DIpil Das

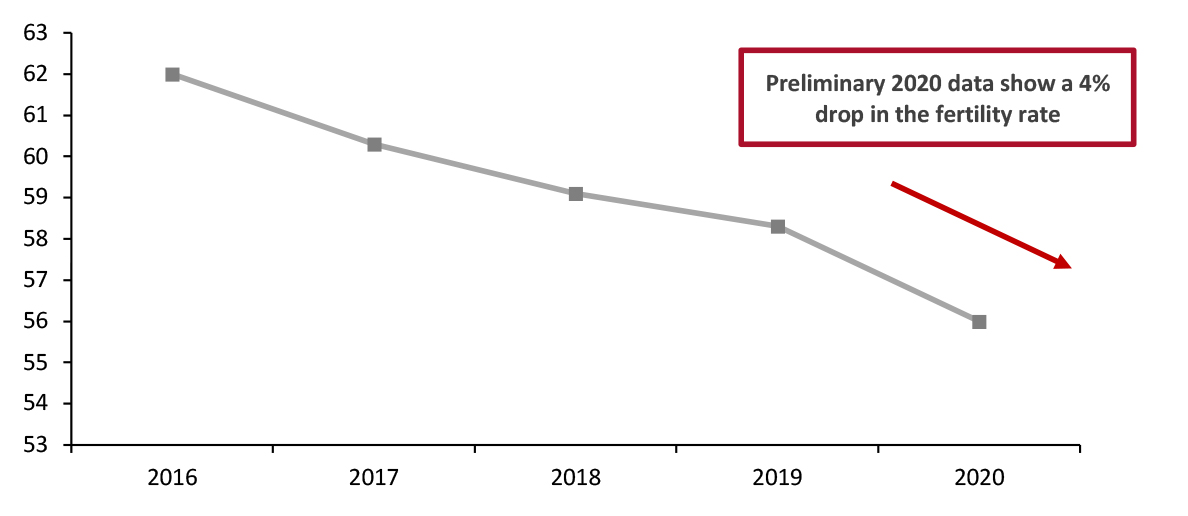

FROM THE DESK OF DEBORAH WEINSWIG

Pandemic-Driven Baby Bust To Have Lasting Impact on Retail Categories Declining birth rates and fertility rates are a structural trend in many Western markets, and 2021 is set to see a more significant decrease due to the lingering impacts of the Covid-19 pandemic. The impact on family planning comes against the backdrop of a rise in US unemployment rates—to a high of 14.7% in April 2020 and remaining at least three percentage points above pre-pandemic rates for the remaining months. The Brookings Institution estimates that there will be a drop of between 300,000 and 500,000 births in 2021: Its forecast suggests that this year will record the most dramatic dip in birth rates since the declines that followed the global financial crisis in 2007 and 2008, which were followed by a five-year decrease in fertility rates. The overall forecast is in line with the results of a Guttmacher Institute study conducted between April 30–May 6, 2020, in which 34% of women reported that they wanted to wait to get pregnant or wanted fewer children in response to the pandemic. Furthermore, lower-income women were five percentage points more likely to report this change in preferences than higher-income women (37% versus 32%, respectively). A sharp downturn would compound the long-term trend for declining fertility rates. The latest data from the CDC (Centers for Disease Control and Prevention) suggest a decline of 4% in the general fertility rate from 2019 to 2020 (a figure that reflects only pregnancies conceived through April 2020, just following the WHO’s official announcement of the Covid-19 pandemic in March).Figure 1. US General Fertility Rate (Average Number of Children per 1,000 Women) [caption id="attachment_129022" align="aligncenter" width="725"]

Source: Centers for Disease Control and Prevention[/caption]

With the US now in a strong recovery mode, the impact on birth rates is likely to be relatively short-lived. Beyond this lull, the recovering labor market and nationwide vaccination campaign will likely spur greater confidence among American households. Assuming no derailment in the economy or public health, we could therefore see a short-lived baby boom from 2022—a recovery in birth rates following the pandemic-induced lull—although we do not expect the longer-term downward trend to reverse.

