From the Desk of Deborah Weinswig

Looking at Retail Prospects for the Final Quarter

As the last of summer’s warm weather fades, our attention inevitably begins to turn to the holiday season. In the US, retail has enjoyed a bumper year so far. This week, we look at whether this momentum will continue through the holiday peak.

The Year So Far

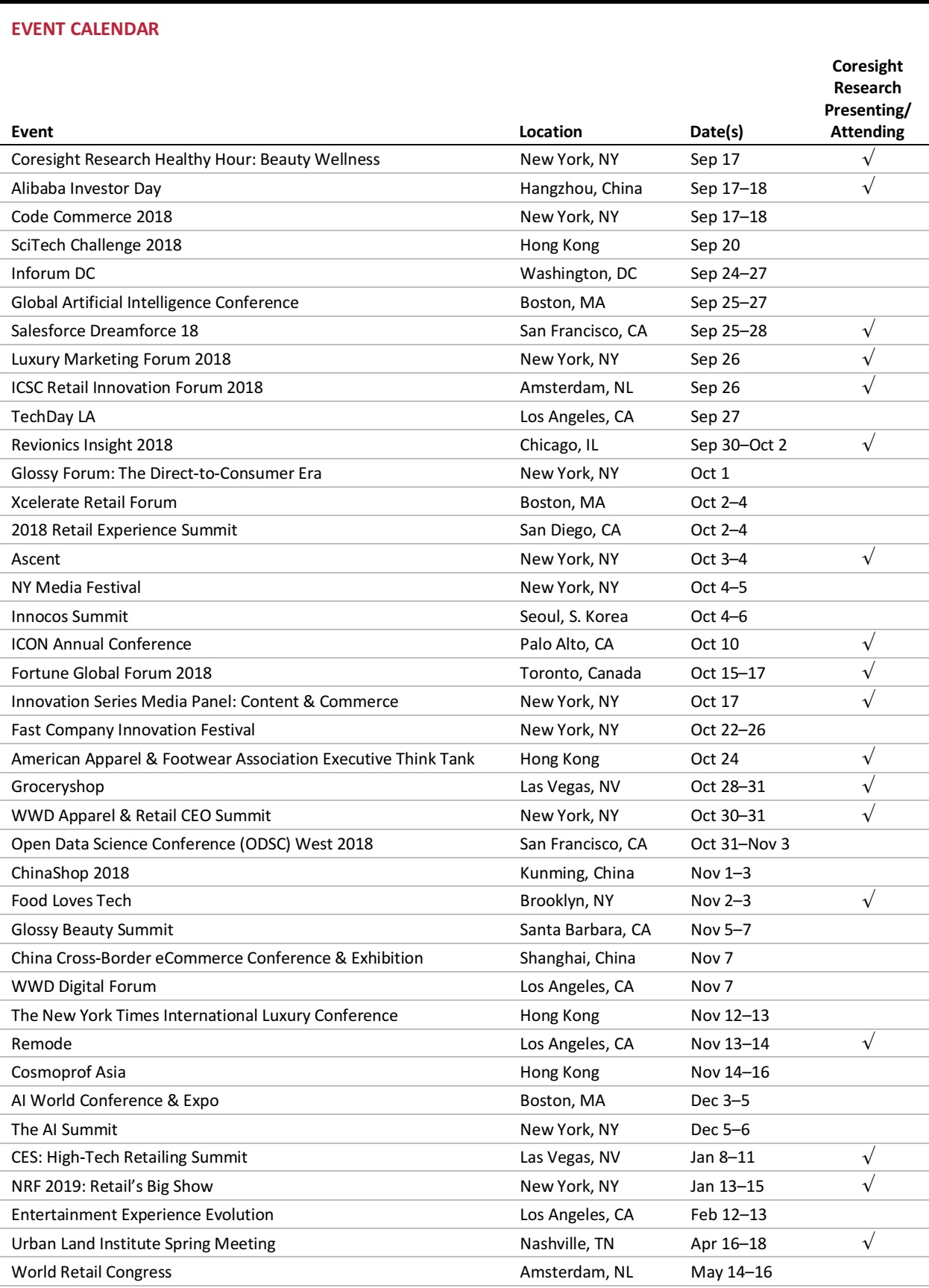

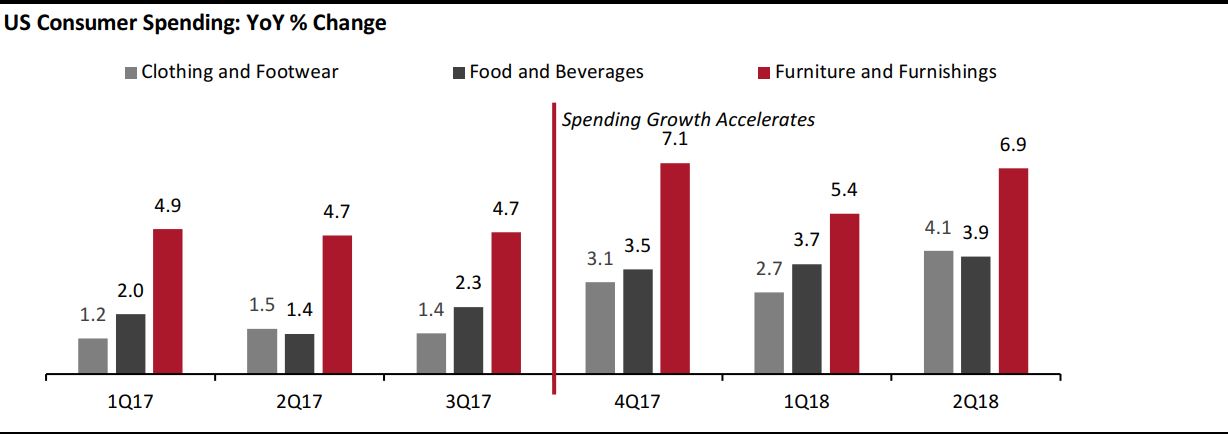

2018 has been a banner year for US retailing. Through July, total retail sales excluding automobiles and gasoline were up 4.5% year over year. We’ve seen demand for big-ticket home goods strengthen, along with a remarkable resurgence in the long-dormant apparel category, which had been perceived to be a lower spending priority for US shoppers for some time. The freer spending has filtered down to discretionary categories, too, with food and beverages, typically a low-growth category, posting a very solid pickup. This growth has come in spite of soaring gas prices, which usually prompt a slowdown in discretionary spending: the pattern we’ve seen this year, of higher gas prices and higher discretionary spending, is decidedly countercyclical.

