FROM THE DESK OF DEBORAH WEINSWIG

Online Grocery: The Choices Facing US Retailers

Of all the behaviors adopted by US shoppers during the Covid-19 crisis, elevated rates of online shopping have so far been one of the most enduring. Post lockdown, we could easily have seen a major slowdown in online sales and penetration rates as consumers returned to pre-crisis habits.

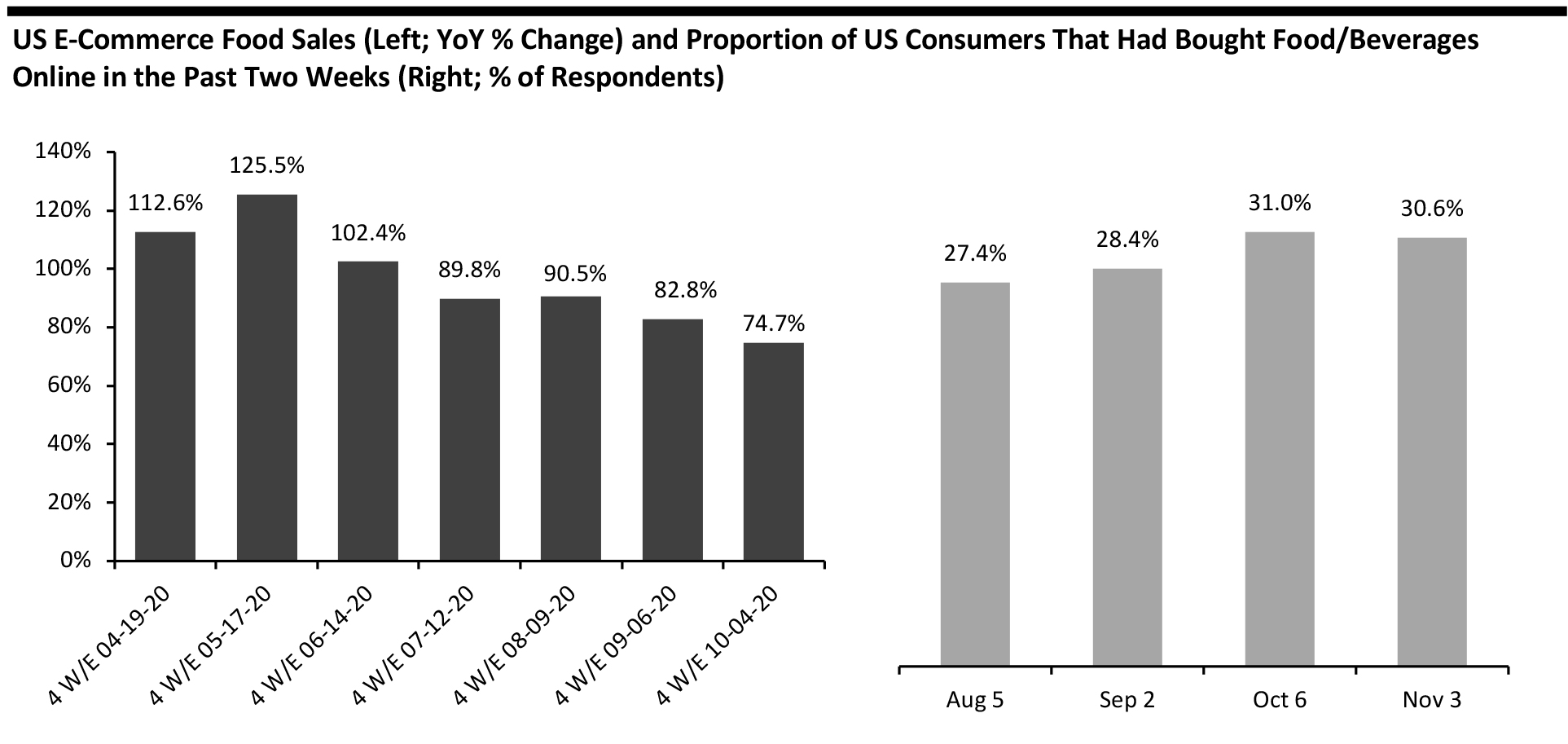

