From the Desk of Deborah Weinswig

The Bonded + Retail Store Model: A New Way for Foreign Brands to Access the Chinese Market

The sheer size of the Chinese market makes it an extremely attractive opportunity for international brands and retailers. The country was home to 1.4 billion people in 2017, and they generated $4.6 trillion in consumer spending, according to the National Bureau of Statistics of China. The country has drawn many foreign brands and retailers in recent years, but not all of them have succeeded, and some have even elected to exit the market.

Demand for foreign products in China has remained generally robust over the past eight years. According to China’s General Administration of Customs, the country’s import value rose by 32%, to $1.8 trillion, between 2010 and 2017. Meanwhile, disposable incomes increased at a much faster rate of 90%, according to the National Bureau of Statistics of China.

At the same time, the primary business models for bringing foreign goods to China evolved. From 2005 to 2010, most Chinese shoppers used

Daigou (overseas shopping agents) to procure foreign goods on their behalf. The

Haitao model (ordering from overseas websites) was dominant from 2010 to 2014. Today, cross-border e-commerce is the primary way that foreign brands and retailers sell to Chinese consumers.

Although cross-border e-commerce may seem like the easiest and best way to test the waters in the Chinese market, the space has become quite crowded, and retailers often struggle to get noticed by Chinese shoppers without incurring substantial marketing expenses. For those foreign brands and retailers looking for a different way to access the Chinese market, there is a new model available that they can use, the Bonded + Retail Store model.

Under this model, foreign brands and retailers can ship products to authorized retail stores in China under the supervision of the country’s General Administration of Customs, in cooperation with two local supply chain companies, E-Matou and Red Star Supply Chain Technology. The products remain bonded during the process, but they go through customs clearance only once consumers have purchased them.

One major benefit of the Bonded + Retail Store model is that it enables foreign brands and retailers to move unsold inventory from bonded warehouses in China to retail stores, where the goods can be sold. Foreign brands can also more effectively market their products under this model, since shoppers are able to view and touch the products in physical stores as well as enjoy the feeling of walking out of a store with their purchase rather than having to wait for it to be delivered.

To help satisfy Chinese demand for foreign products, Shenzhen-based supply chain management companies E-Matou and Red Star partnered to establish the new model. They signed a joint venture agreement in August to bring products from Hong Kong and foreign companies into the Chinese market under this new model, and the Chinese government has approved the system. The Bonded + Retail Store model covers bonded areas (geographic areas where bonded warehouses are located) and pilot free trade zones (geographic areas with freer trade policies), which are typically located near ports and international hubs, far from residential areas.

The model can be considered an extension of the cross-border e-commerce model, in that it effectively expands bonded areas to retail locations in city centers, while also leveraging the favorable political treatment enjoyed by free trade zones. E-Matou and Red Star use supply chain technology to enable their network of retail locations to function as an extension of a bonded area. Their platforms integrate a customs monitoring system with warehouse management systems to ensure products are traceable by authorities. This integration streamlines the customs and quarantine process and allows goods to be inspected and then sold before taxes are levied, eliminating the need for authorities to conduct multiple inspections.

Cross-border e-commerce has not been a panacea for all foreign brands and retailers, and Chinese import models continue to evolve. The Bonded + Retail Store model is the latest step in this evolution, efficiently combining cross-border e-commerce, in-store shopping, the purchase of bonded goods and the in-store collection of those goods.

US RETAIL & TECH HEADLINES

Walmart Using VR for Staff Training in All US Stores

(September 24) EssentialRetail.com

Walmart Using VR for Staff Training in All US Stores

(September 24) EssentialRetail.com

- Grocer Walmart is using virtual reality (VR) technology for staff training across its entire US store portfolio. Oculus VR headsets were originally introduced for employee training and development purposes at Walmart Academies and have now been deployed in all stores.

- More than 1 million Walmart associates will now receive the same level of training as those in the Walmart Academies. There will be four VR headsets in every Walmart Supercenter and two in every Neighborhood Market and discount store, meaning that there will be more than 17,000 Oculus Go headsets in use at the retailer by the end of 2018.

Retailers Warn of Price Hikes as China Tariffs Take Hold

(September 24) RetailDive.com

Retailers Warn of Price Hikes as China Tariffs Take Hold

(September 24) RetailDive.com

- Several US retailers are warning that prices are likely to rise on at least some goods as new tariffs on Chinese imports take effect. The chief executives of Walmart, Target, Gap Inc. and Best Buy, among others, have warned in recent weeks that price hikes are unavoidable.

- Tariffs on some $200 billion worth of Chinese imports took effect Monday. The duties are set at 10%, but will rise to 25% at the beginning of next year, according to the US Trade Representative.

