From the Desk of Deborah Weinswig

As the World (Re)turns: Returning Stuff Is a Whole Lot Easier than It Used to Be

In the ancient days, before e-commerce, when you wanted to return something, you had to go back to the store where you bought it (if you bought it in a store) or wait in line at the post office, if you bought it via mail order. This also involved locating the original packaging, getting the item to fit back in the box, and finding tape to seal the box, not to mention the receipt. PCs and the early Internet improved this process somewhat—if you bought from a good retailer, you could print or download a return label and drop off the item at a UPS location or leave it for a UPS delivery person to pick up.

E-commerce changed things. It enabled you to buy 10 shirts and return nine if you wanted to, but it did little to ease the hassle of returning purchased and unwanted items...until recently. In the last couple of years, several startups have emerged to ease the pain shoppers face when returning things, while attempting to reduce the cost to retailers at the same time. And that cost is significant: according to the National Retail Federation, the retail industry saw $260.5 billion in returned merchandise (or 8% of total sales) in 2015 alone, and online return rates can reach as high as 30%–40% in the apparel and accessories categories. In the last couple of months, however, two large retailers have come up with viable and innovative returns solutions. Below, we run down the startups and retailers that are remaking the returns process.

Happy Returns is a technology, logistics and services company that enables shoppers to make in-person returns of merchandise ordered online via return kiosks at shopping malls.

Returnly provides instant refunds to consumers. Most online product returns result in lost sales for the retailer and frustration for the shopper. It takes brands 21 days, on average, to process a refund. Returnly manages a B2B fintech platform that offers shoppers instant refunds as store credit, so they can make another purchase even before a return is processed. The company fronts order refunds and takes the product return and customer risk on behalf of retailers.

SupplyAI uses an applied artificial intelligence (AI) platform to help retailers derive maximum cost efficiencies from their order-to-cash cycle by minimizing returns of online purchases. The company uses AI deep learning to correlate consumers’ individual online shopping trends with their shipping patterns and return history in order to determine how likely they are to return an item. The company helped one large omnichannel retailer identify and prevent an estimated $61.2 million in returns.

Amazon and

Kohl’s expanded their initial partnership—which called for Kohl’s to sell Amazon electronic devices such as Echo intelligent assistants and Fire tablets—to include Kohl’s accepting Amazon.com returns at some US-based stores. Under the agreement, Kohl’s will pack and ship eligible items and send them back to an Amazon fulfillment center free of charge for the customer. The service was initially available at 82 Kohl’s stores in Los Angeles and Chicago. It is likely that Amazon will leverage the 400-plus Whole Foods stores it has subsequently acquired to expand its return capabilities further.

Walmart recently launched its own in-store returns service called Mobile Express Returns. Under this service, customers can return goods purchased online by using the Walmart app on their smartphone to generate a QR code, which can then be scanned in a physical store to return goods rapidly. The service will be launched this November and ultimately rolled out to all 4,700 Walmart stores.

The advent of the Walmart service creates some interesting questions for retailers with e-commerce operations and physical stores. Namely, can consumers return items purchased on an online marketplace at Walmart stores? And what about goods purchased from Walmart-owned Bonobos or Jet.com? Amazon might need to answer those types of questions, too, if it leverages its Whole Foods stores in a similar way.

Fortunately, consumers now rarely have to stand in line at the post office to return those pants that were optimistically purchased in a size too small, and retailers can choose among several new companies whose solutions mitigate the pain and reduce the cost of returns. Although returns are typically offered for free today, they are, of course, not free for retailers—and, ultimately, consumers will likely have to share the cost of returns, especially in cases of egregious overordering.

