albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

The Holidays Ain’t What They Used to Be

As we head into the final quarter of 2019, more shoppers are turning their minds to the holiday season. As part of our holiday 2019 coverage, we recently examined expectations for the coming season in our US Holiday Outlook report. In our analysis, we explored how the rhythms of shopping have changed over the past two decades, and found that the holiday season is much less meaningful to many US nonfood retail sectors than it used to be.

The Holiday Season’s Share of Annual Sales Has Declined

Back in 1998, November and December accounted for almost 24% of all annual US retail sales. But by 2018 that fell to 21% — and we expect that trend to continue. Why? We see a number of contributing factors:

- Shopping holidays all year round. Consumers no longer need to wait for the holiday peak, which includes Black Friday, to get special deals. We think year-round price promotions and shopping festivals such as Amazon’s Prime Day and Black Friday in July (which attracts a number of major retailers) have pulled more spending to earlier in the year.

- Digitally equipped shoppers. Today, consumers are always shopping — and doing so on their terms, comparing prices ruthlessly and snapping up deals out of season to stretch their budgets.

- Incremental shift to spending on services. US shoppers have migrated more of their discretionary spending away from goods to services — and this includes for holiday gifts. 20 years ago, it would have been standard to give a physical gift. Today, gifts may be digital or experiential.

Which Sectors Have Most Felt the Impact?

