From the Desk of Deborah Weinswig

Tesco Looks to Compete Head-On with Aldi and Lidl: Three Reasons We’re Skeptical About Its New Discount Format, Jack’s

Grocery discounters Aldi and Lidl have taken the UK by storm, shredding the market share and profitability of established British grocery retailers. For the past several years, major incumbents such as Tesco and Sainsbury’s have been fighting back by stripping out costs and dropping shelf-edge prices (or at least absorbing input-cost increases). Recently, market leader Tesco went further, launching its own Aldi-like discount format. Named “Jack’s” after Tesco founder Jack Cohen, the small-store format was launched in two locations on September 19. Like Aldi and Lidl, Jack’s is built on a proposition of small stores, limited ranges, a private-label focus and a more basic service offering.

But while Jack’s borrows core elements from Aldi and Lidl, we are highly cautious about its prospects for a number of reasons:

No imitation brands: Aldi’s and Lidl’s core ranges include a surfeit of “fake brands” whose packaging is typically designed to look like the leading brand in the category. Consumers understand that these private labels are imitations, but we think that their brand-like feel makes shoppers more willing to switch to them from the leading brands stocked at nondiscount supermarkets. In our view, the products’ appearance prevents shoppers from feeling like they are simply trading down to private label—after all, they could more easily switch from leading brands to private-label goods at any of the major grocery chains. Jack’s has eschewed this imitation brands approach, labeling its products under its own name. That means Jack’s shoppers face filling their basket with one eponymous brand across all categories—and we think that makes for an uninspiring, homogeneous shopping experience.

Source: Aldi.co.uk

Few premium opportunities: Similarly, Aldi and Lidl have developed very strong premium lines and, in fact, this is a space where these retailers

do use their own names, with the Aldi Specially Selected and Lidl Deluxe lines. Such premium ranges have underpinned consumer switching to the discounters: market measurement service Kantar Worldpanel recently reported that, on a volume basis, Aldi now sells more premium private-label products than does Sainsbury’s, its much larger, nondiscount rival. By focusing on its core eponymous brand, Jack’s currently offers little opportunity for shoppers to trade up, although it does stock a range of major brands. We think that Jack’s would benefit by building out premium ranges under a separate brand as it grows its operations.

Hands tied by the “80% British” claim: Our final concern is the Jack’s claim that “8 out of 10 food and drink products will be grown, reared or made in Britain,” a claim so central to the brand that it is nailed to signs on its stores. In the UK, Aldi and Lidl have strongly pushed their British sourcing credentials—yet this push has largely been limited to fresh categories such as meat, dairy, fruit and vegetables, while imported products have made a significant contribution to the two grocers’ premium ranges. Consumers (especially nontraditional middle-class shoppers) have switched to the discounters to treat themselves to imported wines and beers, continental European cheeses and cured meats, and bakery products such as panettone and stollen. The Jack’s 80% British promise makes it difficult for the company to cater to this demand for imports, and this challenge dovetails with the limited premium offering mentioned above. In other words, Jack’s is limiting its future options and positioning itself at the bottom of the discount market.

In short, we feel that Tesco may have overlooked certain lessons presented by the growth of the grocery discounters as it developed its Jack’s proposition. Successful positioning is not just about price; it is about quality, perceived brand equivalence and the opportunity to trade up while paying a highly competitive price. (We note that as we write this week, Aldi has just reported a 16.4% rise in full-year revenues and a 26% increase in operating profits for its UK and Ireland business.)

Tesco plans to launch 10–15 Jack’s stores over the next six months. To grow across regions and appeal across demographics as Aldi and Lidl have, we think Jack’s will need to adjust and improve elements of its proposition and copy its discounter rivals even more closely.

