Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Costco Follows Aldi with First China Store Last week, Costco opened its first store in China with a store in Shanghai — and shoppers flocked in such numbers that the store was forced to close early on its first day. It is not the only low-price retailer to have launched into the China market recently: Aldi opened two China stores, also in Shanghai, in June. We note similarities and differences in the approach of these two retailers. What’s Similar Costco and Aldi both launched in China online before they opened stores. Aldi made a soft entry in 2017 selling products on Alibaba’s cross-border e-commerce platform Tmall Global. In 2018, Aldi launched an online flagship store on the domestic Tmall site. Costco also entered China on Tmall (in 2014) and then launched an online flagship store on Tmall Global (2017). China is fast becoming a digital-first retail market, and international retailers are launching on major e-commerce platforms first. Both retailers include substantial ranges of imported products. According to news website Linkshop, approximately 40% of products stocked by Costco China are imported. Aldi Shanghai features a substantial number of imported goods, such as fresh and powdered milk from Australia. Aldi store signage features the strapline “Buy Global, Sell Local.” What’s Different Costco China so far appears very similar to Costco elsewhere in the world. When we , we saw no-frills warehouse stores, bulk-size products, a product mix that ranged from luxury handbags to everyday groceries — and, of course, the paid-membership model. By contrast, when our team visited one of Aldi’s two new Shanghai stores, we noted significant differences from Aldi’s proposition in its European heartland. The store in the Jing’an district has a significantly higher-end feel than Aldi’s traditional format, with premium-looking fixtures; signage highlighting provenance of products, their quality and freshness; and, lower-level shelving – meaning stock densities are lower. Similarly, Aldi China deploys more in-store technology than a typical Aldi store: A welcome screen allows shoppers to access information about Aldi and in-store promotions. The wine department includes a screen that shows information about the product when shoppers scan the barcode. And, while typical Aldi stores are on standalone, edge-of-town sites, the Jing’an store is located in a downtown mall. Despite Aldi’s move toward a premium positioning, its focus on a limited range of products in a small space remains unchanged: The Shanghai store reportedly stocks around 1,300 SKUs in around 6,996-7,535 square feet (650-700 square meters). Costco Shanghai offers around 4,000 SKUs across about 150,700 square feet (14,000 square meters). Key Insights Costco and Aldi took a similar online-to-offline route for China market entry. But their brick-and-mortar approaches look highly different: Aldi has pitched itself higher in the China market, while Costco has transplanted the no-frills approach it adopts elsewhere in the world. While China has not been an easy market for some international grocery-focused retailers (Carrefour is selling the majority of its China business) we think Aldi and Costco stand a strong chance of catering to demand for value and imported products among China’s growing middle-class population. [caption id="attachment_95789" align="aligncenter" width="700"] Crowds outside Costco in Shanghai on opening day

Crowds outside Costco in Shanghai on opening daySource: Coresight Research[/caption] [caption id="attachment_95790" align="aligncenter" width="700"]

Aldi’s store in Shanghai’s Jing’an district

Aldi’s store in Shanghai’s Jing’an districtSource: Coresight Research[/caption]

US RETAIL & TECH HEADLINES

Target’s Curbside Drive Up Service Now Available Across the US

(September 2) Engadget

Target’s Curbside Drive Up Service Now Available Across the US

(September 2) Engadget

- Target's same-day to-car pick up service is now available across all 50 states in the US. The service allows customers to order on the app then pick up at a designated parking spot at the Target store. (A Target employee brings the order to the car).

- With this latest expansion, drive up pick up service is now available at 1,750 Target retail locations nationwide.

- Ralph Lauren became the first brand to roll out a campaign tied to a US sporting event on social video app TikTok. The luxury brand created a dedicated digital campaign to coincide with the 2019 US Open tennis tournament.

- Ralph Lauren's campaign consisted of a series of three videos starring Booksmart actress Diana Silvers, a hashtag campaign dubbed #WinningRL that urges users to post videos of a real-life challenge, and shoppable posts that let consumers buy US Open-branded products.

