DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

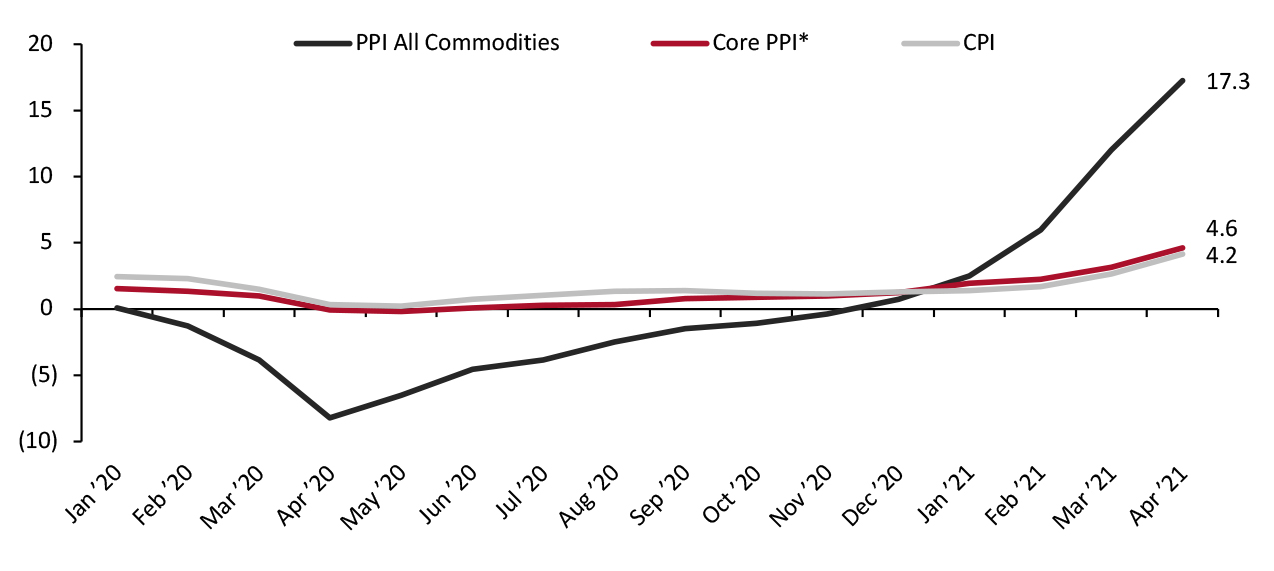

Rising Input Costs To Push Up Prices and Squeeze Retail Margins—Is It Transitory? As many countries start to get back on their feet, surging demand and supply chain challenges—coupled with lower fuel production—are driving up shipping costs and prices for commodities such as cotton, oil and lumber. Tightening labor markets have fanned the flames of this inflationary trend. In our coverage the US of earnings season, we have heard from management about cost challenges: Tapestry management pointed to higher freight costs amid the current environment; Ralph Lauren management forecast a highly volatile and inflationary input cost environment in the current fiscal year; Kohl’s noted that wage inflation was a headwind to margins going forward; and Home Depot and Lowe’s pointed to inflation in construction materials, including very strong inflation in lumber. In strong-demand markets, retailers such as Home Depot and Lowe’s are passing through costs, helping to push up average transaction values by double-digit percentages, and fueling a 160-basis-point sequential jump in the headline US CPI (consumer price index) rate in April, to 4.2%. According to the US Bureau of Labor Statistics (BLS), CPI was running at 6.5% in appliances and 7.8% in furniture, although it came in at a surprisingly soft 2.7% in tools, hardware and supplies in April. However, names in some sectors, such as apparel, are warning of resulting margin erosion on a two-year basis (i.e., compared to pre-pandemic), with Ross Stores guiding for second-quarter operating margin erosion of between 380 and 450 basis points compared to the same period in 2019 due to continued freight, wage and Covid-19 costs. CPI for apparel stood at 1.9% in April. Input costs show the scale of the challenges, and the potential price increases in industries where higher prices can be wholly or substantially passed on to consumers. For March and April (latest), the US PPI (producer price index) for all commodities was up by double digits year over year, as shown in Figure 1. We saw the strongest increases in petroleum products, lumber, and iron and steel. In April, core PPI, which excludes food, energy and trade services, was up by 4.6% compared to one year prior. The trend in commodities suggests that CPI is likely to climb further—for industries with limited ability to pass through full cost rises, that implies an erosion of margins.Figure 1. US PPI vs. CPI: YoY % Change [caption id="attachment_127846" align="aligncenter" width="725"]

