From the Desk of Deborah Weinswig

How Can Brick-and-Mortar Stores Win Shoppers This Holiday Season?

In the battle against e-commerce—and especially against e-commerce behemoth Amazon—long-standing brick-and-mortar retailers are often urged to differentiate themselves by offering exclusive product and quality experiences. But what will

actually drive shoppers to physical stores this coming holiday season? Here, we take a look, using findings from two recent consumer surveys:

- FGRT’s own holiday survey, which was carried out among 1,048 US Internet users between August 11 and August 17, 2017.

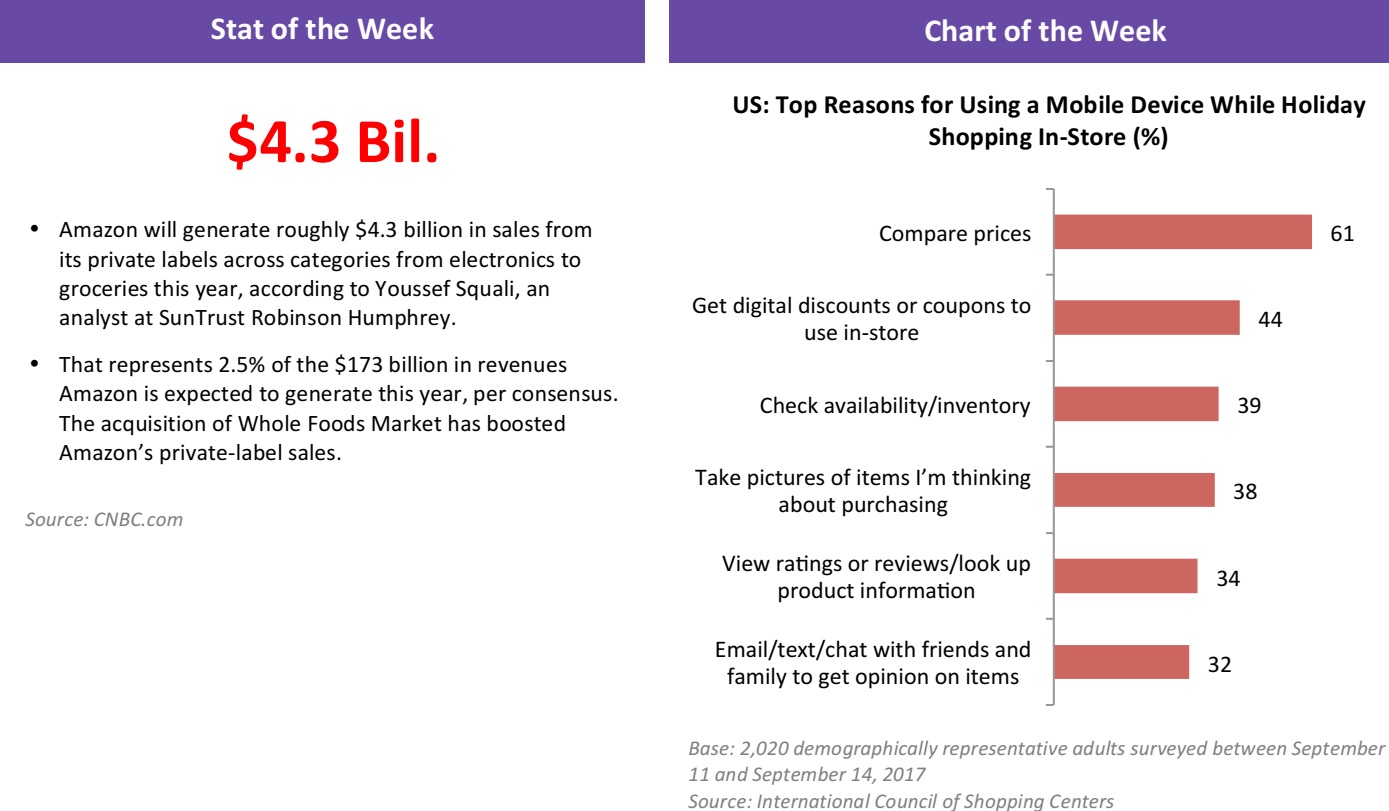

- The International Council of Shopping Centers’ (ICSC’s) Holiday Shopping Intentions Survey, which was conducted among 2,020 US Internet users between September 11 and September 14, 2017.