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

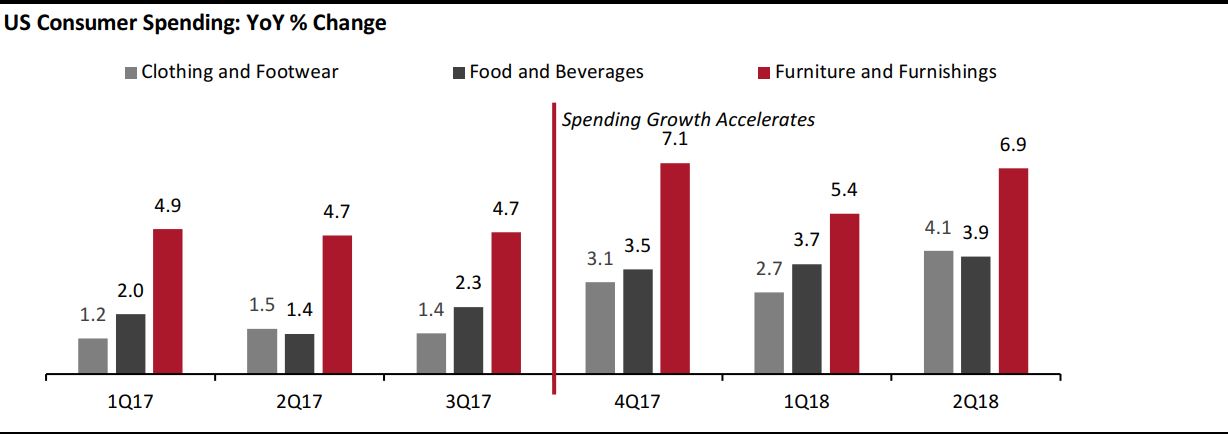

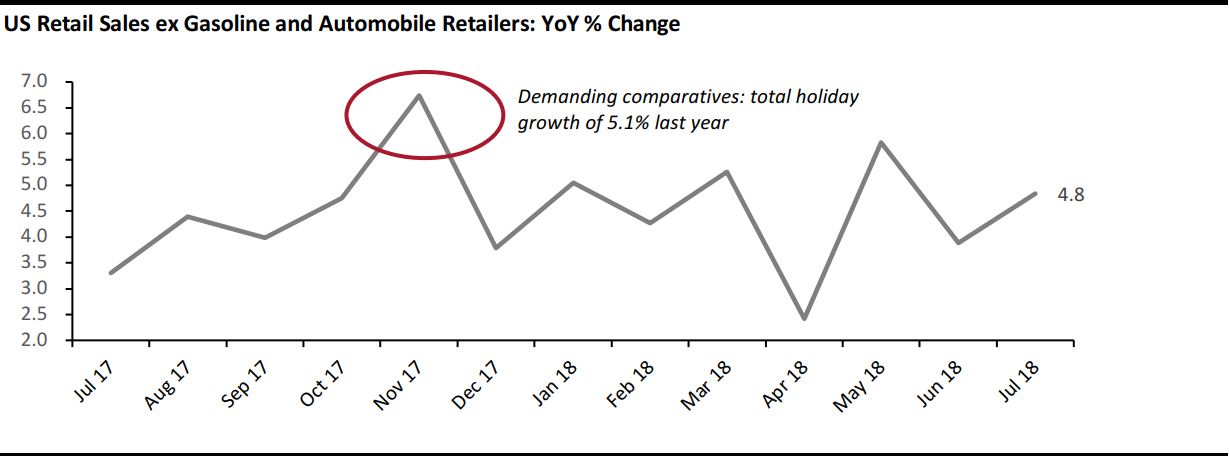

Consumer spending accelerated in the final quarter of 2017, which means that we are about to lap that jump. This annualization will make the comparatives demanding for this year’s holiday season. In particular, retailers face the hurdle of very strong demand in November last year, when total sales jumped by 6.7%.

Data are not seasonally adjusted.

Source: US Census Bureau/Coresight Research

But these considerations will affect the year-over-year rate of change, not demand itself—and we expect demand to remain solid in the holiday quarter this year. With very low unemployment, high consumer confidence, relatively benign inflation (gas prices excepted) and reduced taxes for many, the US macro landscape certainly looks favorable for the 2018 holidays.

A final positive is the calendar. If we take the holiday season as the period between Thanksgiving and Christmas Day, the season this year is as long as it can be. Thanksgiving always falls on the fourth Thursday in November, meaning the earliest that it can fall is November 22—and that is when it is this year. That gifts us 32 days in this year’s holiday season. This means that next year will see a very short holiday season, of just 26 days, but that’s a discussion for a year from now.

- We’ll publish our US Holiday Outlook report next week.

US RETAIL & TECH HEADLINES

US Online Retail Sales Pegged to Reach $525 Billion This Year, and Level Of

(September 11) WWD.com

US Online Retail Sales Pegged to Reach $525 Billion This Year, and Level Of

(September 11) WWD.com

- In its 2018 US Online Retail Forecast, FTI Consulting said that it expects US online retail sales to reach $525 billion by the end of the year, which would represent a 15.9% gain over last year. The firm also said that online sales account for 13.2% of all retail sales in the US, but that e-commerce’s share of total retail sales will begin to level off.

- FTI’s retail practice unit said that due to “stronger-than-expected results in 2017,” the firm “now expects US online retail sales to top $660 billion by 2020 and surpass $1 trillion in 2025.”

Retail Industry Flourishing as Companies Brace for Impact of New Tariffs

(September 11) WashingtonExaminer.com

Retail Industry Flourishing as Companies Brace for Impact of New Tariffs