Amazon’s Smart Microwave Is a Trojan Horse

(September 21) Vox.com

Amazon’s Smart Microwave Is a Trojan Horse

(September 21) Vox.com

- At a surprise press event in Seattle, Amazon announced its first-ever kitchen appliance. The Amazon microwave will cost $60, ship starting November 14 and take commands via Amazon’s Alexa voice assistant.

- It doesn’t sound very exciting, but, per The Verge, it’s “effectively a demo for [Alexa] Connect Kit,” a module that other companies can affix to their normal, nonsmart appliances to enable Alexa to talk to them.

US Retailers Struggling to Fill Holiday Jobs

(September 18) FoxBusiness.com

US Retailers Struggling to Fill Holiday Jobs

(September 18) FoxBusiness.com

- US retailers, struggling to fill jobs for the holiday season, are offering extra perks to attract workers. The retail sector is seeing a sizable amount of job openings in 2018, with 757,000 available in July, an estimated 100,000 more than a year before.

- The Bureau of Labor Statistics reports that the number of open jobs overall surpassed the number of people hired between March and June.

Amazon Will Consider Opening Up to 3,000 Cashierless Stores by 2021

(September 19) Bloomberg.com

Amazon Will Consider Opening Up to 3,000 Cashierless Stores by 2021

(September 19) Bloomberg.com

- com is considering a plan to open as many as 3,000 new Amazon Go cashierless stores in the next few years, an aggressive expansion that would threaten convenience chains, quick-service sandwich shops, and mom-and-pop pizzerias and taco trucks.

- The company unveiled its first cashierless store near its headquarters in Seattle in 2016 and has since announced two additional sites in Seattle and one in Chicago. Two of the new stores offer only a limited selection of salads, sandwiches and snacks.