What In-Store Retailing Will Be About This Holiday Season

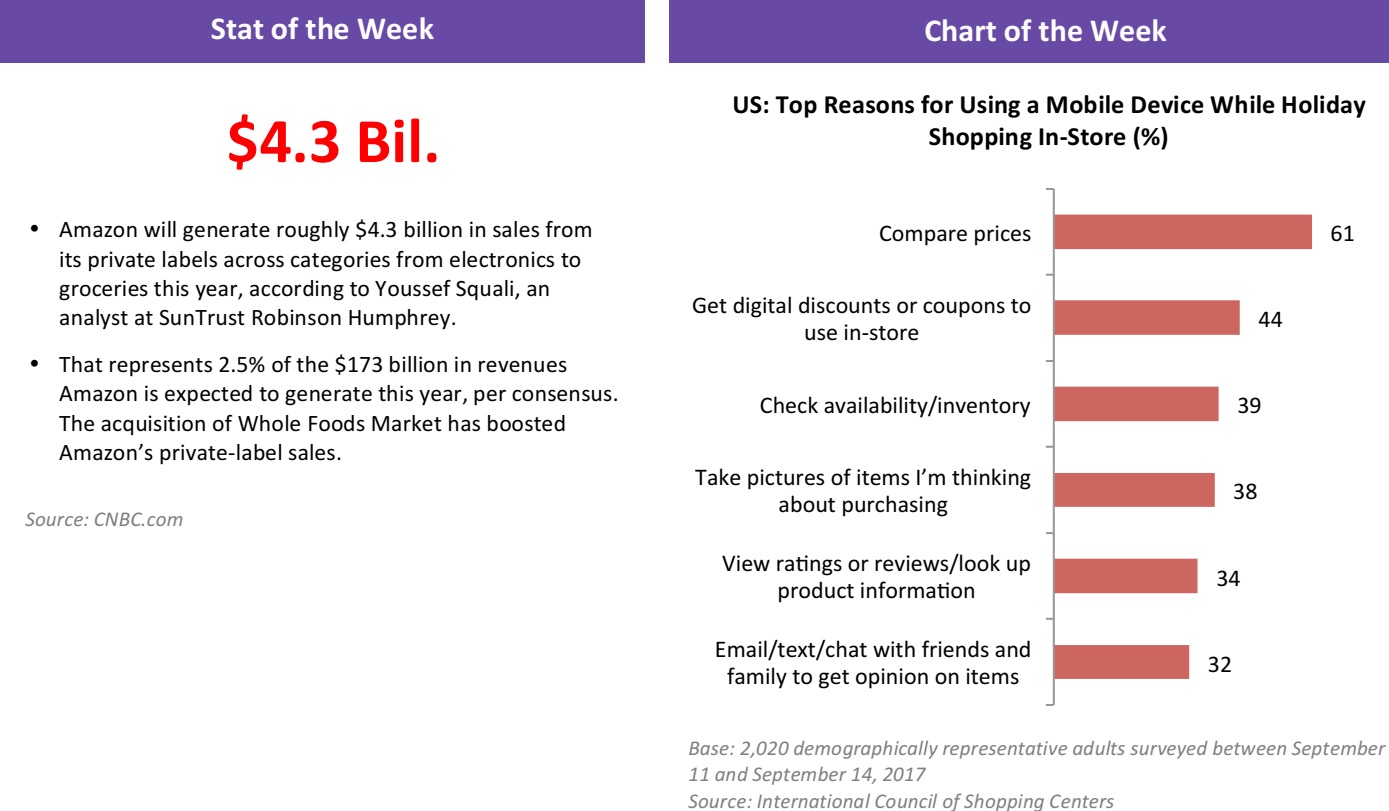

- Quality…and assessing quality: Low prices are, of course, important, but quality of products ranked slightly higher among holiday shoppers when they were asked how they pick a shopping destination. Related to this, both our survey and the ICSC survey found that the ability to see, touch or try products in person was the top reason cited for shopping in physical stores. In other words, consumers want to judge product quality for themselves.

- Curation and discovery: Our survey found that fully 56.5% of those who expect to shop in physical stores this holiday season will do so because they browse in-store to get gift ideas. This was the second-most-popular reason for shopping in-store among those we polled, and it underlines the role physical stores play in “serendipitous shopping” versus e-commerce offering a good fit for “shopping-list shopping.”

- Experience and enjoyment: Some 35% of our survey respondents expect to shop in physical stores because they enjoy it—and that was the fourth-most-popular reason cited for shopping in-store. Bearing out the demand for enjoyable experiences, the ICSC survey found that 81% of shoppers polled who will visit a mall this holiday season plan to partake in an activity that is not related to shopping, such as seeing a movie, visiting a restaurant or having a beauty treatment.

What In-Store Shopping Will Not (Principally) Be About This Holiday Season

- Unfavorable price comparisons: Relatively few consumers now believe that prices are cheaper online than in stores: in our survey, a perception of prices being cheaper online was just the ninth-most-popular reason given for using e-commerce. This suggests that messaging and price-parity efforts by multichannel retailers have been successful.

- Showrooming: The practice of looking at products in a store and then buying them online is set to be relatively rare among shoppers this holiday season. The ICSC survey found that just 7% of those polled expect to browse in a physical store and then buy online this holiday season, while 23% expect to browse online and then buy in a physical store.

- Buy online, pick up in store: Some brick-and-mortar retailers may be counting on their buy-online, pick-up-in-store services to fend off the Amazon threat this holiday season. But only 17.7% of holiday shoppers we surveyed said that such service was important to them when deciding where to shop—despite fully 82% of respondents saying they expect to purchase online. In fact, the ability to buy online, then pick up the order from a store was only the 13th-most-popular reason that those we surveyed cited for deciding where to shop.

In short, buy-online, pick-up-in-store service may not be the draw that some brick-and-mortar retailers hope it will be this holiday season, but physical stores continue to prove a major draw for shoppers looking for experience-rich environments that are imaginatively filled with quality product for them to discover.

