From the Desk of Deborah Weinswig

Amazon Is Making Big Changes at Whole Foods Market and Creating Waves in Grocery

On August 28—the day Amazon closed its $13.7 billion acquisition of Whole Foods Market—subtle changes were already evident in Whole Foods stores, where recently installed display pyramids offered Amazon’s Echo and Dot intelligent connected devices. On the closing date, Whole Foods cut prices up to 40% on many staples, such as bananas, eggs and ground beef.

Amazon also promised to make further changes, including making its Amazon Prime subscription plan the Whole Foods customer rewards program; offering Whole Foods products through Amazon.com, AmazonFresh, Prime Pantry and Prime Now; and putting Amazon Lockers into Whole Foods locations. Prime members are likely to receive additional discounts at Whole Foods stores in the future, effectively driving them from online to offline shopping.

Although it is reasonable to expect that Amazon will need some time to accomplish all of its plans, the company has already hit the ground running. It took advantage of the interim between the acquisition announcement and the deal close to quickly execute on a number of these initiatives—prompting a competitive response from other grocers.

Whole Foods products on Amazon. More than 1,000 Whole Foods products are available on Amazon.com, according to business website BusinessInsider.com. These include butter, turkey breast, cookies, ice cream sandwiches, shampoo and laundry detergent. A simple of search of “Whole Foods Market” on Amazon’s home page turns up beauty products, nutritional supplements and cereal bars under Whole Foods’ 365 Everyday Value private label.

Amazon Lockers in Whole Foods stores. Some Whole Foods locations now include Amazon Lockers, which hold packages securely until customers arrive to pick them up and enter a passcode to retrieve them. Amazon customers can also use the lockers to return items. (Separately, Kohl’s recently announced that it would sell Amazon’s Echo and other smart-home products, as well as accept Amazon returns, in 82 of its stores.)

Centralization and changes to regional offerings. Whole Foods is changing the way it markets products to its customers, according to

The Wall Street Journal. The company will no longer permit brand representatives to visit its stores to ensure that products are stocked and displayed correctly. In addition, the product assortment is becoming centralized, which eliminates the practice of local brands marketing their products to individual stores and regions. Rather, product assortment decisions will largely be made by managers at Whole Foods’ Austin, TX, headquarters. These moves will likely enable Whole Foods to offer better prices to customers through greater bargaining power with its suppliers and to better integrate with Amazon’s e-commerce platform. However, customers will lose the local flavor and uniqueness their nearest Whole Foods offered before.

Despite driving greater efficiency in stores, Whole Foods plans to hire more workers and continue to open more stores. The integration of the two companies’ point-of-sale and merchandising systems will take some time—but Amazon has demonstrated that it is moving at top speed in enacting these changes.

Competing grocers have been forced to respond to Amazon’s changes at Whole Foods. Interestingly, Kroger is moving in the opposite direction in terms of localization by increasing its level of partnership with local brands. The company already sources from thousands of local suppliers and it recently launched a website with the slogans “Kroger Loves Local” and “We Are Local” that aims to encourage more local brands to sign up to sell in its stores, according to CNBC. To increase consumer interest in shopping and eating local, Kroger will continue to offer food sampling and food education in its stores.

Though it has only been a month since the acquisition was finalized, Amazon has already implemented a number of significant changes at Whole Foods stores that are creating ripples throughout the grocery industry. Industry observers and competing grocers are anxiously waiting to see the additional improvements and challenges that Amazon has up its sleeve.

