $1 billion through an initial public offering (IPO), as the company looks to tap into the surging South Korean equity market.

- The IPO is set to take place early next year. The company has appointed Mirae Asset Securities and Morgan Stanley as the transaction’s main underwriters, while KB Securities and Credit Suisse will be co-underwriters.

- Ingka Centres, part of Ingka Group (which also includes Swedish home-furnishing retailer IKEA), has announced plans to open its first IKEA mixed-use development in India. The project’s estimated investment is €400 million ($450 million).

- Ingka Centres stated that the construction is set to commence in early 2022. It expects to create over 2,500 jobs and will support the expansion of organized retail in India.

- Hypermarket and retail company operator LuLu Group plans to invest over AED1 billion ($272 million) over the next three years on its e-commerce and logistics capabilities, aiming to become a top-three online retailer in the Middle East.

- The company will invest in its fulfillment centers and purchase a fleet for last-mile delivery. The company also aims to bring in smaller, online-focused vendors and product categories that are not available at its stores.

- India-based social commerce startup Meesho is finalizing a funding round of $1 billion, which could raise the value of the company to $8 billion. The startup was valued at $4.9 billion in September 2021 after it successfully raised $570 million in a round led by US-based asset manager Fidelity and investment firm B Capital.

- Meesho aims to enable 100 million entrepreneurs across various categories to sell on its digital platform. It has become a leading player in the social commerce arena, competing with companies including CityMall and DealShare, which operate with a community-based sales model.