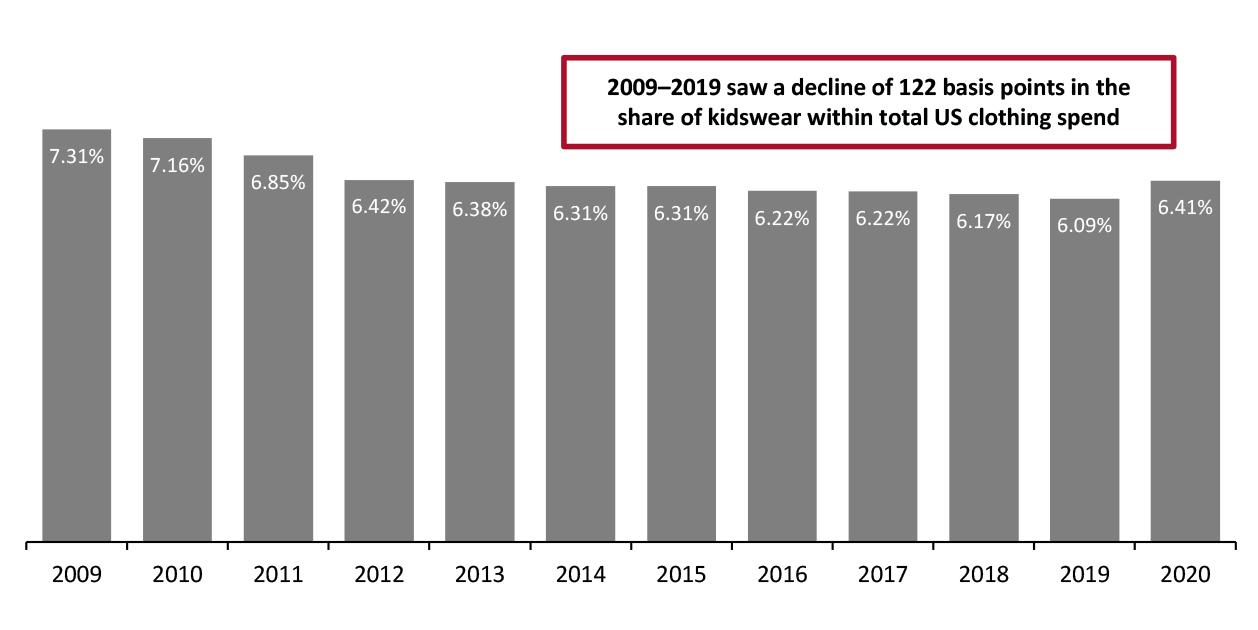

We expect to see 2020’s impact and the structural trend reflected in ongoing weak volume demand for child-relevant retail categories. As shown in Figure 2, birth rates have been reflected in kids’ apparel capturing a decreasing share of the total category since peaking in 2009; 2020 was an exception due to the renewal needs that are more evident in clothing for children than for adults.

Source: Centers for Disease Control and Prevention[/caption]

With the US now in a strong recovery mode, the impact on birth rates is likely to be relatively short-lived. Beyond this lull, the recovering labor market and nationwide vaccination campaign will likely spur greater confidence among American households. Assuming no derailment in the economy or public health, we could therefore see a short-lived baby boom from 2022—a recovery in birth rates following the pandemic-induced lull—although we do not expect the longer-term downward trend to reverse.

We expect to see 2020’s impact and the structural trend reflected in ongoing weak volume demand for child-relevant retail categories. As shown in Figure 2, birth rates have been reflected in kids’ apparel capturing a decreasing share of the total category since peaking in 2009; 2020 was an exception due to the renewal needs that are more evident in clothing for children than for adults.

