Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Retail’s Current Polarized Trajectories Retail’s first-quarter 2022 earnings reporting season has revealed something of a polarized performance. Some retailers have reported healthy revenue and comp growth:- Nordstrom reported an 18.7% year-over-year sales increase, commenting that customers “shopped for long-awaited occasions and refreshed their closets.”

- Macy’s reported 12.8% comps on an owned basis, reporting a similar “shift back to occasion-based apparel and continued strength in sales of luxury goods”

- TJX reported 17% comps, including 40% comps for its HomeGoods division.

- Amazon reported that sales in its online stores (i.e., Amazon.com) declined by 1% year over year.

- Kohl’s reported a 5.2% decrease in comps owing to the ending of last year’s stimulus programs and the current inflationary environment.

- Target reported solid 3.3% comps, yet its gross margin came under pressure due to inventory-reduction actions and higher freight and transportation costs.

- While Walmart reported solid 3.0% US comps, the company reported unexpected bottom-line results owing to an unusual environment of US inflation levels putting greater-than-expected pressure on margin mix and operating costs. The company raised its annual revenue guidance, yet it lowered its earnings guidance.

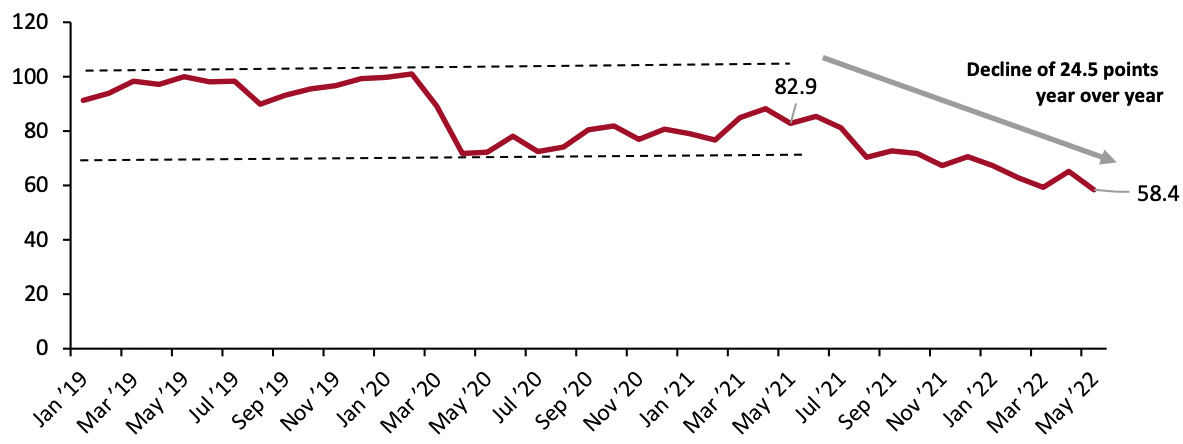

Figure 1. Index of Consumer Sentiment (Points) [caption id="attachment_148685" align="aligncenter" width="700"]

Source: University of Michigan[/caption]

The current environment of high inflation levels, geopolitical conflict, rising interest rates, quantitative tightening, and layoffs and hiring freezes beginning in the tech sector will likely lead consumers to become even more cautious and thus create more retail turbulence. On the positive side, the April US unemployment rate of 3.6% remains below the 5% threshold, indicating that consumers largely still have jobs as well as possibly some savings accumulated during the pandemic. Shanghai’s reopening could also mitigate some cost pressures on global supply chains. For now, upper-income consumers are hanging in there—willing and able to spend and helping to drive retail sales.

Source: University of Michigan[/caption]

The current environment of high inflation levels, geopolitical conflict, rising interest rates, quantitative tightening, and layoffs and hiring freezes beginning in the tech sector will likely lead consumers to become even more cautious and thus create more retail turbulence. On the positive side, the April US unemployment rate of 3.6% remains below the 5% threshold, indicating that consumers largely still have jobs as well as possibly some savings accumulated during the pandemic. Shanghai’s reopening could also mitigate some cost pressures on global supply chains. For now, upper-income consumers are hanging in there—willing and able to spend and helping to drive retail sales.

US RETAIL AND TECH HEADLINES

American Eagle Outfitters’ Subsidiary Announces Delivery Partnership (May 31) Company press release- Quiet Platforms, a subsidiary of apparel specialty retailer American Eagle Outfitters, has announced its partnership with global shipping and mailing company Pitney Bowes. The latter will provide carrier services to Quiet Platforms’ shared supply chain network.

- According to American Eagle Outfitters, the shared supply chain platform enables businesses to collaborate to solve their common logistics, fulfillment and delivery challenges as well as position inventory closer to end consumers.

- Home-goods retailer Bed Bath & Beyond has launched a new private-label brand named Everhome, which will be available in stores and on the retailer's website and app.

- Everhome is Bed Bath & Beyond's ninth private-label launch, bringing it closer to its goal of launching over 10 new private labels, which it announced in late 2020. Everhome’s collection features accessories, bedding, bath linens outdoor furniture with a coastal-inspired aesthetic.

- British online luxury fashion retail platform Farfetch has invested $200 million in US-based luxury department store Neiman Marcus Group for a common equity minority stake.

- Neiman Marcus will use the funds to accelerate growth and innovation by investing in technology and digital capabilities. It has also signed a commercial agreement with Farfetch, wherein Farfetch Platform Solutions (FPS) will re-platform the Bergdorf Goodman website and mobile application, which is owned by Neiman Marcus.