*Final demand less food, energy and trade services

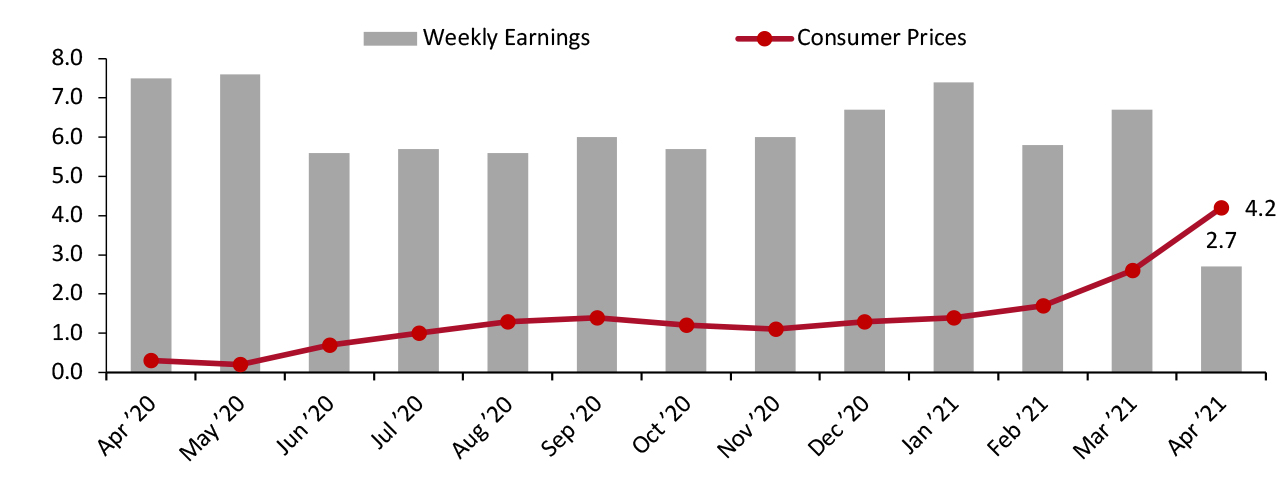

*Final demand less food, energy and trade services Source: BLS/FRED [/caption] In the US, we are already seeing price rises outpace nominal wage growth: Wage growth decelerated to 2.7% in April 2021, from 6.7% in March, due to strong comparatives from April last year, as the month recorded a substantial rise in average weekly earnings owing to huge job losses among lower-paid workers in 2020. The May earnings data will be annualizing a similarly strong month and, given the PPI trends discussed above, we will likely see CPI climb further.

Figure 2. US Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_127847" align="aligncenter" width="725"]

Source: BLS[/caption]

Some transitory inflation was widely expected this year as the US and other economies saw a post-vaccination surge in demand. However, several economists expected that a slack labor market would maintain pressure on wages and so be one offset to rising input costs.

While the US job market recovered at a much slower rate than forecasters generally expected in April, the slight uptick in unemployment is almost certainly a bump in the road rather than a reversion of the anticipated labor market recovery. As we move toward the summer, virus cases are likely to continue to decline and even the most cautious states are expected to lift virus-related restrictions. This should spark a drastic increase in spending on services, creating jobs for workers who were hit hardest by the initial pandemic-related closures.

In that context, retailers are likely to see strong competition for labor, limiting the opportunity to offset rising costs seen elsewhere. As we noted above, Kohl’s has cautioned on rising wage costs.

Source: BLS[/caption]

