DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Warehouse Clubs Pivot Toward E-Commerce Warehouse clubs have come a long way since 1976 when Sol Price pioneered the discount membership warehouse with Price Club in San Diego. Since then, the basic business model has remained much the same: Attract customers to make bulk purchases through paid membership. Until recently, there was limited emphasis on e-commerce. Warehouse clubs have been slow to invest in e-commerce, which means that there is significant room for growth – and for them to learn from others’ experiences. Costco management commented there is a lot of “low-hanging fruit” supporting e-commerce growth at the clubs. With grocery a significant component of warehouse club sales, Amazon’s acquisition of Whole Foods in 2017 helped catalyze the warehouse club sector’s shift toward e-commerce. Until then, these companies were reluctant to invest significantly in delivery services. But after the acquisition, all three major warehouse clubs bolstered delivery services – with Instacart being the biggest beneficiary, securing lucrative relationships with all three companies. At the end of 2017, Costco introduced a two-day delivery service called CostcoGrocery for shelf-stable products and partnered with Instacart to provide same-day delivery service for perishable groceries. Sam’s Club followed suit with its own same-day delivery partnership at 100 additional clubs, for a total of 350 stores. BJ’s announced that by April 2018, all its outlets will offer same-day delivery. This growing emphasis on e-commerce has slowed growth in new warehouse clubs. In 2018, Walmart’s decision to close a number of Sam’s Club outlets ended a period of warehouse club expansion that started in 2005. While Costco has announcing 11 new store openings this year, store growth is likely to remain relatively subdued over the coming years. Warehouse clubs have also been working to improve omnichannel capabilities and are investing in technology to enhance mobile applications. Through these apps, they let customers scan purchases in-store, eliminating the need to wait in checkout lines. With the growing emphasis on e-commerce, warehouse clubs face a conundrum about how much to focus on the channel given they still want to attract consumers to purchase in store rather than online. Costco has stated that the company does not want consumers to become “too comfortable” shopping through Costco’s digital channel such that it impacts traffic in stores. The challenge for warehouse clubs is in finding the right balance in boosting e-commerce to keep up with the competition while retaining foot traffic. Another challenge is operating cost. With wafer-thin margins, warehouse clubs face additional cost pressure around deploying e-commerce. The clubs have reduced storage and distribution costs through direct manufacturer shipments and cross-docking facilities. Adding e-commerce to the mix complicates this business model and entails additional costs to fulfil online orders – both in delivery and pick-up services. In addition, warehouse clubs do not have the extensive distribution networks their rivals do, especially Amazon and mass merchandisers. This puts them at a comparative disadvantage in distribution. To address this shortfall, most are opening more fulfilment centers. The appeal of the warehouse club membership model is still strong, as exemplified by Costco’s ability to raise its annual membership fee without seeing a meaningful drop in renewal rates. We expect warehouse clubs to continue to invest in e-commerce and omnichannel capabilities such as improved order delivery, BOPIS, mobile applications and other features. Get more information from our deep dive: Warehouse Clubs Embracing E-commerce.

US RETAIL & TECH HEADLINES

- Bankrupt retailer Barneys New York was back in court, aiming to finalize the debtor-in-possession financing needed to fund its reorganization. The court date followed a whirlwind period marked by a report of a potential buyer and pushback from creditors.

- Barneys filed a revised financing package with the court that includes key concessions to creditors. The changes also free up more cash for Barneys to keep operating as it races to shutter money-losing stores and line up a buyer by mid-October.

Discount Retailer Fred's Files for Chapter 11 Protection

(September 9) Reuters

Discount Retailer Fred's Files for Chapter 11 Protection

(September 9) Reuters

- Fred’s Inc said it has filed for Chapter 11 bankruptcy protection, months after the pharmacy and discount retailer began shuttering hundreds of unprofitable stores in the US. Since the start of 2017, over 20 US retailers have filed for bankruptcy.

- Fred’s, which has been losing money since 2015, has been trying to turn around its business. In April, it said it would close at least 159 underperforming and unprofitable stores, or nearly 30% of its total outlets.