- Apparel retailer Intermix has appointed its board member and former President and CEO of Neiman Marcus Group, Karen Katz, as its interim CEO, effective June 7, 2022. This follows the exit of the current CEO, Jyothi Rao.

- Gap Inc. acquired multi-brand women’s apparel specialty retailer Intermix in 2012 and operated its online business and retail stores until it sold the retailer to Altamont Capital Partners in 2021.

- Supermarket chain Tops Friendly Markets has expanded its “Tops Shop + Scan” mobile checkout functionality to five new locations in New York–Dunkirk, Cheektowaga, Williamsville, Hamburg and Ithaca. It already offers the service at 19 of its other New York stores.

- The “Tops Shop + Scan” app allows customers to scan products using their smartphones, keep track of their purchases and pay with a simple barcode scan at checkout, according to the company.

EUROPE RETAIL AND TECH HEADLINES

Albert Heijn To Supply Shift To Electric Transport for Home Deliveries (June 1) Company press release- Netherlands-based supermarket chain Albert Heijn, which is owned by Ahold Delhaize, has announced plans to shift to 100% electric transport for home deliveries and supplying its shops in the center of The Hague by the end of 2022, with Amsterdam, Rotterdam and Utrecht to follow.

- According to the company, consumers will benefit from quieter and cleaner transportation in their areas, without comprising on convenience.

- British supermarket chain Asda has launched a budget-friendly brand, Just Essentials by Asda, which it states will help shoppers amid rising inflation. The new range comes as customers tighten their purse strings due to the cost-of-living crisis.

- The range comprises 293 products, equating to 50% more product than the Smart Price range it is replacing. The company stated that over 60 products will be available in stores and online this week, including fresh meat, fish and fresh produce. More than 130 products will be available by the end of June and 267 items will be shoppable by August 13, 2022. The remaining 26 products will land in stores by the end of 2022.

- Berlin-based ultrafast grocery delivery provider Gorillas has added Alnatura products to its app for the German market, paving the way for a more sustainable shopping experience in quick commerce.

- The company stated that this pivotal step in Gorillas' commercial strategy will boost the proportion of organically produced products in its overall assortment to more than 15%.

- Swedish fashion group H&M and furniture retailer IKEA have teamed up on a hyper-local venture to open the first Atelier100 location, in Hammersmith, London, featuring items made within 100 kilometers of the store.

- According to the companies, the Atelier100 store is intended to strengthen their relationships with the creative design community and spark new ideas.

- Italian online supermarket platform Tulips has announced plans to invest in its dark store networks using the €4.0 million ($4.3 million) in funding that it has raised through the CrowdFundMe platform.

- The openings will be concentrated in Northern Italy. The company will also use the funding to enhance its technological and digital efficiencies, improve its use of artificial intelligence (AI), and launch marketing campaigns and brand promotions.

ASIA RETAIL AND TECH HEADLINES

Armani Beauty and La Mer Join JD.com’s Platform (June 1) RetailAsia.com- Armani Beauty and La Mer have opened online stores on Chinese e-commerce company JD.com’s platform. The Armani Beauty store is a collaboration between Italian luxury fashion house Armani, JD.com, and French personal care company L'Oréal Group. Armani Beauty offers around 180 high-end cosmetic, skincare and perfume products.

- New York-based cosmetics company, La Mer, which is owned by Estée Lauder Group, will feature 50 popular products, including the brand's face creams and a selection of gift boxes. JD.com will also provide La Mer with personalized greeting cards to give to consumers and logistical support.

- FJ Benjamin, a Singapore-based fashion and lifestyle retailer, has secured the rights to premium skincare brand MZ Skin in three Southeast Asian markets: Singapore, Malaysia and Indonesia, as part of an effort to extend its cosmetics and beauty portfolio. FJ Benjamin will have the exclusive rights to distribute and sell MZ Skin products for an initial period of two years.

- Items will be available for purchase both online and in select retail locations, including a concession in the Seibu department store in Kuala Lumpur's The Exchange TRX complex.

- Walmart-owned Flipkart’s subsidiary Myntra, an Indian online fashion platform, has acquired the master distribution and management rights for US-based women's apparel brand bebe. Myntra will help bebe with wholesale distribution via a network of independent third-party franchise partners and distributors.

- The brand will target the mass premium segment and will offer a wide range of apparel, with a focus on the urban and fashion-forward cohorts in India’s Tier I cities.

- Sportswear brand Puma India has partnered with Maldives-based sports and lifestyle marketplace Sonee Sports to open its first store in Maldives.

- The two-floor Puma store is located on the country’s popular retail street, Majeedhee Magu, and is set to be a one-stop destination for tourists and fashion enthusiasts, as well as the growing local football and futsal community. Puma stated that it will expand its offline retail presence as well as explore e-commerce, sports clubs and other distribution channels in this new area as part of the partnership.

- SUGAR Cosmetics, an Indian direct-to-consumer (DTC) cosmetics and personal care company, has raised $50 million in a Series D round headed by L Catterton and backed by current investors A91 Partners, Elevation Capital and India Quotient.

- This takes its total funding amount to $85.5 million and its total valuation to $500 million. The company plans to use the new funds to build and expand in distribution, product and community, as well as strengthen its retail footprint.