From the Desk of Deborah Weinswig

Hearing from Jack Ma on China’s Consumption Upgrade and Alibaba’s Plans to Tap the Surge in Spending

This week, the Coresight Research team was in Hangzhou, China, to attend Alibaba’s annual Investor Day event. It was our first opportunity to hear from Alibaba Chairman Jack Ma following the company’s announcement on September 10 that he will step down next year. Ma remarked that Alibaba started to evolve and professionalize its management in 2009, when its 18 founders were asked to resign. He said that he did not want Alibaba to adopt the Asian business culture norm of “gray-hair CEOs” and that fast-growing companies such as his need to have a planned system for succession.

Some of the more interesting points of Ma’s presentation regarded his outlook for China’s consumer economy. He said that the current US-China trade war may prompt some production to move away from China and that tariffs were one of three major short-term problems that China will face:

- The anticorruption program undertaken by authorities represented “painful surgery,” Ma said, and he predicted that it will take China three to five years to recover from it. He suggested that the country needs young leaders who understand business in the wake of this crackdown on corruption.

- China is changing from an exporter to an importer, and from a focus on serving consumers in other countries to a focus on domestic consumption. Ma is urging China to open up its market and make reforms to its domestic economy.

- On tariffs, Ma said that trade wars were easy to start, but hard to stop. He also forecast that China will rely much less on one dominant export destination—the US—in the coming years: it will do business with more countries in Africa, Southeast Asia and Europe, and China’s One Belt, One Road program of infrastructure development will underpin this diversification.

Despite short-term challenges, Ma forecast that the Chinese consumer economy will prove resilient over the longer term, which he defined as the next three to five years. He also pointed to the ways that this will drive Alibaba’s growth:

- Domestic consumption will continue to rise. Today, China is home to 300 million middle-income consumers and that number will soon grow to 500 million. This middle-income segment provides meaningful opportunities to Tmall, which serves consumers seeking branded goods, including those from international companies.

- At the same time, China has more than 1 billion people living below the middle-income line, although some of these consumers will move up the income scale in the years ahead. Low-income shoppers remain an opportunity for Alibaba, Ma said, noting that when people have little money to spend, they head to the company’s Taobao marketplace, which aggregates consumers selling to other consumers and small-business sellers.

Ma was not alone in suggesting that Alibaba is well placed to cater to growing consumption. For instance, Hou Yi, CEO of Alibaba’s omnichannel supermarket chain, Hema, suggested that Hema is well positioned to serve Chinese consumers’ increasing demands. The retailer offers a strong selection of fresh foods that are complemented by restaurant dishes for in-store dining and delivery. It also offers differentiated private-label brands, rapid delivery and greater traceability of products for customers.

Across Alibaba, the expectation is that Chinese consumer spending has a long runway for growth and that the company is in a strong position to expand as the consumption upgrade continues. Ma concluded that, if domestic consumption continues its upward trajectory and technology does not fundamentally change, he sees no barriers to Alibaba’s growth. “Don’t worry about Alibaba,” he said. “If Alibaba cannot grow, no company in China can grow.”

We think that Alibaba has a strong bench and can continue to grow through diverse acquisitions that are fueling its top and bottom line. In addition, it is executing creative strategies that encourage consumers to enjoy more of the Alibaba ecosystem—such as the recently launched 88 VIP membership program—illustrating its prowess in New Retail and the new economy.

