Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

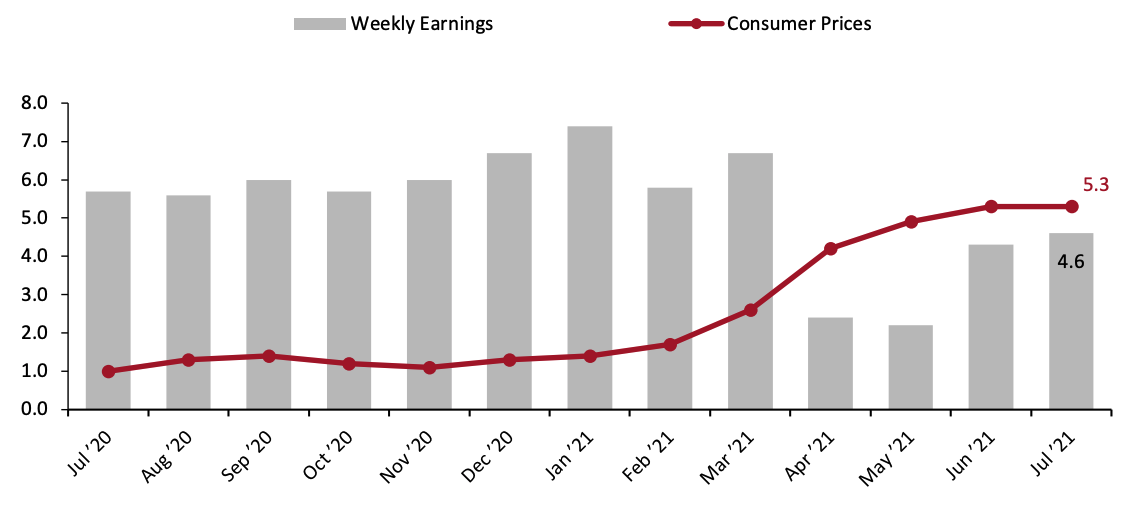

Rising Wages To Help Carry Inflationary Pressures into 2022 Walgreens this week announced plans to raise the wages it pays its US hourly workers in stages, with the aim of reaching $15 per hour by November 2022. It is the latest retailer to target a $15 hourly rate, following on from drugstore rival CVS’s early-August announcement of plans to reach a $15 per hour target by July 2022. Retail firms such as Amazon and Target are already paying a $15 minimum hourly rate. Inflation Outpacing Earnings for Now Despite recent wage hikes, official metrics show wage rises underpacing price growth on a year-over-year basis. Nominal wage growth slightly accelerated to 4.6% in July, from 4.3% in June. Year-over-year growth in April and May was depressed by strong comparatives from 2020, when substantial job losses among lower-paid workers pushed up recorded hourly wages. In comparison, seasonally adjusted inflation stood at 5.3% in July, unchanged from June. While we are seeing higher prices in retail, inflation has been particularly fueled by strong increases in nonretail categories such as airline fares and used vehicles. As charted in Figure 1, the year-over-year trend represents an erosion of average purchasing power for those in work, based on their wages. However, that excludes stimulus, which is helping to strengthen demand and so exert an upward pressure on prices. According to Coresight Research analysis, the US government will have paid close to $1.7 trillion to consumers through stimulus checks, Child Tax Credit, food stamps and unemployment benefits by the end of 2021.Figure 1. US Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_132123" align="aligncenter" width="700"]

Source: BLS[/caption]