(September 11) WashingtonExaminer.com

- The US retail industry is flourishing, a rebuke to critics who just a few years ago predicted its demise, but looming threats such as President Trump’s trade skirmishes may weigh on profits in 2019.

- At least 25 of the top publicly traded stores reported revenue growth for the most recent earnings period, according to a Washington Examiner review of the disclosures. Several, such as footwear company DSW, posted double-digit gains.

Grocery Apps on the Upswing

(September 11) SupermarketNews.com

Grocery Apps on the Upswing

(September 11) SupermarketNews.com

- Grocery mobile apps are some of the nation’s fastest-growing apps. In 2018, 18 million US adults will use a grocery app at least monthly, up 49.6% versus last year, according to eMarketer’s latest app usage forecast.

- The firm projects that, by next year, more than one in five adult smartphone shoppers (22.6 million) will use a grocery app to order food, representing 25.6% year-over-year growth. eMarketer expects the number of users of such apps to reach 25.2 million in 2020.

Amazon Will Dethrone Walmart as the No. 1 Retailer of Apparel this Year

(September 10) CNBC.com

Amazon Will Dethrone Walmart as the No. 1 Retailer of Apparel this Year

(September 10) CNBC.com

- Amazon will be the No. 1 seller of apparel in the US in 2018, according to Wells Fargo. The e-commerce behemoth’s apparel and footwear gross sales are expected to top $30 billion this year, allowing Amazon to leapfrog longtime incumbent Walmart for the top spot.

- “Amazon dominates the online market for apparel and footwear (35% share, or four times the No. 2 player) and [it has] remarkably high market share in the total market,” said Wells Fargo analyst Ike Boruchow.

With Eyes on London, Chanel Ltd. Closes Its New York Headquarters

(September 7) BusinessofFashion.com

With Eyes on London, Chanel Ltd. Closes Its New York Headquarters

(September 7) BusinessofFashion.com

- As Chanel centralizes its global operations in London, it is closing Chanel Ltd. in New York. This does not mean Chanel will be closing its US operations—Chanel, Inc., will remain in its offices in the city.

- However, New York will no longer serve as a global headquarters for the company, and the majority of global functions will now be based out of London. The president of Chanel’s Japanese subsidiary will be moving to Europe as well.