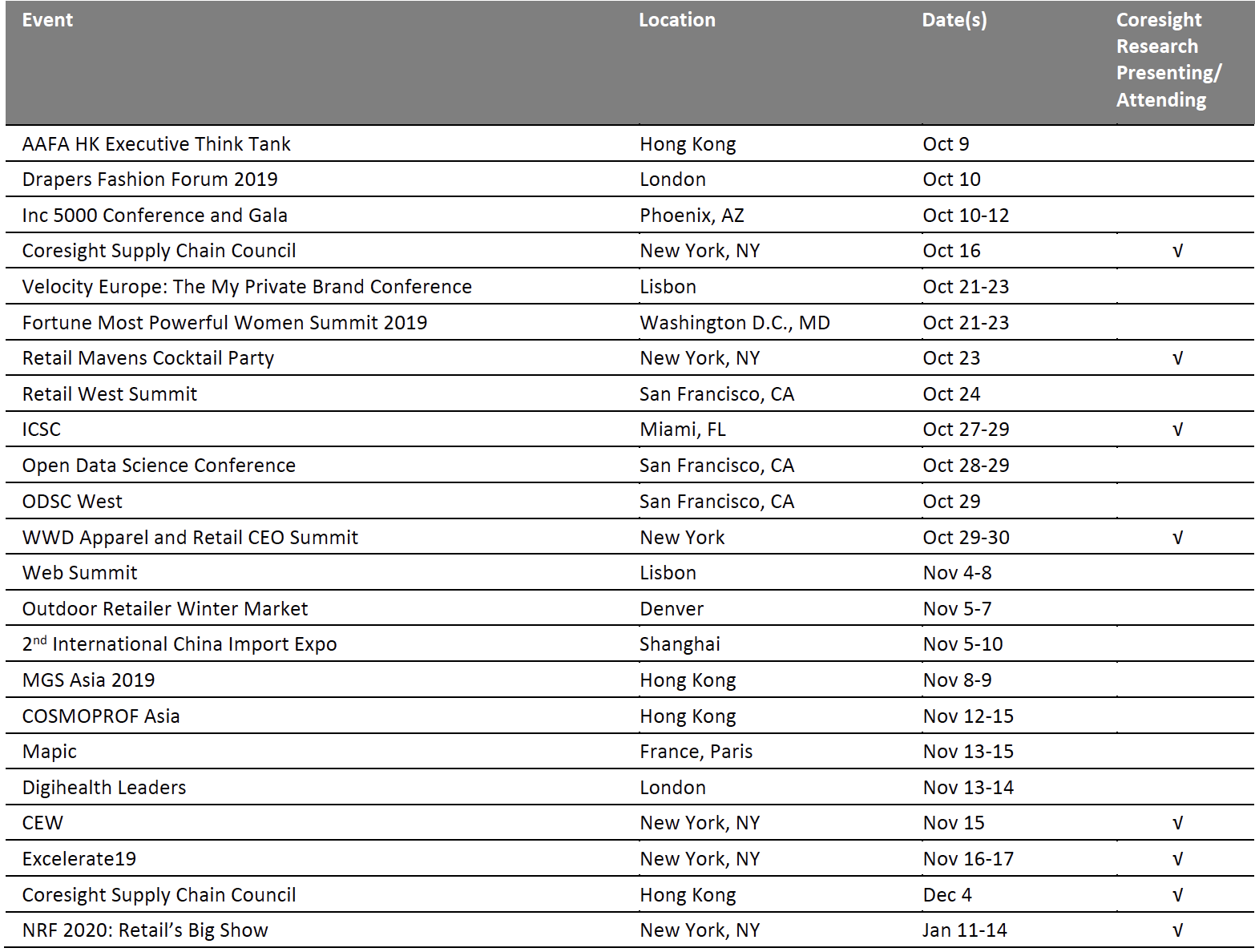

Our analysis focused on six nonfood sectors, shown in the table below. Of these, jewelry stores have seen the contribution to annual sales from the holiday period fall the most: by 670 bps to 26.7%. Department store holiday sales as a share of annual sales dropped by only 80 bps to 23.8%, while the share for electronics and appliance stores declined the least, by 50 bps to 22.1%.

[caption id="attachment_97625" align="aligncenter" width="700"] *A subset of general merchandise stores

*A subset of general merchandise storesSource: US Census Bureau/Coresight Research[/caption]

What Does This Mean?

We expect this trend to continue: New business models and distribution channels will only continue the disruption to traditional shopping patterns. So, legacy retailers must be prepared to serve this reshaped demand: They must become less reliant on peak holiday trading and stand ready to cater to the year-round shopper with shopping festivals and events, and there are opportunities to piggyback on existing calendar events such as Black Friday in July or Prime Day, and for the very biggest to create their own shopping festivals.

US RETAIL & TECH HEADLINES

![]() The Biggest Mall Owner in the US Is Going Online

(October 2) CNBC

The Biggest Mall Owner in the US Is Going Online

(October 2) CNBC

- The biggest mall owner in the US, Simon Property Group, is teaming up with online shopping site Rue La La’s parent company to launch a new website for people looking for deals.

- The real estate company announced it’s partnering with Rue Gilt Groupe to create a new e-commerce business for discount shopping. Simon has been testing the website ShopPremiumOutlets.com since March, building on its premium outlet business, working with retailers to test selling merchandise on the site.

![]() Amazon’s Grocery-Store Plan Moves Ahead with Los Angeles Leases

(October 1) The Wall Street Journal

Amazon’s Grocery-Store Plan Moves Ahead with Los Angeles Leases

(October 1) The Wall Street Journal

- Amazon is moving ahead with a plan to open a chain of US grocery stores, starting in Los Angeles, Chicago and Philadelphia. In the Los Angeles area, it has signed more than a dozen leases.

- The first few stores are likely to be in the dense suburban locations of Woodland Hills and Studio City, while another grocer is slated for the city of Irvine, in nearby Orange County. These stores could open as early as the end of the year.

![]() Amazon Is in Talks to Bring its Cashierless Go Technology to Airports and Movie Theaters

(September 30) CNBC

Amazon Is in Talks to Bring its Cashierless Go Technology to Airports and Movie Theaters

(September 30) CNBC

- Amazon is in talks to bring the cashierless technology that runs its Go stores to other retailers such as airport shops and movie theaters. The effort would help Amazon grow its retail presence to lower its reliance on online shopping, but at a faster pace and at lower cost than building its own stores.

- It may also help Amazon forge bonds with companies that would ordinarily consider Amazon the competition. That type of collaboration could lead to further growth in Amazon’s cloud business.

![]() Forever 21 Files for Bankruptcy and Will Close up to 178 US stores

(September 30) CNN

Forever 21 Files for Bankruptcy and Will Close up to 178 US stores

(September 30) CNN

- Forever 21, the teenage clothing emporium that rode America's mall boom, has filed for bankruptcy. The chain said it is planning to overhaul its global business, closing between 300 and 350 stores, including as many as 178 in the US.