Figure 2. US Consumer Spending on Children’s and Infants’ Clothing as % of Total Consumer Spending on Clothing [caption id="attachment_129023" align="aligncenter" width="725"]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Volume demand is likely to prove softer across an array of categories in 2021 and beyond, from durable baby products to food, kid-specific CPGs (consumer packaged goods), and clothing and footwear. With the decline in volume demand, the opportunities for brands and retailers lie in sustaining or even driving up total value spend—by encouraging shoppers to trade up, achieved by premiumization and new product development.

Companies in this space that do not have the safeguard of diversification must tap into universal parental concerns, such as sustainability, wellbeing and digital conveniences. Brands and retailers should encourage the kind of strong spending that China was known for during the years in which its one-child policy overlapped with its economic boom—and hope that Western parents spend freely on their own kids going forward.

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Volume demand is likely to prove softer across an array of categories in 2021 and beyond, from durable baby products to food, kid-specific CPGs (consumer packaged goods), and clothing and footwear. With the decline in volume demand, the opportunities for brands and retailers lie in sustaining or even driving up total value spend—by encouraging shoppers to trade up, achieved by premiumization and new product development.

Companies in this space that do not have the safeguard of diversification must tap into universal parental concerns, such as sustainability, wellbeing and digital conveniences. Brands and retailers should encourage the kind of strong spending that China was known for during the years in which its one-child policy overlapped with its economic boom—and hope that Western parents spend freely on their own kids going forward.

US RETAIL AND TECH HEADLINES

Amazon Prime Day Witnesses Highest Online Spending So Far in 2021 (June 22) CNBC.com- Amazon’s 48-hour Prime Day event helped total US online retail sales to exceed $11 billion over the two days—a 6.1% increase compared to overall e-commerce transactions during the 2020 event, according to Adobe Analytics data. The first day of the event marked the biggest day for digital sales so far this year.

- Multiple retailers, including Best Buy, Kohl’s, Target, and Walmart, participated in the online sale event, offering competing discounts on products.

- US-based doughnut chain Krispy Kreme plans to raise $560‒640 million through an initial public offering (IPO) later in 2021, according to regulatory filings.

- Krispy Kreme plans to sell its stock for $21–$24 per share. Its implied valuation after the IPO is expected to reach $3.5–4.0 billion. The company plans to use the IPO proceeds to pay off debts, repurchase shares of stock from its executives and for other corporate purposes.

- At-home fitness equipment and media company Peloton is set to enter the wearables market with the launch of a digital armband device. The device comes in two sizes and can be linked up to Peloton equipment, as well as phones, tablets and televisions, through Peloton’s workout app.

- Initiating its move to enter the wearables market, the company acquired Atlas Wearables, a maker of heart-rate-tracking fitness wearables, for an undisclosed amount in March 2021.

- Target has introduced a new sustainability strategy named “Target Forward,” which is focused on co-creating a more equitable and regenerative future with its communities and partners. By 2030, Target aims to become the leading player in offering sustainable and inclusive brands and experiences.

- By 2040, Target aims to become a net-zero enterprise—committing to zero waste disposal in US landfills and achieving net-zero emissions across its global operations and supply chain. The retailer also aims to align 100% of its own-brand products with circular economy principles by the same year.

- US-based prescription eyeglasses and sunglasses retailer Warby Parker has filed for an IPO in the US, with no official timeframe yet announced.

- During its most recent funding round in 2020, Warby Parker raised a total of $120 million—taking the company’s valuation to $3 billion. The company’s list of investors includes Forerunner Ventures, General Catalyst, Menlo Ventures, Spark Capital and Tiger Global Management.

EUROPE RETAIL AND TECH HEADLINES

Jumbo Opens Its Eleventh Home-Delivery Hub (June 23) ESMMagazine.com- Dutch supermarket chain Jumbo has opened its eleventh home-delivery hub in Deventer, the Netherlands, to optimize grocery delivery through its website and app. The new delivery hub cooperates with the company’s fulfillment center in Raalte, the Netherlands, providing customers with shorter and more frequent delivery slots than its previous capabilities.

