DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

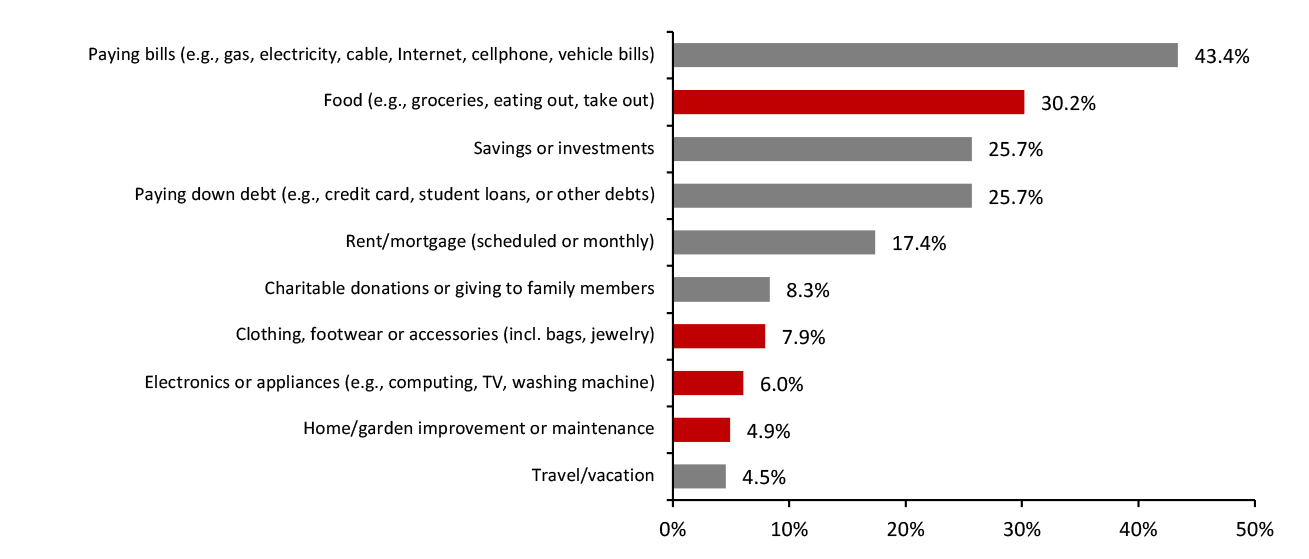

Stimulus Checks Are Benefiting Retail—But Could Be Benefiting It Much More This week saw the US Census Bureau report a 10.8% year-over-year jump in US retail sales (excluding automobiles and gasoline) in January. This marked an acceleration from a very strong holiday quarter, which included December’s 7.9% year-over-year increase. Stimulus checks issued from the end of December undoubtedly supported this boost: The passage of the second round of stimulus authorized distribution of $600 checks to individuals earning less than $75,000 per year, and a reduced stimulus for consumers earning up to $87,000. In January, several sectors saw double-digit year-over-year sales growth. Nonstore retailers and book, hobby, musical instrument and sporting goods stores continued to experience strong year-over-year growth of more than 20%. Grocery sales continued to witness strong growth, of just over 11%, as consumers remain reluctant to visit restaurants and direct food and beverage spending to retail stores. We even saw a major improvement at department stores, where a 22.5% year-over-year decline in December moved to a decline of less than 2% in January. Later this winter, the US government may send out a second round of stimulus checks of up to $1,400 per person. In our weekly survey of US consumers, we asked those who had received a stimulus check—which was about two-thirds of respondents—how they had used or plan to use the money from that second stimulus round (charted below) and how they expect to spend any third-round check (uncharted—see our survey report for details). By far the most common uses of stimulus checks were essential payments such as bills, debt, mortgages and rent, as well as purchases of food. More than four in 10 consumers who received a stimulus check reported that they used it to pay bills—more than 13 percentage points higher than the subsequent category: spending on food. Almost one in three reported spending or expecting to spend the stimulus on food—which includes food service (where options are available) as well as retail purchases. Looking at discretionary retail categories, clothing and footwear leads—understandable given its prominence in retail but also explaining the sequential improvement in department stores and clothing retailers in January’s retail sales figures. Even for apparel, however, fewer than one in 10 expect to spend their check in the category. For retail categories such as appliances, electronics, and home or garden, the rates are lower still—possibly reflecting already substantial levels of spending in several of these categories as seen through 2020. The overall picture is of retail capturing a limited share of stimulus payments—so, while retail sales have recently been impressive, if shoppers could be encouraged to spend a little more in retail, those sales could be stronger still. Retailers must sustain investments in marketing, experiences and events (such as shopping festivals) to maximize their share of shoppers’ windfalls.Respondents That Had Received a Second Stimulus Check: How They Spent or Expect To Spend Their Second-Round Stimulus Checks—Top 10 Options (% of Respondents) [caption id="attachment_123501" align="aligncenter" width="725"]