- It also plans to exit "most of its international locations in Asia and Europe." The company, which currently has 549 US stores and 251 in other countries, will continue to operate in Mexico and Latin America.

![]() Average Gas Price in US on the Rise

(September 29) WFLA

Average Gas Price in US on the Rise

(September 29) WFLA

- Gas prices in the US have spiked 10 cents per gallon. The average price of regular-grade gasoline increased to about $2.73 over the past two weeks.

- The price hike is due to the September 14 attack on Saudi Arabia’s oil facilities. Interruptions in US refining are also a factor. Most of Saudi Arabia’s oil production has been restored. Its oil processing capacity is expected to be operational in October. Retail gasoline prices are expected to slip soon and price cuts may accelerate in October.

EUROPE RETAIL AND TECH HEADLINES

John Lewis Partnership Announces Restructuring

(October 1) Company press release

John Lewis Partnership Announces Restructuring

(October 1) Company press release

- The John Lewis Partnership has announced plans to merge the management team of its two brands John Lewis & Partners and Waitrose & Partners, effective February 3, 2020.

- The new management structure will result in the elimination of around 75 of its current 225 senior head office roles, saving around £100 million ($123 million).

![]() CEO of Sainsbury's Argos Resigns

(October 1) Company press release

CEO of Sainsbury's Argos Resigns

(October 1) Company press release

- Sainsbury's has announced that John Rogers, CEO of Sainsbury’s Argos, is leaving the business on October 31, 2019 to join London-based advertising and public relations company WPP as CFO in early 2020.

- In 2010, Rogers joined the Sainsbury’s board as CFO and since 2016 has served as CEO.

![]() Carrefour Extends Blockchain Technology To Camembert

(September 30) ESMMagazine.com

Carrefour Extends Blockchain Technology To Camembert

(September 30) ESMMagazine.com

- Carrefour has extended the use of blockchain technology to Camembert de Normandie cheese. It is the eleventh Carrefour Quality Line item to be included in the mapping system.

- The technology allows shoppers to trace the location of the producers on a map and see the product's path from the farm to the store shelf by scanning the QR code on the product label with their smartphones.

![]() Shop Direct Adds New Brands to its Portfolio

(September 30) TheRetailBulletin.com

Shop Direct Adds New Brands to its Portfolio

(September 30) TheRetailBulletin.com

- British online retailer Shop Direct has added seven new brands to its home and furniture portfolio in the past six weeks. Shop Direct plans to drive homeware and furniture sales by adding a broad range of branded products to its existing own-brand offering.

- Shop Direct will also increase the frequency with which it launches new home and furniture products.

![]() Browns Unveils Mobile Shopping and Content App

(September 29) FashionNetwork.com

Browns Unveils Mobile Shopping and Content App

(September 29) FashionNetwork.com

- British upmarket fashion boutique Browns has introduced a mobile shopping and content app. The app will offer more than 500 new products each week and allow shoppers to enable alerts for new collections.

- Users can access sales and promotions before other shoppers. The app will also offer exclusive shoppable editorial content including video.

Richemont Acquires Buccellati

(September 27) Company press release

Richemont Acquires Buccellati

(September 27) Company press release

- Swiss luxury goods firm Richemont has acquired Italian jewelry and watch company Buccellati in a private transaction with its Chinese owner Gangtai Holdings for an undisclosed amount.

- ==Richemont announced the transaction was completed on September 26 and will not have a significant impact on its consolidated net assets or on its operating result for the current fiscal year ending March 31, 2020.

![]() Tesco CEO to Leave; Company Could Sell its Polish Division

(September 27) Company press release and Bloomberg.com

Tesco CEO to Leave; Company Could Sell its Polish Division

(September 27) Company press release and Bloomberg.com

- Tesco this week announced its CEO, Dave Lewis, will step down in summer 2020. Lewis joined Tesco in 2014 and implemented a major turnaround plan.

- In separate news, the company is reportedly considering a sale of its struggling Polish operations to focus on its UK operations and more promising international markets. Tesco shut 62 stores in Poland last year and began downsizing its largest stores in August. It also stated that it concluded the sale of its eight largest Polish hypermarkets in July.