Starbucks CEO’s New Ideas Start with a Pick-Up-Only Store in NYC

(September 5) Bloomberg

Starbucks CEO’s New Ideas Start with a Pick-Up-Only Store in NYC

(September 5) Bloomberg

- Starbucks is ripping up the old store blueprints in a bid to revitalize growth. First on the list: a pick-up cafe in New York City set to open this fall to cater to busy coffee-drinkers on the go.

- The Manhattan store, still in development, will build on the chain’s success with its Starbucks Now concept in China that lets customers order in advance on mobile phones and collect items in a specialty “express” shop. The shops aren’t intended to replace existing cafes, which give consumers a “third place” away from home and work.

- Nordstrom is finally bringing its pint-sized and inventory-free shops, called Nordstrom Local, to New York’s Upper East Side. Later this month, a Nordstrom Local will open in New York’s West Village neighborhood.

- This builds on Nordstrom’s existing portfolio of three Nordstrom Local shops in California that offer personal styling services and alterations and serve as a hub for buying online and picking up in store. The catch is, there’sno inventory for sale there.

- American Eagle may be bypassing the emerging softness in beauty sales by tying its new effort to the burgeoning market for products that include CBD.

- Executives said that this fall they will be launching a line of CBD beauty products in stores in partnership with Seventh Sense, a personal care line from Canadian CBD company Green Growth Brands (GGB). Seventh Sense products are already sold through American Eagle's website. The new line will be launched in time for the holidays.

EUROPE RETAIL AND TECH HEADLINES

Jonak Opens First Store in Russia

(September 10) FashionNetwork.com

Jonak Opens First Store in Russia

(September 10) FashionNetwork.com

- French footwear brand Jonak has opened its first store in Russia with its franchise partner BNS Group. The outlet will be on the first floor of Aviapark Shopping Center in Moscow.

- The 969-square-foot outlet will offer a women’s collection of shoes made of genuine leather for the fall-winter 2019 season. Jonak also plans to expand in the Middle East through franchising.

Sports Direct Among Final Bidders for Links of London

(September 9) News.Sky.com

Sports Direct Among Final Bidders for Links of London

(September 9) News.Sky.com

- British sportswear retailer Sports Direct has placed a bid for ailing jewelry retailer Links of London. Mike Ashley, CEO of Sports Direct, is the majority shareholder and one of two final bidders attempting to buy Links from current owner Folli Follie.

- Since 2018, Sports Direct has acquired House of Fraser, Evans Cycles, Game Digital, Sofa.com and Jack Wills.

- German online apparel retailer Zalando is testing artificial intelligence-powered 3D scanning technology at its Berlin headquarters in an effort to slash the number of size-related returns. Zalando will employ “fit-models” with different body shapes to sample items to gather accurate data points on how they fit.

- The new technology will scan the fit-models during trials and generate a 3D depiction to provide an accurate representation of the fittings.

Ahold Delhaize’s CFO To Exit in April 2020

(September 9) Reuters.com

Ahold Delhaize’s CFO To Exit in April 2020

(September 9) Reuters.com

- On Monday, Dutch-Belgian supermarket chain Ahold Delhaize announced that its CFO Jeff Carr will leave the firm when his term expires in April 2020.

- Spokeswoman Ellen van Ginkel said that after serving as CFO at Ahold since 2011, Carr has decided to return to the UK to be closer to his family.

Sainsbury’s to Evaluate Options for its Loss-making Bank

(September 7) Telegraph.co.uk

Sainsbury’s to Evaluate Options for its Loss-making Bank

(September 7) Telegraph.co.uk

- Sainsbury’s is planning a major revamp of its loss-making banking arm, as it reconsiders its business model following a failed attempt to merge with Asda.

- The retailer is assessing options as it prepares for a meeting with investors later this month.

H&M to Launch H&M Music

(September 6) TheRetailBulletin.com

H&M to Launch H&M Music

(September 6) TheRetailBulletin.com

- Fashion retailer H&M has teamed up with music industry partners to launch H&M Music in the UK, a new benefit in its digital loyalty program. The partnership, to be launched next month, is between H&M’s UK arm, British record label Awal and mobile ticketing platform Dice.