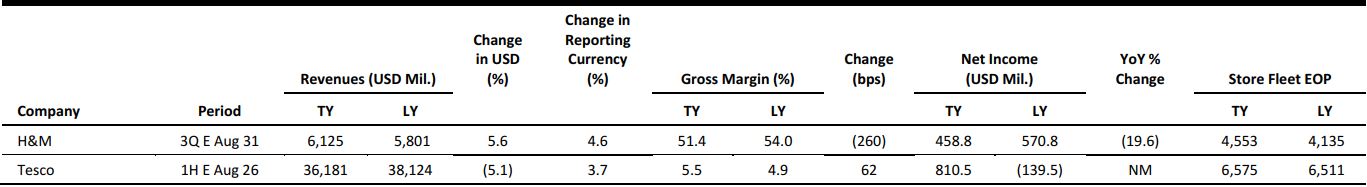

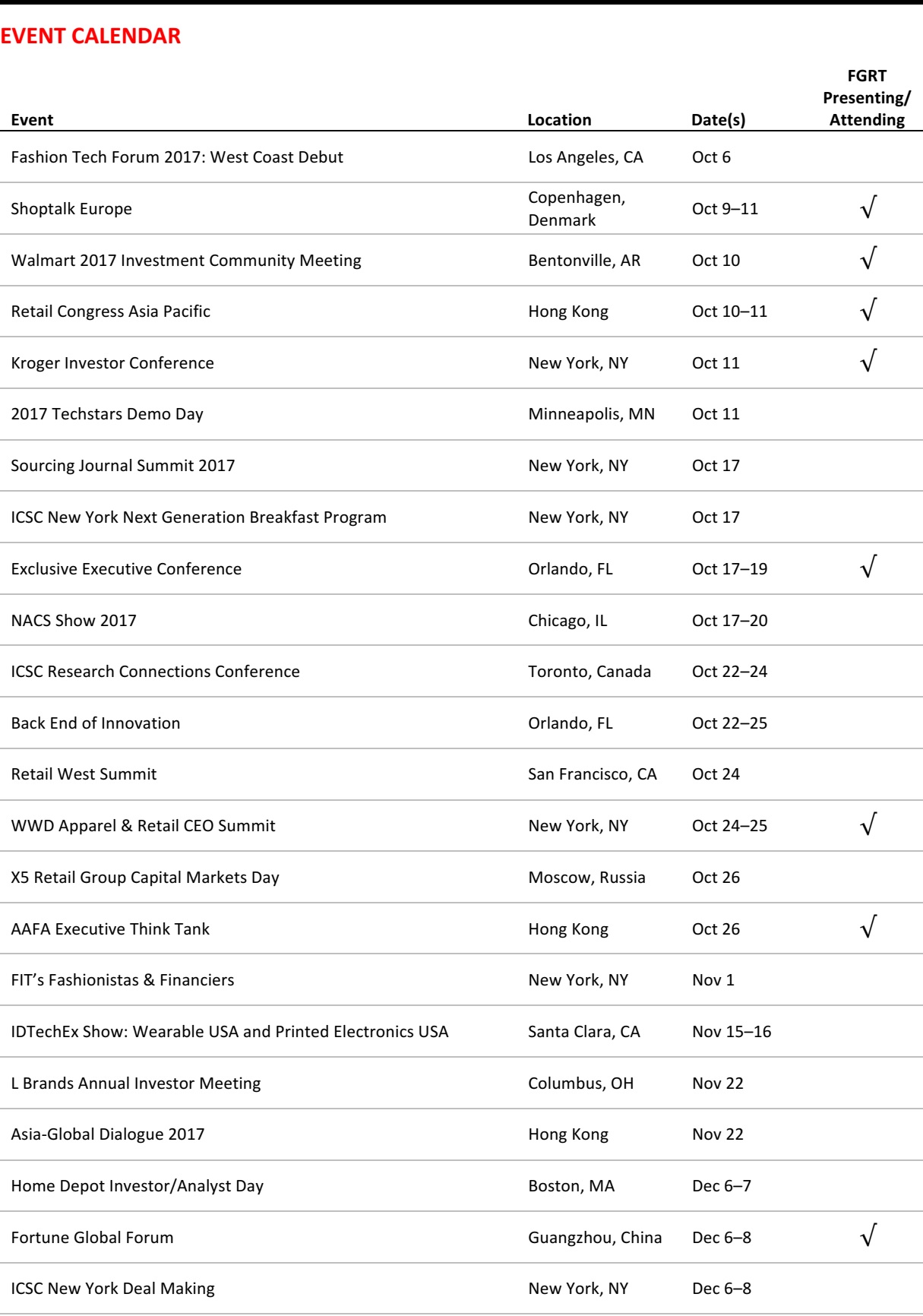

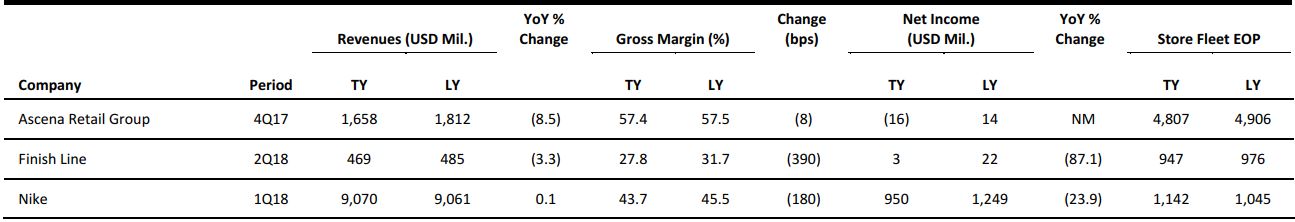

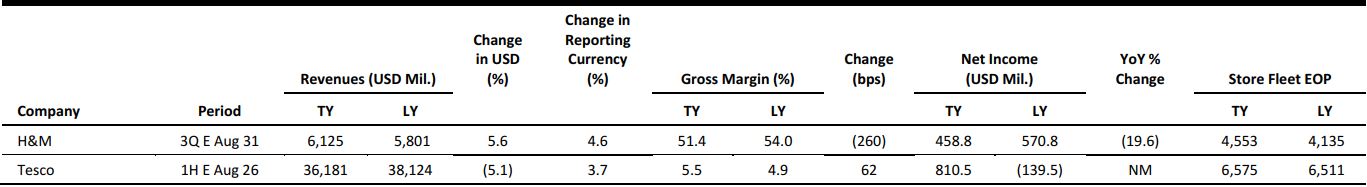

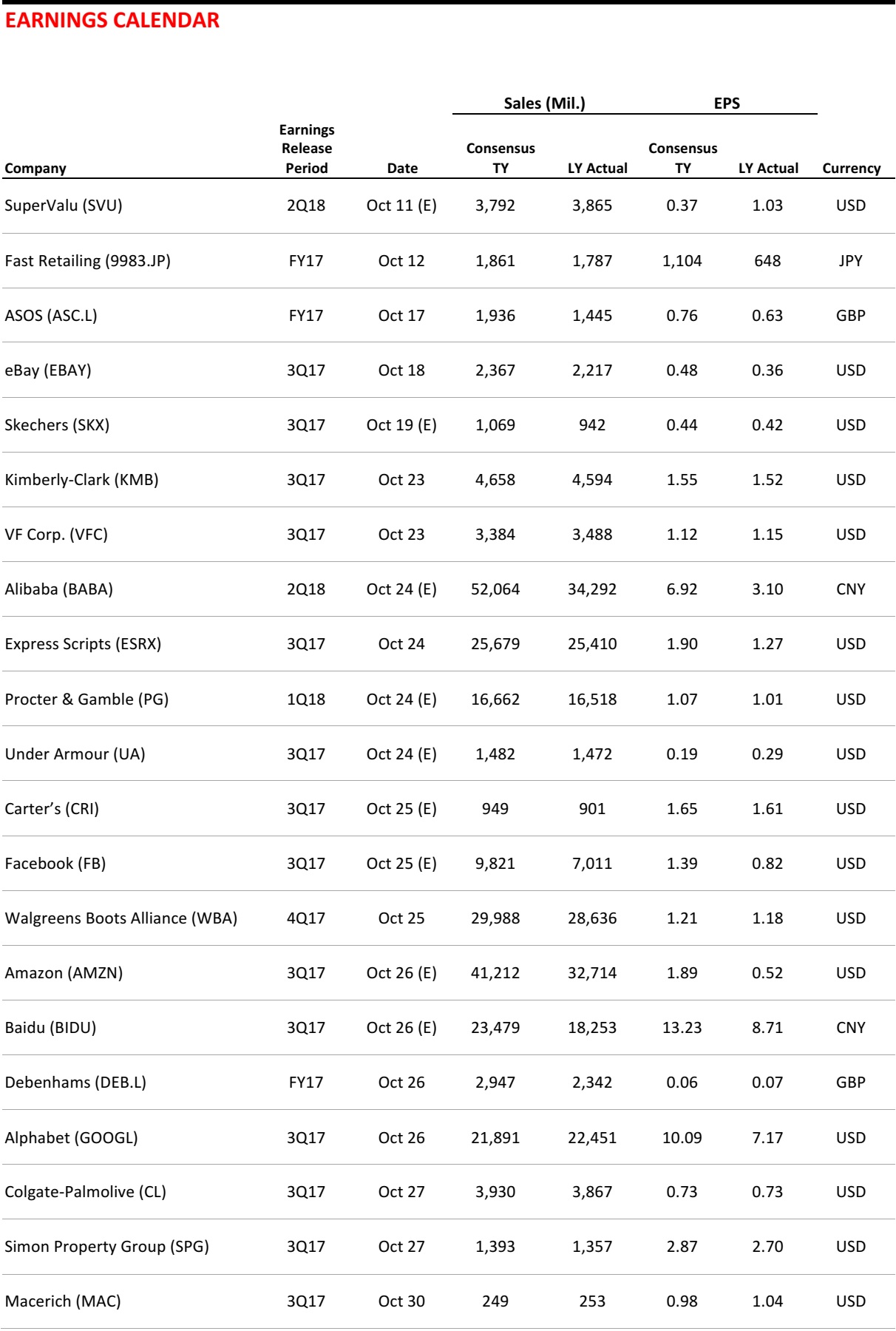

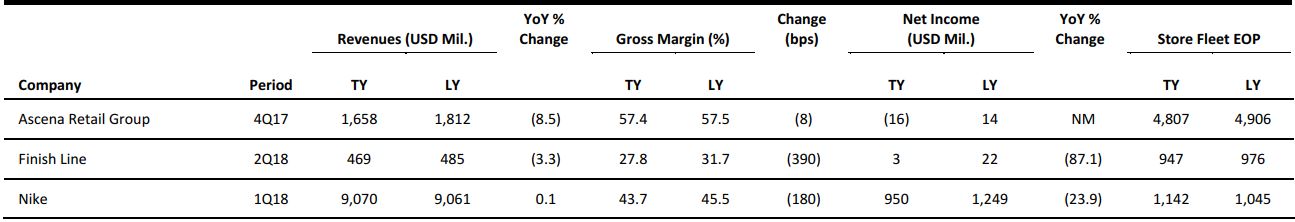

US RETAIL EARNINGS

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

The Era of Holiday Deals Is Dead, and So Is Black Friday

(October 3) The Washington Post

The Era of Holiday Deals Is Dead, and So Is Black Friday

(October 3) The Washington Post

- Fewer Americans plan to shop on Black Friday this year than in previous years, as consumers have grown increasingly accustomed to deep discounts year-round. According to research from PwC, 35% of consumers who plan to shop during Thanksgiving week say they will do so on Black Friday, down from 51% last year and 59% the year before.

- The shift comes as retailers—and shoppers—treat the holiday shopping season as more of a weeks-long marathon than a one-day sprint. Seasonal discounts have become more spread out, both in stores and online, as consumer demand for lower prices and greater convenience has increased.

Toys“R”Us Sees a Future Online

(October 3) PYMNTS.com

Toys“R”Us Sees a Future Online

(October 3) PYMNTS.com

- One week after reporting a $3.1 billion financing infusion from a group of lenders led by JPMorgan Chase, toy and game retailer Toys“R”Us is announcing new steps in its post-bankruptcy restructuring. Chain Store Age reported that Toys“R”Us has partnered with global marketplace solutions provider Mirakl to create a new online marketplace.

- The new marketplace will launch in 2018, offering increased product selection and decreased time to market for new merchandise. It will expand selection, improve brand exposure and allow Toys“R”Us to use data to help identify future retail offerings.

Nordstrom Closing the Gap in Women’s Apparel

(October 3) RetailDive.com

Nordstrom Closing the Gap in Women’s Apparel

(October 3) RetailDive.com