- Pan Pacific International Holdings (PPIH), the Tokyo-based parent company of Japanese discount store chain Don Quijote — known for its jam-packed “jungle displays” — is developing a new retail format in the US.

- Japan's Don Quijote stores, known as "Donki" in Japan, offer everything from groceries to household goods and luxury handbags, all tightly merchandised and punctuated by colorful discount signage.

- Walmart, the world’s biggest retailer, is moving deeper into primary care and mental health, opening a new clinic called Walmart Health in Georgia. The company recently updated its website with a link to its “newest location in Dallas, GA.”

- The company also launched walmarthealth.com for patients to make appointments. Walmart is testing the concept with the initial clinic and could open more in the future.

EUROPE RETAIL AND TECH HEADLINES

- UK retail sales remained flat in August and reached a new 12-month-average low of 0.4%, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 0.5% in August. Helen Dickinson, CEO of BRC, said economic and political uncertainty had driven down consumer demand.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended August, total food sales increased 0.5% and total nonfood sales were down 1.2%. While summer weather boosted food sales, nonfood sales weakened further.

- British supermarket retailer Asda has launched a four-week trial of its in-store Re-Loved charity clothing shop at Milton Keynes. Shoppers can purchase second-hand apparel from a range of retailers.

- Asda currently has clothing recycling points for customers at almost 500 stores and encourages customers to recycle unwanted clothes. Proceeds go to Asda’s Tickled Pink campaign, which supports breast cancer non profits

- British luxury brand Burberry has partnered with Apple Pay to launch “R Message,” a personalized in-app chat service. Burberry will launch the new service first at its Manchester flagship and subsequently extend the service to its 431 stores globally.

- The app will allow high-spending patrons – by invitation only – to purchase online with a direct electronic credit card payment method. Shoppers can also communicate with Burberry employees for product information or to make in-store appointments.

- Grocery retail group Coop Sweden has collaborated with logistics company Widrikssons Åkeri to offer same-day grocery delivery for online purchases in greater Stockholm.

- Customers can order before 11:30 am and choose a same-day delivery slot from 6:00 pm to 8:00 pm, 7:00 pm to 9:00 pm etc. Coop plans to expand the service after the Stockholm launch.

- David Shepherd, COO of Arcadia Group, stepped down from his role last month. Shepherd had been with the group for 25 years and served as COO since 2012.

- The departure adds further pressure on Arcadia, which is in the middle of a restructuring process. On September 1, The Sunday Times reported that Arcadia’s CEO Ian Grabiner was laying the groundwork for a break-up of the brand portfolio.

- Metro Properties, the real estate company of German cash-and-carry chain Metro AG, has announced a sale-and-leaseback transaction of 11 cash-and-carry stores in Poland, Hungary and the Czech Republic. The transaction is valued at over €250 million ($274 million).

- The properties have been acquired by Vienna-based FLE GmbH, a subsidiary of French asset management group LFPI. The cash-and-carry banners Metro and Makro will continue to operate all wholesale locations on long-term lease contracts.

ASIA RETAIL AND TECH HEADLINES

- French beauty retailer Sephora has relaunched in Hong Kong after a 10-year absence with a new store in the International Finance Center.

- Sephora has plans to open seven more stores in Hong Kong: Its second store is already under construction in Windsor House and six further stores will open in the next three years.

JD.com Partners with Philips To Enhance In-Store Customer Experience

(September 2) TheDrum.com

JD.com Partners with Philips To Enhance In-Store Customer Experience

(September 2) TheDrum.com

- com has partnered with the China unit of Dutch electronics firm Philips to analyze customer preferences and shopping habits, and better understand buyer sentiment by using JD’s artificial intelligence (AI) retail service.

- JD’s AI retail service will assist Philips in product design, marketing, advertising, user engagement, branding and store operations based on pre- and post-shopping behavior.

- Swedish clothing retailer H&M, which started operations in Indonesia in 2013 and currently runs 35 physical stores, has made its online store available to customers in Indonesia.

- The online store will sell fashion items for men, women and children. Customers can opt for delivery or in-store pick up.

- Chinese sportswear company Topsports International, owned by Chinese shoe retailer Belle International, is go public this months in an IPO expected to raise up to $1 billion.