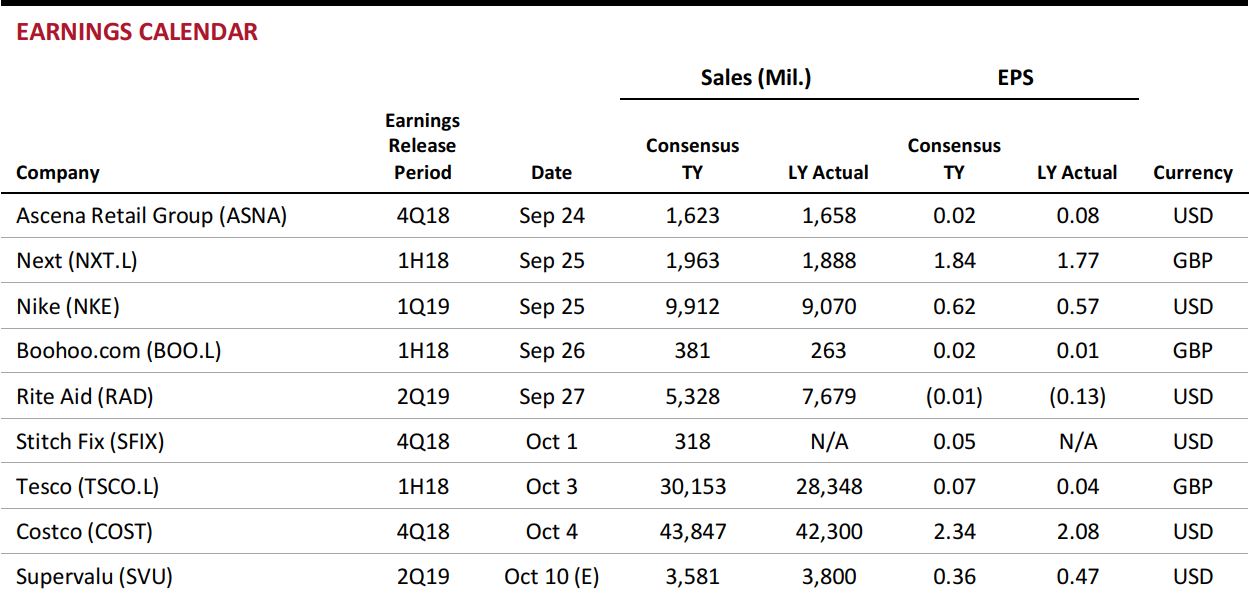

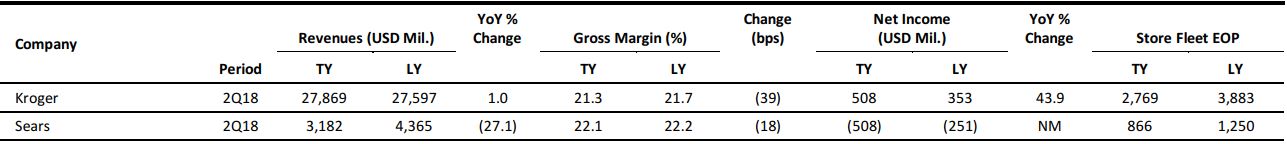

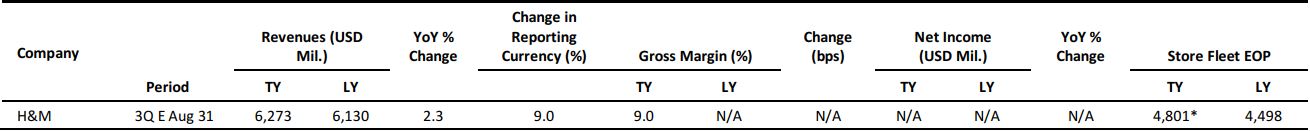

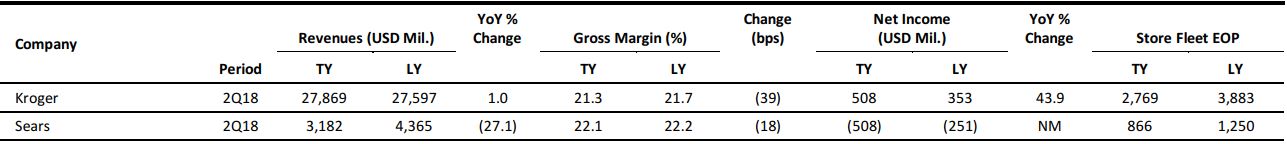

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Off-Price Chains Continue to Roll, but How Long Can the Good Times Last?

(September 18) NREIOnline.com

Off-Price Chains Continue to Roll, but How Long Can the Good Times Last?

(September 18) NREIOnline.com

- Consumers continue to head to brick-and-mortar off-price chains in healthy numbers, keeping the performance of that sector stable. The three largest off-price chains—TJX Companies (the parent company of T.J. Maxx, Marshalls and HomeGoods), Burlington and Ross Stores—are reporting solid sales and aggressively expanding their physical footprints.

- Although some off-price chains don’t even put products for purchase online because inventory changes too frequently, industry experts say that there may be future pressure on off-price retailers to sell merchandise online.