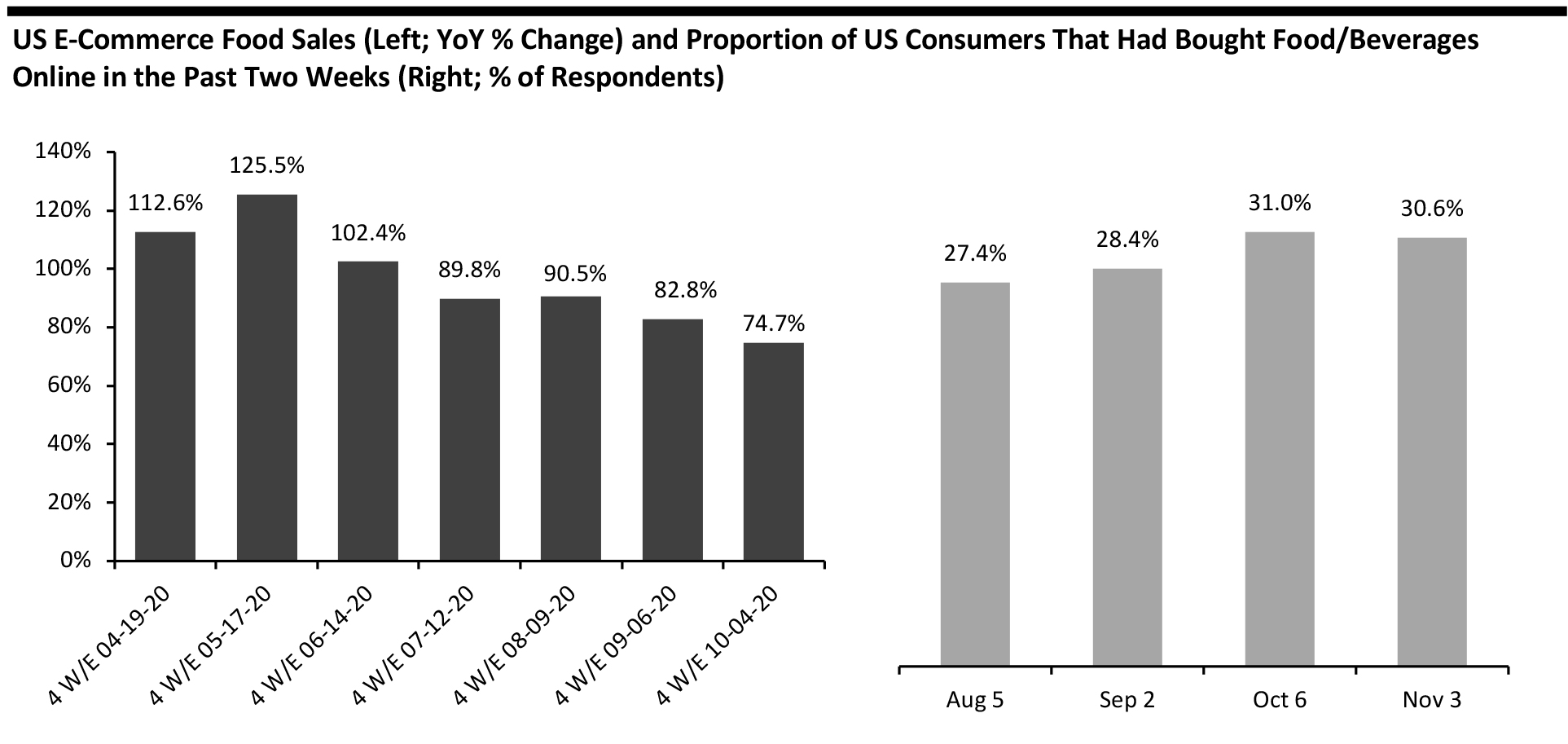

While we have seen a gradual slowing in growth rates for US online food sales, the levels remain elevated and consumer participation rates are still high. In fact, the latter has trended slightly upward over the past three months, according to Coresight Research survey data, implying that the market slowdown is being driven by decreased frequency or smaller basket size per online shopper.