Respondents could select multiple options

Respondents could select multiple options Base: US respondents aged 18+ who received a second stimulus check

Source: Coresight Research [/caption]

US RETAIL AND TECH HEADLINES

Amazon Completes Its Acquisition of Selz (February 16) The Wall Street Journal- Amazon has acquired Australia-based online platform Selz, which enables small and medium-sized companies to launch their own online stores and add payment options to existing websites. Amazon has not disclosed the financial terms of the deal.

- With this acquisition, Amazon gains a competitive edge against competitors in the space such as BigCommerce and Shopify.

- CVS Health reported sales growth of 4.0% in the fourth quarter of fiscal 2020 versus 3.5% growth in the prior quarter. By segment, its Retail/Long-Term Care revenues grew 6.6%, driven by increased prescription volume; and revenues in its Health Care Benefits segment grew 11.4%, driven by membership growth.

- For the full-year 2021, the company expects adjusted EPS of $7.39–$7.55, with a mid-point at $7.47, representing flat year-over-year growth.

- Macy’s has appointed Xingchu Liu as Senior Vice President, Enterprise Data and Analytics, effective February 15, 2021. Liu will report to the company’s Chief Digital Officer, Matt Baer.

- Liu most recently served as the President of retail technology provider BlackLocus, a subsidiary of Home Depot. Before Home Depot, he worked at TrueCar and Zilliant, handling data-driven planning and development.

- Target has named Christina Hennington, who joined the company in 2003, as Executive Vice President and Chief Growth Officer. This is a new position where she will be responsible for identifying and pursuing revenue-generating strategies across Target’s organizations. Jill Sando, who has been with Target since 1997, will oversee the purchase of hardlines and softlines as Chief Merchandising Officer and Executive Vice President.

- Furthermore, Cara Sylvester, who has been with Target since 2007, has been promoted to Chief Marketing and Digital Officer and Executive Vice President; Rick Gomez, who joined Target in 2013, has been named Chief Food and Beverage Officer and Executive Vice President; and Katie Boylan, who joined the company in 2011, has been promoted to Chief Communications Officer and Executive Vice President.

- Walmart has completed the sale of its UK supermarket chain Asda Group to the Issa brothers and investment funds managed by UK-based private equity firm TDR Capital, for an enterprise value of £6.8 billion ($8.8 billion) on a cash-free and debt-free basis.

- Under the new structure, TDR Capital and the Issa brothers, who are the Co-CEOs and Founders of UK convenience store-operator EG Group, hold a majority stake in Asda. Walmart retains an equity investment in the business, along with an ongoing commercial relationship and a seat on the Board of Directors.

EUROPE RETAIL AND TECH HEADLINES

Ahold Delhaize Repurchases Shares for Total Consideration of €42.0 Million (February 16) Company release- Ahold Delhaize repurchased its 1.497 million common shares at an average price of €23.4 ($28.1) per share during the period February 8, 2021, up to and including February 12, 2021.

- The company bought back its common shares for a total consideration of €34.8 million ($42.0 million) as part of the €1 billion ($1.2 billion) share buyback program launched by the company in November 2020.