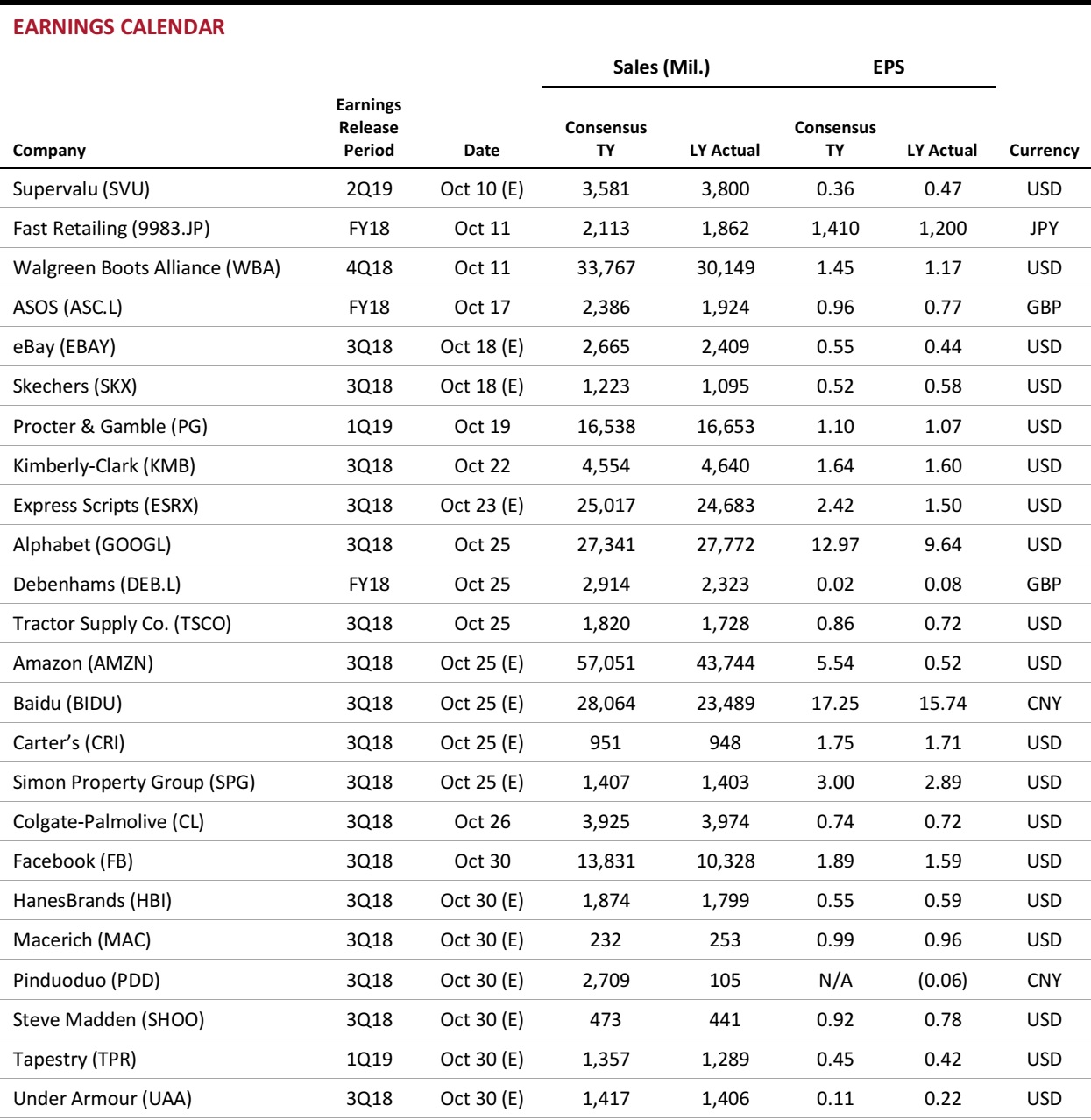

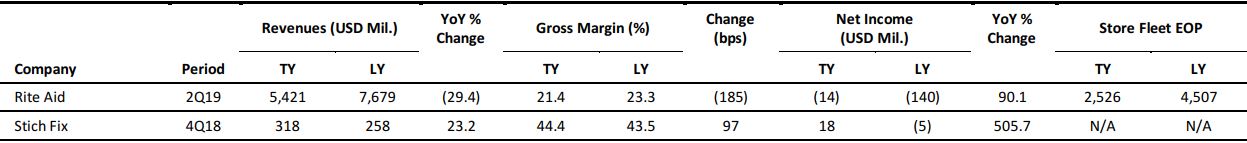

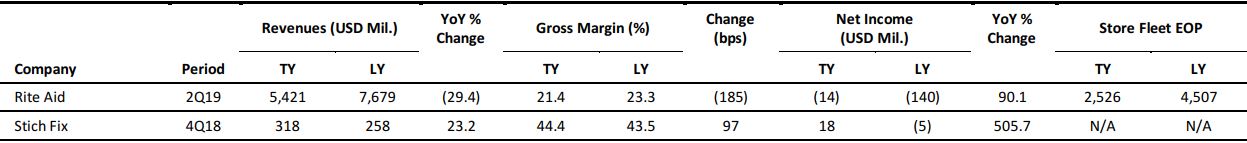

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

NAFTA Is Now USMCA. Here’s What the Deal Means for E-Retailers.

(October 2) DigitalCommerce360.com

NAFTA Is Now USMCA. Here’s What the Deal Means for E-Retailers.

(October 2) DigitalCommerce360.com

- US and Canadian negotiators secured an agreement to salvage the basic framework of the 24-year-old North American Free Trade Agreement. However, the new deal, which is called the US-Mexico-Canada Agreement, or USMCA, includes a few key provisions.