[caption id="attachment_119254" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research

Source: IRI E-Market Insights™/Coresight Research [/caption]

America’s biggest grocery retailers have established sophisticated and substantial online operations. During the crisis, many others scrambled to introduce services or extend fledgling operations. These retailers must now equip themselves for normalization of elevated online demand. We identify two areas of focus:

- Path to Purchase. Amid lockdown, many retailers focused on scaling capacity, often at the expense of the quality of the shopping experience. Against the backdrop of the “new normal,” grocery retailers must now leverage technologies and review working practices to address the experience. Here’s just one example: Some retailers rolled out curbside-pickup services that required customers to call the store when they arrived; long term, that is not a practice that will appeal to shoppers, especially digitally equipped millennials. In addition, some retailers outsourced picking and/or delivery to third-party vendors, such as Instacart, to build capacity at speed—and reviewing the balance of in-house versus outsourced capacity is one component of path-to-purchase consideration.

- Operational Efficiencies. Picking and delivery costs (where orders are not collected) are a major negative associated with online grocery operations and in a context of raised e-commerce levels. Even in mature grocery e-commerce markets, these costs tend to far exceed the fee charged to shoppers. As online grocery becomes embedded, US retailers should refocus on driving efficiencies in their operations. They must decide between capex-lighter but opex-heavier in-store picking and capex-heavier but opex-lighter centralized fulfillment centers. In the hinterland between in-store picking and automated distribution centers lie micro-fulfillment centers—technology-equipped picking centers typically located adjacent to existing stores.