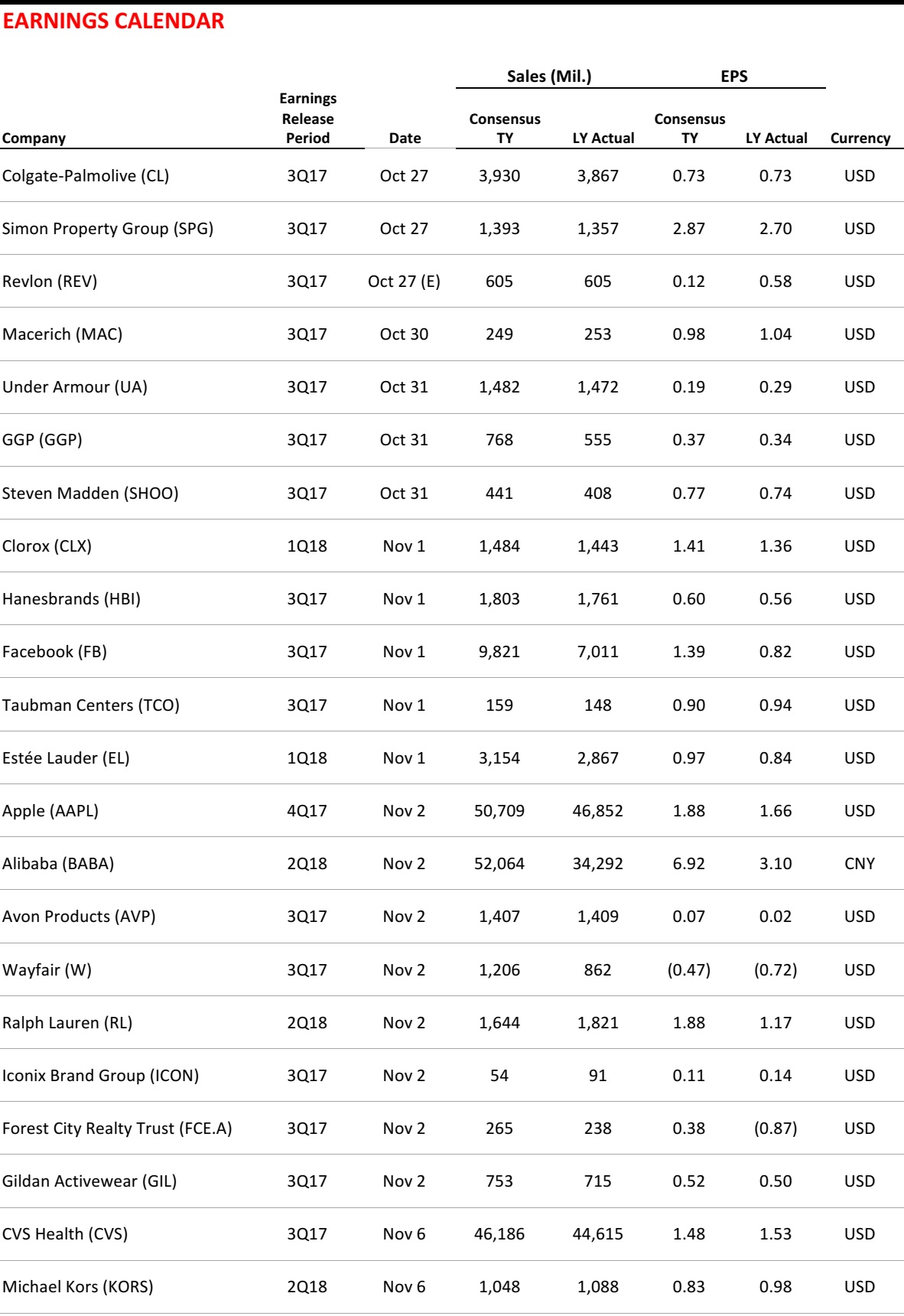

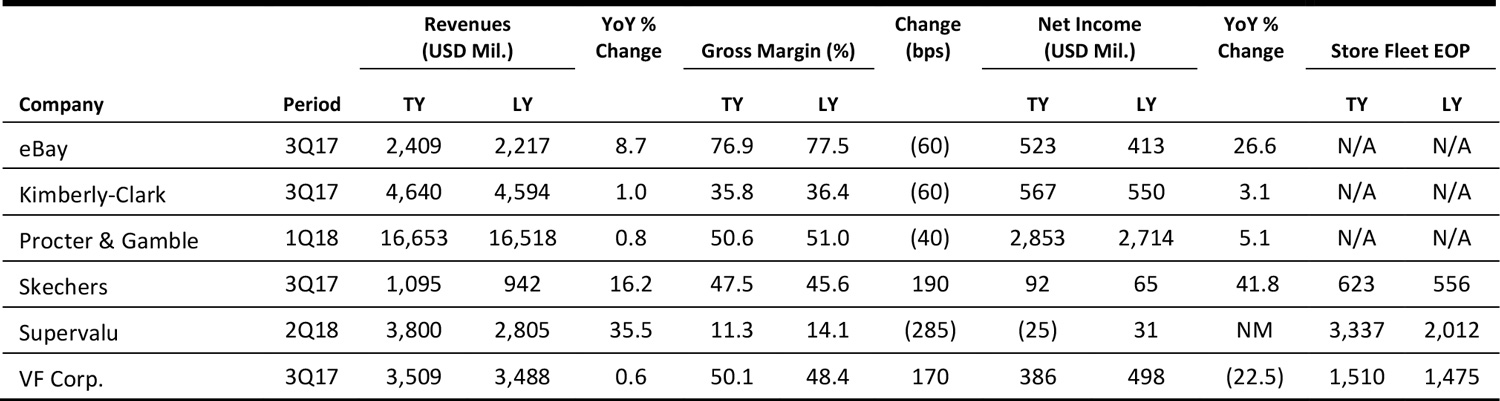

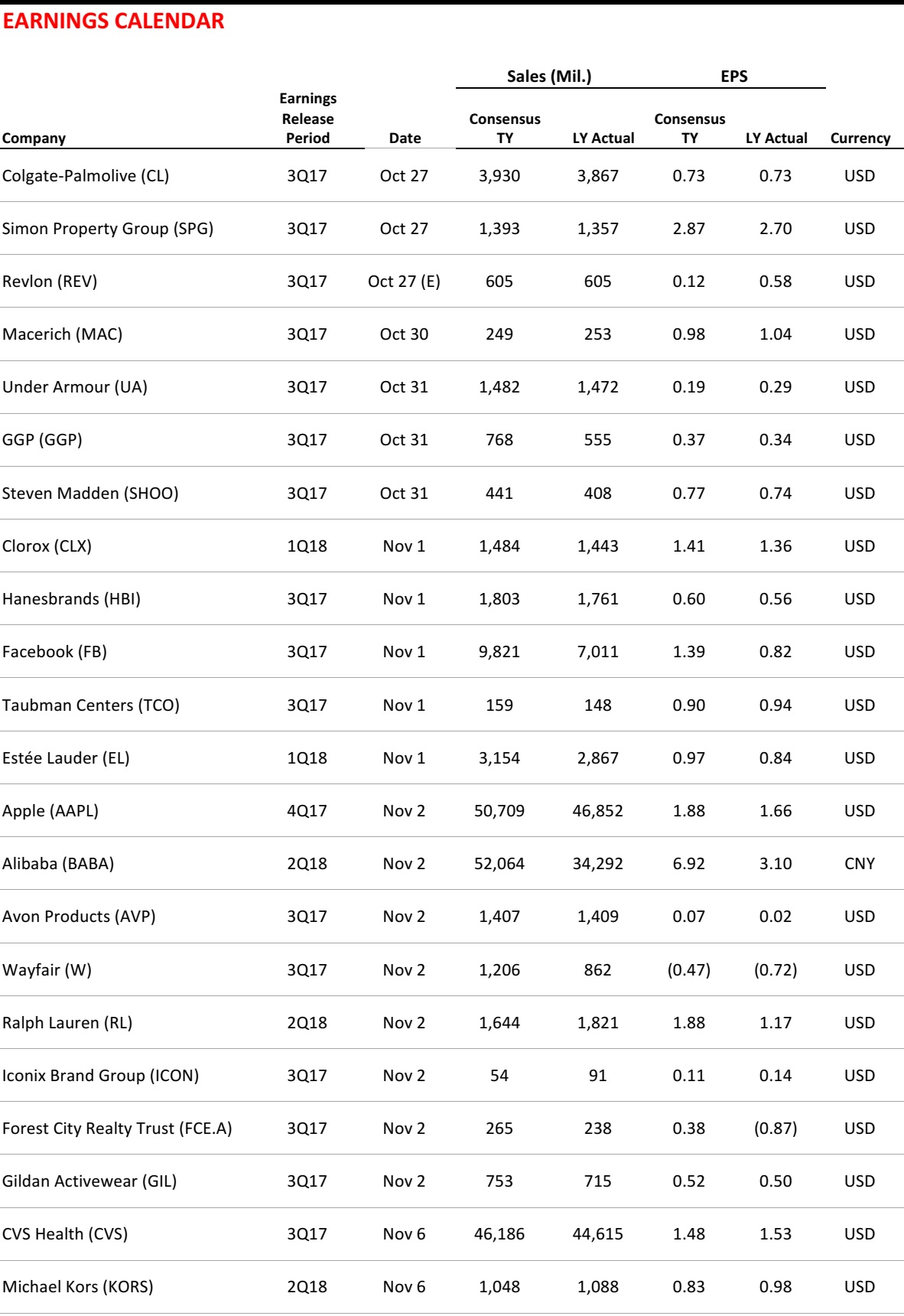

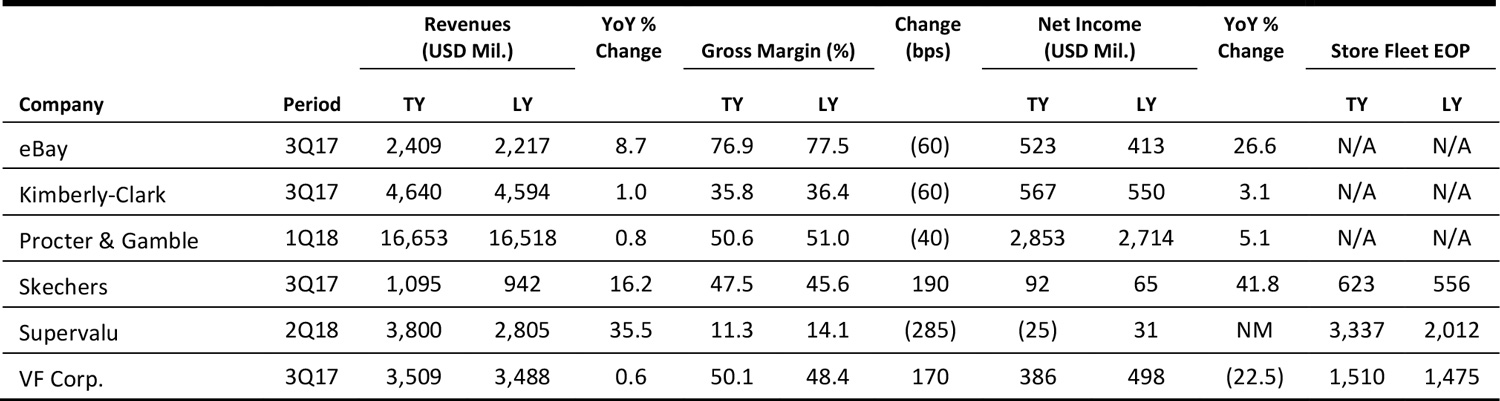

US RETAIL EARNINGS

US RETAIL EARNINGS

Source: Company reports

Source: Company reports

US RETAIL & TECH HEADLINES

Amazon Could Be Responsible for Nearly Half of US E-Commerce Sales in 2017

(October 24) Reuters.com

Amazon Could Be Responsible for Nearly Half of US E-Commerce Sales in 2017

(October 24) Reuters.com

- Amazon will own a bigger piece of e-commerce sales this year, about 44 cents out of every e-commerce dollar spent in the US, up from 38 cents last year, according to new estimates on public companies from research firm eMarketer.

- Amazon’s e-commerce sales are expected to grow by 32%, to $196.8 billion, in 2017 in the US, accounting for 43.5% of total e-commerce sales. These figures represent gross merchandise volume data, which include sales made by third parties on Amazon’s marketplace.

US Retailer Sears Snaps Business Relationship with Whirlpool

(October 25) Domain-B.com

US Retailer Sears Snaps Business Relationship with Whirlpool

(October 25) Domain-B.com

- US retailer Sears will no longer sell Whirlpool-branded appliances, ending a business relationship that started over 100 years ago. Sears sent a note to its stores last week, saying that Whirlpool was making demands that would have made it difficult to sell its name-brand appliances at a competitive price.

- According to market research firm TraQline, consumers in the US buy most of their small appliances from Walmart. Amazon ranks second in consumer preference, with Sears placing fourth behind Target.