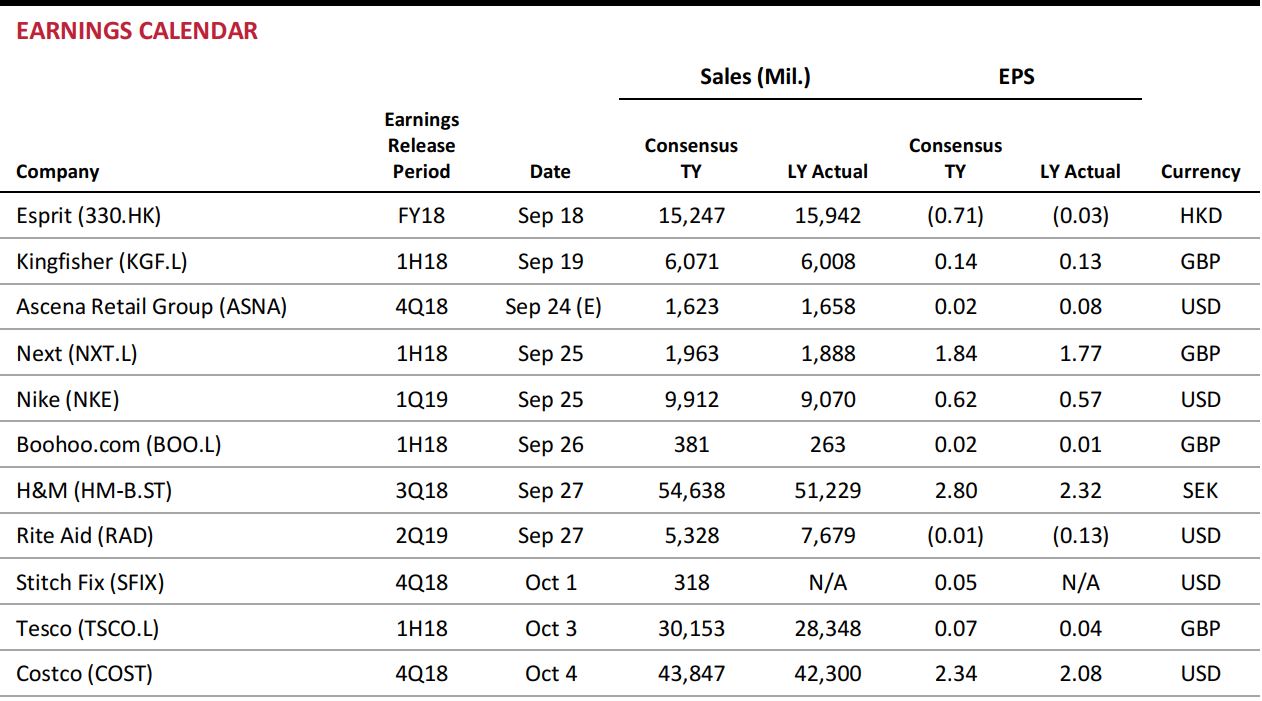

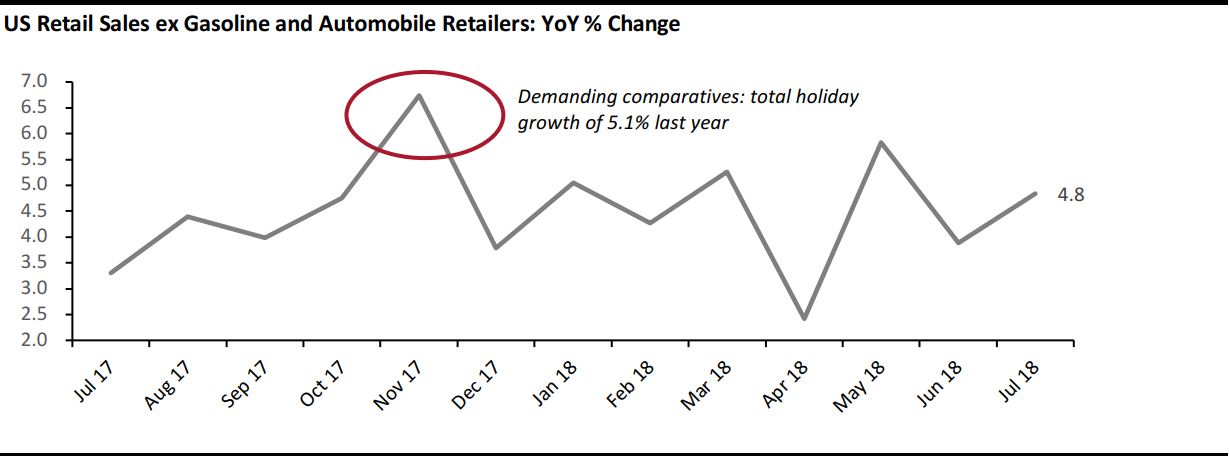

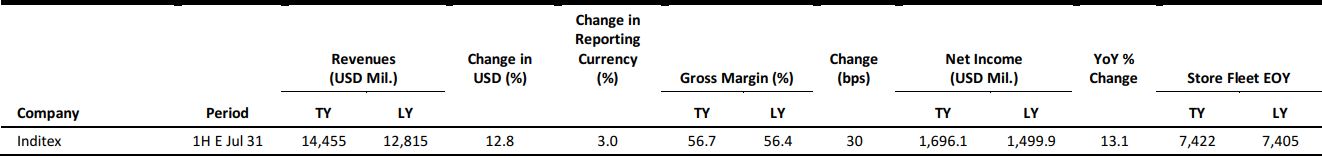

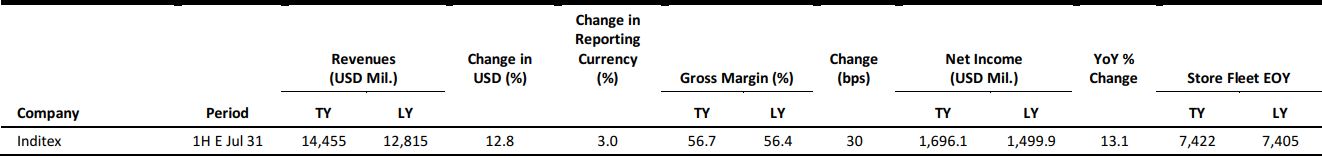

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Suppliers Back Mike Ashley’s Call to Investigate House of Fraser’s Former Directors

(September 10) RetailGazette.co.uk

Suppliers Back Mike Ashley’s Call to Investigate House of Fraser’s Former Directors

(September 10) RetailGazette.co.uk

- Ehab Shouly, cofounder of Tea Terrace, one of House of Fraser’s major suppliers, has joined Mike Ashley in demanding an Insolvency Service investigation into the British department store chain’s former directors. According to the complainants, House of Fraser’s board failed to disclose the full extent of the company’s financial problems.

- Ashley’s Sports Direct purchased House of Fraser a few weeks ago. The department store retailer had failed to find buyers and was on the brink of collapse.

Debenhams Downplays Store Closure Rumors amid Investor Concerns

(September 10) Company press release

Debenhams Downplays Store Closure Rumors amid Investor Concerns

(September 10) Company press release

- In an attempt to appease investors, British department store chain Debenhams announced this week that it expects to report £33 million ($43 million) in annual profits. The announcement follows a report by The Sunday Telegraph that the retailer has roped in restructuring experts from KPMG to help it cope with a downturn in trading.

- Debenhams CEO Sergio Bucher stated, “The market environment remains challenging and underlying trends deteriorated through the summer months.”

UK Retail Footfall Declines by 1.6% in August

(September 10) British Retail Consortium (BRC) press release

UK Retail Footfall Declines by 1.6% in August

(September 10) British Retail Consortium (BRC) press release