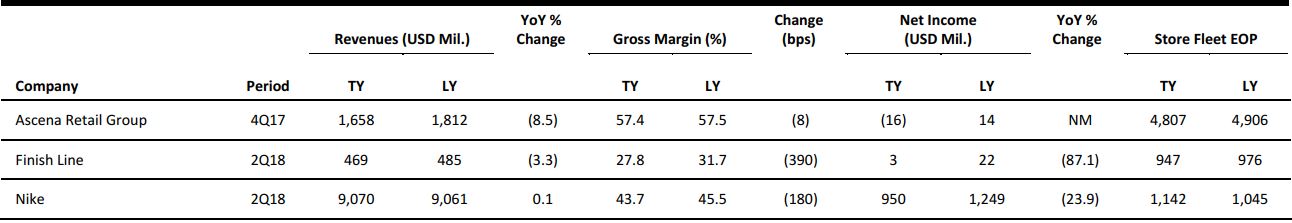

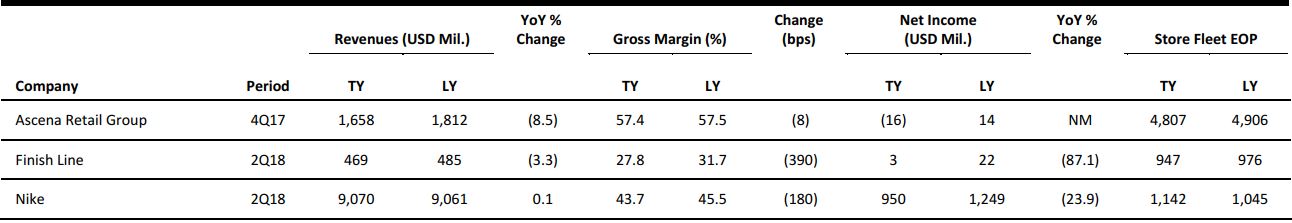

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

Nike Declines After Athletic Giant Gives Bleak US Outlook

(September 26) Bloomberg.com

Nike Declines After Athletic Giant Gives Bleak US Outlook

(September 26) Bloomberg.com

- Nike shares declined early Wednesday after the company squelched any hope of a quick turnaround at its ailing domestic operations. The world’s biggest sportswear maker expects North American sales to decline again this quarter, following a 3% dip in the region last quarter. Nike’s Converse business also will drop in the current period.

- The slump has forced Nike to rely more heavily on overseas growth, especially in China. International sales—along with an aggressive cost-cutting plan—helped the company post first-quarter profits that topped estimates on Tuesday. CEO Mark Parker vowed to ignite global growth through “innovative products and the most personal, digitally connected experiences in our industry.”

Mansell to Retire as Kohl’s CEO; Former Starbucks Executive Gass to Succeed Him

(September 26) JSOnline.com

Mansell to Retire as Kohl’s CEO; Former Starbucks Executive Gass to Succeed Him

(September 26) JSOnline.com

- Michelle Gass, who joined Kohl’s four years ago after a successful run at Starbucks, will succeed Kevin Mansell as CEO at Kohl’s. The change promises new perspectives at the Menomonee Falls–based retailer, which, like other department store chains, has struggled to find a path to growth as online competition eats into sales and consumer preferences evolve.

- Amid the changes, Kohl’s remains committed to brick-and-mortar, but it is reconfiguring its fleet of some 1,150 stores to effectively downsize its retail footprint. And the firm recently raised industry eyebrows by unveiling an alliance with archrival Amazon.

Bankrupt Toys“R”Us Secures Financing, Begins Holiday Hiring

(September 26) JSOnline.com

Bankrupt Toys“R”Us Secures Financing, Begins Holiday Hiring

(September 26) JSOnline.com

- Toys“R”Us said in a release that it had closed on $3.1 billion in bankruptcy financing from a group of lenders led by JPMorgan. The retailer said the funds would be used to modernize its stores as well as update its e-commerce platform and infrastructure. Toys“R”Us announced on September 21 that it would begin hiring seasonal workers in stores and in fulfillment operations in six of its top markets—New York City, Los Angeles, Philadelphia, Chicago, Boston and Groveport, OH.

- The retailer expects seasonal jobs in those markets to top 12,000, according to the release. The hiring announcement came just over a week after the toy retailer filed for Chapter 11 bankruptcy following years of struggling with a multibillion-dollar debt load.

Target Raises Minimum Hourly Wage to $11, Pledges $15 by End of 2020

(September 25) Reuters.com

Target Raises Minimum Hourly Wage to $11, Pledges $15 by End of 2020

(September 25) Reuters.com

- Target said it would increase its minimum hourly wage this year by a dollar, to $11, vowing to raise this by the end of 2020 to $15 an hour—the so-called living wage that labor advocates across the US are campaigning for. The Minneapolis-based retailer, which plans to start hiking minimum pay across its stores to $11 an hour in October, provided assurances that the move would not hurt its previously announced full-year and quarterly earnings forecasts.