10 Years After the Financial Crisis, Americans Are Still Looking for a Deal

(September 18) CNBC.com

10 Years After the Financial Crisis, Americans Are Still Looking for a Deal

(September 18) CNBC.com

- Long after the end of the Great Recession, shoppers are still searching for deals. The crash caused consumers to hunker down, leaving retailers with so much product that they were forced to slash prices to draw shoppers in. The discounting taught consumers that there was no need to pay marked-up prices or even list prices, and those changes stuck around.

- Luxury retailers, which were caught off guard during the recession, have rolled out websites in order to have more control over their products and prevent cheaper inventory from flooding the market during the next downturn.

Retail Rents, Vacancies Stabilizing

(September 17) RetailDive.com

Retail Rents, Vacancies Stabilizing

(September 17) RetailDive.com

- In the second quarter, mall rents fell by 4.6% from the first quarter and by 7.1% year over year, hit by major store closures from Toys“R”Us, Sears and JCPenney. Mall vacancy rates hit 4.0% during the quarter.

- The retail sector suffered its worst quarter in nine years in the second quarter, with net absorption of negative 3.8 million square feet, which pushed the regional mall vacancy rate up by 0.2%, to 8.6%, as the average mall rent increased by 0.3%.

US Retail Sales Trail Forecasts as Autos, Apparel Decline

(September 14) Bloomberg.com

US Retail Sales Trail Forecasts as Autos, Apparel Decline

(September 14) Bloomberg.com

- US retail sales rose by less than forecast in August as purchases of automobiles and clothing fell, suggesting that households took a breather from spending. The value of overall sales climbed 0.1% from the prior month after a 0.7% increase in July. The median forecast of economists surveyed called for a 0.4% gain.

- Combined results from July and August indicate support from a strong job market and more after-tax pay during the back-to-school shopping season.

US Retail Giant Macy’s to Hire 5,500 More Seasonal Workers

(September 12) BusinessLive.co.za

US Retail Giant Macy’s to Hire 5,500 More Seasonal Workers

(September 12) BusinessLive.co.za

- Macy’s said that it would hire 5,500 more seasonal workers than it did in 2017 at its online centers to handle the holiday season. The department store chain said that it would hire 80,000 temporary workers for the holidays, including 23,500 workers for its fulfillment centers.

- The company said that it expects a strong holiday shopping season, noting that the rest of the hires will be based in call centers and on shop floors at Macy’s and Bloomingdale’s, and deployed to support its annual Thanksgiving Day Parade in New York.