ASIA RETAIL AND TECH HEADLINES

Lazada To Launch Installment Credit

(October 1) RetailNews.Asia

Lazada To Launch Installment Credit

(October 1) RetailNews.Asia

- Singapore based e-commerce company Lazada has partnered with online consumer loan provider AsiaKredit to offer monthly installment payment service eShopaLoan to customers in the Philippines.

- Lazada customers will need to install the AsiaKredit pera247 app and fill out an application to use the eShopaLoan service. eShopaLoan finances products between PHP5,000 ($96.29) and PHP50,000 ($962.88).

Flipkart and Amazon Post Record Sales on First Day of India Shopping Festival

(September 30) Reuters.com

Flipkart and Amazon Post Record Sales on First Day of India Shopping Festival

(September 30) Reuters.com

- Flipkart and Amazon announced record sales on the first day of their respective annual flagship sales in India. Both Flipkart and Amazon started their sales on September 29 and will end on October 4.

- Flipkart registered a two-fold increase in total sales on the first day of its Big Billion Days promotion compared to last year, while Amazon claims to have sold INR7.5 billion ($10.5 million) worth of premium smartphones within the first 36 hours of its Great Indian Festival sale.

Net-a-Porter Launches On Tmall Luxury Pavilion

(September 30) Company press release

Net-a-Porter Launches On Tmall Luxury Pavilion

(September 30) Company press release

- Richemont-owned e-commerce platform Net-a-Porter has launched a flagship store on Tmall Luxury Pavilion. The store is the first operation of Feng Mao, a joint venture between Alibaba and Yoox Net-a-Porter (YNAP).

- The new store will offer over 130 luxury and designer brands at the time of launch and will expand its offerings over the next few months.

Uniqlo To Sell Clothing Made from Recycled Ultra-Light Down and Plastic Bottles

(September 30) InsideRetail.com.au

Uniqlo To Sell Clothing Made from Recycled Ultra-Light Down and Plastic Bottles

(September 30) InsideRetail.com.au

- Japanese fashion retailer Uniqlo has partnered with Japanese textile company Toray Industries to launch apparel made from used Uniqlo Ultra-Light Down jackets and recycled plastic bottles. The apparel line will be launched next year in Singapore and other Asian markets.

- Uniqlo will collect used Ultra-Light Down jackets at its stores. The used jackets will then be put through an extraction process run by Toray Industries to create recycled material for use in new pieces.

Miniso Available on Amazon India

(September 30) Retail4Growth.com

Miniso Available on Amazon India

(September 30) Retail4Growth.com

- Japanese retailer Miniso has partnered with Amazon to sell its products on Amazon’s India e-commerce website. Miniso launched its products on amazon.in during the Great Indian Festival, Amazon’s shopping festival, which started on September 29 and will run through October 4.

- Products under Miniso’s kitchen, home and beauty categories are available on amazon.in.

![]() Ecmoho Files For $150 Million US IPO

Ecmoho Files For $150 Million US IPO

(September 30) DealStreetAsia.com

- Ecmoho, a Chinese e-commerce platform for non-medical wellness products, has filed with the US Securities and Exchange Commission to raise $150 million in an initial public offering in the US.

- Ecmoho has stated that the funds will be used to introduce new products, make acquisitions in the future and to repay short-term loans.

LATIN AMERICA RETAIL AND TECH HEADLINES

Lululemon Opens First Store in Guadalajara, Mexico

(September 30) FashionNetwork.com

Lululemon Opens First Store in Guadalajara, Mexico

(September 30) FashionNetwork.com

- Canadian athletic apparel retailer Lululemon has expanded its Mexico footprint with the opening of a new store at The Landmark shopping mall in Guadalajara city.

- Lululemon opened its first store in Mexico in 2017 and now has locations in Mexico City with two showrooms in the Puebla and Polanco areas, and two flagship stores at the Artz Pedregal and Paseo Arcos Bosques shopping complexes.

