From the Desk of Deborah Weinswig

CVS and Walgreens—Going Head to Head

CVS Health and Walgreens Boots Alliance (WBA) are the parent companies of two well-known US pharmacy chains, with each operating pharmacies in 49 of the 50 states and reporting revenues of over $100 billion in 2017. While many consumers may see little distinction between the two companies, their strategies are quite different. CVS Health is embarking on a diversification strategy, whereas WBA has deepened its exposure to the retail pharmacy business.

In terms of revenue and prescription drug share, CVS Health is the largest pharmacy company in the US. The company reported revenues of $184.8 billion and net income of $6.6 billion in 2017. CVS Health operates in two business segments: Retail/Long-Term Care (LTC), which represents 38% of sales, and Pharmacy Services, which represents 62% of sales. The Retail/LTC segment comprises a network of almost 10,000 retail stores, 1,000 retail urgent-care health clinics and 145 LTC pharmacies operating under the Omnicare brand. The Pharmacy Services segment includes pharmacy benefits management (PBM) services, insurance subsidiaries and the company’s specialty pharmacy business.

WBA,formed in 2014 by the merger of Walgreens and Boots Alliance, is the second-largest pharmacy company in the US and one of the largest in the UK. The company reported $118.2 billion in revenues and net profit of $4.1 billion in 2017. WBA has three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The company operates its Retail Pharmacy USA branch under the Walgreens brand, whereas it operates the Retail Pharmacy International segment primarily under the Boots brand. WBA’s nonretail pharmacy offerings include healthcare services provided by Alliance Healthcare and PBM services provided through AllianceRx Walgreens Prime.

The two companies’ business strategies can be distilled into “diversify versus fortify.” CVS Health has broadened its range of health services in the US in recent years, expanding beyond retail pharmacies into the growing PBM business, large specialty and LTC pharmacy segments, and the health insurance market through the proposed acquisition of Aetna, the fourth-largest health insurance company in the US.Conversely, WBA has deepened its presence within the retail pharmacy business. The 2014 merger that formed WBA greatly expanded the combined company’s international reach. In addition, Walgreens has acquired stores from other pharmacy chains in the US and abroad over the past 10 years, expanding its presence in retail pharmacy.

The worldwide retail pharmacy market has grown by less than 1% since 2014, according to Euromonitor International. In the US, prescription drug expenditures have grown at a 2.2% CAGR since 2013. Yet retail pharmacies have been unable to capitalize on this rapidly expanding industry: retail pharmacy sales have declined from 91% of US prescription drug expenditures in 2013 to 77% today. In this environment, revenue growth for both CVS Health and WBA slowed in 2017, and much of WBA’s growth in recent years has stemmed primarily from acquisitions.

Moreover, competition from other types of prescription drug providers—including home-delivery pharmacies such as Amazon’s newest subsidiary, PillPack—is increasingly disrupting the brick-and-mortar retail pharmacies’ prescription drug businesses. However, both CVS Health and WBA are leveraging the Internet, and using apps and home-delivery services, to compete with emerging online-focused pharmacy companies.

CVS Health and WBA are still the two best-known US pharmacy operators, together comprising more than 35% of both the prescription drug and health and beauty retail markets. Despite this market leadership, both companies face challenges from a slow-growth market and a legion of potential disruptors, including Amazon. To combat these challenges, both CVS Health and WBA are taking steps to modernize their businesses, including offering mobile apps and online prescription delivery services.