- Belle International planned to spin off Topsports International more than a year ago, after Belle was privatized by shareholders Hillhouse Capital Group and CDH Investments in 2017.

- French workwear brand Danton is set to open its first independent store, “Danton Tokyo,” at the Omotesando shopping mall in Tokyo on September 20.

- The new store will offer Danton’s full range of French workwear such as coveralls, blousons and pants, and a wide range of casual wear.

H.Moser & Cie Lands in The Indian Market Via Ethos Watch Boutiques

(September 3) FashionNetwork.com

H.Moser & Cie Lands in The Indian Market Via Ethos Watch Boutiques

(September 3) FashionNetwork.com

- Swiss luxury watch firm H. Moser & Cie has entered India in collaboration with local watch retailer Ethos Watch Boutiques. The new partnership will see H. Moser & Cie sell its watches in metro cities across India through Ethos stores.

- The stores will offer the brand’s Heritage, Endeavour, Pioneer, Swiss Alp Watch and Venturer collections, each priced over INR 940,000 ($13,006).

LATIN AMERICA RETAIL AND TECH HEADLINES

Grupo Axo Opens New Nike and TAF Stores in Mexico

(September 2) America-Retail.com

Grupo Axo Opens New Nike and TAF Stores in Mexico

(September 2) America-Retail.com

- Mexico’s multibrand company Grupo Axo has opened its fourth Nike store in Mexico, located at the Parque Delta shopping center.

- Grupo Axo has also opened a new The Athlete’s Foot (TAF) store at the Delta Park shopping mall in Mexico. The company began its partnership with Nike this year and with TAF last year.

- Chinese low-cost retailer Miniso, which already has 150 stores in Mexico, has announced plans to open four new Miniso Factory concept outlets in Mexico City, Querétaro, Cancun and the State of Mexico by the end of 2019.

- The company also wants to expand its catalog to 14 product categories by the end of 2019, from the 10 categories currently available.

- US apparel brand Gap has landed in Central American with its first store in San José, Costa Rica, on August 31. The 2,153-square-foot store offers all Gap brand lines including Gap Body, Gap Baby, denim and classic lines.

- Gap re-entered Costa Rica via its new franchise partner Promérica Group and plans to open a second location in the country in Lincoln Plaza by 2019 and at a third undisclosed location by the end of 2020.

- Walmart Mexico has announced the launch of its new “On Demand” program, which offers customers home delivery in less than three hours, including more than 12,000 technology and home products.

- Customers can also pickup in store.

Havaianas Eyewear Unveils New Collection with Safilo Group

(September 2) FashionNetwork.com

Havaianas Eyewear Unveils New Collection with Safilo Group

(September 2) FashionNetwork.com

- Brazilian brand Havaianas has launched a new collection of sunglasses produced and distributed by Italian eyewear firm Safilo Group.

- The new line, priced between R$250 ($60) and R$280 ($67), includes cosmetic lenses with products named after Brazilian beaches.

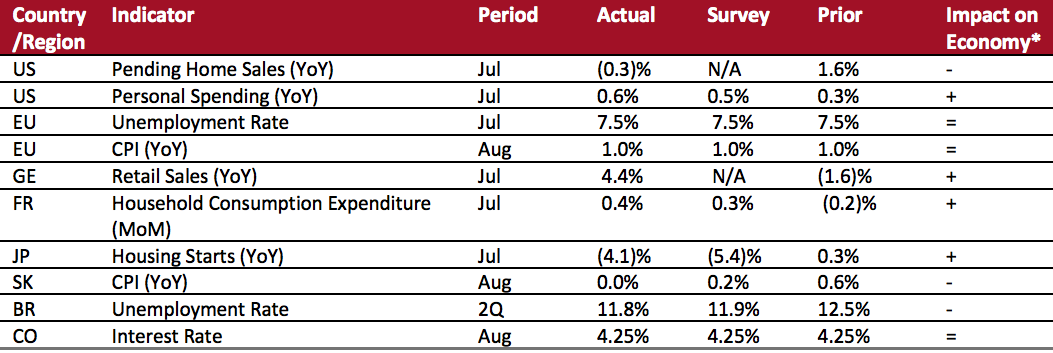

MACRO UPDATE

Key points from global macro indicators released August 28-September 3, 2019:- US: Pending home sales fell 0.3% year over year in July, below the 1.6% growth in June. Personal spending rose 0.6% year over year in July, above the 0.3% growth in June and slightly above the consensus estimate of 0.5%.

