Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

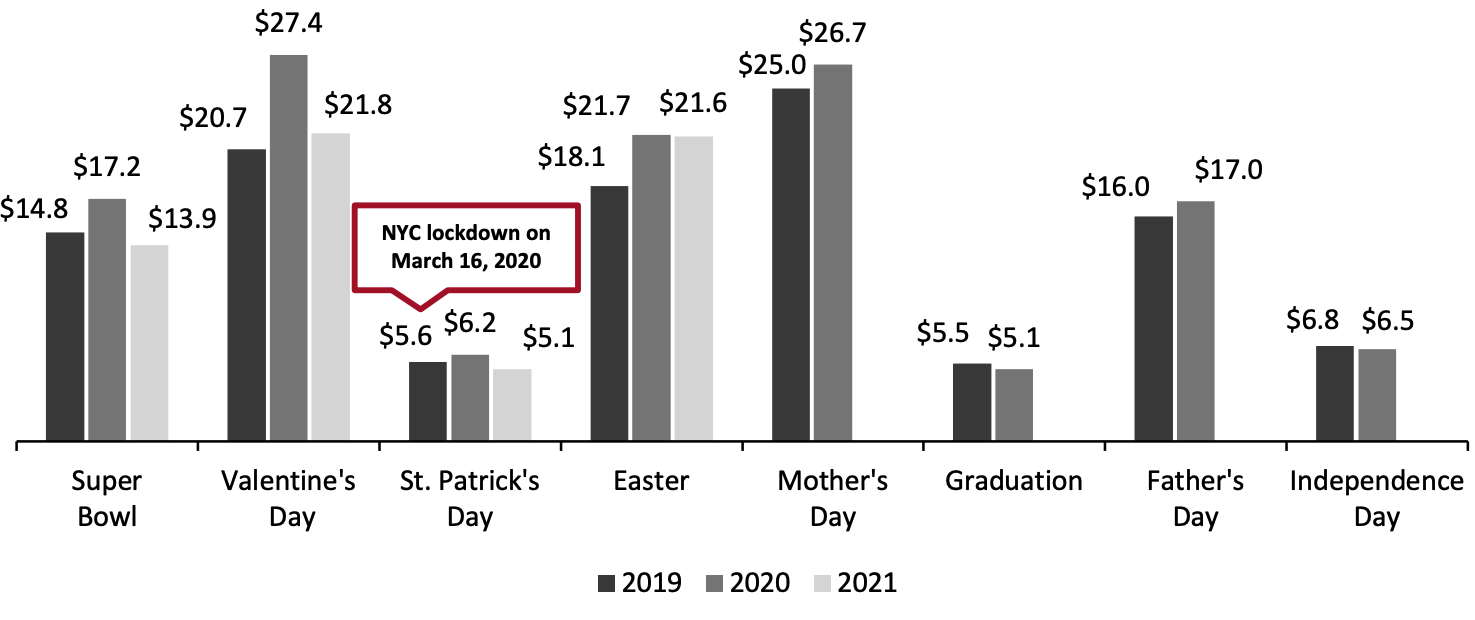

Spring Has Sprung (at Least in New York City) and Residents Start To Look Toward Summer New York City is enjoying a bout of unusually warm, spring-like weather this week, which has prompted us to start thinking about the summer ahead for the retail environment. The present environment appears to be a major inflection point for US retail with the combination of a decline in the number of Covid cases (though many parts of the world are facing renewed and serious challenges) and continuing pick up in retail sales. Increasing vaccination rollout is contributing to the decline in case numbers—around one-quarter of the US population has received at least one vaccination at the time of writing. Our US Retail Sales Databank calculates that retail sales (excluding automobiles and gasoline) increased by 7.2% year over year in February, as part of an eight-month trend of robust retail sales. Around a week on from the Spring Equinox, the publishing of this letter coincides with the beginning of Passover, and the Easter holiday falls a week later. It is also Spring Break season in the US, with many students spending the holiday at the beach. In light of these recent spring holidays, Figure 1 shows spending estimates for selected recent and upcoming retail holidays. The figure indicates that planned spending on some of the 2020 holidays occurring after the US lockdown (which started on March 16, 2020, in New York City) fell below 2019 levels. Planned spending thus far this year has been below 2020 levels for holidays that occurred before last year’s March lockdown. (The NRF spending survey for St. Patrick’s Day was conducted in advance of the holiday, when consumers were still planning to celebrate.) Coresight Research estimates total Easter spending on goods and services of $23.6 billion, as discussed in our upcoming US Easter 2021 Retail Preview; given differences in methodology, data inputs and scope, our estimate may not be entirely comparable to the NRF estimates charted below. Figure 1. US Holiday Retail Spending Estimates (USD Bil.) [caption id="attachment_125008" align="aligncenter" width="720"] Holiday dates in 2021: Super Bowl—February 7 (February 2 in 2020); Valentine’s Day—February 14; St. Patrick’s Day March 17; Easter—April 4 (April 12 in 2020); Mother’s Day—May 9 (May 10 in 2020); Graduation Day—late May; Father’s Day—June 20 (June 12 in 2020); Independence Day—July 4.