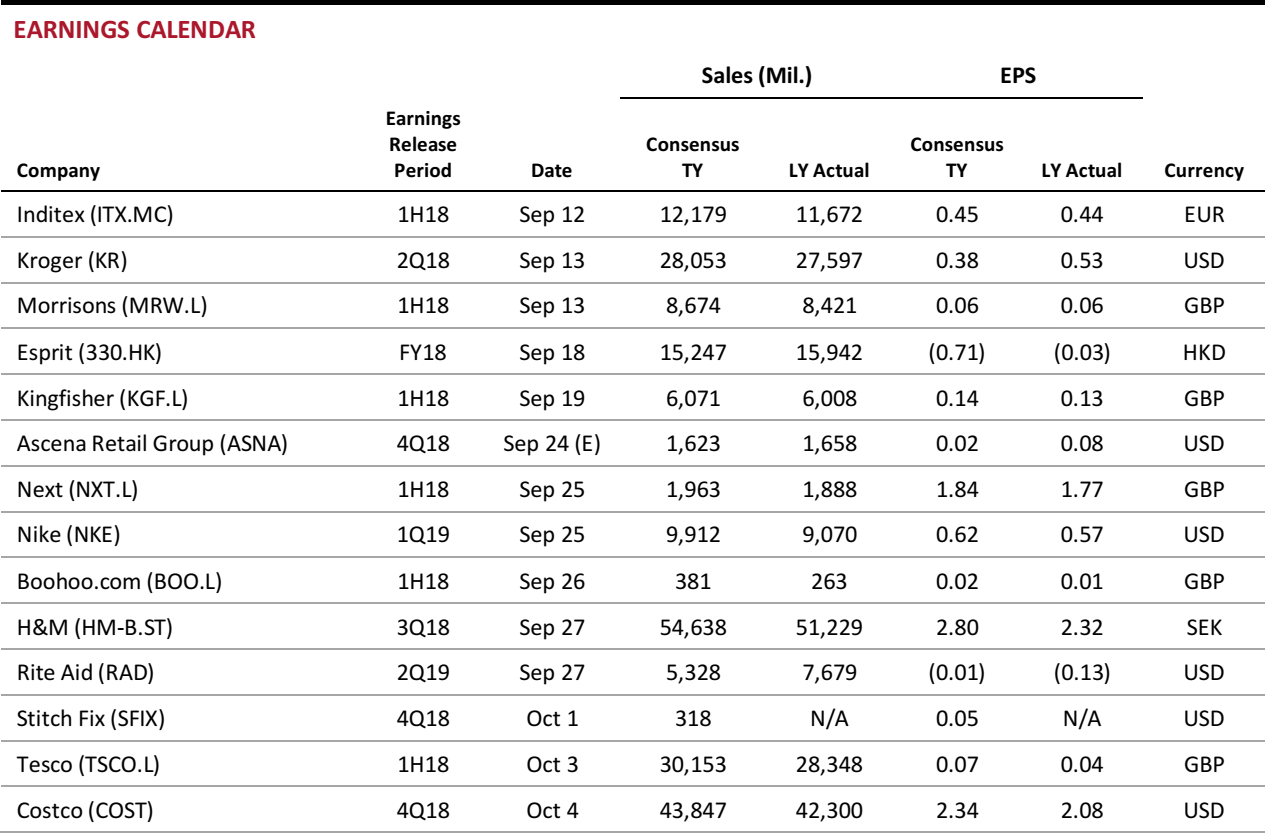

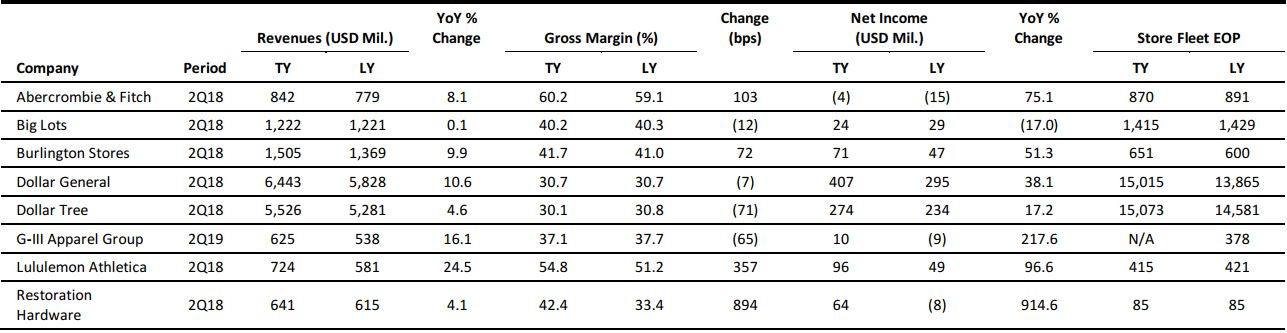

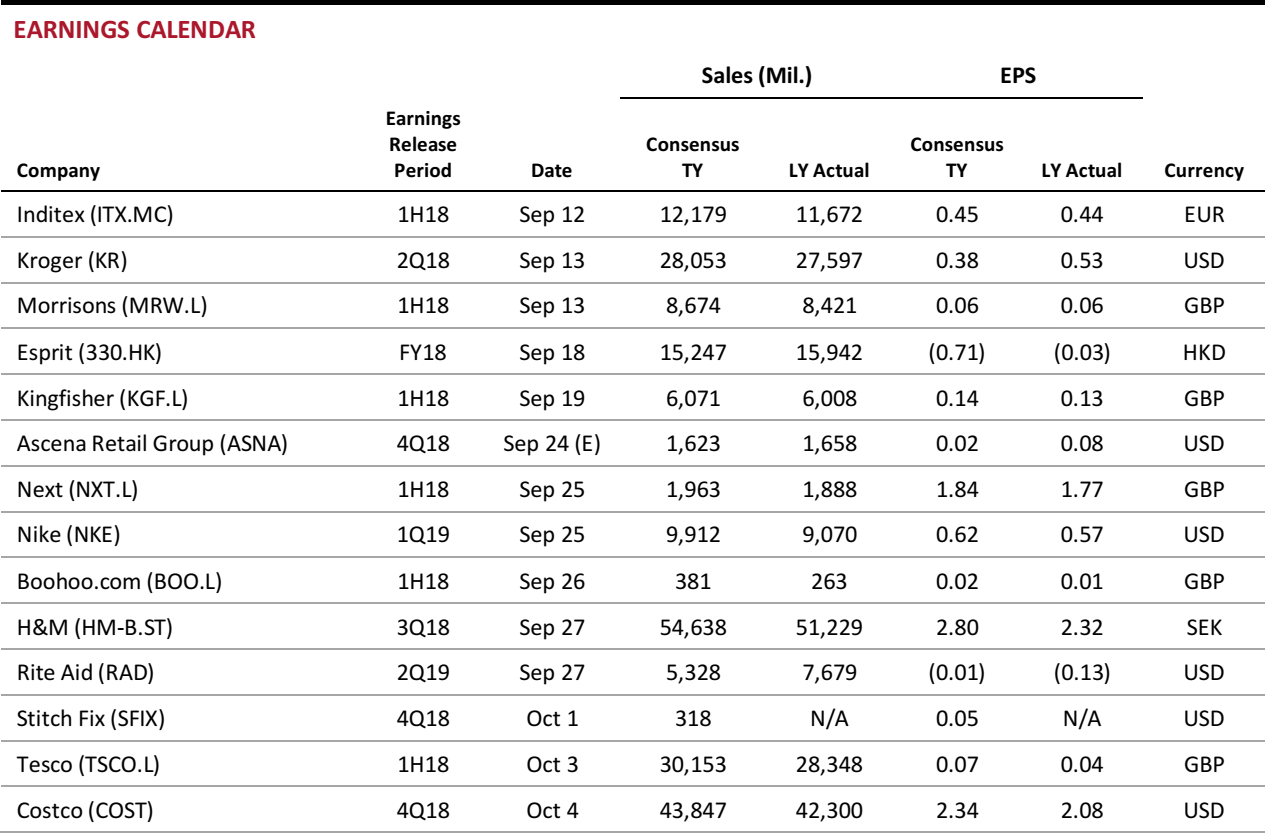

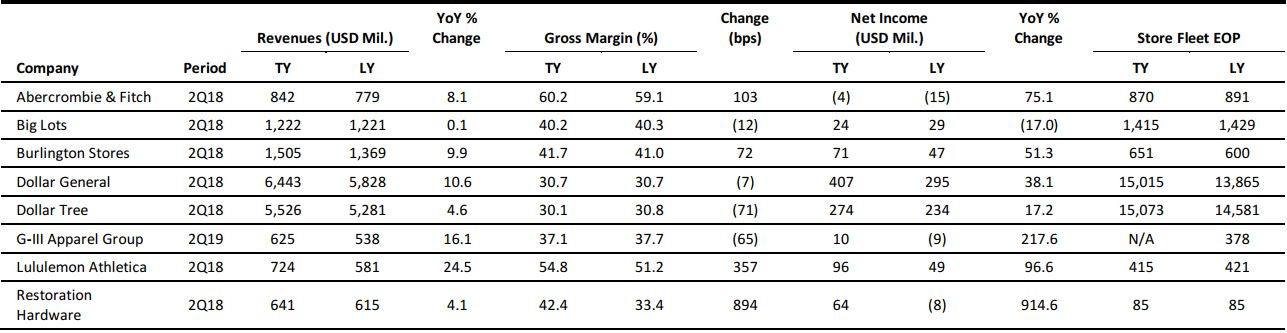

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Click-and-Collect Could Save Brick-and-Mortar Retailers in the Face of Online Shopping