- To start, both Mexico and Canada will increase their de minimis shipment value levels, which is the minimum value of a shipment that is subject to duty and customs. Mexico is doubling its threshold to $100 from $50, and Canada is doubling its threshold to C$40 from C$20.

US Consumers Feel Financially Confident as Holiday Season Approaches

(October 2) USAToday.com

US Consumers Feel Financially Confident as Holiday Season Approaches

(October 2) USAToday.com

- As the 2018 holiday shopping season approaches, most Americans are feeling pretty good about their finances. The majority of consumers believe that the US economy has improved since last year, and 75% expect that trend will continue in 2019, according to a survey of adult shoppers conducted by Harris Poll for OpenX.

- This is good news for retailers. More than four out of five respondents to a recent survey said that they plan to spend at least as much as they did last year for the holidays, with 28% planning to spend more, 56% planning to maintain their 2017 spending level and 18% planning to spend less.

Birkenstock Opens First US Store in NYC’s SoHo

(October 2) RetailDive.com

Birkenstock Opens First US Store in NYC’s SoHo

(October 2) RetailDive.com

- Birkenstock opened its first company-owned retail store in the US, in New York City’s SoHo neighborhood, the company said on Monday. The brand added that in opening the store it was “laying the groundwork for the continued growth of Birkenstock in the US market.”

- Customers will be able to shop for shoes, boots, socks, bags and belts for women, men and kids as well as the brand’s new natural skincare line. The store also features a special gallery of limited-edition styles from designers that include Rick Owens and 10 Corso Como.

Gyms, Fitness Centers Backfilling Empty Retail Space

(October 2) AbqJournal.com

Gyms, Fitness Centers Backfilling Empty Retail Space

(October 2) AbqJournal.com

- Landlords who once leased space to big-box mainstays such as Toys“R”Us or now-defunct stores such as Hastings Entertainment are turning to gyms and fitness centers to fill retail vacancies.

- It’s part of a national, health-driven trend that commercial property owners are embracing as former retail staples such as JCPenney, Macy’s and Toys“R”Us shutter locations or deal with a declining customer base at their brick-and-mortar stores.

Amazon to Raise Its Minimum US Wage to $15 an Hour

(October 2) WSJ.com

Amazon to Raise Its Minimum US Wage to $15 an Hour

(October 2) WSJ.com

- com said that it was raising the minimum wage it pays all US workers to $15 an hour. The move came as the company faced increased criticism about pay and benefits for its warehouse workers.

- The new minimum wage will kick in November 1, covering more than 250,000 current employees and 100,000 seasonal holiday employees. The company said that it also will start lobbying Congress for an increase in the federal minimum wage, which is currently $7.25 an hour.