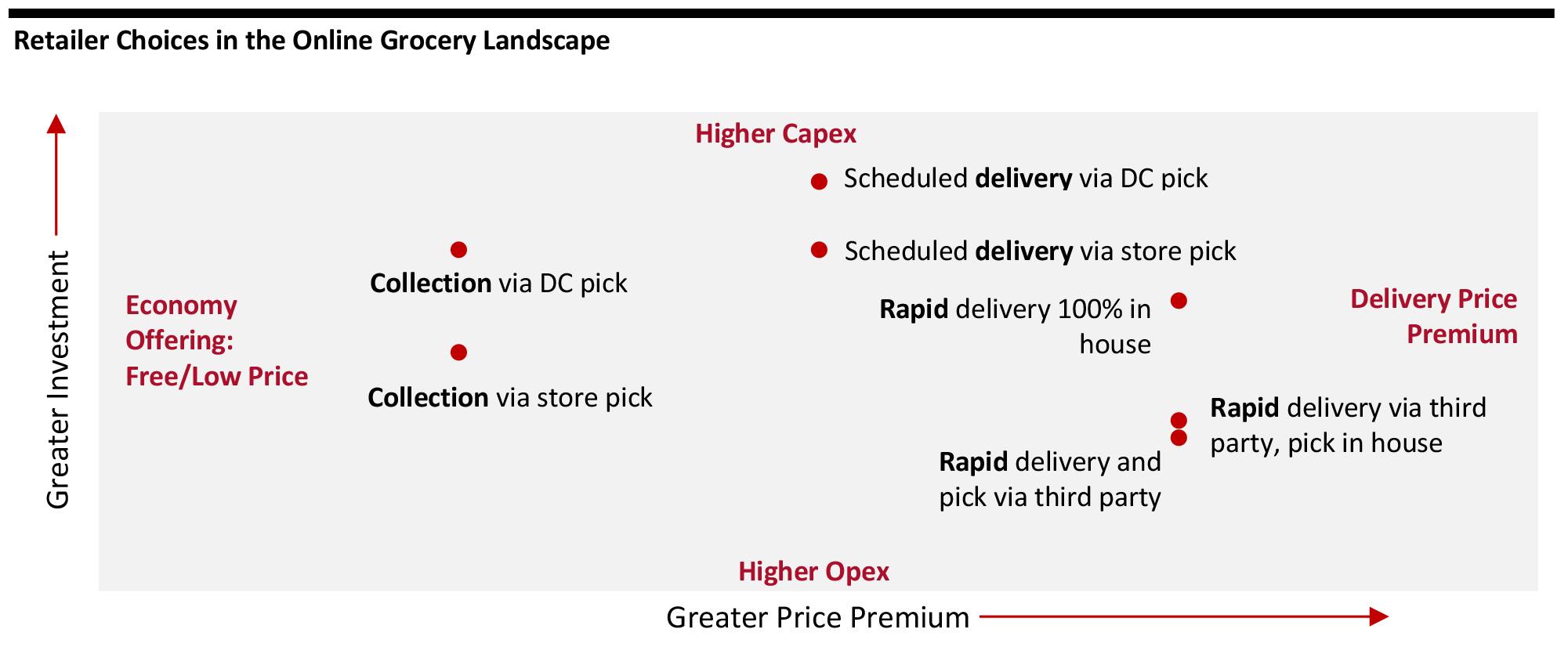

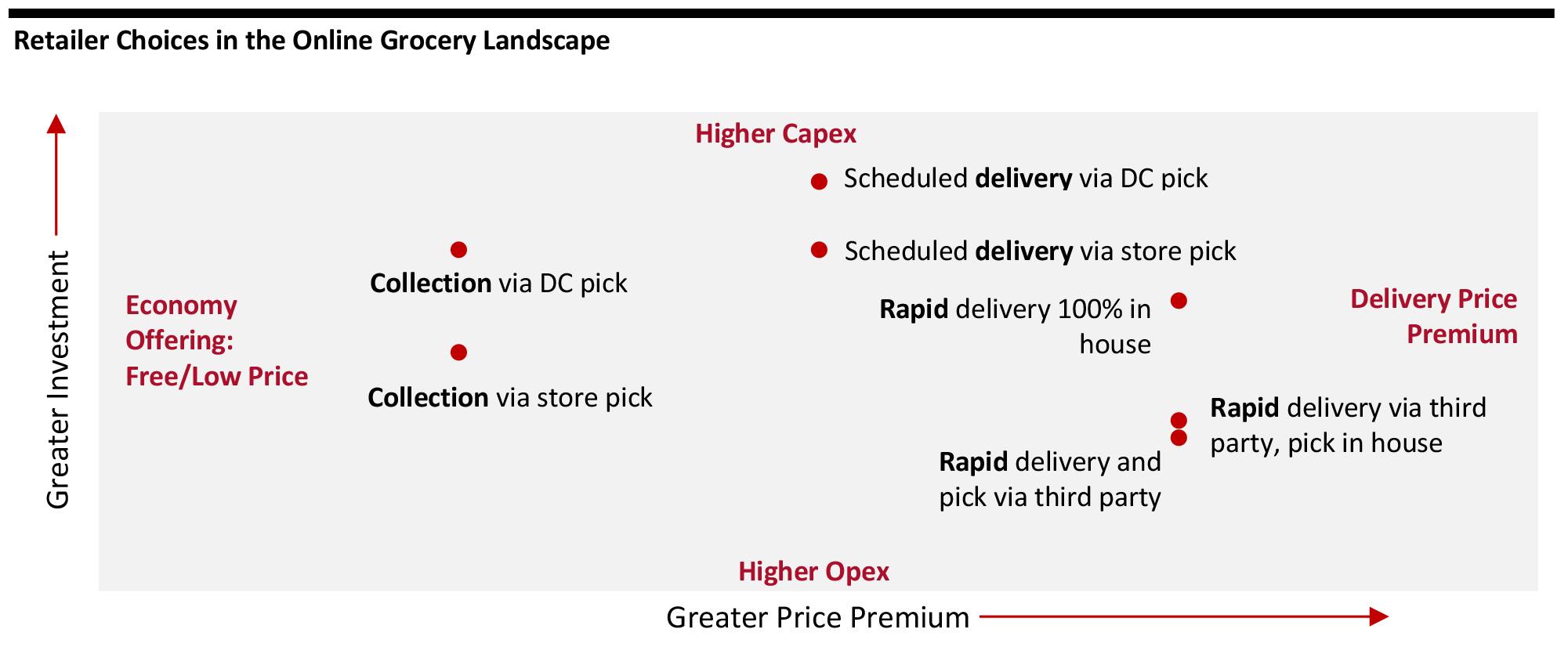

As shown below, retailers have an array of options, ranging from outsourced pick and delivery (drawing on service providers) to in-house, highly automated operations (leveraging the expertise of technology vendors) and spanning rapid delivery and collection. Corresponding to some of those options is the price premium that shoppers will be willing to pay.

[caption id="attachment_119255" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

In short, grocery retailers face the choice of what to keep and what to reject from the crisis in terms of retail offerings and working practices—what was established in a crisis cannot inherently determine their offerings and operations over the long term. Those retailers that raced to build capacity must now turn to the issues of customer experience and efficiency to build sustainable online grocery operations.