(September 4) TheNewDaily.com.au

Click-and-Collect Could Save Brick-and-Mortar Retailers in the Face of Online Shopping

(September 4) TheNewDaily.com.au

- Brick-and-mortar stores are using various versions of the click-and-collect model to satisfy a growing demand for convenience as consumers increasingly shift toward online shopping. Some brick-and-mortar retailers in the US have recorded some of their best growth in years.

- New innovative models have been described as “a cross between a fast-food drive-through and a hotel concierge.” Department store Nordstrom has a self-service returns kiosk—similar to a returns bin for library books. Meanwhile, Walmart has invested in thousands of personal shoppers who save customers time wandering up and down the supermarket aisles.

Retailers Are Trying to Loosen Amazon’s Grip on Affiliate Revenue

(September 4) Digiday.com

Retailers Are Trying to Loosen Amazon’s Grip on Affiliate Revenue

(September 4) Digiday.com

- As customer acquisition costs through Facebook and Google rise, retailers are turning to publishers for help. Affiliate partnerships with publishers are becoming an increasingly appealing solution for retailers to drive traffic to their sites with editor endorsements.

- It’s a game Amazon has already been playing, and winning. As other multibrand retailers wake up to the revenue and traffic potential that affiliate links unlock, they’re hoping to loosen Amazon’s grip on the market.

Hard Lessons (Thanks, Amazon) Breathe New Life into Retail Stores

(September 3) NYTimes.com

Hard Lessons (Thanks, Amazon) Breathe New Life into Retail Stores

(September 3) NYTimes.com

- Malls are being hollowed out. Shops are closing by the thousands. Retailers are going bankrupt. But it may be too early to declare the death of retail. Americans have started shopping more—in stores—and old-school retailers are experiencing some of their best sales growth in years.

- The strong revenues start with a roaring economy and an optimistic consumer. With more cash in their wallets from the tax cuts, Americans have been spending more.The boom also reflects a reordering of the $3.5 trillion industry, with fewer retailers capturing more of the gains.

Burned by Toys“R”Us, Will Suppliers Ever Trust a Bankrupt Retailer Again?

(August 28) RetailDive.com

Burned by Toys“R”Us, Will Suppliers Ever Trust a Bankrupt Retailer Again?

(August 28) RetailDive.com

- In mid-March, attorneys for Toys“R”Us described a “perfect storm” that forced the company to request court approval to wind down its US business in bankruptcy. Along with losing the last national retailer dedicated to toys, suppliers to Toys“R”Us also lost, collectively, hundreds of millions of dollars when the retailer moved to shut down in Chapter 11.

- In July, major suppliers forged a settlement agreement with the retailer to pay a fraction of the money they are owed. But suppliers still have their memories of what happened, and they may not be so quick to trust—or ship to—a company in Chapter 11 again.

Amazon Opens Kids Book Box to All US Prime Members

(August 28) RetailDive.com

Amazon Opens Kids Book Box to All US Prime Members

(August 28) RetailDive.com

- As it first tested its Prime Book Box subscription, Amazon portrayed the children’s book box as a fun, Christmas Day–like experience for kids that fosters reading and snuggling on the couch with Mom and Dad.

- But as one of the few new perks for Prime members, it’s pretty limited. Prime members enjoy a host of free benefits, including an entertainment streaming service, limited music streaming, photo storage and free two-day shipping (the one most people use it for). But other benefits, including this kids’ book subscription, all cost extra.

EUROPE RETAIL & TECH HEADLINES

Homebase CVA Approved; 42 Stores to Close

(August 31) RetailGazette.co.uk

Homebase CVA Approved; 42 Stores to Close

(August 31) RetailGazette.co.uk

- British home improvement and gardening retailer Homebase announced the approval of its company voluntary arrangement (CVA) on August 31. The company is set to shut down 42 stores by early 2019.

- The troubled retailer managed to get the support of 95.92% of its creditors, comfortably surpassing the 75% minimum required for CVA approval.