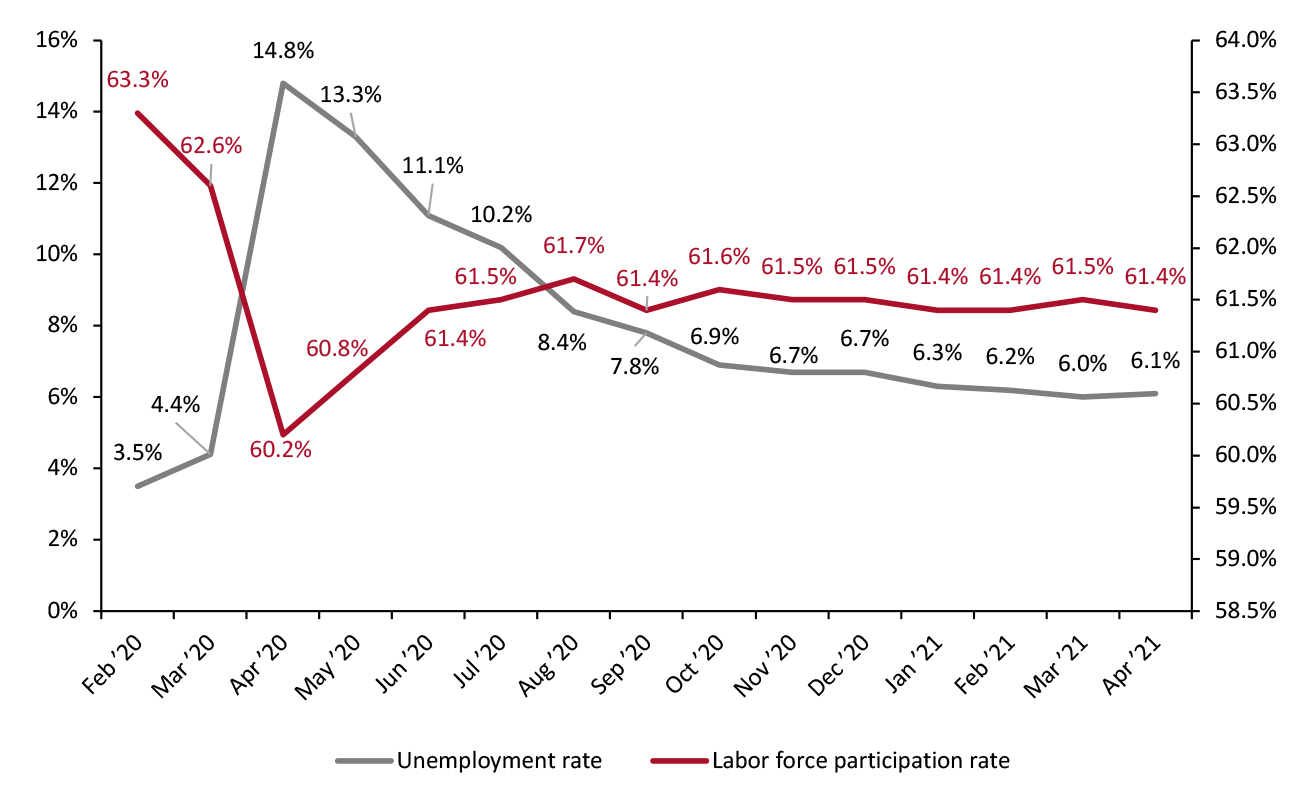

Some transitory inflation was widely expected this year as the US and other economies saw a post-vaccination surge in demand. However, several economists expected that a slack labor market would maintain pressure on wages and so be one offset to rising input costs.

While the US job market recovered at a much slower rate than forecasters generally expected in April, the slight uptick in unemployment is almost certainly a bump in the road rather than a reversion of the anticipated labor market recovery. As we move toward the summer, virus cases are likely to continue to decline and even the most cautious states are expected to lift virus-related restrictions. This should spark a drastic increase in spending on services, creating jobs for workers who were hit hardest by the initial pandemic-related closures.

In that context, retailers are likely to see strong competition for labor, limiting the opportunity to offset rising costs seen elsewhere. As we noted above, Kohl’s has cautioned on rising wage costs.

Figure 3. US Unemployment Rate (Left Axis, %) and Labor Force Participation Rate (Right Axis, %) [caption id="attachment_127877" align="aligncenter" width="725"]

Source: BLS[/caption]

The US Federal Reserve is keeping interest rates close to zero to support the economic recovery, although that could change should the surge in inflation prove to be unexpectedly persistent.

Source: BLS[/caption]

The US Federal Reserve is keeping interest rates close to zero to support the economic recovery, although that could change should the surge in inflation prove to be unexpectedly persistent.

US RETAIL AND TECH HEADLINES

Amazon Faces Lawsuit on Grounds of Anticompetitive Practices (May 25) FashionNetwork.com- Washington, D.C.’s Attorney General Karl Racine has filed a lawsuit against e-commerce giant Amazon, alleging that the company requires that third-party sellers do not offer better deals elsewhere.

- Racine stated, “Amazon has used its dominant position in the online retail market to win at all costs. It maximizes its profits at the expense of third-party sellers and consumers, while harming competition.”

- Brand management company Authentic Brands, which owns apparel retailers Aeropostale, Forever 21 and Nautica, is considering an IPO (initial public offering) as early as this year, according to “people with knowledge of the matter” as cited by Bloomberg.

- The company is set to seek a valuation of around $10 billion—however, plans are not finalized and the valuation is subject to change at the time of going public.

- Department store retailer Nordstrom registered a net loss of $166 million for its first quarter of fiscal 2021 (ended May 1, 2021)—compared to a net loss of $521 million during the same period last year.

- The retailer logged $3 billion in total revenues, up 44% year over year but down 13% on a two-year basis. Digital platforms emerged as a bright spot, with 28% growth in digital sales and a 50% increase in app downloads compared with the same period in 2019.