- Nordstrom is featuring extended sizes at its new Century City store in Los Angeles, the company said in a press release. While most women’s contemporary brands start with size 2 or 4 and go up to size 12, with plus sizes ranging from 18 to 24, Nordstrom is asking its customers what their favorite brands are, to add in more zeros, 2’s, 14’s, 16’s and 18’s.

- To start, participating brands include Topshop, Rag & Bone and Madewell, as well as Nordstrom private-label brands Caslon and Halogen. For the holidays, some 40 brands have committed to offering extended sizes on Nordstrom.com, including in swimwear, activewear and ready-to-wear.

Stressed Retail Industry Plunging Deeper into Junk Territory, S&P Says

(October 2) CNBC.com

Stressed Retail Industry Plunging Deeper into Junk Territory, S&P Says

(October 2) CNBC.com

- The percentage of US retailers with high-risk CCC ratings has doubled since the beginning of the year, according to a new report by S&P. The report says that 18% of US retail ratings are in the CCC range as the industry continues to grapple with increased competition, changing shopping patterns and steep discounts designed to attract shoppers.

- The bankruptcy filing of iconic Toys“R”Us last month, which took many insiders by surprise, further spooked an already rattled industry.

Jet.com to Launch Its Own “Everyday Essentials” Grocery Brand, Uniquely J

(September 29) TechCrunch.com

Jet.com to Launch Its Own “Everyday Essentials” Grocery Brand, Uniquely J

(September 29) TechCrunch.com

- Walmart’s Jet.com is going after millennial shoppers with the launch of its own grocery brand, which will be called Uniquely J. It is expected to arrive in a couple of months. The goal with the brand is to attract a younger shopper.

- Jet believes that Uniquely J will do so not only through a product selection that includes everyday essentials, but also through its focus on product quality and design. Uniquely J will also seemingly target the values that millennials care about, such as product sourcing. The coffee, for example, is labeled “organic” and “fair trade.”