Holiday dates in 2021: Super Bowl—February 7 (February 2 in 2020); Valentine’s Day—February 14; St. Patrick’s Day March 17; Easter—April 4 (April 12 in 2020); Mother’s Day—May 9 (May 10 in 2020); Graduation Day—late May; Father’s Day—June 20 (June 12 in 2020); Independence Day—July 4.Source: NRF/Prosper Insights & Analytics [/caption] Retail sales growth changed direction rapidly in 2020, as consumers directed discretionary funds toward purchasing goods rather than services. Though we have seen some increases in capacity restrictions for restaurants and approval of future outdoor sporting events, these occurrences are few and far between, and this trend is likely to reverse slowly. This means that goods are still the primary spending outlet for the third round of stimulus payments. This combination of increasing vaccinations and warmer weather is likely to encourage consumers to venture outside more. Our most recent US Consumer Tracker shows a continuing decline in consumers avoiding public spaces in general and a significant decline in the avoidance of food-service locations and shopping centers/malls since levels seen in January. We are optimistic that citizens will become increasingly confident in leaving their homes to dine out and seek other forms of entertainment, including visiting retail stores.

US RETAIL AND TECH HEADLINES

Alimentation Couche-Tard Inc. Plans To Sell 355 Sites (March 22) Company press release- Alimentation Couche-Tard has announced plans to downsize its portfolio in the US and Canada. The company expects to sell off 269 stores in the US and 37 sites across six provinces in Canada. This initiative is part of the company’s network optimization strategy.

- The company has entered into an agreement with Casey’s General Stores to divest 49 stores in Oklahoma for $39.0 million. The deal is likely to close by July 31, 2021.

- Bed Bath & Beyond has launched Nestwell, its first private-label brand, both online and in its stores. The company plans to launch a further seven private labels in 2021 as part of its growth strategy for the year.

- The strategy also includes discontinuing underperforming brands and labels from the company’s product offerings.

- GameStop reported net sales of $2.12 billion in 2020, compared to $2.19 billion in 2019. The 3.3% decline in total net sales as the company was forced to sell 12% of its stores due to the Covid-19 pandemic in 2020. The company’s total revenues for fiscal 2020 fell by 21.3% to $5.09 billion from $6.47 billion reported in fiscal 2019.

- Nevertheless, seeing a spike in its online sales amidst the pandemic, the company reported a 175% increase in its total e-commerce sales. Sales from this channel represented 34% of GameStop’s total net sales for fiscal 2020.

- Global beauty technology solution provider Perfect Corp. has partnered with Mineral Fusion, a US-based mineral cosmetics brand, to launch a new virtual makeup testing tool powered by artificial intelligence (AI) and augmented reality (AR) technology.

- The testing tool will be set up in Whole Foods locations, enabling customers to experience the full beauty product range offered by Mineral Fusion by scanning related QR codes. Sharon Chiarella, Ex-Amazon Executive Joins Stitch Fix as Chief Product Officer

- Stitch Fix has announced the appointment of Sharon Chiarella as the new Chief Product Officer, effective March 29, 2021. In this new role, Chiarella will lead the company’s product, design and technical teams.

- Chiarella previously worked for Amazon on introducing innovative customer experience features, including one-tap star ratings and chat features within Amazon Prime Video watch parties, among others.