- The retailer plans to open five more hubs across the country later this year, increasing its home-delivery capacity to meet growing consumer demand in online grocery.

- Finland-based retailing conglomerate K Group has announced plans to invest approximately €10 million ($11.9 million) in partially automating its online grocery order collection system in the coming years.

- Ari Akseli, President of Kesko’s grocery trade division, stated, “Online grocery sales in Finland are expected to grow considerably over the next ten years. We aim to maintain our clear market-leading position in online grocery going forward.”

- Marks & Spencer has announced its partnership with retail technology platform Go Instore to offer a live video service that replicates in-store customer service, named “Video Expert.”

- The service provides remote and on-demand one-to-one consultations with Marks & Spencer’s experts through its website product pages. Marks & Spencer noted that the new service will also enable the retailer’s staff to run livestreaming sessions, allowing an unlimited number of customers to join the broadcast and learn more about the company’s products.

- Luxury department store Selfridges has opened in-store garden centers at its London, Manchester and Birmingham stores. The move is set to capitalize on the pandemic-fueled gardening boom—more than three million people in the UK started gardening in 2020, according to the Horticultural Trades Association.

- The new garden centers sell gardening indoor and outdoor plants, pots, seeds, and tools—as well as Selfridges’ private-label compost and yellow garden gnome.

- Online fashion and lifestyle platform Zalando has announced a collaboration with beauty retailer Sephora to create an online prestige beauty destination on its platform.

- The partnership benefits from Zalando’s customer experience and e-commerce expertise alongside Sephora’s range of beauty products from over 300 brands. Under the terms of the alliance, the beauty assortment will launch on Zalando’s site in Germany in the fourth quarter of fiscal 2021, and continue into other European markets in 2022.

ASIA RETAIL AND TECH HEADLINES

Alibaba Group Expands Hypermarket Chain “Store X” Footprint (June 22) InsideRetail.asia- Alibaba Group has announced plans to expand its members-only hypermarket chain Store X, opening eight more stores by the end of 2021—taking its store count to 11. The company currently operates three stores, two of which opened last week.

- The company’s own-brand products comprise around 40% of the overall store offering, which includes fresh produce, general merchandise and premium imports.

- South Korean convenience store chain E-Mart24 opened its first Malaysian store on June 24, in partnership with local franchise partner United Frontier Holdings. The retailer plans to open 10 stores in the country by the end of this year and around 300 within the next five years.

- The store spans 2,766 square feet and is located in a commercial district in Kuala Lumpur. It offers Korean snacks and street foods, as well as prepared salads and sandwiches.

- The Government of India has proposed stricter e-commerce rules for both domestic and foreign e-commerce players in the country. The proposals are open for public consultation until July 6. The move comes as Amazon and Walmart-owned Flipkart fight antitrust allegations in court.

- The new rules include proposals such as a potential ban on flash sales, barring promotions on private labels and preventing e-commerce companies from listing any affiliates as sellers, among others.

- Myntra, India’s leading fashion and lifestyle e-commerce marketplace, has announced the launch of California-based beauty brand Benefit Cosmetics on its platform. On the first day of launch, Benefit Cosmetics will offer a 25% discount across its product range.

- Myntra’s Chief Business Officer Ayyappan Rajagopal stated, “The partnership with Benefit Cosmetics will strengthen Myntra’s commitment to offer the best international beauty products to our brand-conscious customers. The association will enhance our proposition, especially in the higher end of the segment.”

- Indian conglomerate Tata Group has announced plans to raise funds in the range of $2.0–2.5 billion for its digital arm, Tata Digital. The company is currently working towards the launch of its e-commerce “Super App.”

- The “Super App” will offer a wide range of products and services across consumer electronics, fashion, grocery and healthcare, among others. Its launch will place Tata Group in direct competition with India’s major e-commerce players, such as Amazon India, Flipkart and Reliance JioMart.