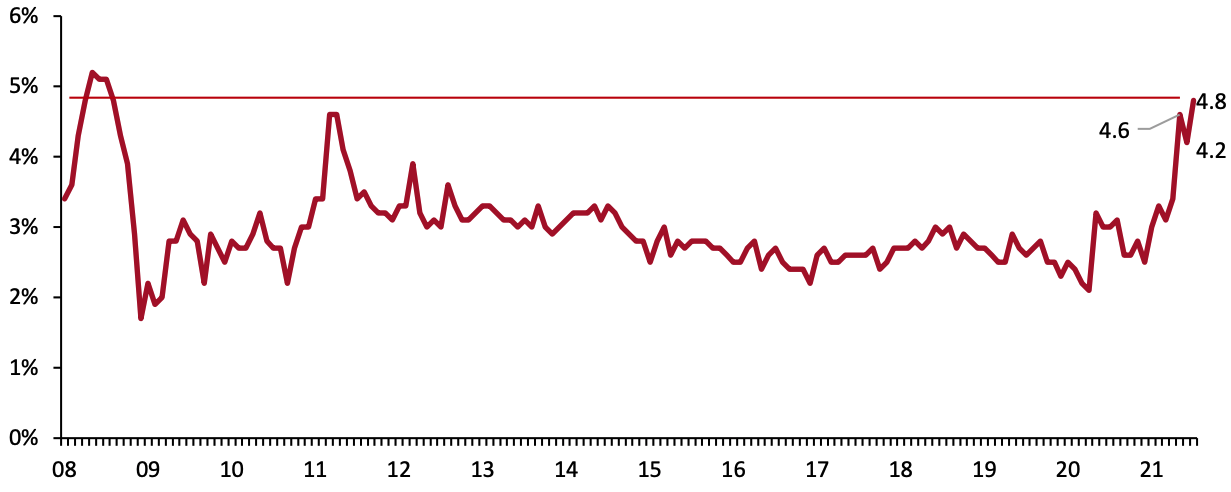

Consumers are expecting more to come. As of July 2021, US consumers’ expectations of 12-month inflation were the highest for 13 years, at 4.8%, according to University of Michigan data. Coresight Research’s own survey data, publishing Monday, confirms that a large proportion of consumers are noticing price rises and a large majority of those are taking mitigating actions, or plan to do so. Official metrics of inflation (i.e., the consumer price index) focus on year-over-year changes—but consumers tend to look at the cost of their shopping week to week or month to month. Even if official retail price rises are, in some cases, relatively modest on a year-over-year basis, our survey data reflect that, on their own terms, shoppers are noticing price increases.

Source: BLS[/caption]

Consumers are expecting more to come. As of July 2021, US consumers’ expectations of 12-month inflation were the highest for 13 years, at 4.8%, according to University of Michigan data. Coresight Research’s own survey data, publishing Monday, confirms that a large proportion of consumers are noticing price rises and a large majority of those are taking mitigating actions, or plan to do so. Official metrics of inflation (i.e., the consumer price index) focus on year-over-year changes—but consumers tend to look at the cost of their shopping week to week or month to month. Even if official retail price rises are, in some cases, relatively modest on a year-over-year basis, our survey data reflect that, on their own terms, shoppers are noticing price increases.

Figure 2. US Consumers’ 12-Month Inflation Expectations [caption id="attachment_132124" align="aligncenter" width="700"]

Through July 2021

Through July 2021Source: University of Michigan[/caption] Hanging Around into 2022? With around $1.7 trillion in government payments in consumers’ wallets, there could hardly be a better context for consumers to absorb price increases. At the same time, a majority of consumers that are noticing price rises are not standing still and claim to be taking mitigating actions, according to Coresight Research surveys. In some categories, and especially for discretionary purchases that can be deferred, this is likely to impact the pace of volume growth in the coming months—even as retailers’ top lines are supported by higher prices. Higher prices have recently been fueled by strong demand (in turn, supported by stimulus) coupled with supply chain challenges—from the closure of ports in China to shortages of truck drivers in the US. Wage hikes have the potential to add another component into the inflationary mix, and many retailers will feel the pressure to pass on higher costs to consumers. Global shipping difficulties are set to last well into 2022. With planned wage increases stretching into next year, too, it looks like raised inflation could be here for some time. Watch out for our upcoming research this week:

- US Consumer Tracker: Inflation—Perceptions and Reactions

- US Stimulus Timeline

US RETAIL AND TECH HEADLINES

Allbirds Files for Initial Public Offering Under “BIRD” (August 31) CNBC.com- Direct-to-consumer (DTC) sustainable footwear brand Allbirds has filed for an initial public offering (IPO) with the Securities and Exchange Commission. The company has applied to list its Class A common stock on the Nasdaq exchange with the ticker symbol “BIRD.”

- The company experienced high net losses during 2020, of $25.9 million—up 78.6% from 2019. During the first six months of 2021, Allbird’s total net losses reached $21.1 million.

- Bed Bath & Beyond has announced the resignation of Cindy Davis as Chief Brand Officer, Executive Vice President and President of Decorist, effective August 30, 2021. Davis joined the company in May 2020.

- Following Davis’s exit, Executive Vice President and Chief Digital Officer Rafeh Masood is serving as Interim Chief Brand Officer, leading the combined brand, digital and marketing and teams. Masood joined the company in 2020 and has played a significant role in establishing its omnichannel experiences.

- PVH Corp. has reported $2.3 billion in total revenues, up 46.0% (40.0% at constant exchange rates) year over year, for its second quarter, ended August 1, 2021. The company registered net income of $181.9 million during the same period. PVH Corp. posted a 77.0% increase in total wholesale revenues, driven by strong performance in Europe, and 35.0% year-over-year growth in digital sales.

- The company raised its full-year guidance to a 26.0–28.0% revenue increase compared to 2020, with expectations for its earnings per share to reach $8.50, compared to 2020’s loss per share of $1.97.

- Sequential Brands Group, owner of multiple consumer brands including And1, Avia, Jessica Simpson and Joe’s Jeans, filed for Chapter 11 bankruptcy protection on August 30, 2021, due to a high debt load of $450 million, as of the end of 2020.