EUROPE RETAIL AND TECH HEADLINES

Amazon Set To Reduce Its Stake in Deliveroo by 4% (March 23) ChargedRetail.co.uk- Amazon has announced its plans to sell approximately 23.3 million shares in Deliveroo, ahead of the company’s upcoming Initial Public Offering (IPO) launch. This will reduce Amazon’s shareholdings in Deliveroo from 15.8% to 11.5%.

- Deliveroo aims for market capitalization of between $10.4 billion and $12.1 billion with its IPO, and plans to sell around 128 million shares for between £3.90 and £4.60 ($5.34 and $6.30).

- Carrefour is set to buy Brazil’s third-biggest food retailer, Grupo BIG, in a deal worth $1.3 billion. The deal comes as part of Carrefour’s plans to expand in overseas markets.

- Carrefour already has a major presence in Brazil. According to the company, the deal would provide an additional $308 million to its earnings before interest, tax, depreciation and amortization annually, three years after the deal completes.

- Home-improvement giant Kingfisher saw its pretax profits jump by 634% to £756 million ($1.04 billion) in the year ended January 2021.

- For the year ended January 2021, group comparable sales grew 7.1%. Growth was supported by online sales, which were up 158%.

- To drive footfall during the UK lockdown, Marks & Spencer has transformed over 50 of its closed in-store cafés into Easter pop-up shops featuring a range of Easter Eggs and holiday-themed products.

- The company stated that its Easter confectionery sales are already up 63% year over year, with Easter egg sales witnessing a year-over-year spike of 130%.

- Dutch start-up Wundermart has announced plans to open two unstaffed stores in Belgium this week. The company’s first Belgian outlets will be at hotels The Hilton Brussels Grand Place and The Hotel Brussels.

- The company has plans to expand its unstaffed store ventures to countries across Europe, including France, Norway, Spain, Sweden and the UK in the coming months, focusing not only on hotels but also on offices, hospitals and petrol stations.

ASIA RETAIL AND TECH HEADLINES

Hula Opens Second Store in Hong Kong (March 21) TheHula.com- Pre-owned designer brand marketplace Hula has opened its second physical retail location in Hong Kong. The store will feature a curated selection of more than 500 unique designer womenswear pieces, such as accessories, handbags, ready-to-wear apparel and shoes from brands including Christian Dior, Gucci, Prada and Louis Vuitton.

- The store offers a reserved try-on service for items that shoppers see online, as well as click and collect services.

- JD.com has announced that it will invest $800 million in on-demand delivery platform Dada Group. After the transaction, the e-commerce giant will own an approximate 51% stake in Dada Group.

- In 2016, JD.com merged its online-to-offline grocery delivery service JD Daojia with Dada Group. The express delivery information service platform Dada-JD Daojia raised $500 million from Walmart and JD.com in 2018.

- Levi’s has launched a new store in Indonesia—its largest store to date in Southeast Asia—which features its new “Next-Gen” design concept. The store is located in the Grand Indonesia East mall and features a range of new technology offerings, including Levi’s first Associate Ordering System that enables retail stores to order online merchandise that is out of stock or not sold in-store.

- Shoppers can design their own t-shirts at the store’s print bar. The store also houses a tailoring shop where customers can customize their items with including embroidery, hemming and alterations.

- Indian direct-to-consumer brand MyGlamm has raised ₹1.75 billion ($24.1 million) in a Series C funding round led by Amazon, Ascent Capital and Wipro Consumer. The investment values the startup at more than $100 million.

- MyGlamm will use the capital to build its data science capabilities and expand its portfolio. The company offers more than 600 products in the makeup, skincare and personal care categories through digital channels and offline locations across 70 cities in India.

- Omnichannel fashion retailer Pomelo has launched a localized e-commerce website in the Philippines, as part of its digital footprint expansion strategy in Southeast Asia. The site will feature exclusive collaborations and fashion apparel, including the new spring/summer 2021 collection.

- Pomelo has been aggressively expanding in Southeast Asia, with the launch of new stores in Singapore and Indonesia so far in 2021. The company also plans to launch a flagship store in Malaysia in May.