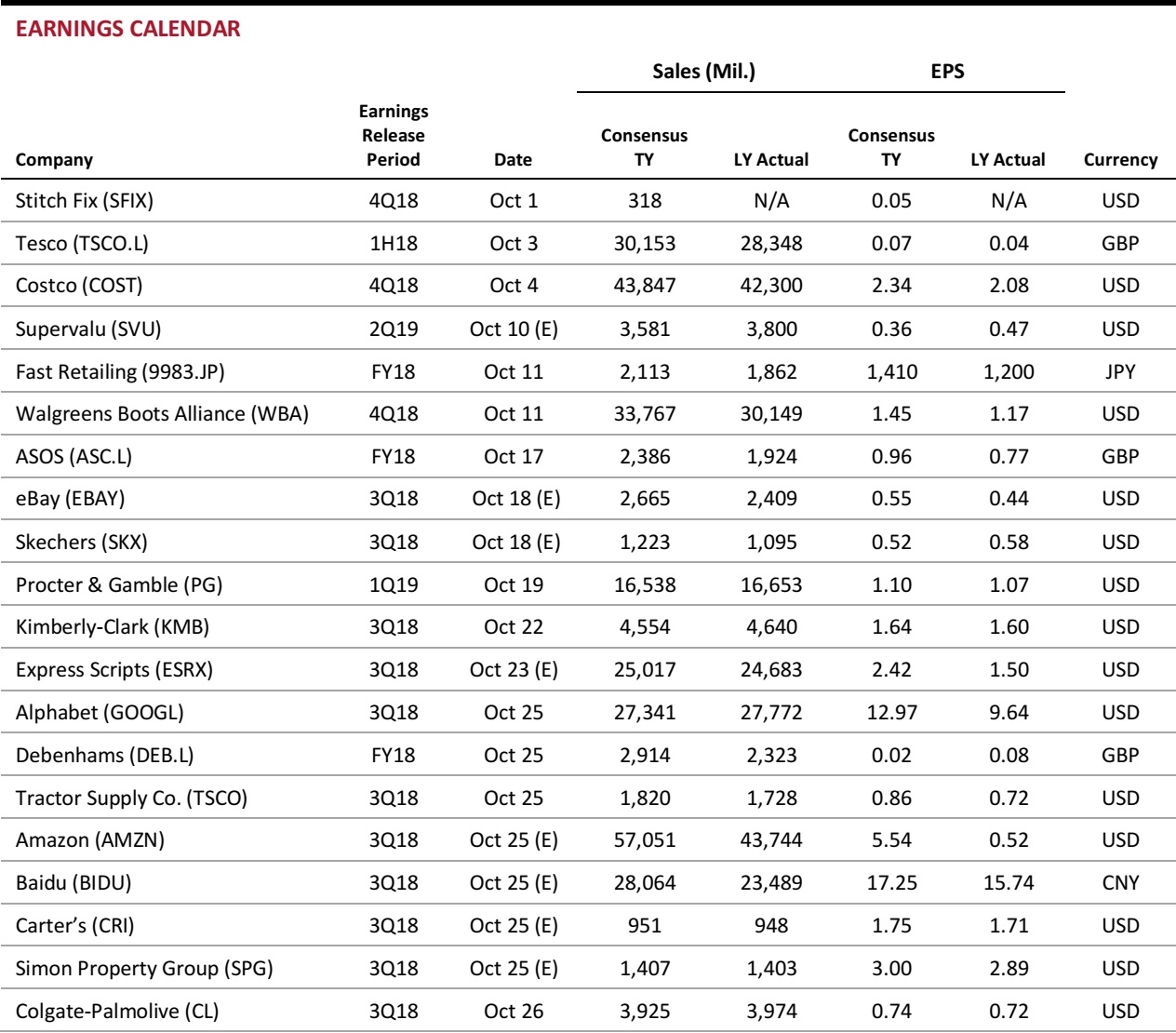

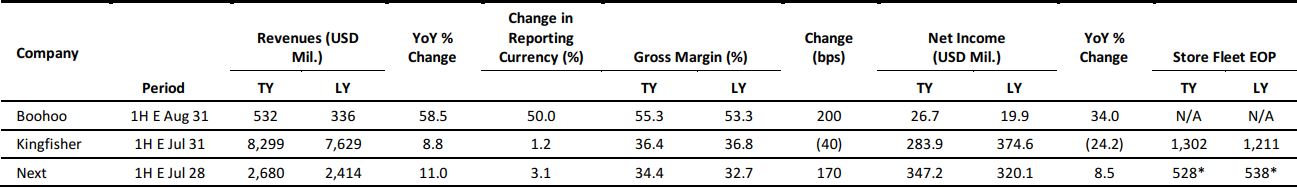

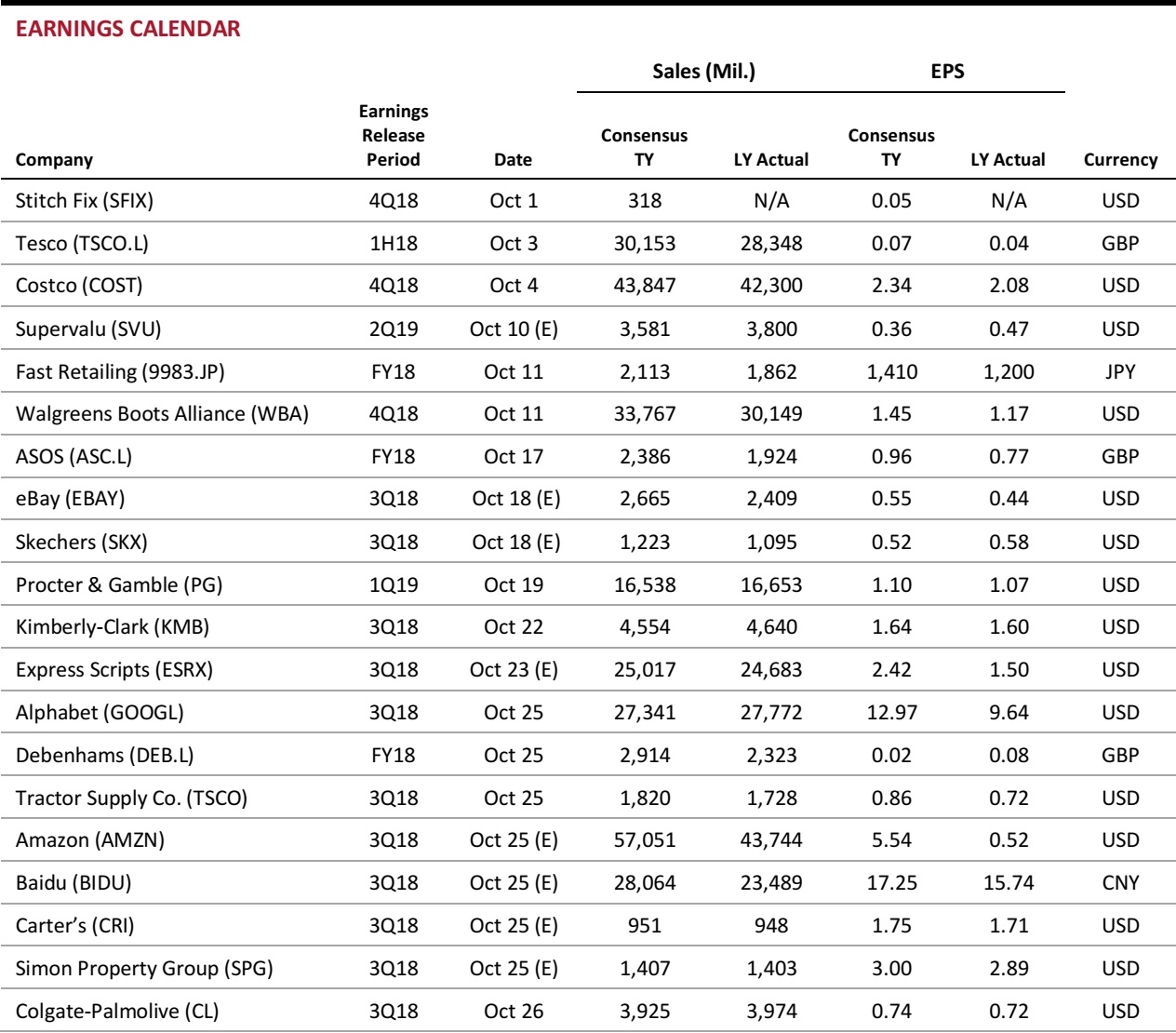

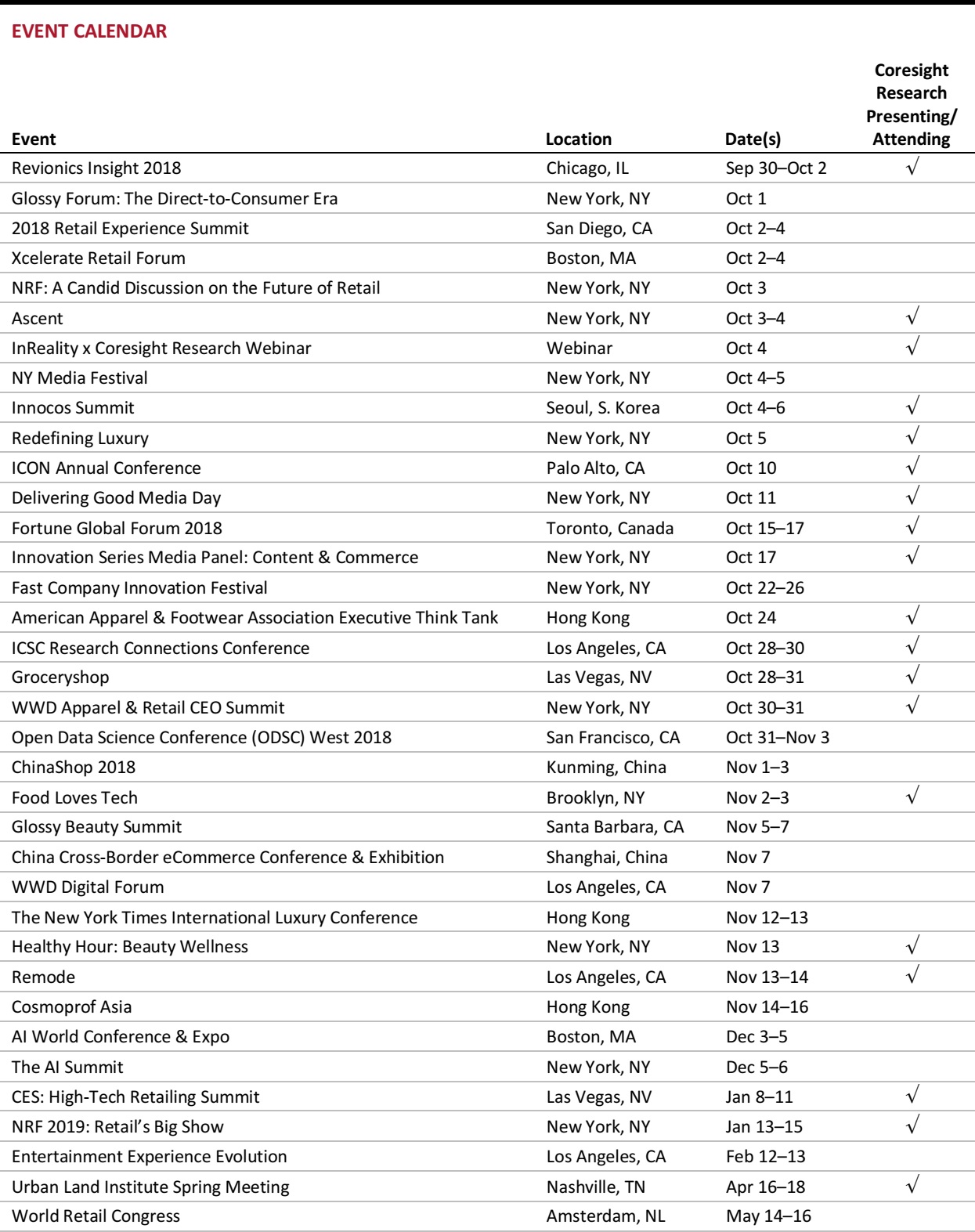

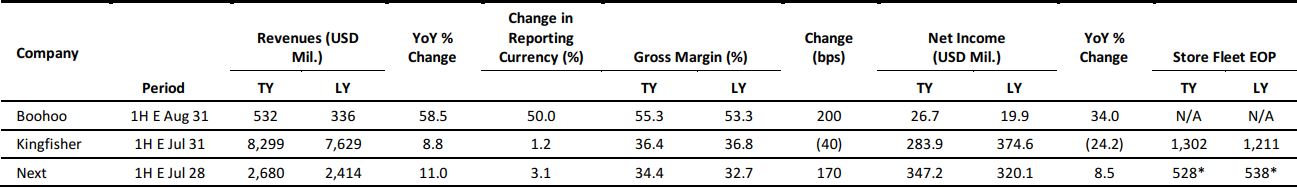

EUROPE RETAIL EARNINGS

*Store numbers are as of the end of fiscal years 2017 and 2016.

Source: Company reports/Coresight Research

*Store numbers are as of the end of fiscal years 2017 and 2016.

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Groupe Casino Claims It Rejected Carrefour Merger Approach, Carrefour Denies Story

(September 24) Company press releases

Groupe Casino Claims It Rejected Carrefour Merger Approach, Carrefour Denies Story

(September 24) Company press releases

- French grocery and nonfood retailer Groupe Casino said on September 24 that it had been approached by Carrefour over the past few days regarding a potential merger and that its “board unanimously decided to reject Carrefour’s approach.”

- Multinational retailer Carrefour, however, denied in a statement on the same day that such an approach even took place and added that it “is reviewing its legal options in order to stop these [u]nacceptable innuendoes.”

Michael Kors to Acquire Versace for $2.1 Billion

(September 25) CNBC.com

Michael Kors to Acquire Versace for $2.1 Billion

(September 25) CNBC.com