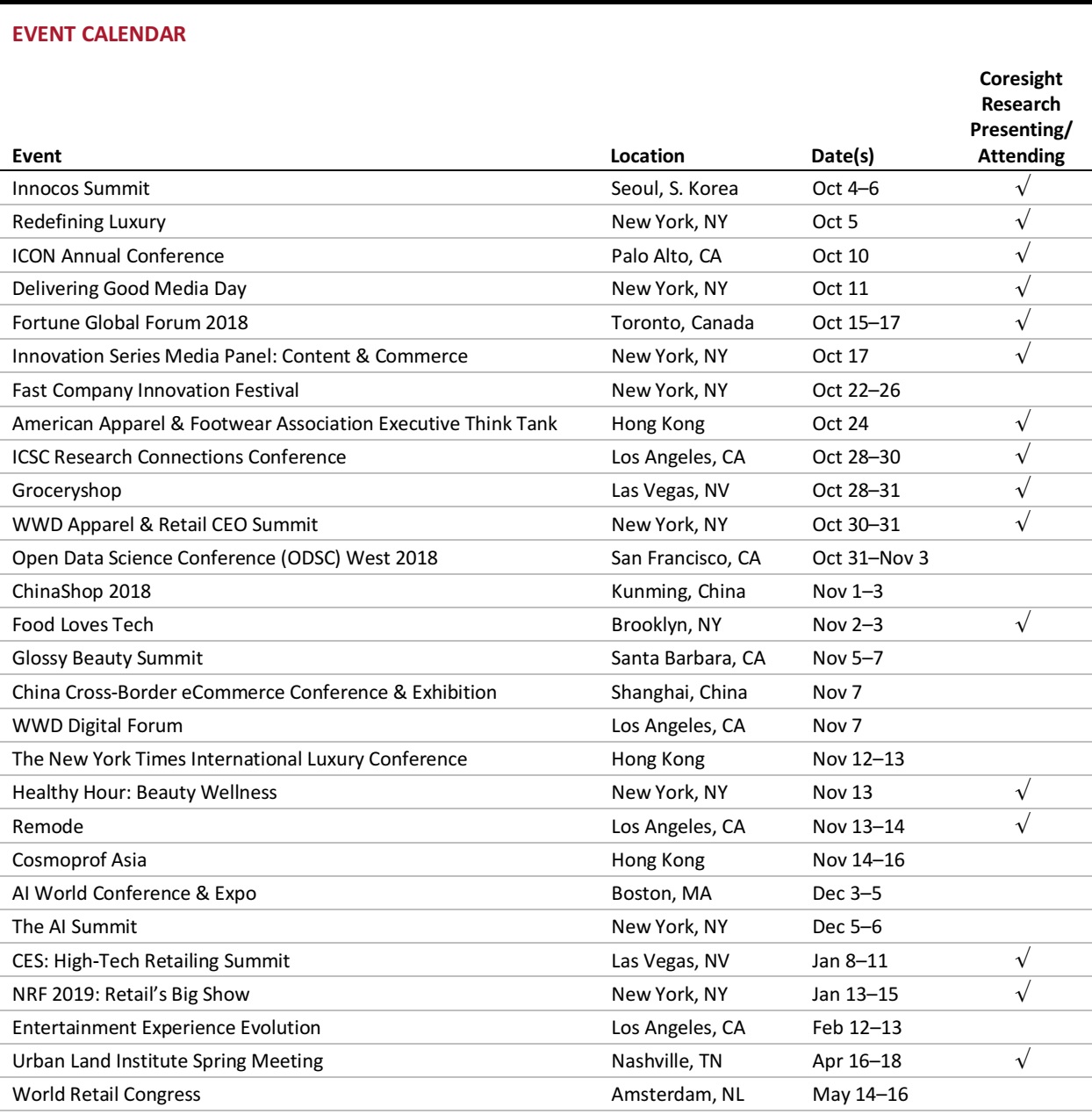

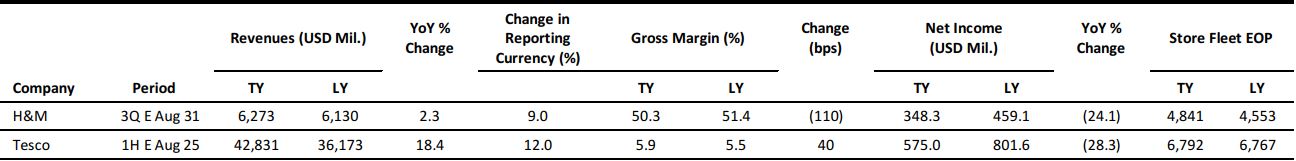

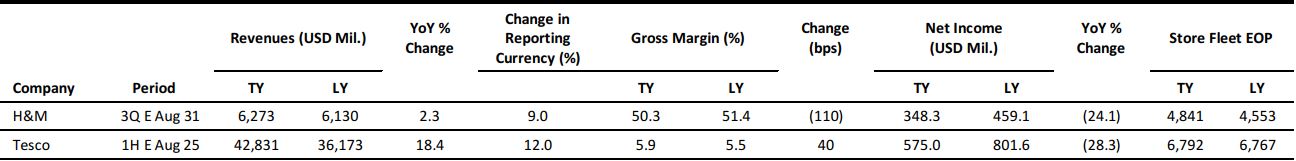

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Aldi UK and Ireland Sales Top £10 Billion

(October 1) FT.com

Aldi UK and Ireland Sales Top £10 Billion

(October 1) FT.com

- Grocery discounter Aldi this week reported that its UK and Ireland sales rose by 16.4% in 2017, to £10.2 billion ($13.2 billion). The company grew operating profit by 26%, yielding an operating margin of 2.6%. This was an increase from 2.4% in 2016 and marked the company’s first margin accretion since 2013.

- Giles Hurley, CEO of Aldi UK and Ireland, said that same-store sales also rose, although he would not say by how much. The company announced a new goal of expanding to 1,200 UK stores by 2025, which includes opening 130 UK stores over the next two years.

House of Fraser’s New Owner Fires Senior Management

(October 2) Company press release

House of Fraser’s New Owner Fires Senior Management

(October 2) Company press release

- House of Fraser’s new owner reported this week that it had dismissed the department store’s former directors and senior management. Sports Direct, which bought House of Fraser in August, stated that the dismissals were in light of the collapse of the chain “and subsequent calls for an investigation into the circumstances of that collapse.”

- House of Fraser’s CEO was Alex Williamson, who was appointed to lead the company in May 2017.

Lidl Blows €500 Million on Failed IT System

(October 2) Global.Handelsblatt.com

Lidl Blows €500 Million on Failed IT System

(October 2) Global.Handelsblatt.com

- In Germany, Lidl spent around €500 million ($576 million) over seven years in an attempt to introduce a new inventory management system. The software, designed by SAP, was finally abandoned this summer.