- Retail footfall in the UK declined by 1.6% in August following a 0.8% decline in July. High-street footfall dipped by 2% following three months of growth. Shopping center footfall was down 2.4%, an improvement over the 3.4% decline in July.

- BRC Chief Executive Helen Dickinson said, “With fewer shoppers visiting the high street and a difficult overall trading environment, the pressure is increasing on retailers as rising public policy costs continue to bite.”

Richemont Reports Double-Digit Sales Growth for Five Months Ended August 31

(September 10) Company press release

Richemont Reports Double-Digit Sales Growth for Five Months Ended August 31

(September 10) Company press release

- Ahead of its annual general meeting on September 10, Switzerland-based luxury goods company Richemont reported a 25% increase in sales (at constant exchange rates) for the five-month period ended August 31. Sales grew by 22% at actual exchange rates during the period.

- Retail sales grew by 14% on the back of strong performances by Richemont’s jewellery maisons and specialist watchmakers business segments, which grew by 14% and 4%, respectively, at constant exchange rates.

HBC and Signa to Merge Galeria Kaufhof and Karstadt

(September 10) Company press release

HBC and Signa to Merge Galeria Kaufhof and Karstadt

(September 10) Company press release

- HBC and Signa, the respective owners of German department store chains Galeria Kaufhof and Karstadt, announced on September 11 that they have agreed to merge the two chains.

- Canada’s HBC, which acquired Galeria Kaufhof in 2015, will own 49.9% of the new business, while Austria’s Signa will acquire a 50% stake in HBC’s German assets. The formation of the new venture is expected to take place within the next 90 days, subject to regulatory approvals from European competition authorities.