- Amid increasing competition for workers in a strengthening labor market, the “Fight for Fifteen” movement—a union-led push for a $15 minimum wage—has been gaining traction in cities across the country.

Retail Sales to Rise 3.5%–4.4% This Holiday Season, According to AlixPartners’ Forecast

(September 20) AlixPartners press release

Retail Sales to Rise 3.5%–4.4% This Holiday Season, According to AlixPartners’ Forecast

(September 20) AlixPartners press release

- Business advisory firm AlixPartners released its forecast for US retail sales for the upcoming holiday season. The firm anticipates that retailers will see a year-over-year sales increase of 3.5%–4.4% over the November–January period.

- Joel Bines, co-head of the AlixPartners’ retail practice and a managing director at the firm, said, “The so-called Retail Apocalypse may not be nigh after all. Based on our unique and historically highly accurate methodology, we see a fairly healthy holiday season for retail.”

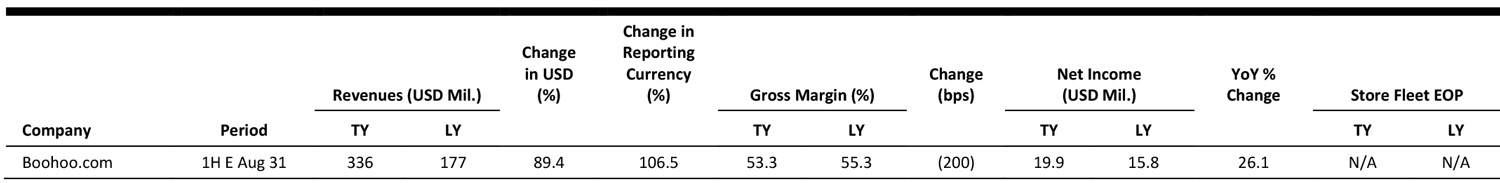

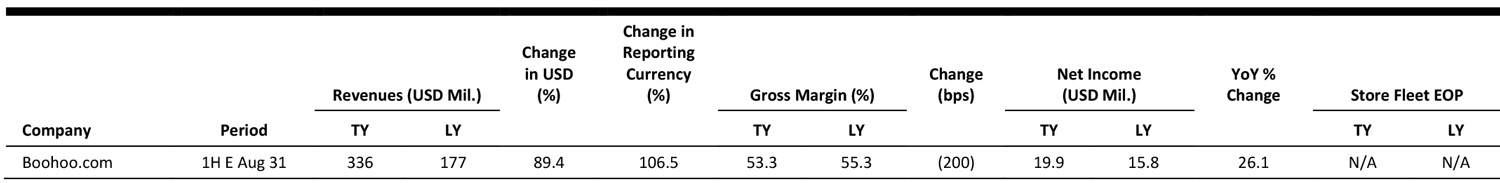

EUROPE RETAIL EARNINGS

Boohoo.com acquired a majority stake in Pretty Little Thing on January 3, 2017, and in Nasty Gal on February 28, 2017.

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

Aldi Reports 13.5% Jump in UK and Ireland Sales

(September 25) Company press release

Aldi Reports 13.5% Jump in UK and Ireland Sales

(September 25) Company press release

- Grocery discounter Aldi reported a 13.5% increase in UK and Ireland sales, to £8.7 billion (US$11.9 billion), for the year ended December 31, 2016. Gross profit declined by 7% in a price-competitive environment. Operating profit declined by 17% as Aldi continued to open stores.

- Privately owned Aldi noted that it saw unspecified positive comparable sales growth in the year. The company currently operates 726 UK stores and plans to open 70 new UK stores in 2018.

Marks & Spencer Launches Grocery E-Commerce Trials

(September 22) Retail-Week.com

Marks & Spencer Launches Grocery E-Commerce Trials

(September 22) Retail-Week.com

- The UK’s Marks & Spencer has launched two grocery e-commerce trials. In one trial, shoppers within range of the company’s Camden (London) branch can opt to have “dinner for tonight” options delivered to them within one hour or have a regular grocery order delivered in two hours. In the second trial, Marks & Spencer is offering a click-and-collect service at its Woodley store near Reading.