Lord & Taylor Building, Icon of New York Retail, Will Become WeWork Headquarters

(October 24) The New York Times

Lord & Taylor Building, Icon of New York Retail, Will Become WeWork Headquarters

(October 24) The New York Times

- From the moment its doors opened more than a century ago, the Lord & Taylor building on Fifth Avenue in Manhattan has stood as a monument to old-school retail. But now, the forces buffeting the retail industry are diminishing Lord & Taylor’s presence as a New York institution.

- The company that owns the department store chain, Hudson’s Bay Company, said that it was selling off the flagship store to WeWork, a seven-year-old startup whose office-sharing model is helping to reinvent the concept of workspace. Lord & Taylor will rent out about a quarter of the building, where it will operate a pared-down department store. WeWork will use the rest of the building for its global headquarters and to lease shared office space to its customers.

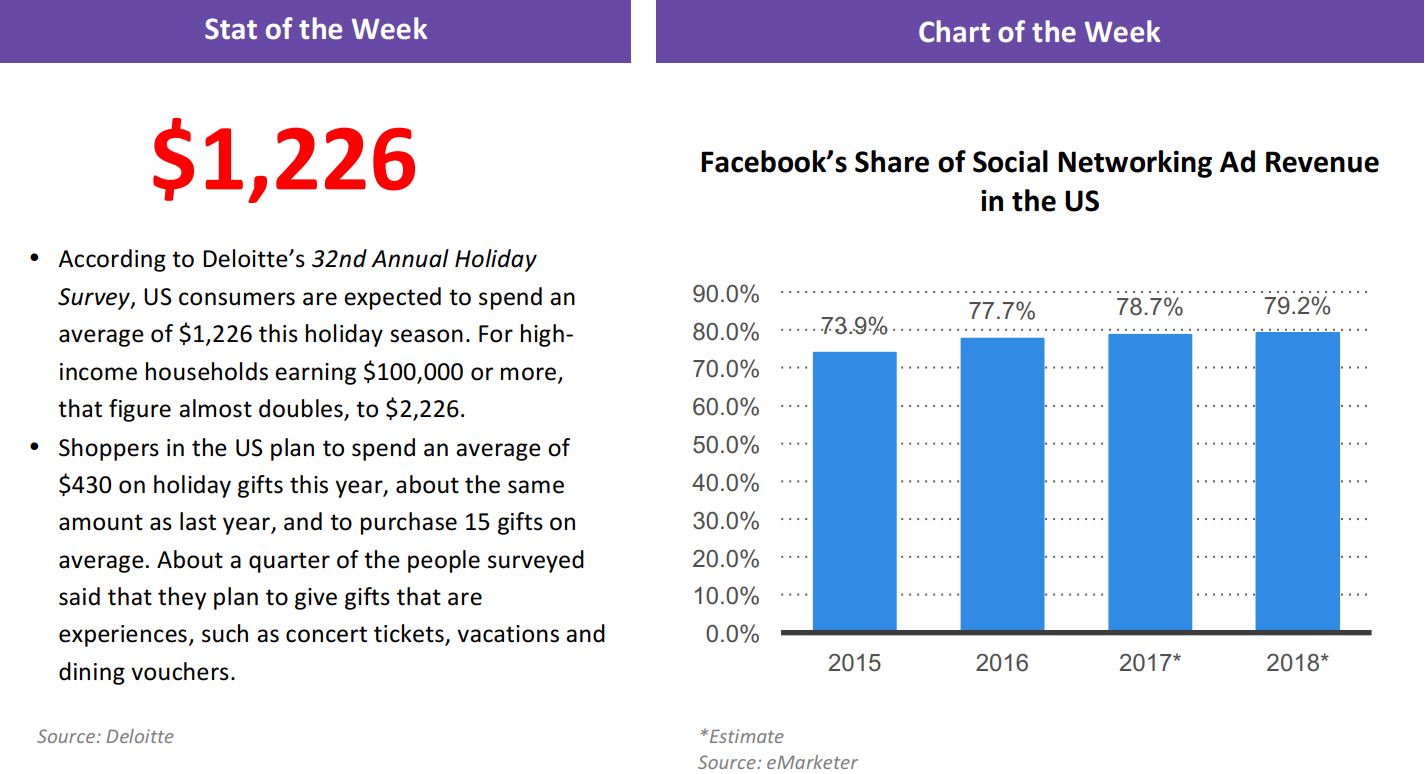

Online Overtakes In-Store Holiday Spend for the First Time

(October 24) RetailDive.com

Online Overtakes In-Store Holiday Spend for the First Time

(October 24) RetailDive.com

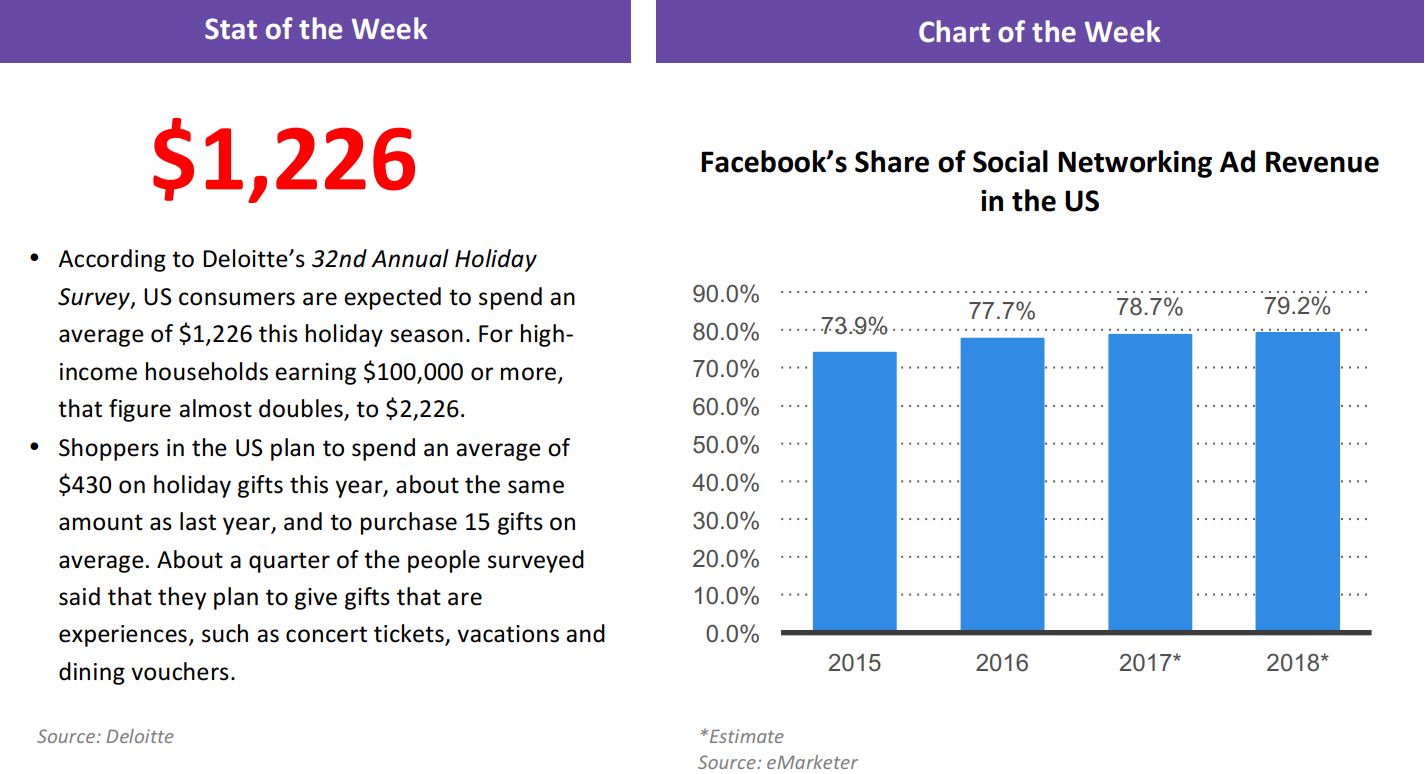

- It was a surprise last year when Deloitte found that holiday shoppers expected to spend as much online as in stores, but this year that has gone even further: more than half (51%) of holiday shoppers expect their budgets to go to online spending, compared with 42% who expect to spend in stores, according to Deloitte’s 32nd Annual Holiday Survey.