- Business news website Handelsblatt reported that implementing the new software required “reassessing almost every process at the company….But Lidl’s management was not prepared to do that.” In a letter to staff, Lidl CEO Jesper Hoyer wrote, “The strategic goals as originally defined were not possible at an acceptable expense.”

Furnishings Chain ScS Reports Sales and Margin Gains

(October 2) Company press release

Furnishings Chain ScS Reports Sales and Margin Gains

(October 2) Company press release

- British sofa and floor coverings retailer ScS reported an increase of 1.3% in revenue and an increase of 67 basis points in gross margin for the year ended July 28, 2018. Pretax profit climbed 10.5%. The company noted that comparable order growth had slowed in the second half of the year, yielding a full-year increase of 0.2% in comparable orders.

- The company has identified eight priority areas to support future growth, including delivering exceptional customer experiences, driving sales densities, creating a market-leading website and accelerating growth in its floor coverings business.

European Commission Looks at Amazon’s Private Labels

(October 1) ESMMagazine.com

European Commission Looks at Amazon’s Private Labels

(October 1) ESMMagazine.com

- European Commission (EC) antitrust regulators are asking retailers and manufacturers whether Amazon’s sales of private-label products similar to theirs have harmed their businesses. The move could result in a formal case and possibly fines against Amazon.In a survey sent to retailers, the EC asked whether Amazon’s private-label products launched in the past five years were identical or very similar to rival products offered on its platform.

- The EC’s focus is on Amazon’s dual function as a marketplace hosting merchants and a retailer competing against those merchants with its own products, which may be made or improved based on competing retailers’ data.

ASIA RETAIL & TECH HEADLINES

Tencent Restructures with Eye on Industrial Internet

(October 1) SCMP.com

Tencent Restructures with Eye on Industrial Internet

(October 1) SCMP.com

- Chinese Internet giant Tencent announced its first restructuring in six years, saying that it will reduce its business divisions from seven to six. The company will combine its social media, mobile Internet and online media operations into one unit, form a new business division devoted to cloud and smart industries, and establish a technology committee to strengthen its research and development and promote internal collaboration.

- The move is seen as the company’s effort to upgrade from consumer Internet to industrial Internet and boost development of its cloud-based data services, an area where rival Alibaba Group dominates in China. Tencent also aims to strengthen its content offering, as competitors have been gaining market share. Tencent’s WeChat social network will remain the company’s key priority.

Indian Social Commerce Startups Attract Investments by Utillizing Social Media User Bases

(October 1) LiveMint.com

Indian Social Commerce Startups Attract Investments by Utillizing Social Media User Bases

(October 1) LiveMint.com

- Indian social commerce startups such as Shop101, GlowRoad, Meesho and EZMall are grabbing investors’ attention as they make use of the large user bases of social media platforms such as WhatsApp and Facebook to build up their e-commerce platforms. This is different from most other e-commerce startups in India, which used to be crippled by customer acquisition costs that wouldn’t decrease with scale—which halted investors’ interests in further investing.

- Shop101, Glowroad and Meesho have attracted investor attention after venture capital firms’ interest in e-commerce companies started waning in 2015. Shop101 raised $5 million in series A funding in July, while GlowRoad raised $2 million from Accel Partners in its first funding round last year.

Alibaba Invests in Chinese Garment-Sharing Platform YCloset

(September 28) InsideRetail.Asia

Alibaba Invests in Chinese Garment-Sharing Platform YCloset

(September 28) InsideRetail.Asia

- Beijing-based YCloset secured an undisclosed amount of funding from Alibaba to expand its data analysis functions and physical operations centers. This followed the company’s series C fundraising round last year, when Alibaba Innovation Ventures was among the investors in a $50 million round.

- YCloset is a garment-sharing platform that allows users to rent clothes and accessories for a monthly subscription fee. It has more than 15 million registered users and provides a range of subscription plans and options to purchase garments.

Uber Partners with Chinese Manufacturers to Create Bikes and Scooters

(September 28) DealStreetAsia.com

Uber Partners with Chinese Manufacturers to Create Bikes and Scooters

(September 28) DealStreetAsia.com

- After buying Jump Bikes, a US bike-rental service, Uber is set to unveil its own scooter, plunging into a chaotic new transit market. Uber is adding supply chain, recruiting and other personnel in southern China to work closely with the manufacturers of these devices.

- Uber will continue to invest in China’s supply chain despite the mounting political costs. Both e-bikes and scooters are included on the tariff list of US President Donald Trump’s administration, meaning that a 25% tax will be levied on each component that Uber imports.