- American fashion retailer Michael Kors is set to acquire Italian luxury fashion company Versace for a reported $2.1 billion, including debt. The acquisition is expected to provide Michael Kors with a launch pad into the European high-end luxury market.

- Michael Kors will change its name to Capri Holdings after the acquisition is completed.

Delhaize Introduces New Concept Store in Belgium

(September 24) ESMMagazine.com

Delhaize Introduces New Concept Store in Belgium

(September 24) ESMMagazine.com

- Dutch retailer Ahold Delhaize announced the launch of a new concept supermarket that offers fresh, ready-to-eat meals and an assortment of digital services.

- The retailer intends to open a further nine outlets with the same format by the end of 2018 and an additional 36 by the end of 2019.

River Island Profits Plunge amid Investments in Modernization

(September 24) RetailGazette.co.uk

River Island Profits Plunge amid Investments in Modernization

(September 24) RetailGazette.co.uk

- British high-street fashion brand River Island reported a 3% decline in sales and a 40% decline in profits in the year ended December 2017. The company said that the declines were due to significant investments in distribution, technology and stock that aimed to help the company keep pace with the changing retail environment.

- “Despite some of the challenges, we have a strong belief in what we are doing, our brand and product proposition, and we are investing in the changes taking place in consumer behaviors to make sure that we stay at the forefront of customers’ minds,” said Ben Lewis, CEO of the privately owned fashion brand.

House of Fraser Set to Close Three Stores

(September 24) TheRetailBulletin.com

House of Fraser Set to Close Three Stores

(September 24) TheRetailBulletin.com

- British department store chain House of Fraser announced that it will be closing three stores, in Edinburgh, Hull and Swindon. Sports Direct recently purchased House of Fraser out of administration for £90 million ($118 million), and Sports Direct boss Mike Ashley has apportioned blame for the store closures on “greedy landlords.”

- Under the original company voluntary arrangement, House of Fraser planned to close 31 of its 59 stores. So far, some 20 stores have been saved from closure.

ASIA RETAIL & TECH HEADLINES

Amazon and Samara Capital Jointly Acquire Grocery Retailer More

(September 25) RetailNews.Asia

Amazon and Samara Capital Jointly Acquire Grocery Retailer More

(September 25) RetailNews.Asia

- Private equity company Samara Capital and e-commerce giant Amazon have combined to complete the acquisition of More, India’s fourth-largest supermarket chain.

- The value of the deal has not been disclosed, but a source close to the deal reportedly put it at around INR 42 billion ($584 million).

JD Introduces Grocery Delivery Service in Indonesia

(September 19) InsideRetail.Asia

JD Introduces Grocery Delivery Service in Indonesia

(September 19) InsideRetail.Asia

- Chinese e-commerce behemoth JD has launched a new online service called JDVirtual that enables customers in Indonesia to purchase groceries for home delivery using QR codes. The service is available at Commuter Line train stations in the Greater Jakarta area.

- ID app users can make immediate purchases using the JDVirtual codes. “We believe that [the] JDVirtual…borderless shopping concept will provide a real solution for [the] modern retail industry, while also helping to [fulfill] our mandate to help bring Indonesia forward,” said Zhang Li, JD.ID’s President Director.

GS25 Launches Cashierless Store in Seoul that Leverages Facial Recognition Technology

(September 18) KoreaJoongAngDaily.com

GS25 Launches Cashierless Store in Seoul that Leverages Facial Recognition Technology

(September 18) KoreaJoongAngDaily.com

- South Korean convenience store chain GS25 has launched a cashierless store in Seoul that utilizes face-recognizing cameras to facilitate payments.

- The company’s first staffless store opened at the Seoul headquarters of electronic systems provider LG CNS on September 18 and is currently accessible only by LG CNS staff.

Careem Hires India-Based Tech Team

(September 18) Inc42.com

Careem Hires India-Based Tech Team

(September 18) Inc42.com

- Dubai-headquartered transportation network company Careem has roped in the team behind Indian bus-shuttle service Commut to handle its technology solutions.

- Commut’s operations in India will be taken over by its rival, Shuttl.

LATAM RETAIL & TECH HEADLINES

WHSmith Launches First of Seven Stores at Galeão International Airport

(September 20) TRBusiness.com

WHSmith Launches First of Seven Stores at Galeão International Airport

(September 20) TRBusiness.com

- British retailer WHSmith has opened its first South American store, at Galeão International Airport in Rio de Janeiro. The company is due to open six more stores at the airport.

- WHSmith struck an agreement with Duty Free Americas to open the stores earlier this year. Books, magazines, travel accessories, souvenirs, confectionery and beverages will be among the items available for purchase.

Asics Launches Operations in Bolivia via Fair Play

(September 20) Peru-Retail.com

Asics Launches Operations in Bolivia via Fair Play

(September 20) Peru-Retail.com

- Japanese footwear and sports equipment retailer Asics has begun operating in Bolivia through a partnership with Bolivian sports fashion chain Fair Play.

- Asics will sell its products in 10 Fair Play stores based in La Paz, Santa Cruz de la Sierra, Cochabamba, Tarija and Sucre.

Retail Sector in Peru to Surpass $11,450 Million in Sales by End of 2018

(September 20) AmericaEconomia.com

Retail Sector in Peru to Surpass $11,450 Million in Sales by End of 2018

(September 20) AmericaEconomia.com

- Retail sector sales in Peru are expected to grow by 6% this year, to more than 38,000 million soles ($11,456 million), according to projections made by the country’s Ministry of Production.

- The ministry also stated that retail sales for the first seven months of the year had grown by 8.4% versus the same period in 2017.

Stanton Plans 30 Openings Across Colombia

(September 20) America-Retail.com

Stanton Plans 30 Openings Across Colombia

(September 20) America-Retail.com

- Colombian footwear conglomerate Stanton, the owner of the Brahma, Aeroflex, Ibiza, Solimar and Baxter brands, is expected to open around 30 stores in Colombia by the end of 2019.

- The retailer, which also has an international presence, primarily in Chile and Mexico, has not divulged details regarding which cities will host the announced 30 outlets.

Maaji and Rapsodia Forge Alliance

(September 20) America-Retail.com

Maaji and Rapsodia Forge Alliance

(September 20) America-Retail.com

- Colombian swimwear retailer Maaji and Argentinian fashion retailer Rapsodia are entering into a partnership to introduce a joint collection under the name “Midnight Blossoms.”

- The joint collection will be available for sale before the year-end.