- No matter where they will spend, holiday shoppers are feeling fairly flush. Most (81%) respondents said that their household financial situation is the same or better than last year, up from 63% in 2012.

Jet.com Rolls Out First Private Label

(October 23) SupermarketNews.com

Jet.com Rolls Out First Private Label

(October 23) SupermarketNews.com

- Jet.com, an online division of Walmart, said that it has officially launched its first private label, an assortment of groceries and other consumables, under the Uniquely J line. Uniquely J includes more than 50 SKUs in the coffee, cleaning, laundry, pantry, paper and food storage categories.

- The products in the line feature the attributes that Jet.com’s customers are seeking, including cleaning products made with plant-based ingredients, organic and Fair Trade Certified coffee beans, and food storage bags made from BPA-free plastics.

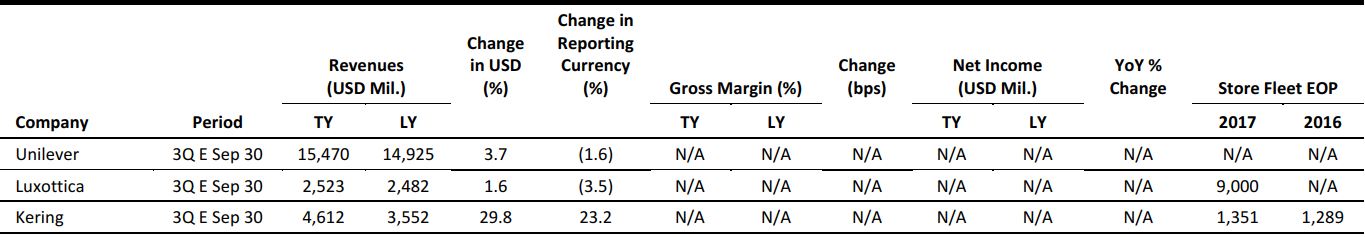

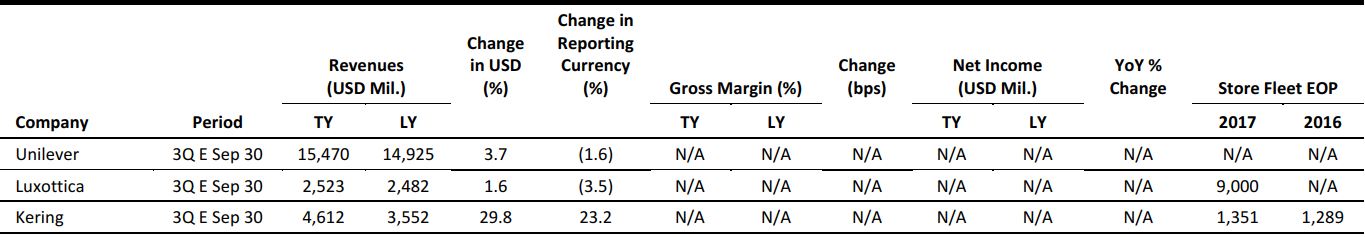

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL & TECH HEADLINES

Raised Inflation Fuels UK Retail Sales Growth in September

(October 19) Office for National Statistics press release

Raised Inflation Fuels UK Retail Sales Growth in September

(October 19) Office for National Statistics press release

- UK retail sales grew by 4.6% year over year in September, comprising 1.6% real-terms growth and a 3.0% rise in prices, according to the Office for National Statistics. Total growth slowed from 5.6% and real-terms growth slowed from 2.6% in August.