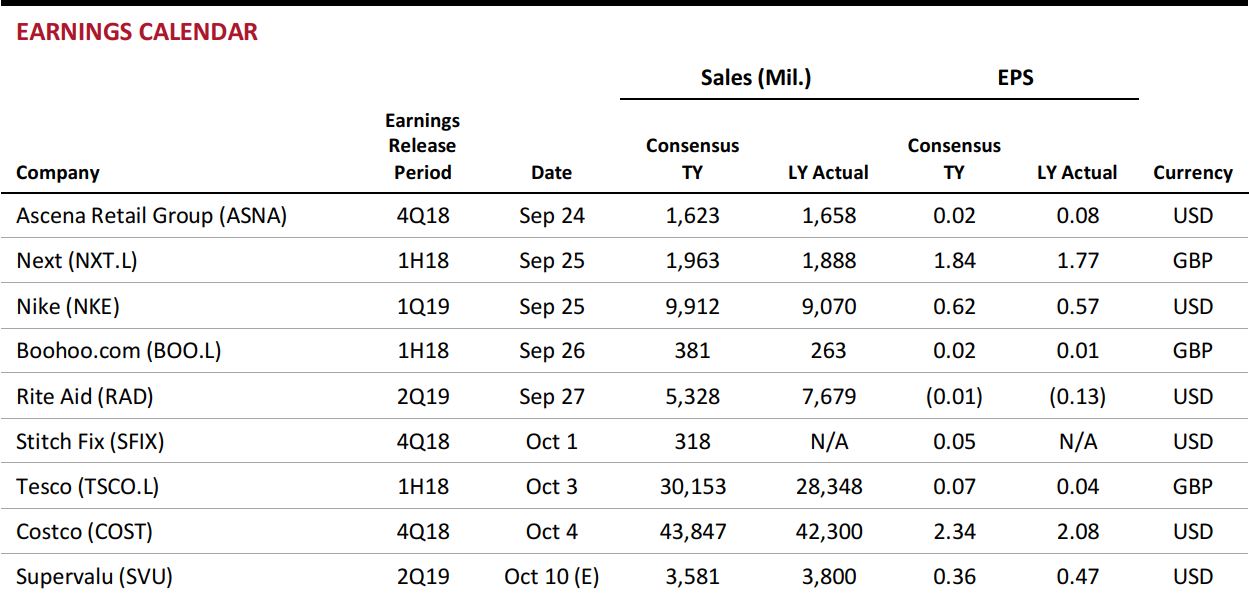

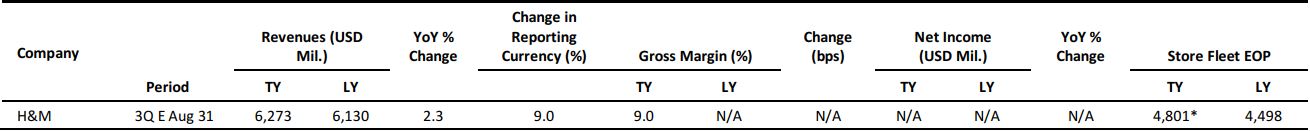

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

House of Fraser to Axe In-House Brands

(September 14) DrapersOnline.com

House of Fraser to Axe In-House Brands

(September 14) DrapersOnline.com

- British retailer House of Fraser is set to scrap its remaining house brands as it realigns its strategy under new owner Sports Direct. While House of Fraser axed four brands, including womenswear label Therapy, in 2016, it continued to operate the Linea, Biba, Issa, Label Lab and Criminal Denim ranges.

- Eliminating these brands will affect the buying and merchandising teams, but it is not known if the move will result in any redundancies.

Zalando Issues Revised Guidance for Fiscal Year 2018

(September 18) Company press release

Zalando Issues Revised Guidance for Fiscal Year 2018

(September 18) Company press release

- German fashion pure play Zalando has revised its guidance for fiscal year 2018, citing a “challenging market backdrop.” The company previously guided for revenue growth in the lower half of its 20%–25% target range, but now expects it to be in the lower end of this range.

- Zalando expects to report adjusted EBIT of €150–€190 million ($175–$222 million); the company previously guided for adjusted EBIT at the low end of the €220–€270 million ($257–$316 million) range.

Amazon Prime Service for Monoprix Launched in Paris

(September 14) Bloomberg.com

Amazon Prime Service for Monoprix Launched in Paris

(September 14) Bloomberg.com

- French retailer Monoprix has begun filling orders for Amazon Prime subscribers in Paris. The partnership, which includes two-hour delivery, has increased the number of SKUs on Amazon Prime’s French site from 3,200 to some 6,000.

- Monoprix is offering a portion of its profits to Amazon in exchange for Amazon offering and delivering its products.

Boohoo Announces Appointment of John Lyttle as Chief Executive

(September 17) Company press release

Boohoo Announces Appointment of John Lyttle as Chief Executive

(September 17) Company press release

- British online fashion pure play Boohoo has appointed Primark COO John Lyttle as Chief Executive, effective March 15, 2019.

- The company stated that “John’s appointment is a key constituent of the group’s positioning for its next stage of growth and will be accompanied by a number of changes to the existing main board roles, all of which are designed to support the journey of the group through its further international expansion.”

Ocado Reports Increase in Revenue in Third Quarter

(September 18) Company press release

Ocado Reports Increase in Revenue in Third Quarter

(September 18) Company press release

- British online supermarket chain Ocado grew revenue by 11.5%, to £348.6 million ($458.2 million), in the third quarter ended September 2. Ocado said that this was in line with its guidance for the year.

- The company stated that growth in customer orders and new capacity at its robotic warehouses drove performance during the quarter. Ocado’s average customer orders per week rose by 11.4%, with a stable average order size of £106.26 ($139.74).

ASIA RETAIL & TECH HEADLINES

Metro Mulling Sale and Partnership Options for China Business

(September 18) Bloomberg.com

Metro Mulling Sale and Partnership Options for China Business

(September 18) Bloomberg.com

- German grocery retailer Metro may sell a stake in its cash-and-carry business in China in order to focus on its wholesaling business worldwide, according to sources.

- Other options Metro is considering include finding a strategic partner or forming a joint venture. The group also may end up retaining its full holding, sources said. Metro Cash & Carry China operates 93 stores and recorded sales of ¥20.3 billion ($3 billion) in its latest fiscal year.

GS Retail Unveils “Smart Convenience Store”

(September 18) InsideRetail.Asia

GS Retail Unveils “Smart Convenience Store”

(September 18) InsideRetail.Asia

- South Korean convenience store operator GS Retail has opened a new “smart convenience store” that will simplify the payment process by using facial recognition technology. The automated system installed at checkout will use the image and weight of a product instead of a barcode to scan items for payment.

- The company said that the newly opened store will serve as a test bed for its automated retail systems. GS Retail will continue to test the system until the end of the year before implementing the technology in other stores.

Go-Jek Plans to Raise $2 Billion from Investors in Southeast Asia

(September 18) TechCrunch.com

Go-Jek Plans to Raise $2 Billion from Investors in Southeast Asia

(September 18) TechCrunch.com

- Indonesian ride-hailing startup Go-Jek is seeking $2 billion in funding from investors as it plans to expand its business overseas and looks to compete more effectively against rival Grab.

- The company raised $1.5 billion from investors that included Google and Tencent in January this year.

Ola Raises $50 Million in Latest Funding Drive, Plans to Enter New Zealand Market

(September 18) Inc42.com

Ola Raises $50 Million in Latest Funding Drive, Plans to Enter New Zealand Market

(September 18) Inc42.com

- India’s largest cab-hailing company, Ola, has raised $50 million from Hong Kong–based Sailing Capital and the China-Eurasian Economic Cooperation Fund. This has valued the company at roughly $4.3 billion.

- Ola also announced plans to expand to New Zealand and said that it has hired Brian Dewil as the country manager. The company launched its services in Australia in February and in the UK in August this year.

First Cashier-Free Store Opens in India

(September 18) InsideRetail.Asia

First Cashier-Free Store Opens in India

(September 18) InsideRetail.Asia

- India’s first autonomous, cashier-free store, known as Watasale, has opened in Kerala. The store uses artificial intelligence to allow customers to purchase products by scanning a QR code.

- Rajesh Malamal, Watasale’s Chief Marketing Officer, said that “our systems are more economical and scalable in comparison to Amazon’s solution.”

LATAM RETAIL & TECH HEADLINES

Walmart to Acquire Cornershop for $225 Million

(September 13) Company press release

Walmart to Acquire Cornershop for $225 Million

(September 13) Company press release

- Walmart announced that it will acquire Cornershop, an online platform for on-demand delivery from pharmacies and grocery and specialty food retailers in Mexico and Chile.

- Walmart has agreed to pay $225 million to acquire the business and the deal is expected to close by the end of the year, subject to regulatory approval.

Alpargatas Sells 22.5% of Topper Business to Sforza

(September 17) BAENegocios.com

Alpargatas Sells 22.5% of Topper Business to Sforza

(September 17) BAENegocios.com

- Brazilian fashion and footwear giant Alpargatas has agreed to sell 22.5% of its Topper sports footwear brand to Sforza, a private equity firm with interests in retail, real estate and sports.

- Sforza will pay some $24 million to buy Topper’s stores and operations in Argentina. Topper accounts for 30% of the turnover at Alpargatas, which also owns brands such as Havaianas and Mizuno.

Liverpool to Bid Adieu to Fábricas de Francia Banner

(September 13) MexicoNewsDaily.com

Liverpool to Bid Adieu to Fábricas de Francia Banner

(September 13) MexicoNewsDaily.com

- Mexican department store operator El Puerto de Liverpool, commonly called Liverpool, is set to convert all 41 stores under the Fábricas de Francia banner to the Liverpool and Suburbia brands.

- This decision follows Liverpool’s acquisition of the Suburbia chain from Walmart for some $838 million in April last year. The store conversions will begin later this year and continue through 2019.

Yellow Raises $63 Million in Series A Funding

(September 13) TechCrunch.com

Yellow Raises $63 Million in Series A Funding

(September 13) TechCrunch.com

- Bike- and scooter-sharing startup Yellow announced that it has closed a $63 million series A funding round, the largest ever series A financing for a Latin American startup.

- Yellow’s cofounders Ariel Lambrecht and Renato Freitas had previously sold their ride-sharing startup, 99, to Chinese giant Didi Chuxing. When they founded Yellow along with Eduardo Musa, they managed to attract seed capital of $12.3 million from venture capitalists.