Debenhams Reveals New Brand Identity

(September 3) TheRetailBulletin.com

Debenhams Reveals New Brand Identity

(September 3) TheRetailBulletin.com

- British department store chain Debenhams has unveiled its first new logo in 20 years as part of its “Debenhams Redesigned” business transformation strategy.

- The retailer has been making improvements to its stores and service offerings. It had previously announced in August that it would roll out the Doddle click-and-collect service across its entire portfolio of 165 stores in the UK, following a successful initial trial within 50 stores. Also this week, department-store rival John Lewis rebranded as John Lewis & Partners and its sister supermarket chain Waitrose rebranded as Waitrose & Partners.

Weak UK Retail Sales Growth in August

(September 4) BRC press release

Weak UK Retail Sales Growth in August

(September 4) BRC press release

- Retail sales in the UK rose by 1.3% in August, according to the British Retail Consortium (BRC). The rate was below July’s 1.6% increase. Comparable sales in August increased by 0.2%, slightly below July’s 0.5% increase. August growth was driven by food sales, although momentum in the category has faded following a strong run in previous months, the BRC said.

- BRC Chief Executive Helen Dickinson said that “the continued pressure on people’s disposable income has meant that some shoppers are increasingly less able to spend on the more discretionary nonfood items, such as clothing and footwear.” She also noted that the trend of slow retail sales growth seen in the early part of the year has continued.

Groupe Casino Confirms “Good Operational Performance” Following Rating Downgrade by S&P

(September 3) Company press release

Groupe Casino Confirms “Good Operational Performance” Following Rating Downgrade by S&P

(September 3) Company press release

- French retailer Groupe Casino reported that it had seen “good operational performance” and financial strength in the wake of a financial rating downgrade by S&P.

- The company opined that S&P’s assessment did not consider its ongoing, €1.5 billion ($1.7 billion) disposal plan, and it restated its objective of achieving a €1 billion ($1.2 billion) net debt reduction in France, to €2.7 billion ($3.1 billion), by the end of 2018.

Avrios Raises $14 Million for AI-Based Fleet Management Platform

(September 3) TechCrunch.com

Avrios Raises $14 Million for AI-Based Fleet Management Platform

(September 3) TechCrunch.com

- Swiss-based cloud-computing platform Avrios has raised $14 million for an AI-powered fleet management platform that focuses on passenger car and van fleets.

- The platform’s customer base currently numbers some 700 companies managing 70,000 vehicles, primarily in Europe.

ASIA RETAIL & TECH HEADLINES

Alibaba Set to Sign Joint Venture with Russian Partners

(September 2) FT.com

Alibaba Set to Sign Joint Venture with Russian Partners

(September 2) FT.com

- Alibaba Group is close to agreeing to terms to form a joint venture e-commerce company with Russian Internet company Mail.ru, supported by the Russian Direct Investment Fund (RDIF), the sovereign wealth fund.

- RDIF’s involvement is an indicator of official government support for the venture.

JD.com Collaborates with Hotels to Offer “Boundaryless Retail”

(September 3) TheRetailBulletin.com

JD.com Collaborates with Hotels to Offer “Boundaryless Retail”

(September 3) TheRetailBulletin.com

- Chinese e-commerce giant JD.com is set to work with various hotels across China to enable hotel guests to experience selected products from the comfort of their rooms as part of its Boundaryless Retail strategy.

- The initiative came about after the company noted that many of its customers make next-day or same-day delivery purchases on their travels.

Meituan Dianping to File for Hong Kong Listing

(September 3) SCMP.com

Meituan Dianping to File for Hong Kong Listing

(September 3) SCMP.com

- Chinese online food delivery-to-ticketing services platform Meituan Dianping is set for an IPO in Hong Kong. The company is valuing itself at up to $55 billion, with an indicative price range of $7.60–$9.20 per share.

- The company is seeking to raise $1.5 billion from five principal investors that include Chinese technology firm Tencent and global asset manager OppenheimerFunds, which are expected to contribute $400 million and $500 million, respectively.

Sumitomo Invests in Lippo Group’s Logistics Subsidiary, Red Carpet Logistics

(September 3) TechinAsia.com

Sumitomo Invests in Lippo Group’s Logistics Subsidiary, Red Carpet Logistics

(September 3) TechinAsia.com

- Japanese integrated trading company Sumitomo has made an investment in last-mile logistics company Red Carpet Logistics (RCL). Sumitomo’s association with RCL, a subsidiary of Indonesian conglomerate Lippo Group, is part of its larger strategic partnership with Lippo.