- Shoppers will can find new artists, access live events and receive other music-related rewards in exchange for loyalty points.

ASIA RETAIL AND TECH HEADLINES

Alibaba’s Chairman Jack Ma Steps Down

(September 10) TechCrunch.com

Alibaba’s Chairman Jack Ma Steps Down

(September 10) TechCrunch.com

- Alibaba Group’s chairman Jack Ma stepped down from his post on September 10. The current CEO Daniel Zhang will take his place.

- Ma will continue to serve on the company’s board until the next general shareholders meeting. He will also remain a lifetime partner of Alibaba Partnership, a group of 38 members of Alibaba’s senior management.

Universal Overall Opens a Store in Japan

(September 9) FashionNetwork.com

Universal Overall Opens a Store in Japan

(September 9) FashionNetwork.com

- US workwear brand Universal Overall opened its first flagship store Universal Overall Tokyo on September 8.

- The new store will offer a range of men’s coats, coveralls and pants as well as women’s jumper skirts and overalls.

Amazon to Allow Customers to Pick Up Deliveries From Mumbai Railway Stations

(September 9) Inc42.com

Amazon to Allow Customers to Pick Up Deliveries From Mumbai Railway Stations

(September 9) Inc42.com

- Amazon has partnered with Indian Railways to install delivery pickup kiosks in the CSTM, Thane, Dadar and Kalyan railway stations in Mumbai, India. Customers can select the pickup location when ordering.

- With this partnership, Amazon hopes to enhance its delivery network in Mumbai and improve the customer experience.

JD.com Partners with Central Group to Launch Dolfin App

(September 9) Reuters.com

JD.com Partners with Central Group to Launch Dolfin App

(September 9) Reuters.com

- JD.com has partnered with Thai conglomerate Central Group to launch a financial services app called Dolfin.

- The Dolfin app will offer facilities such as e-wallet, digital lending, insurance and wealth management. The joint venture company aims to have 400,000 users by the end of the year and 1.5 million by the next year.

Beauty Startup Base Gets Seed Funding

(September 9) DealStreetAsia.com

Beauty Startup Base Gets Seed Funding

(September 9) DealStreetAsia.com

- Indonesian beauty and wellness startup Base raised an undisclosed amount in a seed funding round led by local venture capital firms East Ventures and Skystar Capital.

- Base offers personalized skincare products and online skin consultations. The funds raised will be invested to grow its customer base and hire talented employees.

Alibaba Acquires Kaola from NetEase

(September 6) TechCrunch.com

Alibaba Acquires Kaola from NetEase

(September 6) TechCrunch.com

- Alibaba has acquired Kaola, the cross-border e-commerce unit of Chinese Internet company NetEase, for $2 billion.

- After the acquisition, Kaola will continue to operate under its own brand and Alibaba will integrate Kaola into Tmall to consolidate its position as the largest Chinese e-commerce platform.

LATIN AMERICA RETAIL AND TECH HEADLINES

L’Occitane au Brésil Launches Loyalty Program in Brazil

(September 9) FashionNetwork.com

L’Occitane au Brésil Launches Loyalty Program in Brazil

(September 9) FashionNetwork.com

- L’Occitane au Brésil, owned by French beauty retailer L’Occitane, has launched its loyalty program called Quero + Brésil.

- Shoppers receive a R$1 ($0.24) discount on future purchases for each point, redeemable in groups of 20 points. Customers can also earn points by inviting friends to join the program.

IKEA to Invest in a New Distribution Center

(September 9) AmericaRetail.com

IKEA to Invest in a New Distribution Center

(September 9) AmericaRetail.com

- Swedish furniture retailer IKEA plans to invest around MXN 3.50 billion ($179 million) in a new distribution and production center in Ramos Arizpe, Mexico. This plant will accommodate up to three million products and will be operational in 2020.