- The trials are available only to members of the company’s Sparks loyalty program. Marks & Spencer has long resisted selling groceries online, in part due to the typically smaller basket sizes of grocery orders.

Tesco Closes in on SuperValu in Ireland

(September 25) ESMMagazine.com

Tesco Closes in on SuperValu in Ireland

(September 25) ESMMagazine.com

- In Ireland, second-place grocer Tesco has narrowed the gap with market leader SuperValu, according to new data from market measurement service Kantar Worldpanel. In the 12 weeks ended September 10, Tesco experienced its strongest growth in more than five years, with sales up 4.3%. SuperValu grew sales by 0.9% in the same period.

- Discounters Lidl and Aldi grew sales by 2.4% and 3.3%, respectively, during the 12-week period.

Uber Set for Talks over London Ban

(September 25) BBC.com

Uber Set for Talks over London Ban

(September 25) BBC.com

- Uber looks set to meet London’s transport regulator after Transport for London denied the company a new license to operate in the city. Uber’s current license expires September 30.

- Uber Chief Executive Dara Khosrowshahi issued an apology acknowledging that the company had made “mistakes.” Mayor of London Sadiq Khan said he welcomed the apology and asked Transport for London to “make themselves available” to meet with Uber.

Deliveroo Secures New Funding

(September 25) TheTimes.co.uk

Deliveroo Secures New Funding

(September 25) TheTimes.co.uk

- UK food-delivery service Deliveroo has secured $385 million of new funding, valuing the firm at more than $2 billion and making it one of Britain’s most valuable private companies.

- Investment managers T. Rowe Price and Fidelity led the latest funding round.

ASIA TECH HEADLINES

Didi Invests $200 Million in Chinese Auto-Trading Platform RenRenChe

(September 25) TechCrunch.com

Didi Invests $200 Million in Chinese Auto-Trading Platform RenRenChe

(September 25) TechCrunch.com

- China’s Didi Chuxing has backed RenRenChe, a China-based, online peer-to-peer car marketplace, via a $200 million strategic investment. It is not clear what RenRenChe’s valuation is post-investment, but in its last funding round, a year ago, the company was valued at $500 million. Assuming it has not raised funds at a down-round, it would now be worth at least $700 million.

- Didi is valued at more than $50 billion and its on-demand car empire stretches beyond China, where it is in the process of buying Uber’s local business. The firm has links in Europe, South America, India, Southeast Asia, the US and the Middle East thanks to investments in the likes of Taxify, 99, Ola, Grab, Lyft and Careem.

Southeast Asia Games Firm Sea, Formerly Garena, Files for $1 Billion US IPO

(September 23) TechCrunch.com

Southeast Asia Games Firm Sea, Formerly Garena, Files for $1 Billion US IPO

(September 23) TechCrunch.com

- Southeast Asia–based games and e-commerce firm Sea, formerly known as Garena, has officially filed for its much-anticipated US IPO. The company, which is valued at more than $3.75 billion, will list on the New York Stock Exchange as “SE” and is looking to raise $1 billion.

- Sea is best known for its Garena gaming business, which focuses on PC games but also includes mobile games. In recent years, it has branched out into e-commerce with its Shopee service and into payments with its AirPay business. The Garena games portal had 40.1 million monthly users as of June 2017, with 12.9 million daily users spending an average of 2.3 hours per day on the service. Garena is Sea’s only revenue generator, as the company is still subsidizing Shopee and as AirPay is available in just three markets.

Baidu Announces $1.5 Billion Fund to Back Self-Driving Car Startups

(September 21) TechCrunch.com

Baidu Announces $1.5 Billion Fund to Back Self-Driving Car Startups

(September 21) TechCrunch.com

- Baidu is putting some serious cash behind its self-driving car push with its announcement of a $1.5 billion fund focused on backing autonomous-driving technology companies. The Chinese giant, best known for its Internet search service and artificial intelligence technology, has prioritized autonomous vehicles in a major way in recent years, so the news comes as little surprise.