- While there was no official disclosure regarding the value of Sumitomo’s investment, Nikkei Asian Review estimated it at $9 million. Lippo’s association with Sumitomo suggests that the conglomerate is set to provide stiff competition to ride-hailing firm Go-Jek.

LATAM RETAIL & TECH HEADLINES

Rappi Raises $200 Million in New Funding Round

(September 1) TechCrunch.com

Rappi Raises $200 Million in New Funding Round

(September 1) TechCrunch.com

- Colombian on-demand delivery startup Rappi has raised more than $200 million in its latest funding round at a valuation of more than $1 billion.

- DST Global was the principal investor in the funding round, with Andreessen Horowitz and Sequoia Capital also participating. All three were existing investors in the company.

Advent to Inject $485 Million in Walmart Operations in Brazil

(August 27) Reuters.com

Advent to Inject $485 Million in Walmart Operations in Brazil

(August 27) Reuters.com

- Private equity firm Advent International is set to invest $485 million in Walmart’s existing stores in Brazil, per a published document in Brazil’s official gazette—a federal journal authorized to circulate public and legal notices.

- The development follows Advent’s acquisition of 80% of Walmart’s Brazilian operations in June of this year.

Cencosud to Undertake IPO for Its Shopping Mall Subsidiary

(August 31) Company press release

Cencosud to Undertake IPO for Its Shopping Mall Subsidiary

(August 31) Company press release

- Chilean retail conglomerate Cencosud is set to launch an IPO for its shopping mall subsidiary on the local stock exchange.

- Cencosud is one of the largest retailers in South America, with operations in Chile, Argentina, Brazil, Colombia and Peru. The IPO is expected to take place between March and April 2019.

Falabella Reports 4.2% Growth in Sales in the Second Quarter

(September 4) Company reports

Falabella Reports 4.2% Growth in Sales in the Second Quarter

(September 4) Company reports

- Chilean department store retailer Falabella reported second-quarter consolidated revenues of approximately $3.5 million, representing 4.2% year-over-year growth. Brick-and-mortar sales grew by 3.7% year over year during the period.

- The growth rate was expected to have been even better had currency fluctuations in Argentina not affected sales.

Amazon to Begin Selling Food and Beverages in Mexico

(August 30) Reuters.com

Amazon to Begin Selling Food and Beverages in Mexico

(August 30) Reuters.com

- Amazonis set to launch online food and drink sales in Mexico in an attempt to strengthen its position against Walmart’s business in the region.

- The new items on Amazon’s Mexican site, which was launched in 2015, include coffees, teas, liquors, beers and wines as well as cooking ingredients and nonperishable sweets and snacks.