- Europe: In the eurozone, the consumer price index (CPI) was 1.0% in August, unchanged from the previous month and meeting the consensus estimate. In Germany, retail sales posted a 4.4% year-over-year rise in July, an improvement from the 1.6% decline in June.

- Asia-Pacific: In Japan, housing starts fell 4.1% year over year in July, from 0.3% growth in June. In South Korea, in August, the CPI remained unchanged from the previous year, below the 0.6% increase in July and the consensus estimate of 0.2%.

- Latin America: In Brazil, the unemployment rate for the second quarter ended July 2019 was 11.8%, 0.6 percentage points below the previous quarter and close to the consensus estimate of 11.9%. In Colombia, the interest rate has remained unchanged for the last 16 months, at 4.25%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: National Association of Realtors/Bureau of Economic Analysis, Department of Commerce/Eurostat /Destatis /Insee/Statistics of Japan/Statistics Korea/IBGE/Banco de la Republica/Coresight Research[/caption]

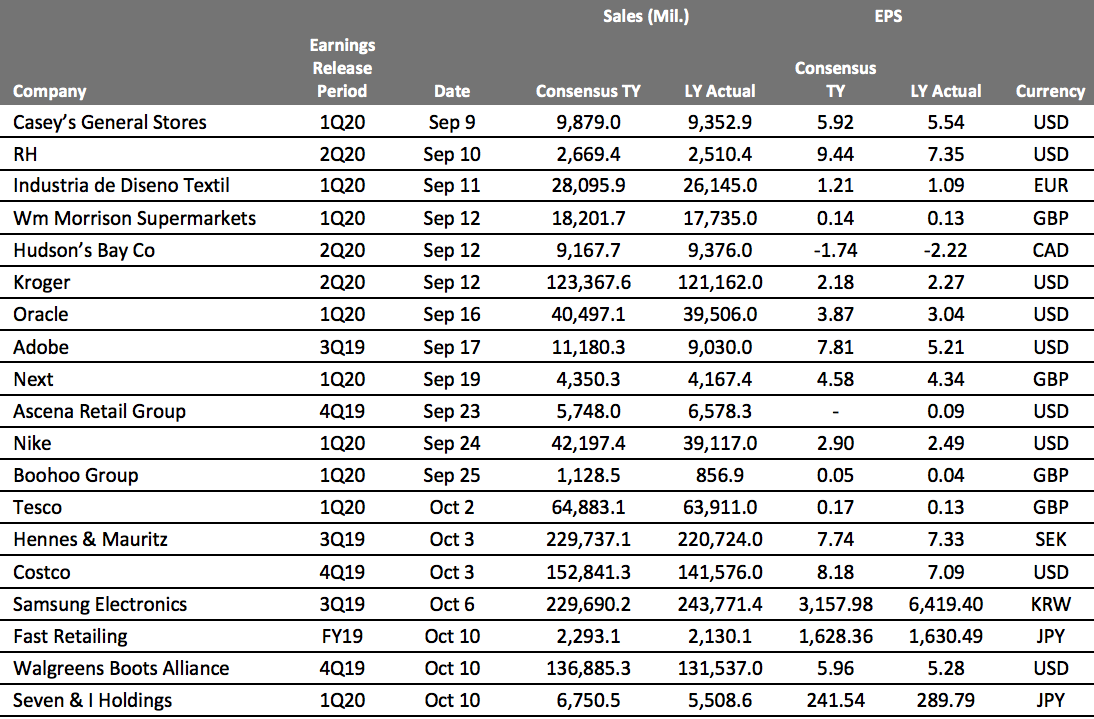

EARNINGS CALENDAR

[caption id="attachment_95814" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR