From the Desk of Deborah Weinswig

Toys“R”Us Files for Bankruptcy: Why? And What Does It Mean?

Retail giant Toys“R”Us filed for voluntary Chapter 11 bankruptcy protection in the US and Canada this week, and the news furthered the popular narrative of a “retail apocalypse” in the US. The bankruptcy proceedings do not affect the company’s operations outside the US and Canada.

Toys“R”Us has been reporting weak top-line numbers in its domestic market:

- Comparable sales in the US market were down 2.3% in the fourth quarter of fiscal 2016 (which included the crucial holiday period), due to poor sales in the entertainment and baby categories. However, the group operating margin stood at 10.3% in the quarter, up from 9.2% one year earlier.

- In the first quarter of fiscal 2017 (latest), performance worsened, with domestic comps down 6.2%. Group operating losses deepened significantly, to $54 million from $7 million a year earlier.

- In both quarters, the company’s international business performed better than its US operations, and the company noted positive sales growth in the Asia-Pacific region in the first quarter of fiscal 2017.

Toys“R”Us noted this week that the vast majority of its stores remain profitable, and that its stores will remain open during the bankruptcy proceedings. Management stated that the objective of this filing is to restructure the company’s $5 billion of long-term debt in order to provide Toys“R”Us with “greater financial flexibility to invest” in its business. “This debt has held us back from making the investments we need to compete effectively in what has become an increasingly challenging and rapidly changing retail marketplace,” CEO Dave Brandon said. As of April 29, 2017, Toys“R”Us had long-term debt on its balance sheet totaling more than $5.2 billion, $444 million of which is due next year. Much of the debt is the legacy of a $6.6 billion leveraged buyout, led by Bain Capital, KKR Group and Vornado Realty Trust, back in 2005.

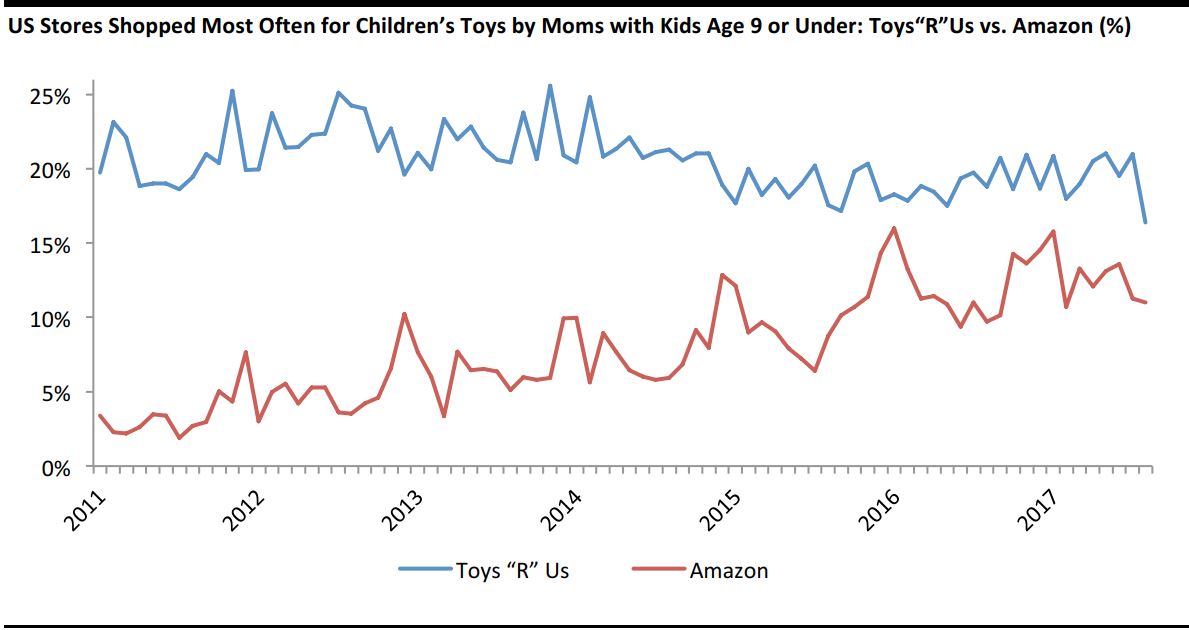

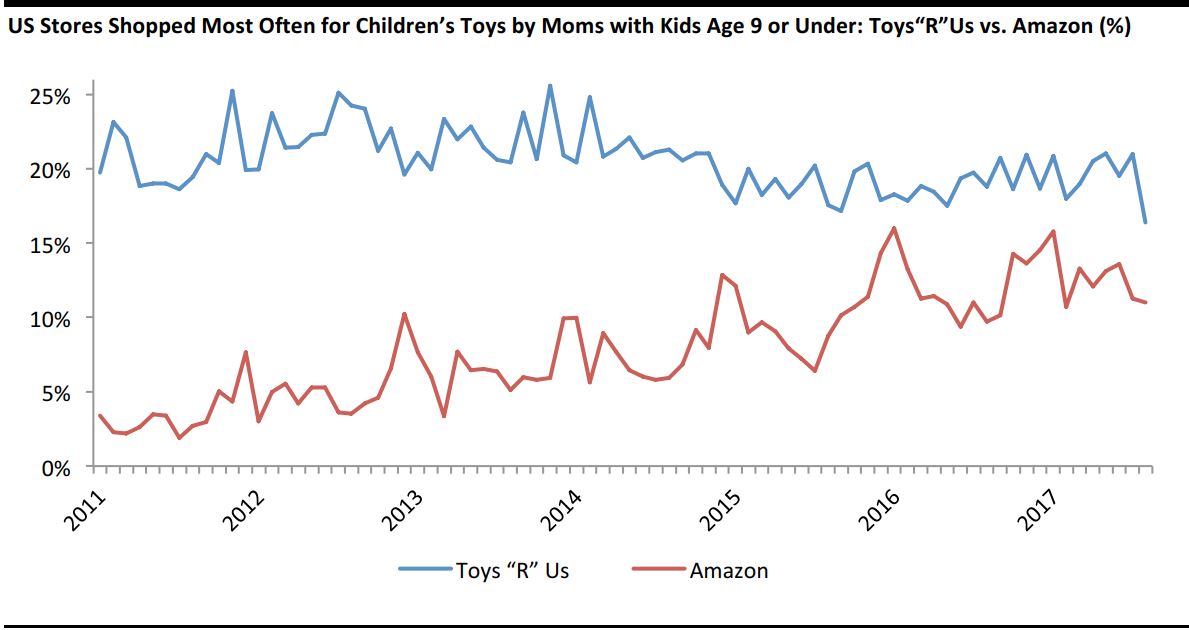

The Challenge: Investing to Compete with Amazon

Like most brick-and-mortar retailers, Toys“R”Us has faced heightened competition from Amazon. Survey data from Prosper Insights & Analytics, charted below, show a steady increase in the number of mothers with young children who rate Amazon as the store they shop most often for toys. By this measure, Toys“R”Us has seen some softening over the medium term. Back in 2013, between one-quarter and one-fifth of such mothers said Toys“R”Us was where they shopped most often for toys, and the lowest level recorded in Prosper’s monthly surveys that year was 20.0%. As of this year, however, that rate has dropped to between one-sixth and one-fifth of mothers with young children, and it reached a low of 16.4% in August (latest).

Base: Between 555 and 1,235 US Internet-using moms with kids age 9 or under in each monthly survey

Source: Prosper Insights & Analytics

The bankruptcy filing by Toys“R”Us looks to have been driven by the pressures exerted by such competition: the company’s communications this week have stressed that Toys“R”Us needs to invest in its business in order to improve its proposition and strengthen its competitive position. So, even if a loss of customers to Amazon has not directly caused these bankruptcy proceedings, the pressures of competing with the Internet giant look to have prompted the filing indirectly.

US RETAIL & TECH HEADLINES

Toys“R”Us Seeks Bankruptcy to Survive Retail Upheaval

(September 19) CNBC.com

Toys“R”Us Seeks Bankruptcy to Survive Retail Upheaval

(September 19) CNBC.com

- Toys “R” Us, the largest US toy store chain, which filed for bankruptcy late Monday, will ask a judge for permission to borrow money so that it can start paying suppliers to ensure it has LEGO building blocks and Barbie dolls for the holiday season.

- The Chapter 11 filing, to restructure $5 billion of long-term debt, is among the largest ever by a specialty retailer and casts doubt over the future of the company’s 64,000 employees and nearly 1,600 stores, which will remain open.

Retailers Boost Holiday Hires in Stores to Help Tackle Online Sales

(September 19) Reuters.com

Retailers Boost Holiday Hires in Stores to Help Tackle Online Sales

(September 19) Reuters.com

- Major retailers are looking to stimulate anemic sales by hiring thousands more workers this holiday season to improve customer service on their sales floors and handle the fast-growing use of their stores to fulfill online orders.

- The move comes as several analysts note that retailers have lost sight of basic in-store customer needs as they have scrambled in recent years to compete better with Amazon by cutting costs through store closures, offering more markdowns and pouring millions into building out e-commerce platforms.

Retailers Say US “Must Compete” on Corporate Tax Rate

(September 19) National Retail Federation press release

Retailers Say US “Must Compete” on Corporate Tax Rate

(September 19) National Retail Federation press release

- The National Retail Federation (NRF) told Congress that lawmakers need to lower the nation’s corporate tax rate in order to remain competitive in the global economy and keep high taxes from hampering job creation.

- NRF Senior Vice President for Government Relations David French called tax reform “vitally important to the US economy,” saying it would “have an immediate positive impact on economic growth, real wages and consumer spending” and that “the US economy cannot thrive when we have the highest corporate tax rate in the industrialized world.”

Kohl’s to Start Accepting Amazon Returns at Some Stores

(September 19) U.S. News & World Report

Kohl’s to Start Accepting Amazon Returns at Some Stores

(September 19) U.S. News & World Report

- Kohl’s, which is opening some in-store Amazon shops, will start accepting returns for the online retailer at some of its stores in Los Angeles and Chicago starting next month. Kohl’s said it will pack and ship eligible Amazon return items for free at the 82 stores offering the service.

- The department store had previously announced plans to open 1,000-square-foot Amazon areas in 10 of its stores in Chicago and Los Angeles that will sell Amazon Echos, Fire tablets and other gadgets.

Walgreens’ $4.4 Billion Deal to Buy Rite Aid Stores Gets US Approval

(September 19) Chicago Tribune

Walgreens’ $4.4 Billion Deal to Buy Rite Aid Stores Gets US Approval

(September 19) Chicago Tribune

- In its fourth attempt, Walgreens Boots Alliance clinched regulatory approval for a deal to buy Rite Aid stores after a last-minute reduction in the number of stores and price. The Deerfield-based drugstore chain said Tuesday that it had secured clearance for a revised deal under which it will buy 1,932 Rite Aid stores for $4.38 billion. That is about 250 fewer stores than under a previous proposal, which totaled $5.18 billion.

- The modified agreement, while reduced, will still enable Walgreens to dramatically expand its footprint and become a more powerful competitor of CVS. With the addition of the Rite Aid stores, Walgreens will have about 10,000 locations in the US.

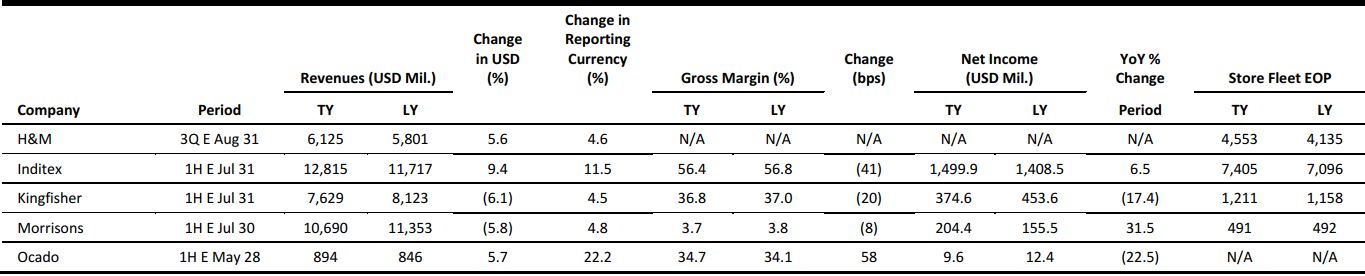

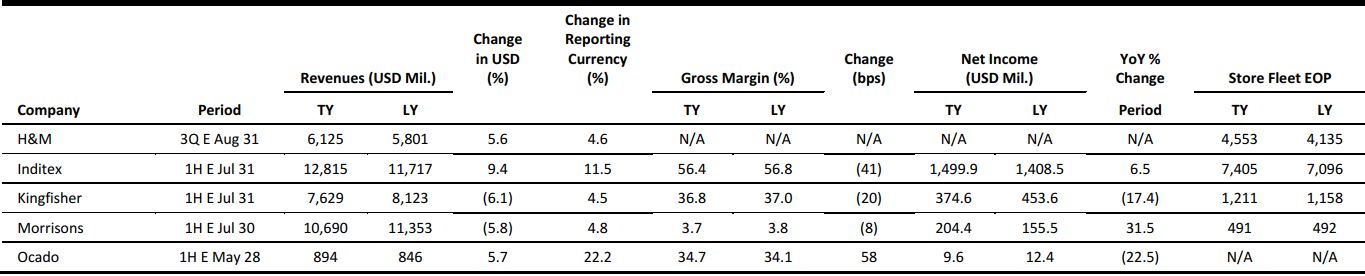

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

EUROPE RETAIL HEADLINES

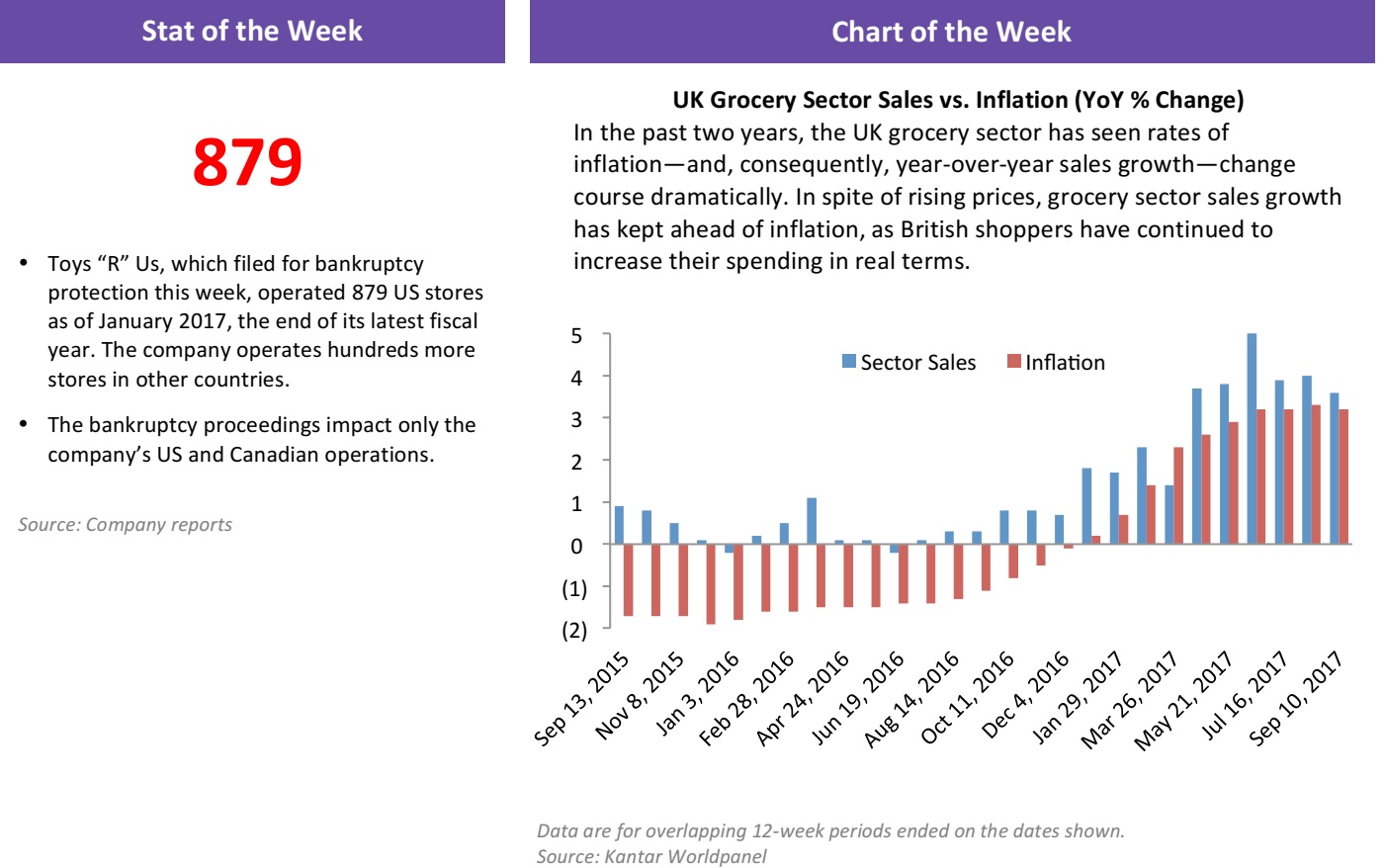

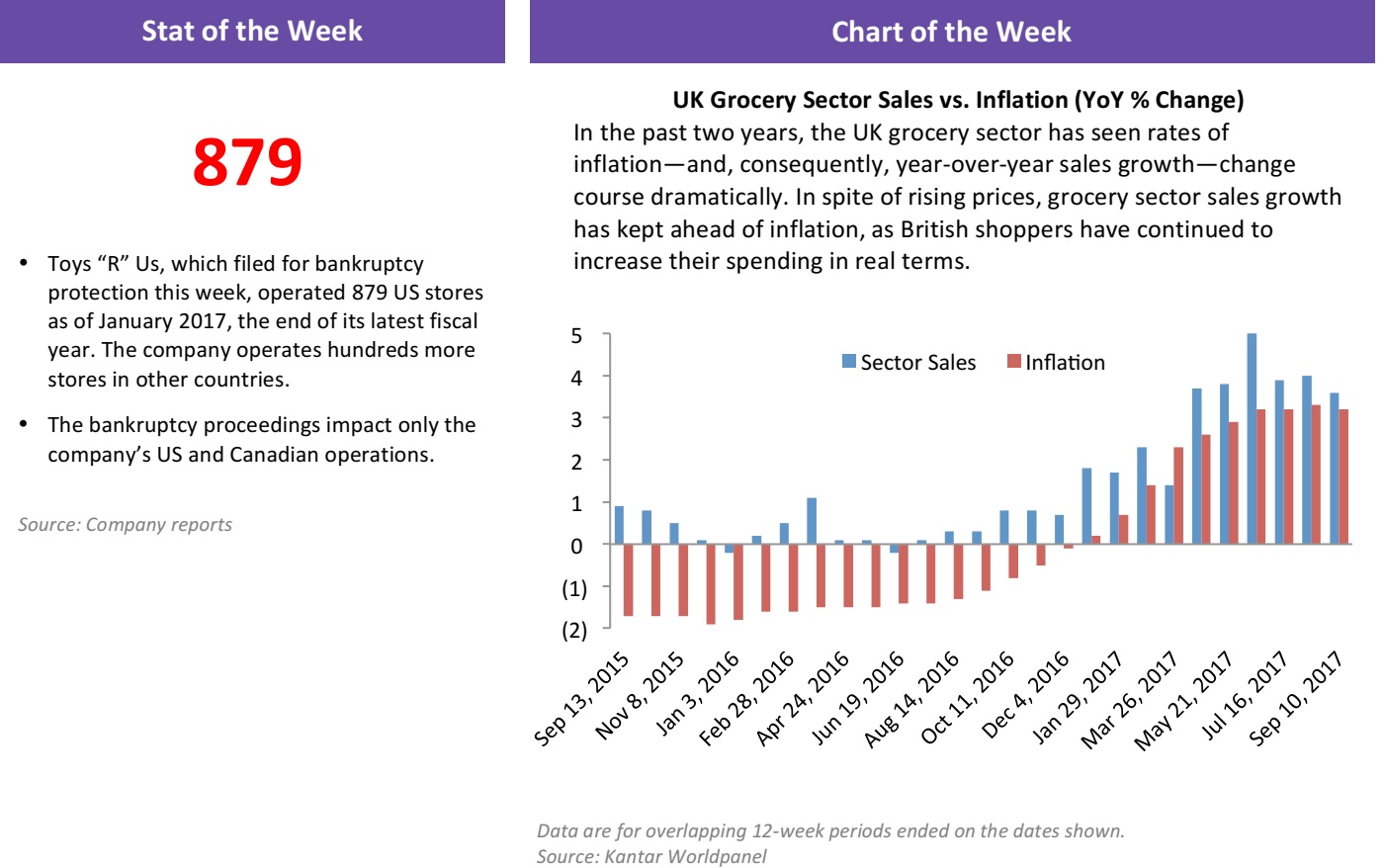

UK Grocery Sales Rise in September

(September 19) Kantar Worldpanel press release

UK Grocery Sales Rise in September

(September 19) Kantar Worldpanel press release

- British grocery sales rose by 3.6% in the 12 weeks ended September 10, 2017, according to the latest data from consumer insights firm Kantar Worldpanel. The increase was fueled by a 1.5% rise in the volume of goods sold as well as by higher inflation, the firm said.

- Lidl and Aldi saw their market shares rise by 70 basis points year over year, to 5.3% and 6.9%, respectively. Market shares of the big four grocers shrank during the period, with market leader Tesco’s share contracting by 30 basis points, to 27.8%.

French Connection’s Losses Narrow in 1H18

(September 19) Company press release

French Connection’s Losses Narrow in 1H18

(September 19) Company press release

- British fashion retailer French Connection posted a group revenue decline of 4.2% at constant currency in the first half of fiscal 2018, to £68.1 million (US$91.9 million). Excluding currency effects, wholesale revenues grew by 2.6%, while retail sales dropped by 8.7%. Retail comps declined by 1.0% compared with a 6.5% rise during the same period last year.

- After several months of difficult trading, the company’s losses narrowed by £2.2 million (US$3.0 million). Chief Executive Stephen Marks noted that retail sales were up in the early part of the first-half trading period and that French Connection is working to return to profitability “in the near future.”

Kurt Geiger’s Sales and Profits Rise in FY17

(September 18) RetailGazette.co.uk

Kurt Geiger’s Sales and Profits Rise in FY17

(September 18) RetailGazette.co.uk

- European premium footwear retailer Kurt Geiger saw revenues jump 12%, to £330 million (US$445 million), in the fiscal year ended January 28, 2017. Comparable sales as well as EBITDA grew by 11%. Online sales bounced by 26% and accounted for 23% of group sales.

- The company acknowledged strong performance across its brands, particularly in its women’s fashion trainer business, which grew by 48%. Chief Executive Neil Clifford remarked that “Kurt Geiger is well placed to deliver another year of growth and innovation.”

Amazon Trials One-Hour Delivery During London Fashion Week

(September 19) Retail-Week.com

Amazon Trials One-Hour Delivery During London Fashion Week

(September 19) Retail-Week.com

- Amazon UK is trialing express delivery of on-trend clothing during London Fashion Week. It has partnered with Italian-Japanese fashion director Nicola Formichetti to deliver ranges from his Nicopanda collection to shoppers’ homes within one hour.

- The “see-now, buy-now” collection is available to London shoppers via Amazon Prime Now for delivery within an hour. Customers across Europe can also order products through Prime Now for next-day delivery.

iZettle Raises $36 Million from the European Investment Bank (EIB)

(September 19) TechCrunch.com

iZettle Raises $36 Million from the European Investment Bank (EIB)

(September 19) TechCrunch.com

- Swedish startup iZettle, a fintech company for small businesses, has raised $36 million from the EIB, the lending arm of the EU. iZettle said it will use the new funds to build its strength in artificial intelligence and other emerging technologies.

- The EIB has been funding several startups through the European Fund for Strategic Investments, part of the Investment Plan for Europe formulated to promote the region’s technology sector and improve its business environment.

ASIA TECH HEADLINES

Tencent Tried to Buy Spotify Earlier This Year

(September 15) TechCrunch.com

Tencent Tried to Buy Spotify Earlier This Year

(September 15) TechCrunch.com

- Spotify has long been linked with going public in the US—it is speculated to be preparing for an IPO-less listing next year—but it has emerged that the company rebuffed the opportunity to sell earlier this year to a major tech name, Tencent, the Chinese Internet giant valued at $380 billion.

- Tencent is said to have approached Spotify regarding an acquisition as part of its effort to extend its burgeoning music business outside China and Asia. Spotify has emerged as the top music-streaming service worldwide, with more than 140 million active users and 60 million paying customers. The 11-year-old company is reportedly valued at $13 billion.

The First of China’s Top Bitcoin Exchanges Has Announced It Will Suspend Trading

(September 14) TechCrunch.com

The First of China’s Top Bitcoin Exchanges Has Announced It Will Suspend Trading

(September 14) TechCrunch.com

- A number of China’s top bitcoin exchanges are preparing to suspend their services following instructions from the government. BTC China (BTCC), one of the country’s top three exchanges, became the first to officially make the move, announcing that it will stop all trading for China-based customers beginning September 30.

- The company—China’s oldest running exchange—said that other services, including its BTCC Pool for miners, will not be impacted and will continue to run. There has been no word on when, or indeed whether, it will reintroduce trading.

SoftBank Group Will Buy a 5% Stake in ZhongAn, China’s First Online-Only Insurance Agency

(September 18) TechCrunch.com

SoftBank Group Will Buy a 5% Stake in ZhongAn, China’s First Online-Only Insurance Agency

(September 18) TechCrunch.com

- SoftBank Group has agreed to be a cornerstone investor in the IPO of ZhongAn, China’s first online-only insurance agency, on the Hong Kong Stock Exchange. SoftBank Group will buy a 5% stake in the company, or about 72 million shares, which would be worth about HK$4.08 billion, or US$522 million.

- SoftBank Group can choose to acquire the shares through one of its wholly owned subsidiaries or affiliates, including the $100 billion SoftBank Vision Fund, which is currently making waves in the venture capital ecosystem by going on an unprecedented funding spree. ZhongAn says it sold more than 7.2 billion insurance policies and served about 492 million policyholders between its founding in October 2013 and the end of last year, and it claims that those numbers make it China’s largest insurer.

Google Debuts Tez, a Mobile Payments App for India

(September 18) TechCrunch.com

Google Debuts Tez, a Mobile Payments App for India

(September 18) TechCrunch.com

- Google unveiled its first big foray into mobile payments in Asia. The Android and search giant launched Tez, a new mobile wallet that will let users in India link their phones to their bank accounts to pay for goods securely in physical stores and online. Users can also use Tez to make person-to-person money transfers.

- “Send money home to your family, split a dinner bill with friends, or pay the neighborhood chaiwala. Make all payments big or small, directly from your bank account with Tez, Google’s new digital payment app for India,” Google tells consumers on its information portal about the new app.

LATAM RETAIL AND TECH HEADLINES

Brazil Leads 4G Expansion in LatAm

(September 14) ZDNet.com

Brazil Leads 4G Expansion in LatAm

(September 14) ZDNet.com

- Brazil is the leader in the adoption of 4G across Latin America, according to new numbers from mobile operator trade body GSMA. The country ranks first in the region in terms of both absolute number of lines operating with that technology and total users.

- According to the report, 35% of all mobile lines in operation in Brazil are equipped with 4G technology. Uruguay has the same proportion of active 4G lines (35%), but its base is smaller in absolute numbers. Brazil also has the highest penetration of smartphones in the region, at 73%, according to the GSMA’s numbers.

Brazilian Government Tries to Prove E-Voting Is Safe

(September 18) ZDNet.com

Brazilian Government Tries to Prove E-Voting Is Safe

(September 18) ZDNet.com

- Brazil’s Superior Electoral Court (TSE) and the Brazilian Computer Society (SBC) have signed a cooperation agreement to apply best practices to the technology supporting voting processes in the country. According to the TSE, the goal is to “[establish] means of integration, research and improvement of computing” at the TSE.

- Despite a lack of details regarding the specific areas where the court and the SBC will work together, a key priority is to demonstrate that the electronic voting devices used at elections are actually safe. “We have to demonstrate to the society that the system works and is safe, so it is important to have the feedback and counsel of a scientific

- organization like the SBC,” said Gilmar Mendes, President of the TSE.

JCPenney Misses Out on 3,300% Rally as Dumped Asset Skyrockets

JCPenney Misses Out on 3,300% Rally as Dumped Asset Skyrockets

(September 13) Bloomberg.com

- Lojas Renner, the Brazilian retailer that JCPenney divested in 2005 for $230 million, is now worth $7.9 billion, an increase of more than 3,300%. Meanwhile, the iconic American department-store chain has seen its own business founder as US brick-and-mortar outlets buckle under the weight of e-commerce. JCPenney is now worth just a fraction of its former value.

- Working in Lojas Renner’s favor is the fact that mall-goers in Brazil have been slower than their US counterparts to alter their shopping habits in the digital age. The company has also eschewed its department-store roots in favor of so-called fast fashion, a strategy that has helped the retailer ride out Brazil’s years-long recession. Investors have rewarded the company by driving the stock up by almost 150% since the start of 2015.

The Body Shop Bought by Brazilian Cosmetics Company

(September 12) RetailDive.com

The Body Shop Bought by Brazilian Cosmetics Company

(September 12) RetailDive.com

- Natura Cosméticos, a Brazilian cosmetics company, has finalized its acquisition of The Body Shop from L’Oréal, according to a press release. The deal, for an undisclosed amount, was first announced in June and some speculation pegged the sale at close to $1 billion, according to Reuters.

- The acquisition helps solidify Natura’s effort to become a global multibrand and multichannel cosmetics group, the company also said. L’Oréal bought the UK natural beauty retailer in 2006, and began looking for offers for it this past spring.