- UK grocery retailer Asda has partnered with The Entertainer to open a prototype toy department at five of its stores, one each in Darlston, Pudsey, Roehampton, Watford, and Wolverhampton.

- Under this “test and learn” partnership, which was first launched in October 2020, The Entertainer is primarily accountable for merchandise, product mix, pricing and staffing of each department.

- eBay’s $9.2 billion sale of its online classified ads business Gumtree to Adevinta is likely to be investigated by the CMA due to competition issues, if competition concerns are not resolved by February 23, 2021.

- Adevinta agreed to purchase eBay’s classified business in July 2020. In return, Adevinta agreed to sell a significant portion of its business to eBay, making it the largest shareholder with 44% stake in the company.

- According to the British Frozen Food Federation (BFFF), the frozen food sector reported year-over-year growth of 13.8% in 2020, with the value of frozen food sold in the UK stores reaching £7.2 billion ($10.0 billion) last year.

- UK shoppers spent an additional £872 million ($1,210.3 million) on purchasing frozen items in 2020 compared to 2019, ranging from frozen avocado to ice cream.

- Kering has announced a 17.5% decline in its reported revenues in 2020. The company reported total consolidated revenue of €13.1 billion ($15.8 billion).

- The overall decline in revenue can be attributed to store closures and coronavirus-related tourism declines. Store sales improved significantly during the second half of 2020, primarily in North America and the Asia-Pacific region.

ASIA RETAIL AND TECH HEADLINES

Charoen Pokphand Group Rebrands Tesco Stores to Lotus (February 17) Asia.nikkei.com- Thailand’s agribusiness conglomerate Charoen Pokphand Group (CP Group) has announced that it will rebrand Tesco stores in Thailand and Malaysia to Lotus stores, featuring a new logo and store design. The new name is based on the old brand Tesco Lotus—many shoppers continued to refer to the chain as “Lotus” rather than Tesco.

- CP Group acquired Tesco’s Southeast Asian business for $10.6 billion in March 2020. The rebranding marks the end of Tesco’s 23-year presence in the region, where it had become a household brand with more than 2,000 locations.

- South Korean e-commerce heavyweight Coupang has filed to go public on the NYSE, reportedly targeting a valuation of around $50 billion. This would make it the largest IPO on the NYSE by a foreign company since Alibaba’s debut in 2014.

- In the regulatory filing, Coupang disclosed that its revenues surged by 91% in 2020 to $11.97 billion and its net losses declined to $474.9 billion from $698.8 billion in 2019. The company’s major investor includes Japan’s Softbank Group, which has channeled around $3 billion into the company since 2015.

- Global investment firm Prosus Ventures has announced plans to invest around $200 million in Indian online pharmacy startup PharmEasy’s parent firm API Holdings, acquiring a double-digit stake in the company. Once the deal is finalized, PharmEasy is expected to be valued at more than $1 billion. Private equity firm TPG Capital acquired a 7% stake in API Holdings in December 2020.

- Competition in the Indian online pharmacy market is heating up, with Reliance Retail entering the space through NetMeds, Tata Group acquiring a majority stake in 1MG and Amazon scaling up its medicine delivery operations in India, all in 2020.

- Italian luxury men’s apparel brand Stone Island has opened its first concept store in Marina Bay Sands mall in Singapore. This move marks further expansion by the retailer into the Southeast Asian market.

- The 114-square-meter space is the work of Marc Buhre, who has also designed Stone Island’s flagship stores around the world. The store alludes to the brand’s modern and tech-infused image and features a series of Stone Island and Stone Island Shadow Project collections.

- Indian multinational conglomerate Tata Group has reportedly inked a deal to acquire a 68% stake in Indian online grocery company BigBasket for ₹9,100-9,200 crore ($ 1.31 billion).

- The two largest investors in BigBasket, Alibaba (29.1% stake) and private equity firm Abraaj Group (16.3%) will exit the startup as part of the deal with the Tata Group. Both sides are awaiting approval of the deal from India’s Competition Commission.