- Baidu made its Apollo self-driving car platform freely available to the auto industry earlier this year. It quickly picked up partners and it currently claims to have about 70, including Hyundai, Bosch, Continental, Nvidia, Microsoft Cloud, Velodyne, TomTom, UCAR and Grab.

Twitter Is Testing a Twitter Lite Android App, First in the Philippines

(September 23) TechCrunch.com

Twitter Is Testing a Twitter Lite Android App, First in the Philippines

(September 23) TechCrunch.com

- Twitter has nearly four times as many monthly active users outside the US as it does in its home market—260 million versus 68 million—and it launched a new app in an effort to boost those numbers further. The social network is testing an Android app for Twitter Lite, a native app version of a mobile website Twitter launched earlier this year that uses less mobile data to work in the Philippines.

- The lighter data load means that the app is especially useful for emerging markets, where data networks are often slower and more expensive for consumers to use. “The Philippines market has slow mobile networks and expensive data plans, while mobile devices with limited storage are still very popular there. Twitter Lite helps to overcome these barriers to usage for Twitter in the Philippines,” said a Twitter spokesperson.

LATAM RETAIL & TECH HEADLINES

Facebook Poaches SAS LatAm Head

(September 25) ZDNet.com

Facebook Poaches SAS LatAm Head

(September 25) ZDNet.com

- Facebook has poached a top executive at analytics firm SAS to head its Brazil operations. Conrado Leister will be taking over as Brazil General Manager at Facebook following the departure of Marcos Angelini eight months earlier.

- Leister’s arrival means that Facebook’s Latin America head, Diego Dzodan, will be able to return to his original role. Dzodan had been combining accountability for Brazil with the regional remit since Angelini’s departure.

Tablet Sales Continue to Decline in Brazil

(September 22) ZDNet.com

Tablet Sales Continue to Decline in Brazil

(September 22) ZDNet.com

- Tablet sales in Brazil continued to drop in the second quarter of 2017, according to analysis firm IDC. The 790,000 devices sold during the period represented an 8% drop from the 860,000 units shipped in the second quarter of 2016.

- According to IDC, tablet sales totaled R$400 million (US$127 million) during the second quarter, 11% less than in the same period last year, but up 9% compared with the first quarter of 2017.

Kaspersky Lab Secures Contract with Brazilian Armed Forces

(September 20) ZDNet.com

Kaspersky Lab Secures Contract with Brazilian Armed Forces

(September 20) ZDNet.com

- Kaspersky Lab has won a bid to supply cybersecurity tools to the Brazilian Armed Forces. After a “complex public competition” through local channel partner EsyWorld, the Russian company said it underwent a “rigorous evaluation process” to establish whether its software offerings were suited to the purpose.

- The three-year contract is worth R$8.4 million (US$2.6 million) in total, of which R$4.5 million (US$1.4 million) will be allocated to Army projects, R$2.3 million (US$735,000) to Air Force projects and R$1.6 million (US$512,000) to Navy projects.

Carrefour Brasil Names Prioux to Replace Desmartis as CEO

(September 22) Kitco.com

Carrefour Brasil Names Prioux to Replace Desmartis as CEO

(September 22) Kitco.com

- Carrefour Brasil has named Noël Prioux as CEO as it expands operations after pricing the country’s largest IPO in years.

- Prioux will replace Charles Desmartis, who decided to leave the group, a statement said. The company also elected Prioux, a 33-year Carrefour veteran, as a member of the company’s board in Brazil, effective October 2.