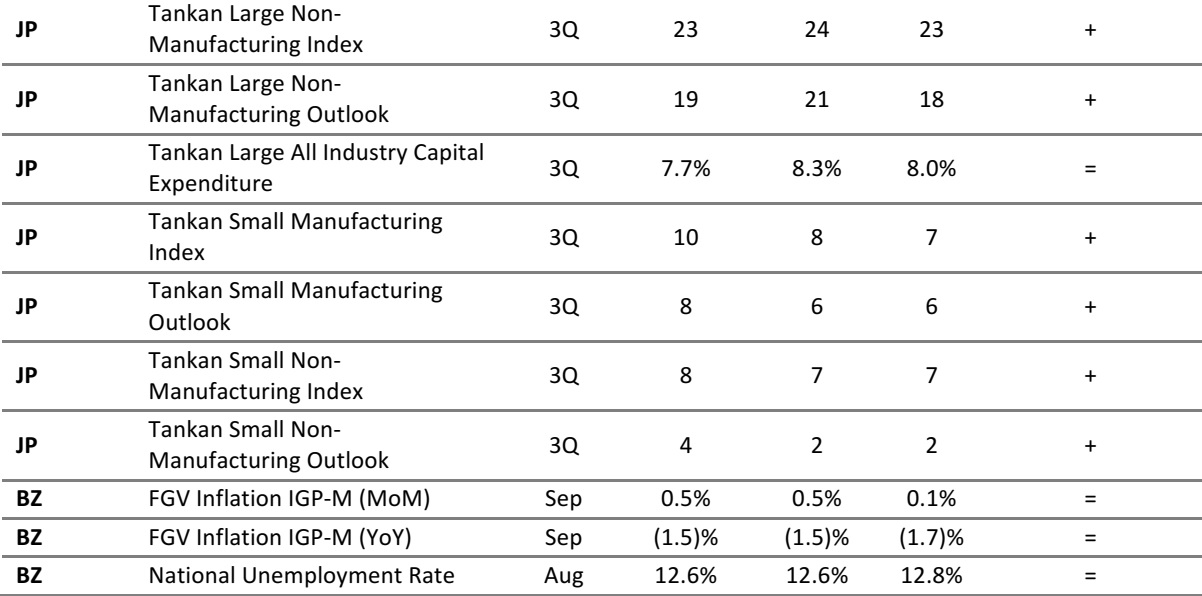

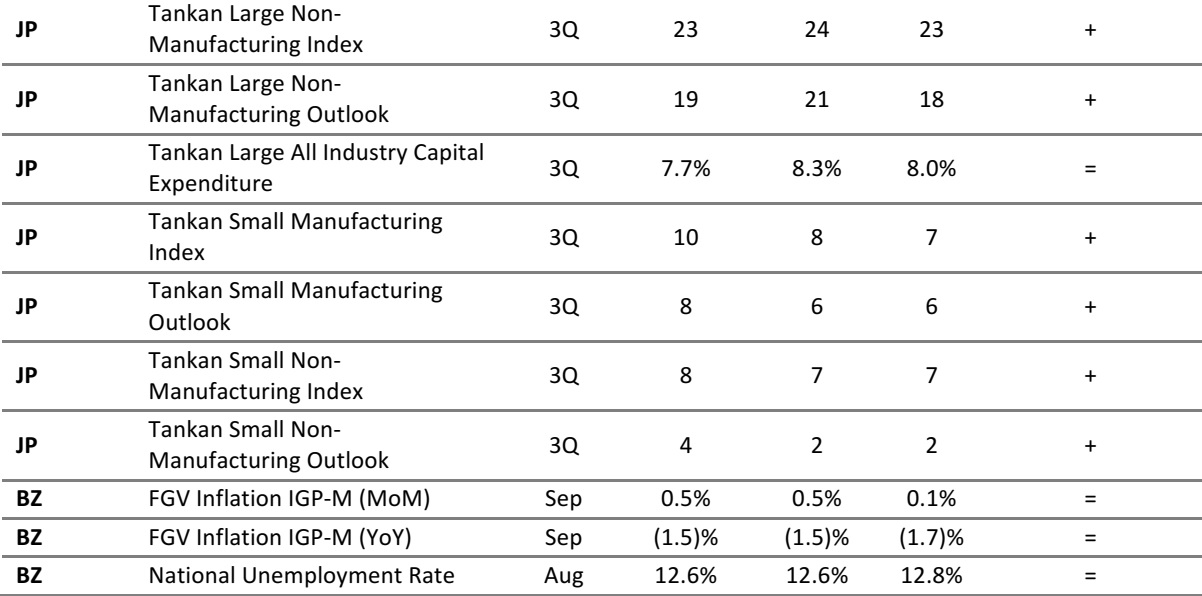

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Net-a-Porter Set to Launch Artificial Intelligence Picking Service

(October 2) DrapersOnline.com

Net-a-Porter Set to Launch Artificial Intelligence Picking Service

(October 2) DrapersOnline.com

- Online luxury fashion retailer Net-a-Porter is set to launch an artificial intelligence robot that will enable customers to pick clothing based on their future plans.

- Net-a-Porter has invested £442 million (US$585 million) in building its technology to personalize shopping experiences for its customers. Another tool that the retailer intends to launch will choose outfits for customers based on their previous purchases.

ScS Grows Sales and Profits in 2017

(October 3) Company press release

ScS Grows Sales and Profits in 2017

(October 3) Company press release

- British sofa and furniture retailer ScS reported a revenue increase of 4.9%, to £333 million (US$441 million), and operating profit growth of 8.8%, to £12 million (US$16 million), for the year ended July 29.

- On a comparable basis, sales fell by 0.7%. Online sales grew by 12.3% during the year. The company noted that trading at the start of its 2018 fiscal year is in line with its expectations.

Shop Direct’s Sales and Profits Boosted by Shopping on Mobile Devices

(October 3) Company press release

Shop Direct’s Sales and Profits Boosted by Shopping on Mobile Devices

(October 3) Company press release

- UK-based online pure play Shop Direct reported sales growth of 5.6% on a comparable basis, to £1.9 billion (US$2.5 billion), and underlying pretax profit growth of 10.2%, to £160.4 million (US$212.5 million), for the year ended July 1. It was the fifth consecutive year of increasing sales and profits for the retailer.

- Some 69% of sales were made through smartphones and tablets. Among product categories, clothing and footwear sales grew by 6.4%, driven by a 21.8% uplift in sportswear. In fiscal 2018, Shop Direct intends to continue to invest in building its technology and artificial intelligence tools to deliver better customer service.