ASIA RETAIL & TECH HEADLINES

Jack Ma to Hand over Alibaba Reins to CEO Daniel Zhang in September 2019

(September 9) Alizila.com

Jack Ma to Hand over Alibaba Reins to CEO Daniel Zhang in September 2019

(September 9) Alizila.com

- On September 10, 2019, Alibaba CEO Daniel Zhang will replace Group Executive Chairman and cofounder Jack Ma as chairman of the Alibaba board, according to a company announcement.

- Ma will continue to serve as a member of the board until the company’s annual general meeting in 2020.

Go-Jek Pulls the Plug on Grocery-Shopping Service Go-Mart

(September 10) TechinAsia.com

Go-Jek Pulls the Plug on Grocery-Shopping Service Go-Mart

(September 10) TechinAsia.com

- Indonesian ride-hailing company Go-Jek has discontinued Go-Mart, the company’s personal grocery-shopping service, without stating the reasons for the move. Go-Mart allowed users to provide Go-Jek drivers with a shopping list and direct them to shop at their favorite retailers.

- Go-Jek is now promoting a stripped-down service called Go-Shop to be used in place of Go-Mart. The company did not state whether it plans to bring back the Go-Mart service.

GreyOrange Raises $140 Million in Series C Funding Round

(September 6) CNBC.com

GreyOrange Raises $140 Million in Series C Funding Round

(September 6) CNBC.com

- Singapore-based technology startup GreyOrange, which develops fully automated robotics for warehouses, has raised $140 million in a series C funding round.

- GreyOrange announced on September 6 that Peter Thiel’s Mithril Capital and Flipkart founder Binny Bansal are among the contributing investors.

DLF to Host Alexander McQueen and Yves Saint Laurent Stores in India

(September 10) InsideRetail.asia

DLF to Host Alexander McQueen and Yves Saint Laurent Stores in India

(September 10) InsideRetail.asia

- Indian commercial real estate developer DLF is set to open stand-alone stores for luxury fashion brands Alexander McQueen and Yves Saint Laurent in India.

- The two brands, which currently have a presence in India only through multibrand outlets, will be launched at DLF’s Chanakya Mall in Delhi by the middle of next year.

Lego China Plans Significant Expansion

(September 10) InsideRetail.asia

Lego China Plans Significant Expansion

(September 10) InsideRetail.asia

- Danish toy manufacturer Lego is set to scale up its expansion in China. The company plans to open two new flagships, one in Beijing and one in Shanghai, within the next few months. Lego achieved double-digit revenue growth in the region in the first half of 2018.

- Lego’s growth in China has already surpassed its growth in Europe and the US, prompting the company to focus on China for its immediate expansion plans.

LATAM RETAIL & TECH HEADLINES

La Polar Reports Sales Decline in the First Half

(September 10) Pe.FashionNetwork.com

La Polar Reports Sales Decline in the First Half

(September 10) Pe.FashionNetwork.com

- Chilean retail chain La Polar reported a 1.3% year-over-year sales decline in the first half ended June 2018. The company attributed the decline to a slowdown in store sales.

- La Polar stated that declines in the footwear, sports, technology and menswear categories offset growth in the household category.

Amazon Launches Amazon Renewed in Mexico

Amazon Launches Amazon Renewed in Mexico

- Amazon has launched its Amazon Renewed platform in Mexico. The platform facilitates the purchase of reconditioned and certified products.

- The e-commerce company noted that it offers discounted reconditioned products at affordable prices with at least a 90-day guarantee through Amazon Mexico.

GPA to Sell Card Reader Machines with Itaú

(September 3) Reuters.com

GPA to Sell Card Reader Machines with Itaú

(September 3) Reuters.com

- Brazilian food retailer GPA is set to form a partnership with Brazil’s largest private bank, Itaú Unibanco, to sell machines that read credit cards. Itaú controls Brazil’s second-largest card processor, known as Rede.

- Assaí’s 129 stores in Brazil will all be selling Itau’s card readers by November this year.

Independence Day Weekend in Brazil Provides R$4.9 Billion ($1.2 Billion) Fillip to Economy

(September 10) RioTimesOnline.com

Independence Day Weekend in Brazil Provides R$4.9 Billion ($1.2 Billion) Fillip to Economy

(September 10) RioTimesOnline.com

- Brazil’s Ministry of Tourism reported that the long Independence Day weekend that started on September 7 prompted a welcome boost of R$4.9 billion ($1.2 billion) into the country’s struggling economy.

- Tourism minister Vinicius Lummertz stated, “Prolonged holidays boost tourism, as they represent an opportunity for short trips to be taken outside of school holidays. These trips produce business for hotels and the attractions of many cities, even generating temporary jobs.”

