Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

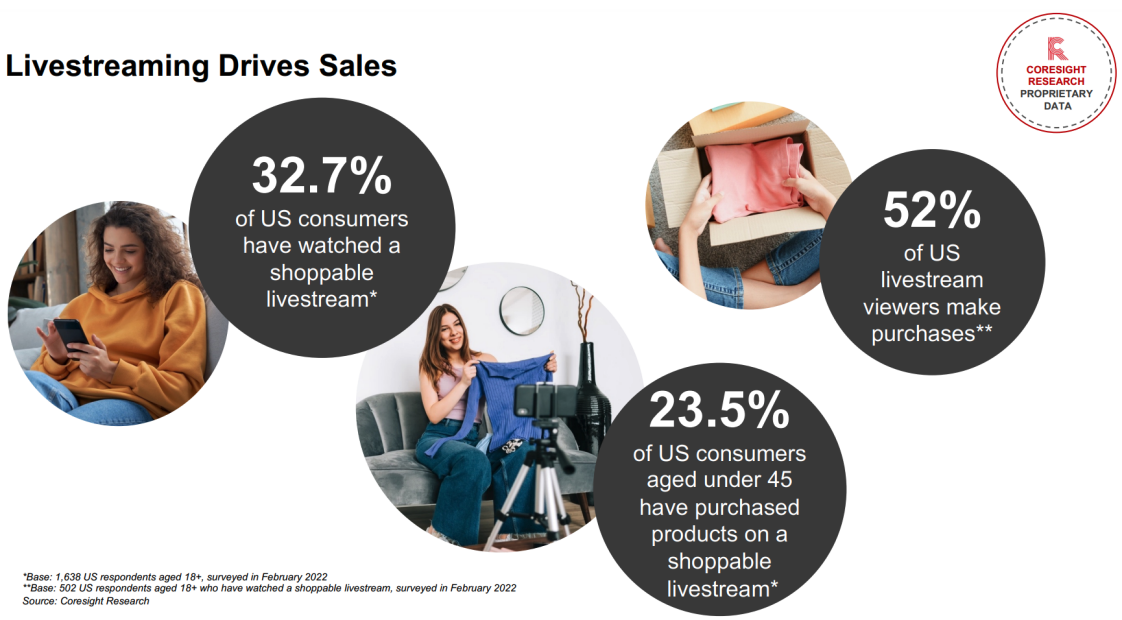

Talking Livestreaming E-Commerce at Shoptalk At Shoptalk this week, I had the pleasure of talking on one of my favorite subjects in retail right now, one in which Coresight Research has an unrivaled body of research—livestreaming e-commerce. I was on stage with Bridget Dolan, Global Managing Director of Shopping Partnerships at YouTube, and Steve Vranes, CEO of Hot Topic, in a session titled “Seizing the Livestreaming and Shoppable Video Opportunity.” We shared insights from Coresight Research’s new survey of US consumers on livestreaming e-commerce, and I’m happy to give a sneak peek of select findings here, too.- Our survey found that 32.7% of US consumers had watched a shoppable livestream in the past year, jumping to around half among those aged 25–34. Over half (52%) of livestream viewers have purchased during a livestream, again peaking in that younger-millennial age bracket.

- In fact, millennials (mid-20s to early 40s), rather than adult Gen Zers (18+) exhibit the peak for livestream participation and shopping.

- The top reason for watching a shoppable livestream is that it is entertaining—beating factors such as getting a good deal or convenience, and underscoring the need for engagement and fun in livestreams. These are much more than purely transactional opportunities.

- Livestreaming is highly popular among men—perhaps surprisingly so, given a perceived association with female-led categories such as beauty. Men’s enthusiasm supports GMV expansion in livestreaming, because those male consumers are more likely than women to buy bigger-ticket items such as gaming consoles.

Slide from Deborah Weinswig’s presentation at Shoptalk 2022

Slide from Deborah Weinswig’s presentation at Shoptalk 2022Source: Coresight Research[/caption] While livestreaming adoption in the US lags behind China, where the channel now captures a meaningful share of total e-commerce sales, the US livestreaming ecosystem is developing quickly. However, our data show that the adoption curve in the US, while steep, would be steeper if it were directly following the kind of path and trajectory we have seen in China. We point to different online shopping habits and digital ecosystems in the two countries as major reasons for different adoption curves. Nevertheless, we believe that greater adoption of best practices and the removal of friction at the point of checkout will boost sales through livestreaming in Western markets. This is not as hard as it may seem and there are effective platform tools to use as enablers on the technology side. Livestreaming platforms integrate existing sales enablement tools to allow purchases within the video and can also seamlessly push the livestream to any channel. We concluded our Shoptalk presentation with our recommendations for retailers and will do likewise in this week’s note:

- One key to success in livestreaming e-commerce is to do it often, and experiment, learn and evolve as you go.