Dutch Retailer Hema Up for Sale

(September 28) Bloomberg.com

Dutch Retailer Hema Up for Sale

(September 28) Bloomberg.com

- Private equity firm Lion Capital, which owns Dutch homewares retailer Hema, is exploring strategic options for the retailer and has hired Credit Suisse Group to advise on a possible sale.

- Hema CEO Tjeerd Jegen has indicated that he would like to stay on with the company and that it could be sold to another private equity firm or a retailer. Several firms have already expressed interest, and Hema may even consider a stock market float, Jegen said.

Weekday to Open Second UK Store in Less Than Two Months

(October 3) RetailGazette.co.uk

Weekday to Open Second UK Store in Less Than Two Months

(October 3) RetailGazette.co.uk

- Swedish fashion retailer Weekday, part of the H&M Group, has confirmed that it will open its second UK store less than two months after it debuted its maiden store on Regent Street.

- The retailer will open its new store at London’s Westfield Stratford City shopping center on November 3.

ASIA TECH HEADLINES

Alibaba Is Leading a $27 Million Investment in Open-Source Database Startup MariaDB

(September 29) TechCrunch.com

Alibaba Is Leading a $27 Million Investment in Open-Source Database Startup MariaDB

(September 29) TechCrunch.com

- Alibaba has spent 2017 pushing its cloud computing business and now it is preparing to make its first major investment in a Western startup in the space. The Chinese e-commerce giant has agreed to lead a €22.9 million (US$27 million) investment in MariaDB, the European company behind one of the most popular open-source database servers.

- Alibaba is contributing around €20 million (US$23.5 million), with the remaining capital coming from existing backers. The deal values MariaDB at around the €300 million (US$354 million) mark and it will see Alibaba’s Feng Yu, a principal engineer within its cloud business, join the startup’s board.

Self-Driving Startup Drive.ai to Open Singapore Office with New Grab Funding

(September 28) TechCrunch.com

Self-Driving Startup Drive.ai to Open Singapore Office with New Grab Funding

(September 28) TechCrunch.com

- Autonomous vehicle technology startup Drive.ai has raised $15 million in a new round from Grab and others. The added funding will help Drive.ai expand internationally, and it plans to open a Singapore office in the coming months in order to provide a base of operations for considering a deployment of its self-driving cars in the country.

- This is not yet a formal partnership between Grab and Drive.ai, though Grab has previously partnered with Boston’s NuTonomy to put self-driving vehicles on the road in Singapore. Instead, it is an investment that will also involve Grab assisting Drive.ai with its evaluation of the local market for deployment of its tech, including facilitating partnerships between government and other local businesses.

First China, Now South Korea Has Banned ICOs

(September 28) TechCrunch.com

First China, Now South Korea Has Banned ICOs

(September 28) TechCrunch.com

- South Korea has banned ICOs, the up-and-coming method of raising funding via cryptocurrency tokens, due to concerns over the potential for financial scams. China’s central bank became the first to outlaw ICOs, which are also known as token sales, and now South Korea is following suit.

- Companies from across the world have raised more than $1.8 billion so far this year via ICOs, which involve the sale of a newly minted cryptocurrency coin based on Ethereum to finance the development of a product. The space is not regulated like mainstream financial markets are, and it has attracted widespread criticism for its potential to deceive investors, who are not required to be accredited in any way.

Alibaba’s Ant Financial Partners with Hutchison to Develop Its Alipay Service in Hong Kong

(September 26) TechCrunch.com

Alibaba’s Ant Financial Partners with Hutchison to Develop Its Alipay Service in Hong Kong

(September 26) TechCrunch.com

- Ant Financial, the Alibaba affiliate that operates payment service Alipay and other digital finance products, has continued its Asia expansion with a move into Hong Kong. Alipay and Alibaba’s MyBank digital bank dominate in China, where they are used by more than 450 million consumers, and this year Ant Financial has broadened its presence with deals in Southeast Asia, South Korea and India.

- Now Ant Financial is turning to Hong Kong through a partnership with telecom giant CK Hutchison. The two will form a joint venture that will operate the AlipayHK service that was first introduced to Hong Kong last year. Beyond helping the digital payment app become more widely accepted in Hong Kong—where it is already covered by 4,000 retailers, the companies said—the joint venture will work to offer additional services, including insurance, loyalty programs, offers and more.

LATAM RETAIL & TECH HEADLINES

Brazilian Companies Cry Out for Coders

(October 2) ZDNet.com

Brazilian Companies Cry Out for Coders

(October 2) ZDNet.com

- Roles related to programming and software development are in high demand in Brazil as local organizations continue to drive their digital transformation agendas. Professionals with PHP, Java and front-end expertise are among the most sought after, according to research by job search engine Indeed, based on job openings, time taken to fill the vacancies and average salaries.

- Other roles that are in high demand in the local job marketplace—but take longer than two months to fill—include software engineer, full stack developer and software architect. “As all companies become digital, demand for professionals with high-level technical skills is increasing much faster than the availability of skilled labor,” says Indeed’s country manager in Brazil, João Luis Olivério.

Google Aims for Cloud Services Growth in Brazil

(September 26) ZDNet.com

Google Aims for Cloud Services Growth in Brazil

(September 26) ZDNet.com

- Google has launched a new Google Cloud Platform (GCP) region in Brazil as part of a plan to intensify the provision of off-premise services to local clients. One of the main draws of the new GCP hub is the ability for customers to pay for services in the local currency. Brazilian users had been paying in US dollars until now.

- Being able to pay in Brazilian reais also makes Google services more attractive to small and medium-sized companies that are unable to make international purchases easily or were hesitant to buy in dollars due to currency fluctuations in relation to the Brazilian real.

Facebook Launches Its First Innovation School in Brazil

(October 3) ZDNet.com

Facebook Launches Its First Innovation School in Brazil

(October 3) ZDNet.com

- Facebook has launched an innovation center in Brazil to foster entrepreneurs with ideas aimed at social disruption. A world first for the company, Estação Hack (“Hack Station” in Portuguese) is based in São Paulo and opened its doors to the public with the aim of supporting about 7,400 people per year who are leading projects with social impact potential.

- “We want to reinforce our commitment to Brazil and, therefore, we will make an unprecedented investment here,” said Diego Dzodan, VP of Facebook and Instagram for Latin America, prior to the launch. “We will help train young Brazilians for some of the professions of the future, within an environment that stimulates innovation,” Dzodan added.