US RETAIL AND TECH HEADLINES

Bankruptcy Court Approves JCPenney’s Rescue Deal with Property Groups and Lenders

(November 9) Company press release

- The US Bankruptcy Court for the Southern District of Texas has approved JCPenney’s asset purchase agreement (APA) with Brookfield Asset Management, Simon Property Group, and the company’s debtors-in-possession and first lien lenders.

- As part of the APA, Brookfield and Simon will acquire JCPenney’s retail and operating assets using a combination of cash and debt. The APA will allow the retailer to emerge from bankruptcy before the upcoming holiday season and preserve approximately 60,000 jobs.

VF Corporation Acquires Supreme for $2.1 Billion

(November 9) Company press release

- VF Corporation, the owner of apparel and footwear brands Vans, The North Face and Timberland, has announced the acquisition of streetwear brand Supreme for $2.1 billion.

- The company said that current investors and private equity firms The Carlyle Group and Goode Partners were selling their stakes in Supreme. VF Corporation expects the transaction to complete within this calendar year subject to regulatory approval.

Casper Sleep Partners with Nordstrom

(November 10) Company press release

- Mattress retailer Casper Sleep has partnered with Nordstrom to sell its products through the department store retailer’s online and offline channels.

- Starting this month, Casper’s products will be available at 31 of Nordstrom’s full-line stores as well as on nordstrom.com. Casper now sells through 23 retailers across the US, as well as its own online store and 66 owned physical stores.

Rite Aid Unveils Refreshed Brand Strategy

(November 9) Company press release

- Rite Aid has revealed its rebranding that includes a new logo, website, an all-inclusive healthcare focus and a new store prototype piloting in selected markets. The retailer hopes to offer a “fusion” of traditional and alternative medicine and allow pharmacists to play a greater role in engaging with consumers.

- The company said that its “strategy (is) targeting Millennial and Gen X women who take care of themselves, their children, aging parents and even pets.”

Walmart Tests Self-Driving Delivery with General Motors Subsidiary

(November 10) Company press release

- Walmart plans to test delivery through self-driving all-electric cars from Cruise, a General Motors subsidiary. The pilot begins early next year in Scottsdale, Arizona, where orders from local stores will be dropped off by Cruise cars at customers’ homes.

- Walmart has been working with several autonomous vehicle makers for some time now, including Alphabet-owned Waymo and Ford.

EUROPE RETAIL AND TECH HEADLINES

Waitrose To Increase Focus on Food-Service Counters

(November 11) RetailGazette.co.uk

- British supermarket Waitrose announced plans to increase its focus on food-service counters, just days after its market counterpart Sainsbury’s announced the closure of its meat, fish and deli counters. Waitrose plans to relaunch its fish and meat counter ranges online at the start of next year.

- Waitrose has already launched 30 new lines across its counters since April. It plans to launch several other products and promotions ahead of Christmas.

Adidas Revenues Decline by 7% in Third Quarter, Ended September 30

(November 10) Company press release

- Adidas posted a 7% decline in its third-quarter revenues, recovering from a double-digit decline of 35.0% in the second quarter. Gross profit contracted by 10.6% and net income by 10.8%.

- The company said that conservative inventory management strategies and profitable sell-through helped to achieve the recovery. It expects to continue these practices into the fourth quarter to achieve gross margin at a similar level to last year. The company anticipates operating profit to decline by 18.4–59.2%.

Printemps Shuts Some Stores To Cope with Effects of the Pandemic

(November 11) Company press release

- French luxury department store Printemps has shut four of its 19 stores in France as it copes with the effects of the pandemic, according to the French national trade union CGT. One of Printemps’ offshoot stores in a Paris mall and three of the group’s sportswear Citadium stores are also slated to close.

- The CGT said that this puts about 450 jobs, or 15% of the Printemps workforce, at risk—including shop assistants and headquarters staff.

Arcadia Group Pauses Shipments in the Wake of New Lockdowns in England

(November 10) DrapersOnline.com

- British fashion group Arcadia, which owns the Topshop and Miss Selfridge banners, has informed some of its suppliers that it had to review stock levels due to the second lockdown in England, which began on November 5 and will last through December 2.

- Sources that spoke to Drapers said that the group has paused some shipments, which are already at the ports, for the forthcoming autumn/winter and spring/summer seasons. Arcadia had agreed to bear the cost of storage at the ports, according to a supplier that spoke to Drapers.