LATAM RETAIL & TECH HEADLINES

Amazon and ProMéxico Sign Agreement to Promote Mexican SMEs

(October 1) America-Retail.com

Amazon and ProMéxico Sign Agreement to Promote Mexican SMEs

(October 1) America-Retail.com

- US giant Amazon and ProMéxico, a federal agency that promotes Mexico’s participation in the international economy, signed an agreement aimed at supporting the development of electronic commerce for small and medium-sized enterprises in Mexico.

- As part of the agreement, about 80 Mexican artisans from the states of Michoacán, Guanajuato, Mexico, Yucatán and Oaxaca will join the Amazon Handmade platform to market their products.

Uber Launches New App and Digital Wallet in Brazil

(September 27) ZDNet.com

Uber Launches New App and Digital Wallet in Brazil

(September 27) ZDNet.com

- Uber has launched Uber Lite, a 5MB app aimed at users of Android smartphones with technology from 2014 onward and those with slower mobile connections in Brazil. The app aims to enable people to move around beyond the metropolitan areas of the capitals in Brazil, which see more active users of Uber.

- The company has also launched Uber Cash in the country. Uber Cash, a digital wallet aimed at the unbanked, allows users to add credit to their wallet in advance by purchasing prepaid cards at high-street retailers nationwide. The app can also be used with debit or credit cards to enable payment on Uber Eats.

Siemens Launches Innovation Center for Livestock in Brazil

(September 24) ZDNet.com

Siemens Launches Innovation Center for Livestock in Brazil

(September 24) ZDNet.com

- Siemens has launched a Meat Competence Center in São Paulo aimed at improving meat production processes with tracking and automation. The center will serve as a global hub for new technology services, with research and development input from other company units throughout the world. The technologies developed at the center will also be used as a global benchmark for the livestock sector.

- Brazil is the largest global exporter of beef and Siemens sees great potential in the growth of the Brazilian meat industry. Aside from the São Paulo location, the center will also have cells in other Brazilian states where meat production is significant.

Brazilian Government Launches City Innovation Program

(October 1) ZDNet.com

Brazilian Government Launches City Innovation Program

(October 1) ZDNet.com

- The Brazilian government will invest R$1 billion ($248 million) over the next two years in a new program, Cidades Inovadoras, to support innovation projects for the development of cities. Key sectors of development include urban mobility, sanitation, water resources and renewable energies.

- The program will be carried out through partnerships with accredited financial agents such as development banks and development agencies. It is hoped that by working with these stakeholders, resources can be passed on to city halls, state governments, mixed-capital organizations and private companies interested in developing innovation projects.