Mobility Apps Celebrate Legislative Victory in Brazil

(September 28) ZDNet.com

Mobility Apps Celebrate Legislative Victory in Brazil

(September 28) ZDNet.com

- Uber, Cabify and local firm 99 are the main companies sharing the urban mobility pie in Brazil. As in other countries, they have dealt with a fair amount of resistance from taxi lobbyists and the politicians that support them. These mobility apps celebrated their latest victory in Brazil, where a Senate vote for a bill that was percieved to make their operation unviable was postponed.

- The bill outlines that drivers working through the apps will need to get taxi license plates and have special driving licenses as well as other documents that are currently required of taxi drivers. These changes, according to the companies, not only render their own operation impossible, but are also unviable for drivers. While this specific bill has been rejected, another draft legislation project, more favorable to apps, was recommended for voting by the Senate.

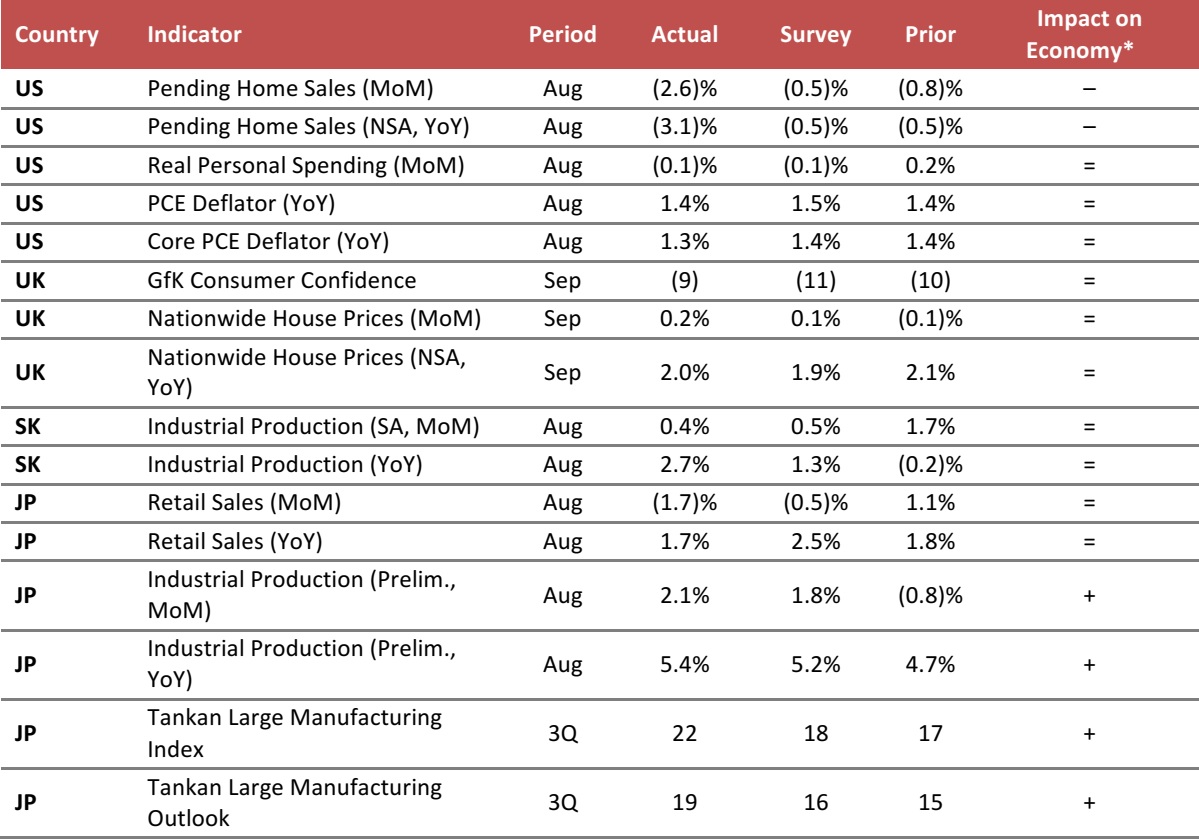

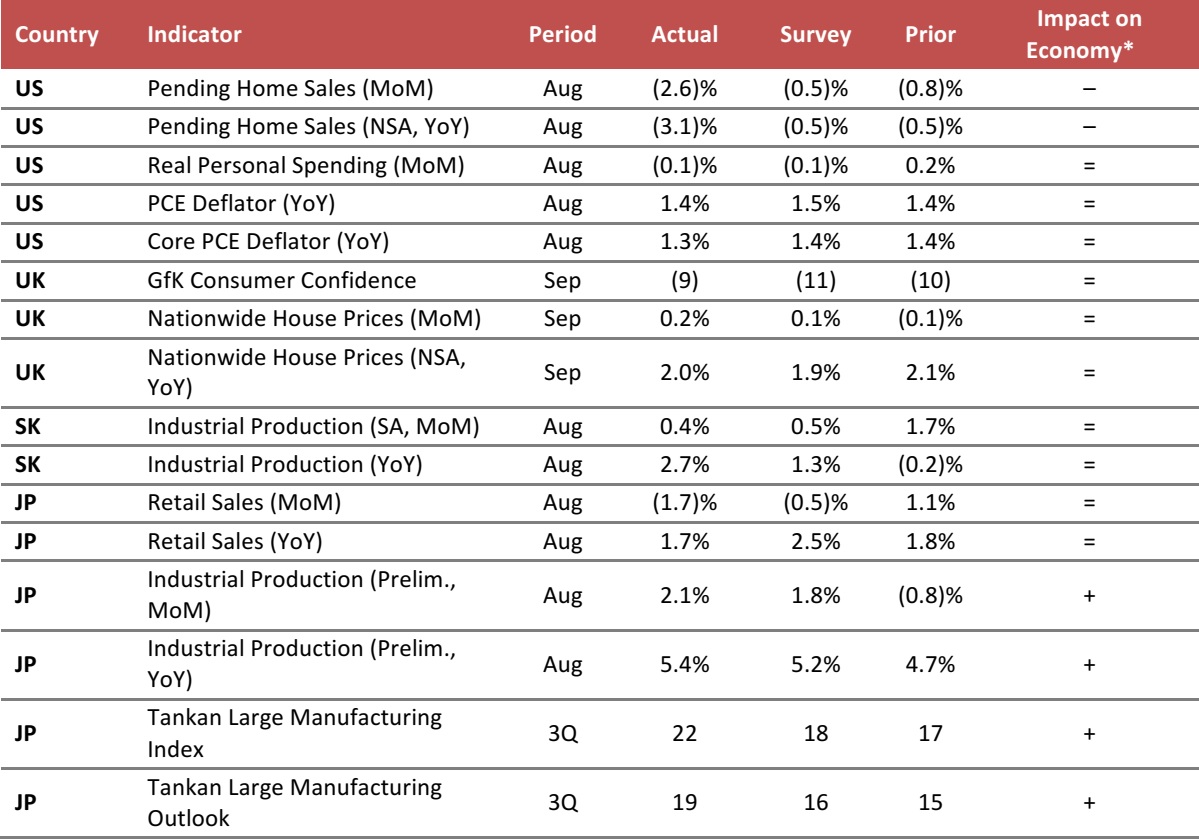

MACRO UPDATE

Key points from global macro indicators released September 27–October 4, 2017:

- US: Pending home sales in the US dropped by more than the market expected in August, falling by 2.6% month over month and by 3.1% year over year. Real personal spending edged down 0.1% month over month in August and inflation came in lower than expected.