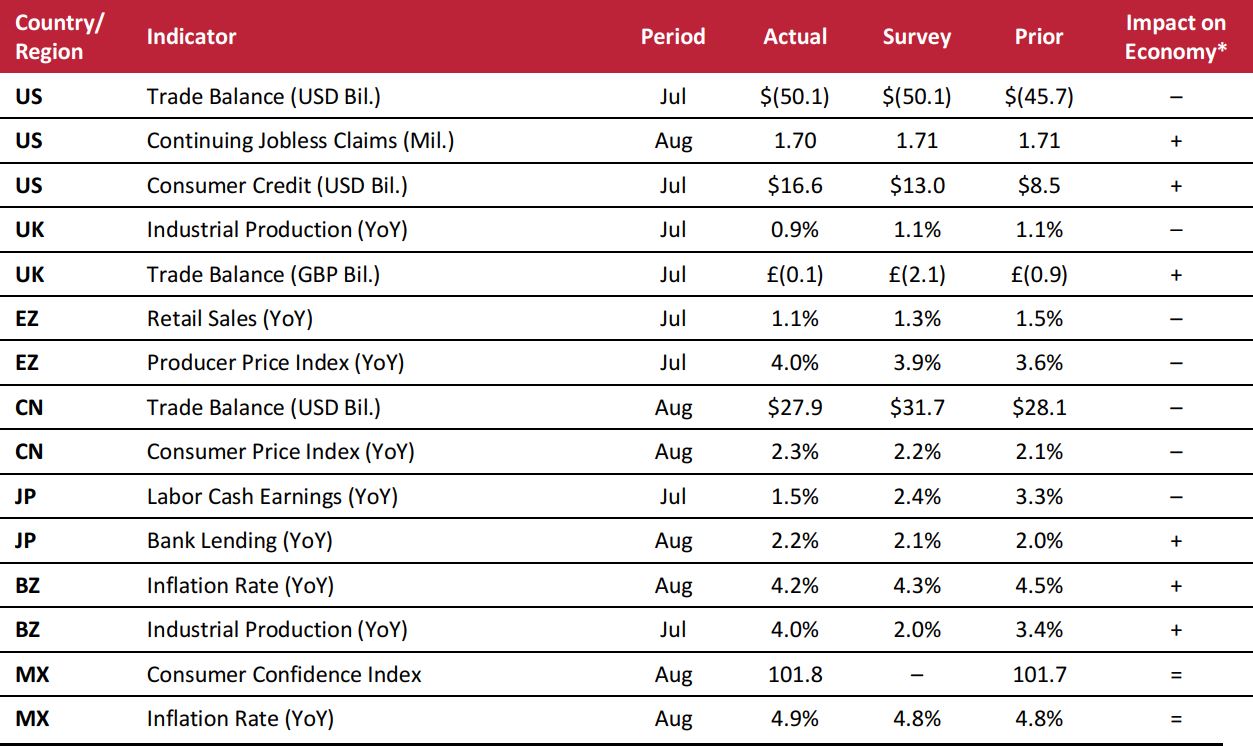

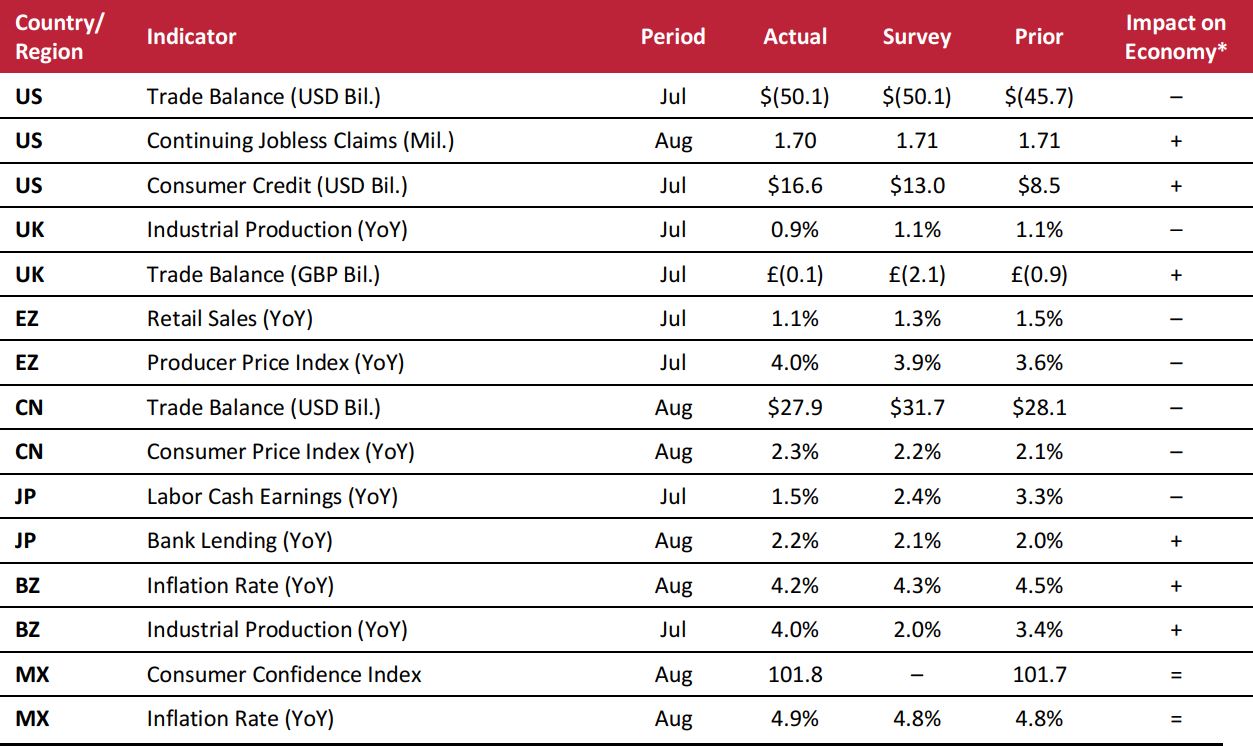

MACRO UPDATE

Key points from global macro indicators released September 4–11, 2018:

- US: The US trade balance reflected a deficit of $50.1 billion in July, higher than the $45.7 billion deficit recorded in June. US consumer credit rose by $16.6 billion in July, almost double the previous month’s gain.

- Europe: In the UK, the industrial sector continued its weakening trend in July. Industrial output rose by 0.9% year over year during the month, after reaching a peak of 3.1% in March this year. In the eurozone, retail sales growth slowed in July to 1.1% year over year, which was lower than the consensus estimate of 1.3%.

- Asia-Pacific: China’s trade balance decreased to $27.9 billion in August from $28.1 billion in July. The trade balance seems to have stabilized following a period of volatility earlier in the year: in February, the country had a trade surplus of $32.3 billion, while in March, it saw a deficit of $55.6 billion. In Japan, cash earnings increased by 1.5% year over year in July, below the consensus estimate of 2.4% and the previous month’s increase of 3.3%.

- Latin America: The Brazilian economy continues its revival, with inflation stabilizing and industrial production continuing to be robust. Industrial production in the country increased by 4% year over year in July, surpassing both the previous value of 3.4% and the consensus estimate of 2.0%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/US Federal Reserve/Office for National Statistics/Eurostat/China General Administration of Customs/National Bureau of Statistics of China/Japan Ministry of Health, Labour and Welfare/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/US Federal Reserve/Office for National Statistics/Eurostat/China General Administration of Customs/National Bureau of Statistics of China/Japan Ministry of Health, Labour and Welfare/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

Retail Industry Flourishing as Companies Brace for Impact of New Tariffs

(September 11) WashingtonExaminer.com

Retail Industry Flourishing as Companies Brace for Impact of New Tariffs