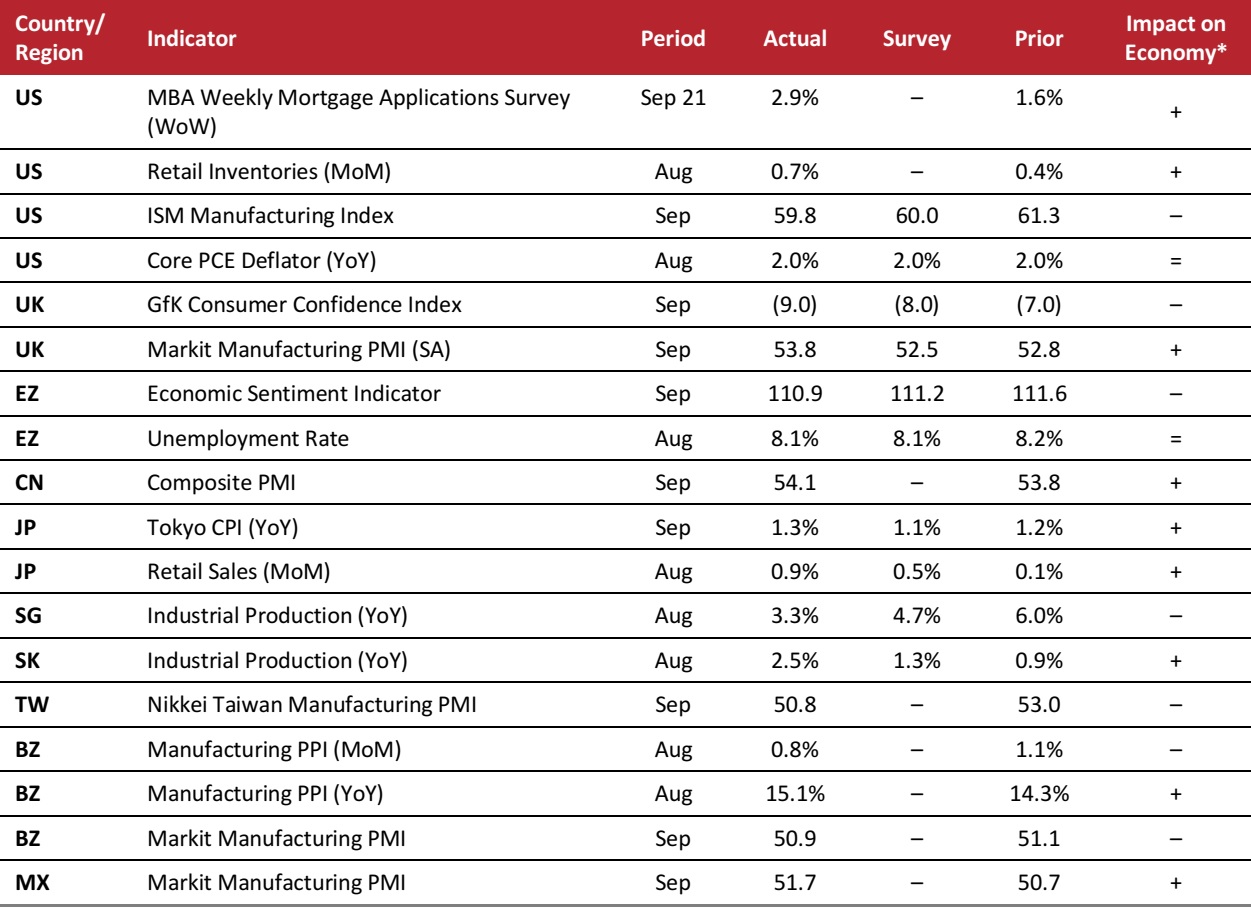

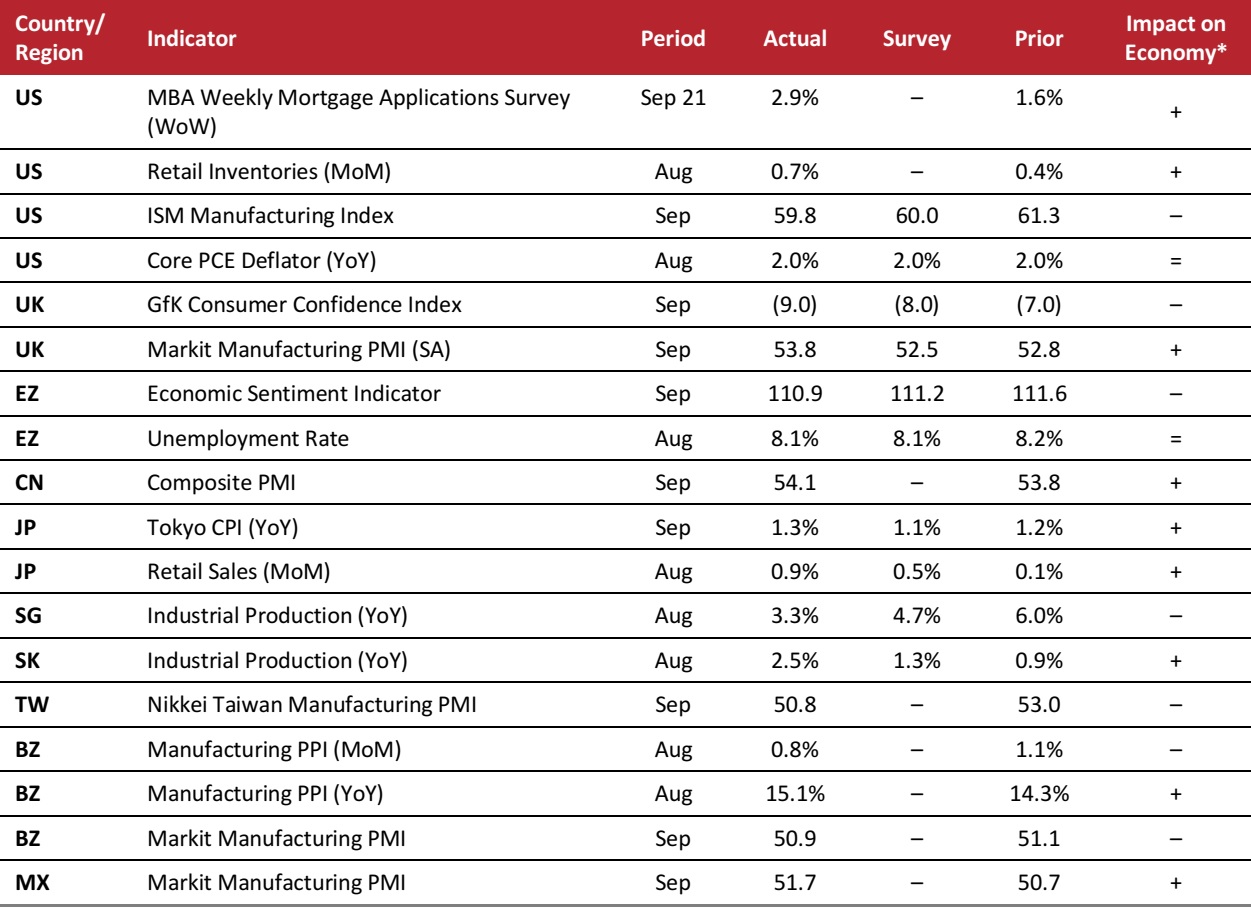

MACRO UPDATE

Key points from global macro indicators released September 26–October 2, 2018:

- US: According to the Mortgage Bankers Association’s (MBA’s) Weekly Mortgage Applications Survey,the number of mortgage applications increased by 2.9% week over week in the week ended September 21. Retail inventories rose by 0.7% month over month in August, compared with a 0.4% increase in July. The ISM Manufacturing Index declined to 59.8 in September; the reading was slightly below the consensus estimate of 60.0.

- Europe: In the UK, the GfK Consumer Confidence Index dropped to (9.0) in September, below the consensus estimate of (8.0). In the eurozone, the Economic Sentiment Indicator decreased to 110.9 in September from 111.6 in August. The unemployment rate in the eurozone fell to 8.1% in August from 8.2% in July.

- Asia-Pacific: In China, the Composite Purchasing Managers’ Index (PMI) increased to 54.1 in September from 53.8 in August. In Japan, the Tokyo Consumer Price Index (CPI) rose by 1.3% year over year in September, versus the consensus growth estimate of 1.1%. Retail sales in Japan increased by 0.9% month over month in August, exceeding the 0.5% consensus estimate. In Singapore, industrial production grew by 3.3% year over year in August, compared with 6.0% in July.

- Latin America: In Brazil, the Manufacturing Producer Price Index (PPI) increased by 0.8% month over month in August, compared with 1.1% in July. The Markit Brazil Manufacturing PMI decreased to 50.9 in September from 51.1 in August. In Mexico, the Markit Manufacturing PMI rose to 51.7 in September from 50.7 in August.

Source: Mortgage Bankers Association/US Census Bureau/Institute for Supply Management/US Bureau of Economic Analysis/GfK/IHS Markit/European Commission/Eurostat/China Federation of Logistics and Purchasing/Japan Ministry of Internal Affairs and Communications/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Statistics Korea/Instituto Brasileiro de Geografia e Estatística/Coresight Research

NAFTA Is Now USMCA. Here’s What the Deal Means for E-Retailers.

(October 2) DigitalCommerce360.com

NAFTA Is Now USMCA. Here’s What the Deal Means for E-Retailers.

(October 2) DigitalCommerce360.com

US Consumers Feel Financially Confident as Holiday Season Approaches

(October 2) USAToday.com

US Consumers Feel Financially Confident as Holiday Season Approaches

(October 2) USAToday.com

Gyms, Fitness Centers Backfilling Empty Retail Space

(October 2) AbqJournal.com

Gyms, Fitness Centers Backfilling Empty Retail Space

(October 2) AbqJournal.com

Aldi UK and Ireland Sales Top £10 Billion

(October 1) FT.com

Aldi UK and Ireland Sales Top £10 Billion

(October 1) FT.com

House of Fraser’s New Owner Fires Senior Management

(October 2) Company press release

House of Fraser’s New Owner Fires Senior Management

(October 2) Company press release

Lidl Blows €500 Million on Failed IT System

(October 2) Global.Handelsblatt.com

Lidl Blows €500 Million on Failed IT System

(October 2) Global.Handelsblatt.com

Furnishings Chain ScS Reports Sales and Margin Gains

(October 2) Company press release

Furnishings Chain ScS Reports Sales and Margin Gains

(October 2) Company press release

Indian Social Commerce Startups Attract Investments by Utillizing Social Media User Bases

(October 1) LiveMint.com

Indian Social Commerce Startups Attract Investments by Utillizing Social Media User Bases

(October 1) LiveMint.com

Uber Partners with Chinese Manufacturers to Create Bikes and Scooters

(September 28) DealStreetAsia.com

Uber Partners with Chinese Manufacturers to Create Bikes and Scooters

(September 28) DealStreetAsia.com

Amazon and ProMéxico Sign Agreement to Promote Mexican SMEs

(October 1) America-Retail.com

Amazon and ProMéxico Sign Agreement to Promote Mexican SMEs

(October 1) America-Retail.com

Uber Launches New App and Digital Wallet in Brazil

(September 27) ZDNet.com

Uber Launches New App and Digital Wallet in Brazil

(September 27) ZDNet.com

Brazilian Government Launches City Innovation Program

(October 1) ZDNet.com

Brazilian Government Launches City Innovation Program

(October 1) ZDNet.com