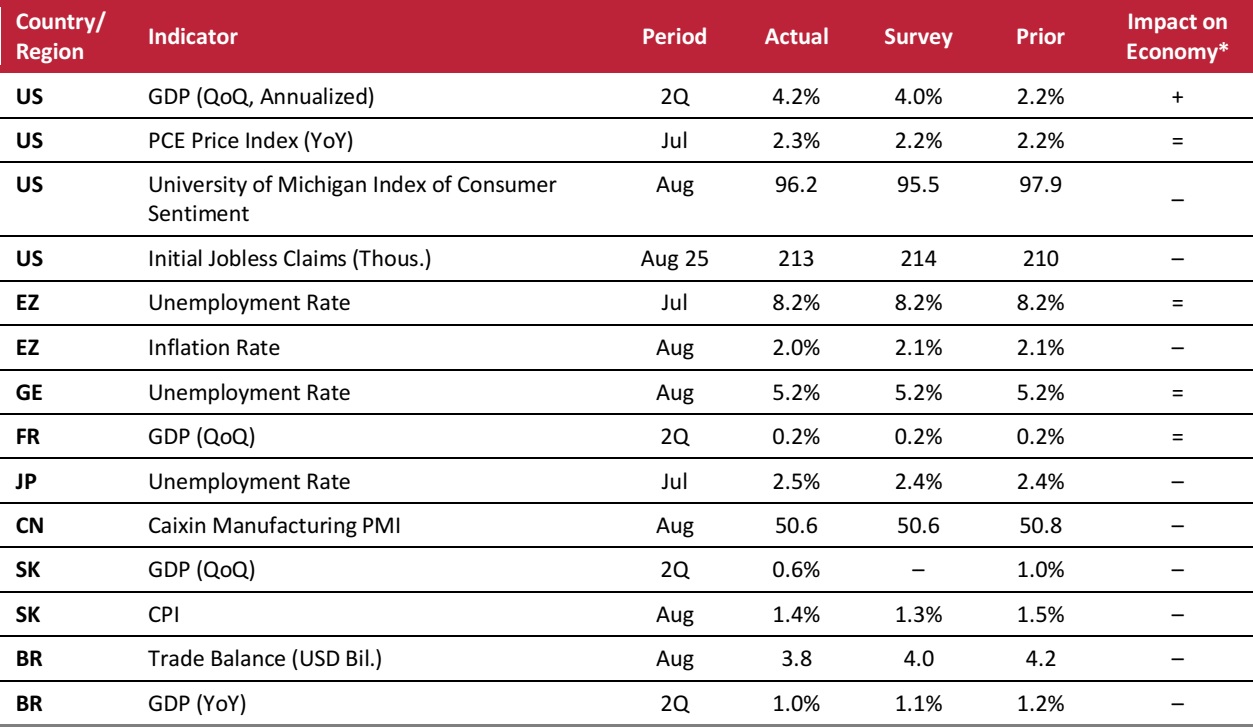

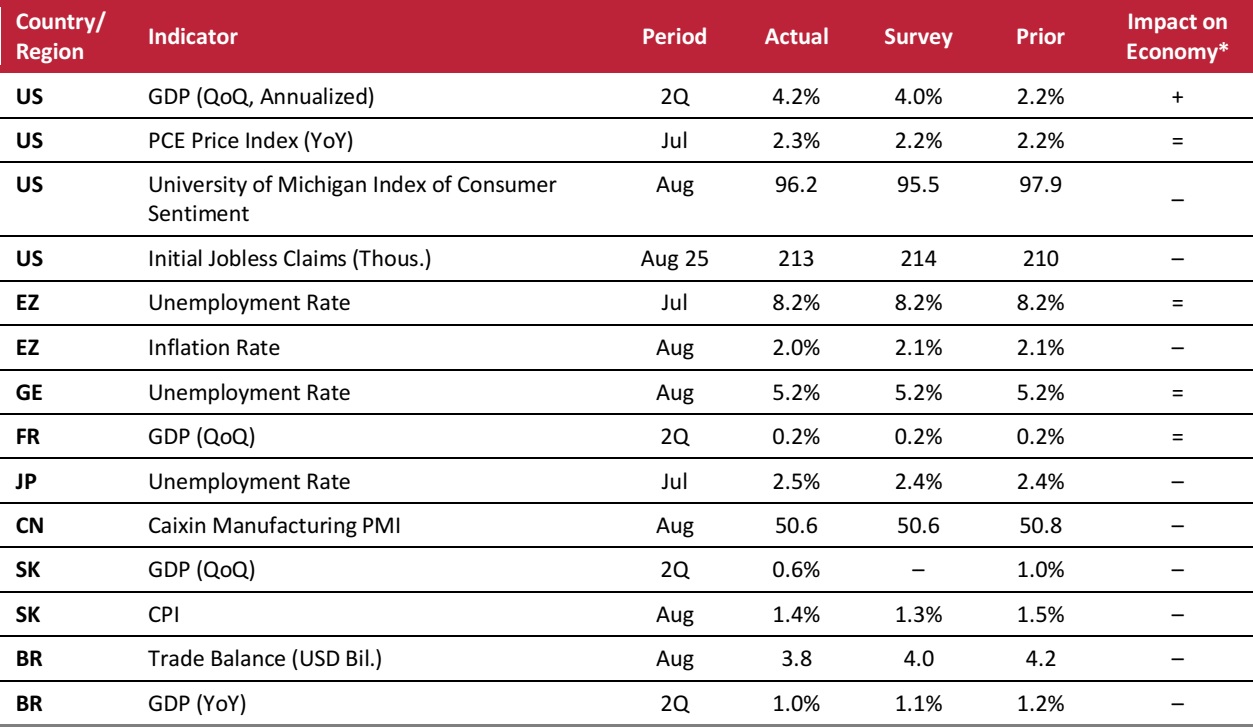

MACRO UPDATE

Key points from global macro indicators released August 29–September 4, 2018:

- US: US GDP grew at an annualized rate of 4.2% in the second quarter of 2018, beating the consensus estimate of 4.0%. The Personal Consumption Expenditures (PCE) Price Index in the US rose by 2.3% year over year in July, marginally above both the June rate and the consensus estimate.