- Tap sales associates to present on livestreams and reward them—livestreaming presentation is not all about influencers or celebrities.

- Be ready to make mistakes! These are not perfect broadcasts.

- Build communities and regular show times to entrench loyalty in viewing.

- Simplify payments. This is the biggest issue for conversion.

US RETAIL AND TECH HEADLINES

Academy Sports and Outdoors Reports Strong Fourth-Quarter 2021 Results (March 29) Company press release- Apparel specialty retailer Academy Sports and Outdoors has reported sales growth of 13.2% year over year, reaching $1.8 billion, in its fourth quarter of fiscal 2021 (ended January 29, 2022). E-commerce sales increased by 22.7% year over year and comparable sales increased by 13.1% year over year.

- The company’s gross margin increased by 110 basis points (bps) year over year to 32.3%, driven by high merchandise margins amid high retail prices. For fiscal 2022, the company expects a low-single-digit sales decline and comp sales in the range of (4.0)%–(1.0)%, year over year. It expects adjusted EPS to decline by 8.3% year over year.

- BJ’s Wholesale Club has teamed up with US-based food-delivery platform DoorDash to offer an on-demand grocery delivery service for the company’s 226 locations across 17 states. BJ’s is the first warehouse club available on DoorDash.

- BJ’s members will be able to order same-day deliveries through DoorDash Drive. Members will receive discounts for the first two weeks of the partnership, March 29 to April 12.

- Canada-based apparel specialty retailer Lululemon Athletica has reported revenue growth of 23.0% year over year in its fourth quarter of fiscal 2021 (ended January 30, 2022). The company’s North America revenue increased by 21.0% year over year and international revenue increased by 35.0%. Comparable sales increased by 22.0% and adjusted EPS increased by 30.6%.

- The company’s gross margin declined by 50 bps year over year to 58.1%. For fiscal 2022, the company expects 20.0%–22.0% year-over-year revenue growth and diluted EPS growth of 22.2%–24.8%.

- Apparel and footwear company PVH Corp. has reported sales growth of 16.0% year over year, in its fourth quarter of fiscal 2021 (ended January 30, 2022). Sales through its digital channel increased by 10.0% year over year. Direct-to-consumer (DTC) sales increased by 13.0% and its wholesale business sales increased by 20.0%.

- The company’s gross margin increased by over 400 bps year over year to 58.3%, driven by high full-price selling and a favorable shift in its regional sales mix. For fiscal 2022, the company expects low-single-digit year-over-year sales growth and anticipates that its adjusted EPS will decline by 11.3%.

- Home-furnishings retailer RH has reported sales growth of 11.0% year over year in its fourth quarter of fiscal 2021 (ended January 29, 2022). Its adjusted operating margin increased by 150 bps to 24.1% and its adjusted EPS increased by 12.0%.

- For fiscal 2022, the company expects mid- to high-single-digit year-over-year sales growth and an adjusted operating margin of 25.0%–26.0% year over year. During the year, RH stated that it will open a new store in San Francisco at the historic Bethlehem Steel Building. It will also launch RH Contemporary, a curated multichannel platform aiming to bring international artists and their work to a global audience.

EUROPE RETAIL AND TECH HEADLINES

Clarks To Cut Online Returns Waste (March 29) RetailGazette.co.uk- British footwear retailer Clarks has signed a deal with a circular economy startup OtaliO, aiming to reduce its environmental footprint. OtaliO will help Clarks to process its online returns more efficiently.

- Through OtaliO’s service, Clarks will be able to evaluate the condition of the product before it is returned, allowing for more efficient business choices and returns routing.

- Dutch supermarket chain Jumbo is expanding its partnership with German rapid-grocery delivery company Gorillas. The investment firm owned by Jumbo’s Van Eerd family, Mississippi Ventures, will secure a financial stake in Gorillas. Gorillas will also sponsor the Jumbo-Visma cycling team.

- In January 2022, Jumbo and Gorillas announced the first phase of their alliance, which placed Jumbo’s products, from both its restaurant chain La-Place and its private labels, on the Gorillas app in the Netherlands and Belgium. Other initiatives, including the shared use of shops in city center, will be launched soon.