- The company has secured $150.0 million through debtor-in-possession financing from existing term lenders to fund its operations through the Chapter 11 process. It plans to sell most or all of its assets via a court-supervised auction.

- Technology manufacturer Zebra Technologies Corporation has announced plans to acquire Antuit.ai for an undisclosed sum. Antuit.ai is a US-based provider of software-as-a-service (SaaS) solutions powered by artificial intelligence (AI), specific to forecasting and merchandising in the retail and CPG industries. The deal is set to close by end of 2021.

- The acquisition will help Zebra Technologies to enhance its offerings for consumer products companies and retail brands. According to Zebra Technologies’ Chief Product & Solutions Officer Bill Burns, “Zebra’s focus on visibility and productivity will be enhanced by the acquisition of Antuit.ai and will expand our customer offerings.”

EUROPE RETAIL AND TECH HEADLINES

Boohoo Announces US Investment Giant as New Shareholder (Aug 31) UK.FashionNetwork.com- UK-based online fashion retailer Boohoo Group has announced that US investment giant T Rowe Price has acquired a 10% stake in the group—and is now the third-largest shareholder in Boohoo.

- The investment comes while Boohoo’s share prices are volatile, currently at a low rate. T Rowe Price also holds a major stake, of 11%, in Boohoo’s rival ASOS.

- Bulgaria-based retailer Fantastico Group has opened a new multi-use retail outlet and entertainment complex in Pernik. The retail complex has an extensive grocery offering and spans 115,744 square feet.

- The grocery outlet provides around 45,000 stock-keeping units (SKUs) and includes both locally and internationally sourced products. The outlet is also the company’s first to house a “MeatCorner” concept space, which offers fresh meat.

- British retailer Marks & Spencer has stopped selling men’s suits in more than half of its 245 large format stores. The move comes amid rising demand for casual clothing among men and women—accelerated by the pandemic-driven shift to remote working.

- The company saw a 61% increase in consumers purchasing casual wear from April 2020 to 2021, including jogging bottoms and sweaters. The retailer launched a dedicated loungewear section in many of its stores in early 2021 to cater to more relaxed clothing preferences.

- British online supermarket Ocado has unveiled its sixth robotic customer fulfillment center (CFC) in Purfleet, England, where it aims to create 1,500 new jobs. The new CFC will be its third to launch in the UK this year and its second-biggest in the country, capable of fulfilling 80,000 orders per week.

- With the three new CFCs fully operational, Ocado’s weekly order fulfillment will increase from 356,000 to 600,000, serving around 75% of UK households. The initiative comes as part of the company’s plans to rapidly expand its capacity to meet the spike in online grocery demand.

- German online apparel retailer Zalando has announced plans to expand its luxury and designer goods category. The company aims to establish itself as a “credible, fresh and inclusive partner” for luxury and designer brands.

- Zalando has already added more than 50 luxury goods brands so far in 2021, including 032C, Christopher Kane, Mansur Gavriel and Missoni. Moreover, the company has also launched a dedicated video marketing campaign named “Luxury on Your Terms” to support growth in the category, starring American actor Lachlan Watson.

ASIA RETAIL AND TECH HEADLINES

Amazon Revamps Delivery Service Partner Program In India (August 31) LiveMint.com- E-commerce giant Amazon has announced plans to revamp its global delivery service partner (DSP) program in India, aiming to strengthen its last-mile delivery services. The company currently operates a network of 1,500 delivery stations across 750 cities, enabling it to reach remote parts of the country.

- Amazon’s revamped DSP program will offer new services, including allocating an account manager to its DSPs and providing them with recruitment, legal and technological support.

- China’s market regulator has proposed amendments to its e-commerce law, stating that licenses could be revoked if companies fail to take measures against vendors that violate intellectual property rights laws.

- Over the past year, China has been drafting new laws in areas such as anti-monopoly and data security, aiming to tighten regulatory control over the nation’s Internet giants.

- Hong Kong retail sales grew 2.9% year over year in July, the sixth consecutive month of growth, which can be attributed to the easing of the pandemic, improved labor market conditions and the recovery of the economy.

- The government’s disbursement of electronic consumption vouchers since the beginning of August has helped stimulate consumption and will provide support to retail businesses through the rest of the year.

- China-based e-commerce giant JD.com and ride-hailing powerhouse Didi have established unions for their workers, reportedly making them the biggest tech firms to establish country-wide unions in China.

- The move comes amid concerns from Chinese regulators over working conditions and treatment of consumer data at large technology firms this year.

- Indian department store chain operator Shoppers Stop has announced plans to sell a controlling stake of its Crossword Bookstore to franchisee partner Agarwal Business House, which currently operates its largest outlet in the country.

- The deal is aligned with Shoppers Stop’s plan to focus on its core business and expand its First Citizen membership plan and private-label brand offerings.