- Europe: The unemployment rate in the eurozone stood at 8.2% in July, unchanged from the previous month and in line with analysts’ expectations. In Germany, the unemployment rate was 5.2% in August, the same as in the previous month.

- Asia-Pacific: The unemployment rate in Japan increased to 2.5% in July from 2.4% in June and was slightly above analysts’ expectations of 2.4%. China’s Caixin Manufacturing Purchasing Managers’ Index (PMI) fell to 50.6 in August from 50.8 in July and was in line with the consensus estimate.

- Latin America: Brazil’s trade surplus narrowed to $3.8 billion in August from $5.6 billion in the same month a year earlier and was below the consensus estimate of $4.0 billion. Brazil’s GDP grew by 1.0% year over year in the second quarter of 2018.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Department of Labor/Eurostat/Federal Statistical Office of Germany/INSEE/Japan Statistics Bureau/Caixin Insight Group/IHS Markit/Bank of Korea/Instituto Brasileiro de Geografia e Estatística/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Department of Labor/Eurostat/Federal Statistical Office of Germany/INSEE/Japan Statistics Bureau/Caixin Insight Group/IHS Markit/Bank of Korea/Instituto Brasileiro de Geografia e Estatística/Coresight Research

Click-and-Collect Could Save Brick-and-Mortar Retailers in the Face of Online Shopping

(September 4) TheNewDaily.com.au

Click-and-Collect Could Save Brick-and-Mortar Retailers in the Face of Online Shopping

(September 4) TheNewDaily.com.au

Retailers Are Trying to Loosen Amazon’s Grip on Affiliate Revenue

(September 4) Digiday.com

Retailers Are Trying to Loosen Amazon’s Grip on Affiliate Revenue

(September 4) Digiday.com

Hard Lessons (Thanks, Amazon) Breathe New Life into Retail Stores

(September 3) NYTimes.com

Hard Lessons (Thanks, Amazon) Breathe New Life into Retail Stores

(September 3) NYTimes.com

Amazon Opens Kids Book Box to All US Prime Members

(August 28) RetailDive.com

Amazon Opens Kids Book Box to All US Prime Members

(August 28) RetailDive.com

Weak UK Retail Sales Growth in August

(September 4) BRC press release

Weak UK Retail Sales Growth in August

(September 4) BRC press release

Groupe Casino Confirms “Good Operational Performance” Following Rating Downgrade by S&P

(September 3) Company press release

Groupe Casino Confirms “Good Operational Performance” Following Rating Downgrade by S&P

(September 3) Company press release

Alibaba Set to Sign Joint Venture with Russian Partners

(September 2) FT.com

Alibaba Set to Sign Joint Venture with Russian Partners

(September 2) FT.com

Sumitomo Invests in Lippo Group’s Logistics Subsidiary, Red Carpet Logistics

(September 3) TechinAsia.com

Sumitomo Invests in Lippo Group’s Logistics Subsidiary, Red Carpet Logistics

(September 3) TechinAsia.com

Cencosud to Undertake IPO for Its Shopping Mall Subsidiary

(August 31) Company press release

Cencosud to Undertake IPO for Its Shopping Mall Subsidiary

(August 31) Company press release

Falabella Reports 4.2% Growth in Sales in the Second Quarter

(September 4) Company reports

Falabella Reports 4.2% Growth in Sales in the Second Quarter

(September 4) Company reports

Amazon to Begin Selling Food and Beverages in Mexico

(August 30) Reuters.com

Amazon to Begin Selling Food and Beverages in Mexico

(August 30) Reuters.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Department of Labor/Eurostat/Federal Statistical Office of Germany/INSEE/Japan Statistics Bureau/Caixin Insight Group/IHS Markit/Bank of Korea/Instituto Brasileiro de Geografia e Estatística/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Department of Labor/Eurostat/Federal Statistical Office of Germany/INSEE/Japan Statistics Bureau/Caixin Insight Group/IHS Markit/Bank of Korea/Instituto Brasileiro de Geografia e Estatística/Coresight Research