- Urban Outfitters has recorded $927.4 million in total revenues for its first quarter of fiscal 2021 (ended April 30, 2021), ahead of consensus estimates of $900.2 million (based on an analyst poll conducted by Thomson Reuters). Total sales were up 57.6% year over year and up 7% from the same period two years ago.

- The company recorded a net income of $53.5 million during the same period and $0.54 per diluted share, ahead of the consensus estimate of $0.17.

- Walmart has launched a crafting brand named Smarts & Crafts with American author, decorator and designer Todd Oldham.

- The brand carries gender-neutral products in eco-friendly packaging. It offers 75 items, covering bedding, craft supplies and interior decorations for children aged between three and 14.

EUROPE RETAIL AND TECH HEADLINES

Fozzy Group Launches “Laboratory Zi,” R&D Center for AI and Innovation (May 25) ESMMagazine.com- Ukrainian food chain and supermarket company Fozzy Group has launched an R&D center for AI (artificial intelligence) and innovation, “Laboratory Zi.” The center will develop solutions for the group’s retail chains, logistics and restaurant businesses.

- The retailer is already carrying out pilot projects in robotics. It plans to conduct experiments in AI, immersive technologies, the Internet of Things, neural networks and machine learning—which will subsequently be used in its store processes.

- IKEA has launched a “buy now, pay later” financial service, offering interest-free financing to its shoppers on purchases over £99 ($140) and up to £15,000 (around $21,200). Customers can apply through a digital application process available online and in-store.

- The initiative will allow customers to extend repayments to between three and 48 months, depending on the amount borrowed.

- Dutch supermarket chain Jumbo has announced plans to open three new Belgian stores, one in West Flanders and two in the northeastern province of Limburg.

- After the openings, Jumbo’s store count in Belgium will total 11. The move comes as part of the retailer’s long-term ambition of operating 100 stores in Belgium.

- Marks & Spencer has announced plans to close 30 stores after sales were negatively impacted by lockdowns. The company registered a loss of £201 million ($284 million) in its fiscal year ended March 27, 2021.

- The retailer currently has over 250 “full-line” stores selling clothing, food and home ranges and plans to reduce the number to 180. The company plans to close around 30 stores and transform some stores into “food only” stores, while others will be moved to new locations.

- British fashion brand Sosander has announced plans to raise £5 million ($7 million) to invest in stock starting this autumn season. The retailer proposed the placement of over 26 million new ordinary shares of £0.10 ($0.14) which closed on Tuesday, May 25, at a price of £0.20 ($0.28) per share.

- The brand has also extended its partnerships with John Lewis, Marks & Spencer and Next.

ASIA RETAIL AND TECH HEADLINES

Indian Startups Raise $7.8 Billion During First Four Months of 2021 (May 24) ETRetail.com- Indian startups have raised a total investment of $7.8 billion during the first four months of 2021 and $12.1 billion in the full-year 2020, according to US-based research firm PitchBook. Between January 2021 and April 2021, 402 funding rounds have taken place.

- PitchBook also reported that the average funding size totaled $25.2 million, up from $14.9 million in 2020. The pace of investments has been accelerated by a rise in global liquidity, as well as the pandemic-driven increase in digital adoption.

- E-commerce platforms JD.com and Meituan and self-driving logistics startup Neolix have received municipal approval to test autonomous delivery vehicles in Beijing. By June 2021, Neolix plans to operate 150 delivery robots in the city (JD.com and Meituan have not yet revealed numbers).

- The companies will begin testing on designated public roads in the Chinese capital’s Yizhuang Development Area. To facilitate the vehicles’ usage, the area has begun improving its infrastructure, including establishing 5G coverage.

- Online medical platform Pharmeasy has announced the acquisition of competitor Medlife. Medlife is a digital platform that offers pharmaceuticals and e-consultation. As part of the deal, its customers and retail partners will become part of Pharmeasy, effective immediately.

- The company is planning for a potential public market listing to raise $400–500 million. Reports suggest that the IPO will value the company at $3 billion.

- Pomelo, a Thailand-based fashion e-commerce platform, has announced plans to launch a fashion technology platform called Prism. The platform will host data analytics and demand-forecasting tools for fashion retailers.

- The JD.com-backed retailer plans to launch the B2B (business-to-business) platform in June 2021. This initiative comes as part of the company’s strategy to boost its revenues after a pandemic-related sales decline.

- Vietnamese coffee label TNI King Coffee has entered the US market, opening its first store in California. King Coffee offers its own products, including instant and whole-bean coffee. The company also distributes Vietnamese coffee across 120 countries and regions.

- King Coffee aims to open 20 stores in the US by the end of this year, and 100 by the end of 2022, using a franchise model. It also plans to open stores in other markets, including China, Europe, the Middle East and Southeast Asia.