EU Regulators File Anti-Trust Charges against Amazon

(November 10) Press release

- EU (European Union) regulators have leveled anti-trust charges against Amazon, accusing it of exploiting business data to get an undue lead over merchants that operate on the platform. The charges stem from a two-year investigation into Amazon’s dual role as a marketplace and a seller competing against other sellers on its platform.

- The competition commission has also opened “a second formal antitrust investigation into the possible preferential treatment of Amazon’s own retail offers and those of marketplace sellers that use Amazon’s logistics and delivery services.”

ASIA RETAIL AND TECH HEADLINES

China Issues Draft Competition Rules for Internet Platforms

(November 10) Reuters.com

- China’s State Administration for Market Regulation (SAMR) has published draft rules aimed to prevent Internet platforms from dominating the market unfairly or implementing practices that could promote a market monopoly.

- According to SAMR’s definitions of Internet platforms, Alibaba Group’s or JD.com’s marketplaces, as well as payment services such as Ant Group’s Alipay or Tencent Holding’s WeChat Pay, could fall under the purview of these rules.

Competition Regulator Approves Tesco Thailand’s Sale

(November 10) RetailNews.Asia

- Thailand’s competition regulator has approved British retailer Tesco’s sale of its supermarket business in the country to the Charoen Pokphand Group (CP Group), despite concerns of a monopoly.

- The regulator’s statement on the transaction acknowledged that the merger of the two businesses could create market dominance but would not result in a monopoly. The regulator has also disallowed CP Group to pursue other merger deals within the retail sector over the next three years.

Grab and Lazada Announce Partnership in Vietnam

(November 11) TechInAsia.com

- Singaporean ride-hailing platform Grab and Alibaba-owned e-commerce platform Lazada have announced a partnership in Vietnam that integrates the two firms’ offerings on each other’s platforms.

- From November 11, Vietnamese consumers can access Grab’s food-delivery service GrabFood via Lazada’s app and site, while Grab users can access Lazada via links embedded within campaign banners on the Grab app.

Xpressbess Raises $110 Million in Series E Funding Round

(November 10) TechCrunch.com

- Indian logistics and delivery startup Xpressbees has raised $110 million in Series E funding. The round was led by private equity firms Investcorp, Norwest Venture Partners and Gaja Capital. The new round values the startup at $350 million.

- Xpressbees plans to use the new funds to further automate its hubs and sorting centers and expand its delivery services across India.

Alibaba’s Digital Factory Participates in Singles’ Day for the First Time

(November 11) PanDaily.com

- Alibaba’s digital apparel factory Xunxi has participated in the group’s annual Singles’ Day (known by Alibaba as the 11.11 Global Shopping Festival) for the first time. Xunxi uses cloud computing, IoT (Internet of Things) technologies and artificial intelligence algorithms to understand real-time market demand and produce products accordingly.

- Alibaba said that Xunxi provided merchants with consumer insights and helped them to predict demand and decide on production mix and volumes ahead of the shopping festival. Alibaba added that the process from production to delivery can be completed within just 10 days and offer consumers custom-made clothing.

Source: IRI E-Market Insights™/Coresight Research [/caption]

America’s biggest grocery retailers have established sophisticated and substantial online operations. During the crisis, many others scrambled to introduce services or extend fledgling operations. These retailers must now equip themselves for normalization of elevated online demand. We identify two areas of focus:

Source: IRI E-Market Insights™/Coresight Research [/caption]

America’s biggest grocery retailers have established sophisticated and substantial online operations. During the crisis, many others scrambled to introduce services or extend fledgling operations. These retailers must now equip themselves for normalization of elevated online demand. We identify two areas of focus:

Source: Coresight Research[/caption]

In short, grocery retailers face the choice of what to keep and what to reject from the crisis in terms of retail offerings and working practices—what was established in a crisis cannot inherently determine their offerings and operations over the long term. Those retailers that raced to build capacity must now turn to the issues of customer experience and efficiency to build sustainable online grocery operations.

Source: Coresight Research[/caption]

In short, grocery retailers face the choice of what to keep and what to reject from the crisis in terms of retail offerings and working practices—what was established in a crisis cannot inherently determine their offerings and operations over the long term. Those retailers that raced to build capacity must now turn to the issues of customer experience and efficiency to build sustainable online grocery operations.