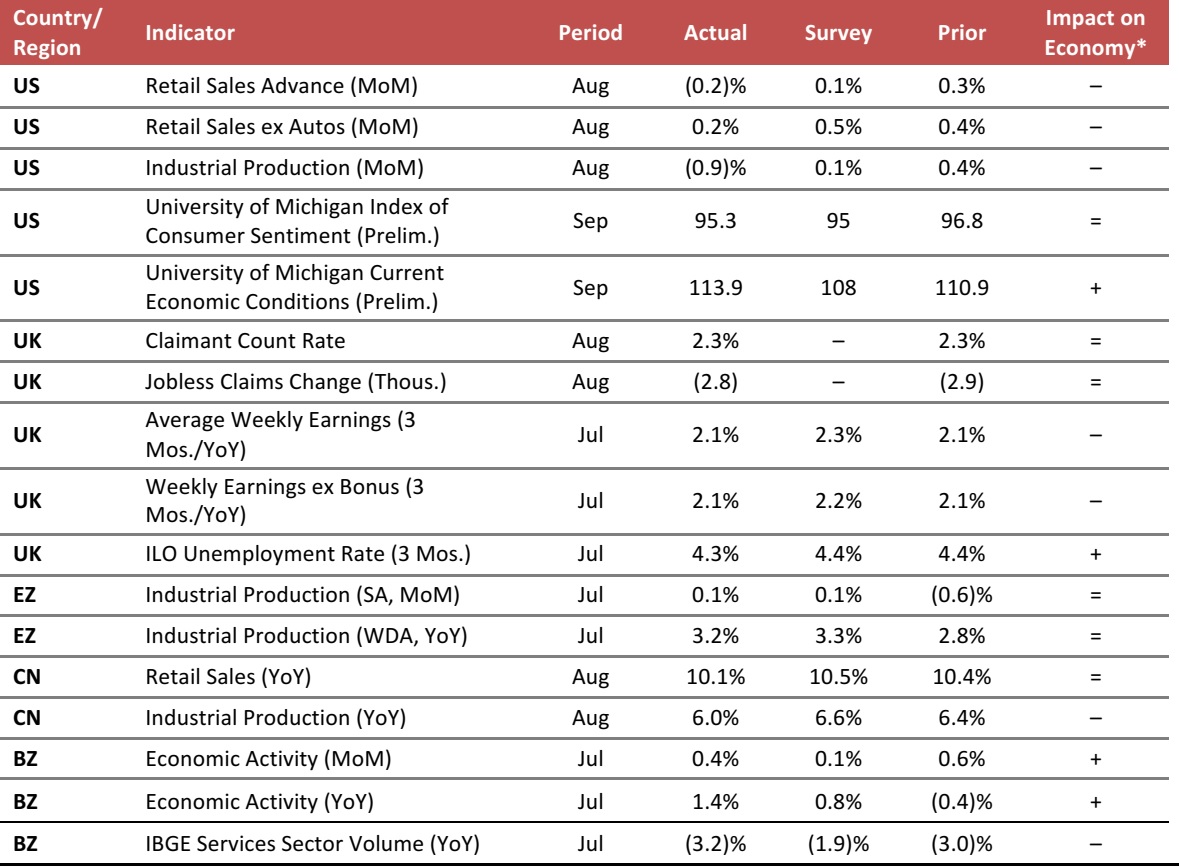

MACRO UPDATE

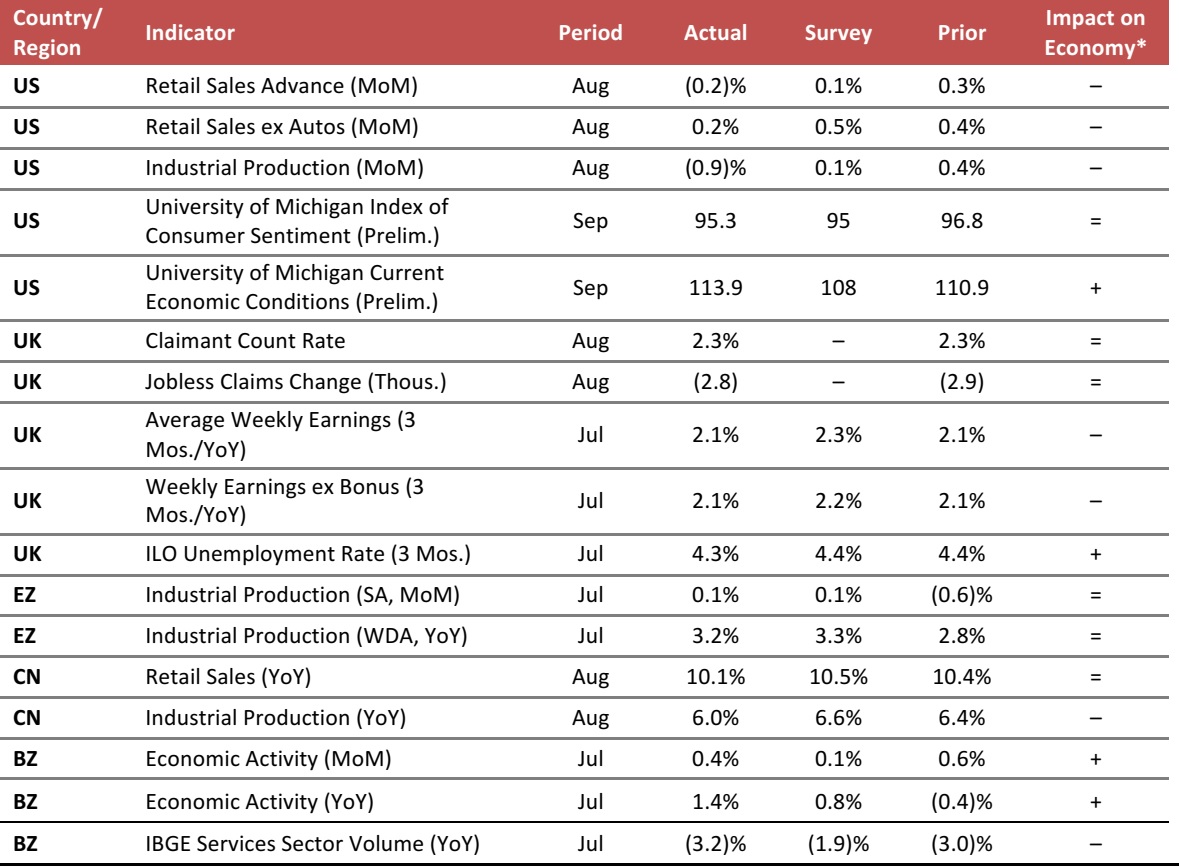

Key points from global macro indicators released September 13–20, 2017:

- US: US retail sales edged down 0.2% month over month in August; the figure was below the market’s estimate of a 0.1% increase. Industrial production was down 0.9% month over month in August. The University of Michigan Index of Consumer Sentiment reading ticked down to 95.3 in September from 96.8 in August.

- Europe: In the UK, the claimant count rate stood at 2.3% in August. Unemployment in the UK edged down to 4.3% in July. In the eurozone, industrial production increased by 0.1% month over month and by 3.2% year over year in July.

- Asia-Pacific: In China, retail sales increased by 10.1% year over year in August, slightly below the 10.5% consensus estimate. Industrial production in China increased by 6.0% year over year in August, signaling a slower-than-expected expansion of the industrial sector.

- Latin America: In Brazil, economic activity expanded at a faster rate than the market expected in July, increasing by 0.4% month over month and by 1.4% year over year. In contrast, services sector volume in Brazil fell by more than expected in July, dropping by 3.2% year over year.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/University of Michigan/UK Office for National Statistics/Eurostat/National Bureau of Statistics of China/Banco Central do Brasil/Instituto Brasileiro de Geografia e Estatística/FGRT

Google Debuts Tez, a Mobile Payments App for India

(September 18) TechCrunch.com

Google Debuts Tez, a Mobile Payments App for India

(September 18) TechCrunch.com

Brazil Leads 4G Expansion in LatAm

(September 14) ZDNet.com

Brazil Leads 4G Expansion in LatAm

(September 14) ZDNet.com