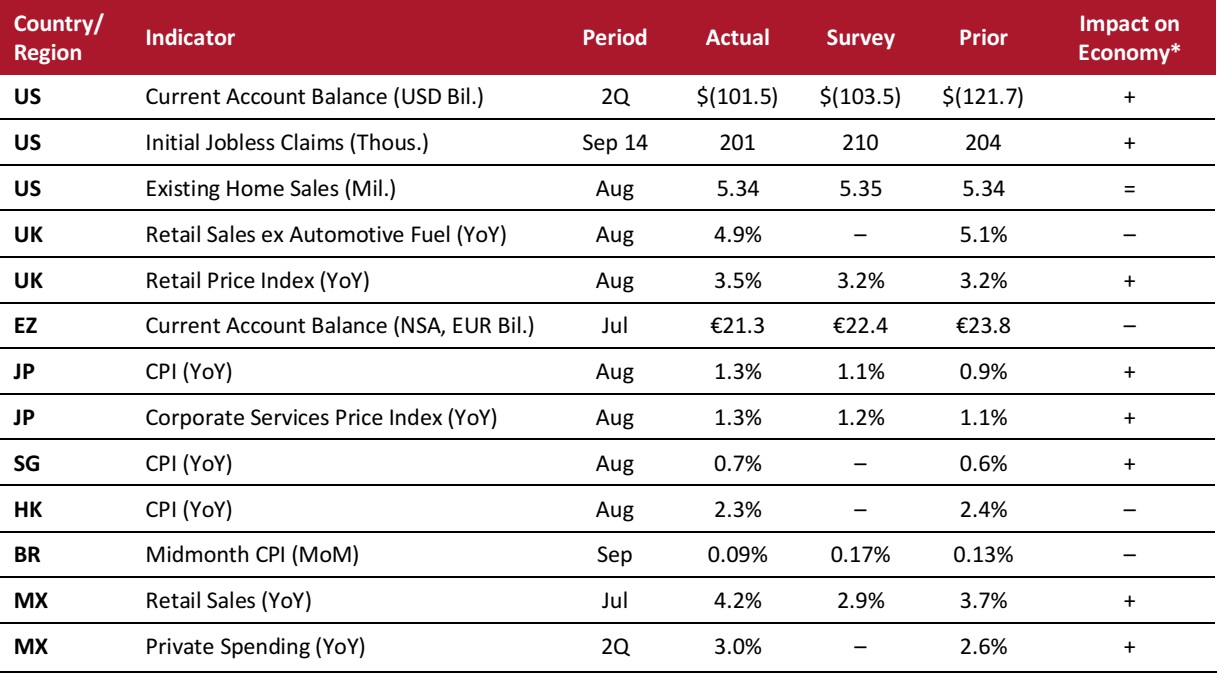

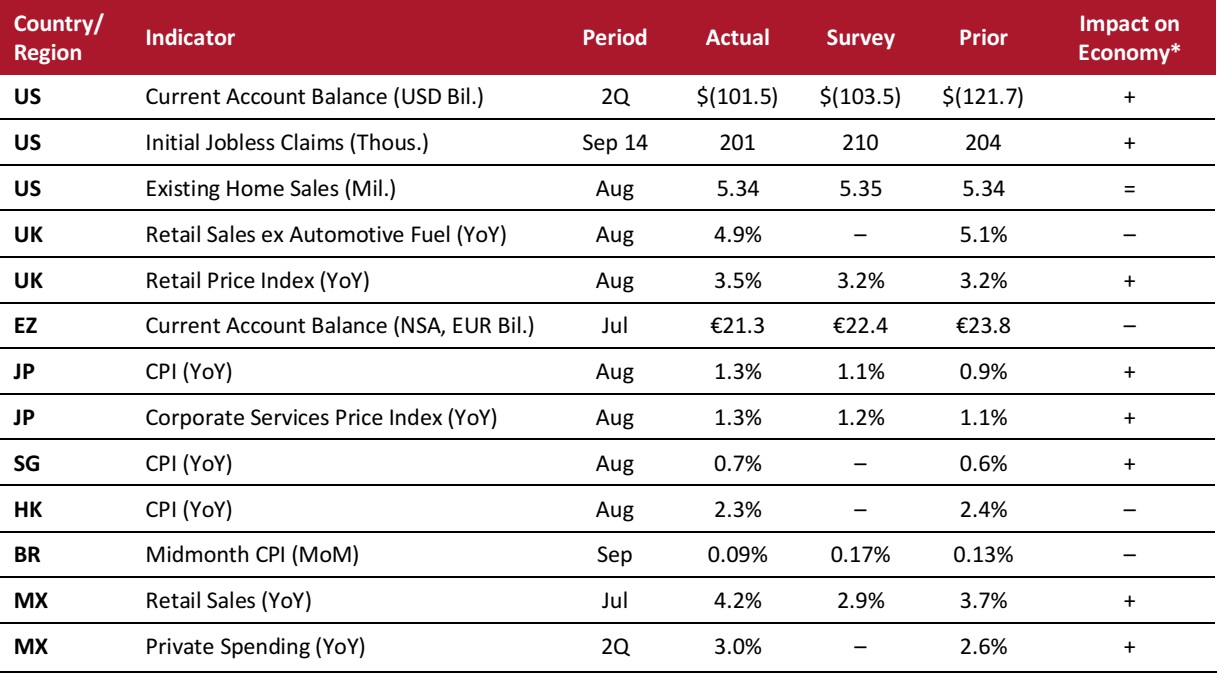

MACRO UPDATE

Key points from global macro indicators released September 19–25, 2018:

- US: Thecurrent account balance reflected a deficit of $101.5 billion in the second quarter, compared with a $121.7 billion deficit recorded for the first quarter. In the week ended September 14, initial jobless claims fell to 201,000, which was far below the consensus estimate of 210,000.

- Europe: In the UK, retail sales grew by 4.9% year over year in August, a slightly lower increase than the 5.1% registered in July. In the eurozone, the current account balance reflected a surplus of €21.3 billion in July, down from €23.8 billion in June.

- Asia-Pacific: In Japan, the Consumer Price Index (CPI) rose by 1.3% year over year in August,with the increase exceeding the previous month’s 0.9%. In Singapore, the CPI increased marginally in August, rising by 0.7% year over year versus 0.6% in July.

- Latin America: Brazil’s Midmonth CPI rose by 0.09% in September, compared with the previous month’s increase of 0.13%. In Mexico, retail sales increased by 4.2% year over year in July, comfortably ahead of analysts’ estimates.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/US Department of Labor/National Association of Realtors/UK Office for National Statistics/European Commission/Japan Statistics Bureau/Bank of Japan/Singapore Department of Statistics/Hong Kong Census and Statistics Department/Instituto Brasileiro de Geografía e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/US Department of Labor/National Association of Realtors/UK Office for National Statistics/European Commission/Japan Statistics Bureau/Bank of Japan/Singapore Department of Statistics/Hong Kong Census and Statistics Department/Instituto Brasileiro de Geografía e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Retailers Warn of Price Hikes as China Tariffs Take Hold

(September 24) RetailDive.com

Retailers Warn of Price Hikes as China Tariffs Take Hold

(September 24) RetailDive.com

US Retailers Struggling to Fill Holiday Jobs

(September 18) FoxBusiness.com

US Retailers Struggling to Fill Holiday Jobs

(September 18) FoxBusiness.com

*Store numbers are as of the end of fiscal years 2017 and 2016.

Source: Company reports/Coresight Research

*Store numbers are as of the end of fiscal years 2017 and 2016.

Source: Company reports/Coresight Research Groupe Casino Claims It Rejected Carrefour Merger Approach, Carrefour Denies Story

(September 24) Company press releases

Groupe Casino Claims It Rejected Carrefour Merger Approach, Carrefour Denies Story

(September 24) Company press releases

Michael Kors to Acquire Versace for $2.1 Billion

(September 25) CNBC.com

Michael Kors to Acquire Versace for $2.1 Billion

(September 25) CNBC.com

Delhaize Introduces New Concept Store in Belgium

(September 24) ESMMagazine.com

Delhaize Introduces New Concept Store in Belgium

(September 24) ESMMagazine.com

Amazon and Samara Capital Jointly Acquire Grocery Retailer More

(September 25) RetailNews.Asia

Amazon and Samara Capital Jointly Acquire Grocery Retailer More

(September 25) RetailNews.Asia

GS25 Launches Cashierless Store in Seoul that Leverages Facial Recognition Technology

(September 18) KoreaJoongAngDaily.com

GS25 Launches Cashierless Store in Seoul that Leverages Facial Recognition Technology

(September 18) KoreaJoongAngDaily.com

Asics Launches Operations in Bolivia via Fair Play

(September 20) Peru-Retail.com

Asics Launches Operations in Bolivia via Fair Play

(September 20) Peru-Retail.com

Maaji and Rapsodia Forge Alliance

(September 20) America-Retail.com

Maaji and Rapsodia Forge Alliance

(September 20) America-Retail.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/US Department of Labor/National Association of Realtors/UK Office for National Statistics/European Commission/Japan Statistics Bureau/Bank of Japan/Singapore Department of Statistics/Hong Kong Census and Statistics Department/Instituto Brasileiro de Geografía e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/US Department of Labor/National Association of Realtors/UK Office for National Statistics/European Commission/Japan Statistics Bureau/Bank of Japan/Singapore Department of Statistics/Hong Kong Census and Statistics Department/Instituto Brasileiro de Geografía e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research