Mercado Libre to Start Giving Credit to Customers

(September 30) America-Retail.com

Mercado Libre to Start Giving Credit to Customers

(September 30) America-Retail.com

- Argentinian e-commerce company Mercado Libre plans to introduce a consumer loan facility for customers through its online payment service Mercado Crédito, which can be used only within its own online platform. The service will be launched by the end of October.

- Customers will not need a bank account to use the loan service, and credit facilities will be based on their transaction history with Mercado Libre.

![]() Walmart Argentina Appoints New CFO

(September 30) FashionNetwork.com

Walmart Argentina Appoints New CFO

(September 30) FashionNetwork.com

- On September 30, Walmart Argentina appointed Patricio Aguirre Saravia CFO. Saravia will lead strategic projects for the growth and transformation of the company.

- Prior to joining Walmart, Saravia worked with San Miguel Global as CFO for the Argentina, Uruguay, South Africa and Peru regions.

![]() Privalia to Enhance Mexico Operations

(September 29) FashionNetwork.com

Privalia to Enhance Mexico Operations

(September 29) FashionNetwork.com

- Spanish online outlet Privalia has announced plans to invest an undisclosed sum in its Mexico operations. Privalia will use the fresh funds to reduce delivery times, link up with new brands and strengthen customer relationships.

- Privalia offers merchandise from local Mexican brands in addition to foreign brands such as Hugo Boss and Burberry. Apart from Mexico, Privalia operates in Spain, Italy and Brazil.

![]() Ilahui Opens Second Store in Peru

(September 27) PeruRetail.com

Ilahui Opens Second Store in Peru

(September 27) PeruRetail.com

- On September 28, Korean lifestyle brand Ilahui opened its second Peru store in Lima. Ilahui opened its first Peru store at Cercado de Lima in October last year.

- The new store offers a wide range of products across categories including fashion, makeup, home and accessories.

MACRO UPDATE

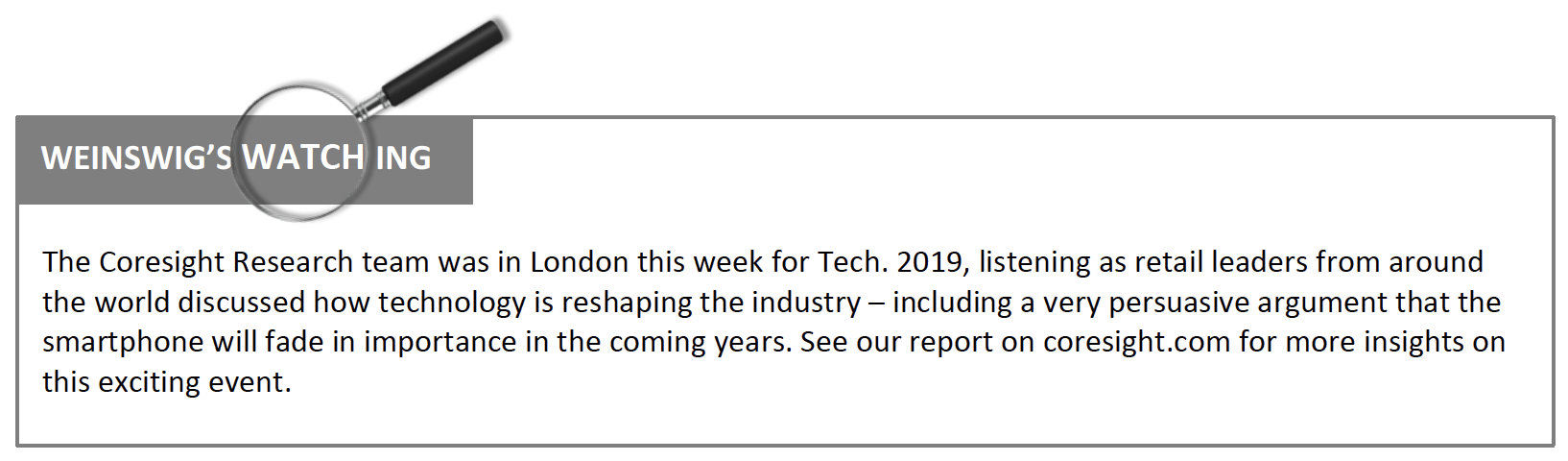

Key points from global macro indicators released September 25–October 1, 2019:

- US: Personal consumption expenditure grew 1.4% year over year in August, unchanged from the previous month. Pending home sales grew 2.5% year over year in August, versus a 0.3% decrease in July.