(September 11) WashingtonExaminer.com

Grocery Apps on the Upswing

(September 11) SupermarketNews.com

Grocery Apps on the Upswing

(September 11) SupermarketNews.com

With Eyes on London, Chanel Ltd. Closes Its New York Headquarters

(September 7) BusinessofFashion.com

With Eyes on London, Chanel Ltd. Closes Its New York Headquarters

(September 7) BusinessofFashion.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Suppliers Back Mike Ashley’s Call to Investigate House of Fraser’s Former Directors

(September 10) RetailGazette.co.uk

Suppliers Back Mike Ashley’s Call to Investigate House of Fraser’s Former Directors

(September 10) RetailGazette.co.uk

Richemont Reports Double-Digit Sales Growth for Five Months Ended August 31

(September 10) Company press release

Richemont Reports Double-Digit Sales Growth for Five Months Ended August 31

(September 10) Company press release

HBC and Signa to Merge Galeria Kaufhof and Karstadt

(September 10) Company press release

HBC and Signa to Merge Galeria Kaufhof and Karstadt

(September 10) Company press release

Go-Jek Pulls the Plug on Grocery-Shopping Service Go-Mart

(September 10) TechinAsia.com

Go-Jek Pulls the Plug on Grocery-Shopping Service Go-Mart

(September 10) TechinAsia.com

Lego China Plans Significant Expansion

(September 10) InsideRetail.asia

Lego China Plans Significant Expansion

(September 10) InsideRetail.asia

Independence Day Weekend in Brazil Provides R$4.9 Billion ($1.2 Billion) Fillip to Economy

(September 10) RioTimesOnline.com

Independence Day Weekend in Brazil Provides R$4.9 Billion ($1.2 Billion) Fillip to Economy

(September 10) RioTimesOnline.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/US Federal Reserve/Office for National Statistics/Eurostat/China General Administration of Customs/National Bureau of Statistics of China/Japan Ministry of Health, Labour and Welfare/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/US Federal Reserve/Office for National Statistics/Eurostat/China General Administration of Customs/National Bureau of Statistics of China/Japan Ministry of Health, Labour and Welfare/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research