- The retailer will open its first store in Latin America in Mexico City and plans to triple its initial investment by expanding its supply network and manufacturing more products.

Cortassa Perfumerías Buys La Parfumerie

(September 9) FashionNetwork.com

Cortassa Perfumerías Buys La Parfumerie

(September 9) FashionNetwork.com

- Argentinian perfume chain Cortassa Perfumerías has acquired perfume chain La Parfumerie for an undisclosed sum.

- With this acquisition, Cortassa will add four La Parfumerie stores to its portfolio. The four stores are located in Buenos Aires.

H&M to Debut in Medellín

(September 6) America-Retail.com

H&M to Debut in Medellín

(September 6) America-Retail.com

- Swedish fashion retailer H&M plans to open two stores in Medellín, Colombia, by the end of this year. The new stores will be located at the El Tesoro and Viva Envigado shopping centers.

- The store at the Viva Envigado shopping center will be H&M’s flagship in Medellín, taking up two floors and over 32,000 square feet.

- LVMH-owned French beauty chain Sephora has opened a new store at the Paseo Querétaro mall in Bajío, Mexico.

- The new store will offer products from brands such as Caudalie, Clinique, Dior, Armani, Urban Decay and Benefit. Sephora has stores in other cities of Mexico such as Playa del Carmen, Monterrey and Mexico City.

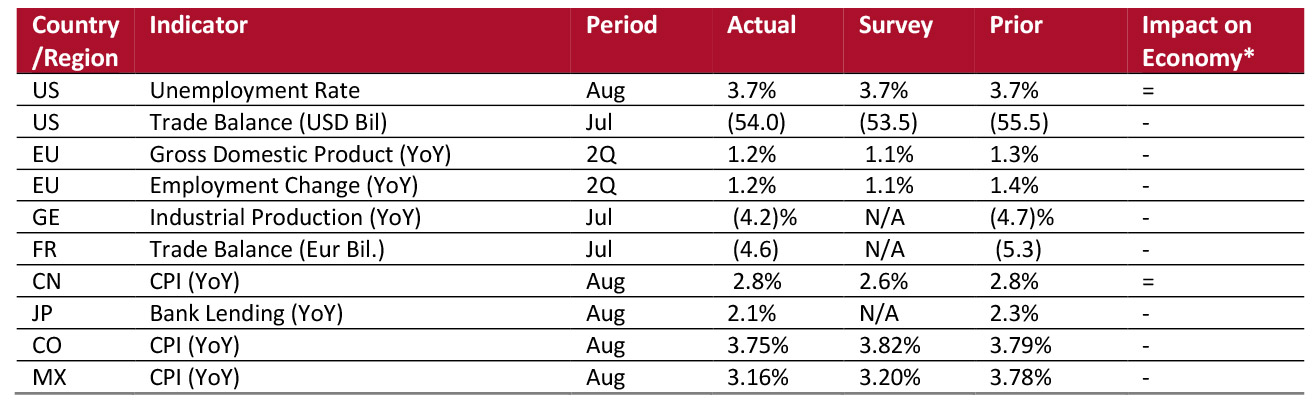

MACRO UPDATE

Key points from global macro indicators released September 4–10, 2019: 1) US: The unemployment rate was 3.7% in August, same as the last three months. Trade deficit decreased to $54.0 billion in July from $55.5 billion in June. 2) Europe: Eurozone gross domestic product rose 1.2% year over year in August, below the 1.3% increase in the previous quarter but above the consensus estimate of 1.1%. In Germany, industrial production fell 4.2% in July, from the 4.7% decrease in June. 3) Asia: In China, the consumer price index (CPI) rose 2.8% year over year in August, unchanged from the previous month and above the consensus estimate of 2.6%. In Japan, bank lending (total loans) rose 2.1% in August, below the 2.3% increase in July. 4) Latin America: In Colombia, the CPI was 3.75% in August, slightly lower than the 3.79% in July. In Mexico, the CPI came in at 3.16%, down from the 3.78% in July. [caption id="attachment_96283" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Bureau of Labor Statistics/US Census Bureau/Eurostat/Destatis/Ministry of Finance, France/National Bureau of Statistics of China/Bank of Japan/Banco de la Republica/INEGI/ Coresight Research [/caption]