- Europe: In the eurozone, the unemployment rate was 7.4% in August, slightly lower than the 7.5% in July. In Germany, the consumer price index (CPI) increased 1.2% year over year in September, lower than the 1.4% growth in August.

- Asia: In Japan, industrial production fell 4.7% year over year in August, versus the 0.7% increase in July. In Korea, the CPI fell 0.4% year over year in September, slightly more than the consensus estimate of a 0.3% decline.

- Latin America: Brazil’s unemployment rate came in at 11.8% in August, the same as in the previous month and edging past the consensus estimate of 11.7%. In Chile, manufacturing production fell 1.5% year over year in August, versus a 6.2% increase in July.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

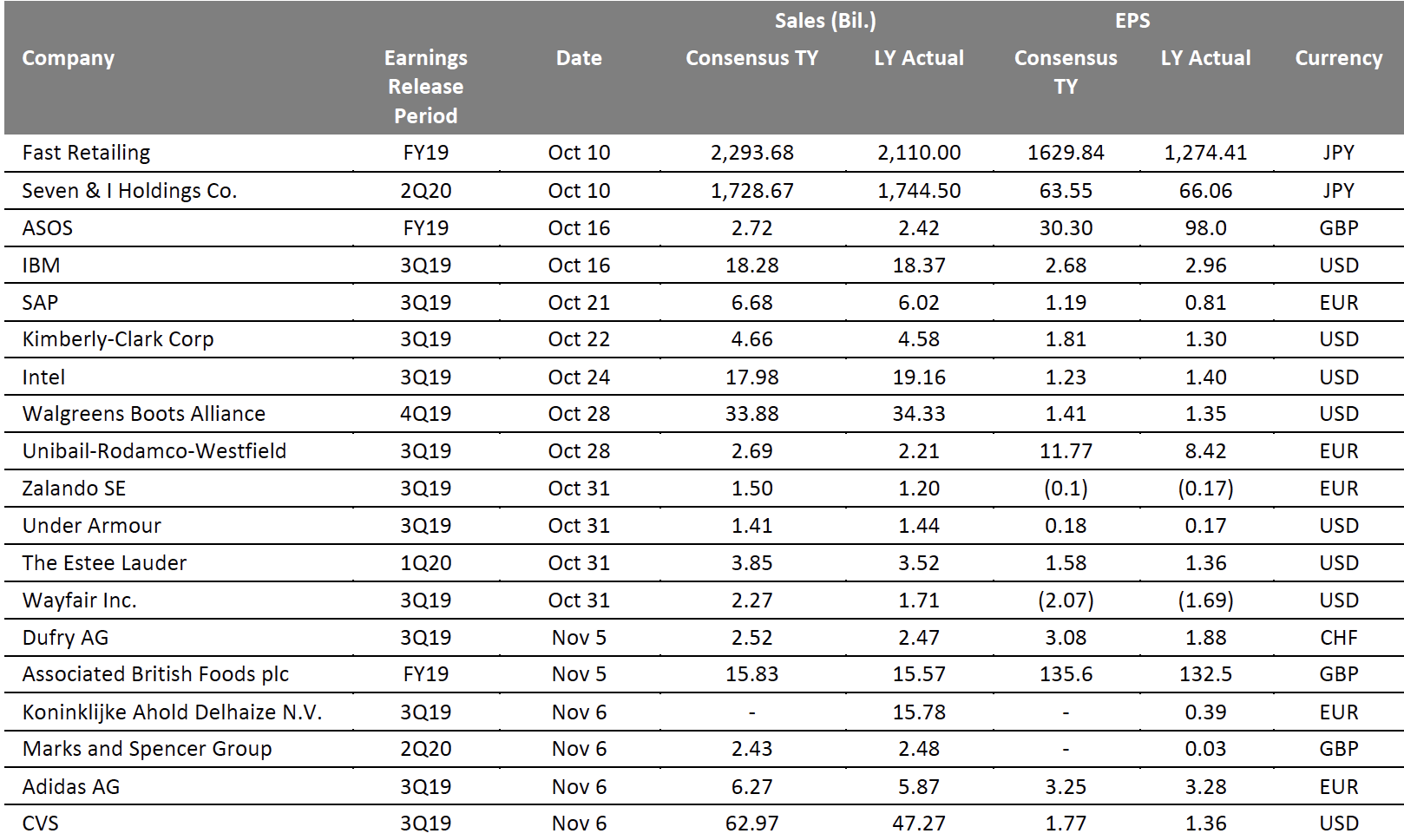

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Economic Analysis/National Association of Realtors/Eurostat/Office for National Statistics/Destatis/INSEE/Ministry of Economy, Trade and Industry/Statistics Korea/IBGE/Estadisticas de Chile/Coresight Research[/caption] EARNINGS CALENDAR [caption id="attachment_97649" align="aligncenter" width="700"]

Source: Bloomberg[/caption]

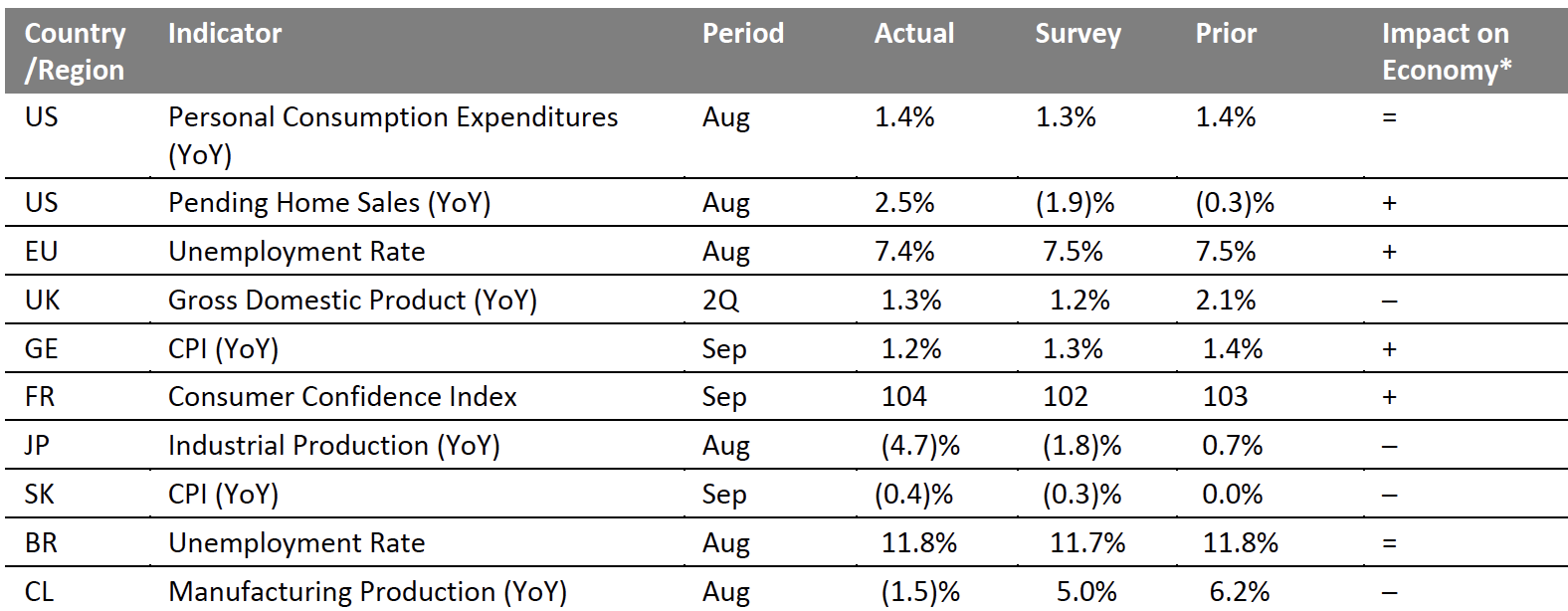

EVENT CALENDAR

Source: Bloomberg[/caption]

EVENT CALENDAR