- In September, grocery store sales grew by 1.3%, while sales at large clothing chains grew by 7.2% and Internet retail sales grew by 14.1%.

John Lewis Launches Concierge-Style Shopping Experience at New Oxford Store

(October 20) Company press release

John Lewis Launches Concierge-Style Shopping Experience at New Oxford Store

(October 20) Company press release

- British department store chain John Lewis launched a concierge-style shopping experience at its new service-led store that opened in Oxford on Tuesday, October 24.

- A fifth of the 120,000-square-foot store is dedicated to services, which range from makeup master classes to shoe fittings to travel advice to eye tests. A brand experience manager and staff that run the “Experience Desk” provide information on what the store offers and help customers plan their visit.

Carpetright Posts Strong Growth in Non-UK Sales in 1H18

(October 24) Company press release

Carpetright Posts Strong Growth in Non-UK Sales in 1H18

(October 24) Company press release

- British furniture and carpet specialist Carpetright posted group sales growth of 1.8% in the first half ended October 21, 2017. Total sales in the UK declined by 0.6% in the period, while UK comparable sales rose by 0.8% as growth in the flooring category was offset by reduced bed sales.

- Carpetright’s total sales in the Netherlands, Belgium and Ireland bounced by 14.4% during the period. Excluding currency effects, sales grew by 7.5% and comparable sales jumped by 6.3% outside the UK.

Solid Year for Dr. Martens as Asia Expansion Drives Sales

(October 23) Company press release

Solid Year for Dr. Martens as Asia Expansion Drives Sales

(October 23) Company press release

- British shoe brand Dr. Martens posted group revenue growth of 25% (12% at constant currency), to £290.6 million (US$383 million), in the year ended March 31, 2017. Store retail sales expanded by 38%, while e-commerce sales swelled by 54%.

- Asia, which represents 23% of total revenue, posted sales growth of 43%. Total revenue grew by 25% in Europe, the Middle East and Africa and by 16% in the Americas.

Assa Abloy to Acquire Smart Lock Firm August Home

(October 19) TechCrunch.com

Assa Abloy to Acquire Smart Lock Firm August Home

(October 19) TechCrunch.com

- Assa Abloy, a $23-billion Swedish lockmaker, is set to acquire US-based smart-lock firm August Home in order to leverage its technology. Terms of the deal were not disclosed, but it is expected to close in the fourth quarter of 2017, subject to regulatory approval.

- The cofounders of August Home will continue in their existing roles and the firm will retain its branding and operate under the Americas division of Assa Abloy following the acquisition.

ASIA TECH HEADLINES

Tesla Reportedly Made Deal to Open a Manufacturing Facility in Shanghai

(October 23) TechCrunch.com

Tesla Reportedly Made Deal to Open a Manufacturing Facility in Shanghai

(October 23) TechCrunch.com

- Tesla has reportedly made a deal with the government in Shanghai to open up a manufacturing facility in the city’s trade-free zone, The Wall Street Journal reports. Foreign carmakers traditionally partner with local manufacturers, but, in this case, Tesla will own the entire factory.

- Tesla will be able to cut some costs of production and, ultimately, the sale price of Teslas in China, but it will likely still be responsible for paying China’s 25% import tariff. China has the world’s largest vehicle market. The Chinese government is aiming to sell 7 million electric vehicles a year by 2025.

Southeast Asia Gaming and E-Commerce Firm Sea Ends First Day on NYSE up 8%

(October 21) TechCrunch.com

Southeast Asia Gaming and E-Commerce Firm Sea Ends First Day on NYSE up 8%

(October 21) TechCrunch.com

- Sea, the gaming and e-commerce company holding the first major US IPO from a Southeast Asian tech firm, had a bumpy start to life on the New York Stock Exchange after closing its first day up around 8% on its list price of $15. The company raised $884 million from its listing, but it could surpass $1 billion if all allotted shares are purchased by underwriters.

- The firm, formerly known as Garena, is Southeast Asia’s highest-valued tech company behind only Grab, Uber’s $6-billion rival. Sea is unprofitable, but it hopes to turn losses into profit as Internet access in Southeast Asia continues to grow and the region’s 600 million consumers become more savvy about spending online.

Grab Raises $700 Million in Debt to Add More Drivers to Its Ride-Hailing Service in Southeast Asia

(October 20) TechCrunch.com

Grab Raises $700 Million in Debt to Add More Drivers to Its Ride-Hailing Service in Southeast Asia

(October 20) TechCrunch.com

- Grab is in the process of raising $2.5 billion for its ride-hailing service in Southeast Asia, but the company is also tapping banks for $700 million in debt facilities to develop its business. These debt facilities take Grab to over $4 billion in funding.

- The company will use the funding to expand its car rental fleet in Singapore and Indonesia, two of its key markets, purchasing vehicles that could then be provided to drivers on a leased basis. The overall aim is to use this flexible financing option to add drivers to its platform who cannot afford to buy cars. The company claims 1.8 million drivers across seven countries in Southeast Asia.

Chinese Local Services Giant Meituan-Dianping Raises $4 Billion Led by Tencent and Priceline

(October 19) TechCrunch.com

Chinese Local Services Giant Meituan-Dianping Raises $4 Billion Led by Tencent and Priceline

(October 19) TechCrunch.com

- Meituan-Dianping, a company formed by a multibillion-dollar merger in 2015, said that it has raised a $4 billion series C round from a group of investors led by existing backer Tencent. Meituan-Dianping is a pioneer of online-to-offline services in China.

- It has reached impressive scale, with up to 21 million orders at peak per day and 5 million merchants selling their wares on the platform over the past year. Meituan-Dianping claims that its deals span a whopping 2,800 cities in China, and that an audience of 280 million users have touched its service in the last 12 months.

LATAM RETAIL & TECH HEADLINES

SAP Brazil Delivers First Leonardo Case Study

(October 23) ZDNet.com

SAP Brazil Delivers First Leonardo Case Study

(October 23) ZDNet.com

- The Brazilian subsidiary of software giant SAP has unveiled its first local client for its Leonardo innovation suite as well as positive performance overall in its third-quarter results. Local firm Citrosuco, responsible for 25% of the global orange juice market, has rolled out SAP Leonardo’s IoT capability to improve fleet optimization and supply chain planning in combination with other SAP products.

- The agribusiness sector as a whole has claimed a larger slice of SAP Brazil’s sales pie, with a three-digit year-over-year increase in products sold to local companies from that sector. For the seventh consecutive quarter, the company has seen a sales boost in such contracts with sought-after products, including HR platform SuccessFactors and private hosting service SAP Hana Enterprise Cloud.

Google Expands Tech Startup Acceleration Projects in LatAm

(October 20) ZDNet.com

Google Expands Tech Startup Acceleration Projects in LatAm

(October 20) ZDNet.com

- Google is looking to promote the integration of technology startups across Brazil and Latin America via a series of initiatives at its Campus São Paulo venue. The Campus Exchange program is one of the new strategies introduced by the web giant to widen its footprint in the local and regional technology startup ecosystem.

- Campus São Paulo is the only Google venue dedicated to fostering entrepreneurship in Latin America. The immersion-week program held there seeks to facilitate knowledge exchange, networking and business opportunities between the Brazilian startups it already accelerates and ventures from Argentina, Chile, Mexico, Peru and Uruguay.

Walmex Posts Third-Quarter Revenue Growth After Earthquake Sales Boom

(October 20) Reuters.com

Walmex Posts Third-Quarter Revenue Growth After Earthquake Sales Boom

(October 20) Reuters.com

- Mexican retailer Walmart de Mexico reported a 7.8% rise in third-quarter revenue, benefiting from earthquakes in Mexico last month that prompted shopping sprees for donations of supplies to displaced people. Walmex’s quarterly revenue hit MXN 136.8 billion (US$7.5 billion), compared with MXN 126.9 billion (US$6.6 billion) in the same quarter last year.

- “People went out to make purchases at supermarkets to support earthquake victims, and I believe Walmex knew how to best capitalize on this,” Alejandra Marcos, an analyst with Mexican brokerage Intercam Casa de Bolsa, said before the results.

Agribusiness and Utilities Lead IoT Adoption in Brazil

(October 19) ZDNet.com

Agribusiness and Utilities Lead IoT Adoption in Brazil

(October 19) ZDNet.com

- The agribusiness and utilities sectors are leading the adoption of IoT technologies in Brazil, according to a recent study. Some 45% of users polled in agribusiness have rolled out IoT technologies in their organizations, while 30% of utilities companies have done the same, according to research by IT services firm Logicalis.

- By comparison, only 12% of manufacturing businesses in Brazil have implemented IoT technologies so far. This, according to the study, is due to an inability to demonstrate the ROI. However, 56% of agribusiness initiatives related to the IoT are strategic rather than ROI-focused, the research points out.

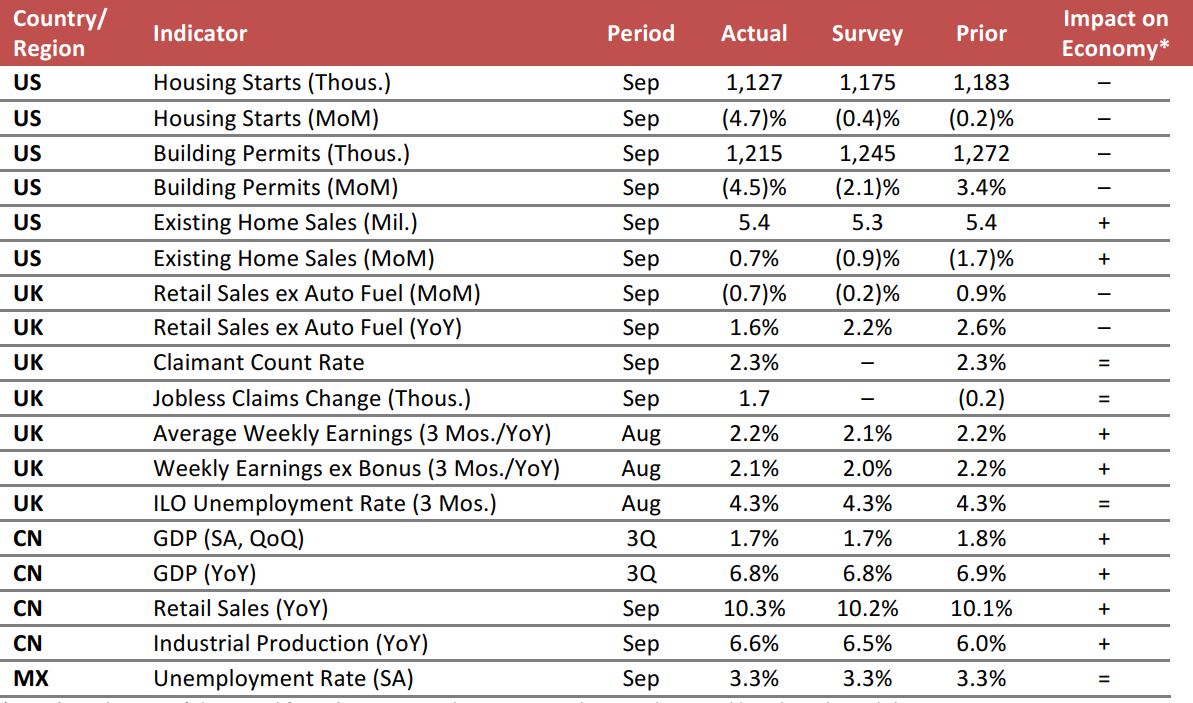

MACRO UPDATE

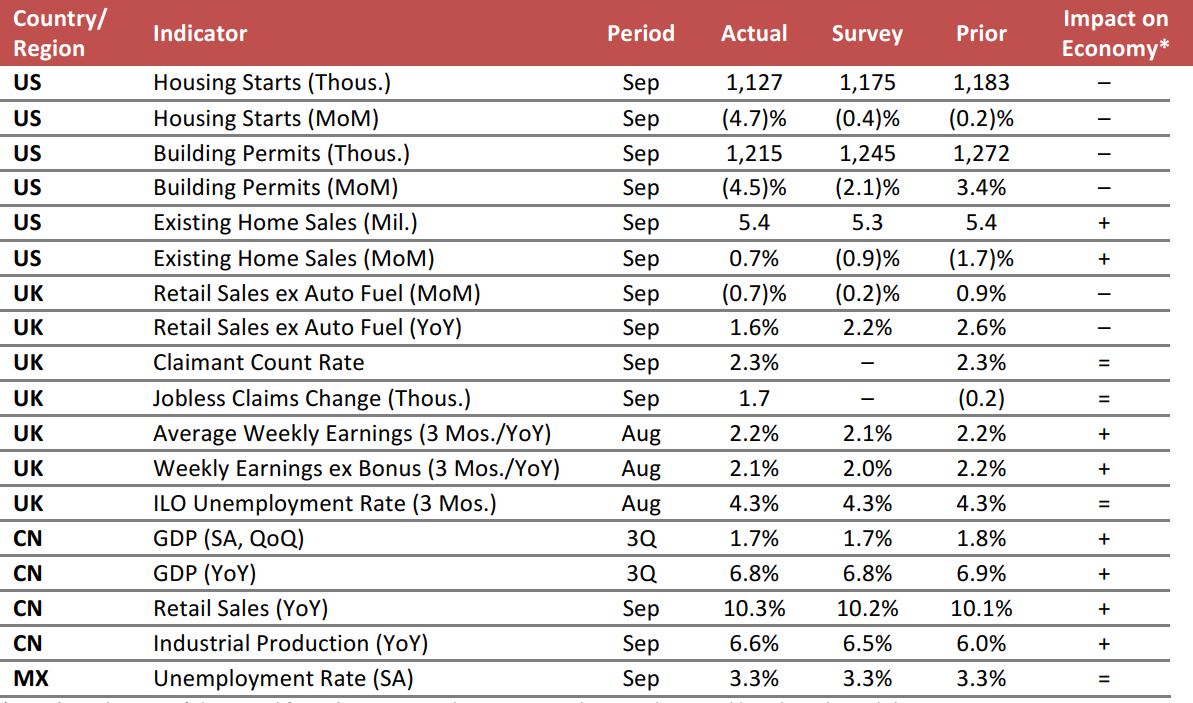

Key points from global macro indicators released October 18–25, 2017:

- US: Housing starts decreased by 4.7% month over month in September, standing at 1,127,000. Building permits were down 4.5% month over month. Both gauges fell by more than had been estimated. Existing home sales ticked up by 0.7% in September, to 5.4 million.

- Europe: In the UK, retail sales in September fell by 0.7% month over month and increased by 1.6% year over year. The claimant count rate in the UK stood at 2.3% in September. In August, average weekly earnings increased by 2.2% year over year in the UK and the unemployment rate stood at 4.3%.

- Asia-Pacific: In China, GDP increased by 6.8% year over year in the third quarter, in line with the consensus estimate. Retail sales in China increased by 10.3% year over year in September and industrial production increased by 6.6% year over year.

- Latin America: In Mexico, the unemployment rate stood at 3.3% in September, unchanged from the previous month and in line with the consensus estimate.

FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/National Association of Realtors/UK Office for National Statistics/National Bureau of Statistics of China/Instituto Nacional de Estadística y Geografía/FGRT

US RETAIL EARNINGS

US RETAIL EARNINGS Source: Company reports

Source: Company reports Southeast Asia Gaming and E-Commerce Firm Sea Ends First Day on NYSE up 8%

(October 21) TechCrunch.com

Southeast Asia Gaming and E-Commerce Firm Sea Ends First Day on NYSE up 8%

(October 21) TechCrunch.com

Walmex Posts Third-Quarter Revenue Growth After Earthquake Sales Boom

(October 20) Reuters.com

Walmex Posts Third-Quarter Revenue Growth After Earthquake Sales Boom

(October 20) Reuters.com