MACRO UPDATE

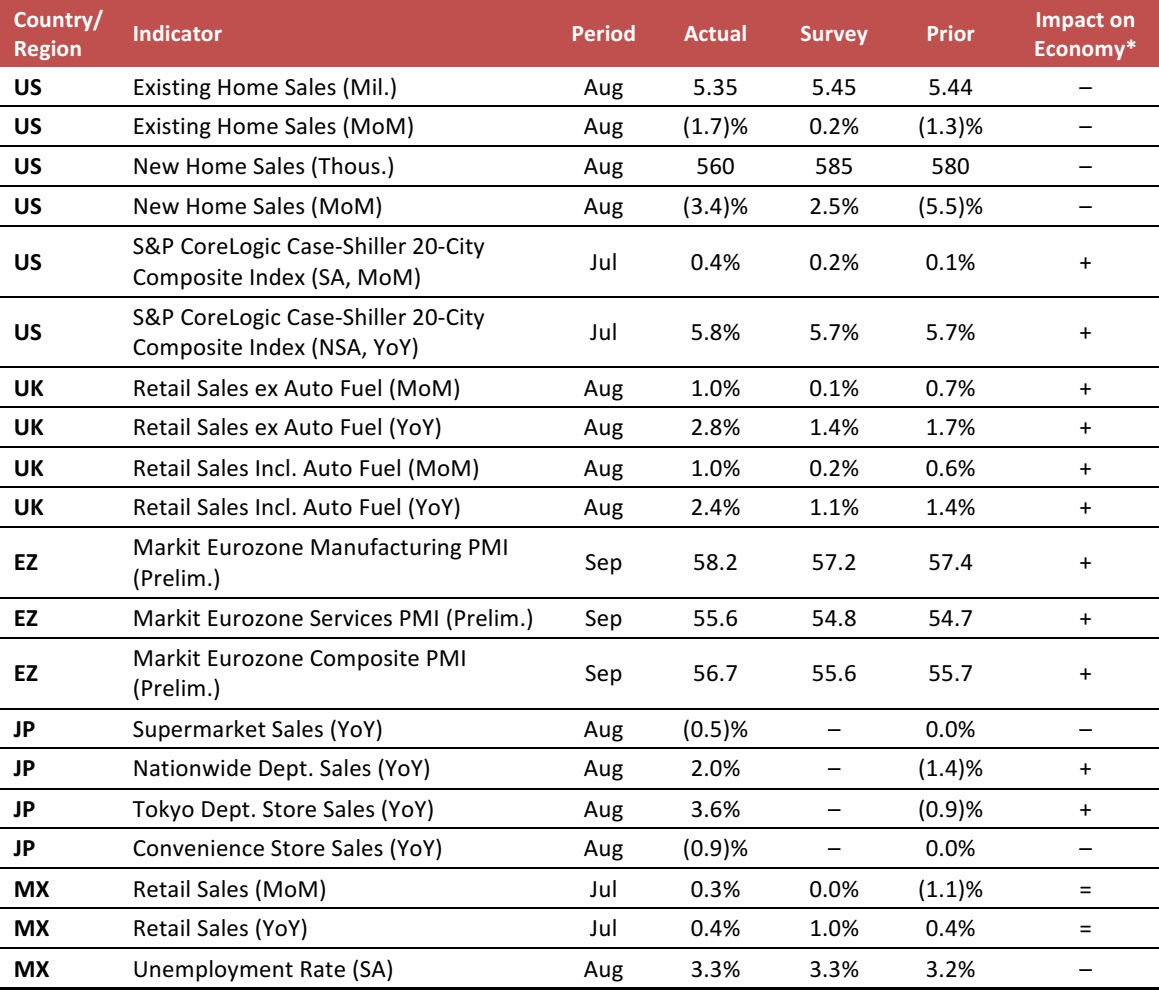

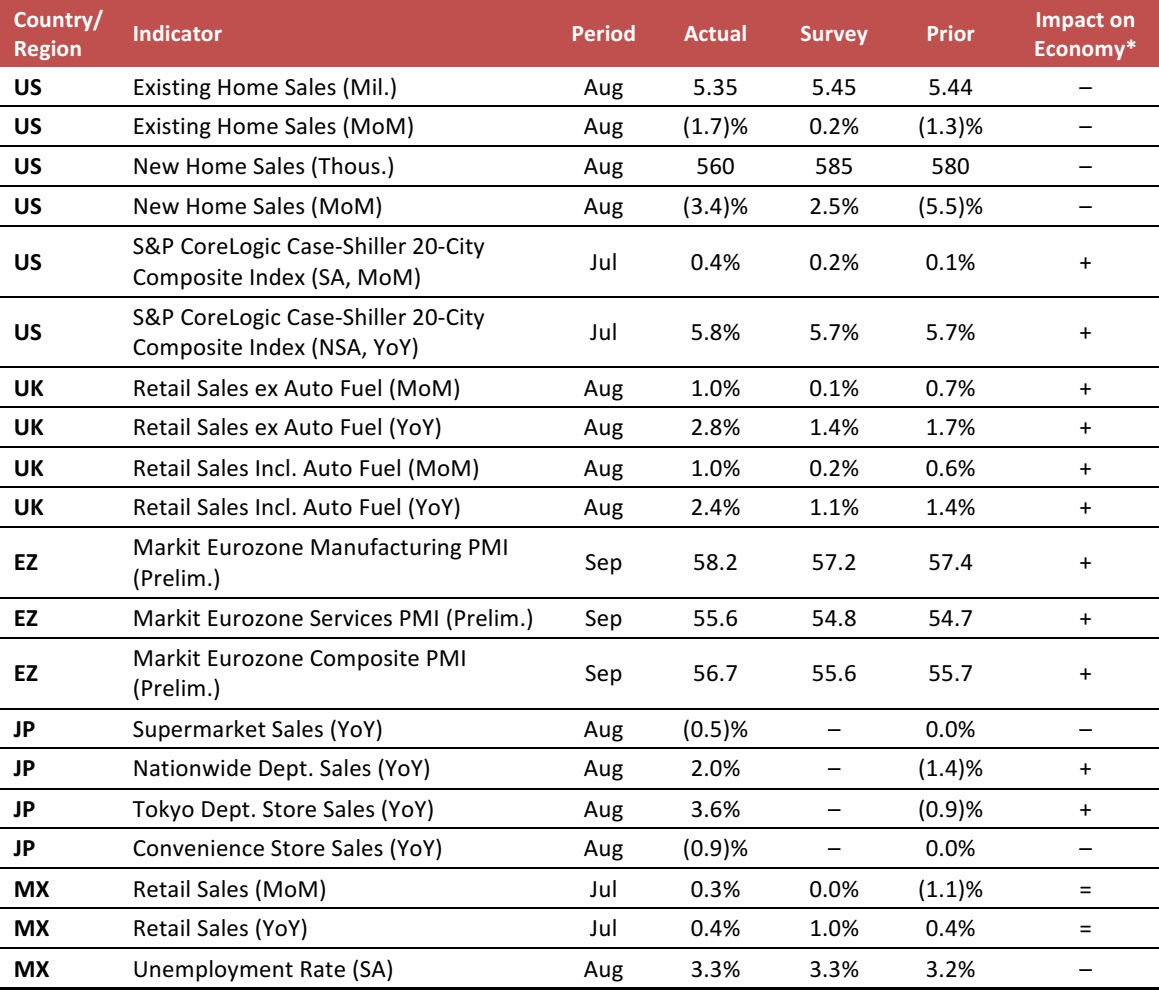

Key points from global macro indicators released September 20–27, 2017:

- US: Existing home sales in the US totaled 5.35 million in August, down 1.7% month over month. New home sales dropped by 3.4% month over month in August, to 560,000. Housing prices increased by 5.8% year over year in July.

- Europe: In the UK, retail sales excluding auto fuel increased by 1.0% month over month and by 2.8% year over year in August. In the eurozone, the Markit Manufacturing Purchasing Managers’ Index (PMI) increased to 58.2 in September, while the Services PMI ticked up to 55.6.

- Asia-Pacific: In Japan, supermarket sales were down 0.5% year over year in August. Nationwide department store sales were up 2.0% year over year in August, while Tokyo department store sales were up 3.6% year over year.

- Latin America: In Mexico, retail sales increased by 0.3% month over month and by 0.4% year over year in July. The unemployment rate in Mexico edged up to 3.3% in August.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/S&P Dow Jones/UK Office for National Statistics/Markit/Japan Chain Stores Association/Japan Department Store Association/Japan Franchise Association/Instituto Nacional de Estadística y Geografía/FGRT

Uber Set for Talks over London Ban

(September 25) BBC.com

Uber Set for Talks over London Ban

(September 25) BBC.com

Carrefour Brasil Names Prioux to Replace Desmartis as CEO

(September 22) Kitco.com

Carrefour Brasil Names Prioux to Replace Desmartis as CEO

(September 22) Kitco.com