- German grocery and DIY retailer REWE has is testing a new cashierless store format for rural areas and town outskirts in Germany. The first store, Josefs nahkauf BOX, provides fresh food and everyday products to approximately 2,000 residents.

- The store has a sales area of around 39 square meters and is open 24 hours a day, seven days a week. REWE divisional board member Peter Maly stated, “In Germany alone, there are around 8,000 underserved settlement areas in which people have to travel long distances to buy groceries every day. Our nahkauf format, which secures local supply where all the competitors have withdrawn, is perfect for this.”

- British department store chain Selfridges is set to launch a virtual department store in Decentraland, a metaverse setting where customers can make purchases using non-fungible tokens (NFTs) and attend fashion shows virtually.

- The virtual department store features digital designs by over 70 brands, artists and designers. It is the first department store in the metaverse, hovering at the intersection of fashion and technology, according to the company.

- Dutch hypermarket SPAR has announced that it plans to expand its logistics center in Czeladź, Poland, by approximately 120,550 square feet to span 215,000 square feet. The expansion will be operational by the end of 2022 and includes ambient, cold and frozen storage.

- Additionally, the company plans to add modern offices, spanning 2,700 square feet, to the facility in the third quarter of 2022. The company expects that the expansion will meet its logistics needs for the next five years, supporting an effective and efficient supply chain for SPAR’s owned and independently operated stores.

ASIA RETAIL AND TECH HEADLINES

GrowSari Raises $77.5 million in Series C Funding Round (March 29) TechCrunch.com- GrowSari, a Manila-based platform for digitalizing small businesses in the Philippines, has secured $77.5 million in a Series C funding round—bringing its total capital raised to over $110 million, including $45 million in January 2022 as part of the same round. The International Finance Corporation, KKR, Wavemaker Partners and Pavilion Capital, which is owned by the Temasek Group, were among the key investors.

- GrowSari plans to use the funds to expand into new store formats, develop a logistics and distribution network and hire for its operations, technology and data science teams. It also plans to extend its fintech offerings for store owners, as well as develop its supplier marketplace, including commodities.

- Beauty and personal care product company L’Occitane has acquired a majority stake in Australian skincare brand Grown Alchemist. The brand was acquired as part of L’Occitane’s plan to grow its health-conscious beauty portfolio and appeal to influential millennials and Gen Z consumers.

- Andre Hoffmann, Vice Chairman and CEO of L’Occitane Group, stated, “With a unique and inspiring brand story and international fanbase, Grown Alchemist is poised for international scalability and rapid growth.” Earlier, in November 2021, L’Occitane bought an 83% stake in personal care brand Sol de Janeiro.

- Pep Technologies, the parent company of caffeine-infused DTC personal care brand mCaffeine, has raised ₹2.4 billion ($31.5 million) in a Series C fundraising round. The round was led by Paragon Partners and valued the company at ₹10 billion ($131.4 million). Other key investors included Amicus Capital Partners, RPSG Capital Ventures, Singularity Growth Opportunities Fund and Sharrp Ventures.

- Pep Technologies stated that the funding will allow the company to expand into 12 more countries, as well as acquire smaller beauty brands in Indian and international markets in the future.

- Singapore-based conglomerate Sea Ltd has announced plans to shut down the Indian operations of its e-commerce business, Shopee. Shopee entered the Indian market in September 2021 and grew rapidly due to its vast choice of low-cost options.

- The withdrawal took effect on March 29, 2022, just weeks after its e-commerce unit announced its exit from France, as well as India’s ban of the company’s popular gaming software Free Fire. Shopee stated that its withdrawal decision was made “in view of global market uncertainties.” Earlier this month, Sea announced that revenue growth in its e-commerce division would decelerate to 76% in 2022 from 157% growth in 2021—owing to reduced online transactions and engagements as more countries recover from the pandemic.

- Taobao, Alibaba’s largest Chinese online shopping platform, has begun to offer Tencent’s WeChat Pay as a payment option in its mobile app. Although the payment option does not currently permit automated switching between the two, it is a significant step toward the broader integration of payment services provided by Chinese internet giants.

- According to images collected by online users, payment options on Taobao have been introduced, including “Scan WeChat QR Code” (for adding another user as a contact on WeChat), and “Send to a WeChat Friend” (for sending money to a contact) on the checkout page. This function, however, is still in alpha testing, and only a limited number of users have access.