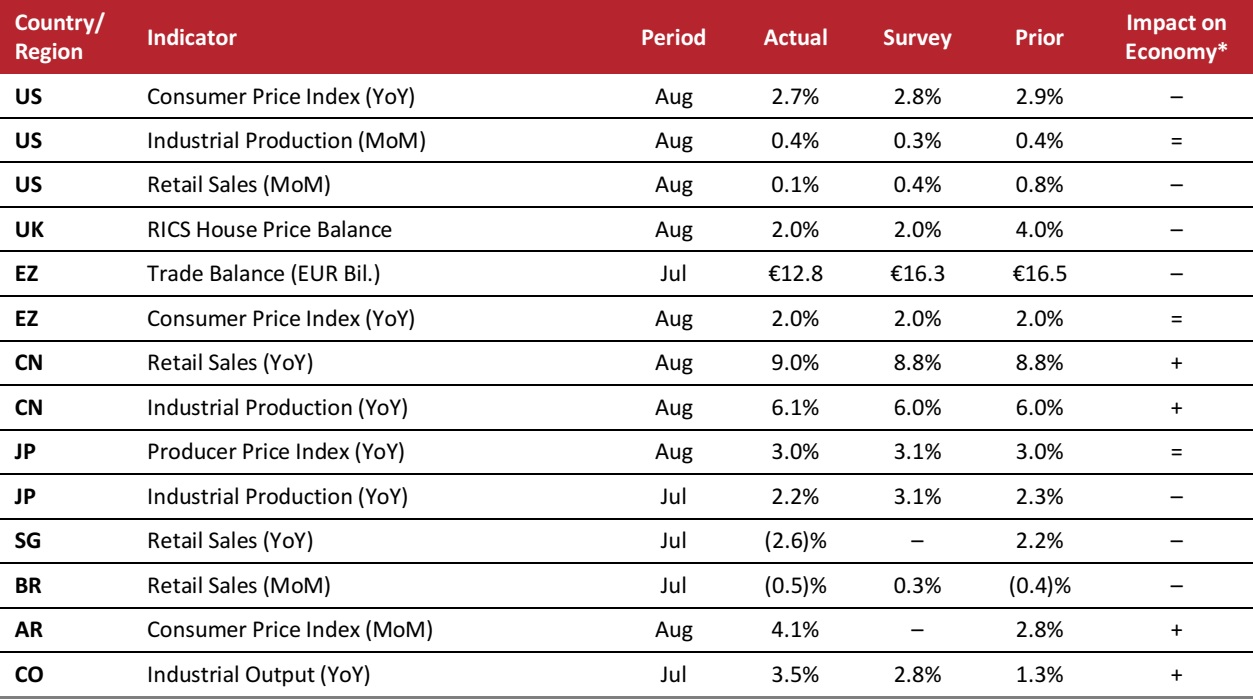

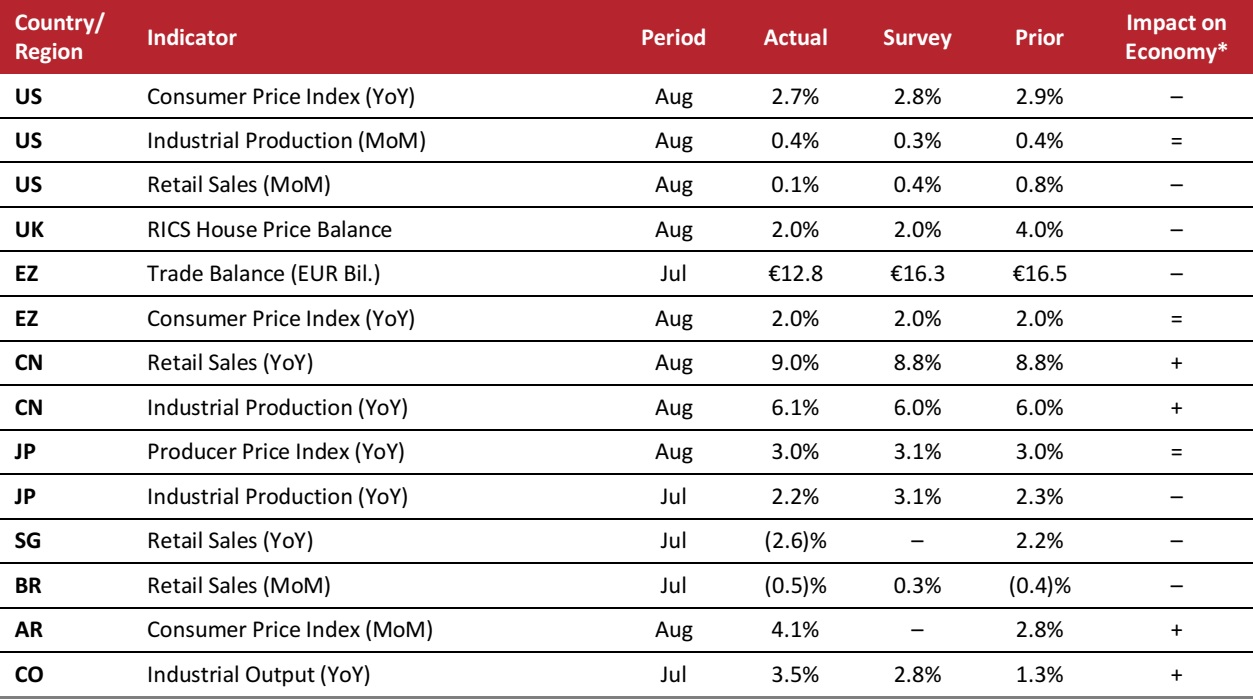

MACRO UPDATE

Key points from global macro indicators released September 12–18, 2018:

- US: The Consumer Price Index increased by slightly less than analysts had expected in August, rising by 2.7% year over year. Month over month, industrial production in August rose by 0.4%, which was slightly higher than the consensus estimate.

- Europe: In the UK, the Royal Institution of Chartered Surveyors (RICS) House Price Balance rose by 2% in August, in line with the consensus estimate.In the eurozone, the trade balance was €12.8 billion in July, down significantly from €16.5 billion in June.

- Asia-Pacific: Retail sales in China increased by 9.0% year over year in August, exceeding the 8.8% growth seen in July. In Singapore, retail sales decreased by 2.6% year over year in July, compared with an increase of 2.2% in June.

- Latin America: Retail sales in Brazil contracted by 0.5% month over month in July, almost in line with the 0.4% decrease recorded in June.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/Board of Governors of the Federal Reserve/Royal Institution of Chartered Surveyors/Eurostat/National Bureau of Statistics of China/Bank of Japan/Japan Ministry of Economy, Trade and Industry/Singapore Department of Statistics/Instituto Brasileiro de Geografía e Estatística/Argentina National Institute of Statistics and Censuses/Banco de la República de Colombia/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/Board of Governors of the Federal Reserve/Royal Institution of Chartered Surveyors/Eurostat/National Bureau of Statistics of China/Bank of Japan/Japan Ministry of Economy, Trade and Industry/Singapore Department of Statistics/Instituto Brasileiro de Geografía e Estatística/Argentina National Institute of Statistics and Censuses/Banco de la República de Colombia/Coresight Research

10 Years After the Financial Crisis, Americans Are Still Looking for a Deal

(September 18) CNBC.com

10 Years After the Financial Crisis, Americans Are Still Looking for a Deal

(September 18) CNBC.com

Retail Rents, Vacancies Stabilizing

(September 17) RetailDive.com

Retail Rents, Vacancies Stabilizing

(September 17) RetailDive.com

Amazon Prime Service for Monoprix Launched in Paris

(September 14) Bloomberg.com

Amazon Prime Service for Monoprix Launched in Paris

(September 14) Bloomberg.com

Ocado Reports Increase in Revenue in Third Quarter

(September 18) Company press release

Ocado Reports Increase in Revenue in Third Quarter

(September 18) Company press release

First Cashier-Free Store Opens in India

(September 18) InsideRetail.Asia

First Cashier-Free Store Opens in India

(September 18) InsideRetail.Asia

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/Board of Governors of the Federal Reserve/Royal Institution of Chartered Surveyors/Eurostat/National Bureau of Statistics of China/Bank of Japan/Japan Ministry of Economy, Trade and Industry/Singapore Department of Statistics/Instituto Brasileiro de Geografía e Estatística/Argentina National Institute of Statistics and Censuses/Banco de la República de Colombia/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/Board of Governors of the Federal Reserve/Royal Institution of Chartered Surveyors/Eurostat/National Bureau of Statistics of China/Bank of Japan/Japan Ministry of Economy, Trade and Industry/Singapore Department of Statistics/Instituto Brasileiro de Geografía e Estatística/Argentina National Institute of Statistics and Censuses/Banco de la República de Colombia/Coresight Research