- Europe: In the UK in September, the GfK Consumer Confidence indicator edged up to (9), which was above the estimate of (11). House prices in the UK moderated higher in September, increasing by 0.2% month over month and by 2.0% year over year.

- Asia-Pacific: In Japan, retail sales dropped by 1.7% month over month in August, while industrial production ticked up by 2.1% month over month. The third-quarter Tankan survey indicates an improved state of the Japanese economy.

- Latin America: In Brazil, inflation increased by 0.5% month over month in September, but decreased by 1.5% year over year; the respective readings were in line with the market’s expectations. The unemployment rate in Brazil edged down to 12.6% in August.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/US Bureau of Economic Analysis/GfK/Lloyds Bank Commercial Banking/Nationwide Building Society/Statistics Korea/Japan Ministry of Economy, Trade and Industry/Bank of Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografía e Estatística/FGRT

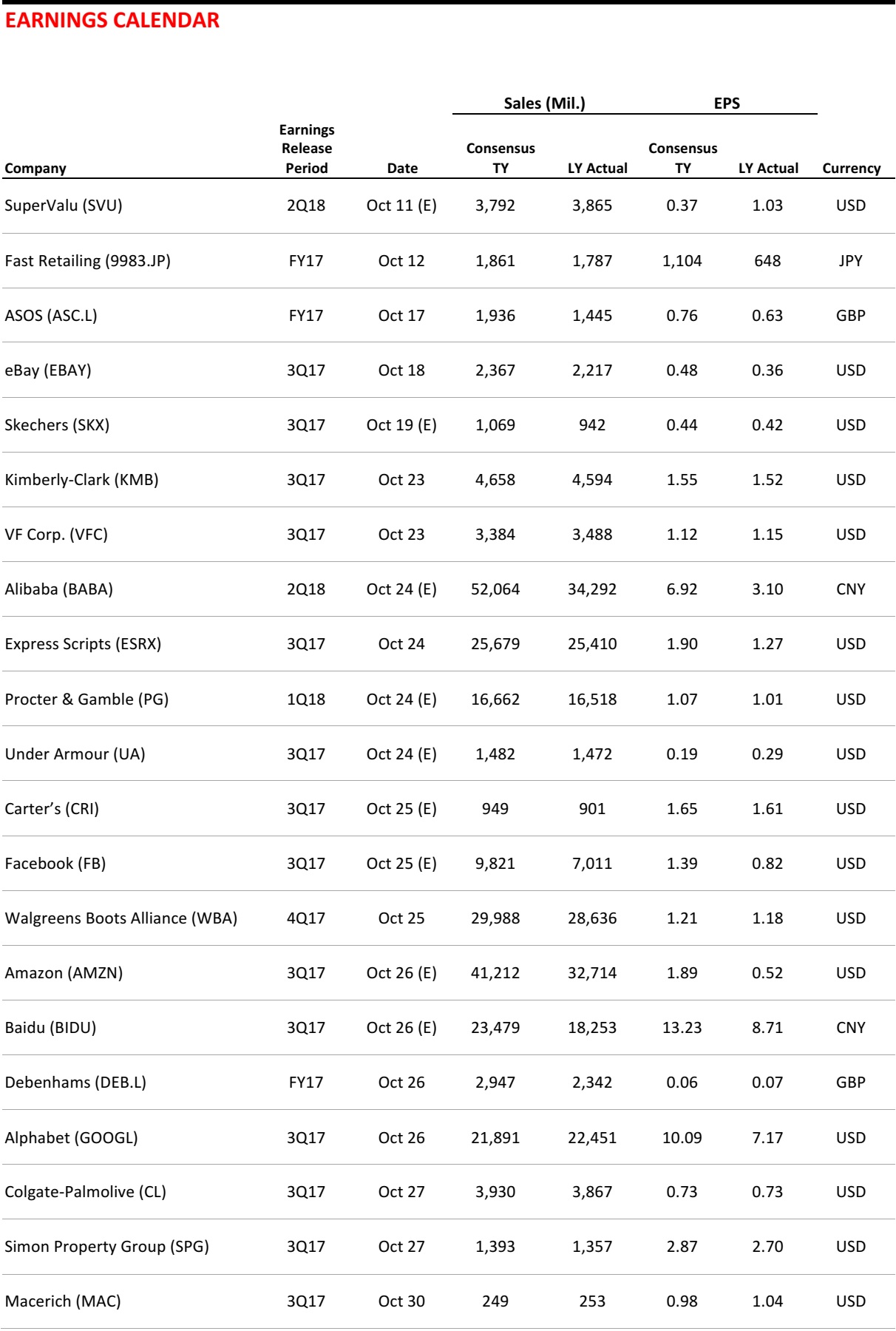

US RETAIL EARNINGS

US RETAIL EARNINGS

The Era of Holiday Deals Is Dead, and So Is Black Friday

(October 3) The Washington Post

The Era of Holiday Deals Is Dead, and So Is Black Friday

(October 3) The Washington Post

Stressed Retail Industry Plunging Deeper into Junk Territory, S&P Says

(October 2) CNBC.com

Stressed Retail Industry Plunging Deeper into Junk Territory, S&P Says

(October 2) CNBC.com