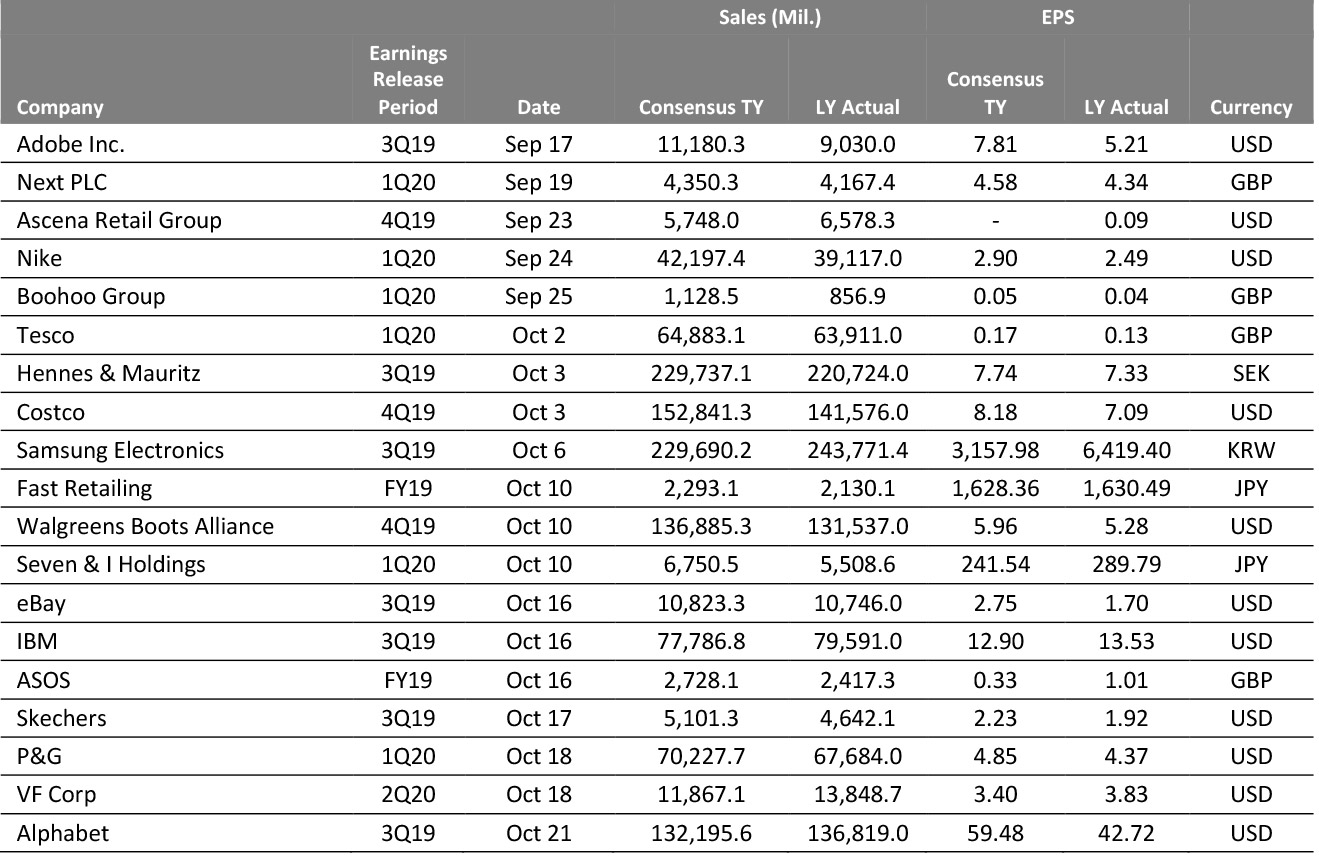

EARNINGS CALENDAR

[caption id="attachment_96308" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR